14 minute read

AAC staff profile: Melissa Hollowell

Law Clerk — Melissa Hollowell

Family information: Just me and my sweet, 3-yearold chocolate lab mix, Grant. My pet peeve is: Bad drivers and rush hour traffic.

My favorite meal: Chicken tacos and Mexican rice with chips and queso.

When I’m not working I’m: Studying, spending time with friends and family or relaxing and watching Netflix.

The accomplishment of which I am

most proud: Getting a Top Paper in my Civil Procedure class. Motto or favorite quote: “Dreams don’t work unless you do.” — John C. Maxwell

The hardest thing I have ever done: Survive a year of law school.

At the top of my bucket list is

to: Travel to Bora Bora and see the world.

How long have you been at AAC and can you describe some of your successful

AAC projects? I have been at AAC since the beginning of June. One of my most successful moments has been catching a civil procedure error in service of process and being able to correct the error before it negatively affected the lawsuit.

You might be surprised to learn that: I’m an only child, and I was born in Belleville, Ill., and lived there until I was 12.

What do you like most about your position

Melissa Hollowell at AAC? What I like most about my position at AAC is that I have the opportunity to be involved in our lawsuits from beginning to end. I get a lot of hands-on experience with different aspects of our lawsuits, and I’m not limited to just performing legal research like many law clerks are.

www.naco.org

About NACo – The Voice of America’s Counties

National Association of Counties (NACo) is the only national organization that represents county governments in the U.S. NACo provides essential services to the nation’s 3,068 counties. NACo advances issues with a unified voice before the federal government, improves the public’s understanding of county government, assists counties in finding and sharing innovative solutions through education and research and provides value-added services to save counties and taxpayers money.

U.S. Court of Appeals delays WOTUS rule nationwide

By Julie Ufner

A federal appeals court has ordered the Environmental Protection Agency (EPA) and the Army Corps of Engineers (Corps) to temporarily delay the nationwide adoption of the “waters of the U.S.” (WOTUS) rule.

The order, from the U.S. 6th Circuit Court of Appeals, was in response to challenges brought by 18 states: Alabama, Florida, Georgia, Indiana, Kansas, Kentucky, Louisiana, Michigan, Mississippi, North Carolina, Ohio, Oklahoma, South Carolina, Tennessee, Texas, Utah, West Virginia and Wisconsin.

While numerous WOTUS cases have been filed by 31 states and private parties in separate district courts, it was recently decided that all state challenges would be consolidated at the 6th Circuit Court of Appeals for review.

In their decision, two of the three appeals court judges held that the states bringing the challenges “have demonstrated a substantial possibility of success on the merits of their claims” and ordered the rule to be, “STAYED, nationwide, pending further order of the court.” However, in the coming weeks, the court must determine whether it has the authority to hear the case.

The Oct. 9 ruling comes after a separate decision, Aug. 27, by the U.S. District Court of North Dakota to delay the rule in 13 states: Alaska, Arizona, Arkansas, Colorado, Idaho, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, South Dakota and Wyoming.

Prior to this latest court ruling, however, EPA and the Corps were still legally allowed to implement the final rule in the remaining 37 states.

In a related but separate development, on Oct. 13, the U.S. Judicial Panel on Multidistrict Litigation denied the federal government’s request to consolidate the various non-state generated lawsuits filed against the EPA and Army Corps of Engineers on the rule. This development only increases the complexity, and likely lengthens the time frame, of the judicial consideration of this rule.

tion Act of 2015 (H.R. 1732) by a vote of 261–155. It would withdraw the final rule and require the agencies to restart the rule-making process, inclusive of state and local governments. The U.S. Senate has a similar bill, the Federal Water Quality Protection Act (S. 1140). The measure would also require the agencies to redo the “waters of the U.S.” rule-making process. It also includes a set of principles the agencies should consider when rewriting the rule, including the types of ditches that should be exempt. The proposal passed out of committee and is currently waiting for floor consideration. The Senate could also take up S.J. Res. 22, a joint resolution expressing congressional disapproval for the rule. The resolution currently has 49 cosponsors. Although it Two of the three appeals court judges held that the states bringing the challenges “have demonstrated a substantial possiblity of success on the merits of remains unclear how Congress will proceed with finalizing its FY16 appropriations their claims” and order the rule to be “STAYED, nationprocess, both the House and the wide, pending further order of the court.” Senate FY16 Interior, Environment, and Related Agencies appropriations bills contains language to stop the final “waters of the U.S.” rule from being implemented.

Rising rates likely to impact county finances

By Joel Griffith Rock-bottom interest rates and easy money may be coming to an end, as the Federal Reserve prepares to hike rates as early as December 2015. Long-term interest rates have remained historically low for an unprecedented stretch of time. Take a look at the 10year Treasury rate, typically considered the standard reflection of a risk-free rate of return. After rarely dipping below 4 percent over the prior five decades, rates plunged to 2 1/2 percent during the financial crisis. Now, six years into the recovery, the rate remains stuck in a narrow range just under 2 1/2 percent. Likewise, the effective federal funds rate which indirectly influences debt pricing nationally, rapidly dropped to near zero in late 2008 in the midst of the financial meltdown. For seven years, it has barely budged.

Unemployment Trending Down

Employment growth remains subdued compared to past recoveries; however, persistent jobs growth combined with a

NACo news briefs

Continued From Page 49 <<<

shrinking labor force participation rate has driven the unemployment rate down to near 5 percent — a level considered close to full employment by many economists. Meanwhile, economic growth has also been quite tepid compared to other post-WWII recoveries, hovering close to 2 percent annually; yet, this too has been of a prolonged, steady nature. With dramatically lower energy prices potentially bottoming, any increases in other production inputs may quickly ripple throughout the broader economy. Indeed, the recent uptick in real wage growth (2.7 percent over past 12 months) suggests this period of steady growth, cheap money and ultra-low inflation could be coming to an end. As such, the Federal Reserve needs to get in front of any inflationary pressures before it gets out of control.

Local Governments Benefit

This policy change will impact local government budgets for numerous reasons. Perhaps most importantly, state and local governments have taken advantage of these low rates. Total liabilities (excluding employee retirement funds) nearly doubled from $1.6 trillion in late 2003 to more than $3 trillion in 2010 before leveling off. Interest payments on this debt could dramatically increase as debt is refinanced — particularly if the initial debt were financed with short-term loans. Prudence suggests officials lock in this debt at the current low long-term rates before the increase.

Interest Rates Likely to Rise

For many local governments, the powerful bull market has replenished defined-benefit pension funds. This market has also inflated price-to-earning ratios in many sectors. As earnings cool and debt becomes more attractive as an investment, equities markets will possibly generate far more tame returns. In fact, the broad U.S. equities market is on track for a negative return in 2015. If this plays out, expect increased calls to shore up pension portfolios and to adjust expected long-term returns downward. The expected increase in interest rates will also likely dent consumer spending as debt servicing swallows a larger proportion of family budgets. And the higher financing costs will deter larger purchases. Financial officers should anticipate marginally lower sales tax revenues as a result.

Some Help for ‘Savers’

In addition, the increase in rates could also cool the brisk housing market recovery. As rates rise, housing demand slows as increasing mortgage rates diminish affordability. The housing recovery has been uneven across the country; but since the depth of the housing collapse, prices have rebounded by nearly 30 percent in real terms. Although not quite rivaling the peak of the bubble, these prices are still significantly above long-term trend lines. Property tax revenue forecasts should take these factors into account. Fortunately, it’s not all negative news. Although the initial impacts from these rate increases may not be welcomed, longerterm a return to normalcy will spur growth by allowing capital to more freely flow to those most adept at creating wealth. As economist David Malpass explains, “Persistent near-zero interest rates punish savers and hurt income growth for average U.S. households. Meanwhile, income inequality worsens as credit flows up the pyramid from middle-class savers earning paltry returns to the upper crust leveraging itself with cheap credit and stock gains.” As the changes sort out, maintaining a “rainy day fund” with excess cash or short-term fixed investments may be the wisest course of action. This liquidity mitigates the need for painful tax hikes or draconian spending cuts should economic conditions rapidly change as interest rates rise.

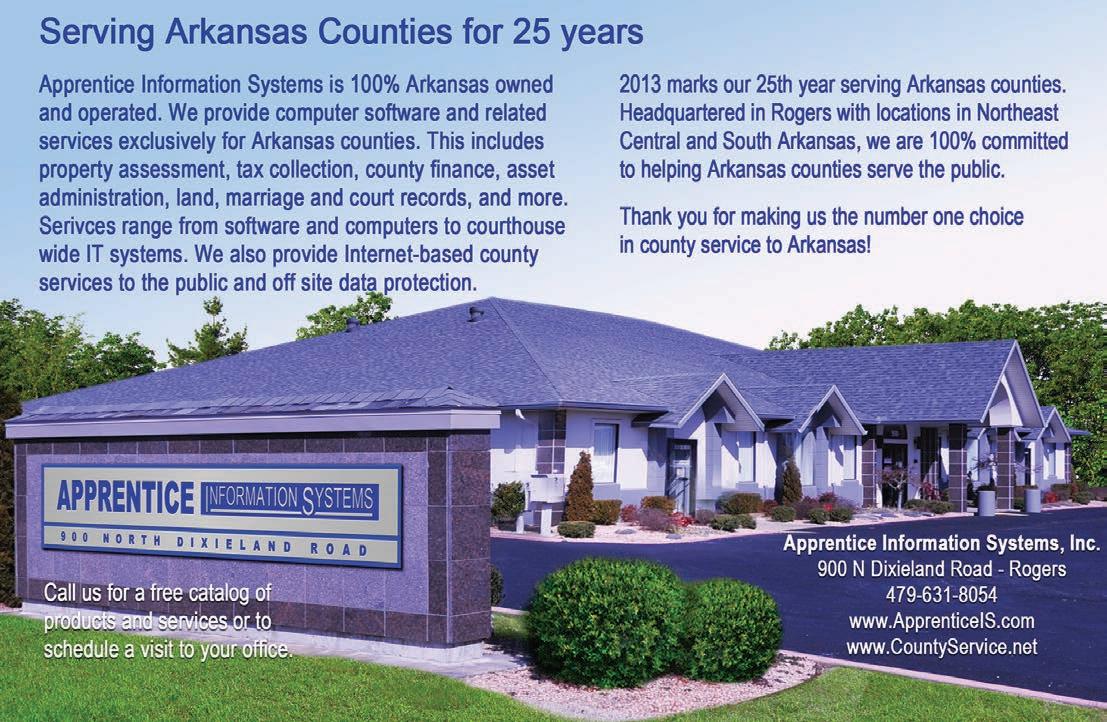

Advertiser Resource Index

AAC Risk Management . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38 AAC Workers’ Compensation Trust . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45 DataScout . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Inside Front Cover Apprentice Information Systems, Inc . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48 Crews and Associates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 Guardian RFID . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22 Ergon Asphalt & Paving . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 Financial Intelligence . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35 Nationwide Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23 Rainwater Holt & Sexton, PA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Back Cover Southern Tire Mart . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51 Tax Pro . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 Time Striping, Inc . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

This publication was made possible with the support of these advertising partners who have helped to underwrite the cost of County Lines. They deserve your consideration and patronage when making your purchasing decisions. For more information on how to partner with County Lines, please call Christy L. Smith at (501) 372-7550.

PERMIT No. 2797

NOMINATE YOUR CHARITY FOR THE

Rainwater, Holt & Sexton is partnering with KATV to present the Rainwater, Holt & Sexton Spirit of Arkansas Award! The award will be given to local charities and nonprofits doing exceptional work in the community. Not only is this a chance for charities to receive a $500 donation, it’s also a way to bring attention to important local causes via a statewide television news audience. TO NOMINATE YOUR CHARITY VISIT KATV.COM!

WINNERS AROUND THE STATE:

Amboy Community Food Pantry Paron Community Center

Twentieth Century Club The Bethlehem House in Conway