The March issue of InTouch has traditionally focused on our Business Excellence Awards Finalists – with good reason. One of the perks of my role is the absolute honour of assisting in the production of the three minute videos that the Chamber produces with the help of Atomic Spark each year, as interviews and visual representations of the businesses and organizations and the work they do. For the past 39 years, our members have nominated their fellow members across categories important to the community, and our finalists have confirmed their eligibility, before they sit down with the CEO to discuss the how and why their organization is delivering an exceptional experience to their clients, staff, and the community.

Many, if not all, finalists are simply doing what they love, and that passion is transforming our community

through great organizations led by warm and caring people, whether a technical trade, exceptional service, volunteering and supporting others, or being a quiet leader. A consistent message with nearly every finalist is

that they want to give back to the community that supports them. The 39th Annual Business Excellence Awards, presented by BDO Canada LLP, will continue the tradition of telling the story of our community through its businesses. Please mark your calendars for Thursday, May 4th, and join us at what will be a very memorable evening.

This issue also leads into our AGM on March 28th. Please join us at the Rope Factory Event Hall to meet your 2023 Board, review our updated Strategic Plan, learn directly about some of the new initiatives of the Chamber and how it is evolving with your help, and toast to a strong set of core financial and operational practices that have led to our Re-Accreditation as a Chamber of Commerce demonstrating excellence in practice amongst our peers across Canada. See you there! I

Bisanti. “Private sector money has to be earning reasonable returns [on investment].”

By Serena AustinIt’s no secret that Canada is facing a housing crisis. As housing costs continue to soar beyond what’s considered affordable to many, now, more than ever, it’s important to consider the factors driving the crisis both on a national and local level.

“What we’re going through right now with a combined interest rate hike and the lack of supply of new housing units on the markets, is contributing to a quickly getting out of control pricing paradigm that we’re in,” said Paul Bisanti, President of the Chamber of Commerce Brantford-Brant.

In his private sector role, Bisanti works as a residential real estate developer where he’s seen the price of land and construction increase year after year. These price hikes have affected the rental market too.

“It really fostered that unaffordability factor for a lot of people,” said David DeDominicis, President of the Brantford Regional Real Estate Association (BRREA). “As an industry, we don’t see rent coming down anytime soon because the supply is still very tight.”

Bisanti typically spends around two to three years on planning and design work before construction can start.

“All that planning and design work has to happen before I sell a single unit,” he said. Because of this, it’s unrealistic to expect the private sector to build houses for those who can’t afford what’s already on the market, said

In effort to address the housing crisis in Ontario, In November, the Ford government passed Bill 23, the More Homes Built Better Faster Act. A piece of legislation meant to support the construction of 1.5 million homes over the next decade with the removal of developer fees paid to municipalities as incentive.

“It’s going to propose a tremendous challenge for municipalities to adjust to,” said Bisanti. Some municipalities such as Hamilton, Milton and Mississauga have spoken out against the act for fears that it may do more harm than good.

Brantford and Brant are forward

thinking, said Bisanti, and have been working with developers to get housing projects started. “Is it going to be enough to address Bill 23 — I don’t know what time will tell, but I know that the local effort is a very strong one,” he said.

DeDominicis hopes to see Bill 23 result in the creation of more affordable housing units through “inclusionary zoning,” he said. “Largely, Brantford is suburban, single family [housing]. So it’s all about intensification.”

Housing is just one of the few issues Canadian citizens are facing today. “Everything is so intertwined, but housing is at the heart of it,” said Bisanti.

Serena Austin is a fourth-year Digital Media and Journalism student at Laurier Brantford.

n Brant Build

LANDSCAPE CONTRACTORS & DESIGNERS

Rob Reid (519) 752-2183

rob@brantbuild.com

Brantford, ON

n BTOWN

JOURNAL & MAGAZINE PUBLISHERS

Amanda Mersereau (519) 304-8255

brantfordapparel@gmail.com

433 Colborne St. Brantford, ON

n JonAyves Learning Club

TUTORING

Maxwell Roach (416) 522-8880 consultant.roach@gmail.com Brantford, ON

n REED Signature Interiors

RENOVATIONS & HOME IMPROVEMENTS

Tyler Reed (289) 442-0044

tyler@reedinteriors.ca

1-28 Lyons Ave. Brantford, ON

n Sadeki Simpson, Edward Jones

FINANCIAL PLANNING CONSULTANTS

Sadeki Simpson (519) 861-3993

Sadeki.simpson@edwardjones.com

442 Grey St. Unit L Brantford, ON

n Scotlynn

TRANSPORTATION SERVICE

Michelle Cochrane (800) 263-9117

info@scotlynn.com

1150 Vittoria Rd. Vittoria, ON

n Tonik Cannabis

MARIJUANA RETAIL

Anthony Horvath (519) 304-5040

anthonyh@tonikcannabis.com

560 West St. Brantford, ON

n Urban Tactical Brantford

SPORTING GOODS - RETAIL

Kyle Deep (519) 753-8776

kyle.deep@urbantactical.com

18 Zatonski Ave. Brantford, ON

n The Water Bar

WATER PURIFICATION & FILTRATION

EQUIPMENT

Bahar Jaberianmarkaz (519) 759-8333

waterbarbrant@gmail.com

97 Charing Cross St. Brantford, ON

Chamber of Commerce Brantford-Brant provides Commissioning Services for Certificates of Origin and other documents. $18 plus HST for Chamber Members. $36 plus HST for non-members. Call (519) 753-2617, ext 25 for more information.

Tasty Road Trips Inc., is an experiential culinary tourism adventure business founded by Jan Vilaca (Spicy Jan) in 2018 with a focus on rural Brant. In 2019, Tasty Road Trips Tours was nominated and won the Community Influencer Award by the County of Brant Business Awards. Through unique culinary experiences, Spicy Jan highlights Ontario farmers, chefs, food creators, bakers, and jelly makers as well as art, history, and agriculture. All this delicious experiential fun, supports over 220 destination hosts in the region. Many of our guests include new homeowners to the area, visiting corporate clients, as well as tourists and visitors looking to explore small town Ontario. Tasty Road Trips has curated a unique way for family, friends & corporate teams to connect again, through authentic multi-sensory local & travel adventures.

What started with one Saturday afternoon guided food tour in Brant, has expanded into self-guided allinclusive and self-directed pay-as-yougo experiences in Brantford, Norfolk, Oxford, Haldimand, Brant, Stoney Creek, Grimsby, Waterloo Region and newly in downtown Toronto. Spicy Jan is also a travel host and enjoys global group-travel opportunities and is now

moving to offer corporate incentive travel hosting as well. There is never a dull moment when culinary tourism is on the menu.

Services include:

n Self-guided walking and driving tasting experiences

n In person and virtual experiential team building

n Private group tours – corporate, celebrations and conference delegates

n #CraveON Box – Corporate gifting and quarterly subscription box (food focused only)

Contact Jan to talk through a travel incentive or taste box idea for your team or delicious client appreciation ideas. Reach Jan directly at: jan@tastyroadtrips.com or call 226-802-0486

and many more established businesses who pivoted and adjusted business plans to fit a new economic climate. I received more phone calls and texts from members in 2022 than ever before asking for connections with members in certain industries, recommendations for local experts, and general advice on ways to build relationships with other local business leaders.

If you’ve never been to a Business After Hours event (or if it’s been a while,) consider coming to the next one; I’ve always said that we’re blessed in the City of Brantford, the County of Brant, and Six Nations to have a business community full of folks who want to see each other succeed and who will go out of their way to assist in any way they can.

Now that we have the first couple of months of 2023 under our belts, it’s a time when a lot of us review whether we’ve kept our promises from the new year; finally get some use out of that gym membership, turn your two nightly glasses of pinot into one (okay, one and a half…) or to finally figure out what died in your garage to cause that awful smell.

But we can use a new year and new beginnings to reflect on the past year to celebrate wins and reflect on the things we’ve done right. What personal benchmarks did you meet? What new strategies worked in both your personal and professional lives? What lessons did you learn from your failures to make 2023 an even smoother ride?

As Homer Simpson once said, “Trying is the first step towards failure.” While he was using the line to talk Marge out of becoming a real estate agent – stay off the West Side – that piece of advice is one we should all take to heart. Don’t be afraid to try new things, get a little outside your comfort zone, and shake up some parts of your business you think could be improved.

We saw so many new Brantford-Brant businesses open and thrive in 2022,

It’s fitting that we’re using this issue to announce our 2023 Business Excellence Awards finalists, because each and every one of those incredible organizations will tell you that they didn’t get where they are today without making mistakes and connecting with other local businesses for advice.

Leverage your membership to connect with the local business community to help reflect and learn as a group. Let your fellow members in on the mistakes you’ve made and the lessons you’ve learned and I promise you’ll pick up some tips along the way that can help 2023 be your best year yet.

Planning to keep a business in the family often means that a business owner needs to consider the legal implications of transferring business assets to a relative. A prudent business owner should think about family law and the property rights of the extended family –namely, spouses and common law partners. A measure of forethought and some timely advice for the intended recipient can go a long way toward ensuring that inherited business assets are passed down however the original owner intends. A spouse may use family law to protect inherited business assets in the event of a separation or divorce. Under Ontario’s Family Law Act, inherited assets are generally excluded from a married couples’ “net family property” and thus are not subject to division in the event of a marriage breakdown. In other words, exclusion of assets means that they can remain untouched should a separation occur. However, the treatment of inherited assets after acquisition can later cause that excludability to be lost, leading to these assets (or the value of the assets) being divided with a spouse according to applicable family law principles.

While the law in this regard is full of nuances, two common circumstances may lead to one spouse sharing in the business interests of the other. Firstly,

though the excludability of inherited assets might be clear at the time of their initial transfer, this exclusion is muddled if ownership of business assets is thereafter shared with a spouse or if the assets are commingled with the family’s general finances (a particular point of consideration for sole proprietorship business models). Secondly, even if ownership of the business or related assets is kept distinct, the non-owner spouse will sometimes gain an interest in a business or its value after taking on a significant internal role or otherwise contributing to the success of the business, either through labour or financial contributions.

Even common law spouses – who do not presumptively share in the same joint economic partnership as married spouses – may similarly come to have an interest in inherited business assets of the other partner unless clear advance steps are taken to define mutual expectations about the parties’ rights in the family business.

Encouraging the intended recipient of business assets to meet with a family law lawyer can help to build

a cohesive post-inheritance plan grounded in a meaningful appreciation of what property will or will not be shared with a spouse. Better still, a well-crafted “domestic contract,” such as a prenuptial agreement or cohabitation agreement, can bring the other spouse or common law partner into the discussion, securing advance arrangements and a mutual understanding about the extent to which inherited business assets will be shared, and any limits which will be imposed.

Whether seeking legal advice, making a domestic contract, or dealing with disputes arising at a later stage, the lawyers at Waterous Holden Amey Hitchon LLP have experience navigating wide-ranging considerations dealing with the intersections between business ownership and family law.

When Mary Jayne’s mother moved into Chartwell Tranquility Place Retirement Residence in the fall of 2019, she wasn’t sure what to expect. Now she believes it was the best move she could have made.

“Her apartment is bright and comfortable and overlooks a nice grass area and garden. It’s an easy walk to Walmart and Zehrs,” Mary Jayne begins. “Mom has made many friendships. Lifestyle activity staff are very upbeat and have thought of

several nice activities. Mom hires their staff to clean her apartment… they are very cheerful and do a thorough job. These ladies and other staff are always there to help Mom with any of her questions or concerns.”

As society continues to shift back to pre-pandemic norms, older adults who have delayed a decision to downsize or seek a living arrangement that provides more freedom from the responsibilities of home ownership have begun to consider their options again.

There is no denying that for many, the prospect of less time and energy spent on home and property maintenance and more opportunities to socialize or pursue interests have increased because of the past three years.

Chartwell Tranquility Place is an established residence with a strong reputation in North Brantford offering

a range of service and care options for a fulfilling retirement. That includes spacious suites in the retirement residence where seniors can access flexible services based on their individual needs and preferences, as well as a dedicated seniors’ apartment building for active and independent older adults.

“The residence is very well run, and the staff is wonderful,” concludes fellow adult child, William. “We are so grateful that our mother is happy and feels secure living at Tranquility Place.”

Explore the lifestyle at Chartwell Tranquility Place today by calling 519-759-2222 or visiting chartwell.com

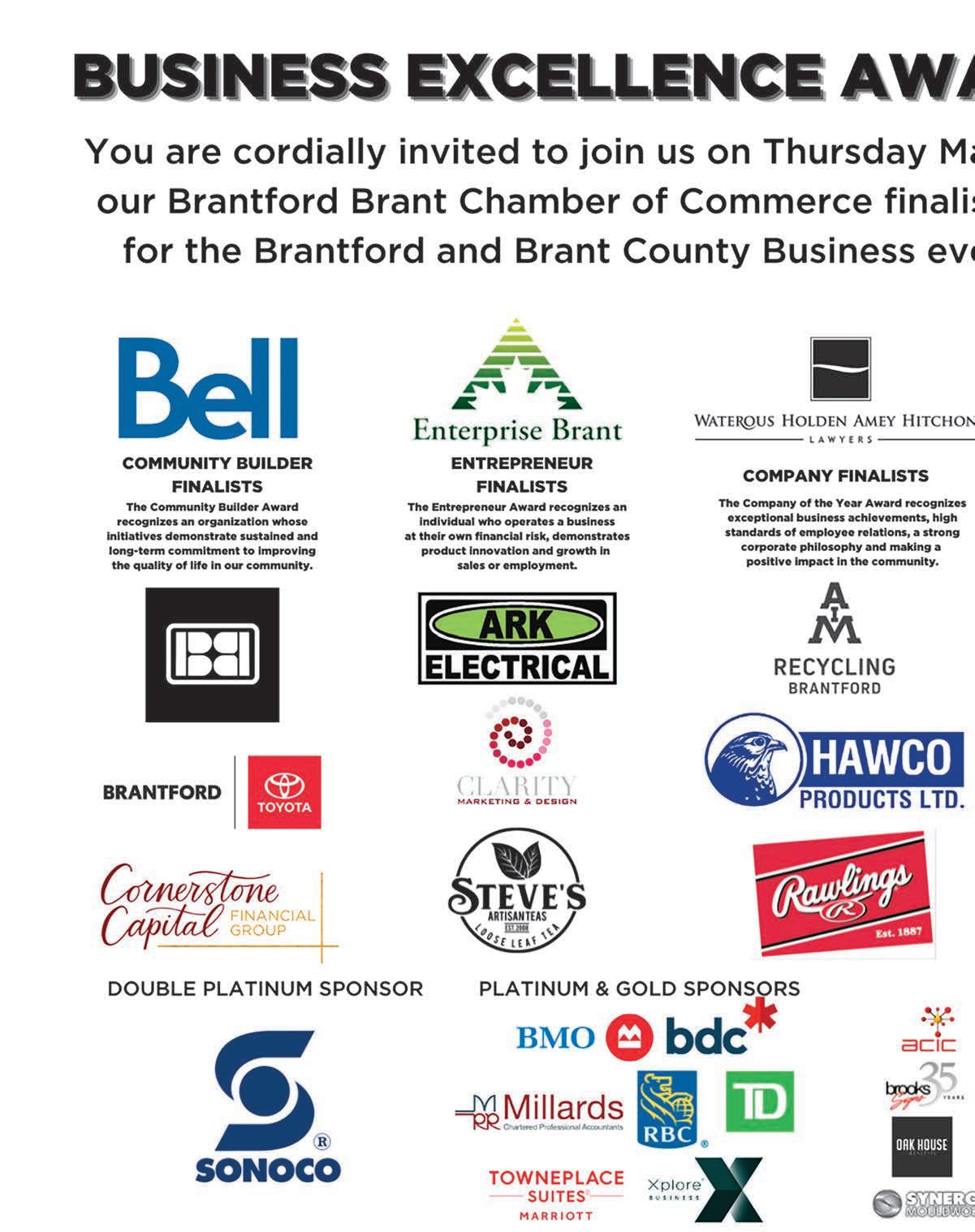

The Community Builder Award recognizes an organization whose initatives demonstrate a sustained and long-term commitment to improving the quality of life in our community.

The Entrepreneur Award recognizes an individual who operates a business at their own financial risk, demonstrates product innovation and growth in sales or employment.

The Company of the Year Award recognizes exceptional business achievements, high standards of employee relations, a strong corporate philosophy and making a positive impact in the community.

DOUBLE PLATINUM SPONSOR

The Diversity, Equity and Inclusion Award recognizes organizations that demonstrate an exceptional commitment to creating workplaces that are inclusive, respectful, and reflective of the community in which they exist.

The Not-For-Profit Resiliency and Business Acumen Award is specifically for not-for-profit organizations and/or charities that have demonstrated exceptional business practises that strengthen their ability to be more efficient, effective and/or resilient.

MILLARD

PARTNERS:

M.J. Dixon, CPA, CA • R.D. Sciannella CPA, CA, CBV • H.C. Johnston CPA, CA • S.E. Goodwin, CPA, CA

•D.A. Cleary, CPA, CGA, CFI • S.D. Klein, CPA, CA • G.S. Gravett, CPA, CA • S.A. Salole, CPA, CA

•J.B. Baetz, CPA, CA • R.W. Storoschuk, CPA, CA • S.W. McGaghran, CPA, CA • J.E. Chowhan, CPA, CA

•P.E. Merrylees, CPA, CA • J.A. Laporte, CPA, CA • R.A. Parker, CPA, CGA, CFI • G.M. Malecki, CPA, CA

•Q.E. Bateson-Hotte, CPA, CA, LPA • W.A. Deane, CPA, CA

ASSOCIATES:

B.Y. Brenneman, CPA, CA • C.J. Storoschuk, CPA, CA • K.B. Weames, CPA, CA • D.E. Paxton, CPA, CA

•M.M. Malecki, CPA CA • N.T. Nguyen, CPA CA • S.C. Dykstra, CPA CA • Wes. E.B. Caldwell, CPA CA

•T.W. Schein, CPA, CA

The Underused Housing Tax (UHT) is applicable to certain underused and vacant properties effective January 1, 2022. The tax is 1% of the fair market value of the property multiplied by the ownership percentage. The reporting and payment of the UHT is due on or before April 30th of the following calendar year; the first UHT returns will be due on April 30th, 2023.

The UHT may apply on the following types of residential properties in Canada,

n Detached house, duplexes and triplexes

n Rowhouse

n Semi-detached

n Residential condominium units

Any taxpayer who meets the criteria of an excluded owner has no obligation or liability under the UHT; an excluded owner includes but is not limited to,

n Any individual who is a Canadian citizen or permanent resident

n Any person, including a Canadian citizen or permanent resident that owns residential property as a trustee

n Publicly traded Canadian corporations

n Registered charities

n Cooperative housing units

n Municipal organizations or public institutions and government bodies

Those not noted above will be referred

to as an affected owner, which includes but is not limited to,

n Any individual who is not a Canadian citizen or permanent

n Any person, including a Canadian citizen or permanent resident that owns residential property as a trustee

n Partners of a partnership that owns residential property

n Corporations incorporated outside of Canada

n Private Canadian corporations

n Canadian corporations without share capital

Exemptions from the UHT are available depending on the ownership and use the property. The UHT may be exempted where the property was recently constructed, can only be used seasonally, uninhabitable due to a disaster, used as a vacation property by the owner or if the property is used by a tenant for at least six months. The exemption does not relieve the requirement to file a UHT return.

If you directly or indirectly own

a residential property that was underused in 2022, please contact a tax professional to better understand your exposure to the UHT and possible filing requirements. One area of concern that we have identified is where property is held by a private Canadian corporation that may be underused due to the nature of its use, such as residential properties for seasonal workers or residential rental properties for short stays (i.e. Airbnb, Vrbo, etc.). Penalties for non-compliance of the UHT start at $5,000 and can be higher depending on the filing date and the value of the residence

The information provided is a summary of the UHT and does not constitute professional advice. Please contact our offices in Brantford, Simcoe, Hagersville and Port Dover and we will gladly assist you in navigating the new UHT. Or visit us at www.millards.com

I

Your leadership investment in the Chamber allows the Board, volunteers, and staff to deliver and work on many events, projects, and issues to improve the environment for doing business in Brantford-Brant, Ontario, Canada, and internationally. Many issues businesses are struggling with in Brantford-Brant are also challenges for businesses in other regions, and vice-versa, and the power of the network of Chambers of Commerce and Boards of Trade to share information and ideas and to collaborate has been strengthened over the past three years.

Recently, a policy resolution developed by our Education Committee in 2019

went through a full cycle, which is important to illustrate. “Maintaining Investment and Innovation in Ontario’s Pubic Education System” was developed to respond to concerns from our about inefficient and ineffective investment in education, and recommended better planning in this area. The policy was approved by our Advocacy Committee and Board, and passed on the policy convention floor in 2019 as an official policy of the Ontario Chamber of Commerce. The OCC, in a January press release marking the International Day of Education, noted that the “Ontario government has introduced several initiatives to promote the skilled trades as a viable career for young people, expand financial literacy within Ontario’s education curriculum and continues to modernizing the computer studies and tech-ed curriculum to promote digital literacy. Ontario’s diversity is an

economic advantage, but we must ensure barriers to accessing education and training programs are eroded, particularly for equity-deserving groups.” Certainly this item will need ongoing attention, but for 2023, our policy will be “sun-setting” from the OCC’s policy compendium, while concurrently our Chamber is working with others to address mental health supports, skilled labour, and WSIB improvements on COVID-19 Employer Counts, among others.

We are also proud to note significant progress on Surety Bonds, Public Procurement, and Red Tape Reduction with our municipal governments, and look forward to advocating strongly for a Regional Transportation Master Plan for Brantford-Brant and Six Nations of the Grand River. Please reach out with your ideas to improve the business community, or to be a part of the Advocacy Committee.

Being a Chamber member means being a leader in our communityPresented by

n 1488553 Ontario Limited

n Advanced Cellular/Bell Mobility

n Allstate Insurance

n Al’s Driveway Sealing & Repairs

n Alzheimer Society of Brant

n ANC Group

n Angela Leach - Happy Workplace Architect

n Ardency Corporation

n Arnold Anderson Sport Fund

n Asacert Assessment & CertificationAmericas Division

n Assante Capital Management Ltd./ Brant Financial Group

n BDO Canada LLP

n Beck’s Printing Services

n Bell

n Bell City Carpet One

n Best Western Brantford Hotel & Conference Centre

n BIA Brantford

n Bialas Printing Limited

n BML Multi Trades Group Ltd.

n Boddy Ryerson LLP

n Braneida Mechanical Service Ltd.

n Brant County Society for the Prevention of Cruelty to Animals

n Brant Custom Machining Ltd.

n Brant Family Eye Care

n Brant Food Centre

n Brant Haldimand Norfolk Catholic District School Board

n Brant Mutual Insurance Company

n Brant Sports Excellence

n Brantford Flight Centre

n Brantford Musicians Association

n Brantford Symphony Orchestra Association Inc.

n Brooks Signs

n Career Colleges Ontario

n Casasanta Complete Baking Solutions

n Child and Family Services of Grand Erie Foundation

n City of Brantford - Economic Development & Tourism

n Clik-Clik Systems Inc.

n CMBB Bakeware Canada Inc & Pan-Glo Canada Pan Coatings Inc.

n College Source for Sports

n Comfort Inn

n Community Living Brant

n Coudenys Management Systems Inc.

n Cowan Insurance Group Ltd.

n Days Inn

n Derek Bond Entertainment

n DHL Supply Chain

n Domclean Limited / Dominion Equipment & Chemical

n Dr. Betty-Anne Story

n Dragonfly Landscape Supply Inc.

n Dudley Lambert LLP

n Dulux Paints

n Eby Boys Transport Inc.

n Enterprise Brant

n ESSE Canada

n The Expositor

n Extend Communications

n Fen Industrial Inc.

n Food4Kids Brant-Haldimand

n General Industrial Services

n George and Edmison Partners

n Gilbert-McEachern Electric Ltd.

n Good’s Machine Shop Inc.

n Greenspace Waste Solutions

n Habitat for Humanity Heartland Ontario Brant-Norfolk Chapter

n J. P. Harris Burford Ltd.

n Hewson Brothers Building Supply Inc.

n J. D. Hill Jewellers Brantford Ltd.

n Holiday Inn Express & Suites Brantford

n Home Hardware Stores LimitedBeautiTone Paint and Home Products Division

n Home2 Suites by Hilton Brantford

n Hotline Apparel Systems

n IG Wealth Management

n Ingham Monuments

n J & K Home Building Centre

n JB Construction Management Corp./ J.B. Landscape Construction Ltd

n Jeff’s at Work Office Furniture-The Design Center

n Kemira Water Solutions Canada Inc.

n Kuriyama Canada Inc.

n Lanca Contracting Limited

n R. L. Lancaster Construction Limited

n Lauderdale Developments Inc.

n Le Chocolat du Savoie Inc.

n Legends Taphouse & Grill

n Levac’s Trophies Unlimited Inc.

n Liftway Limited

n M&T Printing Group

n Marriott Towneplace Suites Brantford & Conference Centre

n McCleister Funeral Home & Chapel

n McClelland Glass Centre (002310921 Ontario Ltd)

n McGowan Office Interiors Incorporated

n McKeough Supply Div. of Emco

n Meridian

n Millards Chartered Professional Accountants

n Millennium Security Services

n MMMC Architects

n Mohawk Motel

n My Tailor

n New Life Pentecostal Assembly

n OE Canada Inc.

n The Olde School Restaurant Est. 1982

n Paulmac’s Pets Brantford

n Pauwels Travel Bureau

n Perry’s Elite Services

n PRODIGY Personnel

n R.B.T. Electrical & Automation Services

n RBC Commercial Banking Centre

n RBL Services

n Remax Twin City Realty-Park Road North

n Robertson Restoration

n Rotary Club of Brantford

n Sacha Pinto - Marketing Strategist and Educator

n Savory Electric Ltd.

n Scott C. Chapin CPA Professional Corporation

n Sherwood Restaurant & Catering

n H. C. Sleeth & Sons

n Sonoco Canada Corporation

n South Coast Financial Services

n Spence Print Solutions

n Stepright Capital Planning Inc.

n STM Construction Ltd.

n Steven J. Szasz Fine Quality Homes

n Tim Horton’s - Colborne St.

n Tirecraft Brantford Inc.

n Town & Country Sales and Service Inc.

n Tulsar Canada Ltd.

n UFT Can. Inc.

n Underwood, Ion & Johnson Law

n David Van Elslander

n West Brant Physiotherapy & Massage Therapy

n West Brant Window World

n Whole Body Health

n William Street Eyecare

n Woodview Mental Health & Autism Services

n J. H. Young & Sons Ltd.

n Your Neighbourhood Credit UnionCharlotte St.

Deciding to build a new kitchen, bathroom or any home renovation can be exciting, but potentially stressful and confusing. At Misty’s Kitchens, we are there for you, easily assisting you with each step along the way!

By combining all three services of a contractor, interior designer and kitchen designer, you enjoy a “one of a kind” service.

There are so many options and so many decisions to be made: door

styles, material finishes, colours, appliances, furniture placement, etc. And there are so many providers of kitchen cabinetry with such varying standards; from cabinet makers and contractors, who are craftsmen, but not designers, to large companies with a sales-first focus.

Relax and enjoy spending as much time as it takes with Misty’s Kitchens to get it right. We’ll provide you with a well scheduled, cost effective and stress-free experience.

You will have the confidence knowing

your investment is in good hands having been thoroughly reviewed with exclusive processes for optimal function and design style, which easily allows you to achieve an amazing dream kitchen.

We offer:

Design Only: Kitchens, bathrooms, basements, main floors, laundry rooms, fireplace built-ins, closet systems.

Design/ Supply/ Install: Cabinetry and closet systems; countertops, sinks an hardware; painting of existing cabinets.

Full Project Managment: Sub trades procurement and coordination; project scheduling; trade payment distribution; electrical and plumbing design consultations; supplies and material coordination.

New Home Design Consultations: House plan blueprint review consultations; electrical and space.

Tuesday, May 16th, 2023

11:30 AM to 1:30 PM

Plated lunch

Thank you to our sponsors: