Southern California BUILDER

The Magazine of the Building Industry Association of Southern California

The American Dream of Home Ownership: on Life SupportEdition

• Seeking Clarity: Adam Artunian on the American Dream

• A Logical Approach to Fulfilling the Dream: Mike Durham, LGI Homes

• Tonight on ER: Can the House Docs Save the American Dream? Laer Pearce

Residential Energy Efficient Fire Rebuild (EEFR) Program Wildfire Response Incentives

Enhanced energy efficiency incentives for those rebuilding homes in cities affected by the January 2025 Southern California Wildfires

In support of the rebuilding effort underway to restore single-family and multifamily homes destroyed or severely damaged by the Eaton, Palisades, Hurst, Lidia, Sunset, Woodley, Olivas, and Hughes wildfires in Los Angeles County, SoCalGas is offering enhanced incentives for energy-efficient homes being rebuilt in the affected areas through the Residential EEFR Program.

The Residential EEFR Program provides financial incentives for single-family and multifamily homes that are built to exceed the State of California Title 24 Energy Efficiency Standards and are equipped with qualifying natural gas equipment. SoCalGas is currently offering enhanced incentives in the wildfire affected areas.

Property owners in zip codes affected by the Los Angeles County wildfires who are eligible for incentives and interested in participating in the program should take the following steps:

1. Visit socalgas.com/Rebuild to download a copy of the application.

2. Consult with your builder or energy analyst to review the program requirements.

3. Work with your builder who will contact a SoCalGas Account Representative to begin the application process.

OR

4. Call 1-866-563-2637 or email scgprocessing@socalgas.com for more information.

The more energy efficient your new home is, the higher the incentive. With enhanced Residential EEFR Program incentives now available for fire rebuilding projects, your single-family and multifamily home may qualify for up to $10,000 in incentives.

Rebates and rebate amounts are subject to change. Home must be within an eligible fire rebuild zip code. To learn more, visit socalgas.com/Rebuild

The Residential Energy Efficient Fire Rebuild Program is funded by Southern California Gas Company (SoCalGas) customers and administered by SoCalGas, under the auspices of the California Public Utilities Commission. Program funds, including any funds utilized for rebates or incentives, will be allocated on a first-come, first-served basis until such funds are no longer available. This program may be modified or terminated without prior notice. The selection, purchase, and ownership of goods and/or services are the sole responsibility of the customer. Customers who choose to participate in this program are not obligated to purchase any additional goods or services offered by manufacturer, vendor, service provider, or any other third party. SoCalGas makes no warranty, whether expressed or implied, including warranty of merchantability or fitness for any particular purpose, use or application of selected goods and/or services selected by customer. SoCalGas does not endorse, qualify, or guarantee the work of any third party. Eligibility requirements apply; see the program conditions for details.

What’s Inside

Southern California BUILDER

BIASC Chair & CEO Joint Message:

Keeping Home Ownership Alive

Chief Executive Officer

For generations, homeownership has been at the heart of the American Dream — the promise of stability, opportunity, and a place to call your own. Yet for too many young people and families today, that dream feels beyond hope.

Across Southern California, the path to buying a first home has become steeper than ever. Rising construction costs, limited supply, restrictive governmental land use policies, and the new normal with higher interest rates have created a perfect storm where even dual-income households struggle to afford a modest home without help from family or extraordinary financial means.

This isn’t just an economic issue — it’s a societal one. When the next generation can’t put down roots, our communities suffer. Teachers, nurses, firefighters, and other essential members of our workforce are being priced out of the very cities they serve. People in their prime wage earning years are leaving the State of California for other places with more reasonable housing costs. Family formation is increasingly delayed.

That’s why the work we do as homebuilders, developers, and advocates matters more now than ever. Our mission goes far beyond just constructing houses. With our new communities we’re building pathways to stability, opportunity, and the enduring dream of homeownership. Through collaboration with policymakers, industry partners, and our members, we continue to push for responsible growth, reduced barriers, and more market-rate housing options that make ownership attainable again.

The Building Industry Association of Southern California has championed housing for over 100 years. As we look ahead, we must continue that legacy — to ensure that owning a home isn’t a privilege for the few, but a possibility for every family who works hard and dreams of one day having a place to call their own.

Together, we can — and must — keep the American Dream alive.

Sincerely,

Jeff Montejano Chief Executive Officer, BIASC

Mike

Balsamo 2025 Chair, BIASC |

Rancho Mission Viejo

Mike Balsamo BIASC Chair

Jeff Montejano BIASC

BIASC Letter from the Editor:

The American Dream of Homeownership: Can It Be Saved?

The American Dream of homeownership goes back much further than the incorporation of the home into the short list of things incorporated into the American Dream, which didn’t occur until the 1940s, as Laer Pearce points out elsewhere in this issue. But think about it – we associate George Washington with Mount Vernon, Thomas Jefferson with Montecello, and Benjamin Franklin with … well, it turns out that the only surviving house that Franklin lived in is in England, not America.

In any case, the tie of a home to the American people goes well beyond its leaders. Every American era has had a type of home associated with it: the salt box homes in colonial New England, the log cabins in the forests of the American frontier, the plantation homes of the Confederacy, the sod houses of the Great Plains in the manifest destiny era, the gilded mansions of the Robber Baron era, and the split-level suburbans of the Mid-Century era.

Most of us have our own American Dream home memories – the house we grew up in, the first home we bought with our own money, the home our children grew up in. But when the supply of new homes gets so out of synch with demand that only 15% of Californians can afford to buy a median-priced new home, and as California is rapidly approaching the point where the majority of its residents live in rental homes, it’s time to ask what effect it will have on our society if the American Dream of homeownership becomes a pipedream.

Back in 2019, the San Barnardino County Chapter (then the Baldy View Chapter) got an answer to that question via a Cal State San Bernardino study it sponsored. The findings were shocking then, and more shocking now: Increased homeownership leads to higher educational attainment,

Craig Foster Chief Operating Officer/ Executive Vice President

lower poverty, lower crime rates, and is a major vehicle for economic advancement, especially for Latino and other minority populations. What will happen to the other elements of the American Dream – the promise of a good future, the opportunities for a better, richer life – if most of our population is living in a series of rental properties, never gaining the social and economic advantages that come from homeownership?

This is why the homebuilding industry is so important, and it’s why the advocacy efforts of BIASC and its Chapters are critical to the future of our state and its residents. Every victory is a victory for the American Dream. Every time the regulations and costs are ratcheted higher, the American Dream gets more out of reach for more Californians.

Most of us, myself included, didn’t think this deeply about what homeownership stands for when we first joined this industry. Maybe it was just the job selected out of a number of others that could have been chosen. But for many more, myself included once again, it was more than that. It was the sense that this is an industry that does good, that makes a product that changes lives, and because of that, it’s an industry that cares about people and wants to make their lives better. It is an industry that I am proud to be a part of, and I’m certain that you are too.

This issue of Southern California Builder is dedicated to the idea that owning a home is integral to the amazing dream that has found its reality in America. I hope these pages inspire you to feel good about what you’re doing, and motivates you to help us put the brakes on the downward skid of homeownership rates so more and more California families will be able to hold for the first time the keys to a home of their own.

BIASC New Home Market Quarterly Report

The Market is Starting to Find its Footing

Market conditions improved slightly in Q3, adjusting for seasonality, driven by an uptick in buyer confidence and marginally lower mortgage rates. However, overall new home sales in the region remain below the “equilibrium” level and builders are still having to offer generous incentives, mostly in the form of interest rate buydowns, to spur sales. Base home prices are relatively flat year-over-year despite some softening in recent months but buyers are spending less on options and upgrades and premiums are down a bit. Some builders are pre-plotting options and upgrades and charging below typical retail value.

Although poor affordability remains a headwind, the housing market is starting to find its footing following turbulence earlier in the year associated with tariff/economic concerns. New home sales in September averaged 2.6/mo, slightly below the same month in 2024 (3.0/mo) and 2023 (3.1/mo) but close to the 2016 – 2019 average (2.8/mo). Also, new home project traffic has returned to more normal seasonal levels after subdued traffic in the first and second quarters. Mortgage rates have been trending downward and the possibility of rates falling below 6% later in the year could provide a tailwind going into 2026.

• New home sales in Southern CA averaged 2.7/project/mo in Q3 which was the same as Q2 but below Q3 2024 (3.2). Sales have been remarkably consistent since April, ranging from 2.6 – 2.8/mo. We consider equilibrium to be 3.0/ mo. Q3 sales were strongest in OC (3.0/mo) and the Inland Empire (3.0/mo), while Los Angeles (2.2/mo) and San Diego (2.4/mo) recorded slower rates.

• New home project traffic started off the year at levels well below previous years. However, traffic has returned to more normal seasonal levels in Q3. There was an average of 17 new home shoppers/project/week in Q3, which is the same as Q3 2024 and a little below Q3 2023 (20). Unlike previous years where traffic has varied seasonally, activity in 2025 has been very consistent at 16 – 18 shoppers/project/week. In addition, shopper traffic in September was only slightly below the same month in 2024 and 2023.

The American Dream of Home Ownership: on Life SupportEdition

Seeking Clarity: Adam Artunian on the American Dream

In his regular Southern California New Home Market column in Southern California Builder, Adam Artunian, Vice President of Clarity Real Estate Advisors, crunches the numbers into something approximating tea leaves, reads them to see how the market is doing, and foretells the future – with far more accuracy than your everyday tea leaf reader.

As someone whose finger is squarely placed on the pulse of the new home market in Southern California, we spoke with him about his thoughts regarding the relative health of the American Dream of homeownership in Southern California.

Southern California Builder: Let’s start with your take on the market this fall. How is it doing?

Adam Artunian: I think the market is shifting in different ways, and that there are some misconceptions about the direction it’s going in. There are some negative feelings about where we’re headed, but I do think there are some green shoots out there and some positive signs that the market’s trying to find its place and footing. Things are looking a little better than they did even a couple of months ago. It does help that rates are moving down a little bit, but basically, affordability is still a huge issue.

SCB: When we talk about keeping the American Dream alive, we’re really talking about keeping the first-time homebuyer in the market, aren’t we?

AA: Yes, it is about the first-time buyer because once you’re in, you’re in. If you’ve got your foot on that first rung of the ladder, you’re in good shape going forward. You’re going to have some equity that you can roll over into the next home, and not having that equity is what makes the first step so hard. The cost of entry is very high.

Adam Artunian Vice President of Clarity Real Estate Advisors

SCB: Is it too high to keep the dreams of the first-time homebuyer alive?

AA: I think the American dream of homeownership is definitely not dead. I know it feels that way for a lot of Americans, particularly young Americans. And even nowadays, middle-aged Americans in their late 30s and 40s are still struggling to buy their first home. Some have even given up, which is too bad.

What we’re seeing, and here I’ll speak to Southern California because obviously there are different factors in other parts of the country, even if they’re mostly similar. In Southern California, we’re seeing more and more that the first-time buyer is relying on some help from their family for a down payment. That’s a big advantage if you’re lucky enough to have that help because oftentimes, the down payment is the biggest challenge to buying a home, particularly in coastal markets. But even in Inland markets, the down payment is an issue, so there’s kind of a tale of two buyers, the ones that can get the help and the ones that can’t. For those who can’t, it’s tough because obviously saving enough for a down payment is going to be a challenge.

Of course, with today’s home prices, families are being asked to contribute more, which also impacts the ability to buy. It’s no longer just a $5,000 or $30,000 gift, so you’re seeing more and more multigenerational buyers where there are multiple incomes and there’s pooling of money to buy homes. There are very few new home purchases that are singlefamily, single-income households, particularly in coastal markets.

On resale homes, it is fairly common to see multigenerational buyers, particularly Hispanic buyers, who are pooling resources to buy homes. On the new home side, mostly the multigenerational buyers are the Asian buyers.

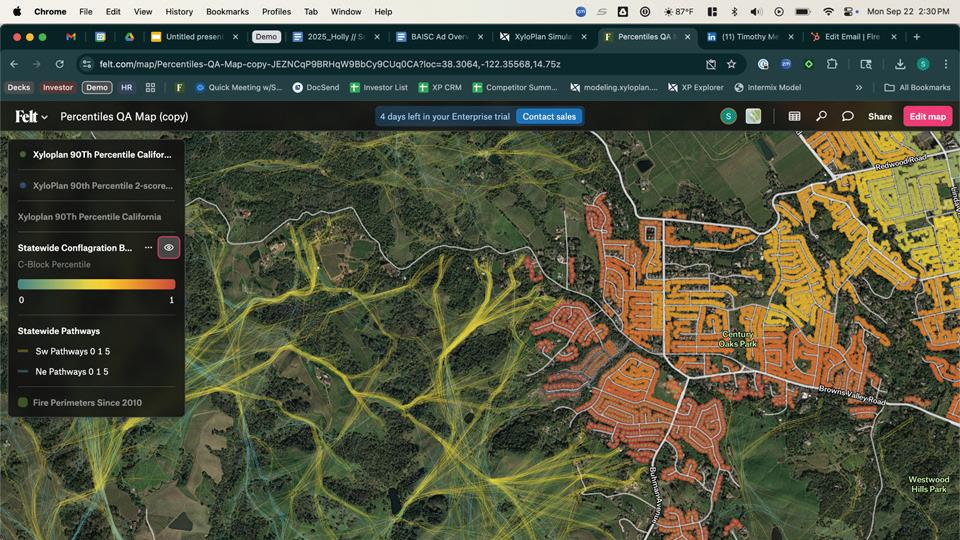

Design communities that stand the test of wildfire.

The XyloPlan Fire Pathways™ platform delivers actionable intelligence to help you build neighborhoods that are measurably safer, more insurable, and easier to entitle.

They’re not necessarily pooling money, but they’re saving money. Having other family members living with them means not paying for housing elsewhere, which saves the family money and makes the cost of the home more attainable. We are seeing more roommates, too, where they’re not related but are going in together to buy a home. Everyone is getting creative in pursuit of home ownership. It’s definitely a challenging time to buy a home, but people are finding opportunities and are becoming more flexible and creative in their living arrangements.

SCB: Is there a shift in the marketplace towards building more affordable homes, be it single-family or multifamily?

AA: There has been a shift, and it’s been going on for a while, picking up in the last couple of years. Even a few years ago, the highest density generally that we would see would be 20 or 24 to an acre, with a row townhome of 1,400 to 1,800 or 2,000 square feet, but now we’re seeing smaller for-sale new homes at higher densities – up to 30 or 35 to an acre, sized from 800 to 1,400 square feet. It’s all about trying to get those price points down.

There are also a lot more smaller lot, single-family products. Whether it’s a motor court or an alley product, even in the Inland Empire, where you maybe didn’t see a lot of that before. But if you go out to Ontario Ranch or The Preserve or Chino and many other markets, that’s really the majority of the single-family neighborhoods – non-conventional products that are offered to get the price points lower and more affordable.

SCB: Are those products selling well?

AA: It’s been a shift that has generally worked in the market. Even though the typical buyer obviously wants a conventional single-family home with a driveway and backyard, they just can’t afford it, so they’re willing to go to a townhome, especially for a first home, so for the most part they are selling well. The challenge now is with the cost of fire insurance and other externals going up, because if HOA dues to get too high, it really impacts pricing. An HOA payment of $400 or $500 a month is a lot for a cost-sensitive buyer buying a first home.

SCB: What other different approaches are builders taking to try to keep the first-time buyer in the market?

AA: In an effort to provide more attainably priced housing, builders are more focused than ever on value-engineering architecture and finishes. Buyers for entry-level product are okay with a more basic spec level if it means a lower price point. Also, more builders have moved to pre-plotting options and upgrades, similar to what Lennar has done for years. This allows for a more streamline construction timeline, which saves costs. Buyers are also spending less on options and upgrades than in the past, and we’re seeing fewer amenities in some affordable communities. Large master plans still typically offer a lot of amenities, but on some of the infill projects it becomes a challenge, and if the target is the first-time homebuyer, they are often welling to trade amenities for lower costs.

SCB: You mentioned fire insurance, isn’t that just a part of the regulatory overhead that is getting in the way of affordability?

AA: It is, because it can hit the affordable attached product particularly hard. So, efforts in Sacramento to push for things like insurance reform becomes important. For attached products, these regulations hit HOA fees as I said, which crept up slowly over time, but have increased even more in recent months. It’s really become a challenge, and one response we are seeing is a shift to a duplex product, which typically has lower HOA dues than a row townhome product because as far as the HOA is concerned, it’s just one shared roof. That’s become a more viable option that’s making a resurgence because you still have pretty good density, with a lower HOA cost. We’re seeing three story duplexes like Wyatt by Tri Pointe Homes in Corona. That product is successful, and a few more examples are popping up in the planning stages.

For the first-time buyer pursuing the American Dream, the density has to be pushed and I can’t really think of any builder who wouldn’t consider it. Certainly, in the core Inland Empire markets, they’re getting built successfully, and that should continue. On Ontario Ranch for example, I think there are 12 to 14 actively selling townhome projects out of 17 to 19 total projects. Even some of the tertiary markets, whether it’s Lancaster and Victorville, you’re starting to hear about building some attached, higher-density products. And of course, in the coastal markets, that’s the primary product type getting built.

These trends are helping to keep the dream alive, along with builders offering interest rate buy-downs, which most of them are at this point. That has really helped with the affordability challenge. If the first-time buyer can get in and qualify at a lower rate, like in the fours or sometimes even the high threes, bought down from something over 6%, that can help get the keys to a new home into a family’s hands.

SCB: So, from the American Dream perspective, is there any other thing that’s happening that is making the houses more affordable?

AA: Beyond the higher density, smaller homes, we’re seeing the spec level come down to make the home more basic. Then, on the city side, they need to get behind the effort by streamlining the process and getting rid of some of exorbitant fees. There’s been some CEQA reform, but it’s still unclear to me how much has been put into place at this point

that has made it more affordable and easier for builders to build. That may be the most important factor because builders want to build homes – it’s just the many obstacles that are keeping our supply at a very low level.

I was looking at Orange County, and the new home sales there are about half of what they were before COVID, and that’s a supply issue more than anything. In Los Angeles, it’s about one-fourth of what it was six years ago. Again, it’s the supply. They’re not able to build as much as they’d like. Some of it is land availability, obviously. We’re getting built out, and there’s not as much land left, but it is up to the cities, the state, and the counties to whittle down some of those costs that the builders have to bear.

SCB: So, bottom line: Is the American Dream on life support?

AA: It’s not quite on life support, and it’s going to get a little bit better in the near term. I think it’s going to be a long road to get back to where we want to be, to where we have been in the past in this country where the majority of folks and households can reasonably buy a home. We’re not anywhere near that now, so we’re going to have to limp back, and it will likely take many years. But I think the small steps that are happening are helping – the higher-density housing and the smaller homes for those first-time buyers so they can get on the property ladder, build some equity, and then move up into a larger home down the road.

Builders are moving in that direction, which will help, and hopefully, interest rates are going to be coming down a little bit. We need to build more homes, but that’s not a builder issue. They want to build; it’s the jurisdictions that really need to allow that to happen and support the dream of homeownership by clearing the way.

T u r n P r o j e c t s I n t o

P r o f i t a b l e P a r t n e r s h i p s

Tonight on ER: Can the House Docs Save the American Dream?

For its first 15 years, the American Dream didn’t include owning a home. A historian named James Truslow is credited with coining the phrase in the early 1930s, which he defined as a better, richer, and fuller life for everyone, with opportunity for each according to ability or achievement. With just a few more years until the phrase reaches its 100th anniversary, it’s surprising just how positively and hopefully those words resonate even today.

The American Dream didn’t include homeownership until the GIs returned from World War II in the mid-1940s, married their sweethearts, and spawned the Baby Boomers. Who added homes to the Dream? That’s lost to history, but those of us in the homebuilding industry know the answer: It was no doubt a sharp new home marketing team. They knew, like all Americans knew, what the vets had fought for – the better life and endless opportunity only America could promise. So why not make a new home a part of the dream?

To capture the excitement of that era when a newly minted family with one income and a couple kids could afford a nice new home, all you have to do is pull off the 405 at Lakewood Blvd., turn north, and drive the streets of the post-World War II housing boomtown of Lakewood. Try to imagine – I dare you! – being able to walk into a sales office and come out a while later as one of the 30 people that day who purchased a new Lakewood home with a 4% loan, no downpayment, and a monthly payment of around $50, including insurance.

I know, inflation. But today, that $50 would only be about $780 – still the house payment of our dreams. That’s why we’re asking in this issue of Southern California Builder if the American Dream that includes homeownership is still something Americans can aspire to. In my experience, as a member of what has come to be known, whether one likes it or not, the privileged White population, the answer is yes, it’s attainable…for about one out of three Orange County

Laer Pearce President of Laer Pearce & Associates

30-somethings. My sample size for this survey is three – my three daughters, all in their 30s, all in two-income households, and only one who owns a home.

That one, the oldest of the three, first moved to Arizona with her partner to buy their first home at an ideal time in the market, then moved up literally and geographically to a second home in Idaho, and finally was able to return to Southern California and buy a home here. And by “Southern California,” I mean the very last mile or two of Southern California, in the Tehachapi Mountains in Kern County. The other two are still renting, in Anaheim and Rancho Santa Margarita.

My oldest works for the Center for Creative Land Recycling, an NGO that helps communities transform polluted brownfields into clean, healthy, and safe places to live, work, and play. She was recently at a conference peopled with like-minded folks and asked them on my behalf for their thoughts about the American Dream. Here’s what we heard:

“Yes, the dream is still alive but fading. People can still succeed through hard work and people still want to come to America for the dream,” – a middle-aged man.

“The American Dream is different for different people, but for me it’s dead,” – a young woman.

“I watched people get over-extended in 2007/2008, so I don’t own a home, but my wife and I are talking about it. So I think it’s still alive,” – a man in his 30s.

“If the American Dream is homeownership, the Dream has been dead in San Francisco for some time,” – a woman in her 50s.

“As an aspiration, it’s still alive. People still strive for homeownership, but it’s not for everyone,” – a man in his 60s.

And then there was the Navajo woman who just shrugged and said, “Seventy percent of my people don’t even have running water.” She and her people have other, more pressing aspirations, and I pray to God that they’re realized.

For what it’s worth, speaking as someone who has been involved in securing regulatory approvals for somewhere around 400,000 new homes, I think the American Dream that includes homeownership is still alive – but it’s in the ER. Fortunately, there’s a team of bright and motivated economists, architects, planners, marketers, contractors, developers, and homebuilders who are all working frenetically to keep that red, white, and blue heart beating.

I think they’re going to pull it off, and they’re going to do it in part by returning to Lakewood and the sort of homes offered to those post-World War II families: three modest bedrooms, a small, tidy kitchen, and a couple basic bathrooms in a 1,400 or 1,600-square-foot floorplan. No marble islands, no 30-foot ceilings, no media rooms, but smart, attractive designs with floorplans that live comfortably. Those are the specs for the first-time-buyer homes that will keep the American Dream alive in Southern California.

The airtight path to Title 24 compliance and performance credit

TRUSTED FOR EVERY HOME UNDER THE SUN

Whether you’re remodeling or building new homes or multi-family residences, we have options for your design and budget.

Mike Durham, LGI Homes A Logical Approach to Fulfilling the Dream

LGI Homes was founded in Texas 22 years ago with a single, two-word purpose: Dream Fulfillment. In its first two years, it hundreds of families fulfill their dream of owning their own home, and since then, it has repeated that achievement for more than 75,000 families, 90 percent of whom were first-time homebuyers. The company’s understanding of the benefits of homeownership and its desire to be the dream fulfiller for its customers excited Mike Durham enough that four and a half years ago he left a very satisfying position at Pulte Homes and moved to LGI Homes “so that going to work every day meant making an even bigger difference in people’s lives – I thought that would make the job very enjoyable.”

LGI Homes now has 150 active communities in 35 markets across the United States, and every one of them approaches its market, its customers, and its products in the same way, applying a logical approach designed to make it possible for families to purchase a home, even if they thought homeownership was beyond their reach. The approach, unchanged since the company’s founding, works as well in California, with all its challenges, as it does in less regulated, more builder-friendly states, so Southern California Builder was interested in talking to Mike, who now holds the position of LGI Homes’ Vice President of Operations for Southern California, about how they do it.

Southern California Builder: If the goal of LGI Homes is dream fulfillment, how do you structure the business so that you’re able to come to market with an affordable home in a state like California?

Mike Durham: The CEO and founder of the company, Eric Lipar, started the company in 2003 with his only focus being dream fulfillment. He was able to build, deliver, and close approximately 337 homes in two years, so the company was off to a very fast start. His focus at the time is unchanged compared to where it is today, that is, fulfilling the dream of homeownership. So, the systems that were put in place back then were developed by an individual who was very focused on catering to a very targeted customer group, the first-time home buyer. That process includes being a spec builder, which we are today, and having no options for a customer to purchase. If they want a specific colored countertop, that’s something they would have to put in after the fact. We put in the exact same countertops in each community, in every home throughout the community. That means we’re able to purchase and bulk and provide at an affordable price with a quality product.

Most of our customers are coming from either a rental situation or they need to move within a 30-day time frame. We put the inventory in front of us so that if someone comes into one of our sales offices today, we’ll have them in a house in 30 days once they’ve qualified. To do that, we make it really simple. We don’t have a lot of ambiguity in our selling system. It’s a very well-structured process that caters to the first-time home buyer. For people who have not gone through the experience of buying a home, it gets complicated between getting a mortgage, finding a lender, selecting a home, going through closing. I mean, just look at the paralysis by analysis that typically occurs with a new home purchase – going to a design center, dealing with whether to buy or lease the solar, is the flooring I want included in the purchase price – we take away all of that.

DREAM OF HOME OWNERSHIP

Mike Durham Vice President of Operations, LGI Homes

The move-up and higher-end buyers have a different level of discernment regarding what type of flooring, cabinets, and countertops they want in their home. But when you focus on dream fulfillment, you have a customer who’s living in an apartment and doesn’t have those expectations. We’re not as hung up on the paint color scheme because we’re focused on the customer’s true problem, which is finding a place to live where they can have the freedom to put in a yard and have space for their children. They are thinking more about having the security of not being evicted, or the security of having a garage where they can park their car and not worry about it getting broken into.

Coming to this company was an eye-opening experience because so much of the approach and process was different. The tactics, strategies, and planning we employ all make our number one priority how to solve our customers’ problems. It’s amazing to find a customer that never would have thought they would be able to own a home, and take them through this process, not only validating that they’re capable, but giving them the steps on how to get there, and then turning their keys over to them as a first-time home buyer. It’s life-changing for their family, creating generational wealth, freedom, all of these things. Everyone who works in homebuilding knows the great feeling of seeing families move into homes you’ve worked so hard to get to market, but take my word for it, it’s an even greater feeling when it’s a family’s first home.

SCB: Is it possible for a builder that’s been focused on the middle market or the high-end market to make the changes needed to be an affordable home builder?

MD: I’m a believer that anything is possible, but it is an absolute paradigm shift. That’s one of the things that intrigued me so much about LGI Homes – that we do most things backwards in comparison to the industry. To your point, where most builders are looking at ROI and maximizing the return on every home, but for us, if we can build and close one more home compared to Brand X, then we’re fulfilling our obligation to our shareholders and to our customers. We’re not as hung up on the return on every single house. Still, all things are achievable, even if it’s a tall hill to climb when it comes to managing a completely different structure and a different process. The system that we have in place is essentially the same system that was created in 2003. LGI has been able to

stamp this out from that one small community called Somerset Estates in Texas to where we sit today as a national builder. The system has been proven to be an all-weather type system.

SCB: Even in California?

MB: Well, we’ve tested it, and it’s worked from Florida to the Carolinas to, yes, even California. The idiosyncrasies may be a little different from jurisdiction to jurisdiction, but the system is the same, for every facet of our business, for every state. If I put my construction hat on, construction methodology is the same, big picture. Now, granted that we don’t build homes the same in Florida than we do in California, so the expertise needed may be different, but our building philosophy is the same from the end-product standpoint of being a spec builder. We’re going to build spec and get ahead of demand. We put the financial investment in place, because our goal is to sell a home to a customer within 30 days of completion, or to sell a completed home and have them move into it within 30 days. So, that determines how we manage everything, everywhere. I imagine builders have spec inventory on the ground today regardless, but we were in that position four to five years ago when no one had any inventory. It takes some capital, but we’ve proven that it works over and over, so our shareholders are happy.

SCB: Thanks in part to BIA’s efforts, there’s more awareness of the need to address the crisis in home affordability. Given this, are local jurisdictions making your entitlement process easier because they understand the need for the type of product you’re building?

MD: I’ve yet to engage with that type of mentality. As great as that would be, as correct as it would be, we still get plenty of red tape to cut through. Every city is its own business, and they have all of their own idiosyncrasies. As we all know, there are standards that cities are required to fulfill in the process of bringing housing into their city or town. Even in the more housing-friendly jurisdictions, this means that there is still so much red tape to cut through. Even though the desire to fulfill their RHNA requirements may be there, the physicalities just don’t present themselves.

In California there’s a housing policy crisis, which creates the housing affordability crisis. To solve it, you have to

E v e n t s

1 7

Check Out List of Events for 2023

Save the Date 2025 BIASC EVENTS

BIA Riverside Chapter Golf Tournament

October 29 BIA LAV Meet the Builder & Elected Officials Mixer

October 30

October 30

BIA Los Angeles / Ventura Chapter Golf Tournament

Monday, June 12, 2023 To Be Announced

BIAOC NextGen Nellie Gail Site Tour (NextGen Members Only)

BIASC Greater Sales & Marketing Council Networking Event

November 3 BIA LAV Trap Shoot Tournament

June 1 2 June 1 5

November 6

BIASC SAGE 55+ Housing Council & BIA Coachella Valley: Coachella Valley Trends & the 55+ Market Presented By Andrew Lauren Interiors

BIA Orange County Chapter Whiskey Tasting Event

Thursday, June 15, 2023

Dacor Kitchen Theater in Irvine

November 6 BIA Riverside County Chapter Presents Virtual Planning Directors & Community Development Directors Workshop

BIASC Coachella Valley “Shots in the Night” Networking Event

BIA Riverside County Chapter Annual Wine Event A p r i l

November 7

BIA Riverside & San Bernardino County Chapter Joint BBQ Networking Event

Thursday, July 13, 2023 To Be Announced

BIASC Inland Empire Emerging Leaders Claremont Pub Crawl

BIASC Special Evening with Industry Leaders

November 8

November 12

November 14

November 19

December 3

BIASC SoCal MAME Awards

BIA Orange County Annual Baseball Night

BIASC Greater Sales & Marketing Council Women’s Leadership Breakfast

BIAOC Annual Installation Gala

Tuesday, July 18, 2023 Angels Stadium of Anaheim

BIA LAV Annual Installation Gala

BIA Orange County Chapter Golf Tournament

December 5

July 1 3 July 1 8 July 2 7

BIA Los Angeles / Ventura Chapter Top Golf

BIASC Golf Tournament, Meet the Builder, & Holiday Mixer

BIASC SAGE 55+ Think Tank

Thursday, July 27, 2023 Top Golf in El Segundo

December 8 BIA Riverside County & BIA San Bernardino County Chapters Golf Tournament

December 10

Thursday, August 17, 2023 Wilson Creek Winery August 1 7

BIASC Inland Empire Joint Meet Your Elected Officials Reception

*ALL DATES SUBJECT TO CHANGE*

BIA San Bernardino County Chapter & BIA Riverside Chapter Joint Top Golf Event BIA Orange County Chapter Women in Leadership Conference

resolve the policy issues that make it such a long, timeconsuming, expensive burden to get a project online –CEQA, insurance, wildfires, building code, all that. Look at the fire code, for example. If they put more land in the high fire risk zone, they’re adding $6,000 to $10,000 to the cost of every home, which further puts homeownership out of reach for people that are looking to attain it. If we’re going to have to jump through a bunch of hoops, all of those hoops have costs that will come down to the bottom line. We need fewer hoops and lower hoops.

SCB: Your approach must also affect home design, right?

MD: Absolutely! We’re focused on affordability, and affordability generally doesn’t mean wild and elaborate elevations, and 30-foot ceilings, and steel beams with multi-sliders. As neat as they are, they don’t fulfill our mission. The architecture that we create may seem lackluster compared to some, but remember, our buyers are usually comparing it to the architecture of an apartment. We are not so proud of ourselves that we need to come up with a new, innovative plan in every

community. The reality is that our proven plans work well, some of which have come from Arizona and Nevada.

Landscaping is another good example. When I’m interviewing landscapers to work with LGI Homes, I tend to let them down by saying, ‘If you’re looking to have an award-winning project, we’re not the builder for you.’ Our focus is on dream fulfillment, and a big part of that is affordability, so we’re not looking to help them make a name for themselves through some landscaping magazine article or creative design award. We want the landscaper that has a formula for affordable landscaping that can be replicated community by community.

SCB: Does your buyer accept all that you’re doing to make homes affordable?

MD: Let’s put it this way: When it comes to our most popular and highest-volume plans, it’s the smallest ones. We’re talking affordability, it’s something the market doesn’t offer, and there’s an absolute demand for the homes we build – homes that create dream fulfillment.

BIA Los Angeles / Ventura County Chapter

Meet The Builder and Elected Official Reception

The New SCV Senior Center at Bella Vida

27180 Golden Valley Road

Santa Clarita, CA 91350

Wednesday, October 29th

4:00 pm - Registration Begins 4:00-5:00pm - Meet the Builder 5:00-7:00pm - Reception

MEET THESE BUILDERS! TICKETS

State

Assemblywoman Pilar Schiavo

Assemblyman Tom Lackey

City of Santa Clarita

Mayor Bill Miranada

Mayor Pro Tem Laurene Weste

Councilman Jason Gibbs

Councilwoman Marsha McLean

Councilwoman Patsy Ayala

BIASC Members Early Bird (Until 9/24): $135

BIASC Members Regular Rate (After 9/24): $145

***5:00PM RECEPTION ONLY FOR NON-MEMBERS*** Non-Members Early Bird (Until 9/24): $95

Non-Members Regular Rate (After 9/24): $105

SPONSORSHIPS

Event Supporter: $700

Includes logo on event marketing and signage and 1 ticket to attend

Reception Sponsor: $1,000

Includes logo on event marketing and signage and 2 tickets to attend

Presenting Sponsor: $1 ,800

Includes logo on event marketing and signage, 4 tickets to attend, and 2-minute welcome at reception.

WHO IS ATTENDING

Newhall School District

Sue Solomon

Saugus School District

Chris Trunkey

Sulphur Springs School District

Shelley Weinstein

Castaic Union School District

Mayreen Burk

Register online at www biasc silkstart com/events

SCV Water

Vice President Gary Martin

Board Member Bill Cooper

Dan Masnada

Hart High School District

Bob Jensen

Erin Wilson

Joe Messina

Dr. Aakash Ahuja

If you have any questions, contact Laura Salgado, lsalgado@biasc.org or 949-777-3861.

More Than a Membership: Building Success Through Engagement, Education & Action

Supporting the BIASC is not only a strategic go-to-market decision for our company, but part of our overall business and builder outreach plan for the year. It is a critical component to how we identify, develop, and target our builder sales opportunity pipeline. BIASC provides great exposure for our sales team via networking mixers throughout the year and the highly sought after “Meet the Builder” events.

Eric Linares Builder/ Architect Sales Leader, LiftMaster

We’ve got you covered. Our innovative products, combined with intuitive software solutions deliver seamless, secure, access to the homes and communities you build. LiftMaster powered by myQ is a simplified, secure smart access system that provides peace of mind and empowers homeowners to move seamlessly throughout their day.

Control, monitor and secure their home’s entry points—anytime, from anywhere.

Conveniently share access to the home without sharing keys or access codes.

Schedule the garage to close and the door to lock at a certain time each night.

Get secure ingarage deliveries.

INDIVIDUAL SHOOTER & AXE THROWING: $345

Two rounds of shooting and ammo

TRAP & AXE THROWING

FIVESOME: $1,550

Team of five shooters w/ two rounds of shooting and ammo

Axe Throwing for five VIP EXPERIENCE: $1,850 f fi e shooters w/ two mo

Axe Throwing for one ANNIE OAKLEY SPONSOR: $2,950

Fivesome with two shooting rounds & ammo Logo

Five Tickets for Axe Throwing and Archery

When people ask me why I’ve stayed so committed to BIASC for more than a decade, my answer is simple: BIASC isn’t just a membership. It is the smartest investment I’ve ever made for both my business and my personal growth.

When I first joined over 10 years ago, I thought I was simply signing up for an industry group. Within 15 months I signed my first contract with a nationally recognized builder, and within three years my sales had tripled. That success came directly from the credibility, exposure, and connections I gained through BIASC.

The impact also goes beyond business. BIASC introduced me to a network of hardworking, humble, and collaborative professionals who have become not only colleagues but also lifelong friends.

For me, BIASC is the most effective way to grow your business and join a community that truly supports one another. It is not just a membership. It is an opportunity to thrive.

Grace Ji Managing Director of Acquisitions, TJ Prestige Properties

BIASC Riverside County Chapter Government Affairs Presents

VIRTUAL PLANNING DIRECTORS AND COMMUNITY DEVELOPMENT DIRECTORS WORKSHOP

JOHN HILDEBRAND Planning Director Riverside County

THURSDAY, NOVEMBER 6TH 10:00 - 11:00 AM

KENNETH PHUNG Director of Developmen Services City of Perris

Join us to hear from Planning Directors and Community Development Directors as they discuss key planning items or issues impacting residential development and building. They’ll discuss any current planning obstacles and opportunities where the home building industry might be able to assist.

www biasc silkstart com/events QUESTIONS? Contact Laura Salgado lsalgado@biasc.org

949-777-3861

PRICING

ORLANDO HERNANDEZ Director of Community Development City of Menifee

I promote BIASC to non-members because I genuinely believe in the value it brings. After many years in this industry, I often meet people who aren’t yet members, and I see how much joining could help them grow their business. BIASC events like Meet the Builder or social gatherings are not only enjoyable, but they also provide powerful networking opportunities. I enjoy making those connections — when people get involved, it benefits them, the industry, and our community as a whole.

Eric Romero Director of Sales, OJ Insulation

3rd Annual Night Golf!

The Coachella Valley Chapter Thanks Its Annual Sponsors:

Coachella Valley Chapter Inquiries Contact Cristina Walters,

Eagle Sponsor - $1,950: team of 4 golfers

custom golf shirts

speaking introduction

logo prominence on all marketing outreach

Birdie Sponsor - $850: team of 2 golfers

custom golf shirts

logo on all marketing outreach

Coachella Valley Sponsor Inquiries

Contact Laura Salgado, VP of Events, at LSalgado@biasc.org

INSTALLATION GALA

Induction and Installation of Incoming President

Joe Oftelie, Warmington Residential & 2026 Board of Directors

Sponsorships Available

GOLD $4,450

• Table of 10

• Logo on Marketing Materials

• (1) Color Power Point Sponsor Slide in Presentation

SILVER $2,950

• (4) Tickets

• Logo on Marketing Materials

• (1) B&W Power Point Sponsor Slide in Presentation

BRONZE $1,850

• (2) Tickets

• Logo on Marketing Materials

• Logo in Sponsor Power Point Presentation

Invidual Tickets

• $235 Early – Until October 10th

• $260 Regular – Until October 31st

• $275 Late Registration or Until Sell Out

Table of 10

• $2350 Early – Until October 10th

• $2600 Regular – Until October 30th

One of the primary benefits of joining BIASC is gaining access to exclusive content, networking opportunities, advocacy and representation within the building industry. These connections have been extremely beneficial for me here in the Coachella Valley!

Jesse Frescas Jr. CCM

Construction Project Executive / Business Development, Capital Building Services

Pre-Construction

Design

Public-Private

Commercial

LA/VENTURA CHAPTER

2025 AWARDS & INSTALLATION GALA

Skirball Cultural Center

2701 N Sepulveda Blvd, Los Angeles, CA 90049

Attendee Pricing

BIASC Member Tickets:

• Early Bird Until Oct 17th: $215

• Regular Until Nov 7th: $235

• Late or Until Sell Out: $245

Non-Member Tickets:

• Early Bird Until Oct 17th: $245

• Regular: $265

Sponsorship Opportunities

Platinum Sponsor – $5000

• (10) Attendee & VIP Reception Tickets

• (2) Color Slides in Sponsor PowerPoint

• Company Logo on all Marketing

Gold Sponsor – $3950

• (8) Attendee & (4) VIP Reception Tickets

• (1) Color Slide in Sponsor PowerPoint

• Company Logo on all Marketing

Silver Sponsor – $2950

• (4) Attendee Tickets + (2) VIP Reception Tickets

• (1) Black & White Slide in Sponsor PowerPoint

• Company Logo on all Marketing

Bronze Sponsor – $1650

• (2) Attendee Tickets

• Company Name in Sponsor PowerPoint

LA/Ventura County Chapter President

NOV 19TH 4:00-8:00 PM

• Company Name on all Marketing 4:00–5:00 PM | Board & VIP Reception 5:00–6:00 PM | General Reception 6:00–8:00 PM | Dinner & Program

NATHAN KEITH Tejon Ranch

Congratulations to the 2025 BIASC Hall of Legends

September 11, 2025

Honored at the BIA Regional, Inland Empire and Coachella Valley Installation Gala:

• Randall Richards, Executive Vice President Operations & Sales at Reliable Wholesale Lumber, Inc.

• Matt Jordan, Founder and Co-Managing Member of Diversified Pacific Development Group

• Frank Williams, Executive Officer of the Baldy View Chapter (now San Bernardino County Chapter)

• Mitch Brown, Principal Consultant | Senior Housing Consulting

• Howard Englander, Owner & President at The Englander Company

To be honored at the BIA Orange County Chapter Installation Gala and the BIA Los Angeles/Ventura Chapter Installation Gala:

• Jeff Roos, Vice President, Lennar Foundation / National Chair, Homeaid / President, Homeful

• Greg McWilliams, Chief Policy Officer, FivePoint

• Tom Grable, Former BIASC Chair and Former Division President - Tri Pointe Homes, Inc. — Orange CountyLos Angeles Division

• Laer Pearce, President, Laer Pearce & Associates

• Leslie Duckett, First American Title

• Fernanda Luick, President of Eliant

• Richard Dunbar, Oakridge Landscape

M E E T T H E B U I L D E R &

H o l i d a y R e c e p t i o n

T h e B a r n a t S t r a w b e r r y F a r m s

1 1 S t r a w b e r r y F a r m R d

I r v i n e , C A 9 2 6 1 2 * * * M e m b e r s O n l y * * *

D E C E M B E R 3 R D

M e e t T h e s e B u i l d e r s

V I P M E E T T H E B U I L D E R - 4 : 0

V I P M E E T T H E B U I L D E R - 4 : 0 0 - 4 : 3 0 P M

M E E T T H E B U I L D E R - 4 : 3 0 - 6 : 0 0 P M

- 4 : 3 0 P M M E E T T H E B U I L D E R - 4 : 3 0 - 6 : 0 0 P M

H O L I D A Y R E C E P T I O N - 6 : 0 0 - 7 : 0 0 P M

H O L I D A Y R E C E P T I O N - 6 : 0 0 - 7 : 0 0 P M

T i c k e t s

B I A S C M e m b e r s E a r l y

B i r d ( U n t i l 1 1 / 1 2 ) : $ 1 4 5

B I A S C M e m b e r s R e g u l a r R a t e ( A f t e r 1 1 / 1 2 ) : $ 1 6 5

S p o n s o r s h i p s

‘ T i s T h e S e a s o n S p o n s o r : $ 8 5 0

I n c l u d e s l o g o o n e v e n t m a r k e t i n g

a n d s i g n a g e , 2 t i c k e t s t o a t t e n d a n d

V I P M T B a c c e s s ( f i r s t 4 s p o n s o r s )

S e a s o n s G r e e t i n g s S p o n s o r : $ 1 , 4 5 0

I n c l u d e s l o g o o n e v e n t m a r k e t i n g

a n d s i g n a g e , 3 t i c k e t s t o a t t e n d , V I P

M T B a c c e s s ( f i r s t 4 s p o n s o r s )

H o l i d a y C h e e r S p o n s o r : $ 2 , 4 5 0

L I M I T 2 O P P O R T U N I T I E S

I n c l u d e s l o g o o n e v e n t m a r k e t i n g

a n d s i g n a g e , 4 t i c k e t s t o a t t e n d , V I P

M T B a c c e s s , a n d 2 - m i n u t e w e l c o m e

a t r e c e p t i o n

R e g i s t e r o n l i n e a t w w w . b i a s c . s i l k s t a r t . c o m / e v e n t s

I f y o u h a v e a n y q u e s t i o n s , c o n t a c t L a u r a S a l g a d o , l s a l g a d o @ b i a s c . o r g o r 9 4 9 - 7 7 7 - 3 8 6 1 .

HIDDEN VALLEY GOLF COURSE

8 2025 10 Clubhouse Dr, Norco, CA 92860

SPONSORSHIPS

$4150 | Tournament Sponsor Free foursome of golf

Company Logo on Sponsor Signage. Company logo on all marketing materials.

$2950 | Raffle Prize Sponsor - no golfers

Company Logo on Sponsor Signage Company logo on all marketing materials.

$2750 | Morning Round Sponsor - no golfers

Company Logo on Bloody Mary or Mimosa Drink Ticket

Company Logo on Sponsor Signage. Company logo on all marketing materials.

$2750 | 19th Hole Reception Sponsor - no golfers

Company Logo on Sponsor Signage. Company logo on all marketing materials.

Company logo on drink ticket for players

$1450 | Beverage Sponsor - no golfers

Company Logo on Sponsor Signage. Company logo on all marketing materials.

Company logo on drink ticket for players

$1450 | Lunch Sponsor - no golfers

Company Logo on Sponsor Signage. Company logo on all marketing materials.

Company logo on lunch ticket for players

$1250 | Cart Sponsor - no golfers

Company logo on all golf carts. Company logo on all marketing materials.

$1150 | Hole In One Sponsor

Company logo printed on Hole-In-One signage.

Company logo on all marketing materials. 19 Hole Reception immediately following game play th 19 Hole Reception immediately

PLEASE WELCOME BACK OUR RENEWING MEMBERS

AUGUST 6 - OCTOBER 6 , 2025

2nd Avenue Sales & Marketing

Addition Building & Design, Inc

Advanced Construction Technologies/GeoKinetics

Airplus of California

Amazing Mindsets

AvalonBay Communities

Bassenian/Lagoni Architects

Bedrosians Tile

Big D Supply

Boudreau Pipeline Corp

BrightSky Residential

BrightView

Builder.Media

Builders FirstSource

Builders Insulation of California, LLC

C & C Development

C W Driver

California Sub-Meters

CBC Framing, Inc

Chameleon Design

Citibank

Clover Masonry Construction

Cornerstone Specialty Insurance

David Evans and Associates, Inc

Davidson Reinforcing Inc

DCSE Associates, Inc.

DePinho Roofing, Inc

Douglas Pancake Architects

Dynasty Fireplaces

Eastern Municipal Water District

Entrussed, LLC

Environmental Construction, Inc.

Eternity Flooring

First American Natural Hazard Disclosures

FirstService Residential

Foremost Pacific Group

FORMA Design, Inc.

Generac

GGG Demolition

Guilin Cabinets

H N & Frances C Berger Foundation

Habitat for Humanity Inland Valley

Habitat for Humanity of Greater Los Angeles

Hagle Lumber Company, Inc.

Henry, a Carlisle Company

Holiday Carpet & Floor Covering Inc

HPI Architecture

Hunsaker & Associates Irvine Inc

Impact Sign & Graphics LLC

Infinity Plumbing Designs, Inc.

Integrated Energy Group LLC, DBA IE Construction

J De Sigio Construction, Inc.

Kevin L Crook Architect, Inc

Keystone Pacific Property Management, Inc.

Kohler Company

Kompan California

KWC Engineers Inc

LGI Homes California LLC

LJP Construction

loanDepot com

Master Roofing Solutions, LLC

MDS Consulting

Mission Springs Water District

Mohawk Industries

Movement Mortgage

MP Digital Strategies

NMG Geotechnical, Inc

OJ Insulation Company LP

Panasonic Eco Systems North America IAQ Division

Paolucci Salling & Martin Communication Arts

PatioShoppers Commercial Pool & Outdoor Furniture

Peter Mayer Productions, Inc

Phoneware

Pivotal Consultants, Inc

PolyGlass U.S.A

Premium Concrete Construction Inc.

Prieto Construction Company, Inc

Pro Engineering Consulting

Procopio

ProTec Building Services

QCellls North America

Rockwell Land Company

Royal Cabinets

Sapetto Real Estate Solutions, Inc

SB & O Inc.

SDK Design Group

SGV Investment Fund LLC

Shaw & Sons

Sheppard Mullin Richter & Hampton LLP

Shopoff Realty Investments

SJA Landscape Architecture l Land Planning

Stantec

Structa Wire Corp.

Sukut Construction, LLC

Symons Fire Protection, Inc.

Synergy Consulting CA

Tax & Financial Group

The Land Stewards

The Money Store

Therma-Tru Doors & Fypon

TJ Prestige Properties

Total Comfort Inc.

Transtech Engineers Inc.

Tri Cascade Inc

Trilogy Plumbing

Truss Creative

TrustLink Mortgage

United Civil, Inc

United Engineering Group

Utility Design Solutions, LLC

Venture Strategic Inc

Watson Legal Group, APC

Weiland Design Group, Inc

Whitenack Consulting, Inc.

Win-Dor

Wright Engineers

T R A F F I C & S A L E S D O W N ?

S I G N S A R E

I N Q U I R E T O D A Y U P B I A S I G N S . C O M

L E T B I A S I G N S P O I N T B U Y E R S I N Y O U R D I R E C T I O N

2025 Junior Builder Camp

Building a Sustainable Future with Leadership, Advocacy and Resolve

The Builders for Better Communities Foundation (BBCF) is a 501(c)(3) charitable nonprofit that serves to promote diversity, equity, and inclusiveness on behalf of the Building Industry Associati on of Southern California within the Southern California region.

BBCF is dedicated to supporting veterans, underserved communities, and individuals impacted by the recent Los Angeles fires.

Supporting Affordable Housing opportunities for U.S. Veterans and their families is a cornerstone of BBCF.

California’s housing crisis continues to have a significant impact on the most vulnerable, including our veterans. BBCF will advocate to improve the Housing Availability and Affordability for those veterans. Learn more at buildersforbettercommunities.org.

BIA Riverside County Chapter & BIA San Bernardino County Chapter Inland Empire

Cornhole Tournament

Presented by SoCalGas - October 22, 2025

COACHELLA VALLEY TRENDS AND THE 55+ MARKET

Join us for an exciting tour of the Coachella Valley to explore the newest 55+ housing options, beginning with the inspiring Cotino™, the first Storyliving by Disney tm community.

Representatives from Cotino™, Anthony Henry General Manager, Cotino™ and Tony Prock Director, Sales – Storyliving by Disney will share valuable insights on how amenity rich communities, like Cotino, are motivating buyers through thoughtful home designs and programming only Disney can deliver. Then dive deeper into the senior housing market, with Scott Wild, Principal at John Burns Research & Consulting.

With more seniors relocating to the Coachella Valley than ever before, this is a unique opportunity to learn why the region is becoming such a hot spot for active adults and to see firsthand the beautifully designed communities created with them in mind.

Following the presentation attendees will be treated to a tasting menu at Architects Fork, Cotino’s table service restaurant. And afterwards stay and enjoy a self-guided tour of other 55+communities in the area, each offering its own unique lifestyle and amenities. Don’t miss this chance to gather fresh ideas, network with peers, and experience what makes the Coachella Valley such a special place for today’s seniors.

This will truly be an event to remember!

REGISTER TODAY!

PRESENTING

SPONSOR

SUPPORTING SPONSOR

Apply for your SAGE 55+ Housing Council membership and RSVP today!

COTINO

October 30th, 2025 11:00 a.m. to 2:00 p.m. COTINO 10 Danube Dr Rancho Mirage, CA 92270

Culinary Lunch Experience at Architects Fork

SAGE Member $65 | BIASC Member $75

Non Member $95

Sponsorships Available

Presenting $1750

• 4 Tickets

• Logo on all marketing materials

• 1-2 min to speak

Supporting $750

• 2 Tickets

• Logo on all marketing materials

Tony Prock Director, Sales Storyliving by Disney

Scott Wild Principal, Consulting John Burns Research & Consulting

Anthony Henry General Manager Cotino

Celebrate the innovation, creativity, and excellence in our industry. Showcase your finest work, honor your team’s remarkable achievements, and take your place in the spotlight.

Saturday – November 8, 2025

The Westin Resort of Anaheim 5:00pm-9:00pm

Tickets: GSMC Members: $175 | BIASC Members $195 | Non-Members: $235

Attire: Be elegant. Be bold.

EARLY ENTRY: September 1

GSMC Members: $225 per entry

BIASC Members: $275 per entry

Non-Members: $450 per entry

LAST CALL ENTRY: September 22

GSMC Members: $325 per entry

BIASC Members: $375 per entry

Non-Members: $525 per entry