4 minute read

NEW REGISTRATION DATA

New registrations UK registrations

New scooter and motorcycle registrations for October 2022

2022 / 2021 Registrations by style Year to date

MOPEDS Oct 2022 Oct 2021 % Change Oct 2022 Oct 2021 % Change

Moped Naked Moped Other Moped Scooters

48 67 -28.4% 543 612 -11.3% 75 82 -8.5% 927 732 26.6% 467 513 -9.0% 4821 4697 2.6% TOTAL MOPEDS 590 662 -10.9% 6291 6041 4.1%

Highest registering model by style

Yamasaki F51-50Q Sur-Ron Light Bee Lexmoto Echo Plus 50

MOTORCYCLES

Adventure Competition Custom Modern Classic Naked Road Sport Scooter 1074 1323 -18.8% 18805 17653 6.5% BMW R1250 GS Adventure 441 514 -14.2% 4948 4687 5.6% Multiple Items 454 838 -45.8% 6933 7405 -6.4% Royal Enfield Meteor 350 871 769 13.3% 10798 9606 12.4% Royal Enfield Classic 350 1730 1698 1.9% 21082 22029 -4.3% Honda CBF125M

530 503 5.4% 7882 7292 8.1% 2038 2014 1.2% 23712 23356 1.5% Yamaha YZF R7 Honda PCX 125

Touring

212 136 55.9% 2653 2122 25.0% Unspecified 1 3 -66.7% 90 81 11.1% TOTAL MOTORCYCLES 7351 7798 -5.7% 96903 94231 2.8% BMW R1250 RT

TRICYCLES

Other Scooter TOTAL TRICYCLES 39 23 69.6% 329 368 -10.6%

Morgan 3 Wheeler 23 34 -32.4% 438 451 -2.9% Piaggio MP3 300 Sport 62 57 8.8% 767 819 -6.3%

TOTAL REGISTRATIONS 8003 8517 -6.0% 103961 101061 2.8%

Oct 2022 registrations

88 21 59 93 361 55 480 49

2022 / 2021 Registrations by Engine Band (inc Electric) Year to Date

ENGINE BAND Oct 2022 Oct 2021 % Change Oct 2022 Oct 2021 % Change

0 - 50cc 797 986 -19.2% 9468 8771 7.9% 51 - 125cc 3321 3300 0.6% 35661 35977 -0.9% 126 - 650cc 1477 1743 -15.3% 20879 18786 11.1% 651 - 1000cc 1263 1308 -3.4% 20672 19864 4.1% over 1000cc 1145 1180 -3.0% 17281 17693 -2.3%

TOTAL REGISTRATIONS 8003 8517 -6.0% 103961 101091 2.8%

Highest registering ICE model by capacity

Lexmoto Echo Plus 50 Honda PCX 125 Royal Enfield Classic 350 Yamaha YZF R7 BMW R1250GS Adventure

Oct 2022 registrations

24 480 93 55 88

International registrations

France Germany Italy Spain

Period 2022 Regs

2021 Regs +/-

Jan-Mar 45,702 44,691 2.3% Jan-Jun 108,069115,458 -6.4% Jan-Sep 154,665168,008 -7.9% Full year n/a 206,955

Period 2022 Regs

2021 Regs +/-

Jan-Mar 48,543 41,50616.9% Jan-Jun 117,838115,883 1.7% Jan-Sep 173,756174,623 -0.5% Full year n/a 199,132

Period 2022 Regs

2021 Regs +/-

Jan-Mar 60,278 60,493 -0.4% Jan-Jun 161,561166,239 -2.8% Jan-Sep 227,411235,143 -3.3% Full year n/a 269,600

Period 2022 Regs

2021 Regs +/-

Jan-Mar 38,922 33,45716.3% Jan-Jun 91,877 82,99010.7% Jan-Sep 135,800127,872 6.2% Full year n/a 166,513

Top Ten Manufacturers

October 2022 October 2021

THE UK’S LEADING SUPPLIER OF PARTS AND ACCESSORIES

1. Honda ...............1540 (7.6%) 2. Yamaha ............... 868 (-3.2%) 3. Triumph .............. 493 (-2.6%) 4. BMW ................ 422 (-8.9%) 5. Lexmoto .............. 348 (-39.1%) 6. KTM ................. 332 (-31.8%) 7. Royal Enfield .......... 328 (-24.8%) 8. Piaggio ............... 280 (1.4%) 9. Kawasaki ............. 273 (21.3%) 10. Ducati ................ 206 (N/A)

Rolling Year Comparison Rolling Year Comparison

18000 16000 14000 12000 10000 8000 6000 4000 2000 0

1. Honda 1431 2. Yamaha 897 3. Lexmoto 571 4. Triumph 506 5. KTM 487 6. BMW 463 7. Royal Enfield 436 8. Piaggio 276 9. Harley-Davidson 245 10. Kawasaki 225

2020/21 2021/22

Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct

For registration statistics for alternative power two-wheelers, see page 26

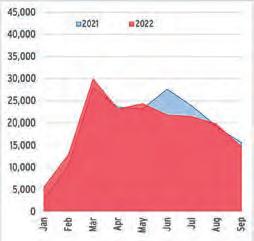

2022 motorcycle registrations data from key European markets

UK SALES OFFSET EUROPEAN LOSSES

THE UK MOTORCYCLE AND scooter market’s positive yearto-date figures helped to reduce overall European market falls over the first three quarters of 2022. For Europe’s largest five markets (France, Italy, Spain, Germany and the UK) the cumulative loss was 1.4% compared to 2021.

France felt the biggest pain, dropping by almost 8%, whereas the Spanish market enjoyed a bull run and maintained overall positive figures throughout the year, despite a marked slowdown in the most recent quarter.

Commenting, Antonio Perlot, ACEM secretary general, said: “Registration figures for the first three quarters of 2022 show that motorcycle and moped registrations in the EU’s key markets remain broadly stable, despite the challenges created by the shortage of semiconductors and shipping delays.

“Next quarter’s figures will allow us to assess the performance of the European motorcycle and moped markets for the entire year. We may see some differences between national markets. But our preliminary data suggest that motorcycle sales in 2022 will be as good as 2021, which was a very positive year for our industry”.

BECOME A DEALER TOO! visit: www.hocoparts.com or call: +44 (0)1484 641 073