8 minute read

The price of pooling. Market- & data-based approach to FuelEU Maritime

by Albrecht Grell, co-Managing Director, OceanScore

FuelEU Maritime represents a whole new level of regulatory complexity for the shipping industry, even as many are still grappling with the challenges of the EU Emissions Trading System (EU ETS). But what is also new about FuelEU is that forward-leaning companies can actually benefit by cutting OPEX and even generating revenue through the compliance pooling option – and this will be determined by pooling prices.

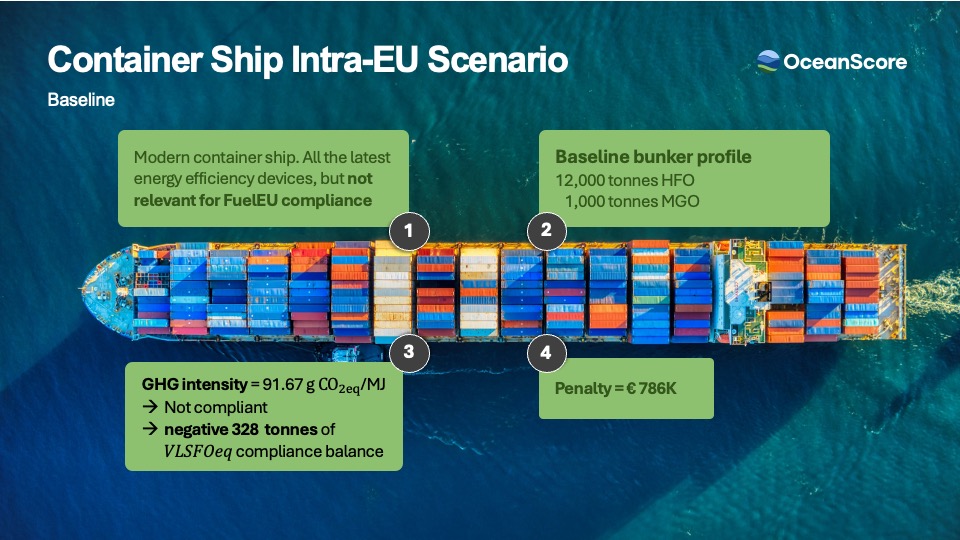

The latest EU Regulation, with implementation less than three months away, requires shipping companies to adopt unfamiliar metrics for bunkers, emissions and energy to measure the greenhouse gas (GHG) intensity of their vessel operations, with well-to-wake emissions in CO2-equivalent and total energy usage (including shore power and wind) expressed in megajoules (MJ).

As well as these different parameters for analysis of carbon intensity, FuelEU introduces the new concept of compliance balances, with surpluses and deficits, that will entail various options, including pooling, paying penalties for non-compliance, banking, and borrowing.

A balancing act

Compliance balances will be a crucial factor in determining the economic impact of FuelEU as companies seek to meet the initial 2% reduction in GHG intensity from a 2020 baseline of 91.16 CO2e/MJ to avoid the penalty of €2,400 per tonne of very-low sulphur fuel oil-equivalent (VLSFOe). But they must also consider seemingly endless options, such as vessel deployment and fuel selection, to optimise their commercial exposure.

Comparatively, the EU ETS, with issues such as opening of Union Registry accounts, getting access to EU carbon emission allowances (EUAs), and efficiently running the processes between owners, managers and charterers, now seems like a walk in the park!

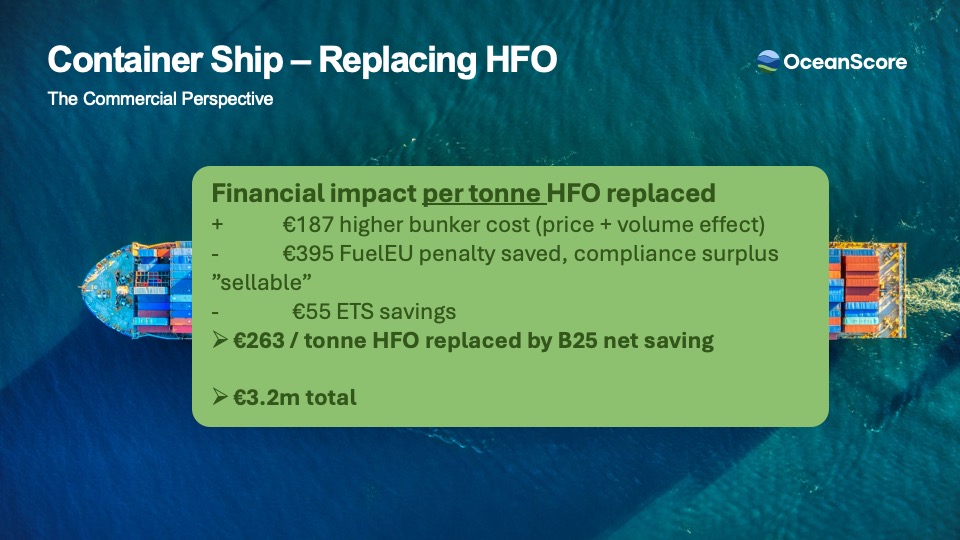

Much industry attention is now focused on the potential benefits of the pooling option under FuelEU. So what does this entail? When burning bunkers that have a GHG intensity below the threshold stipulated by the FuelEU Maritime Regulation, the so-called ‘compliance surpluses’ are generated. This will be the case for either vessels burning liquefied natural gas (LNG) and liquefied petroleum gas (LPG) or those burning certain biofuels. Vessels running on conventional fossil fuels, on the other hand, will accumulate ‘compliance deficits.’

Pooling power

The pooling mechanism, which is designed to stimulate the uptake of low-carbon fuels, allows over-compliance by green-fuelled vessels to offset compliance deficits for ships burning fossil fuels and thereby generate overall compliance for the combined fleet of pooled vessels – owned as well as third-party ships if these are included in such pools (not to be confused with commercial pools already familiar to the industry).

Through this mechanism, vessels generating a surplus can ‘sell’ this to those with compliance deficits. This means deficit-holders can avoid paying hefty penalties for exceeding the carbon intensity threshold, while those procuring the desired alternative fuels can actually generate additional revenues.

However, the price for selling and buying compliance balances in pools is not regulated, which has attracted criticism from quite a few industry players. Rather, it is left to the individual participants to agree on pricing on a case-by-case basis. If pooled internally within a single shipping company, pricing doesn’t matter much: the penalty avoided will be the benefit generated. But if pooling externally, the financial viability of the pooling strategy will depend on the price agreed for pooling surpluses with deficits.

OceanScore is using a market-based approach to discuss possible price ranges for pools. There are two main aspects here: demand and supply of compliance surpluses and deficits, as well as a cost-based approach to identify upper and lower price limits (within these, demand and supply should move prices in an efficient market).

Supply & demand for surpluses

An in-depth analysis has been conducted by OceanScore of every vessel subject to FuelEU, the fuels burned, and the resulting compliance balances per ship. The results show the initial reduction target of 2% set by the EU has already been partly achieved and effectively reduced to 1.6%.

Most vessels still burn conventional fuels, resulting in a cumulative compliance deficit of 560 thousand tonnes of VLSFOe for this ‘fleet.’ Only a few hundred vessels, 85% of which are LNG and LPG carriers, generate surpluses, but these surplus volumes are substantial. Their cumulative compliance surplus comes in at 280kt of VLSFOe, leaving a net industry gap of 280kt.

OceanScore data indicates the compliance market likely will be in balance – i.e., the industry-wide threshold set by the EU will be met already in 2025 – based on contracts already entered into for biofuels. Surpluses generated by these operators, plus the LNG/LPG carrier surpluses, will fuel the compliance pooling markets while at the same time reducing the industry’s compliance deficits. Voluntary emission reduction schemes are expected to have an insignificant impact on the biofuel volumes used for pooling purposes.

This ample supply of compliance surpluses should prevent the pooling market from being purely driven by scarcity of surpluses; prices will likely not be pushing the upper limit. What is more, large operators – found mainly in container shipping and the cruise business that have the highest exposure to FuelEU – will likely focus on securing neutral compliance balances for their fleets, at least initially, further reducing the compliance deficits by looking for external pooling options.

To sell or not to sell, that is the question

To understand where pool prices will land, the cost of alternative courses of action – such as buying compliant bunkers, paying the penalty, banking, and borrowing – needs to be analysed.

In short, no one will pool if the cost of doing so is above the penalty itself. The upper limit of pooling prices will, therefore, be defined by the €2,400 fine, minus some transaction cost and the extra effort to pool, resulting in a price of around €2,300/t/VLSFOe.

In a balanced market, the question is how low those offering compliance surpluses are willing to drop their prices. OceanScore has found that – especially if waste-based biofuels are used – trading compliance surpluses could still be viable at prices as low as €600/t/VLSFOe. Nevertheless, we should not expect pool prices to drop this low when introducing a dynamic component with the option to bank surpluses for future periods into the model.

Surplus-holders could expect that in 2030, after compliance thresholds are lowered, the demand for surpluses to pool will increase substantially, making surpluses scarce and met by substantial demand. If they assume that they could then commercialise their compliance surplus for, say, €2,300/t/VLSFOe, they might opt to bank their surplus rather than selling it ‘below value.’ Given a 10% cost of capital, this would move the equilibrium price up to around €1,400/t, increasing towards 2030. It can, therefore, be concluded that pooling prices over the next five years are likely to fluctuate between €1,400 and €2,300 per tonne of VLSFOe, which is a substantial price range.

Solid data = solid market position

The ability to model different pool prices, which is a feature of OceanScore’s newly launched FuelEU Planner, is crucial for informed decision-making to optimise commercial benefits. This web-based tool also simulates different pooling, payment, banking and borrowing strategies, as well as the financial impact of bunker choices, alternative fuel investments, use of shore power, and different deployment patterns. Given fluctuating prices, moving fast to secure commercial agreements (formal ones can only be finalised once the compliance balances have been verified in early 2026) for pool places at favourable conditions –depending on the perspective of surplus or deficit-holders – can be a significant lever on financial performance. And contractual agreements based on sound data need to be in place to cover risk, given third-party managers remain the Document of Compliance holders under FuelEU.

Focusing initially on fleet internal pooling is advisable, as it will eliminate the uncertainties of the pooling market. It would be risky to assume there will be a rush of undercompliant vessels seeking to pool with surpluses towards the end of 2025.

Given the analytical complexities introduced by FuelEU, solid and granular simulation of different paths of action is of paramount importance. A deviation of just 0.5% in assessing a fleet’s GHG intensity or picking the wrong fuel can lead to wrong assumptions about one’s likely position in the pooling markets, with severe financial implications.

Founded in 2020, OceanScore is a global provider of compliance and data solutions for the maritime industry, with office locations in Germany, Poland, Portugal, and Singapore. Its suite of digital platforms and services is designed to support shipping to successfully navigate emission regulations, facilitating the industry’s transformation towards sustainability. Beyond emissions, OceanScore tracks sustainability, environmental, and reliability of 130,000+ vessels globally, serving the wider maritime ecosystem. Go to oceanscore.com to discover more.