14 minute read

Industry News

from Modern Tire Dealer - June 2022

by EndeavorBusinessMedia-VehicleRepairGroup

ModernTireDealer.com

DIGITAL RESOURCES FOR THE INDEPENDENT TIRE DEALER Stay tuned to MTD’s podcast!

The Modern Tire Dealer Show is available on Stitcher, Spotify, Apple Podcasts, Google Podcasts, iHeart Radio, Amazon Music, Audible and MTD’s website. Download it today!

eNewsletters

Sign up now for Modern Tire Dealer’s e-Newsletters. We’ll send you the latest tire news and our most popular articles. Go to www.moderntiredealer. com and scroll down to The Modern Tire Dealer Newsletter is the De nitive Source for Tire Dealer Success.

MTD digital edition

Check out MTD’s digital edition at the top of our website’s homepage.

Like MTD on Facebook:

www.facebook.com/ModernTireDealer

Follow MTD on Twitter:

www.twitter.com/MTDMagazine @MTDMagazine

In October 2021, executives from Jack Williams Tire celebrated the opening of the company’s 39th store in Carlisle, Pa. This past April, the dealership announced it was selling its locations to Mavis Tire Express Services Corp. The stores will transition to the Mavis brand.

No matter the news, dealer news wins

Dealers want to know what’s happening in the marketplace and they’re curious about what other tire dealers — whether competitors or not — are doing, too. So while some big-name tire dealerships attracted attention last month, so did owners of smaller dealerships, like Dale Donovan, the owner of Donovan’s Auto & Tire Center, who gave up working on the weekends for better pro tability and productivity.

1. Mavis is buying Jack Williams Tire 2. Monro will sell wholesale business to ATD 3. Podcast: Why closing on Saturdays has improved business 4. Discount Tire invests in Revvo Technologies 5. What to remember when selling EV tires 6. Pirelli invests in Mexico plant, will open R&D center 7. Cooper moves into TireHub warehouses 8. Retreaders held back by supply issues 9. Kenda chairman discusses demand 10. Tire dealers grapple with catalytic converter theft

HOME OFFICE 3515 Massillon Rd., Suite 200 Uniontown, OH 44685 (330) 899-2200, fax (330) 899-2209 Website: www.moderntiredealer.com

PUBLISHER Greg Smith gsmith@10missions.com (330) 899-2200, Ext. 2212 EDITORIAL Editor: Mike Manges, ext. 2213 mmanges@10missions.com Managing Editor: Joy Kopcha, ext. 2215 jkopcha@10missions.com Associate Editor: Madison Gehring, ext. 2216 mgehring@10missions.com PRODUCTION Creative Services Director: Zach Pate Art Director: Jonathan Ricketts Graphic Designer: Audrey Mundstock Production Manager: Karen Runion, ext. 2210 krunion@10missions.com Production Artist: Lauren Coleman

MARKETING STRATEGISTS Bob Marinez bmarinez@10missions.com (330) 899-2200, ext. 2217 Marianne Dyal mdyal@10missions.com (706) 344-1388 Dan Thornton dthornton@10missions.com (734) 676-9135 Sean Thornton sthornton@10missions.com (269) 499-0257 Kyle Shaw kshaw@10missions.com (651) 846-9490 Martha Severson mseverson@10missions.com (651) 846-9452 Chad Hjellming chjellming@10missions.com (651) 846-9463 MTD READER ADVISORY BOARD Rick Benton, Black’s Tire Service Inc. Jessica Palanjian Rankin, Grand Prix Performance John McCarthy Jr., McCarthy Tire Service Co. Inc. Jamie Ward, Tire Discounters Inc. CUSTOMER/SUBSCRIPTION SERVICE (800) 260-0562 subscriptions@moderntiredealer.com

EXECUTIVE OFFICE 10 Missions Media 571 Snelling Ave. N. St. Paul, MN 55104 (651) 224-6207 CORPORATE OFFICERS President: Jay DeWitt Vice President: Chris Messer

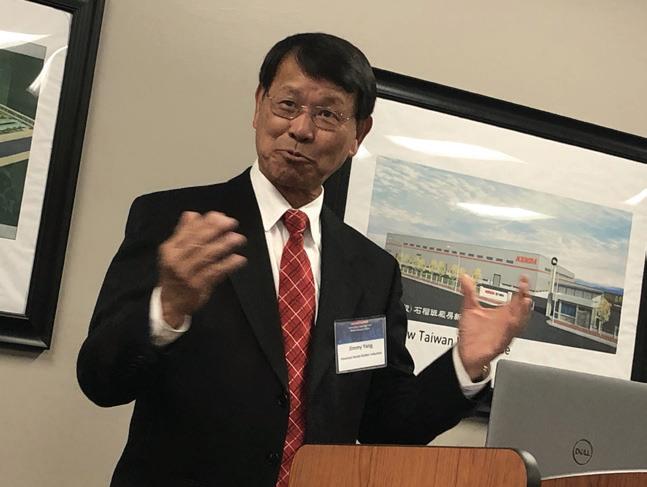

YANG EXPECTS DOUBLE-DIGIT GROWTH IN 2022

As chairman of Kenda Rubber Industrial Co. Ltd., Jimmy Yang oversees a multinational operation that includes offices in the United States, Europe and the company’s native Taiwan; seven manufacturing plants – including one in Taiwan, one in Indonesia, two in Vietnam and three in China; and a North American subsidiary, American Kenda Rubber Co. Ltd., that continues to gain market share.

During a recent event at Kenda’s North American Technical Center near Akron, Ohio, to celebrate the company’s 60th anniversary, Yang sat down with MTD to discuss Kenda’s growth, plus the impact of supply chain issues, tariffs and other challenges.

Kenda’s 2021 global sales totaled $1.25 billion. (Approximately 35% of Kenda’s revenue last year was generated by its North American operation.)

MTD: Demand for tires in North America exploded across all product segments in 2021. Do you see that continuing?

Yang: During the pandemic, demand for all kinds of tires — bicycle tires, motorcycle tires, passenger and light truck tires and outside equipment tires — shot up very high. Kenda enjoyed very strong growth in 2021. Kenda had record high sales.

We forecast the market will continue to be strong. In the last few years, we’ve put so much investment in branding, marketing and product development (in North America.) The image our team has created — premium products at a value price — is working well.

MTD: Are you planning to make further investments at your passenger and light

truck tire plants? (Editor’s note: Kenda ships passenger and light truck tires to the North American market from one of its two plants in Vietnam.) capacity. Today, we are at 60% capacity. So we will (fill) that remaining 40% … by the end of 2022.

MTD: Supply disruptions and elevated shipping costs have been a major topic of discussion among MTD readers. What’s your take on the situation? Has it affected Kenda’s ability to get products to its North American customers?

Yang: Our manufacturing in Asia was not (initially) disrupted by the pandemic. But without (shipping) containers, it made it difficult … as tires were produced and piled up at factories. You can’t continue to make tires if you have nowhere to store them. So that hurt production.

And shipping costs are probably five to six times what they used to be. In the good old days, it cost no more than $4,000 to ship a box from Asia — whether it was China, Taiwan or Vietnam — to the United States. Now you have to pay $20,000 or more for containers. Every tire we import from Asia has to bear (additional freight costs.) And I don’t see that easing up anytime soon. But now at least shipping capacity is more available. We can now get the shipping space. We can book containers. But the cost is still very high.

We have opened business with carriers we did not have a relationship with (previously.) We’ve tried to grab as much shipping space as possible and we’ve had a good degree of success.

MTD: Last year, the U.S. International Trade Commission applied duties to consumer tires made in Taiwan, plus South Korea, Thailand and Vietnam. What impact has this had on Kenda’s business?

Yang: Trade wars across the world seem to be constant. It’s not just America and China. It’s Europe and China. It’s India and China. In the past, our factories in China were a very important part of our

“Depending on the situation, we have long-term plans that we may eventually have to expand our tire manufacturing capabilities in North America and also Europe,” says Jimmy Yang, chairman of Kenda Rubber Industrial Co. Ltd.

manufacturing base globally. (Tariffs levied on passenger and light truck tires made in China) forced Kenda to move some of our production from China to Taiwan.

In 2021, the anti-dumping tribunal (in the U.S. levied) substantial duties against South Korea, Taiwan, Thailand and Vietnam. So we were already branching out capacity into our Vietnam factory. That put Kenda in a better position. And the factory (in Vietnam) is the newest factory for Kenda automotive tires. Before the duty was imposed … we were already in production. Our factory is doing really well and will meet the growth generated by our team.

MTD: We continue to hear reports about tensions between Taiwan and China. Does that concern you?

Yang: That’s something that’s a very sensitive issue. Kenda has been very happy investing in China. We set up our first factory in China in 1990. Kenda was one of the earliest (tire) companies to invest in China. We have a lot of friends there. Will there be conflict? It’s hard to predict what may happen. We have to prepare ourselves… with our factories in Indonesia and Vietnam and also continue expansion in Taiwan. ■

63

Bites

Bandag prices go up

On May 2, Bridgestone Americas Inc. increased prices on Bandag tread rubber and cushion up to 17% in the United States and Canada. Ancillary products’ prices were slated to increase as well.

Michelin hiked prices

Michelin North America Inc. raised passenger and light truck tire prices between 5% and 12% and increased on- and off-road commercial tire prices up to 12% on June 1.

Pirelli increases prices

Pirelli Tire North America Inc. is increasing its passenger and light truck tire prices in the U.S. by up to 10% on June 15. Specific amounts will vary by line and tire size.

Yokohama plans price hike

Yokohama Tire Corp. will raise its consumer replacement and commercial truck tire prices in the U.S. on July 1. Specific amounts have not been disclosed.

New Simple Tire leaders

Brothers Andy and Josh Chalofsky, the founders of Simple Tire LLC, are both leaving behind their executive leadership roles in 2022 to co-lead other businesses. For CEO Andy Chalofsky, that will include partnering with Dealer Tire LLC in a start-up venture. Karthik Iyer is Simple Tire’s new president and CEO.

Lowe Industrial joins Purcell

Purcell Tire & Rubber Co. has acquired Lowe Industrial Tire Service LLC, a single-location dealership in Grain Valley, Mo., from Jason Lowe, its owner. Lowe will bring his 30-plus years of industrial tire expertise to Purcell’s location in Kansas City, Mo.

Sullivan acquires C&R Tire

Sullivan Tire Co. Inc. has acquired C&R Tire, a two-store business with locations in Worcester and Sturbridge, Mass. The acquisition gives Sullivan Tire 77 retail locations throughout New England.

Unimax gets new investor

National Bank Investments Inc. has acquired a 30% stake in Unimax Ltd., a company that manages several retail tire and automotive banners in Canada, including Point S. The deal has led to Unimax buying all shares of Distribution Stox Inc., its former distributor.

Monro will sell wholesale business to ATD

Monro Inc. is divesting of its wholesale and tire distribution business — which the company values at an estimated $105 million — and selling it to American Tire Distributors Inc. (ATD)

In the agreement with ATD, Monro says ATD will provide tire distribution directly to its stores.

Monro President and CEO Mike Broderick told investors that a thorough review of the company’s wholesale operations showed “we were too small to be an effective competitor.”

Monro has seven wholesale locations — in the Carolinas, Kentucky and Tennessee — and in a joint press release, the companies said those facilities serve more than 3,500 customer locations. According to Monro’s 2021 annual report, the company leases all seven of its warehouses. Monro says that the supply agreement “will improve the company’s tire availability, allowing the company to be a better seller of tires at higher margins.” ATD is acquiring Monro’s whole- Monro also will be able to focus on its retail sale business, which has operated under the Tires Now brand. operations, category management and working capital optimization.

“We are adding volume and geographic reach that will make us an even stronger supply chain partner to our customers and the manufacturers with which we work,” says Stuart Schuette, president and CEO of ATD.

The deal is expected to close this month after it clears customary antitrust review hurdles. ATD will pay Monro $105 million in cash for the assets, with an initial payment of $65 million to be paid at closing. The remaining $40 million will be paid quarterly “based on Monro’s tire purchases from or through ATD.”

How lockdowns in China could impact shipping

COVID-19 lockdowns in China “are hitting a global container distribution system that is already severely stressed and facing reduced capacity,” according to a report from global shipping consultancy Drewry.

While a reduction in “port calls” in Shanghai, China — which has been under strict lockdown since mid-March — “accelerated considerably since mid-April,” ship congestion “worsened considerably at Shanghai,” according to Drewry officials.

“The greatest uncertainty is when China’s lockdown restrictions will end and the bullwhip/rebound impact this will have across the supply chain.”

Many factories “will need first to replenish their inventories of raw materials and then do a cold ‘re-start.’ Also, liner shipping schedules COVID-19-related lockdowns in China will take at least one rotation to normalize. may complicate the shipping crisis

“This would mean that even if lockdowns even more, according to Drewry. were to end today, the predictability and capacity of the container distribution system would be jeopardized during summer peak season.”

Bites Graber promoted to Toyo USA CEO

Tire Discounters expands

Tire Discounters Inc. has acquired Virginiabased Thompson Tire. The deal, which includes seven retail stores and a commercial tire center, gives Tire Discounters 12 outlets in Virginia and 170-plus locations nationally.

Marvin Bozarth is honored

Marvin Bozarth was honored by Valebridge Media Services in the United Kingdom with a Lifetime Achievement Award for his many contributions to the retreading industry over the decades. Bozarth worked for Purcell Tire & Rubber Co., the American Retreaders Association and ultimately the Tire Industry Association before retiring in 2018.

Register for SEMA/AAPEX

Registration is open for both the 2022 Specialty Equipment Market Association (SEMA) Show, which will take place Nov. 1-4, and the Automotive Aftermarket Products Expo, which will be held Nov. 1-3, both in Las Vegas, Nev. Toyo Tire Holdings of Americas Inc. has appointed Michael Graber president and CEO of Toyo Tire U.S.A. Corp.

Graber had been vice president of sales for the company and brings nearly 30 years of professional experience to the role, much of it in the tire industry.

Tatsuo Mitsuhata, vice president in charge of global sales at Toyo Tire Corp. of Japan, says, “We are excited to have Mike as our next president and CEO of Toyo Tire U.S.A. Corp. (TTC).

“His broad background, including the last eight years of progressive responsibilities within TTC, gives us confidence that Mike will be able to lead this critical unit in our most significant market.

“He has the knowledge and respect of our customers, understands the market and challenges we face and is a great advocate for the Toyo Tires brand. Mr. Graber will continue our aggressive U.S. growth plans by maintaining our commitment to our dealers and customers.”

Graber will lead a team at Toyo Tire U.S.A. Corp. responsible for replacement market sales, strategic sales planning, pricing, marketing, product planning and consumer affairs.

“It is an incredible honor to have the opportunity to lead this organization,” says Graber. “Our talented team is committed to exceeding the expectations of our dealer partners and loyal customers. We intend to build on our strong foundation while continuing to develop innovative products and deliver first class customer service.”

An interview with Graber will appear in the July 2022 issue of MTD. “Our dealer partners are critical to growing our brand,” he says.

Michael Graber has been promoted to president and CEO of Toyo Tire U.S.A. Corp. He joined Toyo in 2013 as the company’s truck tire sales manager.

offical tire partner

CLASSIC LOOk CONTEMPORARY PERFORMANCE

Vredestein and Mille Miglia share a rich European history and a passion for vintage cars. We are proud to be the offi cial tire partner for Mille Miglia 2022.

Available at: