We are far from being a cashless society it is important to offer all your customers the freedom to use their preferred payment method. From 2000 to 2023, circulating cash in the U.S. tripled. The amount of cash in circulation has been steadily increasing with an average annual growth rate of 6%.

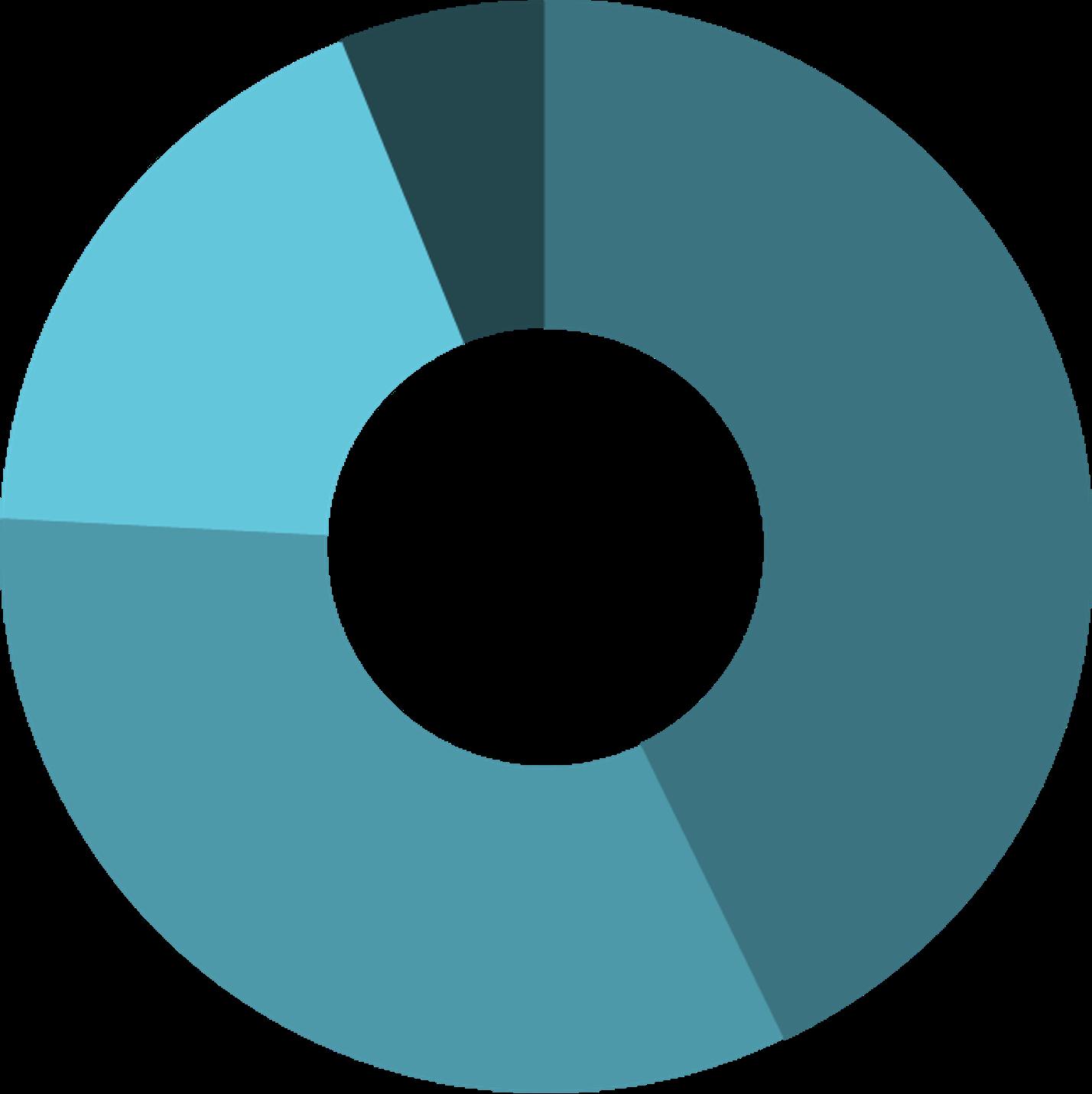

18% of Americans prefer cash as their primary payment method.

• In October 2021, the average number of cash payments increased from six to seven payments, and accounted for nearly 20 percent of all payments

• The value of cash held in a consumer’s pocket, purse, or wallet (called on-person holdings) averaged $67 in 2021, compared to $76 in 2020 and $60 in 2019

• In 2021, the value of cash held in a consumer’s home, car, or elsewhere (called store-of-value holdings) remained elevated at $347, compared to $299 in 2020 and $241 in 2019

Savings on the costs of paper checks

• Postage to send notices to pay

• Returned checks

• Lost checks

• Disputed checks

• Fraud

Savings on human resources

• Reduced office overhead

• Shorter hours

• Eliminate payment offices

• Reduce resources

Savings on the costs of taking cash payments on site

• Lost cash

• Cash Management Service/Logistics cost

• Fraud

• Security

Savings on cost of service maintenance

• because bills are paid more timely, there are less operational costs to maintain service

• Less disconnect/reconnect service calls

• Lower labor costs

• Lower fuel/equipment costs (less wear & tear)

Ease of service

Enjoys convenience of the method

Pays bills on time more (less late fees, less interruption of service due to disconnects).

Can’t use other methods (i.e. pay with a debit card) because they don’t have a bank account, so they need to pay in cash.

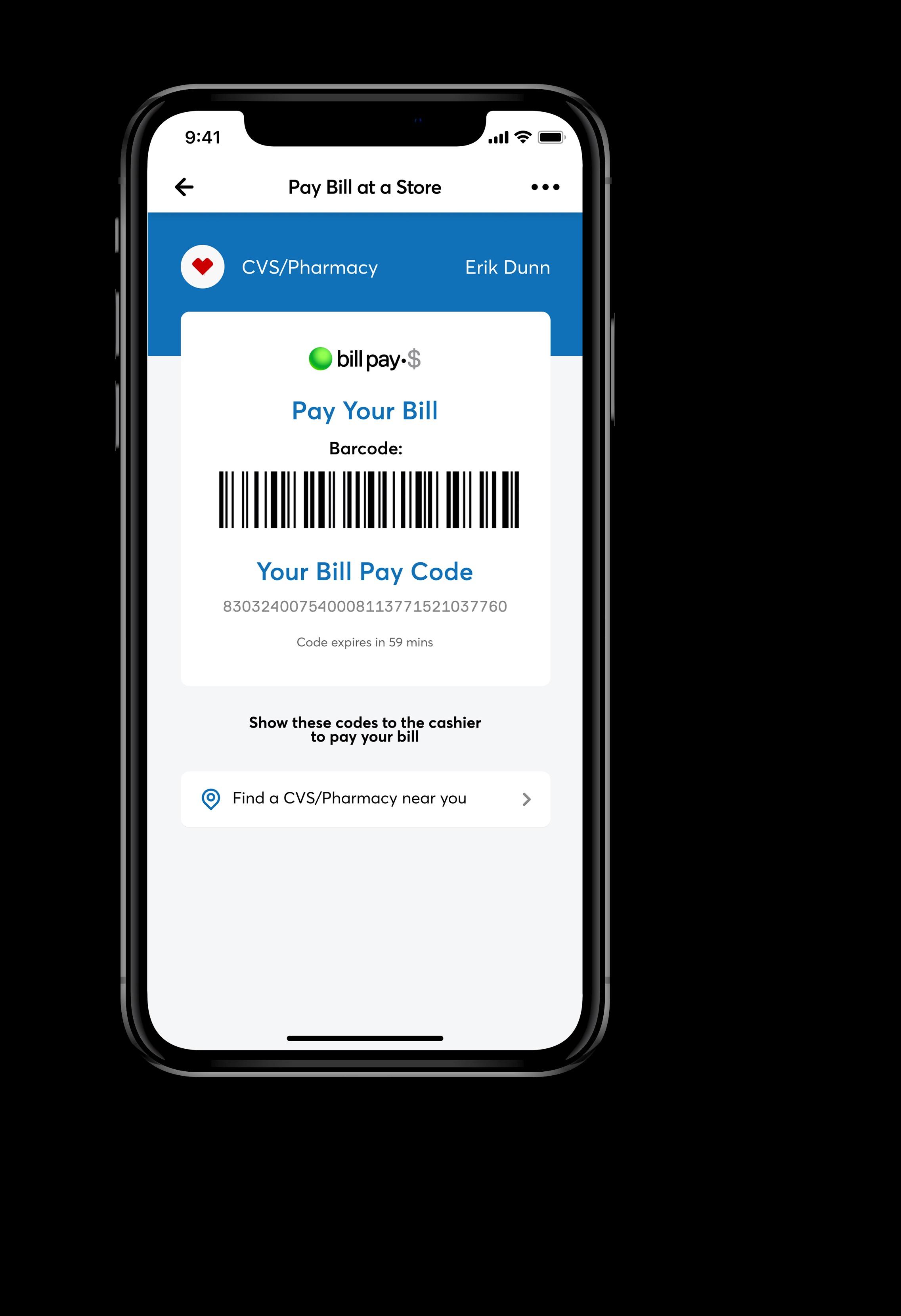

Less trips to get more things done, one stop shop – Now they can pay their bill & get their needed consumer goods. Ex. By being able to pay a bill while also picking up a prescription from CVS saves time & effort Prefers cash payments.

A patented technology platform that bridges cash to digital. It enables in- store cash payments (as well as deposits, and withdrawals) with just a smartphone or code. It can be seamlessly embedded into your other digital customer touch points via web or app. Leading cash-in network in the U.S.

Over 30,000 retail locations nationwide, most available at any register, during the same hours the store is open. Network coverage projected exceed 60,000 retail locations in 2023.

READY TO LAUNCH

EXISTING RETAIL – COMING SOON

READY TO TEST

NOT USED AT THIS TIME FOR BARCODE PAYMENTS

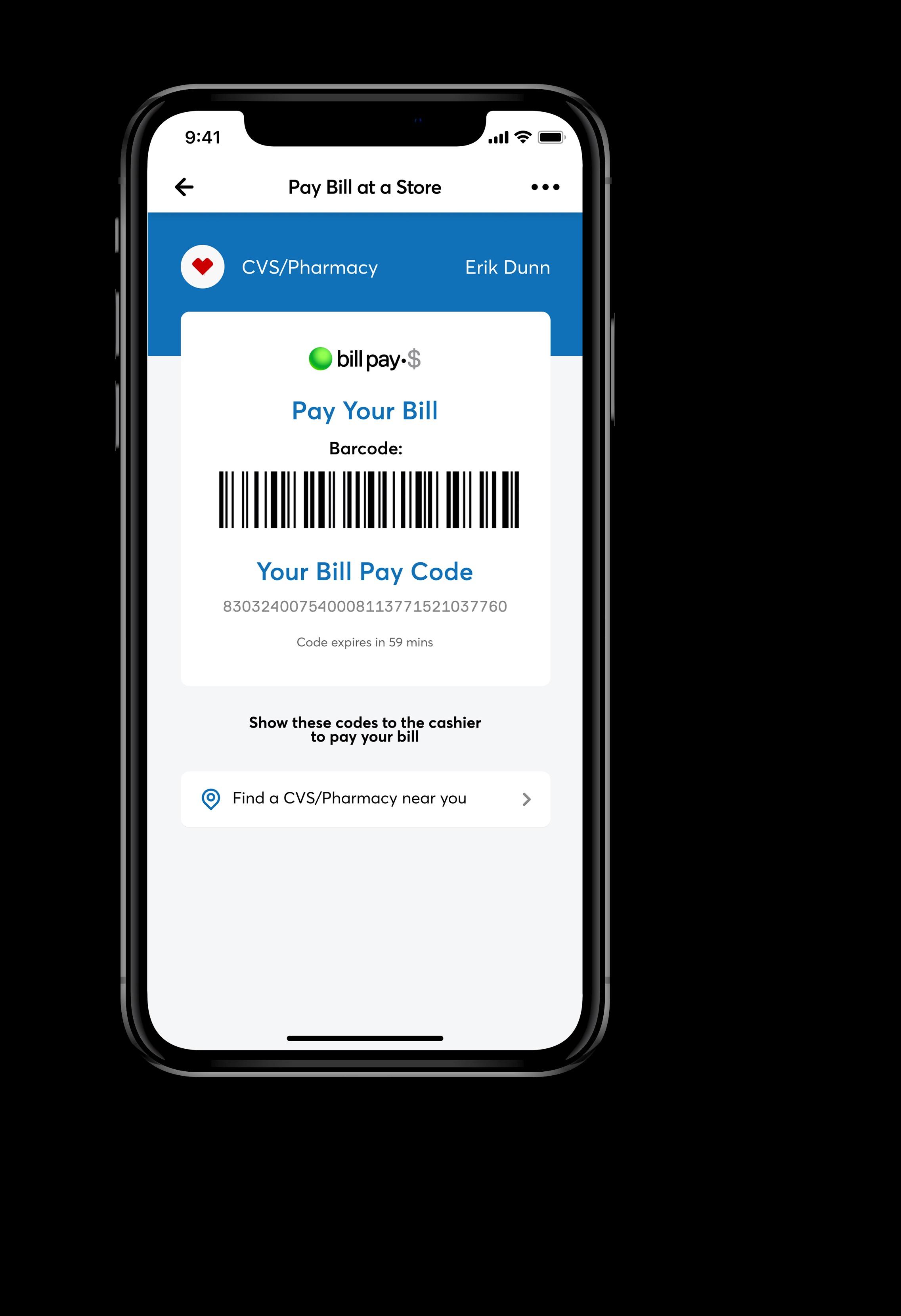

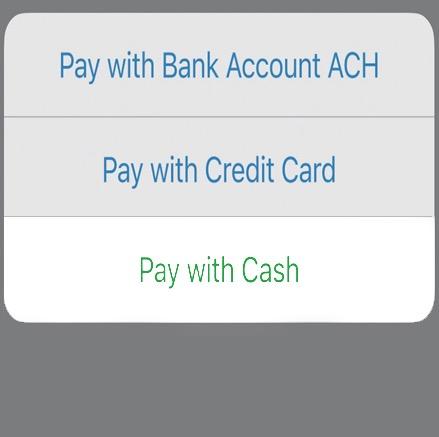

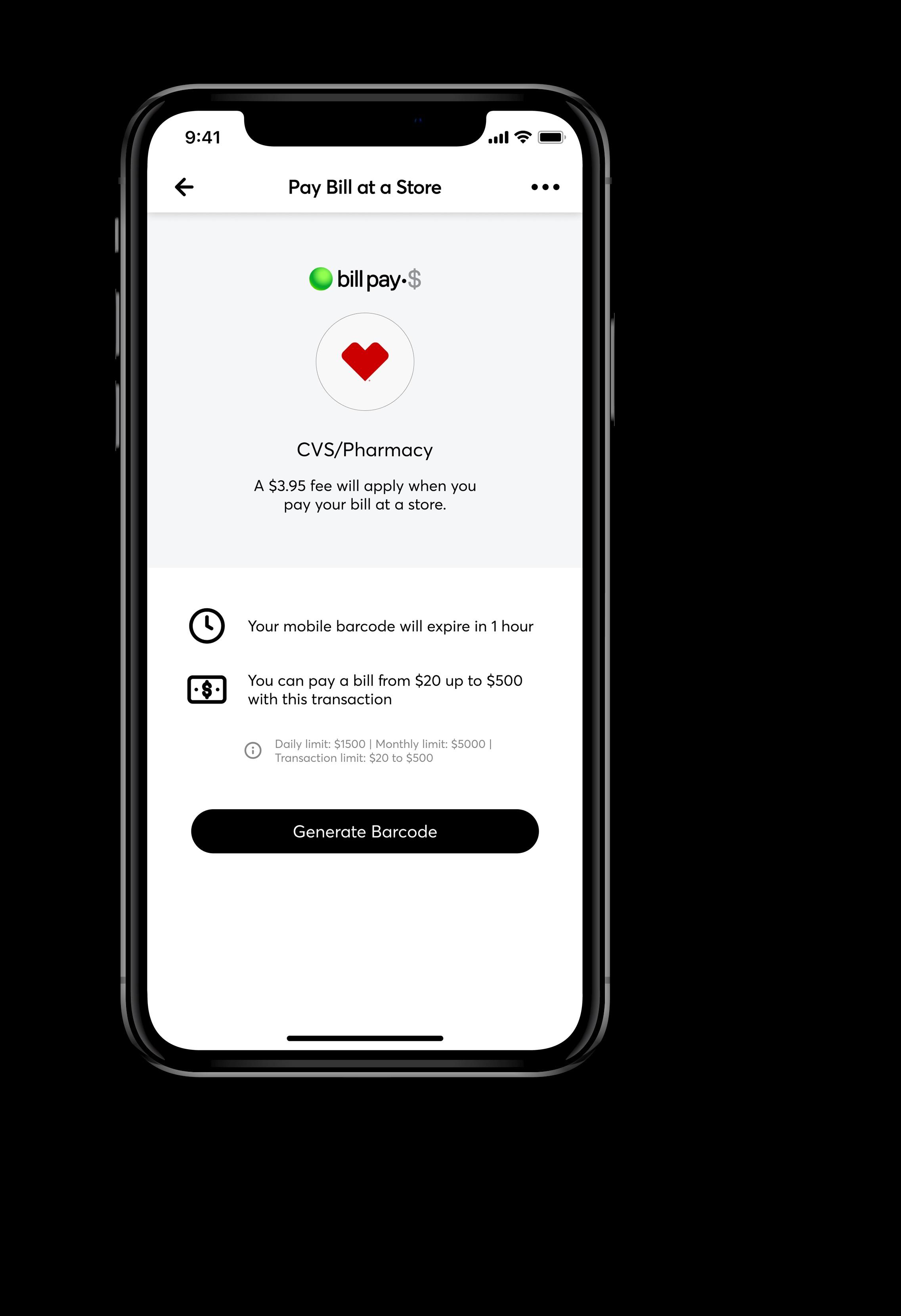

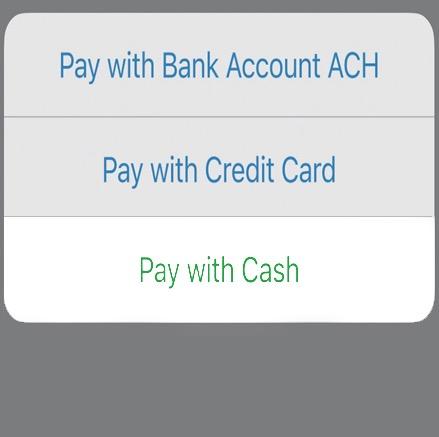

Customer logs into the app or website to generate barcode or get text/email with barcode.

At the store, customer presents the barcode to a cashier who then scans the barcode, collects cash, and completes the transaction.

Payments are posted to the destination account within 10-15 minutes, or overnight for batch payment partners.