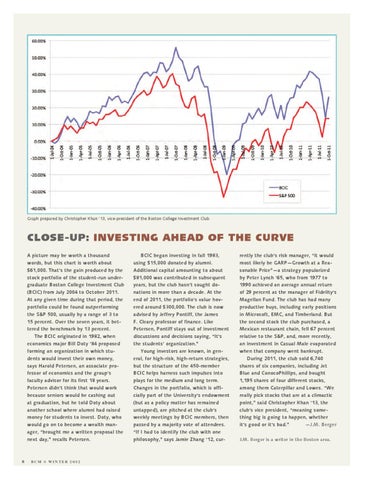

Graph prepared by Christopher Khan ’13, vice-president of the Boston College Investment Club

CLOSE-UP: investing ahead of the curve A picture may be worth a thousand words, but this chart is worth about $61,000. That’s the gain produced by the stock portfolio of the student-run undergraduate Boston College Investment Club (BCIC) from July 2004 to October 2011. At any given time during that period, the portfolio could be found outperforming the S&P 500, usually by a range of 3 to 15 percent. Over the seven years, it bettered the benchmark by 13 percent. The BCIC originated in 1982, when economics major Bill Doty ’84 proposed forming an organization in which students would invest their own money, says Harold Petersen, an associate professor of economics and the group’s faculty advisor for its first 18 years. Petersen didn’t think that would work because seniors would be cashing out at graduation, but he told Doty about another school where alumni had raised money for students to invest. Doty, who would go on to become a wealth manager, “brought me a written proposal the next day,” recalls Petersen.

8

bcm v winte r 2012

BCIC began investing in fall 1983, using $15,000 donated by alumni. Additional capital amounting to about $81,000 was contributed in subsequent years, but the club hasn’t sought donations in more than a decade. At the end of 2011, the portfolio’s value hovered around $300,000. The club is now advised by Jeffrey Pontiff, the James F. Cleary professor of finance. Like Petersen, Pontiff stays out of investment discussions and decisions saying, “It’s the students’ organization.” Young investors are known, in general, for high-risk, high-return strategies, but the structure of the 450-member BCIC helps harness such impulses into plays for the medium and long term. Changes in the portfolio, which is officially part of the University’s endowment (but as a policy matter has remained untapped), are pitched at the club’s weekly meetings by BCIC members, then passed by a majority vote of attendees. “If I had to identify the club with one philosophy,” says Jamie Zhang ’12, cur-

rently the club’s risk manager, “it would most likely be GARP—Growth at a Reasonable Price”—a strategy popularized by Peter Lynch ’65, who from 1977 to 1990 achieved an average annual return of 29 percent as the manager of Fidelity’s Magellan Fund. The club has had many productive buys, including early positions in Microsoft, EMC, and Timberland. But the second stock the club purchased, a Mexican restaurant chain, fell 67 percent relative to the S&P, and, more recently, an investment in Casual Male evaporated when that company went bankrupt. During 2011, the club sold 6,740 shares of six companies, including Jet Blue and ConocoPhillips, and bought 1,195 shares of four different stocks, among them Caterpillar and Lowes. “We really pick stocks that are at a climactic point,” said Christopher Khan ’13, the club’s vice president, “meaning something big is going to happen, whether it’s good or it’s bad.” —J.M. Berger J.M. Berger is a writer in the Boston area.