5 minute read

Virtual event tackles climate risks

Some of the risk and insurance sector’s leading voices met online to discuss the rising threat of climate risks and how to tackle the issue in New Zealand.

Research firm CoreLogic hosted a virtual event, ‘Moving ahead on climate change: tackling risks in financial services’, to discuss how the financial sector can assess and manage climate risks.

Milena Malev, CoreLogic GM of Financial Services & Insurance Solutions, said: “Climate hazards present systemic risks to the economy, strategy and governance. The increase in severity and frequency of natural disasters is no longer temporary, it’s close to permanent.

“There was consensus across our panel that cross-sectoral collaboration will be key to effective management of the impact of climate change. Responsibility is shared. The flow of information between different collaborative parties, between research and scientific communities, industry including banking, insurance and investment, government and regulators, and even consumers, is what’s important,” Malev said.

The panel acknowledged that there were actions businesses can start taking to understand their risk exposure, including looking at the possible impact of climate change on real assets and portfolios down to the property level or at a less granular level, at postcode level.

“The panel acknowledged while there’s still some work to be done in transition risk and modelling compound events, tools, software systems and data is already available and being most effectively utilised by the insurance and reinsurance sector. Now is the time for bankers and investors to follow suit.

“Many different outcomes can be achieved with the data; not just assessing a loan, but also to help comply with regulations, conduct portfolio stresstesting and follow it through time and ultimately, connect with customers to ensure their awareness of the risk exposure of their property or physical asset.

“For example, Munich Re’s knowledge of natural hazards combined with CoreLogic’s rich property data and attributes is bringing the evaluation of property risks to life, enabling the industry to start evaluating the impact of climate change on their physical assets and portfolios in a very real, accurate and practical manor,” Malev said.

The panel agreed both Australia and New Zealand governments and financial sectors had made decent progress on the topic.

Malev said: “This is very encouraging and positive. It’s accepted by the industry that more needs to be done to integrate the discussion between government, regulators, industry and consumer; becoming more client-centric, understanding the problem but also sharing the knowledge if it exists.

“The community education piece is another important consideration in how we move ahead on climate change. The role should be shared between banks, insurers and customers. Transparency between these three parties will provide stability for everybody.”

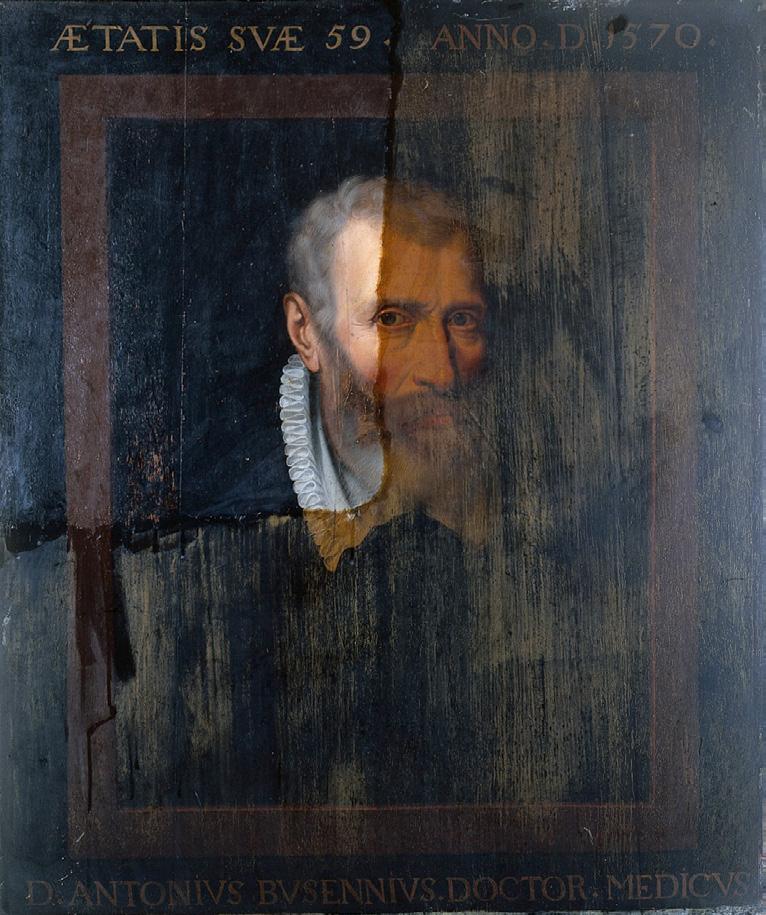

Caring for works of art and protecting them against physical risk

Every art collection faces a range of physical exposures, and natural disasters such as cyclones, earthquakes, and bushfires are all potential risks. However, most art losses are due to transit, water, fire, theft, inadequate storage, improper installation, accidents and lack of environmental controls.

To minimise the likelihood of damage, the insured can help protect their art by utilising some of these preventative measures: • Light damage is a common occurrence and shielding a collection from direct sunlight or other intense lighting sources is essential. Installing UVfilters on windows, or simply closing the curtains to reduce light levels, can limit the damage caused by direct sunlight. • To limit deterioration from environmental conditions, maintain a steady temperature and humidity in rooms containing artwork. A constant relative humidity (RH) of 45-55% and a climate of around 22 degrees is recommended for most collections. However, it is important to note that certain materials require specific recommendations, e.g. pastels. While the insured can use a dehumidifier to adjust humidity levels, it is best to consult a conservator to determine an acceptable range. • Never store items on the floor and avoid placing artwork in high-traffic areas. • Ensuring that artwork is correctly framed is also worthwhile. Framing helps to protect artwork from environmental conditions and also minimises the risk of damage from mishandling. • Avoid hanging unprotected artwork above fireplaces or beneath air ducts, and engage a professional art handler to install artwork. • Mount smoke detectors in every room that contains artwork. For high-value collections, consider installing moisture alert sensors in areas that may be potential sources of flooding. • To avoid accidental toppling, consult a conservator if it would be appropriate to use museum wax or a similar product to secure objects to pedestals or shelving. • Use archival quality materials to wrap artwork, and consult an art handler or conservator about which materials are best suited for the collection.

Since an object's condition affects its monetary, cultural and aesthetic value, it is worth consulting with a conservator regularly, but first, ensure that they are registered with the New Zealand Conservators of Cultural Materials. By taking some simple steps now, the insured can help preserve the integrity of their artwork.

In addition to the preventative measures summarised above, an accurate inventory management system also helps maintain an art collection. Inventory records reduce the likelihood of

a mysterious disappearance, eliminate misappropriation and lost provenance, and expedite the claims process in the event of a loss.

Some essential inventory management tips include: • Saving receipts and invoices and storing information about the collection in a secure off-site location.

• Maintaining a digital inventory with descriptions and images of each item, and organising data by date of last appraisal, location, genre and other relevant information.

• Request periodic updates on an appraisal when there is a significant change in the market. A good rule of thumb is every three to five years. • If assistance is required with establishing a digital inventory system, consult an art professional with experience in collection management.

Ben Ashley is the director at Ashley & Associates, an art appraisal and consultancy firm based in Tāmaki Makaurau Auckland.