30 minute read

Judges, sheriffs discuss crisis intervention units with legislators

ROADS

years, the revenues have been flat or declining. This, along with more fuel-efficient vehicles, results in road users paying less in motor fuels now than when the federal and state taxes were increased in 1993 and 2001, respectively. These factors along with the inflation for the costs of construction result in fewer revenues to maintain a deteriorating public state and local transportation infrastructure.

The 70-15-15 split is needed to maintain the rather substantial rural economy in Arkansas. As was aptly stated by Randy Veach, president of Arkansas Farm Bureau, “Any decision that would lead to decreased focus on rural roads would be detrimental to rural Arkansans and Arkansas agriculture. We can’t afford any negative impact to our state’s largest industry … Arkansas Farm Bureau policy is solidly behind the maintenance and upkeep of quality farm-tomarket infrastructure.”

Historically, the county officials have not done well at explaining or quantifying their needs to state officials or to the public. However, a couple of recently launched programs are proving helpful to this end.

During the CJAA Road Seminar and Annual Fall Meeting in September 2015, Dr. Stacy Williams, director of the Center for Training Transportation Professionals (CTTP) and a research associate professor in the Department of Civil Engineering at the University of Arkansas, CJAA President and Sebastian County Judge David Hudson, Michael Morgan of Greenburg-Farrow, and Darryl Gardner of Ergon Asphalt and Emulsions made a presentation on the establishment of a pavement management program (and parenthetically on a double chip-seal method). This program was a follow up of the presentations of Larry Galehouse, executive director of the National Center for Pavement Preservation for Michigan State University, to the CJAA in September 2014. In essence, the presentation this year explained the pilot project conducted in Sebastian County for assessing the paved roads and establishing a pavement management program. Other larger counties have recently sought these consultant services primarily as an internal management tool. However, this information should prove useful in further assessing the maintenance and funding needs for our massive system of county roads.

Similarly, Shelby Johnson, director of Arkansas GIS, and Jonathan Duran, GIS Analyst, made a presentation for the CJAA at the Road Seminar and Annual Fall meeting on another valuable tool under MAP 21 (the “Moving Ahead for Progress in the 21st Century Act” of the U.S. Congress). In particular, they reported on the progress underway in providing uniform foundational data to each county and the public on the location, number and miles of public roads in Arkansas. This massive undertaking will help provide a foundation for the number and miles of public unpaved, gravel, dirt and paved roads in Arkansas. The CJAA also met with directors of the various Economic and Planning and Development Districts to seek a way to assure each county has this foundational uniform data and has access to an assessment of their roads and bridges and (as sought by the Governor’s Proclamation) the “present and future maintenance and funding needs of the county roads and bridges in Arkansas.

Continued From Page 15 <<<

Moving Forward: Immediate Solutions for Maintenance; Long-term Solutions for Construction

On Nov. 18, 2015, the CJAA Executive Board finalized a resolution that was discussed at the CJAA meeting on Oct. 2. It provides:

1. The CJAA opposes any proposal to reduce funding to counties or departure from the traditional 70-15-15 split; and 2. The CJAA opposes any proposal to transfer thousands of miles of state highways to counties and cities; 3. The County Judges of Arkansas and CJAA support the proclamation and statements of the Governor and preliminary findings of the Working Group that:

• State highways, county roads, city streets and bridges in Arkansas are in dire need of construction, reconstruction and maintenance; • there is a need for increasing revenues for state highways, roads, streets and bridges in accordance with the traditional 70-15-15 split; • “the tax structure on motor fuels in this state is currently inadequate”; • dedicated road revenues have been flat or declining because of more fuel efficient motor vehicles and the tax on motor fuels is on a per gallon tax basis rather than a sales tax; • these factors along with the inflation for the costs of construction have resulted in less revenues to maintain a deteriorating public state and local transportation infrastructure.

In particular the CJAA took note of the Governor’s recent statement that highways should be funded through a method that is not static and that “can grow with our economy as every other tax does.” The Governor observed that one example of what other states have done is to base the fuel taxes on costs rather than gallons purchased. The CJAA resolved to support the statement of the Governor and concurred that it is imperative that construction, reconstruction and maintenance of our state highways, county roads, city streets and bridges in Arkansas should be funded through a method that, as stated by the Governor, is not static and “can grow with our economy as every other tax does.”

Cleburne County Judge Jerry Holmes was appointed by the Governor and diligently served on the Working Group. Judge Holmes advocated that if Congress adopts the Marketplace Fairness Act, that: the hundreds of millions in increased sales tax revenues be directed in part toward: (a) responsible reductions in taxes imposed upon Arkansans; and (b) addressing the dire needs for construction, reconstruction and maintenance of our state highways, county roads, city streets and bridges caused in part by the increased use by commercial transportation of inventory from internet sales. This potential

windfall could satisfy the need for a growing revenue stream for maintenance and construction. Also, there is a direct nexus between the substantial increases over the past decade in commercial truck traffic on our highways and local roads and bridges from the substantial increases in transportation of inventory from internet sales.

It is apparent a simple increase in the motor fuels tax would not meet the criteria of growing over time, as posed by the Governor. Indexing motor fuel taxes to the U.S. Consumer Price Index will assist to correct the systemic lack of growth in motor fuel tax revenues and the purchasing power. Several states have enacted a sales tax on the motor fuels tax at the wholesale level. The Working Group recommendation included both of these methods for due consideration and the CJAA resolved to support funding methods that meet the Governor’s stated criteria.

Finally, the Working Group recommended due consideration of several modest to large transfers from general revenue. Transfers from General Revenue were proposed during the last two regular sessions, unsuccessfully. If done in respect to a portion of sales related to motor vehicles, such transfers could meet the Governor’s proposed criteria. Perhaps responsible transfers in accordance with the 70-15-15 split for purpose of maintenance tied to motor vehicle related sales could meet the Governor’s criteria and not jeopardize the priority needs of state and county governments. The Devil is in the details.

The CJAA, county officials, justices of the peace and their constituencies will continue to work with the Governor and the General Assembly to arrive at a prudent solution that meets the Governor’s proposed criteria for addressing the dire needs for increasing revenues for our state highways, city streets, county roads and bridges. Meanwhile, each county judge and county quorum court are encouraged to engage the Governor and their members of the legislature to oppose efforts to modify the traditional 70-15-15 split, to shift thousands of miles of state highways to local taxpayers, to delegate new funding be directed exclusively for new construction or state aid. Please assure that the funding needs of your local roads and bridges are no less important to your community than building more four-lane interstates and highways.

On the Web:

Look for the Governor’s Working Group on Highway Funding preliminary report and the CJAA resolution at www.arcounties.org

Search “Highway Funding” and “Judges’ Resolution.”

County & District Officials Directory 2015-2016 Corrections/Updates

CLEBURNE COUNTY

• E-mail for County Judge Jerry Holmes: judgejholmes@yahoo.com

CLEVELAND COUNTY

• E-mail for County Clerk Jimmy Cummings: jimmycummings@yahoo.com

FAULKNER COUNTY

• Interim sheriff is Matt Rice

GRANT COUNTY

• E-mail for County/Circuit Clerk Carol Ewing: grantcoclerk@gmail.com

HEMPSTEAD COUNTY

• E-mail for Treasurer Judy Lee Flowers: treasurer@hempsteadcountyar.com

JOHNSON COUNTY

• E-mail for Treasurer/Collector Leta Willis: jocotreascoll2@yahoo.com

LONOKE COUNTY

• E-mail for Sheriff John Staley: jstaley@lonokeso.com

MARION COUNTY

• Interim sheriff is Joan Vickers

MILLER COUNTY

• Phone Number for County Treasurer Danny Lewis: (870) 774-0003

OUACHITA COUNTY

• Fax number for County Judge Robbie McAdoo: (870) 837-2218 • Phone number for County Sheriff David Norwood: (870) 231-5300

VAN BUREN COUNTY

• Address for County Judge Roger Hooper:

P.O. Box 60 • Email for County Clerk Pam Bradford: bradford.vbcclerk@mymedia3.com • Email for Circuit Clerk Ester Bass: vbccircuitclerk@gmail.com • Email for Collector Lisa Nunley: vbctaxes@gmail.com • Email for Treasurer Kim Hunley: vanburencountytreasurer@gmail.com • Email for Assessor Trina Jones: vbcassessor@gmail.com • Spelling of J.P.’s name should be Dell Holt, not Dell Hold

WHITE COUNTY

• Email for County Judge Michael Lincoln: wcjudgeasst@att.net

YELL COUNTY

• Phone number for Collector Bill Gilkey: (479) 495-4869

cover story

Super project spurring growth

Story by Michael Dougherty For County Lines Photos courtesy of Big River Steel

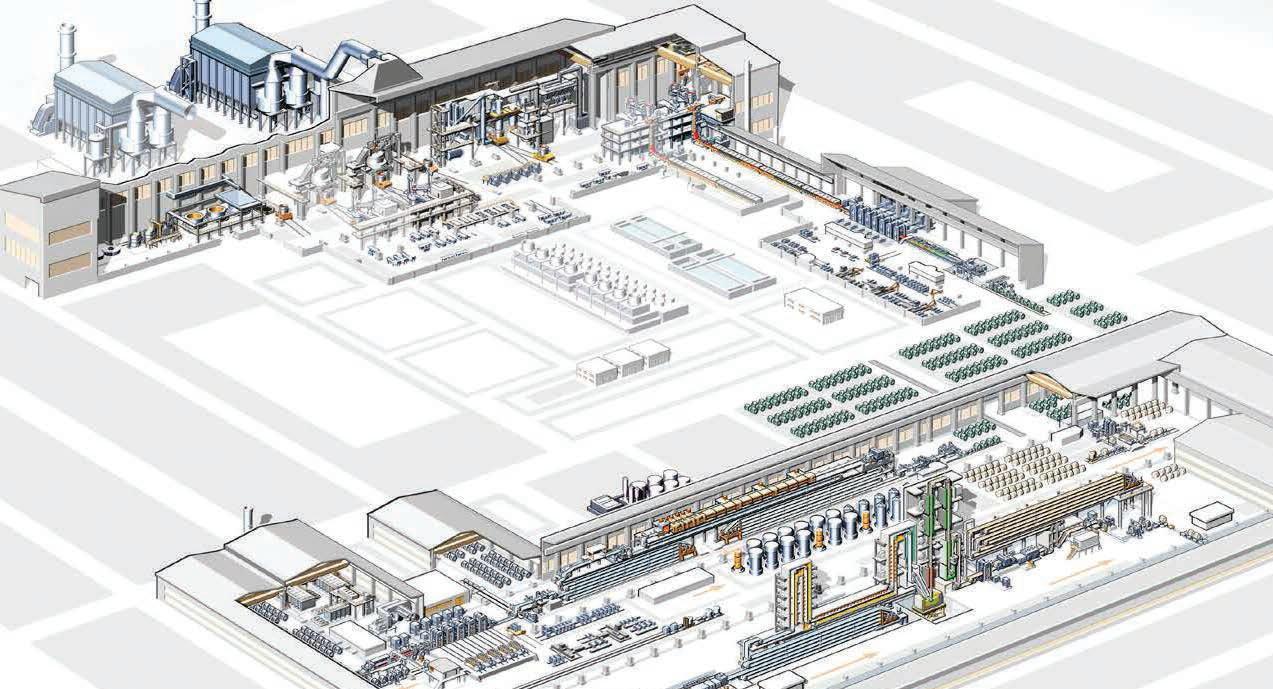

Adozen or so high-lift cranes hoist steel beams and concrete blocks into place in what used to be a soybean field near Osceola in northeast Arkansas. All of these pieces are coming together to create Big River Steel, a massive steel complex that when finished next year will stand as the single largest private investment in the state’s history.

The $1.3 billion steel mill and recycling facility also is expected to bring an economic boon to Mississippi County, which has a rich agricultural history.

“We’ve been told to expect that the number of permanent jobs should rise from 525 to 1,100 after Phase II [of the steel mill] is completed,” said Mississippi County Judge Randy L. Carney. “So that has to have an enormous positive effect in our county. Our tax base will raise by 17 percent after the permanent jobs are filled.”

Those projections provide hope to area leaders and residents who have in recent years seen the closure of a U.S. Air Force Base and several manufacturing facilities.

Big River Steel’s flat-rolled flex mill — the first in the nation — was the dream of John Correnti, the company’s chairman and chief executive officer before he died suddenly Aug. 18 on a business trip to Chicago.

Ground was broken on the 1,300-acre site in September 2014. Completion is expected some time in 2016. Company officials, now led by new CEO Dave Stickler, say the state-ofthe-art flex mill combines the best aspects of old and new, “a merging of the wide product mix and superior grade capabilities of an integrated mill with the nimbleness and technological advancements of a mini-mill.”

It also will be the cleanest, most efficiently produced steel in the world, they said. One example of the efficiency is the hydraulic power roof system in the electric arc furnace, which the officials say will cut down on the amount of heat that escapes, thus reducing energy consumption.

“Steel-making equipment, like all technology, evolves,” said BRS Chief Commercial Officer Mark Bula. “What was cutting-edge 20 years ago, today is naturally not as advanced as the newest steel mills being built around the world.

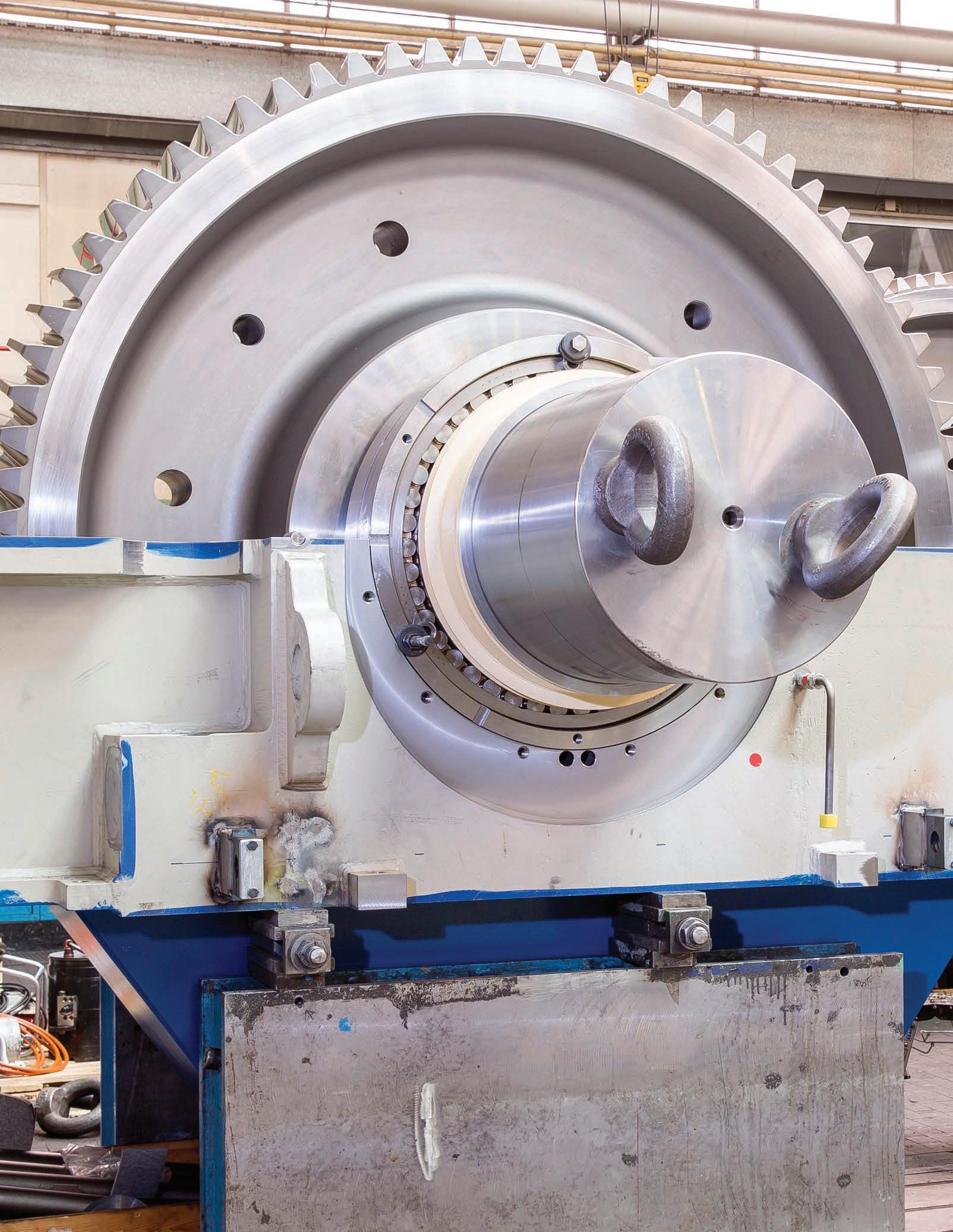

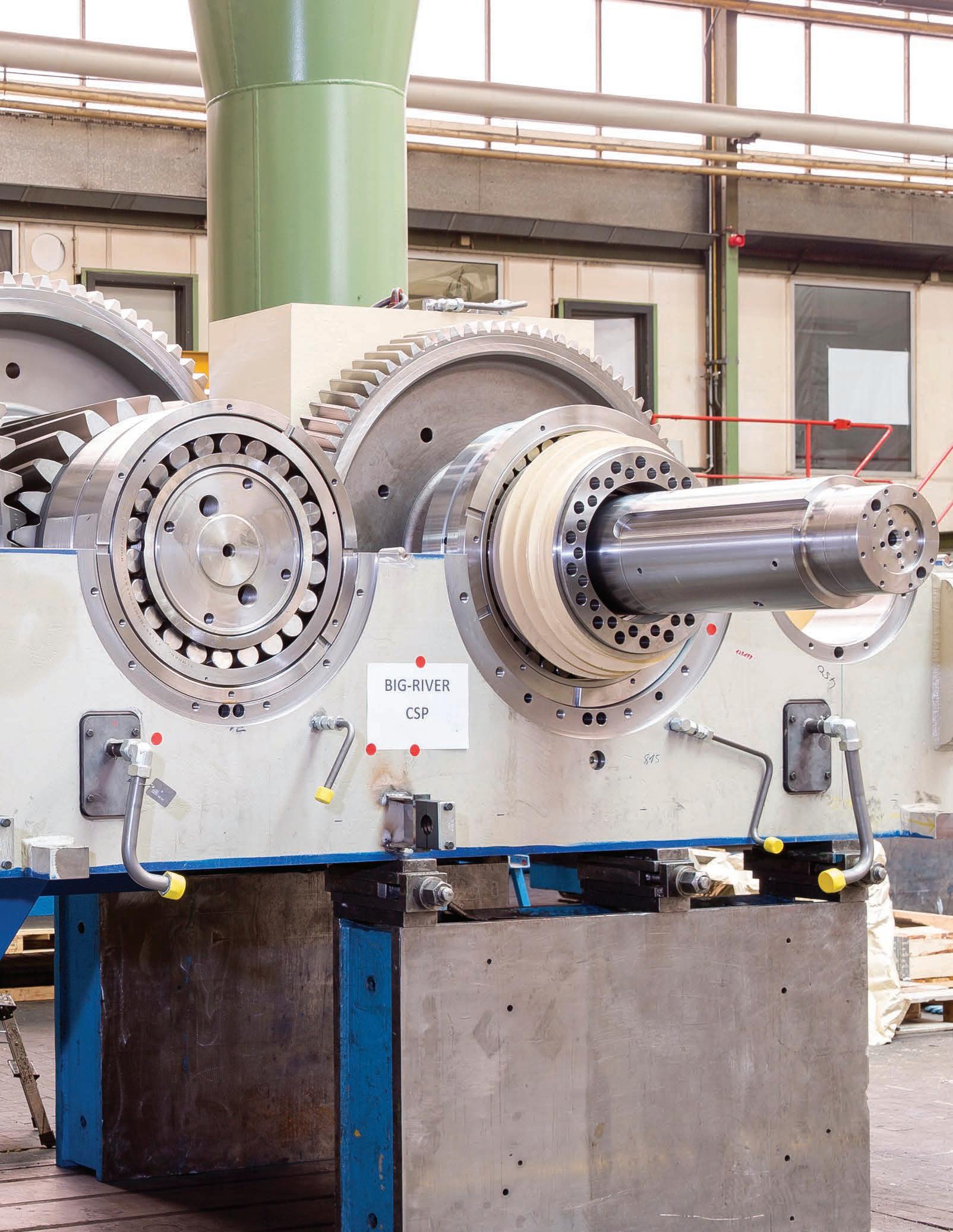

“Big River is the newest in the world. It is the widest of any compact strip production [CPS] facility in the world. It can produce the thickest hot bands of any mini-mill in North America. And probably most significant is our ability to make the cleanest and most demanding grades of steel because Big River Steel is the only EAF [electric arc furnace] and compact strip production mill in North America to install an RH [Ruhrstahl Heraeus] degasser.

He explained the degasser as a way to clean up the product made from the scrap steel that goes in on the front end.

“Think of this as the process that mixes the steel to remove impurities,” Bula said. “RH degassers are more typical in inte-

Super project spurring growth

cover story

County Judge Randy Carney Mississippi County

grated steel mills located near Detroit and Chicago.”

The width of the hot band black steel manufactured in the new plant will range from 36 inches to 78 inches.

The products to be manufactured by the 550 mill employees after the plant opens will range from lightweight advanced high-strength steels to the complex electrical steels, energy pipe grades and coiled plate dimensions required by the world’s newer products, according to the Big River Steel web site.

Initial production capacity is expected to be between 1.5 million and 1.6 million tons per year. Eventually, company officials say, a three-phase expansion will bring employment at the plant up to 800 workers and production to 3 million tons annually.

Mississippi County once was the world’s largest producer of rain-grown cotton. And though it is still known for its agricultural production — with cotton, soybeans, rice and corn as major crops — it has evolved into a manufacturing base. Eight steel-related industries have located in the county in recent years due in large part to its transportation system — a combination of river (Mississippi River), rail line (BNSF) and interstate highway (Interstate 55). But some of those industries — and others — have scaled back production.

“Our biggest hit was the loss of the Fruit of the Loom plant and a car parts manufacturer, which, between the two, [meant] we lost about 2,500 jobs, plus another 1,000 or so with the loss of other smaller plants,” said Osceola Mayor Dickie Kennemore. “For a period of time we were in a area depression, while the rest of the nation prospered.

However, that has changed since the state landed its first “super project.”

“Obviously, we expect growth for the city, county and northeast Arkansas,” said Mayor Kennemore. “Our unemployment will be reduced and growth will occur, as families move in to take advantage of the these jobs. The steel mill is projected to start with 500 jobs and grow to 850 jobs, but that is only the [beginning] of bigger things to come. The support industries and down-stream users are projected to bring in up to another 2,500 jobs over the next several years. In fact, these jobs have already started to come to the area. With all this economic activity, we will see an increase in sales tax, property tax and commercial-type business expansions.”

Judge Carney said the 500 or so plant construction jobs have had a positive effect on the community’s outlook.

“Attracting BRS has been a positive morale boost, in that being able to attract a super project of this magnitude makes us realize that we can attract any major industrial project,” he said. “We expect the subsidiary growth to be an additional possibly three or four smaller industries, with employment figures reaching between 50 and 150 per company. With 525 permanent jobs and Phase II of this project already being planned, the growth projection for the City [of Osceola] and [Mississippi] County will be most positive.”

According to Mayor Kennemore, real estate sales during

This schematic drawing depicts the Big River Steel mill, a $1.3 billion project on approximately 1,300 acres in Osceola. The first flatrolled flex mill will have a production capacity of 1.6 million tons when completed next year.

the 2014-2015 period were better than they have been in several years. In addition, he said, revenue from the city sales tax has increased.

Clif Chitwood, executive director of the Great River Economic Development Foundation, a group with governmental and private support charged with attracting business to Mississippi County, pointed to other indicators that the area economy already is improving.

Wilson has a new housing subdivision, the first that’s been built in the county in 15 years, Chitwood said.

“Some of the new businesses that support a new plant are only now starting to break ground. SMS Siemag AG [the Dusseldorf, Germany-based maker of all of Big River Steel’s manufacturing equipment] just purchased a building near the plant that will make a good regional center for them to serve BRS and the other steel mills they serve in the area,” Chitwood said.

Other support businesses related to the steel mill’s opening are in the works, including Tenaris, Ipsco and Atlas, he said, noting that all of the related growth that Big River Steel had indicated would follow its plant construction has materialized.

“The change in morale out in the community [since construction on the mill started] has been huge,” Chitwood said. “And, in considering that, I’m thinking a lot about John Correnti and his life. I think he has had the biggest effect on the growth of this county of anyone since R.E.O. Wilson. In the long run, people will look at what Correnti did for this community that way.”

Correnti was not alone in impacting the local community; area leaders also took steps to ensure economic growth.

Indeed, area leaders were hardly passive as they watched manufacturing facilities shutter their doors. They formed the Great River Economic Development Association and set out to prove Mississippi County worthy of new businesses.

“GREDA identified our strengths, which are the Mississippi River, I-55, Burlington Northern Railroad, available high-voltage electricity, and large tracts of land adjacent to or near these other assets. Our strengths are attractive to heavy manufacturing,” Mayor Kennemore said.

In addition, the county passed a half-cent sales tax for job creation.

With money for promoting and two “super sites,” Mississippi County went on the hunt for a super project. John Correnti, who lived in the county, tried to bring a plant there with an earlier company. Others visited and considered the area for their plants, Kennemore said, but politics and the lack of support in previous administrations stymied each effort. Years passed.

Above: Pictured is Big River Steel’s main substation with hubs and transformers installed.

Far Right: This is an example of the type of laser welding machine that will be part of the steel mill and recylcing facility in Osceola.

Right: Mississippi County Judge Randy Carney said the 500 or so construction jobs already created by the plant have boosted morale in the community.

Then Gov. Mike Beebe came into office, and the state legislature proposed revisions to Amendment 82 that would relax some of the thresholds put into place by voters in 2004. The measure allowed the state to issue $125 million in general obligation bonds in support of the Big River Steel project. That legislation also allowed the state Legislature to approve up to 5 percent of the state’s general revenue budget to be used for bonding of large-scale economic development projects.

Political support for the “super project” had changed — and just in time.

“John Correnti had sold his facility in Mississippi [with a previous company] and he and others wanted to build a new steel mill,” Mayor Kennemore explained. “He was already familiar with our site. He called me on an early Saturday morning in the fall of 2012 [and] said, ‘Let’s go look at your site again.’”

Both Mayor Kennemore and Judge Carney say it took the joint effort of the Beebe administration, the state legislature, county and city officials, GREDA and others to land the Big River Steel project. However, Judge Carney also gives much credit to Correnti.

Three things were key, Carney wrote in an e-mail:

Bula, the BRS chief commercial officer, said that while the loss of Correnti was difficult to his co-workers on a personal level, the CEO’s death never endangered the project.

“Big River Steel, like all companies of its size, has contingency plans in place for unforeseen events,” Bula said. “Although one never hopes to have to implement the plans, Big River Steel took steps following John’s passing that allows the company to continue on its path of building a growthfocused company. Dave [Stickler] and John had worked together for over 15 years and over the past few years developing the Big River Steel project. Dave held the position of chief administrative officer prior to John’s passing and he was and is a member of the board of directors and a significant investor in the company.”

Bula added that Sticker had moved to Osceola over a year ago, demonstrating his dedication toward the success of the community.

“Dave and his wife, Rebecca, will continue to be active in the local community,” Bula said.

* Nucor Steel, once headed by Correnti, has two mills near Blytheville. It filed a lawsuit in Arkansas district court, opposing the Big River Steel project on environmental grounds, but that was dismissed. The company refiled the suit in federal court, where on Dec. 9, 2015, the court affirmed the Arkansas Pollution Control and Ecology Commission’s decision to grant a permit for Big River Steel.

THE Line King

Artist Richard DeSpain recreates state’s landmarks in pen and ink drawings.

Photo by Kitty Chism

Story by KITTY CHISM For County Lines

Step inside the Association of Arkansas Counties headquarters in Little Rock, and you can hardly miss the 19 pen and ink drawings in the lobbies and on the office walls. Take a closer look and you will discover that all were done by the same homegrown artist, renowned for the beauty of his hundred pen strokes per inch to illustrate familiar landmarks around the state.

The artist is Richard DeSpain, 68, a longtime architectural draftsman for the state turned preeminent fine-line artist, famous for his deft drawings of some of the most notable places in Arkansas.

His genius amounts to a keen eye, a steady hand and the sort of attention to minutia that allows him to depict with microscopic precision all manner of subjects, duplicating exactly their texture, light and scale.

He’s never done an official count of his originals. But based on the hand-written, leather-bound ledger he started a few years back, he puts the number close to 2,000. Large and small, they are all elaborate compositions that focus a high magnification lens on famous buildings and bridges, military aircraft and working crop dusters, as well as outdoor landscapes and elegant interiors with all of their fractal planes — or, when his subjects

are people, all the distinct lines and edges that define their faces.

“It’s a matter of control of the soft and harsher strokes of the pen to get just the right effect,” he said of his technique. “That is where the art comes in.”

Prints of his originals, fine reproductions from the Horton Brothers presses in North Little Rock, now hang in hundreds of homes and offices of politicians, bankers, lawyers, chief executive officers and military brass. One is even in the collection of the only U.S. president from Arkansas, Bill Clinton, who called DeSpain’s 1994 portrait of him in front of the Old State House “a wonderful likeness.” And that it is — down to his animated eyes, shock of wavy hair and approachable stance.

Of course, hundreds of DeSpain prints also hang in ordinary kitchens, living rooms and offices across the state and beyond. For most of his 24-year administration, former North Little Rock Mayor Pat Hays handed out to visiting dignitaries one of DeSpain’s best sellers, a sketch of the Pugh Old Mill, the city’s most famous landmark that appeared in the opening scene of the 1939 movie “Gone With the Wind.”

But the nerve center of the AAC, dedicated to serving, representing and promoting this state’s 75 counties and their nearly 1,400 elected officials, seems like an especially appropriate backdrop for his Arkansas-centric art.

That’s at least what Brenda Pruitt thought in the late 1980s, when she looked around at the empty walls of the association’s original West Third Street headquarters from her desk, first as an administrative assistant, then as head of risk management services, and then as the association’s executive director. She says she started thinking about what kind of wall art would complement the association’s mission when the AAC board decided in the mid-1990s to quadruple the size of its headquarters, adding 10,000 more square feet of office and meeting space.

One day she admired two tiny pen and ink sketches of the historic town of Des Arc near one staffer’s desk. She asked about them and learned they were the work of a central Arkansas artist who did mostly larger pieces of some of the most significant buildings and destinations across the state. Instantly she was smitten and began combing local galleries for more DeSpain work.

“I started collecting from one gallery [in Little Rock] and then did some research about him,” she said. “I liked the idea of art about Arkansas done by an Arkansas artist. It just seemed to fit [what we were about.]”

By then she had three decades of DeSpain creations to choose from, the originals all done in his spare time and made into prints. By day, to support his wife and two growing sons, he worked as a draftsman for the state Cooperative Extension Service, drawing blueprints for things like environmentally friendly hog and chicken pens that agents could show farmers how to build, he recalled.

But in the evenings he would retreat to the studio he had built onto the back of their 1950s-style ranch house in Levy. There he would hop up on the bar stool in front of his drawing table and, working from an enlarged photograph, devote himself to mastering an art form that leaves almost no room for error.

“Once you get started you can’t go back,” he says, then stops mid-sentence to pick up a razor knife and tend to a nearly invisible speck in the upper left corner of the drawing in front of him. “Wait a minute, I have to get that little smudge off there.”

He is a lean, quirky, bespectacled man with a buzz haircut, a

Opposite page: Artist Richard DeSpain has created approximately 2,000 pen and ink drawings of Arkansas landmarks over the course of his career. Above: AAC commissioned DeSpain to create a pen and ink drawing of the AAC building for former Executive Director Brenda Pruitt. stubby white start of a beard and mustache, and an oddly easygoing manner for an artist so pedantic about the incline and strength of his every pen stroke Born in the tiny town of Marked Tree, the next to the youngest child in a family of seven kids raised by a no-nonsense single mom who moved her brood to wherever she could find work, he spent his teenaged years in Blytheville, where he took art lessons at the local YMCA. In time he started drawing comic book characters, and, for extra money, sketches of houses around town to sell to their owners. But sibling rivalry was behind much of his ambition then, he admits. “My sisters and brothers were all more accomplished in school, and I had problems, probably dyslexia that just wasn’t diagnosed, and when I found something I was good at, well, I wanted to pursue it.” After graduating from high school in 1966, he was drafted into the U.S. Army, where he served as a medic for two years. That qualified him for the GI Bill, which he used for a year studying drafting at a vocational institute, where he found immediate success. The federal government also agreed to pay for a year of the Famous Artists School, a correspondence course started in the 1950s by some famous New York illustrators, including Norman Rockwell and Robert Fawcett. He moved to Little Rock when he got the job with the Extension Service and within a few years met his wife Gail at Sunday School. They were married a month after they met, then bought their house in Levy with the idea of adding a back room to let him retreat from the bustle of the family and pursue his pen and ink passion. Now in retirement since 2003, DeSpain has packed that room ceiling high with books, old prints, originals and works in progress, not to mention all of the paper and vellum he buys in bulk. And it remains his sanctuary. He is there all day most days. He rises early and works late. Because this is what he loves to do: Labor feverishly for weeks or even months on a single piece, one brick or leaf or blade of grass at a time with magnifying visors over his eyes, classical music on his boom box and one of his See “ARTIST” on Page 34 >>>

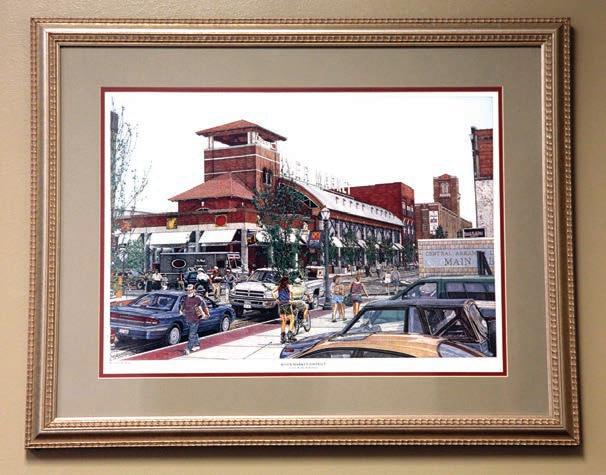

Above: The Rivermarket piece, with its portrayal of the hustle and bustle of downtown Little Rock, warranted a color treatment from the artist. Right: The pen and ink drawing of the Powhaten Courthouse hangs in the main lobby at AAC headquarters and garners much attention from visitors.

dozens of rapidograph pens in his hand.

He starts with a photograph. Most of them are ones he has taken or found, unless it is an old, out-of-focus one like the sweeping view of Little Rock’s Second Street in 1896 that he was asked not long ago to replicate for a local architect. Then placing a piece of drafting vellum over the photograph, he makes a rough sketch of its main components, which he then blows up to the final size he wants and traces it onto that size of vellum. On that piece of vellum — he occasionally substitutes bond paper and, now and then, canvas — he then painstakingly begins sketching in the details in pen and ink that will give it the rich perspective, authenticity and texture that are his signature.

If he decides the piece merits color, he does that in watercolor or acrylic layers with a paintbrush.

“Then I go back with more pen and ink and touch it up, so to speak,” he said, speaking in particular about his famous print of the Rivermarket bustling with people and bicycles and delivery trucks and little kids, which is in one AAC staffer’s office.

In the Executive Assistant Jeanne Hunt’s office is a print of the only work the association ever commissioned from DeSpain. It is a pen and ink of the association headquarters, which true to form, he did without sparing a detail — including the little bird that was hopping around the lawn the day he photographed it. When Pruitt retired in 2006, the AAC board of directors presented her with the original of that sketch in tribute to her choice to bring DeSpain into their consciousness and his work into this workplace.

In such a busy office, you might think people would hardly give the wall art a second glance. But somehow DeSpain’s works keep drawing attention and awe. When Eddie Jones succeeded Pruitt as executive director in 2007, one of the first things he did was acquire more DeSpains.

“I am not an artist, but I really enjoy good art,” Jones said. “And I feel that his works add an element of history to this building. They capture and exude realism, but many also exude a bit of nostalgia.”

And so during Jones’ seven years at the helm, the association purchased another half dozen DeSpains, including the large pen and ink of the 1888 Powhatten Courthouse displayed prominently in the main lobby; the 1912 Pulaski County Courthouse; the 1877 Capital Hotel; and the Arkansas State Capital, completed in 1915.

Those additions turned out to be providential, since the year after Jones stepped down, the board launched yet another headquarters expansion and renovation, adding 5,000 more square feet — and even more wall space.

When that latest renovation was complete, Kim Nash, a risk management claims adjuster, recalls how everyone who wanted a DeSpain in their office had to raise to claim one, and she quickly grabbed the vibrant Rivermarket scene.

The details beguiled her, she says.

“Every time I look at it, and I do so all the time, I discover something different, someone else on a bicycle or carrying something or another delivery I hadn’t noticed,” she said.

And that was his fun, DeSpain said.

His obsession has taken a physical toll — a problem vertebra in his neck and severe shoulder pain after too many hours of such work as coloring a sky with pale-blue pencil lines a millimeter apart. But he will never stop. This is who he is.

“I do this for myself, strictly for myself,” he says. “Because as an artist you have to do what suits you. Like I really enjoyed going down to the Rivermarket with my sketch pad those days and observing all of the people and activity there and imagining all the details I could include.”

Why does Financial Intelligence software work for you?

Honorable Debbie Baxter, Montgomery County Clerk

“We made the decision to make a software change in 2013. We wanted to find a company to provide new payroll, accounts payable, and general ledger software specifically designed for County government. Our goal was to be more efficient with the different options provided by the software while keeping our costs down…we have succeeded. We remain impressed with the training and ongoing support we have received.”

Honorable Larry C. Davis, Saline County Treasurer

“…if we have a problem or question, FI is there to help. Amanda Epperson is the Arkansas Operations Manager for FI. Mandy is retired from the State of Arkansas where she worked in the Legislative Audit Division for many years…if you are considering changing financial software companies I certainly recommend Financial Intelligence.”

Honorable Tim Stockdale, Garland County Treasurer

Honorable Alma Davis, Calhoun County Circuit & County Clerk

“It was such a blessing to have a software company that was willing to help me in any situation… there was never a question that I couldn’t ask FI personnel without getting a full response…many times FI personnel went out of their way to help me resolve many issues…this software enables our office and the County Clerk’s office to work efficiently as a team…the staff has become like family…the complete solution to our software needs…”

To see the full client testimonials, please visit our website: