bimonthly-daily companion

bimonthly-daily companion

Unlocking decarbonisation with energy independence

Why onshore power supply is crucial for ferry decarbonisation

Flexible shore power solutions for European ports

MARITIME Ship happens! Interview – Wasaline LOGISTICS

Navigating the modern challenges facing project cargo shipping

The Port of HaminaKotka is a multipurpose seaport serving trade and industry. This major Finnish port is an important hub in Europe and in the Baltic Sea region.

Welcome to the Port of HaminaKotka!

Ihope you had a proper summer break, perchance as a ferry or cruise traveller in our beautiful Baltic Sea region. In its southern parts, the weather was rather summer-ish; but like many things in life, it depends on your liking – of the particular temperature indications, how strongly the wind teases your tangles, or how frequently rain ruins your coiffure altogether. While my Mum would label the summer of 2025 as ‘nightmarishly autumn,’ I more than enjoyed the long forest treks without the sun boiling my doggies (and my brain, for that matter). And that’s also the case with transport & logistics: circumstances alter cases. As a case in point, you’ll find in this issue, in the Venture forth column, an apt quote from Wasaline’s boss, who stressed that one could either yell one’s guts out against the eco-regulations or break one’s own ceiling to capitalise on the change. Another bit, this from What’s in the Cabinet , shares laments about the latest IMO deal that, according to the organisations mentioned in the news, will fall short of decarbonising the shipping industry. The voices continue that the EU should further push its green agenda to encourage other corners of the world to up their ante. In contrast, other opinions praise the IMO and keelhaul the EU for championing regional regulations. And so on, and so forth.

Amid such uncertainties, we’re doing our best to leave no stone unturned in shining a veritable rainbow of perspectives on a given topic. Take, for instance, sustainability. This issue tackles it from the point of view of energy independence (with sludge as your unexpected hero here), next-level ship supply, and onshore power supply (OPS) that goes beyond cold ironing. The 3-4 edition looks at performance through the lens of buying a new grab for dry bulk handling, digital tools, and perseverance after a business start that was a far cry from hitting the jackpot. Technology includes another OPS read, this one focusing on its flexibility if the EU and its seaports really want to energise their quay game, so to speak; how machine learning can crunch data on, among other things, vessel-type performance (plus whether you should buy a certain ship now or maybe postpone the purchase); and why and how storage is one of the key ingredients in ‘baking’ hydrogen a marine fuel of the future. Speaking of data – the Logistics section goes detailedly into the (still) persisting gap between what terminals think they deliver and what shippers think they get. The column also hosts an article that underpins the notion that hardly anything beats experience, especially with handling project cargo. In this context, nothing bests reading a journal that has your back when it comes to all things transport & logistics!

Przemysław Myszka

Publisher

BALTIC PRESS SP. Z O.O. Address: Aleja Zwycięstwa 96/98 81-451 Gdynia, Poland office@baltictransportjournal.com

www.baltictransportjournal.com www.europeantransportmaps.com

President of the Board BOGDAN OŁDAKOWSKI

Managing Director

PRZEMYSŁAW OPŁOCKI

Editor-in-Chief

PRZEMYSŁAW MYSZKA przemek@baltictransportjournal.com

Roving Editor MAREK BŁUŚ marek@baltictransportjournal.com

Proofreading Editor EWA KOCHAŃSKA

Contributing Writers

ASHISH ANILAN, NICHOLAS BALL, ROBERT BLADES, WILL FRAY, ALEXA IVY, JEHAN KANGA, DAVE LEE, FREDERIK LERCHE-TORNOE, MONIKA ROGO, FITZWILLIAM SCOTT

Art Director/DTP DANUTA SAWICKA

Head of Marketing & Sales PRZEMYSŁAW OPŁOCKI po@baltictransportjournal.com

If you wish to share your feedback or have information for us, do not hesitate to contact us at: editorial@baltictransportjournal.com

Contact us:

PRZEMYSŁAW OPŁOCKI tel.: +48 603 520 020 Cover Port of Esbjerg

62 Events: Determination despite uncertainty

ECG’s 2025 General Assembly & Spring Congress by Przemysław Opłocki

64 Events: Hundreds of maritime and defense companies will meet in Gdańsk this October by Fitzwilliam Scott

66 Who is who

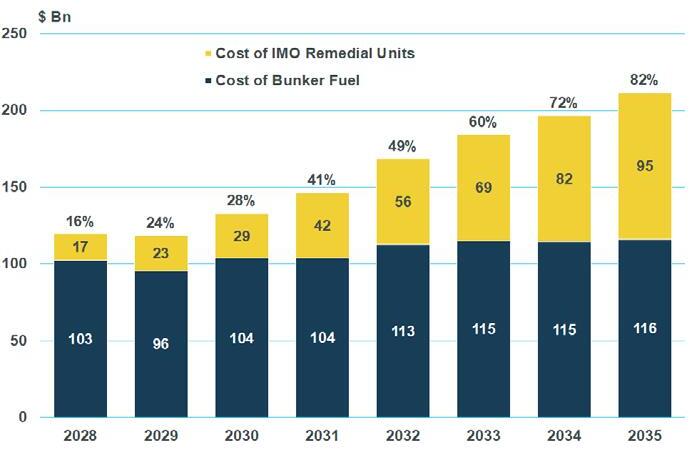

Bridging regulatory pressure and business continuity

How to enable greener & smarter compliance across the maritime sector by Frederik Lerche-Tornoe

Still plenty of room for growth

Interview with Marc-Oliver Hauswald, CEO, JadeWeserPort-Marketing by Przemysław Myszka

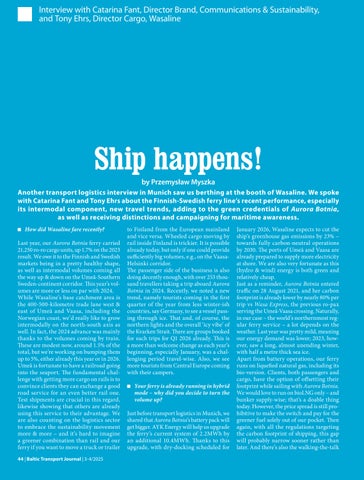

Ship happens!

Interview with Catarina Fant, Director Brand, Communications & Sustainability, and Tony Ehrs, Director Cargo, Wasaline by Przemysław Myszka

Never mind our stunning sea view. Every port has one. We’re talking about the railroad and motorway right outside our office windows. For a port, that’s a view, and a location worth its weight in gold. At the Port of Oxelösund, we have a direct connection to the Swedish railway system, and to Sweden’s biggest motorway, European route E4. This gives us unique possibilities when it comes to processing and transporting goods. If you value logistics with speed and flow, give us a call.

The Port of Oxelösund is more than a port. We can handle your entire logistics chain and optimize every part of your goods’ journey, from start to finish. Our goal is to be the Baltic’s leading port terminal, with Europe’s best stevedoring services.

46 Sweden and Lithuania chart the course to zero-emission shipping by Monika Rogo

48 The Baltic and Norwegian cruise markets – report by Monika Rogo

49 BPO lunch debate in Brussels by Monika Rogo

50 Beyond the grid

– Flexible shore power solutions for European ports by Dave Lee

52 Coming out of the dark

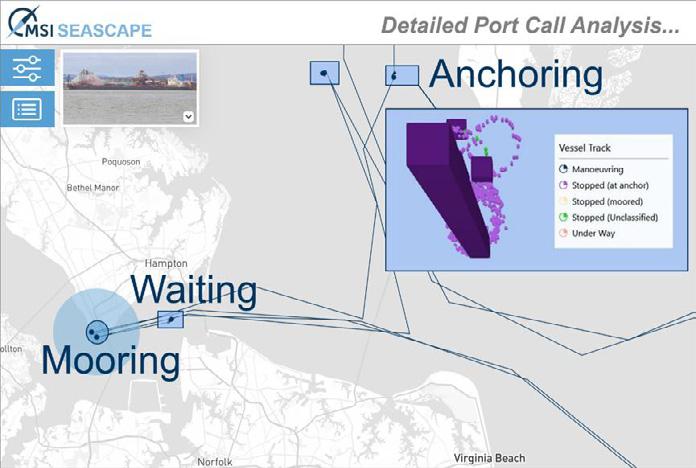

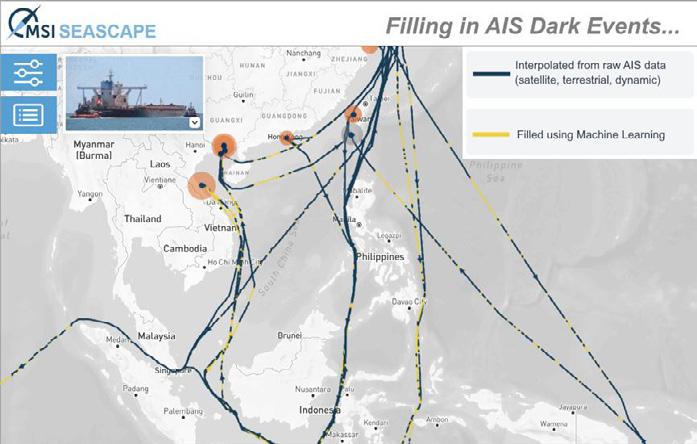

– How machine learning can drive smarter decisions in today’s shipping markets by Will Fray

54 From hype to reality

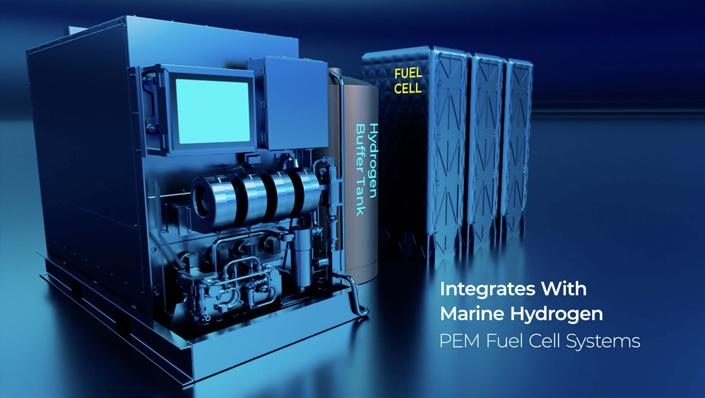

– Novel storage solution promises to position hydrogen as a safe & viable marine fuel by Ashish Anilan, and Dr Jehan Kanga

56 Lost in transhipment

– Bridging the gap between terminals and shippers by Ewa Kochańska

59 Added cost value

– Interview with Shinichi Kakiyama, President, NX Europe by Przemysław Myszka

60 Out-of-gauge times

– Navigating the modern challenges facing project cargo shipping by Robert Blades

LogiChain Expo, 16-18/09/25, PL/Nadarzyn, logichainexpo.com/en

The event will showcase innovations in logistics and supply chain management, focusing on automation, digital platforms, and smart technologies that transform transport, warehousing, and distribution. The Expo will also house the Smart Logistics Forum for experts to share insights on the digital transformation and future-ready logistics solutions.

Baltic Ports Conference 2025, 6-8/10/25, PL/Gdańsk, balticportsconference.com

This year’s edition will focus on all things changing – geopolitics, the port market, green investments, digitalisation, military mobility, threats & risks to transport & logistics, and much more! BPC 2025 will coincide with the Baltexpo exhibition (incl. a tour around the fairgrounds), plus feature a gala dinner and a boat tour in the Port of Gdańsk.

BALTEXPO – 23rd International Maritime and Military Fair, 7-8/10/25, PL/Gdańsk, baltexpo.eu/en

The trade fair is a place where key players in the maritime sector have been meeting for over 40 years to create the future of the industry, together forming a unique platform for establishing strategic business contacts and exchanging knowledge & experience in the maritime and military industries.

GreenPort Congress 2025, 15-17/10/25, MT/Valletta, portstrategy.com/greenport-cruise-and-congress

GreenPort Congress is a meeting place for the port community to discuss and learn the latest in sustainable environmental practice. It offers ways to reduce their carbon footprint and be more sensitive to environmental considerations, both of which are vital to future success.

TransLogistica Poland , 4-6/11/25, PL/Warsaw, translogistica.pl/en

TransLogistica Poland is a place where shippers and cargo owners can find comprehensive and highest quality logistics services for their goods. The exhibition is also perfect for showcasing a variety of telematics and fleet-management solutions to transport companies, including local and international carriers.

Offshore Energy Exhibition & Conference (OEEC), 25-26/11/25, NL/Amsterdam, oeec.biz

TOEEC is a leading international event in the offshore energy industry (wind, hydrogen, oil & gas and marine energy) held each year in Amsterdam that serves as an essential gathering point for professionals, experts, and companies active in the offshore energy sector and beyond.

The International Maritime Organization (IMO) and the Women’s International Shipping & Trading Association ( WISTA) have published the second Women in Maritime Survey with data from IMO Member States and the private sector on the proportion and distribution of females working in the maritime sector. Because more IMO Member States partook in the survey, the 2024 figure of 176,820 women in the industry is higher than the 151,979 from 2021. Yet, the latest data set shows that women account for just under 19% of the total workforce sampled (vs 2021’s 26%) and only 16% in the private sector workforce cohort (excluding seafarers; at sea, women account for just 1% of the total number of seafarers employed by the surveyed organisations). While greater female representation was found in emerging sectors such as ESG and decarbonisation services, others, such as bunkering and legal, recorded a decline. The report also provides detailed recommendations on how IMO Member States and the industry can contribute to improving gender diversity in maritime – by enhancing recruitment and retention initiatives, expanding mentorship and leadership development programmes, strengthening policy implementation, and guaranteeing safe and supportive working environments. “Attracting, retaining and promoting women – both on land and at sea – remains a priority moving forward. However, the new data also shows how opportunities across the industry continue to be limited for women due to barriers such as gender stereotyping, workplace safety concerns, a lack of family-friendly policies, and the ongoing gender pay gap,” noted Elpi Petraki, President, WISTA International.

The new set of cyber-security guides , prepared by the International Association of Ports & Harbors ’ ( IAPH ) Data Collaboration Committee ( DCC ) with the support of IAPH member ports & experts as well as the World Bank and the World Economic Forum , assesses the particular cyber risks associated with the increasing use of emerging technologies in ports. Specifically, the publication deals with quantum, artificial intelligence, drones, the internet of things, 5G, automation, and green energy in terms of their potential beneficial application to enhance cyber resilience, likewise to pinpoint risks and vulnerabilities. The Guidelines also cover the measures that can be taken to detect, mitigate, and protect against cyber threats. Moreover, the document features a chapter that addresses training & education needs to support emerging cyber-security technologies, while the concluding section outlines critical emerging technologies that should be addressed in maritime cyber-security legislation, why they are necessary, and the relevant regulatory bodies that need to be involved. “The implementation of emerging technologies in the maritime supply chain is getting wider, which is precisely the reason why it is important to raise awareness to implement cyber security by design. That means preparing now, not after an incident,” commented Gadi Benmoshe , Managing Director of Marinnovators Consulting and Lead Author of the Cyber Resilience Guidelines. In 2021, DCC produced the IAPH – Cybersecurity Guidelines for Ports and Port Facilities , subsequently adopted by the International Maritime Organization as part of its cyber risk management guidelines. Then, The Mindshift to Innovation in Ports white paper was put forth, alongside Risk and Resilience Guidelines for Ports

Hailed as the first-of-a-kind, the nine-point Guidelines aim to improve working conditions amid the shipping industry’s 17-year high workforce shortage (a forecasted shortfall of 90,000 trained seafarers by 2026). The ‘what good looks like’ list was put together by the Global Maritime Forum (GMF) and 12 major shipping companies following years of research and real-world pilots involving over 400 seafarers. The Guidelines address challenges related to abuse and harassment, work-life balance, and onboard facilities to make life at sea safe & inclusive, and attract the next generation of talent. “Despite the world’s 1.9 million seafarers keeping $14 trillion worth of global trade moving, the maritime sector continues to fall short in worker protection and treatment, making a career at sea less safe and appealing, contributing to high attrition rates. Preliminary research carried out to inform the Guidelines showed that 25% of seafarers experience harassment and bullying (rising to >50% for female seafarers), 90% report having no weekly day off, and many are isolated with limited or no access to internet services at sea,” GMF stressed in a press brief. The organisation furthered, “Struggling with inexperience, fatigue, and insufficient resources, workers face an increased risk of accidents, endangering both crew members and ships. It is estimated that 75-96% of accidents and incidents at sea involve human error (Allianz) and that 15-20% of all fatalities are linked to fatigue (Science Direct).” Susanne Justesen, Director of Human Sustainability at GMF, said, “We need a complete re-think of what good looks like when it comes to seafarer well-being. While existing measures like the Maritime Labour Convention provide minimum standards for working conditions at sea, we hope the Sustainable Crewing Guidelines can serve as inspiration to those companies that want to go beyond the bare minimum – and lead the way for the industry to become both safe, attractive, and sustainable for seafarers.” The nine points call for establishing clear expectations of respectful and professional behaviour; zero tolerance for abuse and harassment; setting rank-specific criteria for tasks, training, and appraisals; ensuring appropriate equipment and facilities for all; providing a reliable daily connection to the wider world; reducing isolation by building supportive communities; offering flexible contract lengths and respect contract terms; providing paid parental leave; and continuously collecting feedback and taking action.

The V.Group (V.), a global ship manager and provider of marine services, and the International Seaways (INSW) tanker company, have launched a programme that’s specifically designed to enable more gender diversity at sea. It aims at creating a more female-friendly working environment on board, including access to gender-specific facilities, workwear, safety equipment, and health & wellness programmes. Female cadets will join two dedicated and adapted training ships in September 2025 and will be supported throughout their first rotation by INSW female senior officers. These initiatives, along with an onboard culture training programme, will be used to establish best practices for a safer and more inclusive environment at sea to benefit

all seafarers. “Female seafarers represent a wealth of untapped talent for the maritime industry. […] We call for all hands on deck in championing a safe and supportive workplace for everyone. We recognise that when people have equal opportunities to thrive in their roles, the entire industry benefits and grows,” highlighted Lois Zabrocky, CEO, INSW. Her counterpart at V., René Kofod-Olsen, added, “This programme is not only a natural extension of our long-standing partnership with INSW, but it’s also a must-win battle for the entire industry. Enhancing diversity on all fronts is a commercial and strategic advantage. It ensures we have the best talent in our teams and are able to deliver on our promise of operational excellence at sea.”

Particularly affecting container ships, ro-ros & ferries, and car carriers, parametric roll happens when a vessel experiences large rolling motions as it moves in waves. A hard-to-predict phenomenon, it poses a threat to vessel, cargo, and crew safety. ABB and CMA CGM have partnered to integrate the latter’s theoretical framework into the former’s OCTOPUS Marine Advisory system. By detecting and helping to prevent extreme parametric rolling, the new algorithm will help enhance operational safety by reducing the risk of accidents, vessel damage, and cargo loss at sea (thus also protecting the marine environment from oceanic pollution). CMA CGM will deploy the solution across its global fleet (with some 200 ships already OCTOPUS-equipped) and offer comprehensive user training services for the users (also to be available to the wider

shipping industry). “Recent developments in the maritime sector have focused increasingly on safety and sustainability. Our partnership with CMA CGM on the parametric roll algorithm underscores our commitment to improving vessel safety and operational efficiency as well as contributing to environmental protection. By providing a tool that helps to mitigate the risks associated with parametric roll, we are taking a meaningful step forward in the global shipping industry,” underlined Tomas Arhippainen, Business Line Manager, ABB. CMA CGM’s VP Group Operations, Emmanuel Delran, added, “This solution not only enhances safety and operational efficiency but also helps to minimize risks for cargo damage and loss at sea. This collaboration represents a major leap forward for the industry, enabling more efficient operations and safer voyages.”

Kombiverkehr: 780,000 containers, swap bodies, and semi-trailers carried by rail in 2024 (-5% yoy)

Of these, international shipments amounted to 600k units (-6% year-on-year), while in-Germany traffic accounted for the remaining 180k (-3% yoy). “Kombiverkehr is […] feeling the effects of the deepest economic slump, which has far exceeded the dimensions of the 2008/2009 crisis,” commented Armin Riedl, Kombiverkehr’s Managing Director. His fellow MD, Heiko Krebs, added, “Unfortunately, the many construction activities are at the expense of quality and often lead to further train delays, which we very much regret.” Riedl furthered, “There is a risk of a shift back to road transport, which must be avoided. Price adjustments need to be predictable and made with a sense of proportion. Combined transport needs the complete exemption of pre- and onward carriage from tolls, as proposed by the EU Commission in the draft EU CT Directive. Those who transport their consignments in an environmentally friendly way should benefit from a corresponding bonus.”

Finnlines: 439 thousand private & commercial passengers served in H1 2025 (+7.3% yoy)

The company’s fleet also carried 399 thousand ro-ro cargo units (-0.2% year-over-year), 584 thousand tonnes of non-unitised freight (-11.2% yoy), and 37 thousand vehicles (excl. private cars; -21.3% yoy). “The first six months of the year indicate that the latest fleet development plan implemented in 2024 was correctly designed. While the freight market continues to show no signs of recovery, our ro-ro fleet rationalisation and investments made in passenger traffic are beginning to take effect. This, in combination with reduced debt and falling interest rates, explains the significant improvement in results,” Thomas Doepel, Finnlines’ President and CEO, commented on the January-June 2025 figures.

Though import traffic contracted by 12.2% year-on-year to 2.13 million tonnes, exports advanced by 13.9% yoy to 4.99mt, thus making total international trade served by the Finnish seaports rise by 4.6% yoy to 7.12mt. On the other hand, domestic freight traffic lost 82.1% yoy, down to 19.5kt.

949,000 road consignments carried by rail in 2024 (-2.6% yoy)

“Since the beginning of 2025, we have been routing some of our Belgium-Italy traffic through France instead of Germany. This enables us to counter the risk of irregularities and increase the reliability of our transport operations,” noted Michail Stahlhut, CEO of Hupac. He also stressed, “If there are significant additional costs, we expect the infrastructure managers to make concessions. After all, the current performance crisis is the result of structural neglect and underfunding in the past.”

Eckerö: 101,886 ro-ro cargo units carried in H1 2025 (+18% yoy)

“We never had such high passenger volumes, so many freight units, and such a sound result for the first half of a year,” Björn Blomqvist, CEO of Rederi Ab Eckerö, commented to Ålands Radio & TV. The company’s Helsinki-Tallinn ferry service saw 975,460 passengers (+8.8% year-on-year), while the Eckerö-Grisslehamn crossing carried 459,545 (+5.4% yoy). Altogether, 1,435,005 travellers were served (+7.7% yoy).

4.48 million tonnes handled in H1 2025 (+14.5% yoy)

With 2.4 million tonnes, a yearover-year increase of 66.5%, liquid bulk topped the Latvian seaport’s cargo traffic in the first six months of 2025. Wheeled (ferry) cargo came in second, totalling 808kt (+20.6% yoy). Coal transshipment from Kazakhstan totted up to 656kt (+ 22.7% yoy). “Historically, the Port of Ventspils was developed as a hub for large-scale fossil fuel cargo, with powerful terminals for the handling of oil products and coal. Any geopolitical fluctuations in this cargo transit have a direct and significant impact on Ventspils. It is gratifying that some terminals have managed to restructure their operating models, replacing the historical East-West transit with a model based on ship-to-ship cargo import, storage, processing, and export,” commented Igors Udodovs, the seaport’s Acting CEO.

Advertisement

The Port of Tallinn: 6.82 million tonnes handled in H1 2025 (+3.5% yoy)

The handling of liquid bulk noted the sharpest increase of 52.1% year-over-year to 986 thousand tonnes. Wheeled cargo (ferry & ro-ro), Tallinn’s prime trade, saw a downtick of 5.3% yoy to 3.29mt. Dry bulk advanced by 0.6% yoy to 1.21mt. Containerised freight totalled 1.04mt (+1.4% yoy).

TEU traffic amounted to 128,039 (+2% yoy). Break-bulk rose by 14.2% yoy to 267kt, while goods classified as ‘non-marine’ grew by 331% yoy to 30kt. With nearly 3.66 million ferry & cruise travellers, Tallinn’s passenger traffic was up 0.8% on the H1 2024 result. The ferry crossing to Helsinki accounted for 3.25m (+1.2% yoy), followed by 232k on the Stockholm route (-9% yoy). The Muuga-Vuosaari link welcomed 92k (-1.1% yoy), while passengers labelled as ‘other’ totted up to 20k (-0.3% yoy). Cruise traffic gained 24.8% over H1 2024 to, altogether, 67k guests. “We see a continuous increase in liquid bulk, which is related to the movement of project-based goods of European origin. In terms of bulk cargo, growth has been driven by the transport of grain, crushed stone, and wood pellets. The number of passengers has also increased, including 4.3% [yoy] on the Tallinn-Helsinki route [in Q2 2025], which celebrated its 60 th anniversary this summer,” Valdo Kalm, Chairman of the Port of Tallinn’s Board, detailed the results.

THE PORT OF KARLSHAMN is one of Sweden’s major ports and is strategically located in the south, facing the ”new” Europe. There are plenty of industries and major consumer areas in the surrounding region. Customers all over the south of Sweden and Denmark can be reached from Karlshamn within 3–5 hours. Karlshamn has lots of development areas offering direct access to the port, intermodal rail terminal, E22, Logistics cluster and

environmentally friendly energy. The port, with it’s business mindset, is constantly developing and expanding. There is ongoing expansion of the RoRo-port with a 3:rd berth and widening of berth no. 2 for 230 m long vessels. Also shore-to-ship power connection, extended line-up areas and more. Large investments are planned for development of the rail infrastructure.

HES Gdynia Bulk Terminal commissioned a flat grain warehouse with a total capacity of 64,000 tonnes, located at the Silesian Quay in the Port of Gdynia. The four-separate-compartments facility features an integrated transfer conveyor system, plus truck & railcar loading and bottom-discharge points. Before long, HES Gdynia will add three other grain-handling silos (21kt of additional capacity in total). “This expansion will increase our grain export storage capacity by 150% and ramp up our annual handling potential by 1.0-1.5 million tonnes, enabling more efficient, scalable logistics for Poland’s agricultural producers and exporters. It will also allow us to service both Panamax and Capesize vessels with greater efficiency,” the terminal operator said in a LinkedIn post.

YIT Infra has been tasked with expanding the southern end of the West Harbour in a project worth €28 million. The contract covers the large-scale construction of the quay and the field area, including the demolition of existing structures, dredging, filling, as well as the fabrication and installation of quay elements, technical systems, and surface infrastructure. Some 120,000 m3 of soil will be dredged from the site, and around 250,000 m3 of quarry will be used for construction purposes. The expansion will provide 12,000 m2 of loading space, more than a kilometre of lane space for vehicle traffic, and 330 metres of quay wall. The work will be carried out mainly from the sea, so that passenger and cargo traffic can continue to operate as normally as possible throughout the construction period (to be completed by the end of 2027). Kaj Takolander, the Finnish seaport’s VP Passenger Services, commented, “The start of the expansion of the southern end is a much-anticipated and important moment for us at the Port of Helsinki. In the coming years, major infrastructure works will be carried out in the West Harbour, and the work that is starting now is the first step in the overall renovation project. All traffic between Helsinki and Tallinn will be concentrated in the West Harbour in 2032, and the port’s services will be upgraded to meet the future needs of passengers and cargo traffic. It will be two football pitches’ worth of field space that allows for modern, customer-oriented solutions such as automated traffic control. At the same time, we are preparing for the future needs of electric ship traffic. This will improve the reliability and competitiveness of the port, also in the future.” The next phases of the West Harbour renovation project include the setup of a new passenger terminal, plus drilling a harbour tunnel to take heavy traffic underground.

The Swedish seaport has contracted (SEK137 million; €12.6m) Peab to construct the 122-metre-long Berth 8. The project will also cover dredging, with part of the material stabilised and used for constructing the new infrastructure. Works commenced in June 2025, slated for completion in the spring of 2027. “We are creating another ship berth, which will give us the capacity we need to be part of enabling the steel industry’s climate transition, likewise grow the port organically,” commented Jens Jacobsen, Maintenance Manager, the Port of Oxelösund.

Liebherr Rostock handed over the 2,000th mobile harbour crane, an LHM 600, to Marcegaglia, which put it to use at its Ravenna site for handling steel coils, billets, and plates. The machinery features an outreach of 61 metres and a lifting capacity of 154 tonnes. The new LHM 600 became the largest in Marcegaglia’s fleet (which saw the first Liebherr mobile harbour crane, an LHM 400, in 2001). “We are proud to have received this milestone crane. It is not only a technical asset but a symbol of our shared journey with Liebherr – one built on reliability, innovation, and mutual respect,” highlighted Antonio Marcegaglia, President and CEO of Marcegaglia. Andreas Ritschel, General Manager Sales Mobile Harbour Cranes at Liebherr Rostock, added, “To deliver our 2,000th mobile harbour crane to Marcegaglia is a proud moment. It speaks to the strength of our legacy and to the shared innovation with our customers that drives us forward.”

The €45-million project, run by the ports of Helsinki and Lübeck-Travemünde, will receive €22m in support of putting in place hard- & software to streamline cargo & passenger traffic. Among others, onshore power supply facilities and automooring systems will be installed (to prepare for the deployment of Finnlines’ Hansa Superstars cruise ferries in 2028-29). Hansalink 3 will come to its conclusion with 2027’s end. “The significant EU support [€12m for the Finnish seaport] will enable measures in ports to improve the competitiveness of the Helsinki-Travemünde corridor and develop maritime transport in line with sustainable development goals. I am glad that we have been able to collaborate closely with the Lübeck Port Authority to build a project that supports the development of the unit cargo and passenger vessel fleet on this route and ultimately serves the needs of North European companies and consumers,” said Vesa Marttinen, the Port of Helsinki’s VP Cargo.

AIDAnova of AIDA Cruises was the first vessel to cold iron at the new facility at Oceankaj, dubbed by Copenhagen Malmö Port as Europe’s largest of its kind. Once fully developed by 2028, the new onshore power supply station, built by By & Havn, will be able to cater to five ships simultaneously (two now).

The intermodal terminal in Central-southern Poland, which sits at the European and broad-gauge rail networks to/from Ukraine, will receive PLN180 million (€42.3m) of investment from the Polish Industrial Development Agency. The funds will be spent on a new area with seven tracks, plus cargo handling equipment. Once upgraded, Euroterminal Sławków’s yearly capacity will double to 530 thousand TEUs.

RWE has become the first to use the Danish seaport’s new infrastructure, handling components for the 72-turbinebig offshore wind farm Thor (located 22 kilometres off Jutland’s west coast). Some 110 thousand m2 of the 190k m2 in total area, sitting in the Port of Thyborøn’s South Harbour, are already taken (with large secondary steel components – work platforms, boat landings, and internal cassettes for the foundations – having arrived this spring). Granite chippings (221,000 tonnes) were sourced from Norway and laid out over the new drained area to provide sufficient load-bearing capacity. Buss Ports, its Danish chapter, and Mammoet Danmark are in charge of handling the components at the new storage site.

“In addition to the benefits deriving from being able to gather components at a single location, the continuous unloading of main components ensures the components are available in time for installation. This guarantees being able to keep pace with the installation vessel during the installation work, which reduces the risk of waiting time,” the Port of Thyborøn highlighted in a press brief. The Danish seaport also underscored, “The fact that RWE is the first to store offshore wind turbine components at the new heavy-duty storage areas greatly supports the future development of more capacity at the Port of Thyborøn. The installation of the [over 1.0-gigawatt] wind farm is generating considerable activity as well as boosting local development.”

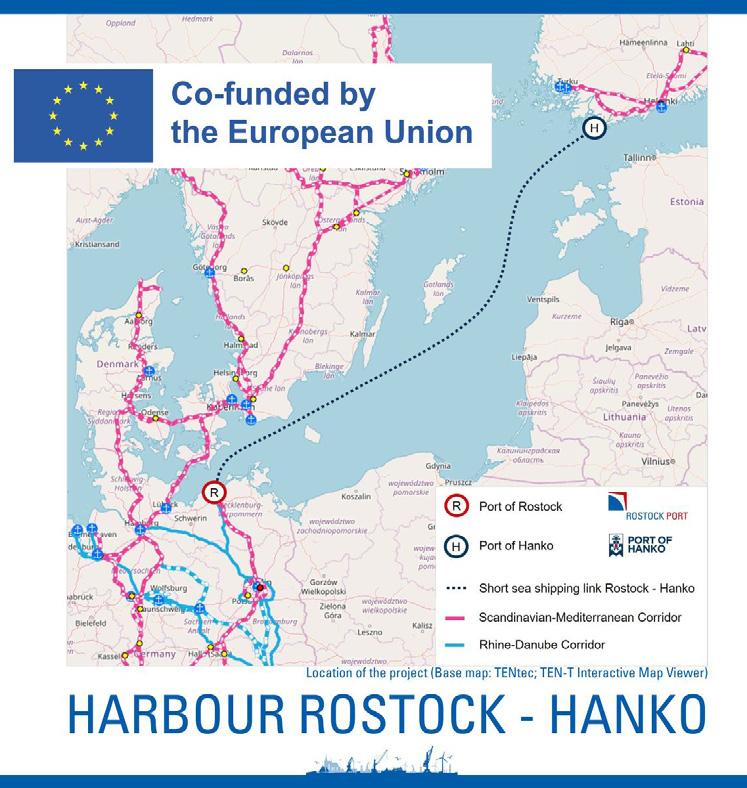

The two Baltic seaports will receive almost €14.2 million from the Connecting Europe Facility to carry out the development of port capacity for an integrated Baltic Sea Link on the Rostock-Hanko route; Part 2 (24-EU-TG-HARBOUR) project. On the Finnish side, the investment will go into modernising the main gate area, plus renovating the RoRo 5 quay. In Germany, CEF money will be used for extending the tracks of the combined traffic terminal to 680 metres and for setting up new storage areas.

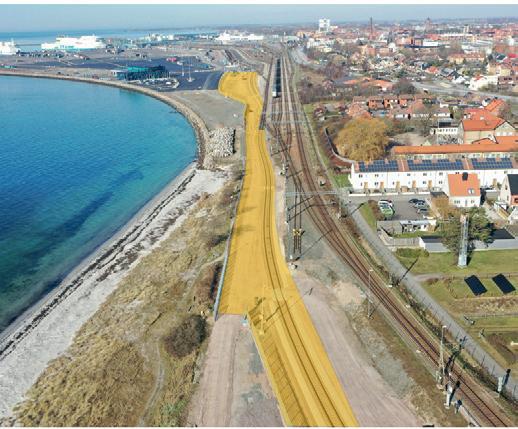

The Danish seaport completed (on time & under budget) the Connecting Europe Facility-funded NORTHERNSEALYTS project that saw its fairway dredged from 9.3 to 12.8 metres. To that end, over 3.7 million m3 of seabed material was relocated along the 21.6-kilometre route through Grådyb. Thanks to this and other recently completed investments (570k m2 of new port areas), the Port of Esbjerg expects to double its cargo turnover over the next decade.

“We are already seeing that several partners and companies within the maritime sector are in need of ports that can accommodate significantly larger vessels. This is not something in the future – it is here and now. And Port Esbjerg is ready,” commented Dennis Jul Pedersen, CEO of the Danish seaport.

Van Oord’s Vox Alexia has started working at the 656,000-square-metre site that will house Poland’s first floating storage regasification unit (FSRU; currently under construction in South Korea) and its second large-scale LNG import terminal. Dredging, to be carried out in four phases, was preceded by clearing metallic objects from the seabed. The first stage involves increasing the seabed depth in the area of the future jetty. Then, dredging will be continued in the immediate vicinity, up to the breakwater (to be constructed by the Maritime Office in Gdynia). The two final stages will cover the southern and eastern parts of the offshore construction site. After dredging, pile driving will start. Once commissioned at the turn of 2027/28, the FSRU, alongside onshore in-process storage and regasification infrastructure, will be able to handle over six billion m3 of natural gas per year. The preparatory works are grantsupported (up to €19.6 million) through the EU’s Connecting Europe Facility.

First, the Port of Gdańsk Authority has commissioned DORACO to reconstruct the Vistula Quay in the Inner Port, a project worth PLN351 million (€82.5m) and scheduled for completion in Q2 2028. The construction works will see the rebuilding of 920.25 metres of quay wall, dredging the dock to 12 m, setting up new road & rail infrastructure (altogether 3.4 km of rail tracks), erecting a new terminal for handling sugar, and putting in place a new manoeuvring area. The new Vistula Quay will serve vessels able to carry 100,000 tonnes. Next, the Authority’s daughter stevedoring company, Port Gdański Eksploatacja, will set up, with the help of Premium Quality Care, a 7,000-square-metre, 30,000-tonne-capacity flat warehouse in what will make up the first phase of setting up the ultimately 160,000-tonne-storage-capacity Gdańsk Agro Terminal (GAT). The investment’s completion is planned for 2026; the entire GAT will be operational in 2028 following its integration with the Vistula Quay and the erection of other silos. The GAT project’s value is PLN240m (€65.4m). The reconstruction of the Vistula Quay is part of a bigger initiative, 85% EU-supported through the Connecting Europe Facility. The construction of GAT will, in turn, be 100% financed from Polish funds.

The NDI Group finished overhauling the infrastructure in question, broadening 537 metres of the quay wall by six metres, plus dredging it to 15.5 metres. The investment also involved several other works, including modernising the road & rail network (the length of the quay’s track totals 1,615 metres now), extending the waterfront trans-loading facility, and installing new fenders

The 1.1-gigawatt joint venture offshore wind farm project of the Torontoheadquartered Northland Power and the Polish ORLEN saw the setup of the first (out of 76) V236 15-megawatt turbine from Vestas at the beginning of July 2025. Cadeler’s Wind Osprey, recently fitted with new main cranes (lifting capacity of 1,600 tonnes), mounted the first turbine (the vessel can transport up to three turbines at once). Expected to start commercial operations next year, Baltic Power will generate electricity for over 1.5 million households in Poland (equivalent to 3.0% of the country’s electricity demand). Work continues across other parts of the project, including foundation and transition piece installation, export and inter-array cable preparations, and erecting onshore infrastructure. The service base in the Port of Łeba was opened in April 2025; it will support Baltic Power’s operations and maintenance activities (meanwhile, the installation is being carried out from the Port of Rønne).

In mid-summer, two electric mobile harbour cranes of the LHM 550 model left Liebherr’s factory in the Port of Rostock for the Indian Vizag Port. There, Green Energy Resources deployed the brand-new machinery at its EQ1A berth. The LHM 550s feature a four-rope configuration, a 124-tonne safe working load, electric drives, and integrated overpressure units to protect components from abrasive dust and humidity. “The cranes’ modular control systems and intuitive interfaces simplify operator training and maintenance planning, key factors in maintaining uptime in high-throughput environments. This added versatility supports the company’s ability to respond to shifting market demands and seasonal cargo flows without compromising service levels,” the manufacturer highlighted in a press brief. Siddharth Saxena, Founder & Director, Green Energy Resources, commented on this first-time purchase from Liebherr, “We are pleased to partner with Liebherr for this important investment. The new cranes will allow us to improve turnaround times and meet the growing demands of our customers with greater efficiency and reliability.” Green Energy Resources handles over 3.5 million tonnes of dry bulk annually.

The company’s Finneco ro-ros, each offering 5,800 lane metres for cargo, started visiting the Polish seaport as of week 26 of 2025 (23-29 June). The connection in question is part of the North Sea & Biscay Line network that links the Baltic ports of Kotka, Helsinki, Hanko, Travemünde, and Gothenburg with Fredrikstad, Antwerp, Zeebrugge, Sheerness, Rosslare, Bilbao, and Vigo. “These state-ofthe-art hybrid ro-ro vessels are tailored to accommodate a wide array of cargo types, including ro-ro, break-bulk, container, and automotive. They are particularly wellsuited for special and oversized shipments, such as extrawide or heavy units transported on weather decks or mafi trailers,” highlighted Blasco Majorana, Line Manager at Finnlines. His company added in a press release, “To support the service expansion, Finnlines is also introducing brand-new 80-foot mafis with embedded rails, specifically designed to facilitate the transportation of non-standard cargo – such as trains and wagons – with greater efficiency and flexibility.”

Incat’s shipyard in Tasmania has been entrusted with constructing two battery-powered high-speed ferries for the Danish shipping line. The first 129-metrelong and 30.5-metre-wide e-catamaran, able to transport 1,483 passengers and 500 cars, will enter Danish waters around the turn of 2027 and 2028. Discussions are ongoing with multiple shipyards capable of delivering a vessel identical to the first two. Each ferry will have 45,000kWh battery packs, enabling 40+ knot speeds. Apart from new tonnage, the DKK3.5 billion (€470 million) investment involves associated onshore infrastructure. Charging the ferries will be possible both in the Aarhus and Odden ports. When plugged in, a single catamaran will charge with 15kV AC at 55,000kW for 30 minutes – receiving an average of 25,000kWh of energy before its next journey (enough to power an electric car for a 150,000-kilometre drive). “Molslinjen’s fast ferries were specifically mentioned in the Danish green tax reform – a package of political initiatives aimed at reducing greenhouse gas emissions and accelerating the green transition. As a result, Molslinjen has now applied for support from the government’s green funding programme to help finance the electrification of its Kattegat operations. The possibility of state support has been the decisive factor behind the company’s decision to place the order,” Molslinjen highlighted in a press release. “This is a massive undertaking, involving not just the three ferries but also extensive land-based infrastructure projects and energy storage systems for the new ships. We now have two and a half years to get ready for full electric operation on the Kattegat. It is a fantastic milestone for our company. We are among Denmark’s five largest CO2 emitters, and with support from the fund, we and the government now have a chance to remove 132,000 tonnes of CO2 emissions from Denmark’s climate footprint each year,” outlined Kristian Durhuus, CEO of Molslinjen.

The ferry & ro-ro line has introduced a new concept of shipping, both for freight & passengers, where vessels can now sail fully electric or with biofuel in place of fossil bunker. The 100% electricity-powered cargo shipments are available between Naantali and Kapellskär, with the crossing’s two 5.0MWh cruise ferries green-charged while connected to an onshore power supply in the Finnish and Swedish seaports. “Our utmost goal is to reduce emissions, and we are already seeing concrete results. With the introduction of our new vessels, Finnsirius and Finncanopus , we have entered the hybrid era and can now offer our customers even more efficient and sustainable sea transport services. Although the cargo capacity of the vessels operating on the Naantali-Kapellskär route has increased significantly, absolute carbon dioxide emissions per nautical mile have decreased by 22%,” underscored Antonio Raimo, Line Manager at Finnlines. The biofuel Green Lane option for freight is available on the Naantali-Kapellskär, Malmö-Travemünde, Malmö-Świnoujście, and HankoGdynia services. “The use of biofuels [derived from renewable sources] can reduce well-to-wake greenhouse gas emissions of transport by up to 90% compared with conventional fossil fuels,” Finnlines highlighted in a press release. The company’s Commercial Director, Merja Kallio-Mannila, added, “We want to offer our customers concrete solutions to help them achieve their decarbonisation targets. Both solutions ensure low emissions; for example, using biofuel can reduce carbon dioxide emissions by up to 700kg per trailer on the Hanko-Gdynia route.” Green Lane is also available for passengers on the Naantali-Långnäs-Kapellskär, HelsinkiTravemünde, Malmö-Travemünde, and Malmö-Świnoujście crossings. “If passengers choose this option, Finnlines will consume renewable biofuels to replace the corresponding volume of fossil fuels, and the emissions per passenger on the route will decline,” the company said.

CMA CGM has made the Polish seaport part of the container loop that connects it with Helsinki and Tallinn in the Baltic and Rotterdam, Teesport, and Zeebrugge in the North Sea. The link is served by the 2019-built sister, gas-run, 170 by 27-metre vessels Containerships Aurora and Containership Borealis , each offering 1,380 TEU of capacity (378 reefer plugs). Also, as of 16 July 2025, CMA CGM’s new Scandinavia West Coast Express (SWX) weekly loop connects the ports of Aarhus, Gdańsk, Gothenburg, and Klaipėda.

First, on 3 August 2025, a new service set sail, Finland Express 2 (FI2), while from 22 August, Baltic Bridge Express (BBX) offers a new rotation. FI2 connects the ports of Rotterdam (ECT Delta Terminal), Antwerp (Gateway), Helsinki (Steveco), Tallinn (HHLA TK Estonia), and Kotka (Steveco). The loop is served by the green methanol-run Eco Levant and Eco Maestro, each offering 1,260 TEUs of capacity. The new BBX links the ports of Rotterdam (Short Sea Terminals & Rotterdam World Gateway), Gdańsk (Baltic Hub), Klaipėda (Klaipėda Container Terminal), and Riga (Riga Universal Terminal). The 1,084-TEU Svendborg and the 1,118-TEU Ballata feed the volumes.

The Lübeck-headquartered TT-Line has set in motion a new combined rail service (for trailers & containers) that links the Port of Trelleborg and Hallsberg with five weekly round trips. The ferry company also underscored that waste transports are permitted on the new link.

The all-electric passenger-car ferry, put together by the Turkish Cemre Shipyard for the Danish Alslinjen (a subsidiary of Molslinjen), arrived in the Baltic and entered traffic on 16 June 2025. The 116.8-metre-long ferry offers room for 600 passengers and 188 vehicles. Initially set to sail between Fynshav and Bøjden, Nerthus served Samsølinjen’s crossing between Ballen and Kalundborg this summer. Nerthus features technology for automatic docking as well as for charging its 3.1MWh battery system (supplied by Echandia). Cemre Shipyard is also constructing Tyrfing, a sister ship originally destined for the Ballen-Kalundborg link (as the service is longer than Fynshav-Bøjden, she’ll have a bigger battery pack of 3.8MWh).

After successfully carrying out sea trials, the brandnew ro-ro has replaced ML Freyja on the TurkuSouthern Paldiski-Bremerhaven-Zeebrugge-TilburyCuxhaven service under a five-year-long charter. The 1A Ice Class, methanol-ready freighter – put together by shipbuilders from Visentini and designed by NAOS Ship and Boat Design – is 203 metres long and offers 3,000 lane metres of cargo space.

Under the supervision of Lloyd’s Register and in collaboration with the builder, Cemre Shipyard, the company’s newbuild has successfully completed its second sea trial in the Sea of Marmara. This included simulations of a blackout, plus advanced navigation systems and automated safety tests. The 147.4-metre-long, 25.4-metrewide, 10MWh electric Futura (also equipped with three diesel generators) will offer room for 140 passengers and 1,200 lane metres for cargo on the Puttgarden-Rødby 45-minute crossing later this autumn. Apart from the ship, the €80 million project saw the installation of charging systems in the German and Danish seaports. It will take approximately 12 and 17 minutes to charge the ferry in Puttgarden and Rødby, respectively. “An intelligent charging tower ensures that the ferry is automatically switched on, regardless of water levels and movements, in under 15 seconds,” Scandlines underscored in a press brief, talking about its recent investment in a 50kV/25MW power cable and a new transformer station in the Danish ferry port.

The shipping line Lillgaard from the Åland Islands has sold its subsidiary to another Ålandic shipowner, with the deal covering the vessel Fjärdvägen, her crew, and other assets. The 1972-built ro-ro (780 lane metres for wheeled cargo) plies between the Port of Långnäs on the Ålands and Naantali on the Finnish mainland (since 1994 under Lillgaard’s banner). “The Långnäs-Naantali route fits perfectly in our strategy of providing ‘floating bridges’ where sea shipping is the most obvious and sustainable choice. The connection between Åland and Finland has in many ways been the missing link in our customer offer; a link that we can now attach to the chain,” underscored Björn Blomqvist, CEO, Eckerö.

• The Finnish-Swedish ferry company, plying between Umeå and Vaasa, has signed a contract with Gasum for the delivery of biogas, plus entered a FuelEU Maritime pool with Stena Line. The bunker deal will see Wasaline’s Aurora Botnia using only biofuels in the future – thus making it possible to check off the company’s goal of becoming carbon-neutral before the initial 2030 deadline. This will also mean that the Umeå-Vaasa crossing will become a green shipping corridor in practice. Also, earlier Wasaline had contracted the marine battery specialists from AYK Energy to up the ferry’s current battery system of 2.2MWh by an additional 10.4MWh. Delivery is scheduled for the autumn of this year, with Aurora Botnia set to use the new lithium iron phosphate pack as of January 2026. “We have attended many seminars where shipping companies are talking about the growing costs with the EU Emission Trading System and focusing on how to get exceptions from the rules. We have instead focused on the opportunities,” noted Peter Ståhlberg, Managing Director of Wasaline. He furthered, “We have constantly worked with the possibilities to reduce our greenhouse gas emissions and environmental footprint, and we have seen the coming rules as an opportunity for our traffic between Finland and Sweden. With this unique collaboration with Stena Line and Gasum, Wasaline can achieve carbon neutrality already now as a forerunner for the industry. This also means that all cargo and passengers travelling with Wasaline are sustainable with no additional extra charges for being carbon-neutral.” Vegar Rype, Segment Director RoRo and Ferries at DNV, also highlighted, “At DNV, we have been actively collaborating with partners, through the Nordic Roadmap,

to launch green shipping corridors, and we are very pleased to see the VaasaUmeå route, operated by Wasaline, recognized as the first international green shipping corridor in operation. This milestone directly supports the ambitions of both the Clydebank Declaration and the ministerial declaration on zeroemission shipping routes between the Nordic countries.” Niclas Mårtensson, CEO of Stena Line, commented on the co-op, “By integrating Aurora Botnia into Stena Line’s FuelEU Maritime pool, we gain access to biogas previously unavailable for Stena Line, which enables further emission reductions for the entire pool, lowers fuel costs, and strengthens our strategic position as biofuels become increasingly scarce under more stringent regulations.” •

• The move follows the certification of FERNRIDE’s safety concept and system design by TÜV SÜD, as well as approval by the Estonian Transport Administration. FERNRIDE is the first to receive TÜV SÜD certification for an autonomous terminal tractor under the EU Machinery Directive (2006/42/EC).

“This certification confirms that FERNRIDE’s autonomous vehicle platform –including the vehicle, sensors, computers, and software – meets EU standards for safety, cyber security, and system reliability. It marks an important step toward CE compliance and industrial deployment across Europe,” the company underscored in a press release. Its CEO and co-founder, Hendrik Kramer, added, “This is a defining moment not only for FERNRIDE but for the entire autonomous logistics industry in Europe. From day one, we’ve made safety the foundation of everything we build. Meeting Europe’s most stringent

regulatory standards took a remarkable effort, and I’m incredibly proud of our team’s dedication and precision throughout this journey. This certification proves that our technology meets the highest safety benchmarks, not just in theory, but in practice, and brings us one step closer to making autonomous logistics a commercial reality across the EU.”

Riia Sillave, CEO of HHLA TK Estonia, also commented, “Entering the phase of driverless terminal transport marks a good step on the path to being the digital front-runner and a test field –not just for our collaboration with FERNRIDE but for the future of terminal operations. As one of the first terminals to take this step, we are shaping the path towards more intelligent logistics. We trust that innovation succeeds by including the know-how of our employees – our team’s engagement is the foundation for the integration of this technology into everyday operations.” •

• Inter Terminals Sweden (ITS), in co-op with the Port of Södertälje, has started a front-end engineering design study for an open-access intermediate storage facility in the Swedish port for regionally captured carbon dioxide. The project also aims at securing permits. The terminal, expected to be operational by 2030, will see the CO2 exported by sea either for permanent storage or further use, e.g., in the production of e-fuels. “This initiative marks an important milestone for Inter Terminals, positioning us as a key enabler

in the emerging CO2-logistics market in Mälardalen. The objective is to offer an open and accessible solution for all regional companies aiming to capture CO2 and seeking efficient solutions for storage or for reuse,” said Johan Zettergren, Managing Director of ITS. Måns Frostell, the Port of Södertälje’s CEO, also commented, “This joint initiative further strengthens Södertälje Port’s position as a hub for sustainable freight logistics and the future infrastructure for energy management in the Stockholm region.” •

• BLRT Repair Yards’ Western Shiprepair will convert two ships serving the Puttgarden-Rødby service with 5.0MWh battery systems. The €31 million project will also see both seaports fitted with charging facilities, with 12 minutes needed to charge the batteries up to at least 80% of the energy needed for the crossing. The conversion of the first vessel started in August 2025, while the other will begin in December. The hybridisation is slated for completion in early 2026. “By electrifying two of our Fehmarn Belt ferries, we are moving much closer to our goal of making the route direct emission-free by 2030 [Scandlines’ overall ambition is to become a direct emission-free company by 2040]. This is what our customers want, and it will significantly strengthen our competitiveness,” said Michael Guldmann Petersen, Scandlines’ COO. He also

underlined, “It is about more than just technology – it’s about responsibility. As a ferry company operating daily in one of the world’s most sensitive waters, we have a special obligation to protect the marine environment we operate in.” His company also highlighted in a press release, “Between 2013 and 2024, Scandlines invested €380 million in technologies to reduce emissions such as new hybrid ferries for the Rostock-Gedser route, rotor sails and new centre propeller blades for the Rostock-Gedser ferries, new highly efficient and lownoise thrusters for the Puttgarden-Rødby ferries and algae-repellent silicone paint, which saves energy compared to conventional types of bottom paint.” The German Ministry of Transport has awarded the project financial support that will cover up to 40% of the conversion expenses. •

• Munck Havne & Anlæg has won the Port of Aalborg’s tender for the construction of a 500-meter-long quay with 60,000 square meters of adjacent land area at the East Port. The new infrastructure will chiefly serve Fidelis New Energy’s Norne Carbon Storage Hub, a reception facility with a pipeline network and storage to receive up to five million tonnes of CO2 per year (potentially 15mt in the future). Construction is set to begin this autumn, with completion scheduled for the end of 2027. The designand-build construction project will follow the Integrated Construction model developed by Molt Wengel. “We chose to use the Integrated Construction model to bring both consultancy and contractor expertise into play, from design through to delivery. It gives us a unique opportunity to challenge one another and enhance quality throughout the entire project,” explained Mikkel Guldhammer, Project Manager at the Port of Aalborg. The total budget for the quay expansion runs into several hundred million Danish kroner. The project has received nearly DKK80m (about €10.7m) in EU support through the Connecting Europe Facility. “The new quay is essential for realizing the CO2 reception facility with Norne, which will position Aalborg as one of Europe’s leading areas for CO2 management. We are pleased that, with this agreement with Munck Havne & Anlæg, we’re now ready to accelerate development,” commented Kristian Thulesen Dahl, CEO of the Port of Aalborg. He also underlined, “Equally important, the quay expansion enables a significant enlargement of our business park, allowing us to offer many more quay-adjacent square meters to industries, especially the wind industry, that are in high demand for such space.” •

• St1 and St1 Biokraft provided the fuel to Terntank’s Tern Ocean at Quay 519 in the Port of Gothenburg’s Energy Harbour. “In order to accelerate the maritime sector’s transition, it’s essential that all actors across the value chain pull in the same direction, cooperate, and translate ambitions into practice. We are pleased to have all of this in place at the Port of Gothenburg,” said Therese Jällbrink, Head of Renewable Energy at the Swedish seaport. She furthered, “Liquefied biomethane is an important part of the fuel palette that must be available to support the shipping industry’s transition. It is one of the fuels the Port of Gothenburg is working with within the framework of green shipping

• The Skagen-based tanker company will see its two dual-fuel (diesel/ methanol) hybrid tankers equipped with 16-metre, foldable, ATEXcertified wind wings, four units for each vessel. The deal follows the initial order of May 2023 for three newbuilds, bringing the new tonnage number to five and 20 VentoFoils. China Merchants Jinling Shipyard (Yangzhou) delivered the first one, Tern Vik, in April 2025. “At Terntank, we are always looking for ways to reduce fuel consumption. It is part of our DNA. The installation of the VentoFoils and their integration with the Kongsberg [energy & propulsion management] system went seamlessly. It is great to see that the actual fuel savings match what was predicted. We are very pleased with the results,” commented Claes Möller, CEO of Terntank. “Econowind’s engineering team has worked closely with Terntank and Kongsberg to ensure seamless integration of the VentoFoils into the vessel’s overall energy system. The collaborative approach allows real-time optimisation of power sources, where wind, batteries, and fuel-based engines work together to minimise emissions and maximise efficiency. Under the K-Sail concept, wind can take the lead when conditions are favorable,” the manufacturer from the Dutch Groningen highlighted in a press release. The Terntank order upped Econowind’s sales of VentoFoils to over 130 units, mounted on dry bulk carriers, tankers, ro-ros, and container ships. •

corridors, aimed at creating the conditions for fossil-free logistics chains. This bunkering operation brings us another step closer to our ambition of becoming Scandinavia’s primary bunkering hub for alternative fuels.” In 2026, Nordion Energi will build a liquefaction facility for biomethane at the Swedish seaport, connected to the West Sweden gas grid. “Once the liquefaction plant is completed, we will have a solid solution in place at the Port of Gothenburg. This is a strategic step towards our goal of scaling up and offering competitive liquefied biomethane to the shipping sector, thereby taking a leading position in this segment,” commented Ted Gustavsson, Head of Value Chain at St1 Biokraft. •

• A two-week trial saw Stena Line’s two ferries drawing power from a hydrogen-powered generator connected to the company’s onshore power supply (OPS) facility at its Germany Terminal in the Port of Gothenburg. Hitachi Energy has developed the HyFlex hydrogen generator (already used to run a Volvo excavator during the construction of Gothenburg’s Arendal 2), with the PowerCell Group supplying the power modules and sharing its expertise in fuel cell integration. Linde Gas provided the 100% green hydrogen for testing. “In 2030, a new EU regulation will come into effect, requiring container and passenger vessels to use OPS while at berth. According to a study by ICCT [International Council on Clean Transportation], this is expected to reduce emissions by just over one million tonnes of carbon dioxide per year,” the Swedish seaport highlighted in a press release. The Port of Gothenburg also houses a hydrogen-fuelling station for trucks and is testing hydrogen-powered work vehicles. •

• The Danish seaport, the Esbjerg Municipality, and INEOS Energy hosted the groundbreaking ceremony for a terminal, part of what is hailed as the first full value chain for carbon capture & storage (CCS) in the EU. Once operational in late 2025/early 2026, the facility of Project Greensand will be able to handle up to 6,000 tonnes of CO2 at a time. In the first phase, some 400kt/year is predicted for handling, up to 8.0mt of biogenic & fossil CO2 in the future. Project Greensand says it expects investments of $150+ million across the Greensand CCS value chain to scale storage capacity (with CO2 ultimately stored offshore in the North Sea). “With today’s groundbreaking, we are not just starting a construction project – we are opening a new chapter, where Port Esbjerg plays a central role in the infrastructure needed for a greener Europe,” the seaport’s CEO, Dennis Jul Pedersen, commented. •

• The two have signed a letter of intent to develop the Port of Hanko’s Koverhar Harbour into an offshore wind energy (OWE) hub for the 250-turbine-big, 4,000-megawatt-strong Noatun Åland North OWE farm. “Unlike a greenfield development, the Koverhar Harbour already possesses the fundamental infrastructure needed for the offshore wind logistics. With limited adaptations and targeted investments, it can be quickly optimised to serve the industry, making it a highly efficient and cost-effective solution,” the parties said in a press release. As such, the letter of intent outlines a framework for evaluating storage, assembly, and logistical needs. It also includes an option for using Koverhar in setting up Noatun Åland South (4.7GW). In addition, the Port of Hanko and Euroports have a separate exclusive agreement to explore the long-term development of the Koverhar Harbour to meet the growing demands of the general OWE market. •

• The shipping company from Hamburg will have six of its newbuilds, constructed by Nantong Xiangyu Shipbuilding & Offshore Engineering, fitted with Norsepower Rotor Sails. Each of the four 3,850-deadweight (dwt) chemical tankers will be equipped with one 20-metre-tall and 4.0-m-in-diameter rotor, while the two 7,900 dwt chem carriers will get the 28-by-4.0 version. All six rotors will feature Norsepower’s EX-compliant design, certified for use on vessels transporting flammable cargoes. GEFO will also have access to the Norsepower Digital Dimension, including the AI-powered Norsepower Sentient Control for real-time performance optimisation, predictive maintenance, and full transparency on emission savings. The sails will be manufactured at Norsepower’s site in China, delivered to the yard already tested, fully assembled, and installationready. GEFO’s newbuildings, designed by Ship Design & Consult, are scheduled for commissioning in 2026-28. “At GEFO, we are committed to building a future-ready fleet that meets the highest standards of environmental performance and operational efficiency. Partnering with Norsepower allows us to integrate proven wind propulsion technology into our newbuilds from day one – supporting both our sustainability targets and our longterm competitiveness,” underscored Henning Brauer, GEFO’s Technical Director. Heikki Pöntynen, CEO of Norsepower, added, “This is a landmark agreement for Norsepower, not just because it involves […] six vessels – but because it signals a fundamental shift in how wind propulsion is perceived in commercial shipping. We are no longer talking about

one-off pilot installations; we are now securing full fleet commitments. That is a clear sign we have not only opened the market, but we are now leading it – both in terms of proven delivery capacity and customer trust.” He also underscored, “And with access to the Norsepower Digital Dimension, including our AI-powered Norsepower Sentient Control and Norsepower Cloud, our customers are fully equipped to maximise the return on their investment from day one.” GEFO has received support for their new chemical tankers from the German Government’s Namkue Fund, a financial instrument aimed at promoting sustainable coastal shipping and accelerating decarbonisation technologies. •

NGOs and industry alliances urge the EU to push through the “disappointing

A collective of 82 clean maritime and green hydrogen industry stakeholders has written a letter to the European Commission (COM) and European Union Presidency urging it to strengthen the bloc’s clean shipping policy. “More ambitious IMO measures could have eased existing barriers for the industry’s growth. A stronger price on all shipping pollution and high rewards targeting early green hydrogen fuel adoption would have helped e-fuel producers access the finances needed to increase production, and ships to switch to e-fuels. The weak measures will leave pioneering green companies continuing to struggle to develop, at the expense of global and EU climate goals and European industry,” the parties underlined in a joint press brief. To amend what they see to be IMO’s shortcomings, their letter urges COM to adopt a policy roadmap based on already planned legislation, including the introduction of financial mechanisms to support e-fuel producers in the upcoming Sustainable Transport Investment Plan (2025); expand the maritime part of the EU Emissions Trading System and use revenues to support e-fuels (2026); strengthen e-fuel uptake targets in the FuelEU Maritime review (2027); and continue to push for ambitious regulation at the IMO that incentivise e-fuel uptake. “The EU must deliver the policy support that the shipping industry is crying out for and that the IMO failed to secure. There is only one credible path to net-zero shipping, and that is using green hydrogen fuels. But without EU support, the maritime sector will not be able to access and adopt these fuels, in turn failing to deliver the potential for industrial competitiveness these innovative sectors promise Europe. In the aftermath of the IMO’s disappointing outcome, there is a window of opportunity for the EU to nurture rather than neglect its nascent green shipping businesses – what’s to win is nothing less than meeting Europe’s climate targets and its Clean Industrial Deal goals,” said Aurelia Leeuw, Director of EU Policy at the SASHA Coalition. To this Madadh MacLaine, Secretary General of the Zero Emissions Ship Technology Association (ZESTAs), added, “From every angle, be it climate, industry, or innovation, it is in the EU’s best interest to strengthen clean shipping regulation where the IMO didn’t. The IMO measures could have delivered the gust of wind ZESTAs’ members needed to set their next-generation technologies sailing, but instead, it opened a gap for solutions that will bake in infrastructure investment in fuels that may do more harm than good: biofuels and LNG. ZESTAs calls upon the EU to support a rigorous and specific science-based fuel life cycle analysis methodology at the IMO, to support the nascent ZEST industry, penalise pollution, and to strengthen its own targets, for the sake of the shipping industry’s future resilience as much as for the climate.”

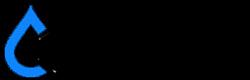

The European Commission selected 94 transport projects to receive nearly €2.8 billion in EU grants under the latest Connecting Europe Facility (CEF) call. Rail transport will receive the largest share of the funding (77%), with investments directed towards major infrastructure upgrades across the Trans-European Transport Network, both Core and Extended, particularly in cohesion countries (including Rail Baltica). Projects tasked with reducing the environmental impact of maritime and inland waterway transport will receive backing as well, particularly for setting up onshore power supply facilities in seaports. Support will also go to the construction and upgrading of multi-purpose icebreakers in Estonia, Finland, and Sweden to strengthen the security and resilience of submarine cables. In road transport, safe and secure parking areas will be built or modernised. Funds will continue to be channelled to the EU-Ukraine Solidarity Lanes, with projects to improve rail connectivity and border crossing points (between Slovakia and Ukraine, but also between Romania and Moldova). The CEF 2021-27 transport €25.8 billion budget has already been allocated in 95%. The latest selection will see several Baltic seaports getting CEF funds: Hanko, Helsinki, Lübeck, and Rostock, plus the Maritime Office in Szczecin for widening the Port of Świnoujście’s fairway.

The European Sea Ports Organisation (ESPO) has welcomed the A revamped long-term budget for the Union in a changing world report of the European Parliament’s Budget Committee. The document stresses the need for the next Multiannual Financial Framework (MFF) to allocate significantly greater funding to energy and transport, in line with the objective of the EU achieving climate neutrality by mid-century. It also recognises that budgetary needs post-2027 will be significantly higher than the amounts allocated in the 2021-27 MFF, including more money to be spent

on military mobility. “Europe’s ports are important partners in enhancing energy, economic and geopolitical resilience. This comes with huge investments, which are often high risk and without direct or important return on the investment, even if these investments are key in meeting Europe’s ambitions. It is good to see that the budget experts in the European Parliament are understanding the importance of both transport and energy investments and funding in the current geo-economic and geopolitical context,” commented Isabelle Ryckbost, ESPO’s Secretary General.

At the latest edition of the International Transport Forum’s (ITF) Summit, Eugenijus Sabutis, Lithuania’s Minister of Transport and Communications, proposed the establishment of the facility in question. The Fund would help secure increased financial contributions from international donors, promoting the recovery of Ukraine’s critical transport infrastructure (estimations speak of $38

billion of damage to it until now). The proposal follows the set-up of CIG4U, a cooperation platform between Lithuania, Canada, Sweden and Ukraine, during last year’s Lithuanian presidency of the ITF. CIG4U has been put in motion to mobilise international support and facilitate faster & more efficient information exchange, all towards supporting Ukraine’s transport restoration projects.

POH_205_x_133.5_.qxp_(BTJ Package) 09.02.24 17:46 Seite 1

During the 11th International Maritime Congress in the Polish port city, EU transport ministers signed the document in question , which highlights the need to safeguard the global competitiveness of European shipping through a level playing field, likewise fit-for-purpose regulatory and taxation frameworks. “At a time of rising protectionism across the world, the Declaration sends a strong signal that Europe does not need protectionist measures but investments to bridge the innovation gap and to make the maritime industrial cluster more competitive,” underlined the European Community Shipowners’ Associations (ECSA) in a comment to the Declaration. Among others, EU Member States call for regulatory action on fuel supply, recognising that decarbonisation depends on the contribution of fuel producers & suppliers. ECSA said, “European Shipowners consider the introduction of a binding mandate on suppliers to produce and make available the fuels necessary for the energy transition of shipping.” Here, the Declaration suggests measures to de-risk investment in clean fuel in Europe under the upcoming Sustainable Transport Investment Plan. “European Shipowners firmly support

the use of the EU and national ETS revenues for bridging the enormous price gap with clean fuels,” underscored ECSA.

Port of Trelleborg, with the ambition of being Europe’s most sustainable RoRo port, is constantly working on various improvement measures within environment and sustainability. We invest a lot in intermodal transports, i.e. a combination of rail, sea and road, since it is the most sustainable way to get your goods.

Port of Trelleborg has worked to ensure that a larger proportion of trailers and containers choose the train to and from Trelleborg, a work that has had a fantastic development in recent years. In 2024 the increase was 17% compared with the previous year, which means that more than 46,000 trailers have traveled to or from Port of Trelleborg by rail. The port’s unique logistical location, where Europe meets Scandinavia, and with the possibility of combining the transport modes sea, rail and road, is a success factor.

The Port of Trelleborg has an activity, with the aim of improving the handling of intermodal trains and rail connections, in the EU project ”Green FIT”. The completion of the rail works was completed in May 2025. With the investments, some existing constraints in the port area were eliminated and the intermodal trains no longer need to be split in two parts. Therefore, the train handling operations towards the intermodal terminal have been significantly optimized.

By 2033, the forecasts point to 150,000 units. In order to handle this large number, the Port of Trelleborg needs to rebuild the intermodal terminal to improve the handling of intermodal trains and rail connections. Port of Trelleborg works together with the Swedish Transport Administration to reach an agreement regarding a takeover of the old freight railway yard in order to develop and become a modern intermodal terminal.

Together with our shipping line customers and our partner ports, we can tie together the intermodal solutions to increase the volumes further.

Port of Trelleborg is Scandinavia’s largest RoRo port for rolling traffic, one of Sweden’s five core ports designated as strategically important by the EU and an important part of the European transport corridors. We are also Sweden’s only port with rail ferries. The port is an important node for Sweden’s import and export, and thus has an important meaning and role for the climate transition of freight transports.

by Nicholas Ball, CEO and Co-Founder, XFuel

Many shipowners face costly and unappealing choices to meet global emission regulations. There is, however, another way to connect the dots of being green and commercially sound. Namely, vessel owners can make strides to build their low-carbon fuel supply chain end-to-end, thus reclaiming some energy independence.

The shipping industry faces ambitious decarbonisation targets; from aiming to achieve net-zero emissions by 2050 to shorterterm objectives. In April, the International Maritime Organization (IMO) agreed on mandatory emission limits and a global price on emissions for ships that exceed them, set to come into effect in 2028 – subject to approval at its Marine Environment Protection Committee (MEPC) session in October this year. Shipowners will need to reduce the greenhouse gas (GHG) emissions of the fuel that powers their vessels by 30% by 2035, up by 65% five years later. Such regulations are putting pressure on the maritime sector to explore all viable decarbonisation pathways.

The clock is ticking

Low- and zero-carbon fuels are a critical solution to decarbonisation. Yet, despite rapid developments, the gap between the current state of low-carbon fuel production and distribution and the scale required for meaningful decarbonisation remains vast. Closing it at a cost that is accessible to operators and their customers is an additional challenge for the sector. With more than 95% of the global fleet still running on conventional fuels, shipowners need to find economically viable, low-carbon, drop-in solutions that can secure global and regional regulatory compliance.

Today, owners face tough choices: fleet overhaul means significant investment and paying a premium for newbuilds that incorporate low-carbon and clean technologies. Failure to act will expose companies

to financial penalties. Meanwhile, relying on vessel pooling to secure compliance will mean ceding some independence and aligning with the operational plans of somebody else. With the clock ticking on fleet compliance and costs on the rise, shipowners need reliable long-term solutions without delay.

Whose move is next?

The shipping industry has historically relied on an energy strategy that uses low-quality, low-cost bunkers. Today, regulations across all transport sectors are mandating higher-quality, lower-carbon-burning fuels, pushing demand and costs up. This very regulatory framework is defining the path and pace of the shipping industry’s decarbonisation transition. As such, fuel buyers in the shipping industry need to rethink their strategies.

But this is easier said than done! The range and complexity of the alternative fuel choices mean many owners lack clarity about the best route to compliance. There is no silver bullet. Particular alternative fuels may suit the needs of different shipping segments, and the supply and technological maturity of alternative fuels are often determined by where in the world a vessel is operating. Consequently, many owners are waiting for suppliers to move first, aware that their return on investment will depend on the cost of alternative fuel 10-20 years in the future.

However, fuel suppliers and their clients have different expectations. To safeguard their investments in production and distribution infrastructure, energy suppliers are eager to secure long-term off-take

agreements. But such agreement structures are unfamiliar to the maritime sector. Shipping companies want the flexibility of the spot market, suited to their routes and charter agreements, and to hedge against the changing price of fuel.

The sector would greatly benefit from a fuel that’s affordable, scalable, and proven to reduce emissions. One that can work as a drop-in fuel for over 50,000 vessels on the water today and help them strengthen their compliance with emission regulations.

Sludge, found in the most familiar of places, is one contender to bridge this gap. The shipping industry produces millions of tonnes of residual waste oil every year, equal to 1-3% of all fuel oil used by vessels. MARPOL Annex 1 regulates this significant problem for the sector.

Vessel operators view MARPOL Annex 1-sludge as waste to dispose of as easily and cheaply as possible. In reality, though, its disposal is an expensive and time-consuming process. Sludge is a regulated waste stream that every ship has to manage. Processes for handling the waste material vary around the world. In the US, operators pay for disposal; however, in less regulated states, they may store waste in open ‘lakes,’ contaminating the environment and harming local wildlife. The illegal discharge of sludge still occurs – an estimated 3,000+ illicit dumping incidents per year in European waters alone. Adequately disposing of sludge with contained environmental impact often requires incinerating it on board – a process that offers no direct benefit to the vessel.