Q4 2023 | CHARLESTON, SC

INDUSTRIAL MARKET REPORT

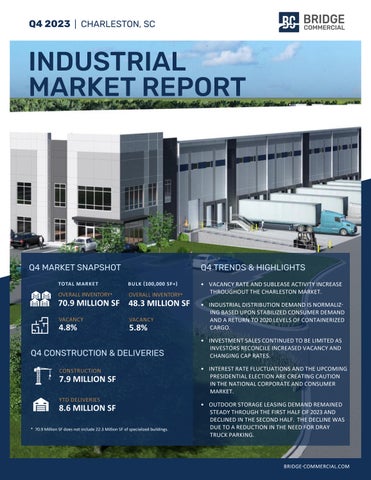

Q4 MARKET SNAPSHOT

Q4 TRENDS & HIGHLIGHTS

TOTAL MARKET

BULK (100,000 SF+)

OVERALL INVENTORY*

OVERALL INVENTORY*

70.9 MILLION SF 48.3 MILLION SF VACANCY

4.8%

VACANCY

5.8%

Q4 CONSTRUCTION & DELIVERIES CONSTRUCTION

7.9 MILLION SF YTD DELIVERIES

8.6 MILLION SF * 70.9 Million SF does not include 22.3 Million SF of specialized buildings.

• VACANCY RATE AND SUBLEASE ACTIVITY INCREASE THROUGHOUT THE CHARLESTON MARKET. • INDUSTRIAL DISTRIBUTION DEMAND IS NORMALIZING BASED UPON STABILIZED CONSUMER DEMAND AND A RETURN TO 2020 LEVELS OF CONTAINERIZED CARGO. • INVESTMENT SALES CONTINUED TO BE LIMITED AS INVESTORS RECONCILE INCREASED VACANCY AND CHANGING CAP RATES. • INTEREST RATE FLUCTUATIONS AND THE UPCOMING PRESIDENTIAL ELECTION ARE CREATING CAUTION IN THE NATIONAL CORPORATE AND CONSUMER MARKET. • OUTDOOR STORAGE LEASING DEMAND REMAINED STEADY THROUGH THE FIRST HALF OF 2023 AND DECLINED IN THE SECOND HALF. THE DECLINE WAS DUE TO A REDUCTION IN THE NEED FOR DRAY TRUCK PARKING.

BRIDGE-COMMERCIAL.COM

Q4 2023 charleston industrial MARKET REPORT

Q4 SUBMARKET SUMMARY PERCENTAGE BREAKDOWN BASED ON OVERALL SQUARE FOOTAGE BY TYPE, SIZE & CLASS Other

AVERAGE ASKING RENTAL RATES BY BUILDING TYPE/CLASS

CLASS A BULK WAREHOUSE

INDUSTRY TYPE Manufacturing

100,000 - 350,000 SF $7.25- $8.25 PSF NNN 350,000 SF + $6.75 - $7.50 PSF NNN

9%

Distribution / Warehouse

57%

34%

Distribution/Warehouse Manufacturing Other

CLASS B WAREHOUSE 50,000 SF - 200,000 SF + $6.50 - $7.75 PSF NNN

28%

200,000 SF + $5.50 - $6.25 PSF NNN

SIZE

29%

+500,000 SF 100,000 - 499,999 SF 10,000 - 99,999 SF

43% 500,000

SHALLOW BAY

200,000 - 499,999

100,000 - 199,999

16%

10,000 - 20,000 SF $11.00 - $14.00 PSF NNN 20,000 - 40,000 SF $10.00 - $12.00 PSF NNN

OVERALL CLASS

45%

39%

C ssalC

ALL NON-SPECIALIZED BUILDINGS (+10,000 SF) TOTAL VACANT SF

Class A: 172 Buildings

B ssalC

Class B: 431 Buildings Class C: 503 Buildings

A ssalC

YTD DELIVERIES SF

VACANCY RATE

UNDER CONSTRUCTION SF

568,971

3.33%

30,000

84,032

48

0

0.00%

0

127,000

9,761,563

108

400,873

4.11%

1,312,840

860,805

Clements Ferry

5,847,138

109

24,295

0.42%

0

0

Summerville/Jedburg

21,839,743

205

1,987,129

9.10%

3,221,063

5,038,811

Goose Creek/Moncks Corner

3,711,258

51

27,303

0.74%

0

135,200

Other*

7,570,198

90

407,755

5.39%

3,347,902

2,378,638

TOTAL MARKET**

70,931,127

1,111

3,416,326

4.82%

7,911,805

8,624,486

RBA SF

# OF BLDGS

Charleston/N. Charleston

17,086,662

500

Hanahan/North Rhett

5,114,565

Ladson/Palmetto

SUBMARKET

Bridge tracks buildings 10,000 SF and greater. Source: Bridge Commercial Bridge uses only internal research within its Charleston office for its market research. *Other includes Ridgeville, St. George and other outlying rural areas within +/-50 miles of I-26/526. **Total market statistics do not include specialty or specialty manufacturing buildings (22.3 Million SF). PG. 2

BRIDGE-COMMERCIAL.COM

Q4 2023 charleston industrial MARKET REPORT

CHARLESTON’S INDUSTRIAL MARKET CHANGES COURSE IN 2023

CHARLESTON’S INDUSTRIAL MARKET DRIVERS

2023 RECAP

AUTOMOTIVE MANUFACTURING

• Vacancy gradually increased throughout 2023 due to demand stabilizing in the second half of the year and new supply exceeding previous years of development.

AVIATION / BOEING

• Sublease activity has grown significantly in the second half of 2023 with square footage available totaling 1.7 million square feet within 10 buildings. • Record deliveries occurred with supply additions in 2023 totaling 8.6 million square feet. Under construction square footage totals 7.9 million square feet. This square footage is largely delivering between 1st and 2nd quarter of 2024.

PORT / SCSPA DEFENSE / NAVAL INFORMATION WAR COMMAND (NWIC)

• Rental rates stabilized with a slight decline toward the end of 2023 after historic growth over the last three years. • Investment activity was limited in 2023 due to major changes in interest rates and corresponding changes in cap rates. Cap rates are up 150 to 200 basis points from their lowest point.

2024 OUTLOOK • The Charleston region will see limited new construction starts. • Existing and new developments will have competition from each other as well as from sublease space. • Manufacturing in North America and Mexico will continue to increase with a focus on advanced manufacturing in the southeastern United States. • We expect additional corporate consolidations as manufacturers and distributors shift their focus to profitability from growth. • Government policy, such as the implementation of Inflation Reduction Act, has created opportunities for large government grants for domestic manufacturing particularly related to EV, energy and recycling projects. • 2024 is a pivotal election year for the U.S. presidency, and as such, brings anticipation of change for 2025.

#1

STATE IN THE U.S. FOR GROWTH IN MANUFACTURING JOBS SITE SELECTION GROUP | 2023

$926 MILLION IN

ECONOMIC IMPACT ANNOUNCEMENTS FY 22-23 CRDA.ORG

65+ AUTOMOTIVE

MANUFACTURERS & SUPPLIERS CRDA.ORG

BRIDGE-COMMERCIAL.COM

PG. 3

Q4 2023 charleston industrial MARKET REPORT

INDUSTRIAL OPPORTUNITIES

PORT 95 St. George ±1,219,772 SF Available (3 Buildings)

CHARLESTON LOGISTICS CENTER Summerville/Jedburg ±228,784 SF Available

2660 CARNER AVENUE Charleston/North Charleston ±50,000 SF Available

BERKELEY CHARLESTON TRADEPORT 3 Summerville/Jedburg ±354,202 SF Available

PORT CITY CENTRE Summerville/Jedburg ±489,918 SF Available (3 Buildings)

DORCHESTER COMMERCE CENTER Summerville/Jedburg ±534,081 SF Available (2 Buildings)

INDUSTRIAL ADVISORS HAGOOD MORRISON, SIOR, MBA, CRE Executive Vice President hagood.morrison@bridge-commercial.com PETER FENNELLY, MCR, SIOR, SLCR President peter.fennelly@bridge-commercial.com SIMONS JOHNSON, SIOR, MCR, CCIM Executive Vice President simons.johnson@bridge-commercial.com JOHN BEAM, SIOR Vice President john.beam@bridge-commercial.com WILL CROWELL, SIOR Vice President will.crowell@bridge-commercial.com

INVESTMENT ADVISOR HAGOOD S. MORRISON, II, SIOR Executive Vice President hs.morrison@bridge-commercial.com

PROPERTY MANAGEMENT MEREDITH MILLENDER, CPM Vice President of Property Management meredith.millender@bridge-commercial.com

SIGN UP FOR MARKET REPORTS AT www.bridge-commercial.com

NEED PROPERTY MANAGEMENT EXPERTISE? BRIDGE OFFERS PROPERTY MANAGEMENT, ACCOUNTING & PROJECT MANAGEMENT SERVICES

BRIDGE COMMERCIAL 25 Calhoun Street, Suite 220 Charleston, SC 29401 +1 843 535 8600 info@bridge-commercial.com Bridge Commercial uses only internal research within its Charleston office for its market data. Bridge Commercial makes no guarantees, representations or warranties of any kind, expressed or implied, including warranties of content, accuracy and reliability. Any interested party should do their own research as to the accuracy of the information. Bridge Commercial excludes warranties arising out of this document and excludes all liability for loss and damages arising out of this document.