11 minute read

Managing the past

Legacy pensions continue to be a burden for SMSF trustees. Cooper Partners director and head of SMSF and succession Jemma Sanderson examines the rules governing these income streams and some strategies to address some of their associated compliance issues.

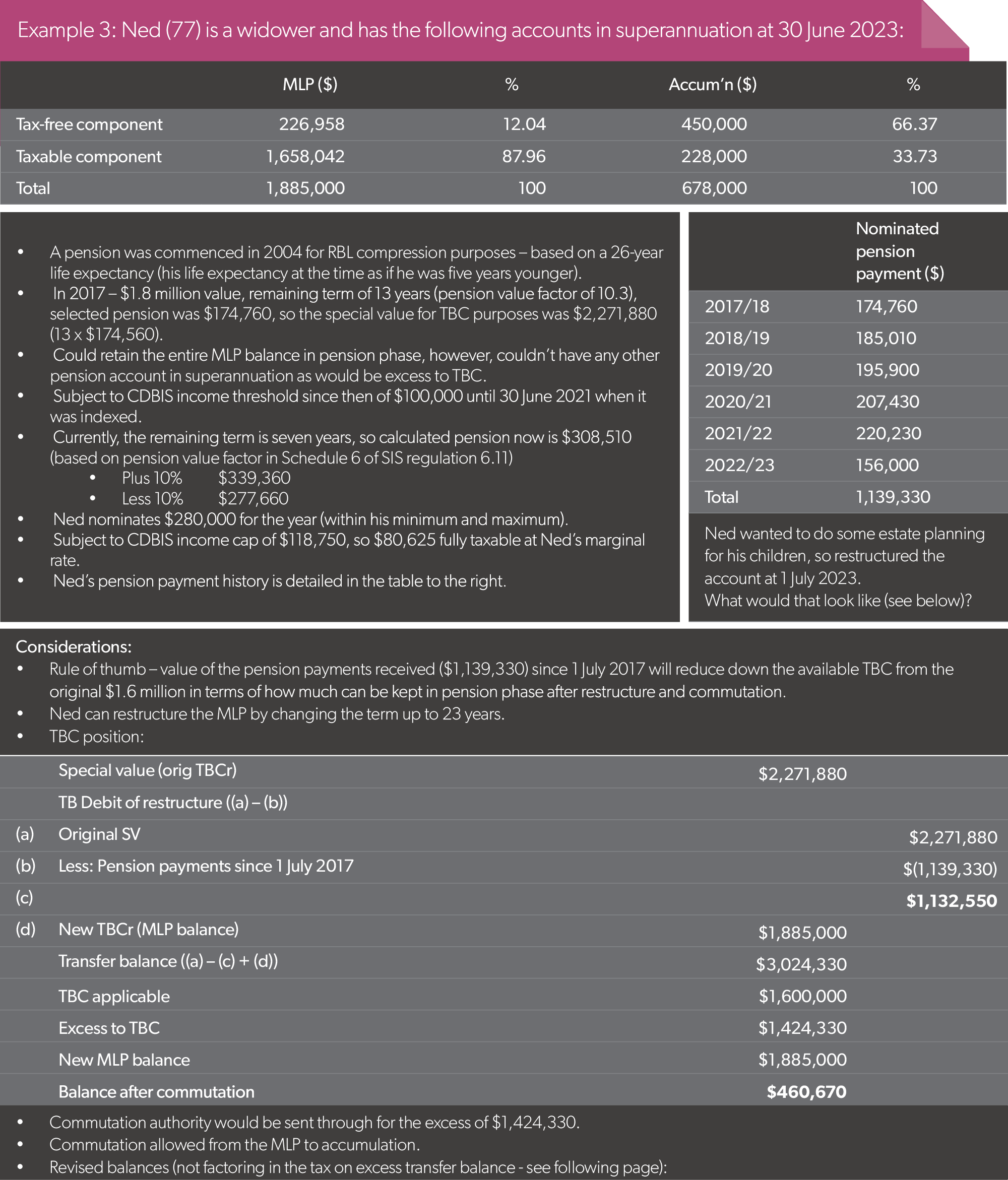

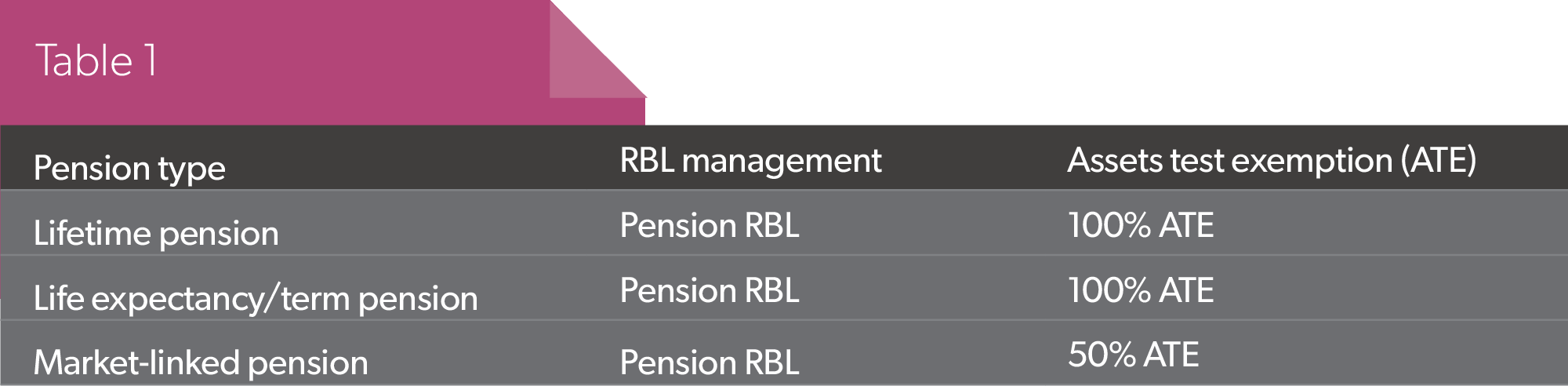

Prior to the 2006 budget and the Simpler Super regime, we had reasonable benefit limits (RBL) and Centrelink assets test exempt (ATE) pensions. These provisions resulted in many taxpayers structuring their pension accounts so that they optimised their position from an RBL or ATE perspective.

In an SMSF, these types of pensions were available, however, they were discontinued for new pensions early in calendar year 2005. The pensions in Table 1 were those that were available in an SMSF prior to this time.

One of the main features of these types of income streams was the fact they were unable to be commuted, unless the commutation was to then commence a new pension that satisfied the requirements of the pension accounts in Table 1, or of a pension account that was similarly restricted.

In the lead-up to 30 June 2007, many members restructured a lifetime or life expectancy/term pension to a market-linked pension (MLP), however, they were still subject to the MLP rules regarding commutation restrictions. However, where the pension originally had an ATE, such a restructure didn’t necessarily occur as it would have resulted in the loss of the ATE. For some members, where a pension originally had a 100 per cent ATE, this had a substantial benefit to them from a Centrelink age pension perspective and therefore they would keep such a pension intact.

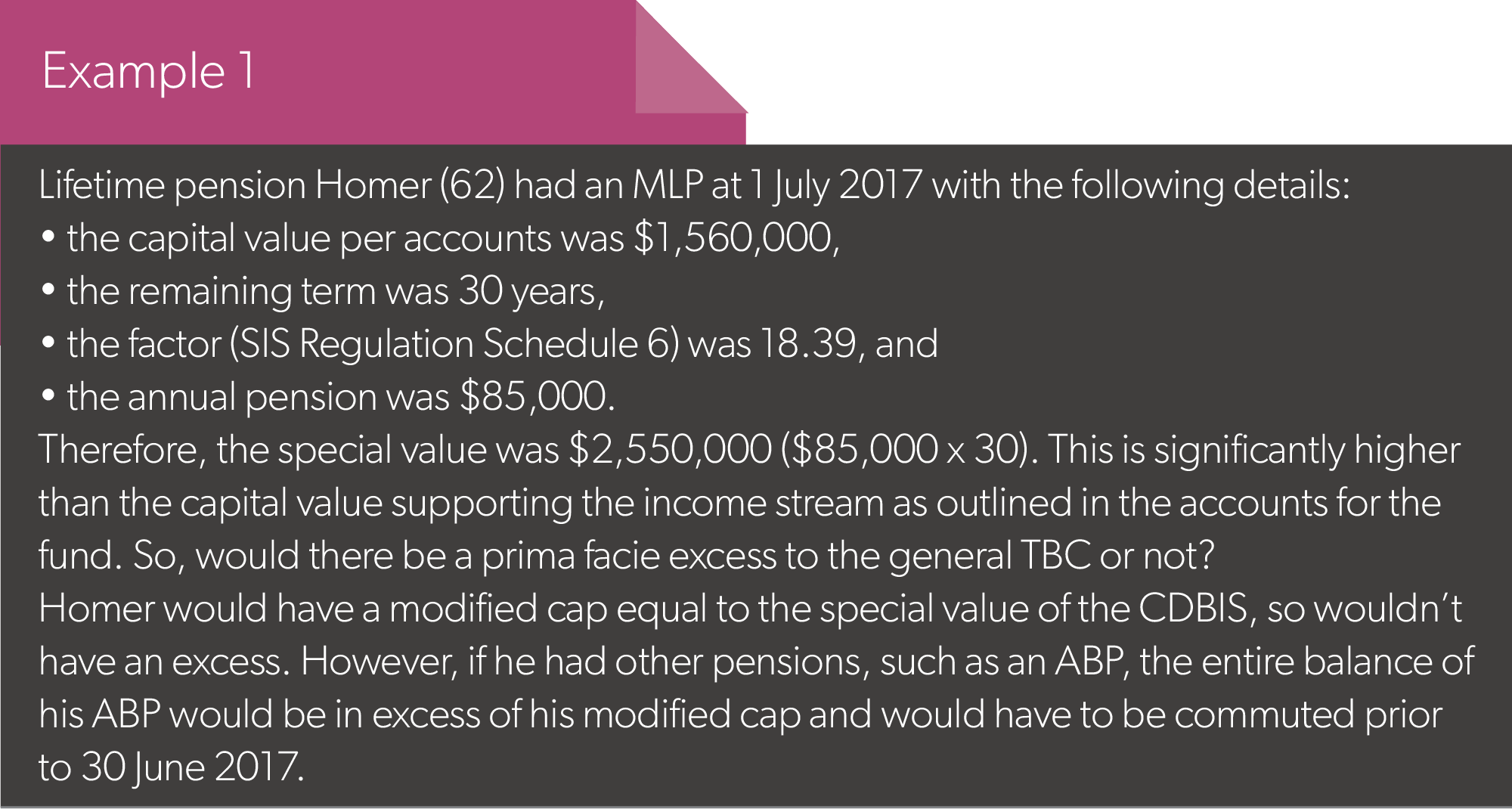

Fast-forward to the transfer balance cap (TBC) regime, where these accounts are capped defined benefit income streams (CDBIS) as defined by section 294-130 of the Income Tax Assessment Act 1997 (ITAA). The TBC treatment of a CDBIS depended on whether it was a lifetime product whereby a ‘special value’ is determined to calculate the amount of a transfer balance credit.

1. Special value of lifetime products – section 294120(2) of the ITAA provides a formula for the special value of a lifetime product: Annual entitlement x 16

The annual entitlement is the annual pension amount over the 12 months from either 1 July 2017 or the date of commencement of the income stream (if subsequent to 1 July 2017, which wouldn’t be any such pension in an SMSF).

2. Special value of life expectancy products/MLPs – section 294-120(3) of the ITAA provides a formula for the special value of a life expectancy product or an MLP/annuity: Annual entitlement x Remaining term

The annual entitlement is the annual pension amount over the 12 months from either 1 July 2017 or the date of commencement of the income stream (if subsequent to 1 July 2017, which wouldn’t be any such pension in an SMSF).

Given the way MLPs work, whereby the income is based on a remaining term and pension valuation factor contained in Superannuation Industry (Supervision) (SIS) Regulation Schedule 6, in most cases the operation of the formula in ITAA section 294-120(3) resulted in a higher special value for the MLP than the capital value that is actually supporting that income stream in the member’s account.

To reiterate, one of the considerations with a legacy pension is they are non-commutable, meaning the recipient is unable to roll back the MLP balance to accumulation phase and keep it there. The only changes that can be made in an SMSF are:

(a) For an MLP – amend the term, which would then impact the annual payment amount. It is important to note any amendment to the term must be in accordance with the rules, being it can be a minimum remaining term equal to the life expectancy of the pensioner or reversion, and to a maximum term of the number of years to age 100 of the pensioner or reversion.

(b) For a non-MLP – to cease the pension and commence a new MLP from the capital within the SMSF.

Capped defined benefits and excess to TBC

It wasn’t uncommon for a CDBIS to be in excess of the TBC in its own right. In that situation, ITAA section 294-125 operated such that if the special value of the CDBIS of a taxpayer was greater than their TBC, as long as it did not exceed the taxpayer’s capped defined benefit balance, then there would be no excess. The capped defined benefit balance is the special value of any CDBIS the taxpayer has. However, a nonCDBIS the taxpayer may have in place, for example, an account-based pension (ABP), would be excessive as the taxpayer does not have a separate applicable TBC (see Example 1).

MLPs – special value implications

The rules with respect to the calculation of the special value for an MLP were more often disadvantageous for those who had an MLP asset balance under $1.6 million, as the special value was always higher than the capital amount supporting the income stream. This then limited the amount these members could retain in an ABP even though the capital supporting all of their income streams was less than the $1.6 million cap.

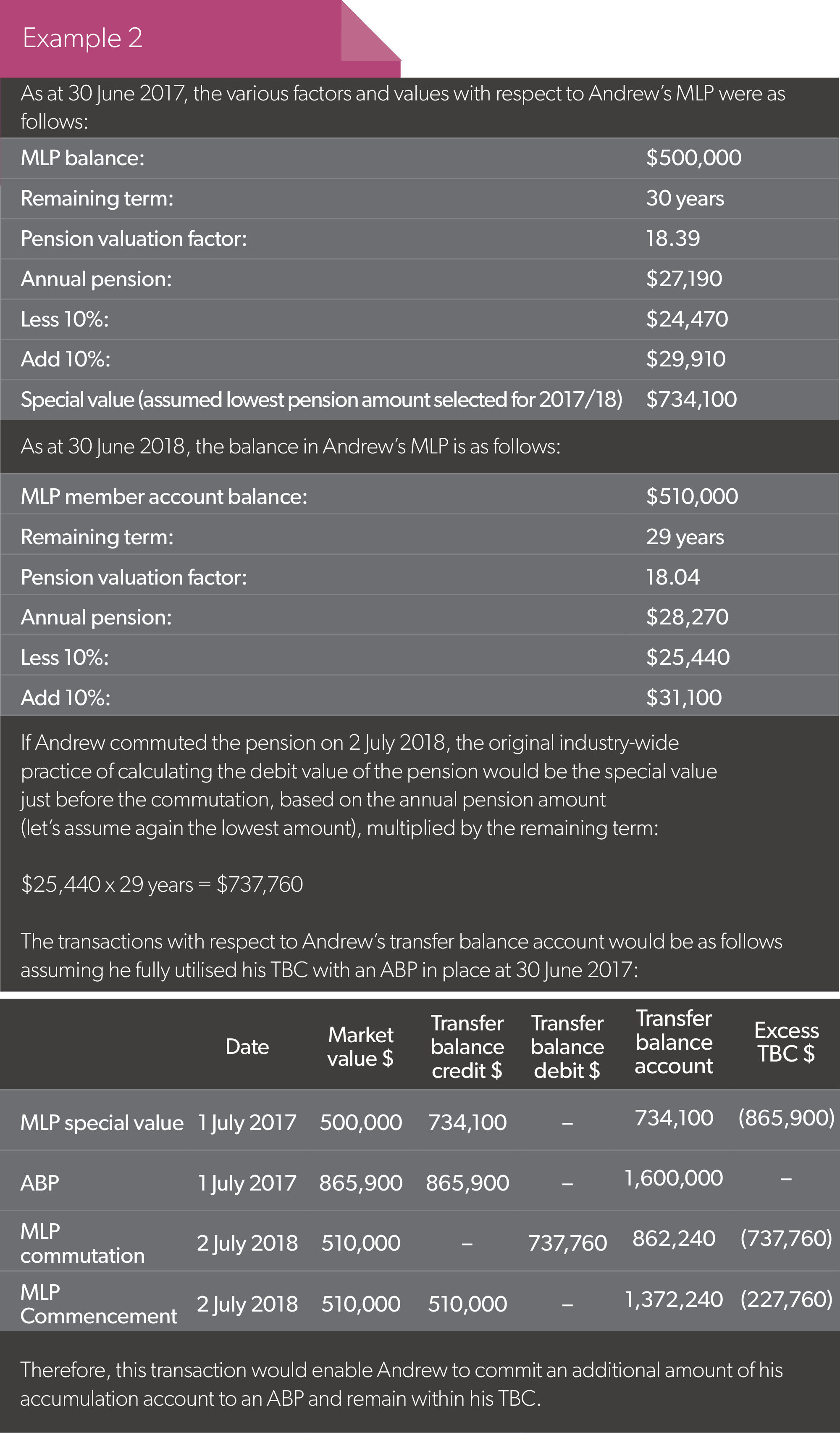

However, there was a strategy for such members to commute their MLP back to accumulation and commence a new one with the resulting benefit. Where this was undertaken after 1 July 2017, the MLP was no longer a CDBIS, as it requires the MLP to have been in place prior to 1 July 2017, and therefore the account balance would be assessed towards the TBC and not the special value. This has the benefit of enabling the pension member to have a higher level of benefits in an ABP within their TBC (see Example 2).

However, even though many in the industry considered the calculation of the transfer balance debit was uncontentious as in Example 2, the ATO took the view that, at the time of the MLP commutation, the transfer balance debit value would be nil as there would be no annual entitlement because the pension was being commuted.

Accordingly, where the strategy was in Example 2 implemented, for example, for Andrew, there would be a nil transfer balance debit on the commutation of the MLP and the commencement of a new MLP would result in an excess.

This was a substantial issue for many members with MLPs because if they undertook the transaction in Example 2 and had a TBC excess, they would not be able to resolve the excess and would have an excess accumulating until they died because the MLP was non-commutable.

On 14 June 2018, the ATO released SMSF News Alert 2018/3:

“We are aware of circumstances where an individual was receiving a life expectancy or market-linked pension just before 1 July 2017, which was a capped defined benefit income stream; they then commuted the pension on or after 1 July 2017 and the transfer balance debit, worked out under the special value rule in Income Tax Assessment Act 1997 subsection 294-145(1), is nil. Where the individual then commences a new market-linked pension, this may cause them to exceed their transfer balance cap or have a higher than anticipated account balance.

The government recognises the unintended consequences associated with the current law and is committed to ensuring smooth implementation of the 2016 super reform measures.

If an individual’s circumstances align with the above, our practical compliance approach will be:

• We will not take compliance action at this stage if a fund does not report the transfer balance account events of the commutation or the commencement of the new market-linked pension.

• We will not apply compliance resources, at this stage, where the fund has reported the transfer balance debit for the commutation as other than nil.”

The above issues with respect to the determination of the transfer balance debit for a CDBIS commutation led to consultation with Treasury to provide a solution, and for any taxpayer who had restructured to ‘sit pretty’ with respect to the TBC position until such time as a solution was determined.

Legislative change

In 2020, the relevant provisions in ITAA Division 294 were amended to address the above issue.

In summary, the changes were:

1. For life expectancy pensions:

a. The transfer balance debit is the value of the transfer balance credit at 1 July 2017.

b. The taxpayer would have a TBC of $1.6 million and therefore they could restructure to use this amount, or where they had an ABP as well, an amount using the remaining balance up to the $1.6 million.

2. For MLPs:

a. The transfer balance debit is the value of the transfer balance credit at 1 July 2017 reduced by the pension payments received since 1 July 2017 for the account.

b. The taxpayer has a TBC of $1.6 million.

c. So effectively the available amount they have to retain in pension phase after a restructure is the $1.6 million TBC, less the value of the pension payments received over the period from 1 July 2017 through to the date of the commutation.

However, despite this clarification, where a CDBIS member restructured post 30 June 2017, it could be the case they would still have a non-commutable pension in excess of the TBC and would be unable to resolve it.

CDBIS income cap

It is also important to note that where an MLP is restructured post 1 July 2017, it is no longer classified as a CDBIS and no longer subject to the CDBIS income cap ($118,750 from 1 July 2023), whereby 50 per cent of any amounts above this cap is taxed at the individual’s marginal tax rate.

For some individuals, this is a relevant consideration to any restructuring as it means they don’t have to pay personal tax on the income payments, although where that is invariably the case, they would then be missing out on the exempt current pension income (ECPI) on a pension account balance higher than the TBC.

Where a member had more than $1.6 million of capital in their MLP, they were eligible for ECPI with respect to that higher balance. In such a case, if the MLP paid more than the cap as a pension, 50 per cent of the excess would be taxable to the individual.

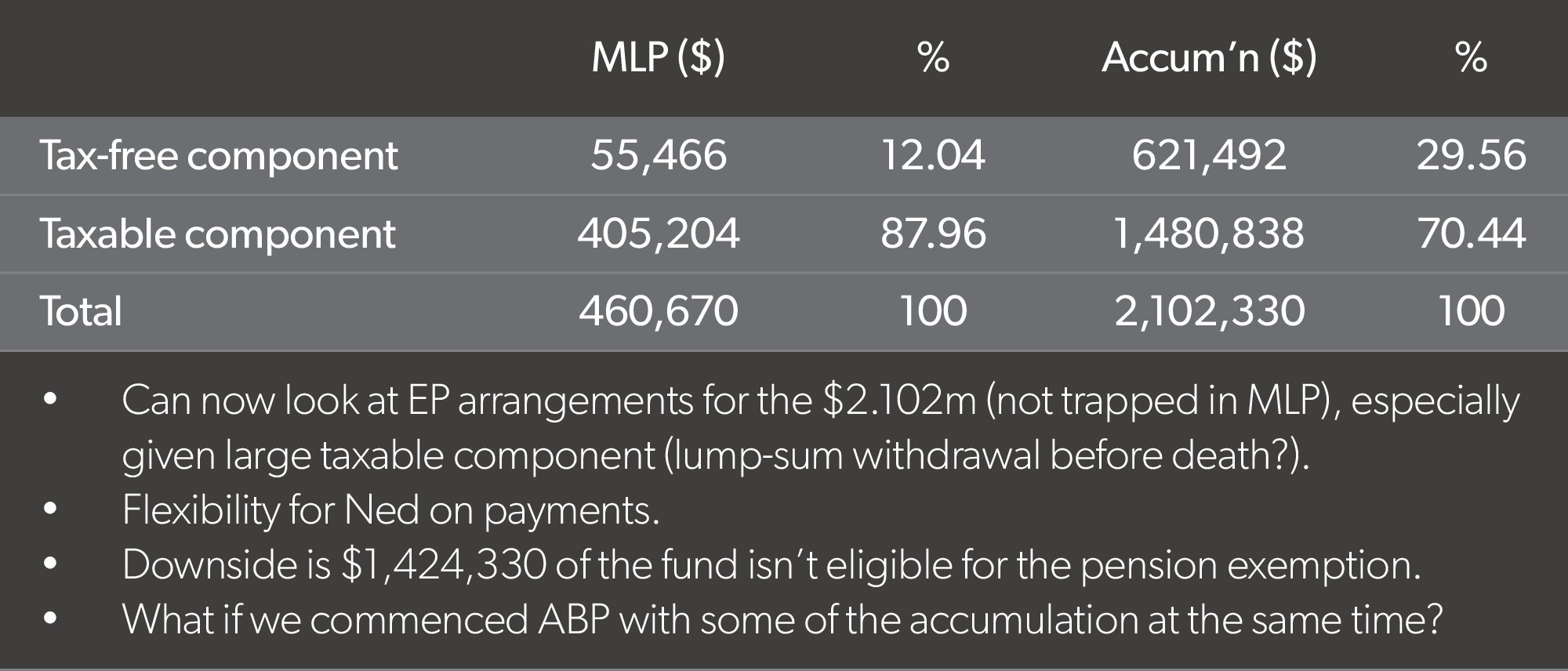

Budget announcement (see Example 3)

As part of the 2021/22 federal budget, an announcement was made to allow CDBIS or legacy pensions to be commuted (with relevant snippets below):

• temporary option to transition from legacy retirement products to more flexible and contemporary retirement products,

• a two-year period will be provided for conversion,

• it will not be compulsory for individuals to take part,

• completely exit these products by fully commuting the product and transferring the underlying capital, including any reserves, back into a superannuation fund account in the accumulation phase,

• any commuted reserves … will be taxed as an assessable contribution of the fund (with a 15 per cent tax rate),

• the existing social security treatment … will not transition over for those who elect to take advantage of the conversion,

• exiting a product will not cause reassessment of the social security treatment of the product for the period before conversion,

• existing rules for income streams will continue to apply so that individuals starting a new retirement product will be limited by the transfer balance cap rules,

• the existing transfer balance cap valuation methods for the legacy product, including on commencement and commutation, continue to apply.

This announcement was a positive for the industry, however, to date we are only halfway there.

In April 2022, new law allowed excess transfer balance amounts arising from the restructure of a CDBIS to be commuted from that pension back to accumulation.

The change to allow the commutation is as follows within SIS regulation 1.06(8)(d)(ix) for MLPs:

(d) the market linked pension cannot be commuted except in any of the following circumstances:

…(ix) in order to comply with section 136-80 in Schedule 1 to the Taxation Administration Act 1953….

We still don’t have a position on the full commutation to accumulation of a legacy pension, so that it can either be held in accumulation, if desired, or an ABP can be commenced with the resulting amount (subject to having TBC available).

The downside to any restructure is:

1. If an ATE pension, ATE status would be lost, so then there would be Centrelink age pension considerations (although this wouldn’t technically be backdated as any such debt would be waived).

2. If the age pension is impacted, then any aged-care costs are also likely to be impacted.

3. If an MLP, only the amount up to the remaining TBC after considering the pension payments since 1 July 2017 is available to have in pension phase and eligible for ECPI. Therefore the following must be considered:

a. The personal tax on any income payments (if above $118,750) versus the loss of ECPI.

b. The amount that might be available in pension phase subsequent to a restructure.

c. The advantage of a restructure from a flexibility perspective and estate planning, rather than purely short-term tax.