1 minute read

Self Managed Super: Issue 42

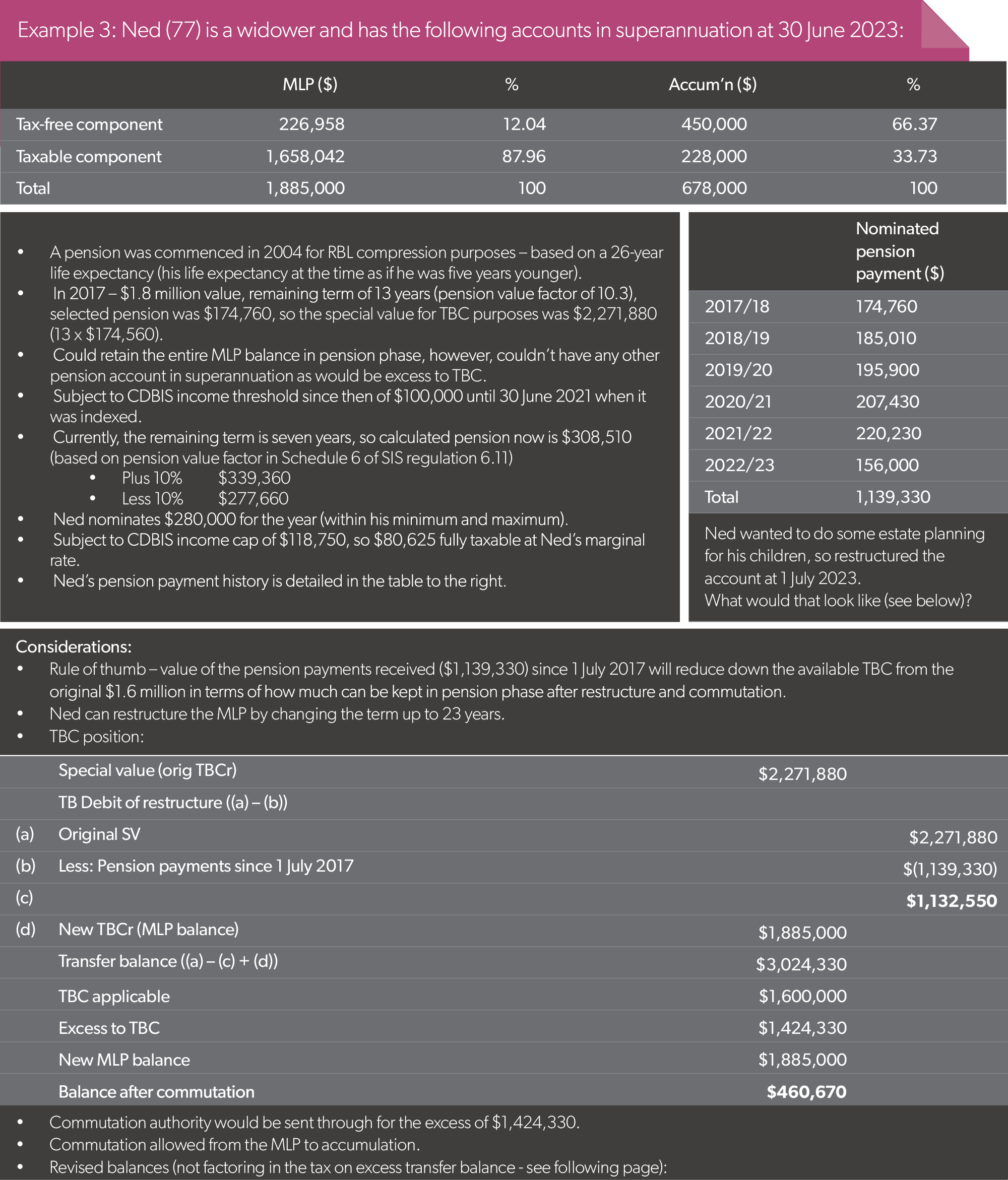

Legacy pensions continue to be a burden for SMSF trustees. Jemma Sanderson examines the rules governing these income streams and some strategies to address some of their associated compliance issues.

Prior to the 2006 budget and the Simpler Super regime, we had reasonable benefit limits (RBL) and Centrelink assets test exempt (ATE) pensions. These provisions resulted in many taxpayers structuring their pension accounts so that they optimised their position from an RBL or ATE perspective.

In an SMSF, these types of pensions were available, however, they were discontinued for new pensions early in calendar year 2005. The pensions in Table 1 were those that were available in an SMSF prior to this time.

One of the main features of these types of income streams was the fact they were unable to be commuted, unless the commutation was to then commence a new pension that satisfied the requirements of the pension accounts in Table 1, or of a pension account that was similarly restricted.