MARCH 22, 2024 Buy, Buy, Buy Tips for first-time homebuyers Be Our Guest Getting your home ready for an open house Homeward Bound Preparing for a long distance move Photo courtesy of Adobe Stock ESTATE GUIDE REAL THE PRESS

2B | WWW.THEPRESS.NET REAL ESTATE GUIDE MARCH 22, 2024

ANDREW RULLODA

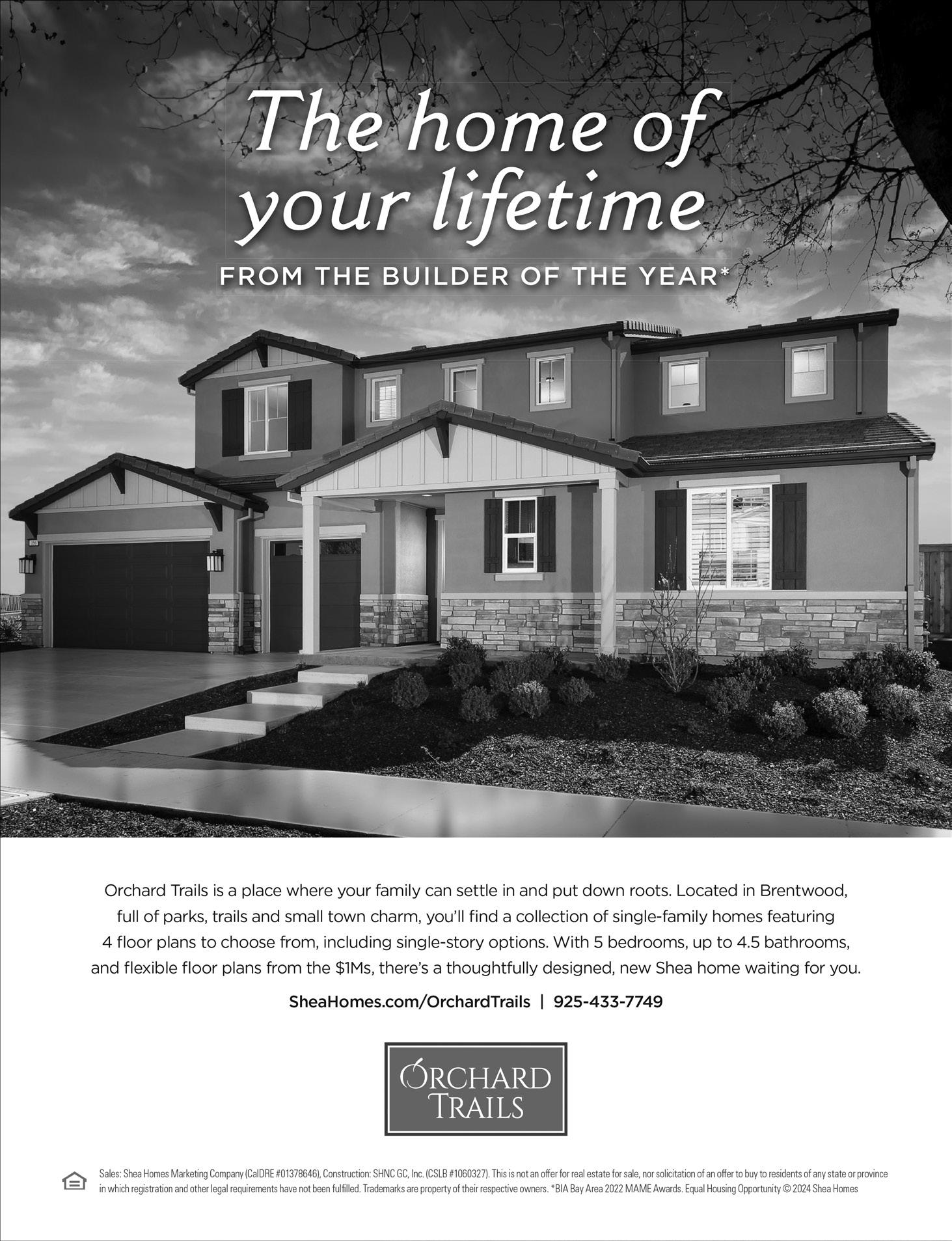

market. So whether you are staging for an empty house or a furnished one, here are three design tips on how a home should look when it comes to being ready for a photo or an open house.

Declutter - depersonalize

During your cleaning phase, if you are going to stage a furnished home, remove all personal items, especially photos of yourself and family members. Although it may seem harsh, it is important to transform the house so potential buyers can envision their own personal items in the home. Seeing other people’s family photos will remind the buyer that someone still lives there and it feels intrusive. Clear the counter tops. The only thing that a counter top should have is something decorative such as a vase of flowers, a few candles, or the Realtor’s flyer and information. The more you open the space, the easier it will be for the potential buyer to envision their dream home as they tour.

You can never have enough lights

If your home is lacking natural or electrical light, make sure every light switch that leads to a light source turns

on. Windows should be opened to their fullest, so open those curtains as well as any folding or automatic shutter and blinds. Bedroom closets, bathrooms and laundry rooms should all be lit up. Visually there is nothing more awkward when there are lights that do not work and show up in photos. It’s like leaving the toilet seat cover up.

Rooms with purpose

It’s important to assign roles for each room. The goal is to inspire the thought and creativity from the buyer. Even if a themed room is something you

wouldn’t do for yourself, the idea is to bring each room to life with their own story. So maybe now would be a good time to turn that reading room into a kids room, or turn the entertainment room into a small fitness room.

Staging your home for sale can be stressful. Working with many interior designers I’ve learned it’s best to stick with the basics and always leave room for creative thought for the buyer to work with.

To comment, visit www.thepress.net

MARCH 22, 2024 REAL ESTATE GUIDE WWW.THEPRESS.NE T | 3B *APR = Annual Percentage Rate. Your APR will vary based on your final loan amount and finance charges. Your actual payments are based on the interest rate, not the APR. The interest rates and Annual Percentage Rates (APRs) shown are subject to change without notice. All mortgage loans through 1st Nor Cal Credit Union are for primary residence homes in California only. Adequate property insurance required for the life of the loan. Flood insurance may be required. All loans subject to credit approval. Other restrictions may apply. Payment example: For a 30 year, $350,000 conforming mortgage and a fixed rate of 6.250% (6.343% APR), approximate payment amount is $2,155.02. The monthly payment includes principal and interest, as 1st Nor Cal CU does not offer impound accounts. NMLS # 580488 APPLY ONLINE 1stnorcalcu.org OR CALL US (925) 335-3870 2023 2023 SILVER MEDALAWARD THE PRESSBRENT WOOD You Can Still Get a Low Fixed Rate. 6.343% Buy or Refi Now and Save. Rates as low as APR* Lower rates available for shorter terms. 30-Year Fixed Rate, Low Fee Mortgages Top 3 tips when staging your open house H aving been a real estate photographer the past decade, I always find that a staged home can be one of the most important phases when putting a house on the

Photo by Andrew Rulloda

Preparing a home for an open house is one of the most important parts of selling. It gives homeowners a chance to make their home look better for potential buyers.

You Need The 40 Year Trusted Real Estate Market Leader In This Complex Transitional Market! Let the all-time leading broker in your marketplace provide you with the unparalleled real estate representation you deserve! and MarplesTeam @MarplesTeam SALES, LEASING AND PROPERTY MANAGEMENT TM Lic #00881485 CALL US TODAY (925) 634-8040 For All of Your Buying, Selling, Leasing & Property Management Needs BRENTWOOD OFFICE: 8340 Brentwood Blvd. Brentwood CA 94513 (925) 634-8040 DISCOVERY BAY OFFICE: 2453 Discovery Bay Blvd. Discovery Bay CA 94505 (925) 634-2224 www.MarplesTeam.com www.MarplesPM.com For a FREE detailed asset analysis of your property, please visit our website: www.MarplesTeam.com/PropertyValues 4B | WWW.THEPRESS.NET REAL ESTATE GUIDE MARCH 22, 2024

How to determine how much house you need

The mantra “bigger is better” is well known, but bigger homes may not be ideal for all buyers. “How much home do I really need?” is an important question for buyers to ask themselves before they embark on their home-buying journeys. Here’s how buyers can identify how much house they need.

How many occupants will be living in the home?

The first consideration in home size is the number of residents. Rocket Mortgage says a good rule of thumb is to give each person 600 square feet of space. So that means a family of four would ideally live in a home that is 2,400 square feet, while a couple may be fine in a 1,200-square-foot home.

Number of rooms

Generally speaking, the more rooms in a home, the larger the house. Potential buyers should identify rooms they feel are essential. While formal dining rooms once were de rigueur, they largely fell out of favor in recent years in lieu of open floor plans. The more rooms you need, the larger a house should be.

Potential life changes

It’s important to consider life changes on the horizon, and buyers should decide if they want to move as a result of those changes or if they want to set down strong roots and stay in one home. For example, a starter home may be perfect for newlyweds, but the space may be too tight when kids come along. Also, those who anticipate caring for a parent in the future may want a home that will accommodate an extra resident in the years ahead.

Tiny house movement

The trend to live in small houses has gained popularity in recent years. Many people have chosen to live with less and downsize to diminutive homes. Most “tiny” homes are less than 400 square feet and are not much bigger than some owner’s suites in larger homes. There are merits to small homes, and that includes a small environmental impact, less clutter, financial advantages, and other perks like spending more time outdoors.

Housing budget

Sometimes, how much house a person needs comes down to how much he or she can afford. Small homes tend to be less expensive than large ones. However, even small homes in urban areas or those close to the water or other attractive amenities could still cost quite a bit.

– Courtesy of Metro Creative

MARCH 22, 2024 REAL ESTATE GUIDE WWW.THEPRESS.NET | 5B Patrick McCarran “Know Your Options” • Text or email for a buyer handbook • Sellers ask for a free list of staging tips • Contact me for a FREE Market Evaluation (925) 899-5536 www.CallPatrick.com pmccarran@yahoo.com Patrick McCarran DRE# 01325072 In association with Realty One Group Elite DRE#01931601 BUY OR SELL A HOME WITH THE DEBBIE ANTHONY TEAM AND RECEIVE A FREE HOME WARRANTY AT A VALUE UP TO $525.00 PLEASE CONTACT US FOR A FREE HOME VALUATION NO CHARGE NO OBLIGATION. Debbie Anthony is your Realtor Neighbor in Summerset Vista The Debbie Anthony team can assist with all of your Real Estate needs – buying or selling –in Contra Costa County and surrounding areas. www.SoldByTracyNelson.com S ocial Handle: @EastBayAreaRealtor Tracy Nelson East Bay Area Realtor® FIND YOUR HOME VALUE 925.872.0400 ‘The Best Move You’ll Ever Make’ EXPERIENCE | INTEGRITY | RESULTS DRE 01841691

3 tips for first-time home buyers

Real estate has garnered considerable attention since 2020, and for good reason. Though speculators and real estate professionals may point to a number of variables that have affected the market for homes in recent years, the pandemic certainly was among those factors. Real estate prices and mortgage interest rates increased significantly during the pandemic and have remained well above pre-pandemic levels ever since.

The spike in home prices and interest rates has had a significant impact on young home buyers, some of whom feel as though their dream of home ownership may never be realized. Data from the National Association of Realtors (NAR) indicates the median age of home buyers is now significantly higher than it was two decades ago. In 2023, the median age of buyers was 49, which marked an increase of 10 years compared to the average buyer age 20 years ago.

First-time home buyers may face a more

challenging real estate market than they would have encountered just a half decade ago. The following three tips can help such buyers successfully navigate the market as they look to purchase their first home.

1. Expect to move quickly. Inventory remains very low, which means buyers are in heated competition for the few homes that are on the market. In late 2023, NAR

data indicated the rate of home sales was the lowest they had been in 13 years, so buyers will likely need to move quickly and make an offer if they see a home they like, as chances are the property won’t be on the market too long before it’s sold. In fact, the NAR noted that homes spent an average of just 23 days on the market in October 2023.

2. Apply for mortgage preapproval. The competitive nature of the market for buyers means it’s in their best interests to arrange financing prior to beginning their home search. A mortgage pre-approval can be a competitive advantage, as it indicates to sellers that buyers won’t be denied a mortgage or lack financing after making an offer. The financial experts at NerdWallet note that buyers will be asked to provide details about their employment, income, debt, and financial accounts when applying for mortgage pre-approval. Gather this information and clear up any issues, such as credit disputes or delinquent accounts, prior to applying for pre-approval.

3. Set a realistic budget and expect to offer over the asking price. A financial planner and/or real estate professional can help first-time buyers determine how much they should be spending on a home. In the current market, buyers should know that they will likely need to pay more than the asking price for a home. For example, the NAR reports that 28 percent of homes sold for above list price in October 2023. With that in mind, first-time buyers may do well to look for homes that are under budget in anticipation of offering more than list price after seeing a property.

– Courtesy of Metro Creative

6B | WWW.THEPRESS.NET REAL ESTATE GUIDE MARCH 22, 2024

Courtesy of Metro Creative The real estate market remains competitive for buyers. First-time buyers can use three strategies to increase their chances of realizing their dream of home ownership. See our web site for money saving coupons! www.fairviewair.com 925-625-4963 Fax 925-625-7816 100-A Brownstone Road, Oakley, CA 94561 Contractor’s Lic. #533790 C-20 FAIRVIEW HEATING & AIR CONDITIONING, INC. Service • Repair • Installation Large Enough to Serve You, Small Enough to Know You! We have our own line of AMERICAN assembled HVAC equipment that comes with 10 year parts and labor warranties standard and we give a 1 year money back guarantee on all HVAC replacements. 35th Business Anniversary HVAC Repair HVAC Maintenance HVAC Replacement Indoor Air Quality FREE ESTIMATES ON FURNACE AND A/C REPLACEMENTS HOME OF THE $79 A/C OR FURNACE TUNE-UP After $50 Mail-in Rebate. Expires 9-22-24. 20 2021 1 BRENTWOOD GOLD MEDALAWARD THE PRESS SPECIAL REBATES AND CREDITS UP TO $10,250 FOR QUALIFYING UNITS 20 2023 3 OA K LEY GOLD MEDALAWARD THE PRESS

Planning a smooth long-distance move

Prospective home buyers are widening their home search areas to find new places to live. The National Association of Realtors says the median distance that buyers traveled to their new homes was 50 miles in 2022, which was triple the median distance that most people clocked in the 30 years prior. Still, the NAR 2022 Profile of Home Buyers and Sellers also indicated one-quarter of buyers studied traveled more than 470 miles to find new homes.

Home prices have been historically high in recent years and those prices are not expected to drop anytime soon. So a greater number of people may be looking for homes well outside of their current metro areas. Buying a house far from home base requires some extra know-how, and these tips can help the process.

♦ Contact a local real estate agent early on. Working with a qualified agent can facilitate the process of a long-distance move. As a long-distance buyer, you likely won’t be available to drop into a new listing on a moment’s notice if you live hundreds of miles away. A local real estate agent can visit homes and present his or her findings, or even provide video walk-throughs so you can see properties in real time. This person also will offer guidance through every step of a real estate transaction.

♦ Start calling for estimates. Once you’ve zeroed in on where you would like to move, start pricing out moving companies that can safely transport all of your belongings from point A to point B. Some homeowners prefer using a storage/moving service, particularly if there is a lag between when the current residence is sold and the new one is available. Also, storing items prior means having access to an entirely empty home to make improvements before furniture and other belongings are moved in.

♦ Make a plan and stick to the schedule. There are a lot of moving pieces to a long-distance move. It is important to make a task list early on and cross off each job as it is completed to help stay on track. Strongly consider purchasing moving insurance to protect belongings in the move, as many moving companies offer limited insurance, and check to see if your automotive and home insurance plans cover moving.

♦ Create an inventory and packing system. Itemize all of your belongings and establish a system for packing so that you’ll know where each item is. This can help you recognize if any boxes go missing. Also, pack boxes with distance in mind, as things

will likely get jostled more so than if they were only traveling down the street.

♦ Consider moving during the offseason. Lots of people prioritize moving in the spring and summer, particularly if they have children attending school. This is the busiest and most expensive time to move. Moving during less busy times of year to move can cut down on stress and may be more frugal.

– Courtesy of Metro Creative

www.EdwardYoungerLaw.com 420 Beatrice Court, Brentwood DON’T LEAVE YOUR FAMILY AT RISK! STOP PROCRASTINATING! Prepare for the future well-being of your loved ones and get an up-to-date Will, Trust or Estate Plan put together. 925-420-4111 www.edwardyoungerlaw.com 1210 Central Blvd. Brentwood ~ Gift Certificate ~ $101 OFF FULL TRUST/ESTATE PLAN OR BUSINESS LAW PACKAGE Hurry! Limited time offer! Call for an appointment! 20 2023 3 BRENTWOOD GOLD MEDALAWARD THE PRESS MARCH 22, 2024 REAL ESTATE GUIDE WWW.THEPRESS.NE T | 7B

200 SAND CREEK ROAD, SUITE A, BRENTWOOD, CA 94513 | 925.634.1010 | WWW.OLDREPUBLICTITLE.COM SUCCESS STORIES ARE WRITTEN TOGETHER

04/2023 | © 2023 Old Republic Title

ANDY PERRYAIMEE RODRIGUEZFARIS SANCHEZ-TISCHLERLISA LOUIETINA GARCIA

8B | WWW.THEPRESS.NET REAL ESTATE GUIDE MARCH 22, 2024