CHARLESTON OFFICE MARKET REPORT

15,240,570 SF

• CONTRARY TO NATIONAL MEDIA CONVERSATION, THE OFFICE MARKET IN CHARLESTON IS STILL VERY VIBRANT AND ACTIVE AND GROWING.

• CHARLESTON’S OFFICE MARKET STARTED STRONG IN 2023. APPROXIMATELY 200,000 SF IS UNDER CONSTRUCTION WITH NEARLY TWO-THIRDS PRE-LEASED.

• CHARLESTON CONTINUES TO SEE JOB GROWTH THROUGH NEW AND MEDIUM-SIZED COMPANIES RELOCATING TO CHARLESTON, SPECIFICALLY IN THE TECH AND FINANCIAL SECTORS.

• LIMITED SUPPLY, HIGH CONSTRUCTION COSTS, AND RISING DEMAND FOR HIGHER-QUALITY SPACE WILL LIKELY CONTINUE TO INCREASE FUTURE RENT GROWTH.

NEXTON WWW.BRIDGE-COMMERCIAL.COM

2023 | CHARLESTON, SC

HIGHLIGHTS

Q1 MARKET SNAPSHOT Inventory

Q1

Q1

& TRENDS

Vacancy

Construction YTD

13.2% Asking Rents

Deliveries $29.04 SF 209,472 SF 145,000 SF

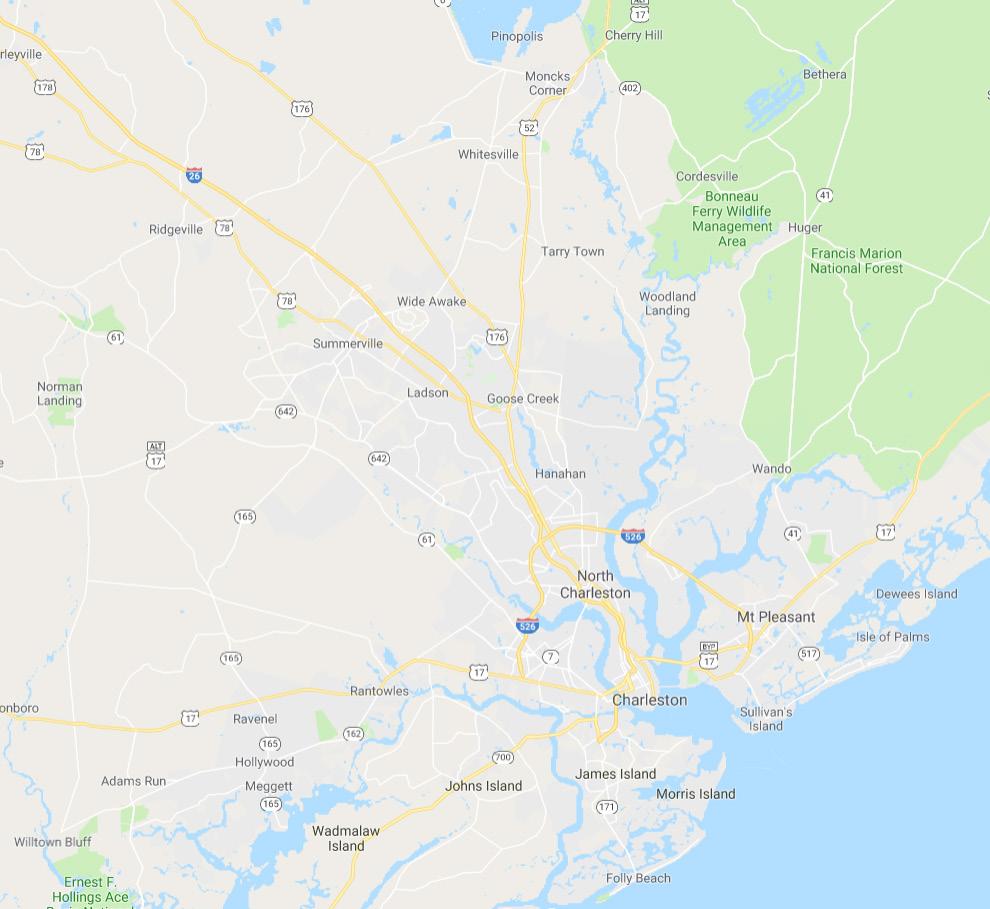

WWW.BRIDGE-COMMERCIAL.COM Lower North Charleston 3,098,108 370,561 72,631 443,192 $24.71 14.3% -Upper North Charleston 2,466,018 293,032 18,905 311,937 $23.79 12.6% -Mount Pleasant 2,235,676 145,308 37,681 182,989 $29.31 8.2% -Summerville 979,027 33,859 2,375 36,234 $23.69 3.7% 78,000West Ashley 1,159,784 72,870 4,295 77,165 $24.99 6.7% -TOTAL SUBURBAN 11,817,349 1,143,945 513,204 1,657,149 $26.73 14.0% 78,000 145,000 TOTAL MARKET 15,240,570 1,493,326 518,971 2,012,297 $29.04 13.2% 209,472 145,000 Bridge tracks buildings 10,000 SF and greater,

Bridge uses only internal research within

for

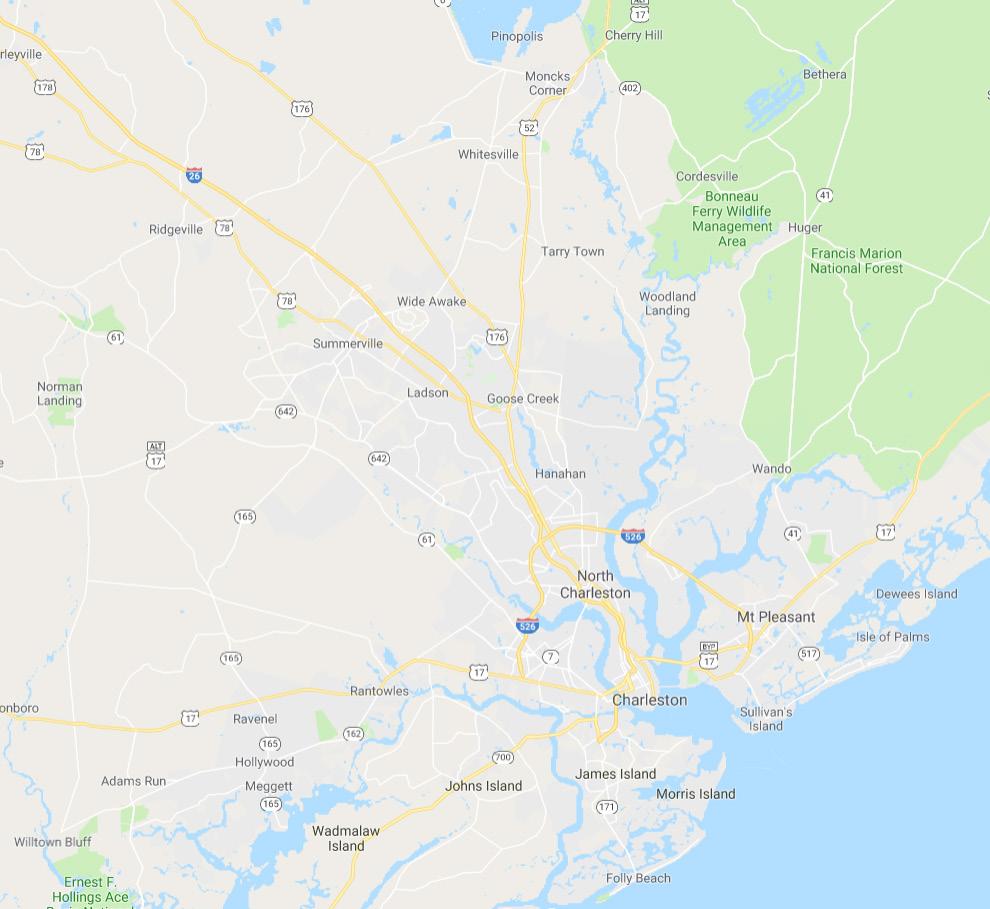

research. Source: Bridge Commercial 26 526 17 17 52 17A 78 UPPER NORTH CHARLESTON 12.6% Vacant $23.79 FS MOUNT PLEASANT 8.2% Vacant $29.31 FS DANIEL ISLAND 32.2% Vacant $30.67 FS WEST ASHLEY 6.7% Vacant $24.99 FS LOWER NORTH CHARLESTON 14.3% Vacant $24.71 FS DOWNTOWN 10.4% Vacant $37.59 FS SUMMERVILLE 3.7% Vacant $23.69 FS UNDER CONSTRUCTION PROPOSED CONSTRUCTION Q1 2023 charleston OFFICE MARKET REPORT PG. 2

excluding medical office and user-owned buildings.

its Charleston office

its market

CHARLESTON’S OFFICE MARKET EXPERIENCES GROWTH

Q1 RECAP

• The Greater Charleston market has seen continued population growth and job growth despite the drastic changes in interest rates and the changing national economy.

• Overall vacancy rates increased in the first quarter due to a handful of new projects delivering and a large amount of sublease space coming online.

• Many notable transactions took place in the first quarter, including:

- Morgan Stanley, Morrison Yard, 17,622 SF

- Undisclosed Tenant, The Morris, 11,081 SF

- OHMIQ, LLC, 3860 Faber Place, 10,068 SF

- Raptor Group Holdings, The Morris, 7,451 SF

- Sands Investment Group, 302 Wingo Way, 4,924 SF

- HNTB, Garco Mill Three, 4,900 SF

CONSTRUCTION CONTINUES

• Due to limited land, new construction has shifted from Downtown Charleston to suburban areas, such as the Summerville submarket, and particularly, the master- planned development, Nexton, which has approximately, 250,000 SF of office space currently being marketed.

• Developers continue to build out Charleston’s high-end office inventory more than any other metro in South Carolina over the past decade.

• Atlanta-based developer, Jamestown, is underway on Navy Yard, the conversion of a former U.S. Navy Base into a mixeduse project with residential, retail, and office space.

CHARLESTON’S GROWTH ECONONY

• According to the CRDA, overall job growth in Charleston is up more than 7% since February 2020, which equates to nearly 30,000 new jobs, 60% of which were in the traditionally office-using sectors of financial, technology, and professional services.

• Additionally, the CRDA reports the long-term growth of the technology sector in Charleston has given South Carolina one of the fastest increases in venture capital funding in 2022.

• Some of the largest office leases in Charleston in 2022 came from co-working companies, which appeal to entrepreneurs or remote workers attracted to Charleston’s historical amenities, beaches, and weather.

• Charleston’s relative affordability, fast-growing population, and educated workforce should help protect the market from the effects of any potential downturn.

NEXTON IS CHARLESTON’S NEWEST OFFICE HUB

BRIDGE-COMMERCIAL.COM

Q1 2023 charleston OFFICE MARKET REPORT PG. 3

ATELIER | 175,000 SF TOTAL 36,000 SF (PHASE I) | Q4 2024 DELIVERY

THE HUB @ NEXTON BUILDING 2 | 20,000 SF Q3 2024 DELIVERY

DAYFIELD PARK | 115,000 SF TOTAL 34,000 SF (PHASE I) | Q3 2024 DELIVERY

THE HUB @ NEXTON BUILDING 1 | 30,000 SF Q3 2025 DELIVERY

OFFICE ADVISORS

Q1 2023 charleston OFFICE MARKET REPORT www.bridge-commercial.com SIGN UP FOR MARKET REPORTS AT

MARK A. MATTISON, CCIM, SIOR Executive Vice President mark.mattison@bridge-commercial.com

BRIDGE COMMERCIAL 25 Calhoun Street, Suite 220 Charleston, SC 29401 Tel +1 843 535 8600 info@bridge-commercial.com

COLBY FARMER Senior Associate colby.farmer@bridge-commercial.com

Bridge Commercial uses only internal research within its Charleston office for its market data. Bridge Commercial makes no guarantees, representations or warranties of any kind, expressed or implied, including warranties of content, accuracy and reliability. Any interested party should do their own research as to the accuracy of the information. Bridge Commercial excludes warranties arising out of this document and excludes all liability for loss and damages arising out of this document.

PETER FENNELLY, MCR, SIOR, SLCR President peter.fennelly@bridge-commercial.com

INVESTMENT SALES THE HUB @NEXTON BUILDING 2 Summerville 50,000 SF Available 4360 CORPORATE ROAD North Charleston 38,834 SF Available FABER CROSSING North Charleston 10,000 SF Available DAYFIELD PARK @ NEXTON Summerville 34,000 SF Available (Phase I)

MICHAEL KELLY Brokerage Associate michael.kelly@bridge-commercial.com MEREDITH MILLENDER Vice President of Property Management meredith.millender@bridge-commercial.com PROPERTY MANAGEMENT BRIDGE OFFERS PROPERTY MANAGEMENT, ACCOUNTING & PROJECT MANAGEMENT SERVICES NEED PROPERTY MANAGEMENT EXPERTISE? THE LANDING Daniel Island 19,100 SF Available COLBY FARMER Associate +1 978 998 9243 colby.farmer@bridge-commercial.com WWW.BRIDGE-COMMERCIAL.COM MARK MATTISON SIOR, CCIM Executive Vice President +1 843 437 1545 mark.mattison@bridge-commercial.com OFFICE SPACE FOR LEASE LOCATED IN HIGHLY SOUGHT-AFTER EXECUTIVE PARK AT FABER PLACE $28.00 RSF FULL SERVICE 2,032 RSF - 34,816 RSF CLASS A OFFICE 4105 FABER PLACE DRIVE, NORTH CHARLESTON, SC 29405 OFFICE SPACE FOR LEASE FaberPointe Developed, Leased and Managed by Holder Properties MICHAEL KELLY Associate +1 843 568 2970 michael.kelly@bridge-commercial.com FABER POINTE North Charleston 24,988 SF Available ATELIER Summerville 36,000 SF Available (Phase I) OAKS AT CENTRE POINTE North Charleston 6,960 SF Available DANIEL PELLEGRINO Executive Vice President daniel.pellegrino@bridge-commercial.com

HAGOOD S. MORRISON, II, SIOR Senior Vice President hs.morrison@bridge-commercial.com

OFFICE OPPORTUNITIES