6 minute read

Where Can I Get a Loan Without Collateral in the Philippines?

from Best Loan PH

Where Can I Get a Loan Without Collateral in the Philippines?

In today's fast-paced digital economy, getting access to emergency funds is more important than ever—especially for traders, gig workers, freelancers, and regular Filipinos dealing with rising expenses. A major roadblock in traditional lending? Collateral.

The good news? You can now access legit loan apps with low interest that do not require any form of collateral. These platforms are designed to provide fast, accessible, and legal loan services to people who need money quickly, without having to risk their property or assets. 💰

This guide explores the top no-collateral loan options in the Philippines for 2025—focusing on legality, speed, and user convenience.

What Is a No-Collateral Loan?

A no-collateral loan (also known as unsecured loan) is a type of loan that doesn't require you to pledge any property or asset as a guarantee. Unlike traditional bank loans that might require a car, land title, or bank savings, these loans rely on your digital credit profile and income capacity.

Key benefits of no-collateral loans:

No need to surrender any asset 💲

Fast processing (some under 15 minutes)

100% online application

Ideal for emergency situations

With fintech on the rise, several platforms now offer instant loans without collateral—fully SEC registered and optimized for both mobile and desktop.

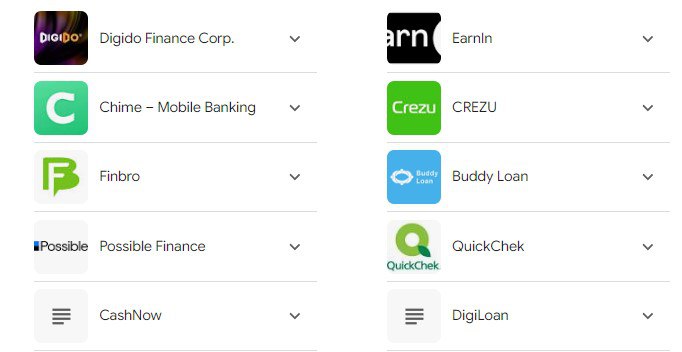

Top Apps That Offer Loans Without Collateral in the Philippines (2025)

1. DIGIDO

Digido is an AI-powered digital lender fully registered with the SEC. It offers personal loans without collateral in under 10 minutes for returning users.

Pros:

Approval within 10–15 minutes 💰

Loan amounts from ₱1,000 to ₱25,000

Repayment term: up to 180 days

Fully automated application

Summary: Fast, legit, and ideal for first-time borrowers looking for quick funding.

2. FINBRO

Finbro is another top choice for no-collateral loans. It uses smart scoring to assess your eligibility, meaning no need for bank statements or land titles.

Pros:

Loan range: ₱1,000 to ₱50,000 💲

No collateral, no hidden fees

Flexible terms up to 12 months

Approval in as fast as 10 minutes

Summary: Ideal for higher amounts and flexible repayments with zero collateral required.

3. MONEY CAT

MoneyCat offers short-term loans without any form of guarantee. It’s beginner-friendly and suitable for first-time borrowers.

Pros:

No collateral needed

First loan up to ₱3,000 at 0% interest

Max loan ₱20,000 💰

Disburses within the same day

Summary: A fast, no-collateral option for those seeking micro-loans without red tape.

4. CREZU

Crezu is not a direct lender but a loan-matching platform that connects you with legit online loan apps—all of which offer no-collateral options.

Pros:

Instant loan offers in 2 minutes

Loan range: ₱1,000 to ₱25,000

No credit history or collateral required 💲

100% online

Summary: Great for exploring multiple unsecured loan offers in one place.

5. CASHSPACE

CashSpace is a loan comparison engine that works similarly to Crezu but with faster pre-qualification filters for unsecured loans.

Pros:

No asset or document needed

Results in under 3 minutes

Loans from ₱1,000 to ₱25,000

Summary: Ideal for urgent cases where time and privacy matter most.

6. LOANONLINE.PH

LoanOnline makes it easy for users to receive no-collateral loan offers with just one application form.

Pros:

No need to upload documents or pledges

Loan range up to ₱30,000 💰

Approval within minutes

Summary: Simple, fast, and efficient for users who want to avoid long processes.

7. CASH-EXPRESS

Cash-Express provides unsecured loans and is perfect for users with no credit history. Application only requires basic information.

Pros:

No collateral, no guarantor

Quick approval process 💲

Loans up to ₱10,000

Summary: Recommended for first-timers who need small cash without risking property.

8. KVIKU

Kviku is a direct lender that specializes in digital no-collateral lending. No need for income proof or payslips.

Pros:

Loans up to ₱25,000

Fast ID verification

Fully online and automated 💰

Summary: Excellent for salaried workers or freelancers with verified ID.

9. FINMERKADO

Finmerkado connects borrowers to legit loan apps with low interest and zero collateral required.

Pros:

Fast offers from partnered lenders

Loans up to ₱30,000

No document or collateral submission 💲

Summary: Versatile for comparing unsecured loan offers and terms.

10. PEROLOAN

Peroloan is rising in popularity for its fast approval and no-collateral policy. Designed for micro to small loan needs.

Pros:

First loan as low as ₱500

Fast approval engine

No income proof required

Summary: Great for emergencies and fast-track approvals without collateral.

Why Choose a No-Collateral Loan?

✅ No risk to your assets

✅ Faster approval process

✅ Easier eligibility for freelancers, traders, and first-time borrowers

✅ No need for co-makers or bank accounts in most cases

Tips for Getting Approved Without Collateral

Always provide accurate ID and contact information

Avoid multiple simultaneous loan applications

Keep your credit history clean (repay on time)

Use a reliable phone number and email

Choose apps with high approval ratings like Digido and Finbro 💰

FAQs About Where to Get Loan Without Collateral in the Philippines

1. Where can I get a loan without collateral in the Philippines?

Apps like Digido, Finbro, MoneyCat, and Crezu offer fast unsecured loans with no asset needed. 💲

2. Are there legit loan apps with low interest and no collateral?

Yes. Check out platforms like Finbro and CashSpace which offer legit loan apps with low interest and zero guarantee requirements.

3. Is it safe to apply for a loan without collateral in the Philippines?

If you use SEC-registered apps like Digido or verified brokers like Crezu, it's completely legal and safe.

4. Can freelancers or traders get loans without collateral?

Yes. Most apps are tailored for digital professionals who don’t have fixed income or physical assets to pledge.

5. Which apps offer no-collateral loans in under 15 minutes?

MoneyCat, PeroLoan, and Cash-Express provide quick approvals with no need for any collateral. 💰

Need options with longer payment periods? Explore 👉 Legit Online Loan Apps With Long Term Payment in Philippines

Explore our latest list of 👉 Legit Online Loan Apps

Apply now 👉 Click here to Get Loan Now!

💲 Don’t risk your assets. Choose the fastest and safest no-collateral loan apps in the Philippines today!

Final Thoughts

If you’ve ever hesitated to apply for a loan because you lacked property or a guarantor, you’re not alone. Fortunately, fintech has transformed access to credit in the Philippines. With the apps listed above, you no longer need collateral to get approved fast and legally.

Whether you’re a trader needing fast capital injection or someone facing an emergency expense, your solution is just a few clicks away.

Get the money you need, no collateral required. 💰

👉Articles that may help you👇