Berlin Packaging EMEA presents Material Trends

PackConnect 2025 – Andrea Collini

Material Trends

What’s driving packaging change?

Sustainability

Top of every industry report, government policy, brand roadmap. Pressure to reduce carbon footprint. Everyone is pushing for actions.

E-Commerce

Completely transformed packaging needs. More shipping, more returns. Secondary packaging, protective formats, durable materials.

Cost & Volatility

Price swings, freight disruption, energy costs.This forces more agile and cost-resilient material decisions.

Regulation

Bans, taxes, EPR schemes. Massive influence today. In many cases, regulation determines what can or cannot be used.

Brand Perception

Desire for premium, tactile, transparent packaging. Materials now send messages. It’s not just about function anymore it’s storytelling.

Infrastructure

Often underestimated, but hugely important. One country’s solution might be another’s headache.

Regulatory Proliferation

Sustainability is driving the shift

Over the past 10 years, the EU and UK have introduced a series of regulations aimed at enhancing packaging sustainability:

These regulations underscore the legislative commitment to sustainability in packaging, influencing industry practices and material choices.

PPWD Revision of the Packaging and Packaging Waste Directive.

Brands Commmitments

Sustainability is driving the shift

75% OF COMPANIES MADE FORMAL COMMITMENTS TO SUSTINAINABLE PACKAGING

Industry Leaders Paving the Way:

• Unilever : 100% of its plastic packaging to be reusable, recyclable, or compostable by 2030 for rigid formats and 2035 for flexible ones.

• Nestlé : pledged to make 100% of its packaging recyclable or reusable by 2025.

• Kraft Heinz : 87% of the way toward its 2025 goal to make all packaging recyclable, reusable, or compostable.

• Estée Lauder Companies: 75 – 100% of its packaging to meet at least one of the “5 Rs” recyclable, refillable, reusable, recycled, or recoverable by 2025.

• Diageo: 100% of its packaging will be widely recyclable, reusable, or compostable by 2030.

Consumer Pressure

Sustainability is driving the shift

60% of consumers actively prefer brands that use eco - friendly packaging.

82% 1. 2023 NielsenIQ , “Unpackingecoexcellence:Howsustainablepackaginginfluencesconsumers” of global consumers say they’re willing to pay more for products that use sustainable packaging.

1/3 consumers globally stopped buying from brands that they perceive as not sustainable enough.

Sustainability is driving the shift

Material Trends

What’s driving packaging change?

Sustainability

Top of every industry report, government policy, brand roadmap. Pressure to reduce carbon footprint. Everyone is pushing for actions.

E-Commerce

Completely transformed packaging needs. More shipping, more returns. Secondary packaging, protective formats, durable materials.

Cost & Volatility

Price swings, freight disruption, energy costs.This forces more agile and cost-resilient material decisions.

Regulation

Bans, taxes, EPR schemes.Massive influence today.In many cases, regulation determines what can or cannot be used.

Brand Perception

Desire for premium, tactile, transparent packaging. Materials now send messages. It’s not just about function anymore it’s storytelling.

Infrastructure

Often underestimated, but hugely important.One country’s solution might be another’s headache.

Material Trends

Winners & Losers

Paper & Cardboard: the expected winner Winners

& Losers

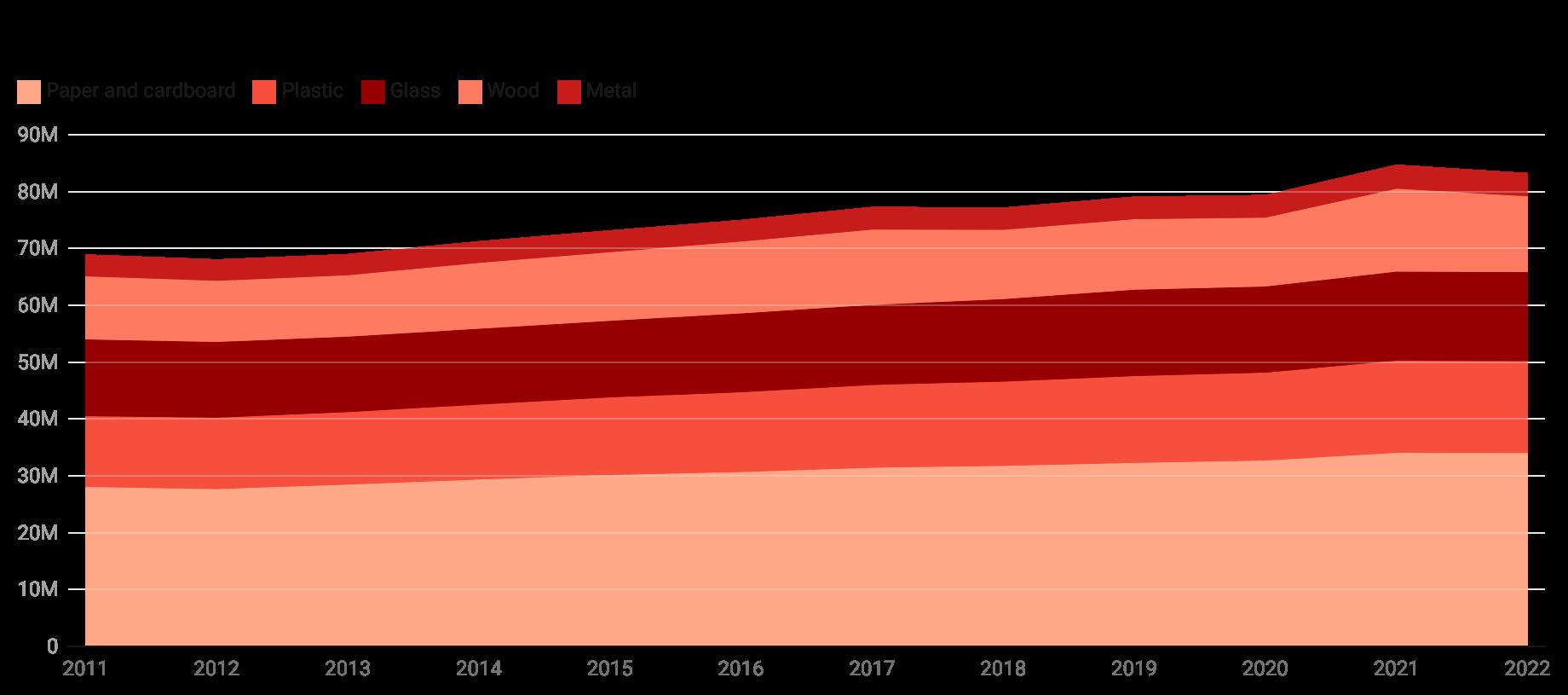

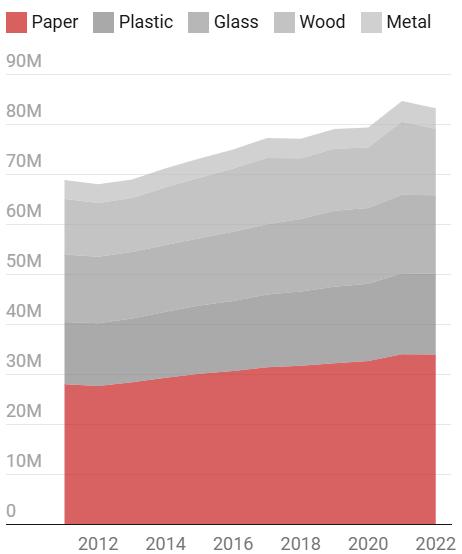

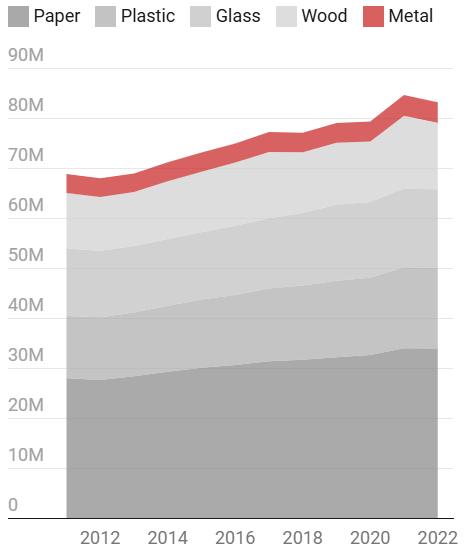

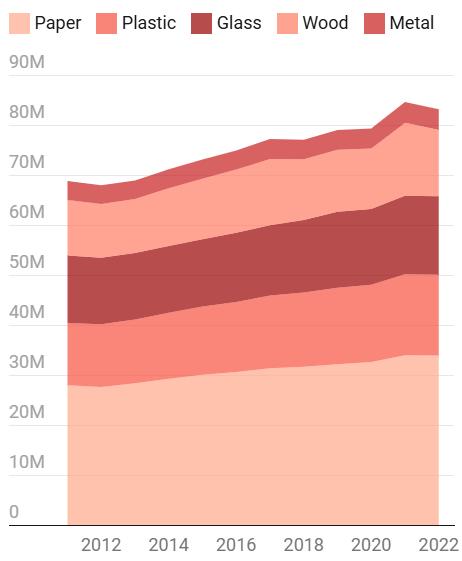

Unsurprisingly, paper is the clear leader, consistently accounting for around 41% of packaging waste. It’s the only material whose volume has steadily increased year after year.

• Narrative : Recyclable, biodegradable, “natural.” Highly favored in public opinion

• Growth drivers :

• E - commerce boom (corrugated boxes, sleeves, fillers, paper cushioning).

• Lightweighting & design innovation (e.g., molded pulp trays).

• Policy incentives (plastic bans favor paper replacements).

• Insight : Paper is the clear beneficiary of sustainability trends, but also of functional substitution, particularly in secondary packaging.

Plastic: The “Controversial” Winner

Winners & Losers

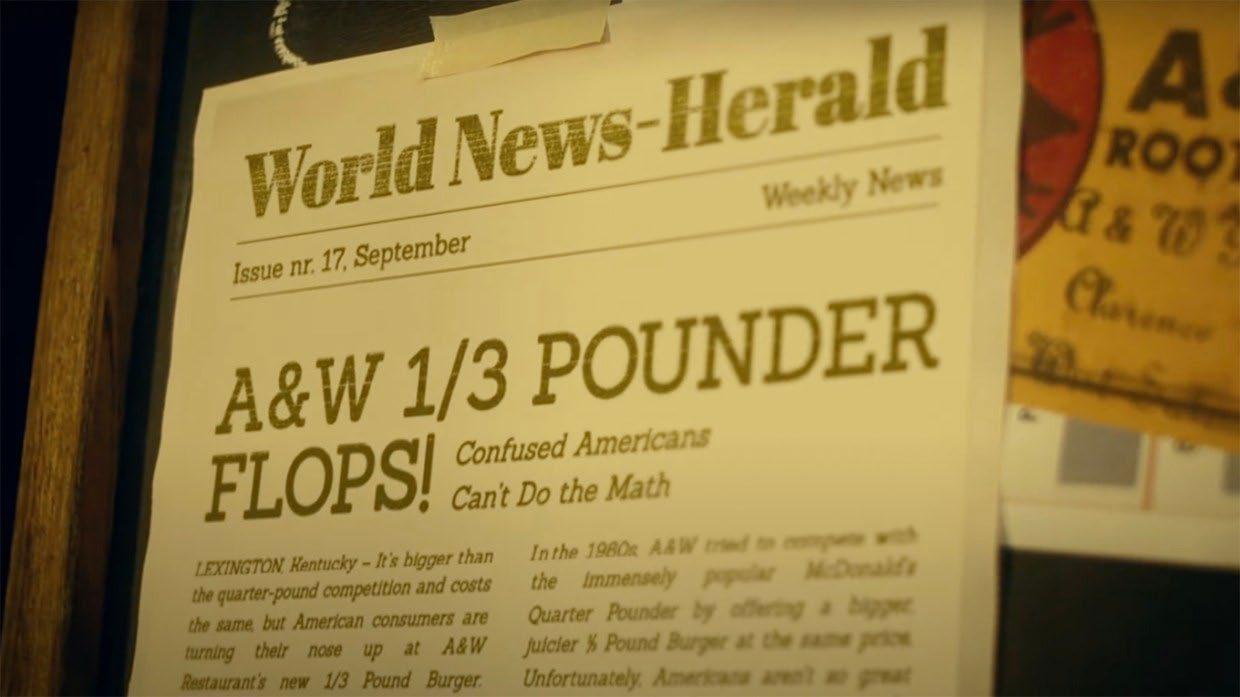

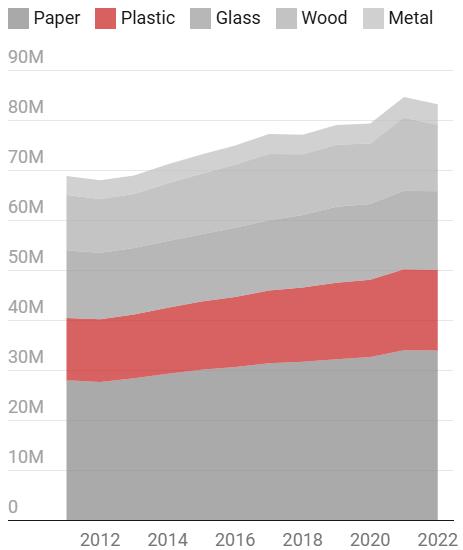

Despite being widely portrayed as the villain of the packaging world — Plastic is the only major material that has actually increased its share of EU packaging waste over the last decade, from 18.1% in 2011 to 19.4% in 2022.

• Narrative : The villain of packaging under fire for pollution and fossil origin

• Growth drivers :

• Functionally superior (barrier, flexibility, cost, weight).

• Adaptable (mono - material films, PCR content, downgauging).

• Pricing.

• Recycling infrastructure improvement (“stay in the loop”).

• Insight : Plastic isn't going away it’s evolving. The industry has found ways to defend plastic’s role through innovation and cost efficiency, especially in primary packaging.

Glass: Steady Volume, Sidelined by Growth Winners & Losers

Glass lost ground in percentage terms, but overall volumes remain stable. It hasn't kept pace with other materials, but it’s far from irrelevant. In fact, glass remains a preferred choice for premium positioning.

• Narrative : Premium, recyclable, inert perceived as sustainable.

• Resilience Factors :

• Premiumization.

• Refillable & Reusable Models (local loops, refill program).

• Regulatory leverage (plastic ban, EPR’s closed - loop programs).

• Customer perception & Health - Safety association (pharma/baby food, migrations).

• Insight : Glass isn’t scaling fast, but it remains strategically irreplaceable. While other materials chase functionality and cost, glass holds its ground through premium cues, recyclability, and brand storytelling.

Metal: The Unexpected Loser Winners &

Losers

Despite its strong recyclability credentials, metal's share of packaging waste declined from 5.5% in 2011 to 4.9% in 2022. Held back by weight, cost, and limited versatility, it remains relevant in niche applications — but struggles to scale.

• Narrative : Recyclable, durable, protective yet underutilized outside of beverage and industrial formats.

• Decline drivers :

• Weight and Cost vs Plastic (heavier, expensive).

• Limited Design Flexibility

• Perceived as “old tech” (not emotionally engaging like glass or paper).

• Insight : Metal’s strength lies in circularity and performance but that’s no longer enough. Its rigidity, weight, and lack of design adaptability have limited its role in today’s packaging landscape. That said, beverage cans continue to gain traction, especially in single - serve and sustainable formats.

Metal: The Unexpected Loser Winners & Losers

Key Takeaways :

Sustainability is a major driver, but real-world decisions are shaped by cost, functionality, and supply chain constraints.

Material trends don’t follow a single narrative paper grows on perception, plastic adapts, glass holds premium ground, and metal loses relevance despite recyclability

The market is shifting from material substitution to material adaptation and reengineering — balancing sustainability with performance and commercial viability.

The Rise of Mono-Material Structures

Trends of the future

Why it matters:

Boosts recyclability by eliminating complex, multi-layer combinations.

What’s happening:

• Brands are shifting from PET/PE or paper/polymer laminates to fully recyclable PE or PP mono - structures .

• New designs for shrink films, pouches, trays, and wraps meet recyclability guidelines (e.g. CEFLEX, RecyClass).

• The EU’s proposed Packaging & Packaging Waste Regulation (PPWR) promotes mono-materials through design - for - recycling criteria.

Challenges & Limitations:

• Lower barrier performance can limit use in food/pharma.

• Requires investment in new lines, adhesives, and sealing systems.

• Design constraints (e.g., stiffness, clarity, tactile appeal).

The Rise of Mono-Material Structures

Trends of the future

Colgate: Mono-HDPE tube

Unlike traditional laminated tubes made with aluminum and multi-material layers, this HDPE version is compatible with existing bottle recycling streams and has already achieved recyclability certification in many EU markets.

Nestlè:

Mono-PP

pouches

This innovation is now live across 20+ countries. Pouches are sterilization-grade, lightweight, and recyclable within existing PP streams.

Pepsi-Co: Mono-PE Film

These structures replace conventional multi-layer films and improve recyclability, while still offering the needed barrier protection .

The Push Toward Bio-Based & Compostable Trends of the future

Why it matters:

Reduces dependence on fossil feedstocks and supports carbon reduction goals . Gains traction where recycling falls short.

What’s happening:

• Bio - based plastics (e.g. bio-PE, bio-PET) made from sugarcane, starch, or cellulose.

• Compostables (e.g. PLA, seaweed films) adopted for food service, biowaste, and retail.

• Brands and policy leaders (Italy, France) are pushing alternatives where recycling struggles.

Challenges & Limitations:

• Consumer confusion and incorrect disposal.

• Lack of composting infrastructure in most markets.

• Lower performance for barrier needs or shelf life.

• Higher cost and conversion complexity .

The Push Toward Bio-Based & Compostable Trends of the future

Just Eat: seaweed-based takeaway containers

Designed to biodegrade naturally, even outside industrial composting conditions - making them especially relevant in the food delivery sector.

San Benedetto: bio-PET bottles

Made from sugarcanederived ethanol, These bottles are chemically identical to standard PET, so they remain fully recyclable — but they reduce reliance on fossil feedstocks .

J.Crew: seaweed-based films

These films are compostable and aim to address the massive volume of single-use plastic bags used in fashion retail .

The Growth of Recycled Content & Circularity Trends of the future

Why it matters:

• Reduces dependence on virgin materials and supports brand carbon and ESG targets.

• Gives waste economic value , making collection and recyclying system more viable.

What’s happening:

• Growing use of PCR plastics, paper, glass and aluminum.

• Mandatory recycled content targets in EU PPWR (e.g., 30% rPET by 2030).

• Circular models like refill & reuse are being piloted by major FMCG and personal care brands.

Challenges & Limitations:

• Inconsistent quality , color/odor issues, food-contact limits.

• Limited availability of food - grade PCR.

• Higher cost than virgin, plus supply volatility .

• Infrastructure and design barriers for reuse/refill systems.

The Growth of Recycled Content & Circularity Trends of the future

Nestlé: reusable stainless-steel containers

Pilot project, these containers are designed to be collected, cleaned, and refilled in a true closed-loop reuse model.

The Body Shop: refillable aluminium bottle

Refill scheme where customers can bring back and refill across a range of personal care products, dramatically reducing singleuse plastic and building repeat consumer engagement.

Coca-Cola: 100% rPET bottles

Rolled out 100% rPET bottles for many of its flagship SKUs across multiple European markets.

Lightweighting & Source Reduction Trends of the future

Why it matters:

• Reduces material use and carbon footprint without requiring new substrates.

• Often the most immediate, cost - effective lever for packaging sustainability.

What’s happening:

• Brands are redesigning formats to use less plastic, glass, paper, and metal .

• Down - gauging and structural optimization applied to bottles, trays, and closures.

• Source reduction targets embedded in ESG and product development roadmaps.

Challenges & Limitations:

• Risk of performance loss (product protection, shelf life).

• Can conflict with brand perception (e.g., “feels flimsy” or “less premium”).

• Requires equipment recalibration , retesting , and multistakeholder alignment.

Lightweighting & Source Reduction Trends of the future

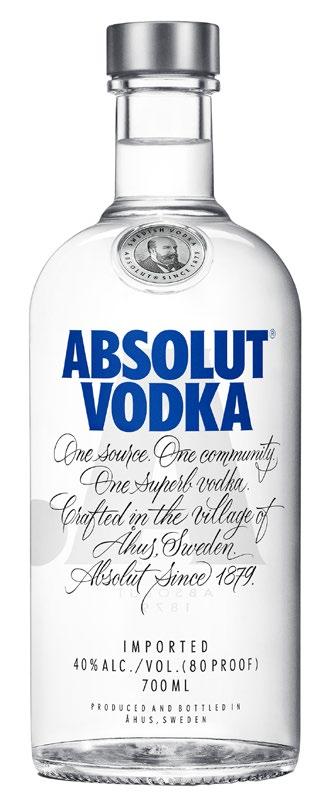

Pernod Ricard: Absolut Vodka

lightweigthing

10% lighter glass bottles that uses thinner walls and a slimmer neck. Saves 2,000 tonnes of glass per year and cuts CO₂ emissions by 8% per bottle.

PepsiCo: Lightweight PET Bottles

Across Pepsi, 7Up, and Mirinda, bottles are now up to 12% lighter through preform optimization and blow molding.

Amazon: Ships in Product Packaging (SIPP) Program

Allows eligible products to be shipped in their original manufacturer’s packaging without additional Amazon packaging. Reduced packaging weight by 12%. .