Our Mission

The Stephen D. Cutler Center for Investments and Finance is dedicated to advancing finance education and improving the marketability of Babson students. We provide programs and cutting-edge resources that enrich the student learning experience, support faculty research, and engage our alumni community. We’re committed to furthering Babson’s innovative and practical approach to finance education and enabling industry practitioners, faculty, and students to collaborate and learn from one another.

The Cutler Center

@BabsonFinance

CONNECT With Us:

/cutlercenter

/cutler-youtube babson.edu/finance-institute/

? 7 12 13 Table of Contents Message from the Director 2 Cutler Center by the Numbers ........................ 3 State-of-the-Art Finance Lab ......................... 4 Experiential Learning 5-8 Thought Leadership ..................................9-10 Faculty Research ......................................... 11 Commencement 2023 .................................. 12 Alumni Engagement 13 Partnerships ................................................14 Advisory Board ............................................. 15 94

“The Cutler Center allows professors and students to experience the same technologies that the world’s leading banks, corporations, and government agencies use on a daily basis. This real-world experience gives Babson students the competitive edge to succeed in finance.”

1

– John Bailer ’92, CFA, Deputy Head of Equity Income, Portfolio Manager, Newton Investment Management Group

MESSAGE FROM THE MANAGING DIRECTOR

The 2022-23 academic year was filled with memorable moments, both inside and outside the classroom, for Babson finance students.

The Cutler Center hosted a wide range of panel discussions, fireside chats, and other thought leadership events for students, alums, and finance community members. FinTech continued to be a popular topic of interest. Our offerings included a lively panel discussion on embedded finance as part of Boston FinTech Week and a fintech startup pitch competition where our undergraduate students pitched their ideas to an esteemed group of fintech professionals for the opportunity to win cash prizes from our sponsor, BlueSnap. We also hosted fireside chats with Jean Hynes of Wellington Management and Michael Mauboussin of Morgan Stanley as part of our Distinguished Speaker Series. Read more about these events and others in this report.

The Center also offered several experiential learning programs. One of our most popular programs, the 8-week Private Equity Seminar Series, was approved as an undergraduate course designed for students interested in pursuing a career in private equity. The course will be taught by Adjunct Professor Jaime d’Almeida and a talented group of alumni who have delivered the curriculum over the last two years.

The finance lab continued to be integrated into several undergraduate and graduate courses. These courses, which include Financial Data Analysis and Practice, Financial Trading Strategies, and Fixed Income, integrate the data and analytical tools available through the lab. The Center also hosted two full-day workshops designed to improve students’ financial modeling and programming skills. We partnered with Wall Street Prep, Gutenberg Research, and the Marque Group to deliver these workshops. When not used as a classroom, the Babson Finance Association and SPEAR IB used the lab for their seminars and events.

Outside the classroom, our students continued to excel in many competitions. A group of undergraduate students in the Babson College Fund won the local CFA Institute’s Equity Research Challenge. It is the fifth time in seven years that Babson has won. This success rate is a testament to the skills our students develop in the program and the benefits of having industry mentors. Our finance students also took center stage at commencement, where they were honored for their outstanding work. The undergraduate Senior Awards ceremony was highlighted by Joyce Wang ’23, being presented with the prestigious Roger W. Babson Award for her excellence in scholarship, co-curricular activities, and leadership. Nathan Watts ’23 was also awarded the Carroll W. Ford Scholarship Award as class valedictorian. Glenn Migliozzi, Assistant Professor of Practice, was selected as the Undergraduate Faculty of the Year by the Class of 2023. Glenn has more than 30 years of practical experience and teaches courses in Personal Finance, Fixed Income, and Alternative Investments.

In closing, I would like to highlight the career placement statistics for the Class of 2022. Among the undergraduate class, 27.6% of students secured a job in the financial services industry, making it the most popular sector for the entire class. Notably, the starting salary for those in the finance industry was $78,358, higher than the class average. For the graduate class, all students enrolled in the Master of Science in Finance program secured employment within six months of graduation. As we reflect on these and other highlights over the past academic year, we thank you for your continued support of the Cutler Center as we further our mission of advancing Babson’s innovative and practical approach to finance education, improving our students’ marketability.

Regards,

Patrick Gregory, CFA

Managing Director, Stephen D. Cutler Center for Investments and Finance Faculty Director, Babson College Fund (BCF)

Associate Professor of Practice, Finance Division, Babson College

Associate Professor of Practice, Finance Division, Babson College

2

Expanded the Babson College Fund

$4.5M Portfolio

Cutler Center by the Numbers

During the 2022– 23 academic year, the Cutler Center has…

Hosted 20 programs and events for students, faculty, staff, and alumni

8 programs that featured 353 participants, including students, staff, and alumni

26 hours of programming and events

12 events hosted featuring 705 students, staff, faculty, and alumni attendees

CFA Institute Research Challenge

Program consists of:

• 1 Professor

• 5 Alumni Mentors

• 9 Executives in Residence

• 35 Students Enrolled (undergraduate and graduate)

Maintained it’s Finance Lab

• 42 workstations equipped with 18 Bloomberg terminals

• 10 data screens

• 7 student assistants

• 7 courses with a total of 14 sections taught in the lab with 373 students

• 10 events hosted by student organizations, including Babson Finance Association, Babson Analyst Initiative, Scholars of Finance, and Women in Finance

Babson Trading Competition

Student Competition WINNERS

Team Babson won the local competition for the fifth time in the last seven years.

Speaker Seminar Series

Welcomed 6 professors from other colleges and universities to present research papers

48 students from Babson competed in the annual competition, sponsored by Fidelity Investments, which awarded $900 in prizes to the top five student winners

Alumni Engagement / 101 alumni and friends have volunteered to be part of a program or event that helps support our finance students

23 ADVISORY BOARD MEMBERS who help support the mission of the Cutler Center

3

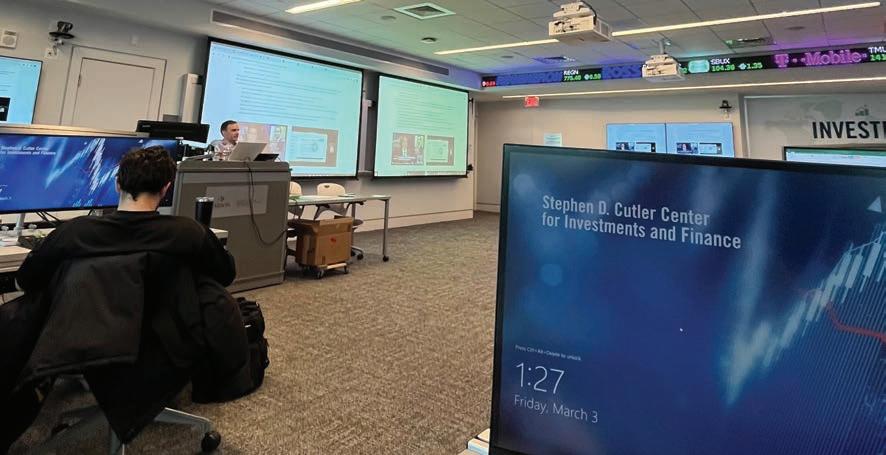

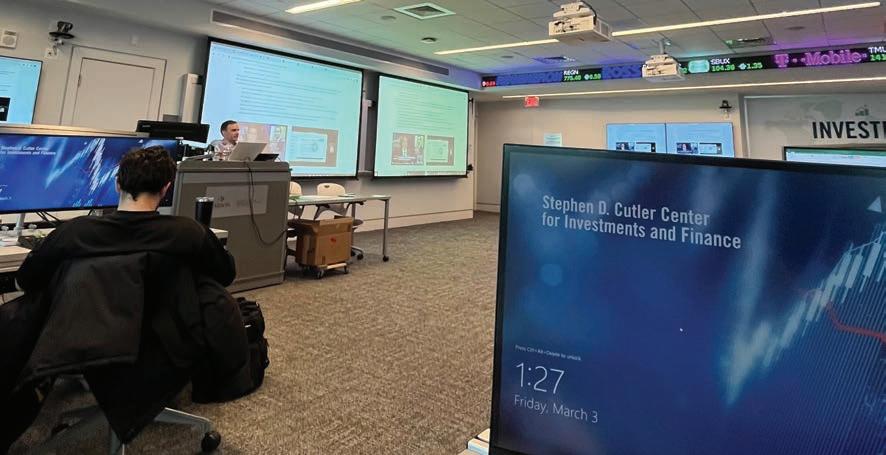

State-of-the-Art Finance Lab

The Cutler Center Finance Lab sits at the heart of campus and features 42 workstations with various analytical tools that industry professionals use. The facility provides Babson students with unique opportunities to learn and lead through learning experiences designed to prepare them for successful careers in financial services.

When not utilized as a classroom, the finance lab is open to all Babson students and staffed by our Cutler Center student assistants, who are trained on multiple financial research resources and can assist with research and assignments during library hours.

BABSON FINANCE ASSOCIATION (BFA)

The Babson Finance Association strives to bring together undergraduate students with an active interest in finance and facilitate further exposure and engagement in the field. Throughout the year, BFA utilizes the finance lab for workshops, guest speakers, and recruiting events.

SPEAR INVESTMENT BANKING PROGRAM

The Students Prepared Educated and Ready (SPEAR) Investment Banking program was designed by Tyson Corner ‘22 in conjunction with the Undergraduate Center for Career Development and leveraging the resources of the Cutler Center. The program meets Friday afternoons during each semester in the finance lab, with thirteen sessions specifically designed to improve students’ chances of receiving an internship offer in investment banking for sophomore students.

OUR LAB OFFERS A WIDE ARRAY OF ANALYTICAL TOOLS: ARGUS Commercial Real Estate, Bloomberg, Capital IQ, FactSet, Morningstar, ESG Direct, Rotman Interactive Trader

4

Experiential Learning Student Competitions

CFA INSTITUTE RESEARCH CHALLENGE

Team Babson won the local CFA Institute Research Challenge for the fifth time in the past seven years. The team of undergraduate students Peter D’Ambrosio ‘24, Arya Patel ‘24, Nathan Watts ’23, and Joyce Wang ’23. The team was required to analyze a publiclytraded company, write a comprehensive research report, and present their research to industry judges. The team competed against local colleges and universities, including Suffolk, Western New England, and Northeastern University.

On behalf of the team, the Cutler Center would like to thank David Wellinghoff MBA’07, whom the students benefited from his guidance and support as the industry advisor.

BABSON TRADING COMPETITION

Sponsored by Fidelity Investments, the 12th annual Babson Trading Competition brought a limited number of Babson students to the Cutler Center finance lab for the sales and trading competition. Special thank you to Marco Gargurevich MBA ’01, Janis Voldins MBA ’99, and Ken Martin ‘99, who spoke with students before the competition about the trading operations at Fidelity Investments and Geode.

1ST PLACE FINISHES

the last five out of seven years:

2023 | Babson College » BJs

2022 | Babson College » Akamai

2021 | Babson College » Rapid7

2019 | Babson College » CarGurus

2017 | Babson College » Global Partners LP

BABSON TRADING COMPETITION WINNERS

1st » Gabriel Papa ‘23

2 nd » Angel Hill ‘23

3 rd » Sarah Glinski ‘24

4th » Alex Bowers ‘24

5th » William Li ‘25

Pictured below from left to right

5

Experiential Learning Babson College Fund (BCF)

The Babson College Fund is an accredited two-semester program that allows a select group of undergraduate and graduate students to manage $4.5 million of the Babson College endowment, gaining investment research and portfolio management skills and practical experience. Students conduct fundamental and quantitative research, pitch their ideas, and work with experienced money managers to create a diversified, long-short equity portfolio.

BCF PARTICIPANTS

RECENTLY RECEIVED JOB OFFERS FROM THE FOLLOWING FIRMS:

Aeris Partners, Bank of America, Citi, Deutsche Bank, Fidelity Investments, Morgan Stanley, Oppenheimer & Co., Piper Sandler, and Stifel

Our Executives in Residence are industry professionals who generously volunteer their time and energy to enrich the educational experience for the students, serving as mentors, coaches, and advisors for those pursuing careers in finance. They also recruit students for employment opportunities post-graduation.

» Pratima Abichandani, Retired Mutual Fund Manager

» Brittany Bascom MBA’16, Global Head of Investment Analysis, John Hancock

» Jack Cahill, Retired Manager, Research and Instruction

» Edward Ciancarelli, CFA, ’00, Principal & Senior Portfolio Manager, The Colony Group

» Richard Grasfeder, CFA, MBA’05, Managing Director, Senior Portfolio Manager, Boston Private Wealth, an SVB company

» John Hickling, CFA, Retired Hedge Fund Manager

» Adam Liebhoff, VP, Investment Analysis, FM Global

» Colleen MacPherson, CFA, MBA’14, Director of Research, Portfolio Manager, Penobscot Investment Management Company

» James Spencer ’73, CFA, Former CIO, Cambridge Trust Co.

» Holland Ward MBA ’99, Retired Hedge Fund Manager

6

Experiential Learning

Babson FinTech Start Up Pitch Competition

In conjunction with our undergraduate fintech course, FIN3502, the Cutler Center hosted its first-ever Babson FinTech Start Up Pitch Competition, sponsored by BlueSnap. Six teams from the course, taught by assistant professor Linghang Zeng, presented their start up ideas to a group of esteemed fintech professionals for the opportunity to win cash prizes.

TOP 3 WINNERS & PRIZE AMOUNTS

1st PLACE » BeSure » $1000

Mahdi Rahideh ’23

Giorgio de Camargo Andrade Bonachela ’23

Qadeer Shahbaz ’23

Santiago Coppoletta ’23

2nd PLACE » Bark » $750

Maria Eduarda Rudge ’23

Omar Abdellah ’23

3rd PLACE » Kite » $500

Bridget Handley ’22

Yehya Albakri (Olin class of ’23)

SPECIAL THANK YOU TO THE JUDGES:

» Abdul Abdirahman, Senior Associate, F-Prime Capital

» Deniz A. Johson, COO, Stratyfy

» Ralph Dangelmaier, CEO & Board Member, BlueSnap

» Linghang Zeng, Assistant Professor, Babson College

7

Experiential Learning

Seminars & Workshops

ESSENTIALS OF VALUE INVESTING SEMINAR

A select group of undergraduate and graduate students participated in a yearlong seminar series with Gary Mishuris, CFA, Managing Partner and CIO of Silver Ring Value Partners. Throughout the seminar, readings, such as Benjamin Graham’s Security Analysis and Warren Buffett’s partnership letters, are used to discuss the investing philosophies and processes of successful value investors. Students can use the insights from the readings to build an internally consistent value-investing framework that suits their strengths.

ESSENTIALS OF PRIVATE EQUITY SEMINAR

During the fall 2022 semester, 39 undergraduate students participated in a semester-long seminar series on private equity. Led by several private equity practitioners, the seminar provided an in-depth understanding of private equity with sessions devoted to prospecting, valuation, LBO modeling, negotiating skills, and the lifecycle of private equity investments. Through interactive discussions and case studies, students were able to develop the skills necessary to pursue a career in private equity and be better prepared for the interview process. Special thank you to our seminar instructors:

» Steve Achatz ‘07, Vice President, OpenView

» Mark Jrolf ‘86, Managing Senior Partner, New Heritage Capital

» Eric Lee ’16, Vice President, Abry Partners

» Rob Nicewicz ‘07, Partner, Abry Partners

» Jessica Reed ‘03, Partner, Alta Equity Partners

PYTHON: CORE DATA ANALYSIS WORKSHOP

The Cutler Center partnered with Toze Francisco of The Marquee Group to offer a professional development training using Python for Babson students. During this hands-on workshop, participants gained the skills needed to develop Python programs to solve typical finance problems. Participants were introduced to best-practices programming in Python to clean, analyze, and visualize financial data. This training was specifically designed for business and finance professionals, with the course being offered at many financial firms around the world.

GUTENBERG RESEARCH FINANCIAL MODELING BOOTCAMP

During the spring semester, 32 undergraduate and graduate students spent a full day in the Cutler Center finance lab participating in the Gutenberg Research Financial Modeling Bootcamp. The session offered an exciting real-world, real-time financial modeling experience. Participants built a three-statement model for Starbucks Corp. ahead of the next quarterly earnings release. The course was taught by John Moschella, who has analyzed companies in various capacities for the last 15 years.

8

Thought Leadership: Panel Discussions

ESSENTIALS OF PRIVATE EQUITY

Students had the opportunity to learn what private equity is and how a group of Babson alumni successfully navigated their careers in one of the toughest areas of investing to break into. Special thank you to Steve Achatz ‘07, Vice President, OpenView, Rob Nicewicz ‘07, Partner Abry Partners, and Jessica Reed ‘03, Partner, Alta Equity Partners for participating on the panel, which was moderated by Gabriel Papa ’23.

FINANCE 101: AN INTRO TO A CAREER IN FINANCE

In partnership with the Centers for Career Development, students were invited to hear from a group of alumni to discuss what their finance jobs entail on a day-to-day basis, the skills needed to succeed in their respective sectors, and how they broke into their competitive fields. A special thank you goes out to Matthew Apkarian, CFA, MBA ‘20, Associate Director, Product Development at Cerulli Associates, Edward Ciancarelli, CFA ‘00, Principal & Senior Portfolio Manager at The Colony Group, Brittany Lane MBA ‘21, Global Enterprise Director at WeWork, Nikhil Reddy ‘13, Vice President at GP Bullhound, and Ben Simon ‘14, Private Wealth Advisor at Goldman Sachs for participating.

THE RISE OF EMBEDDED FINANCE

As part of Boston FinTech Week, a group of industry experts came together to discuss how embedded finance impacts their sectors and thoughts and discussions about what the future holds. A special thank you goes out to Arjun Bhatnagar, CEO at Cloaked; Ying Le, CFA, CAIA, Senior Investment Manager, PWM at Fidelity Investments; Eric McCabe, Senior Payment Strategist at Silicon Valley Bank; Jared Shulman, CFA, ‘12, Co-Founder/ CEO at Lendica; and Karen Webster, CEO, and PYMNTS.com.

EXPANDING DIVERSITY, EQUITY, AND INCLUSION IN THE COMMERCIAL REAL ESTATE INDUSTRY: INITIATIVES, OPPORTUNITIES AND MARKET OUTLOOK

In partnership with the Real Estate Program, the Babson community was invited to join a panel discussion with industry leaders about expanding diversity, equity, and inclusion (DEI) in commercial real estate (CRE). Special thank you to Erin Degnan Escobedo, Assistant Professor of Practice at Babson College; Patrick Kimble, Vice President of Leasing at The Davis Companies; Anthony Noble, Senior Vice President and Chief Strategy Officer at American Tower; Amanda Strong ’87, Director Asset Management at MIT Investment Management Company, and Lisa Strope, Vice President, Research at TA Realty.

9

Thought Leadership: Distinguished Speaker Series

JEAN HYNES

In partnership with Scholars of Finance, the Cutler Center welcomed Jean Hynes, CFA of Wellington Management, to campus for a fireside chat with moderator Bruce Herring ’87, P’19, CFA. Hynes, one of five female CEOs among the top twenty asset management firms, discussed her life story and the road to where she is today. On the professional side, she spoke about diversity, ESG, the markets, and healthcare.

MICHAEL MAUBOUSSIN

Michael Mauboussin, Head of Consilient Research at Counterpoint Global, Morgan Stanley Investment Management, was welcomed to campus for a candid conversation on investing in the turbulent market. With over 30 years of experience in the finance industry, Michael is also an adjunct professor at Columbia Business School and a published author.

10

Faculty Research

The Cutler Center supports Babson faculty as they pursue vital research, develop intellectually rigorous programs, and deliver engaging lectures.

SEMINAR SPEAKER SERIES

The Cutler Center sponsors the Seminar Speaker Series, allowing faculty to build academic community relationships and exchange ideas with other top researchers. The 2022-23 Speaker Seminar Series welcomed scholars from various institutions back to campus. The six speakers came from four schools: Boston University, Cornell, Harvard Business School, and MIT.

Featured speakers included:

» Tarek Hassan, Professor of Economics, Boston University, presented his paper, “The Diffusion of Disruptive Technologies”

» Sasha Indarte, Assistant Professor of Finance, Wharton, presented her paper ”Bad News Bankers: Underwriter Reputation and Contagion in Pre-1914 Sovereign Debt Markets”

» Dragana Cvijanovic, Associate Professor, Cornell SC Johnson College of Business, presented her paper “Opioid Crisis and Real Estate Prices”

» Victoria Ivashina, Lovett-Learned Professor of Finance and Head of the Finance Unit, Harvard Business School, presented her paper “High-Yield Debt Covenants And Their Real Effects”

FACULTY RESEARCH

Featured research papers from the 2022-23 academic year include:

» Restrepo, F., Taillard, J.P., (2022). Private Firms’ Incentives and Opportunities to Manage Earnings: Evidence from the use of Inflation Adjustments. Journal of Business, Finance, and Accounting, 49(1,2), 69-110.

» Cole, B., Goldstein, M.A., Moser, S.M., Van Ness, R.A., (2022). Trade Price Clustering in the Corporate Bond Market. China Finance Review International, 12,(3), 353-377.

» Goldstein, M.A., Lynch, A.H., Norchi, C.H., (2022). Conflict’s impact raises costs for Arctic shipping and the climate. Nature, 606,250.

» Chava, S., Oettl, A., Singh, M., Zeng, L., (2022). Creative Destruction? Impact of E-Commerce on the Retail Sector. Management Science, Accepted

11

Commencement 2023

UNDERGRADUATE AWARDS CEREMONY

Each year, Babson College honors graduating Undergraduate Seniors with awards from Babson College divisions, departments, and notable supporters.

On behalf of the Cutler Center and the finance division, we are thrilled to have five of our seniors be honored, including Joyce Wang ‘23 receiving the prestigious Roger W. Babson Award, which is presented to the graduating senior who has excelled in scholarship, co-curricular activities, and leadership.

Undergraduate Award winners:

» Calliope Cortright1 - Student Contribution Award

Presented to a senior for meaningful contributions to student life and the Babson community

» Anna Dibble2 – Global Student Leadership Award

Presented to a senior who has fostered a climate of understanding and respect between student groups on campus as a true example of a Global Student Leader.

» Gabriel Papa3 – Babson College Finance Award

Presented to a senior who will have taken at least four or more Finance courses and has completed the most distinguished academic record in the field of Finance.

» Anna Dibble4 – Wallace P. Mors Award

Presented to a senior for outstanding performance in Finance and division activities.

» Nathan Watts5 – Carroll W. Ford Scholarship

Presented to the graduating senior who has the highest GPA in the class.

» Joyce Wang6 - Roger W. Babson Award (3.5 GPA and Above)

This award is presented to the graduating senior who has excelled in scholarship, co-curricular activities, and leadership.

Undergraduate Faculty of the Year: (Pictured above)

Glenn Migliozzi7, Assistant Professor of Practice, Finance Division

Graduate Awards Ceremony:

» Florian Mehl8 – Award for Academic Excellence MSF Program Highest GPA

» Maria Toledano Cabrera9 – Award for Academic Excellence MSF Program Highest GPA

» David J. Ettenson10 – Finance Award MBA

Retiring Faculty: Erik Sirri, Professor of Finance

7 8 9 10 2 4 1 6 3 7 5 12

Alumni Engagement

Alumni Spotlight: Alumni have countless ways to stay connected with the Stephen D. Cutler Center for Investments and Finance. Here are a few highlights from the 2022-23 academic year:

KENECHUKWU E. ANADU, CFA, CAIA, Vice President at Federal Reserve Bank of Boston

Ken co-heads the Supervisory Research and Analysis Unit at the Federal Reserve Bank of Boston. Last fall, he sat across from our distinguished speaker, Michael Mauboussin, as the moderator of a fireside chat.

BRITTANY LANE MBA ’21, Managing Director, Sales & Solutions, CBRE

Brittany participated in our annual finance career panel, in partnership with the Centers for Career Development, where she discussed her career path, the skills needed for her role, and her experience at Babson.

JOSE M. LINARES ‘93, Senior Executive Vice-President and Global Head of Santander CIB, Grupo Santander

With over 25 years of experience working for leading financial firms, Jose sat down with students to discuss his career path from Babson, opportunities working for leading financial services firms around the world, and his most recent role as the Global Head of Santander´s Corporate and Investment Bank.

AMANDA STRONG ’87, Director Asset Management, MIT Investment Management Company and Trustee, Babson College Board of Trustees

Amanda is Director – Asset Management for MITIMCo, MIT’s Investment Management Company, where she is responsible for overseeing a portfolio of commercial real estate assets in Cambridge, MA. Amanda joined a panel of real estate industry professionals to discuss expanding diversity, equity and inclusion (DEI) in commercial real estate (CRE).

MARK WILLIAMS MBA’04, Partner, Cape Horn Coffees Inc.

Mark returned to campus for a discussion surrounding what it’s like to trade and finance commodities.

A SPECIAL THANK YOU TO OUR ADVISORY BOARD MEMBERS WHO CAME TO CAMPUS THIS PAST YEAR TO INTERACT WITH OUR STUDENTS IN AND OUT OF THE CLASSROOM:

» John Bailer ’92, CFA – Babson College Fund class guest speaker

» Marco Gargurevich MBA ‘01 – Babson Trading Competition guest speaker and hosted winners at the Fidelity and Geode offices

» Bruce Herring ’87, P’19, CFA – Distinguished Speaker Series moderator

» Jeff Mortimer ’86, CFA – Babson Finance Association guest speaker

» Catherine Friend White MBA ‘86 – Babson Acceleration Club’s Annual Pitch Competition judge

13

Featured Partnerships

Babson College is a proud member of the CFA Institute’s University Affiliation Program and Bloomberg’s Experiential Learning Partner Program.

CFA INSTITUTE UNIVERSITY AFFILIATION PROGRAM

Through the CFA Institute University Affiliation Program, students have access to a suite of benefits as they prepare for the CFA Program, including:

» 16 annual scholarships

» Access to the CFA curriculum (Levels I, II, and III)

» Practice Exams (Levels I, II, and III)

BLOOMBERG EXPERIENTIAL LEARNING PROGRAM

Babson was the inaugural recipient of Bloomberg’s Experiential Learning Partner program. The Bloomberg ELP is designed to recognize academic institutions that are leaders in experiential learning by integrating Bloomberg terminal exercises in their curricula.

MASS FINTECH HUB

Mass Fintech Hub is a public-private partnership comprising a network of fintech leaders, financial experts, academics, public sector leaders, and venture capitalists who empower fintech startups to achieve success.

Leadership

The Cutler Center was founded in 2000 with a generous gift from Stephen D. Cutler MBA’61 and is wife, Alice. Thanks to their continued generosity and the support of many additional alumni, parents, and friends, the Cutler Center advances finance education and improves the skill set and marketability of Babson students.

PATRICK GREGORY, CFA

Managing Director, Faculty Director, BCF, Senior Lecturer,

Finance Division

781-239-3895

pgregory@babson.edu

FARRAH NARKIEWICZ

Marketing & Events Manager

781-239-4448

fnarkiewicz@babson.edu

LESLIE ROMIZA

Program Manager

781-239-5115

lromiza1@babson.edu

RYAN DAVIES, PH.D

Professor Division Chair

781-239-5345

rdavies@babson.edu

14

Advisory Board

» John Bailer ’92, CFA, Deputy Head of Equity Income, Portfolio Manager, Newton Investment Management Group

» Brian Barefoot ’66, H’09, P’01, Senior Advisor, Carl Marks Advisors

» Chris Chandor MBA’98, Senior Vice President of Development & Asset Management, The Davis Companies

» Karen Chandor MBA’74, Principal, Mercer

» Anthony Chiasson ’95, Chief Investment Officer, Aurmedis Global Investors LP

» Eric Crawley MBA’09, Director, Investment Strategist, Bank of America

» Chip Dickson ’74, MBA’76, CFA, Co-Founder, DISCERN

» Marco Gargurevich MBA’01, Head of Strategic Initiatives, Geode Capital Management

» Bruce Herring ’87, P’19, CFA, President, Strategic Advisers, Asset Management Division, Fidelity Investments

» Rich Katz ’91, President, Rodeo Capital

» Harold Kotler ’65, CFA, Partner, CEO, CIO, Gannett, Welsh & Kotler (GW&K Investment Management)

» Chris Menard ’96, Chief Financial Officer, BlueSnap

» Jeff Mortimer ’86, CFA, Director, Investment Strategy, BNY Mellon Wealth Management

» Jason Orlosky ’04, Chief Strategist & Managing Director, Bridgeway Wealth Partners LLC

» Nick Platt P’23, Partner/Chief Operating Officer/Chief Compliance Officer, Kudu Investment Management

» Annabelle Reid MBA’86, Managing Partner, FoxMoor Capital

» Harison Sidhu MBA’10, Head of Manager Selection and Due Diligence, Fiduciary Trust

» James Spencer ’73, CFA, Former SVP & Chief Investment Officer, Cambridge Trust Company

» Rick Spillane, CFA, Director, Eaton Vance Management

» Joseph Spinelli ’98, Trader, Millennium Management

» Jim Taylor ’86, Managing Director and Wealth Partner, J.P. Morgan Wealth Management

» Catherine Friend White MBA’86, Managing Director, Golden Seeds

» Mark Williams MBA’04, Partner, Cape Horn Coffees Inc.

15

babson.edu/finance-institute/

“The Cutler Center is a critical component of students’ education in finance and investments, giving them the tools to hit the ground running when they enter the workforce.”

– James Spencer ’73 , CFA, Former SVP & Chief Investment Officer, Cambridge Trust Company

Associate Professor of Practice, Finance Division, Babson College

Associate Professor of Practice, Finance Division, Babson College