6 minute read

What Is the Fastest Loan App in the Philippines?

from Best Loan PH

What Is the Fastest Loan App in the Philippines?

When you're in a tight financial situation, time is your most valuable asset. Whether you're a trader needing quick cash to seize a market opportunity or an everyday Filipino needing emergency funds, the question is always the same: What is the fastest loan app in the Philippines? 💰

In this comprehensive guide, we will walk you through the fastest and most legit loan apps with low interest in 2025. These apps are fast, reliable, and legally registered with the SEC, giving you peace of mind. More importantly, they're optimized for speed—most approve loans within minutes and disburse funds in less than 24 hours.

Why Speed Matters in Online Lending

Speed in online lending isn’t just a convenience—it’s a necessity. Market traders, gig workers, and salaried professionals all face situations where immediate cash flow is required. Waiting for traditional bank loans can take days or even weeks, which is not feasible when you're handling urgent financial commitments.

Fast loan apps solve this by offering:

Instant online application with no paperwork

Approval within minutes

Same-day fund release 💲

No collateral or face-to-face interviews

And with that in mind, let’s break down the top-performing, fastest loan apps for Filipinos in 2025.

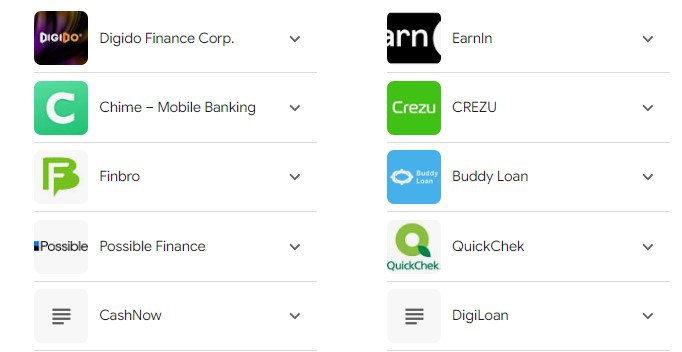

Top Fast Loan Apps in the Philippines 2025

1. MONEYCAT

MoneyCat is one of the legit online loan apps known for ultra-fast approvals and clean UX. The process is 100% online, and you can get your money in as fast as 15 minutes for returning borrowers.

Pros:

First-time borrowers get 0% interest

Instant decision within 5 minutes 💰

Loan range: ₱500 to ₱20,000

Terms: 3 to 6 months

Quick Summary: MoneyCat is a reliable option for short-term needs with one of the fastest approval rates in the industry.

2. DIGIDO

A fully automated loan app approved by the SEC, Digido stands out for its speed and transparency. It's also ideal for repeat users who want higher limits and better terms.

Pros:

SEC-licensed and AI-powered

Instant approval in 10 minutes

Loan amount: ₱1,000 to ₱25,000 💲

Term: 7 to 180 days

Quick Summary: Fast, secure, and great for scaling your credit score over time.

3. FINBRO

Finbro combines technology with high-speed processing. Borrowers often get money in their account within 30 minutes of approval.

Pros:

Approvals in 10–15 minutes

Loan amount: ₱1,000 to ₱50,000

Flexible repayment up to 12 months 💰

Quick Summary: Excellent for higher-value loans with a need for fast approval.

4. CASH-EXPRESS

Cash-Express is perfect for first-time borrowers. The interface is beginner-friendly, and the verification process is streamlined.

Pros:

Quick release in less than 30 minutes

Loan range: ₱1,000–₱10,000

Repayment period: up to 30 days

Quick Summary: Best for small, urgent cash needs without any credit history.

5. CREZU

Crezu acts as a loan broker, helping you compare offers from multiple lenders. The platform has built-in filters to prioritize fast disbursement.

Pros:

Fast comparison of loan options

24/7 accessibility

Loan range: ₱1,000 to ₱25,000 💲

Results in under 2 minutes

Quick Summary: Crezu helps you find the fastest legit loan apps with low interest through instant comparison.

6. CASHSPACE

CashSpace uses intelligent matching to get you connected with lenders that can fund your loan within minutes.

Pros:

Smart filters for same-day funding

Loan amount: ₱1,000–₱25,000

Approval time: 5–10 minutes

Quick Summary: A dependable solution for those who value both speed and loan option variety.

7. LOANONLINE.PH

LoanOnline is another comparison platform where you fill out one application and get matched with multiple fast lenders.

Pros:

100% online application

Loan range: ₱1,000 to ₱30,000 💰

Loan offers in under 5 minutes

Quick Summary: Saves time by giving you instant access to several lenders in one place.

8. KVIKU

Kviku is a direct lender and uses tech to speed up the loan approval process. Good for small to medium loans.

Pros:

Fast ID verification

Loan amount: ₱1,000 to ₱25,000

Disbursement within 24 hours

Quick Summary: Well-optimized for mobile users and quick loan disbursement.

9. FINMERKADO

Finmerkado connects users with a wide range of partner lenders. It's ideal for users who want flexibility and fast fund release.

Pros:

One application = multiple offers

Approval within 10 minutes

Loan range: ₱1,000–₱30,000 💲

Quick Summary: A strong choice if you're looking for variety and fast payouts.

10. PEROLOAN

Peroloan is one of the newer apps but gaining popularity for its no-fuss interface and rapid disbursement.

Pros:

Minimal documentation

Quick approval engine (within 15 minutes)

Loan range: ₱500 to ₱20,000

Quick Summary: Ideal for micro-loans and urgent needs without jumping through hoops.

Key Features to Consider in Fast Loan Apps

When choosing the fastest loan app in the Philippines, always evaluate:

Speed of approval and disbursement

Interest rates and transparency

Loan term flexibility

SEC registration and legitimacy

💲 If speed is crucial, go for apps like MoneyCat, Digido, or Finbro. If you're comparing rates and prefer options, Crezu and LoanOnline are excellent.

👉 Also explore this curated list of Legit Online Loan Apps

Maximize Your Loan Approval Chances

Use your real name and correct ID numbers

Maintain a good repayment history

Avoid multiple applications at once

Apply during business hours for faster response

Use the same mobile number and email for all financial applications

The more consistent and credible your digital footprint, the faster your loans get approved.

FAQs About Fastest Loan Apps in the Philippines

1. What is the fastest legit loan app in the Philippines?

MoneyCat, Digido, and Finbro are among the fastest and most legit loan apps with low interest, offering approval in as little as 5–15 minutes.

2. Which loan app gives money instantly in the Philippines?

Cash-Express and Crezu are known to disburse funds quickly, with loan processing often completed in under 30 minutes.

3. Are there legit loan apps with low interest in the Philippines?

Yes. Apps like Finbro, CashSpace, and Digido are legit loan apps with low interest, regulated by SEC and offering reasonable terms.

4. Can I get approved in 15 minutes with loan apps in the Philippines?

Yes, platforms like MoneyCat and PeroLoan offer approval times within 10–15 minutes for qualified borrowers.

5. What are the top 10 legit loan app Philippines for fast approval?

Check this list of What are the top 10 legit loan app Philippines? to find options reviewed for speed, interest rates, and legitimacy.

Looking for long-term repayment options? Visit 👉 Legit Online Loan Apps With Long Term Payment in Philippines for top-rated solutions.

💰 Need fast money today? Click here to Get Loan Now!

Final Thoughts

In 2025, getting a fast and legal loan in the Philippines has never been easier. With the rise of automated platforms and AI-driven approval engines, you can apply, get approved, and receive your cash all within an hour—no more waiting in line or filling out endless forms.

Choose smart. Choose speed. Choose legit.

Apply now and get your loan today! 💲

See more:

👉Articles that may help you👇