The Boston City Council established the Boston Groundwater Trust with the primary goal of monitoring groundwater levels in specific sections of the City where the structural integrity of building foundations supported by wood pilings is at risk due to declining groundwater levels. Alongside monitoring, the Trust is also tasked with making informed recommendations aimed at addressing and resolving this critical issue. In Fiscal Year 2025 (covering the period from July 1, 2024, through June 30, 2025), we made steady progress in advancing these important efforts. The Trust’s core responsibilities include maintaining a comprehensive network of approximately 800 observation wells across the city, conducting groundwater elevation measurements in these wells, and ensuring that this valuable data is made available to the public as well as the relevant governmental agencies.

The Trust’s success is driven by the dedicated contributions of our 16 Trustees, who generously serve without compensation. These Trustees convene on a bi-monthly basis to review all aspects of the Trust’s operations, establish policies, and provide strategic guidance to the executive director to ensure the Trust remains effective and responsive.

Throughout the past year, public outreach and awareness initiatives have continued unabated. The Trust has actively engaged with a wide array of audiences—including interested residents, city departments and agencies, neighborhood organizations, law firms, and real estate brokerages—to educate them about the groundwater challenges facing Boston and the ongoing efforts to protect building foundations and maintain the health of the City’s groundwater system

In FY25, the Trust carefully considered extending the term lengths for Trustees. To ensure a wellinformed and deliberate decision, the Trust consulted closely with the City’s law department and conducted a comprehensive survey of all of the City’s Boards and Commissions. Following a detailed and thoughtful discussion among board members, the Board voted to extend the Trustee term length from the previous two years to a longer period of four years. This change helps ensure stability and consistency within the Board, allowing the organization to continue advancing its mission effectively over time.

Building upon the effort to extend the Trustees' term limits, the Trust also sought to include additional areas of the City that were not currently represented. Collaborating closely with our partners in both the city and the state, the Trust carefully surveyed multiple organizations that could effectively represent their constituents in the affected areas. This approach aimed at ensuring broader and more equitable representation across the affected communities within the city. The Trust added the following organizations to nominate constituent Trustees to be represented on the Board:

Audubon Circle Neighborhood Association

Leather District Neighborhood Association

Bay Village Neighborhood Association

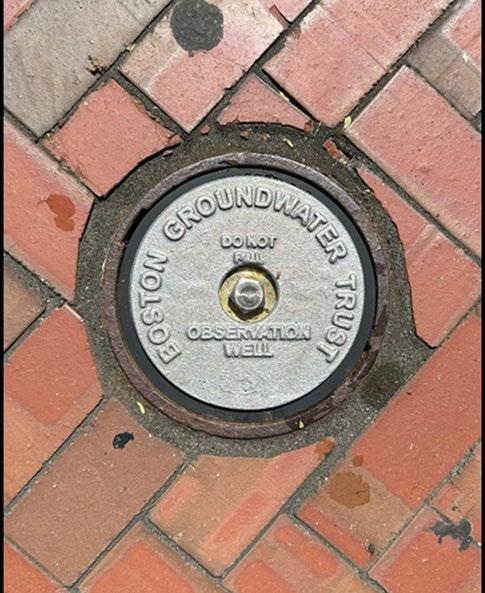

We are pleased to report that we have successfully expanded our remote monitoring project for groundwater levels, significantly advancing our data collection capabilities. These innovative automated devices enable us to collect groundwater-level data in real-time, which is absolutely crucial for supporting our ongoing efforts to manage and protect groundwater resources effectively. They are specifically designed to rest securely on top of the observation well riser pipe and fit snugly within our roadway boxes, as illustrated clearly in the images above. The majority of these devices have performed exceptionally well, consistently providing reliable and accurate data that forms the foundation of our comprehensive analysis. Thanks to this enhanced monitoring capability, if water levels begin to drop, we will be alerted much sooner, enabling us to respond promptly and effectively to any emerging concerns in our key areas of interest.

The Planning Department, working in close collaboration with the Trust, proposed a series of minor but important updates to the Groundwater Conservation Overlay District (GCOD) zoning regulations. The GCOD areas are specifically mapped in parts of the city built on filled land, where numerous buildings are supported by wood piles. The regulations governing GCOD are outlined in Article 32 of the Boston Zoning Code, whose primary purpose is to prevent groundwater level deterioration and to encourage the restoration and protection of these vital groundwater resources. Any applicable development projects located within the GCOD are required to incorporate groundwater recharge systems designed to ensure that stormwater infiltrates into the ground rather than running off onto streets or other impervious surfaces. Additionally, project proponents must certify that their proposed developments will not negatively impact groundwater levels. The Zoning Board of Appeal (ZBA) plays a key role by issuing conditional use permits for these projects, ensuring that groundwater protection measures are properly implemented.

Recent updates to the GCOD regulations introduced streamlining measures for the review process related to ‘Substantial Rehabilitation’ projects. These projects typically involve the renovation or significant improvement of existing buildings and are considered to have minimal impacts on the groundwater regime. By easing the permitting requirements for such projects, the updated process facilitates a more efficient path forward while maintaining necessary protections. Furthermore, amendments were made with the goal of consolidating and simplifying the zoning text, making the regulations clearer and easier to understand for developers, officials, and the public alike. It is important to note, however, that any projects proposing to dig below grade, increase paved areas, or add more than 50 square feet to building lot coverage or that otherwise violate zoning provisions are still required to undergo full review and approval by the ZBA before they obtain their building permit.

The Trust’s ongoing efforts would not achieve the level of success we see today without the essential support and close collaboration from the Mayor of the City of Boston, the Boston City Council, the City of Boston’s Department of Environment, Energy and Open Space, as well as the Boston Water and Sewer Commission (BWSC). We are pleased to report that our requests for funding from both the City and BWSC were thoughtfully considered, granted, and successfully received. Thanks to this vital financial support, the Trust’s operations throughout the year were once again conducted efficiently and responsibly within its established annual budget.

2026 will mark the Trust’s 40th year in existence! While considerable progress has been made over these four decades, it is essential to remind people that the work remains ongoing and ever important. It is crucial to recognize that structures supported by wood pilings will always remain vulnerable to the adverse and often damaging effects of lowered groundwater levels. Carefully evaluating the potential impact of climate change and thoroughly understanding how it may influence and alter groundwater levels are critical steps in protecting the long-term economic viability and structural integrity of Boston’s downtown neighborhoods. Collaborating closely and continuously with the City on increasing, expanding, and enhancing Green Infrastructure initiatives will be essential to preserving the historic character and unique heritage of this magnificent city for future generations to appreciate and enjoy.

Christian Simonelli Executive Director

Boston Groundwater Trust Financial Statements and Report

June 30, 2025 and 2024

To the Board of Trustees of

The Boston Groundwater Trust

Boston, Massachusetts

We have reviewed the accompanying financial statements of Boston Groundwater Trust (the Company), which comprise the as of June 30, 2025 and 2024, and the related for the years then ended, and the related notes to the financial statements A review includes primarily applying analytical procedures to management’s financial data and making inquiries of the Company's management A review is substantially less in scope than an audit, the objective of which is the expression of an opinion regarding the financial statements as a whole Accordingly, we do not express such an opinion statements of financial position statements of activities and cash flows

Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement whether due to fraud or error.

Our responsibility is to conduct the review engagements in accordance with Statements on Standards for Accounting and Review Services promulgated by the Accounting and Review Services Committee of the AICPA. Those standards require us to perform procedures to obtain limited assurance as a basis for reporting whether we are aware of any material modifications that should be made to the financial statements for them to be in accordance with accounting principles generally accepted in the United States of America. We believe that the results of our procedures provide a reasonable basis for our conclusion.

We are required to be independent of Boston Groundwater Trust (the Company) and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements related to our reviews

Based on our reviews, we are not aware of any material modifications that should be made to the accompanying financial statements in order for them to be in accordance with accounting principles generally accepted in the United States of America.

Respectfully submitted,

Raphael and Raphael LLP

Boston, MA

September 16, 2025

Statements of Financial Position

Statements of Activities

Statements of Cash Flows

Notes to the Financial Statements

As of June 30, 2025 and 2024

The accompanying notes are an integral part of the financial statements.

$ 1,013,202

For the years ended June 30, 2025 and 2024

The accompanying notes are an integral part of the financial statements.

Statements of Activities

For the years ended June 30, 2025 and 2024

Net Assets, Beginning of Year 1,010,324 931,163

Net Assets, End of Year $ 1,087,901 $ 1,010,324

The accompanying notes are an integral part of the financial statements.

Total Adjustments

For the years ended June 30, 2025 and 2024

The accompanying notes are an integral part of the financial statements.

For the years ended June 30, 2025 and 2024

1. Organization

The Boston Groundwater Trust (the "Trust") was established as a trust in Massachusetts on July 18, 1986 under the custodianship of the City of Boston. The Trust’s mission is to serve the public interest by re-establishing and maintaining a system for monitoring groundwater levels in parts of the City of Boston. It achieves this by engaging engineers, contractors and other professionals to reactivate existing wells and install new observation wells in addition to collecting, managing, publishing and analyzing data derived from old and new observation wells.

a. Basis of Accounting

The financial statements of the Trust are prepared on the accrual basis of accounting, under which revenues are recognized when earned and expenses are recognized when incurred This is different from the cash basis of accounting, under which revenues are recognized when cash is received and expenses are recognized when cash is disbursed

b. Basis of Presentation

Contributions, net assets, and changes therein are classified and reported as without donor restrictions and with donor restrictions, based on the existence or absence of donor-imposed restrictions. Contributions that are restricted by the donor are reported as increases in unrestricted net assets if the restrictions expire in the fiscal year in which the contributions are recognized. All other donor-restricted contributions are reported as increases in net assets with donor restrictions. When a restriction expires, net assets with donor restrictions are reclassified to net assets without donor restrictions.

c. Cash and Cash Equivalents

Cash and cash equivalents are held in banks and money market mutual funds, and consist of highly liquid investments with a maturity when purchased of three months or less.

On March 26, 2009, the Trustees voted to create an unrestricted reserve fund for the following uses: groundwater research; network upgrading; and a contingency for technical assistance

d. Investments

Investments consist of bonds and certificates of deposit and are reflected at fair market value. Generally, management relies on its custodian for securities valuations. Bond premiums and discounts are amortized over the maturity life of the bond. Unrealized gains and losses are included in the change of net assets.

e. Accrued Expenses

Accrued expenses include current period labor and other expenses paid after the balance sheet date.

For the years ended June 30, 2025 and 2024

The Trust’s revenue consists of grants and contracts and investment income.

The Boston Groundwater Trust receives substantially all grants and contract revenue from the City of Boston and its independent agencies, the U.S. government, and the Commonwealth of Massachusetts. The Trust records grant/contract revenue as deferred revenue until it is expended for the purpose of the grant/contract, at which time it is recognized as revenue.

Investment income and gains and losses on investments are reported as increases or decreases in net assets without donor restrictions unless a donor or law restricts their use Investment income and gains restricted by a donor are reported as increases in net assets without donor restrictions if the restrictions are met (either by passage of time or by use) in the reporting period in which the income and gains are recognized

The thirteen Trustees of the Boston Groundwater Trust contribute their services to assist in maintaining the various programs of the Trust.

Property and equipment is valued at cost and is being depreciated over 5 years on the straight line method. Maintenance and repairs are charged to expense when incurred. Upon retirement or disposition, the cost and related accumulated depreciation are removed from the accounts and any resulting gain or loss is reflected in operations. 2025 depreciation expense is $8,855, while 2024 depreciation was $9,004. 2025 accumulated depreciation is $71,976, while 2024 accumulated depreciation was $63,121.

The Trust is a not-for-profit organization that is exempt from income taxes under section 501(c)3 of the Internal Revenue Code. The Trust’s tax returns generally remain subject to examination for three years after filing

For the years ended June 30, 2025 and 2024

The Trust reports its expenses by their functional expense classification. Expenses related to monitoring of groundwater levels in the City of Boston are classified as program expenses. All other expenses are classified as management and general expenses. Some expenses are allocated between program and management and general. Payroll, payroll taxes and employee benefits are allocated between program and management and general based on time spent on program work versus administrative work. Rent and utilities are allocated based on square footage of space used for program activities versus administrative work. Depreciation expense related to program equipment is classified as a program expense; depreciation expense related to office equipment is classified as a management and general expense.

Management uses estimates and assumptions in preparing financial statements. Those estimates and assumptions affect the reported amounts of assets and liabilities, the disclosure of contingent liabilities, and the reported revenues, gains, support, expenses and losses. Actual results could differ from those estimates.

Employees of the Trust are entitled to paid vacations, sick days, and other time off depending on job classification, length of service, and other factors Unused paid time off does not carry over from year to year; therefore, no liability has been recorded in the accompanying financial statements The Trust’s policy is to recognize the cost of compensated absences when paid to employees

Subsequent events are events or transactions that occur after the balance sheet date but that could affect the amounts or disclosures in the financial statements. Management has evaluated subsequent events through the date that the financial statements are available to be issued, which is the date noted at the bottom of the auditor’s report.

For the years ended June 30, 2025 and 2024

For the years ended June 30, 2025 and 2024, management has classified all of the securities held by the Trust as held-to-maturity. In 2025 and 2024 the Trust had unrealized gains or (losses) of $22,330 and $14,813, respectively.

The marketable securities portfolio is comprised of the following:

The maturities of the investments in bonds and CDs for each of the next five years and thereafter are as follows:

For the years ended June 30, 2025 and 2024

The Trust uses a three-level hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the reliability of inputs to the valuation of the Trust’s investments. The three levels are defined as follows:

Level 1 - Valuations based on quoted prices for identical securities in active markets

Level 2 - Prices determined using other significant observable inputs

Level 3 - Valuations based on inputs that are unobservable and significant

The following is a summary of the inputs used as of June 30, 2025 in valuing the Trust’s investments:

Asset Valuation Inputs

Level 1 - Quoted Prices $ 551,485

Level 2 - Other Significant Observable Inputs -

Level 3 - Significant Unobservable Inputs -

The following is a summary of the inputs used as of June 30, 2024 in valuing the Trust’s investments:

Asset Valuation Inputs

Level 1 - Quoted Prices $ 740,158

Level 2 - Other Significant Observable Inputs -

Level 3 - Significant Unobservable Inputs -

The Trust relies on its custodian for valuations of its trading securities.

For the years ended June 30, 2025 and 2024

The Boston Groundwater Trust was primarily funded through the following grants and contracts for the year ended June 30, 2025:

Funding Source Grant/Contract Period Total Grant/Contract Recognized Support City of Boston:

The Boston Groundwater Trust was primarily funded through the following grants and contracts for the year ended June 30, 2024:

Funding Source

of Boston:

Period

The Boston Groundwater Trust receives substantially all grants and contract revenue from The City of Boston and its independent agencies, the U.S. government, and the Commonwealth of Massachusetts.

The Trust maintains its cash accounts in Massachusetts financial institutions. Accounts at these financial institutions are insured by the Federal Deposit Insurance Corporation (“FDIC”) up to $250,000. At times, the Trust’s cash balances were in excess of federally insured limits. The Trust has not experienced any losses in these accounts.

For the years ended June 30, 2025 and 2024

The Trust has a discretionary retirement plan under Section 408(k) of the Internal Revenue Code. Under the plan and at its discretion, the Trust has contributed 5% of gross earnings to eligible employees who are at least twenty-one years old and have completed at least 3 years of service in the preceding five years. Employees are 100% vested upon participation. The Trust’s contributions to the plan were $6,000 and $5,650 for the years ended June 30, 2025 and 2024, respectively.

The Trust sub-leases its facilities from the Back Bay Association. The operating lease was effective June 1, 2010, and is automatically renewable if not canceled. The lease is cancelable at any time by either party on one month’s notice with no penalty.

Rent expense paid by the Trust was $18,168 00 and $19,512 00 for the years ended June 30, 2025 and 2024, respectively

The Trust regularly monitors liquidity required to meet its operating needs, while also striving to maximize the investment of its available funds.

The following reflects the Trust’s financial assets as of the statement of financial position date:

551,484 Financial Assets Available to Meet General Expenditures Within One Year $ 1,053,713