4 minute read

UK economic outlook for 2023 and beyond

With the chancellor’s autumn statement now complete and the accompanying Office for Budget Responsibility’s economic and fiscal outlook report now assuming a pivotal role we summarise below the main findings of the latest OBR report.

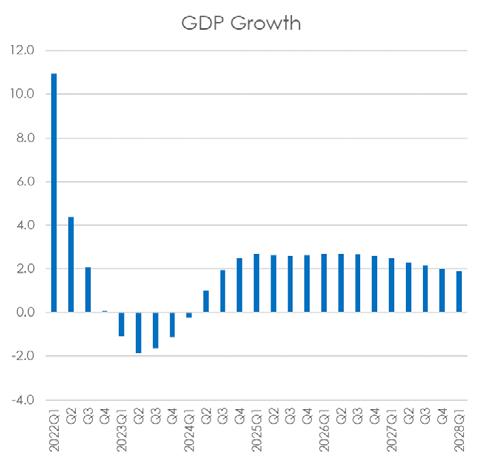

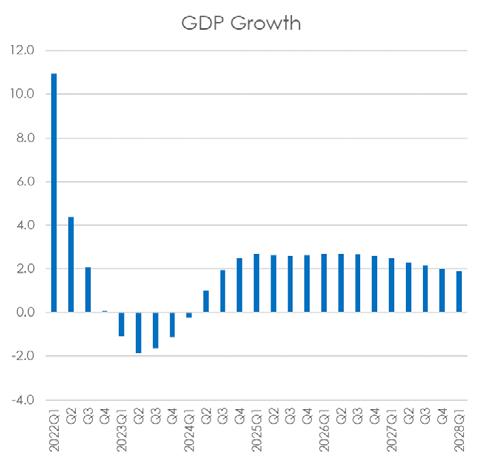

In terms of the key measure of GDP growth, Q3 this year showed a fall of 0.2% on the previous quarter (although still being up 2.1% on this time last year) and the expectation is that Q4 will see a similar decrease. For 2022 as a whole, better outcomes in the first half of the year mean the last year will still be about 4% higher than in 2021. However, Q1 2023 is expected to see the start of a prolonged recession with quarterly output decreases continuing until the end of March 2024 and with 2023 in total forecast to see a fall in annual GDP of -1.4%. The bottom of the downturn is expected to be reached in Q2 when the fall in GDP will reach a low point of -1.9% before easing to -1.6% in Q3 and -1.1% in Q4 2023. The downturn is forecast to continue into Q1 2024 with growth down -0.2% but Q2 is predicted to see an improvement of 1.0% with the year in total ending up 1.3% higher. Thereafter, the OBR expect annual growth to be 2.6% in 2025 and 2.7% in 2026.

Advertisement

In all cases, these forecasts are well below the previous predictions by the OBR back in March this year, with the earlier forecast of 1.8% growth for 2023 being sharply downgraded in the latest report to a fall of -1.4%.

For comparison purposes, the financial crisis of 2008/2009 (sometimes referred to as the great recession due to its longevity and depth) showed a decline in GDP of -4.2% at its low point while the recession of the early 1990s showed GDP down -1.2% in 1991. More recently, the policy induced recession resulting from the 2020 pandemic saw GDP crash by -9.1% before recovering strongly as the economy re-opened in 2021 and early 2022.

So, in summary the immediate outlook for 2023 is grim although not as bad as 2008/2009 and only slightly worse than the early 1990s but with better news on the horizon for 2024 and beyond. Having said this, much will depend on the forecasts coming good and nothing can be taken for granted with many factors being highly uncertain. Not least of these is the outlook for inflation, energy prices and the uncertainties of the continuing war in Ukraine which will all weigh heavily on the world economy and our industry.

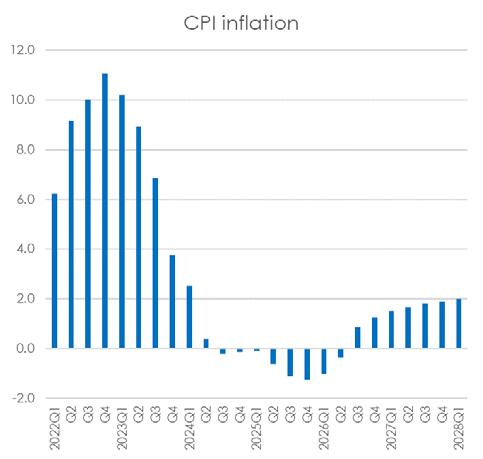

Consumer price inflation is now at a 40 year high of 11% for the latest month of October and the current year is expected to see an increase of 9.1% before falling back to 7.4% in 2023 as a whole. By Q4 2023 inflation is expected to be down to 3.8%, falling to just 0.4% 6 months later by Q2 2024, then followed by the rare spectacle of two years of negative inflation through to mid-2026.

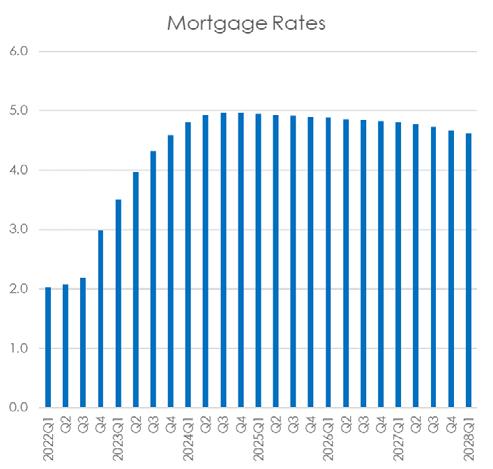

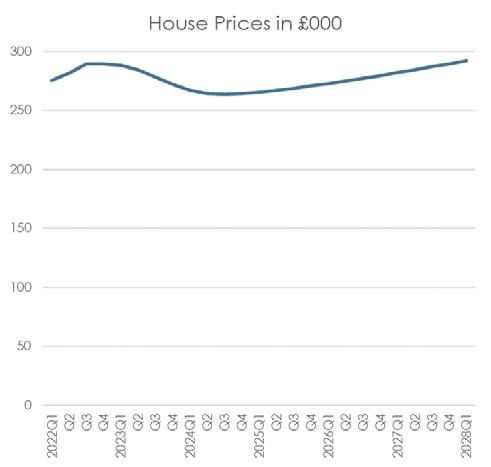

Looking at the other key measure affecting the UK economy, and especially the decorative paint market, the recent surge in interest rates since March this year confirms that the ultra-low rates of the last ten years are now clearly well and truly behind us with typical mortgage rates of about 4.5% for 2023 and 5% thereafter likely to be the new normal going forward. The OBR forecast that this will result in a fall in average house prices of about 9% from current peak levels between now and the end of Q3 2024. The impact of this is unclear, but usually lower prices result in reduced activity including lower new housing starts by builders, lower transactions and reduced activity across the board.