2 minute read

BioCopy AG

Name ›

Address/P.O. Box › Postal Code/City › Country › Contact Person › Telephone › Email › Website ›

Areas of Activity ›

Request for ›

Further Collaborations BNY Mellon

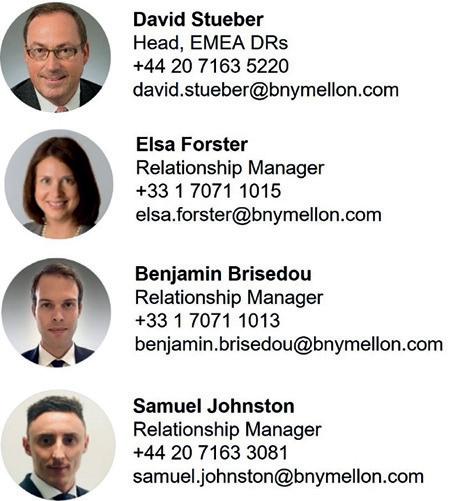

240 Greenwich Street New York, NY 10286 USA David Stueber +44 207 163 5220 david.stueber@bnymellon.com www.bnymellon.com

Depositary Receipts

Assisting issuers with accessing US capital markets

US Offerings Using Depositary Receipts (DRs)

More than 251 non-US biotechnology & healthcare companies have their equity securities traded on US markets in the form of DRs. The unique investor base, combined with the quality and depth of research coverage in the US is an important driver of this activity. Given the sector’s importance, BNY Mellon has developed specialised expertise to meet the needs of companies. For investor relations support, management reporting and transactions, and corporate action servicing, BNY Mellon is the leading depositary bank.

Specific benefits of utilising DRs for a US listing

A US-listed DR is the primary capital markets tool used by many non-US companies to list and/or raise equity capital in the US These exchange-listed, capital-raising DRs obtain maximum visibility and liquidity.

In connection with a potential US listing, while listing an ordinary share in the US may be possible, the benefits of the simplicity, flexibility, and lower cost provided by the DR structure offer numerous advantages. These advantages are the reason why a DR programme is a valued alternative for non-US companies listing in the US, even in the case of a single market listing. DRs are an accepted, proven, and economic way for non-US companies to access US capital markets.

The establishment of a DR programme (verses the US listing of ordinary shares) does not require any changes or require any reconciliation with current local administrative, governance, and registration procedures. US regulatory requirements are the same for an ordinary share or DR, but the administrative burden for a foreign ordinary share listed in the US is higher than that of a DR. A DR programme is simpler.

DR biotechnology & healthcare highlights

Both 2020 and 2021 were extraordinary years for the biotechnology & healthcare sector. During the COVID-19 pandemic, the sector was innovative and resilient, therefore developing greater investor attention.

This momentum continued throughout 2021, with issuers continuing to raise capital via Initial Public Offerings outside their domestic markets.

From a regional perspective, DR issuers from the United Kingdom, Israel, France, and the Nordics were the most active and were responsible for over 61% of the volume of transactions.1

From an indication perspective, DR issuers whose therapies include oncology and immunology were responsible for 61% of the value of transactions.1

The average DR amount raised per transaction in 2021 was $141 million, 25% higher than the $113 million raised per transaction in 2020.1

A section of our recent biotechnology & healthcare DR programme establishments2: › Achilles Therapeutics (UK) › BioNTech (Germany) › Biophytis (France) › Evaxion Biotech (Denmark) › Genenta (Italy) › Olink Holding AB (Sweden) › Vaccitech (UK)

For more information, please visit the BNY Mellon website.

¹ Derived from public sources as of 31st December 2021. 2 These are selected examples solely for the purpose of this document. BNY Mellon provides no advice nor recommendation or endorsement with respect to any company or securities. Nothing herein shall be deemed to constitute investment advice or an offer to sell or a solicitation of an offer to buy securities.