69 minute read

Numbers that Count

from Modern Tire Dealer - May 2019

by EndeavorBusinessMedia-VehicleRepairGroup

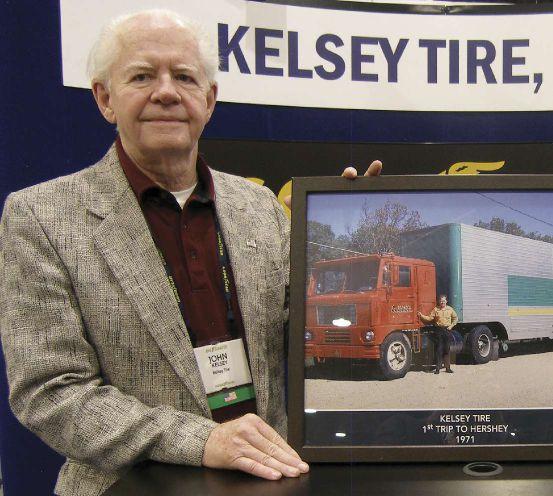

Kelsey turns 50!

THAT’S KELSEY TIRE. OWNER JOHN KELSEY IS STILL GOLDEN TOO, HOWEVER

By Bob Ulrich

n the fall of 1969, John Kelsey purchased

Ithe first automobile tires for his fledgling vintage tire business, then called Kelsey Tire Co. “Being an antique automobile collector and raised with antique cars, tires were always a problem, the sizes in particular,” he says.

Fifty years later, Kelsey, 75, continues to buy old molds or have new ones made to meet the needs of antique or vintage vehicle owners. The main difference is in the tire brand: He used to sell Armstrong and

Denman products. Now he is the exclusive distributor of Goodyear Collector Series tires from the 1920s to the 1980s.

Oh, and he is member of the Tire Industry

Hall of Fame.

DEFINITIONS IN FLUX In general, vehicles at least 25 years old are often referred to as being antique, vintage or classic. The descriptions are not interchangeable, although their definitions vary depending on the company or organization. For example, the Antique Automobile Club of America defines antique as cars at least 25 years old. With some exceptions, the Classic Car Club of America considers cars produced between 1915 and 1948 to be classic, although members generically describe the vehicles on their “approved” list as vintage.

“To us, ‘antique’ encompasses essentially automobiles from the late 1890s thru to 1925,” says Kelsey. “‘Classic’ is from that point thru 1942, with vintage covering the period from the end of World War II to vehicles 25 years of age. Truthfully, as time has evolved, the slide rule of definition by various national clubs has moved ‘the goal posts,’ especially in the defining of classic and vintage.

“I believe antique encompasses the Brass Era to the late Nickel Era, 1929. The heavy classics defined the time frame and naming of the age groups: the Cadillac, Duesenberg, Cord, Auburn, Stutz, Lincoln, Chrysler Imperial, Mercedes, Rolls Royce, ad infinitum. I consider the classic marques mentioned and not mentioned a category of vehicles as well.

“The Model T and A, Chevrolet, Durant, etc., are another group of popular cars vastly outnumbering the classics, both in units produced and participating brands. This family of vehicles placed America on the road. They are simply beautiful vintage automobiles. Thus, if you view the classic and vintage parameters within my layered definition, you will find ample examples coexisting.

“This conversation has been continuing at length for decades, a tribute to malleable viewpoints,” says Kelsey. “I encourage the debate to continue.”

When Kelsey started out, his main competitors were Lucas Automotive, which started in 1957, Coker Tire Co. (1958), Lincoln Highway Tire Co. (1966) and Universal Vintage Tire Co. (1968). Lincoln Highway Tire later morphed into Lester Tire Co. Three free standing vintage tire companies remain in operation today: Kelsey Tire, Coker Tire and Lucas Automotive.

TOURIST ATTRACTION

Modern Tire Dealer may be 50 years older than Kelsey Tire, but the latter offers tires for cars almost as old as we are. John Kelsey’s love of older vehicles was handed down to him by his father, Paul, who built a museum in 1949 near Albert Lea, Minn., to house his collection. A reporter writing about the opening of the museum in the Oct. 16, 1949, edition of the local Sunday Tribute defined the cars in the elder Kelsey’s collection not as antique or vintage but “ancient.”

“The museum had two locations, Minnesota and Missouri,” says Kelsey. “We were in the museum business close to 50 years.”

The museum may be unofficially closed, but Kelsey’s collection remains intact. His oldest car is an 1899 Mobile steamer, featuring a steam-powered engine.

“During the Centennial year for Wisconsin in 1948, Dad drove this car on a circuitous route to Milwaukee for the celebration. Total mileage was 1,000. No breakdowns.”

John and Jan Kelsey, pictured here at the Goodyear Customer Conference in Dallas last January, continue to spend a lot of time on the road selling Kelsey antique and classic tires.

Other favorites of his include a 1903 Curved Dash Oldsmobile, 1906 Cadillac and a 1906 Stanley Steamer.

Kelsey says he never owned a Buggyaut, which is considered by many to be the first American gas-powered automobile. It was

built in 1893 by Charles and J. Frank Duryea.

“Many people were expanding their thoughts and usage of the internal combustion engine in the 1890s. To be included as well were the development of steam and electric cars during this time period.”

Ask him to name a favorite car, and he can’t. “I have personal memories with all of them. To say I really have a favorite, that would be a tough one. I was raised around steam cars first of all, but again, being in the museum business and whatnot, as time

Hup, two, three, four… Personal nods to a forgotten marque car

Hupmobiles were the product of the Hupp Motor Car Co. for some 30 years beginning in 1909. At one time, the Kelsey Museum housed a 1910 Hupmobile, Model 20 Runabout.

“Great little cars!” says John Kelsey, owner of Kelsey Tire Inc. “The appropriate tire — clincher design — is 32x3½, or if a straight side (conventional bead design), the size was 33x4. The rim diameter is 25 inches (different designs) in both cases.

“We do not offer these tires. We do offer the Goodyear 6.00/16 and 6.50/16 for the 1934 forward Hupmobiles.” — Bob Ulrich

My grandfather Dr. Joseph Ulrich (pictured with sons Richard, left, and Joe) owned a Hupmobile in the mid-1920s prior to the Great Depression.

goes by, you generate a set of experiences, events you go to with cars, your parents, your children, yourself, and so forth as time goes on.”

THEN AND NOW Kelsey hoped to open his antique tire business three years earlier than he did.

“When I came home from the service, I had my separation pay from the Army,” he says. “That gave me a certain amount of liquidity to make the purchase of these tires, which I started to do in 1966 initially. However, I needed to complete my military obligation before I’d be able to be considered for some financial assistance from one of our local banks. I started buying the first vintage auto tires in the fall of ’69.

“Armstrong and Denman were our primary sources for these types of products. As you were able to afford them, you’d make purchases and work the swap-meet circuit. That was very active. That was the only way you really met your customers, face to face. Credit cards weren’t used. 800 numbers were not available. FedEx didn’t exist. UPS was servicing only a few states.”

Kelsey started a dialog with Goodyear Tire & Rubber Co. in 1980. By 1984 he was solely a Goodyear distributor.

“In my case, I saw more of a particular need for the Goodyear major brand, which, up to that point didn’t have a presence in the vintage auto tire market.”

Kelsey has exclusive rights to Goodyear antique and classic tires globally. That includes antique military tires.

“Based upon our size range mix, primarily driven by the American auto manufacturers, I would say our business is probably 85% domestic.

“At one time we had six warehouses in North America. We were doing about 150 swap meets and shows a year.”

Kelsey and his wife, Janice — “a very staunch supporter and advocate of the business” — need only one warehouse now. It is located in Missouri near Kelsey Tire Inc. headquarters in Camdenton.

Kelsey primarily advertises in vehicle enthusiast publications. But he sells by phone, in person and online.

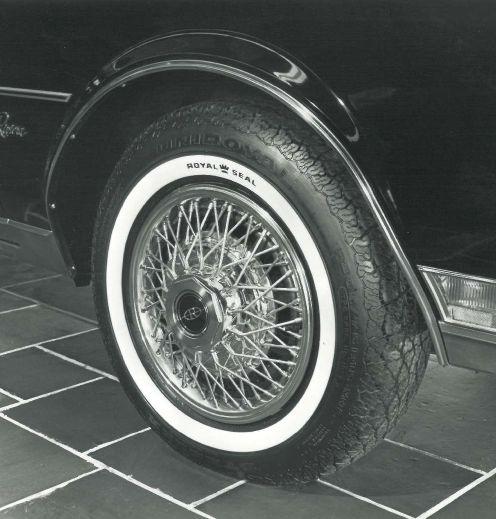

All the tires offered by Kelsey Tire are identical to the originals, a necessity, particularly with show cars. “In the world we live in, authenticity is everything,” says Kelsey. “External optics have to be identical for maximum judging points.”

The oldest tire he sells is the 450-21 Balloon Goodyear. “My 1925 Chevrolet Superior K Touring Car uses that particular size,” says Kelsey. “Then the sizes go forward from there.

“The newest tire we’re working with at the present time would be a mid-’80s Fox Body Mustang tire, the Eagle VR60 Gatorback tire. And we’re active in the development of vintage original equipment radial tires.

To look back on Kelsey Tire in 1985, written by our own Lori Mavrigian, check out MTD’s March 1985 story starting on page 24.

1930 to 1970s: Goodyears for collector cars

By Lori L. Wiese Senior Editor

“This is God’s country,” an old sign in Kelsey’s Antique Cars museum reads, “so don’t drive through it like Hell.”

This particular sign refers to the area around Camdenton, Mo., the home of the museum, and if you don’t take the advice you could miss downtown Camdenton entirely. It is literally a one-stoplight town.

Yet, the main reason for not speeding through the region is it is far too beautiful to be properly appreciated with a cursory glance out a car window at 55-plus mph. It is called the Lake of the Ozarks, where rolling hills relax into shorelines.

In the winter, appearances are deceiving in Camdenton. This seemingly sleepy town of 2,303 within the corporate and approximately 20,000 within the county has no apparent commercial activity.

Commercial value it has, however, for in three months the area’s number one industry

kicks into gear. Tourism.

Droves of water-sportseekers will descend on the area to partake of swimming, water skiing and fishing. They will also shop at the wide variety of re-awakened souvenir shops and browse through the antique auto museum owned and operated by John Kelsey.

Kelsey’s business, which includes the museum as well as his tire dealership, is in an area of the country being promoted heavily by the Missouri Board of Tourism as “a land of opportunity.” The promotions are paying off. Not only are the hotels and resorts filled to the maximum during the summer months, but increasing numbers of people are deciding to move to the area and enjoy the atmosphere year round. According to Kelsey, the area is the second fastest-growing in the nation.

Kelsey is in the hub of the activity, and he got in on the ground floor. As it is in his choice of locality, it is in his business. Kelsey knows a good thing when he sees it, and he seems to see it, and know it, long before others. This is one reason he came to own the more than 30 valuable collector cars displayed in his museum, and why he became involved in selling tires that fit those, and other, antique cars.

After getting out of the service, Kelsey wanted a job in an area that always interested him – antique autos. He had experience in the parts and accessories market before serving his country, but after his discharge he decided to go into tires, an area where he felt there was a need for product supply and customer service.

Kelsey has been selling more than 75 types of whitewall and blackwall tires for collector cars under his private brand name of Bedford, manufactured for him by Denman Rubber Manufacturing Co., and is the authorized distributor of Dunlop Vintage tires. He is now introducing a

line of collector tires with the Goodyear name.

If you don’t recognize the significance of this, you don’t know the antique car/tire market. Throughout the years, many tire manufacturers have supplied tires for antique, vintage and collectors cars, either producing the tires or selling molds to other companies which produce tires. For example, Kelsey has the Dunlop line, Firestone tires have been available through Lucas Automotive, BFGoodrich tires can be bought through Coker

Dealers will soon be customers’ main source for collector car tires.

Tire Co., and a host of other brands are available from these and other suppliers.

As Goodyear discontinued the production of a certain tire line, however, the company would store or destroy the molds, refusing all offers for the blueprints. The reason? The firm did not want another company to make tires with the Goodyear name on them, tires the company feared might not live up to the high standards it sets for its products.

How, then, is it possible that Kelsey can sell Goodyearbranded collector car tires? Because Goodyear has begun to produce the tires at its Argentina plant. Kelsey had the molds taken out of storage, or rebuilt from blueprints, and put back into limited production. Kelsey is the sole distributor on Goodyear’s side of the ledger.

This turn of events was precipitated by Kelsey, who knows the market as well as, if not better, than anyone. The unavailability of Goodyearbrand tires to replace tires fit as original equipment in years past left a definite void, he felt. Collector car owners had to take

their second choice on tires, and to a true car enthusiast, second best is not good enough.

Dealers will soon by customers’ main source for collector car tires.

“Authenticity is the key to any vintage endeavor,” Kelsey noted. “Coming close doesn’t hit the mark.” Kelsey knew there was a market out there, the next step was convincing Goodyear.

“You can’t expect a company to crank up assets, human and material, to satisfy someone’s curiosity.” Kelsey stated. “You have to be certain the proposition has bottom-line merit.”

Kelsey reports it did not take too much pushing to get key people interested in the project. He credits Jacques Sardas, execuNew technology played a part in the selection of collector tires between the tive vice president of Goodyear years 1864 through 1972. A computer company representative listens as Kelsey requests his analysis of vehicle production with standard and optional Tire & Rubber Co. and president tire fitment data. of Goodyear International Corp.; John Purcell, president and manin getting the project up and Goodyear was another market aging director of Goodyear/ running. area for promoting the Goodyear Argentina; Joseph Graden, vice “These people looked at the name. And it is a market that will president, manufacturing for idea with a magnifying glass,” reap benefits for years to come. Goodyear International Corp. Kelsey says. “They viewed the Thirteen tire sizes will be in Akron; Frank Corcoran, vice marketing requirements, the available for tire dealers by president of Goodyear Internadevelopment of the project and the end of this month. These tional/western hemisphere, and the implementation. They gave bias tires will fit cars built from Emmett Sellars, vice president of it a fair overview and decided it the 1930s through the 1970s, tire sales marketing, Goodyear was a viable market.” explained Kelsey. “These 13 International, as instrumental What Kelsey proposed to items cover the largest volume of vehicle production during those Chart A years. And from this nucleus, Goodyear “performance package” we will develop satellite sizes.” Goodyear Polyglas (See Chart A). For a segment of the tire line, Size Sidewall treatment Kelsey discerned which tires E70/14 Raised white letter would fit the maximum number F70/14 Raised white letter of applications using yesterday’s F70/15 Raised white letter information incorporated with F70/15 White line today’s technology He utilized F60/15 Raised white letter vehicle production data and tire guides printed for the model Goodyear collector tires available through Kelsey years 1964 through 1972 to do

Size W/W width Construction an “analysis of vehicle produc695/14 7/8-inch Four ply poly tubeless tion and a list of standard and 750/14 2 ¼-inch Four ply poly tubeless optional tire sizes fitted to cars.” 670/15 3 ½-inch Four ply poly tubeless This information was put into a 670/15 670/15 2 11/16-inch 2 ¼-inch Four ply poly tubeless Four ply poly tubeless computer program and, with the 670/15 1-inch Four ply poly tubeless push of a few buttons, Kelsey can 600/16 3 ½-inch Four ply poly tube-type tell the potential tire demand for 650/16 4-inch Four ply poly tube-type the collector. “Turning back the pages of history is much more

precise than looking forward into a crystal ball,” joked Kelsey.

“Our focus and intent for setting up our program was to show Goodyear the long-term advantages it would bring to the company. These tires have been so long awaited,” Kelsey said, noting that Goodyear was OE on a large portion of the cars produced in those years.

When Goodyear gave the nod to the project, it was decided the tires would be made in the company’s South American facility because, Kelsey explained, “it was the plant with the most recent association with these bias products.”

One thing that Kelsey is grateful for is the “similarity of enthusiasm in Akron and in Argentina. The only difference is geography. Both places maintain the same high level of communication and quality.

“Tire dealers can be assured these tires are designed with ultimate positive performance as the main characteristic. Goodyear has not compromised the product to match the possible end use,” Kelsey indicated, referring to the cases where the collector cars are never driven, only trailored to shows.

Another thing dealers can be assured of, Kelsey stated emphatically, is that “the tools needed to fit these tires to collector cars are already in the tire dealer’s shop.”

“Mention vintage cars to dealers and most visualize themselves struggling on the floor replacing a tire on a Model T. That thinking needs to be turned around. It is no more difficult to service a 1935 to 1970 car than it is to service late model cars. The vast majority of cars can be dealt with no problems,” he said.

For autos which require any out-of-the-ordinary items, Kelsey wants the dealer to know the he, and his experts in warehouses around the country, are only a phone call away.

“The frustration factor comes up very quickly,” Kelsey said. “We make ourselves as accessible as possible,” referring to himself, his San Jose, Calif., warehouse manager, Ralph Finley, and his Elizabethtown, Pa., warehouse manager, George Walborn.

Kelsey admits that currently, the majority of business in collector car tires is mail order. He and other collector car tire companies advertise in magazines geared toward the auto enthusiast, such as Hemmings, the most widely-read antique car buff book, and other offshoots such as Mustang Monthly, Camaro Corral and Popular and Performance Car Review.

Another avenue for sales is antique and collector car shows. Kelsey reported his company attends approximately 35 shows per year, including the biggest of them all, the annual collector car show and swamp meet held in Hershey, Pa. “It is not unusual for 100,000 people to attend the Hershey show,” informs Kelsey.

However, people who buy through mail order, as well as the people who buy at Hershey, have one problem.

It’s called “lugging the tires,” noted Kelsey. Whether the tires are purchased through the mail or at a car show the fact remains the tires have to be lugged to a tire dealership for mounting and balancing. Because of this inconvenience, Kelsey sees tire dealers playing a more important role in collector car tire sales.

“We see our role changing in the future,” Kelsey said. “We see

The Kelsey Tire support team (left to right): Tom Rohde, store manager, Helen Randle, secretary/bookkeeper, and Melvin Miller, alignment specialist.

our major influence changing from supplying the customer to supplying the dealer. It is important for the tire dealer to recognize the potential of this market. It holds golden opportunities for growth and profit for dealers.”

Recognizing the possibilities covers a broad spectrum. The dealer should find out if anyone on his staff is involved in collector cars. Kelsey feels very often there is at least one person at each dealership who is an auto buff. It is natural that people who choose to work around cars are interested in their development.

The dealer should also look for antique and collector car clubs operating in his area, as well as canvass the area for members of the largest group, the Antique Automobile Club of America (AACA). Repair shops that deal with the restoration of collector cars should also be noted.

And the dealer should look for competition. If there are no dealers in his area already specializing in serving this market segment, and if the dealer decides there is a sufficient number of people in the area to justify offering collector tires, this is an area of good growth and profit.

“Gross profit potential is equal to, or more than, what a dealer will get on his everyday product line,” Kelsey affirmed. He added that prices are dependent on applications, yet “the pricing structure will not leave the dealer at a disadvantage.

“When a dealer sells the Bedford or the Goodyear line, he will find himself offering major brand tire lines at competitive prices.”

It should also be noted that dealers need not worry about carrying a lot of inventory. “Because of United Postal Service delivery times, it is my opinion that dealers should not handle much inventory. Customers are used to mail order, so they will not be unaccustomed to waiting a little for their tires.” Kelsey figures dealers can receive ordered tires within three to five days, depending on the dealerships’ distance from his warehouses.

“What a dealer does need is to allocate a certain amount of floor and wall space for a display of collector tires. Nothing helps a sale more than letting the customer have his hands on the product he is buying.”

It is apparent the customer base is increasing, as is the number of cars to be fitted with collector tires. The Baby Boomers, who are credited with being the main purchaser of high performance cars and replacement performance tires, are becoming a major influence in the collector car market. They can now afford the cars they longed for while growing up.

Collector car owners are, as stated, demanding. They won’t settle for second best. If you offer the service and product, they won’t have to.

The CPX-900 battery and system analyzer from Midtronics for conventional and advanced vehicle systems assesses the health of both a battery’s starting and reserve capacity abilities through patented Conductance Profiling technology.

By Ann Neal

The latest battery testing tools: What you need to have in your shop

t any moment in time, one out

Aof four car batteries needs replaced. The only way to know which one is to test every vehicle that comes in for service.

Battery testing is a great opportunity for shops to service their customers, according to Cliff Sewing, product category manager at Interstate Batteries Inc. “Looking at the total volume of batteries sold in the market, and based on the number of cars that are out there, our research indicates that one out of four batteries is going to need replaced.”

Sewing says proactively testing the battery builds trust with a customer. “A lot of times it’s cost, cost, cost to a consumer when they bring their car to a shop. With the battery test, three out of four times it’s positive feedback. You can tell your customer their battery is good and come back in three months and we’ll test it again for free. But one out of four times you want to give that negative feedback so the customer has the opportunity to replace the battery and avoid a no-start situation.”

BATTERIES WILL NEED REPLACED MORE OFTEN Interstate Batteries expects the rate of battery replacement to increase. “We know once shops test, they are going to see one of four cars need batteries,” says Dusty Russell, product development and marketing manager. “From a market standpoint, battery life will continue to be adversely impacted based on vehicle electrification placing higher load demands on the battery. The downward trend in battery life is going to necessitate even more so proactive testing platforms that we think will build the kind of trust that customers would want.”

But new batteries, systems and components require improved technology for accurate diagnostics. Battery service tools are evolving and expanding to keep pace. Modern Tire Dealer asked manufacturers for an update on the market and their products, beginning with the types of batteries shops need to be prepared to service.

In addition to Sewing and Russell from Interstate Batteries, four other companies answered. Speaking for Bosch Automotive

Service Solutions Inc. were Pat Pierce, product manager-battery testers, and Surender Makhija, consultant-battery testers. Answering on behalf of Clore Automotive Inc. was Jim O’Hara, vice president of marketing. Responding for Midtronics Inc. was Rob Salach, senior product manager-aftermarket. EnerSys Inc. shared perspective via Bruce Essig, transportation and specialty national program manager.

STANDARD FLOODED PRODUCT DOMINATES FOR NOW What types of batteries do independent shops need to be prepared to test? All respondents agree standard flooded lead acid batteries dominate the market now, but changes are on the horizon. Midtronics expects Absorbed Glass Mat (AGM) and Enhanced Flooded Batteries (EFB) to increase to more than 65% of the market in the next three to four years.

Bosch: Although AGM and EFB batteries usage is becoming more popular, flooded lead acid batteries still hold the predominant market share for independent aftermarket battery service. Lithium-ion batteries are now being used in electric and hybrid vehicles, but high costs prohibit use in everyday vehicles. There are some heavy-duty applications that use 24-volt systems, but those typically run two 12-volt batteries.

Clore: For conventional vehicles as well as many hybrids, the primary battery types shops should be prepared to service are: flooded, AGM, spiral wound, gel cell, and deep cycle batteries. In addition, they likely will encounter vehicles with capacitor-based starting systems and lithium starting batteries, but these will be fewer in number.

EnerSys: The AGM sealed, lead-acid battery is growing in popularity as being installed by the car manufacturers, especially with the growing popularity of the engine stop/start feature. This feature increases the discharge and charge cycling on the battery, with the traditional SLI (starting, lighting, ignition) battery not being capable of providing the required discharge-recharge cycles to give good service life. The AGM battery requires more sophisticated chargers that can assess the battery’s state-of-charge and chemical condition and choose the most appropriate charging algorithm versus a fixed charge procedure. AGM also requires more complex performance testing with

PHOTO COURTESY OF INTERSTATE

The IB Pulse from Interstate Batteries recommends Interstate replacement batteries by part number to reduce installation error, provides battery reset instructions, and retrieves battery test history by vehicle identification number.

advanced conductance testers as well as an understanding of how to exchange a battery in a vehicle without disrupting various on-board microprocessors and engine management systems.

Interstate: The automotive aftermarket is going to be largely standard flooded product for the next 24 to 36 months. We are clearly going to see a continued shift to more premium lead acid battery types such as AGM and EFB as vehicle electrification trends increase and original equipment manufacturers position their vehicles to address the higher load demands being placed on automotive batteries. But while the OE market is growing with higher-performing batteries, it represents a comparatively minor amount of the total in today’s automotive aftermarket. Testing requirements will therefore remain largely driven by the existing flooded lead acid product seen in the market today.

Midtronics: Independent shops still need to be prepared to service lead acid batteries. Conventional flooded batteries will be the majority of what they see now but with the increased volume of start/ stop vehicles and greater electrification in today’s vehicles, the amount of AGM and EFB batteries in use will continue to grow. Currently AGM and EFB batteries represent less than 20% of the market, but within the next three to four years those battery types are predicted to increase to more than 65% of the market.

THE LATEST DIAGNOSTIC TOOLS Modern Tire Dealer asked manufacturers for an update on the latest technology in battery diagnostic tools.

Bosch: The latest technology in battery diagnostic tools, like the Bosch BAT-120, integrate battery test services with scan diagnostic service into one system. The tool offers a single solution for battery charging/testing services, computer scan battery reset/relearn calibrations, and battery replacement guidance.

Clore: The latest technology centers around the need to constantly update and refine the diagnostic judgement maps used by modern battery testers to determine if a particular battery is sufficient to perform its task (is it good or bad?). We are constantly refining our judgement maps to ensure we can accurately assess the widest possible array of battery type, battery size, battery condition and more.

EnerSys: Dynamic conductance technology provides handheld testers that provide unparalleled testing accuracy and decision making. For example, the Odyssey OBT2000HD battery and electrical system analyzer is used for commercial truck applications and offers a user-friendly smart html PC interface and features patented single load, dynamic resistance technology for accurate results.

Interstate: AGM, enhanced flooded, SLI batteries all can be tested with the conductance battery testers in the market today. The new IB Pulse provides the capability to test all those technologies, as well as the ability to test group 31, lawn and garden, marine, powersport and commercial batteries. We’ve also integrated additional information and databases into the IB Pulse. For the automotive testing in the Pulse, these include battery location diagrams and battery reset instructions. The IB Pulse also displays the automotive Interstate Batteries that fit the vehicle

The Odyssey OBT2000HD battery and electrical system analyzer for commercial truck applications from EnerSys has patented single load, dynamic resistance technology for accurate results.

and alerts the technician if a car requires a battery registration tool. We expect to integrate a battery registration tool into the IB Pulse by the end of 2019.

Midtronics: Conductance Profiling, a patented Midtronics technology, represents the latest advancement in battery diagnostics. With increased electrification in today’s vehicles, batteries must do more than just start the vehicle. They also supply power to items like infotainment systems, vehicle safety components, regenerative braking, etc. The measurement of the battery’s ability to sustain these loads is called reserve capacity and traditional conductance or load testers cannot perform an analysis of the battery’s reserve capacity status. Conductance Profiling is the only technology on the market today that can accurately assess the health of both a battery’s starting and reserve capacity abilities.

IS IT TIME TO BUY A NEW TOOL? MTD asked manufacturers if there are specific types of diagnostics tools a shop must have in order to service vehicles.

Bosch: New battery testers have separate testing algorithms for batteries used in start/stop vehicles. Battery testers that shops use should have capabilities to test AGM and EFB batteries, which differ from conventional flooded lead acid batteries. Existing tools will work if they have been recently updated or are equipped with the latest technology.

Some of the suggested tools for battery diagnostics and service include a digital battery tester featuring printout or a means to capture, store and share test results. Bosch recommends model BAT-135 tester with integrated printer or model BAT-120 Bluetooth battery tester that integrates with Bosch scan tools. Also, a scan tool with the capability to reset or relearn the ECU (engine control unit) where the vehicle is equipped with computer controlled electrical systems like those found in 2010 and newer F-150s and most vehicles from Audi, Volkswagen and Mercedes-Benz. Other recommendations are a parasitic drain tester to help locate electronic vehicle components that continuously drain the battery, a memory saver device that provides 12-volt power to the entertainment /comfort and ride systems on vehicles to keep them live while a battery is replaced, and an anti-zap surge protector that protects sensitive electronic systems while replacing the battery.

Clore: All shops should have a quality battery tester with a testing capacity that exceeds the range of battery sizes they normally encounter. It should also be optimized to accurately assess the specific battery types that they are likely to encounter. It is possible that their existing tools are sufficient to meet this need. But, if their tool is dated, it is a worthwhile investment to update their equipment to improve their testing accuracy.

EnerSys: Today’s vehicles have a level of electronics and sophistication with complex integration that only a few years ago would have been considered a dream more than a reality. Knowledge and sophisticated diagnostic tools are a must to troubleshoot and correct operational issues with today’s vehicles.

Interstate: Older diagnostic tools will perform a battery test. But the older tools do not provide all that additional information and techs will have to do Google searches for battery reset instructions, for example. Battery tools a shop should have include battery reset tool, battery registration tool and a continuous power source.

Midtronics: Existing conductance and load testers will continue to be successful in diagnosing a vehicle battery’s ability to start the vehicle. But, based on how heavily newer vehicles rely on the 12-volt battery, they can no longer deliver a complete picture of battery health. Battery testers such as the Midtronics DSS-5000 Battery Diagnostic Service System and CPX-900 Battery and System Analyzer feature conductance profiling technology, which enables testing of both cranking and reserve capacity.

TIPS TO BOOST PROFITABILITY Manufacturers suggested a number of ways for shops to improve the profitability of their battery service. There was one tip they all agreed on: Test every vehicle.

Bosch: Making battery service checks part of every shop’s preventive maintenance program for their customers is a way to improve profitability. Some helpful hints/ tactics for these preventive maintenance programs include: Use a battery tester that provides a battery health report featuring battery state of charge (SOC) and state of health (% of battery estimated remaining life). Some battery testers provide an app or a means to capture and store tests electronically or through cloud-based internet systems to record customers’ battery life cycle through service intervals over time highlighting battery performance. This is a professional way to show a customer he or she may need a battery replacement before encountering a no-start condition. For multi-store operations, we recommend having a test solution that tracks the number of batteries and the test results performed by a store or a technician to help store operations better track battery warranty management.

PHOTO COURTESY OF CLORE

Clore says the BA327 digital battery and system tester with integrated printer is a complete testing solution for 6- and 12-volt batteries and 12- and 24-volt charging systems. With an operating range down to 1.5V, it can accurately test discharged batteries.

Clore: First, it is important to ensure that all personnel know how to properly utilize the battery tester, whether it is a digital tester or a more traditional carbon pile tester. Particularly with digital testers, if the tester is configured to test a specific battery type but deployed to test a different battery type, the results provided could be affected. All personnel need to be trained to properly identify the different battery types and understand the importance of getting that step right.

Second, the most important factor in improving profitability is to be using the tester frequently. We suggest testing every vehicle that enters the shop. This will result in increased sales of batteries, rotating electrical components, belts, cables and other related items. It is a proven fact, but you have to use the tester to drive add-on sales and increase profitability per ticket.

All Solar electronic testers equipped with printers incorporate a counter function so that the shop can track exactly how many tests are performed in a given period. If a shop’s car count is four times the number of tests performed, they are not maximizing their return on their equipment investment.

EnerSys: Utilizing these advanced battery conductance testers on every vehicle in for service can provide early detection of a failing battery before a true no-start, and provides an opportunity to sell a battery. Offering a range of good, better, best in batteries provides a service to the customer and revenue to the service dealer.

Interstate: The way you have more profit is you sell more batteries; the way you sell more batteries is you test every car.

When the battery does need replaced the customer thinks you tested that the last couple times, first time it was good, last time there was some degradation. Now you tell him or her it’s bad and that makes sense because of that history.

Make battery testing part of your multipoint inspection. Have the right product in the shop to actually close the sale. At Interstate we pride ourselves with identifying the batteries and stocking the batteries at the dealer’s location. In addition, the IB Pulse tracks the types of cars and batteries tested. Dealers have the option to log into an online portal and see a record of the batteries and cars serviced. We will stock the batteries for the dealer as a service. The data on year, make and model of cars serviced will help them stock brakes and other parts.

Midtronics: Test every vehicle’s battery that comes into your shop for service as an added preventive maintenance benefit. Combining a preventive maintenance battery testing program with conductance profiling technology will further enhance the benefit for your customers. Conductance profiling is one of the most decisive and comprehensive battery testing technologies available. When you combine preventative maintenance testing with increased decisiveness, you will be able to identify more opportunities to advise your customers

PHOTO COURTESY OF BOSCH

Bosch says the BAT-135 battery tester includes an integrated printer to capture test results for customer records such as presenting the state of health and state of charge percentage of the batteries to ensure optimal efficiency and usage.

about failing batteries and increase the potential to sell batteries.

WHAT ABOUT HYBRIDS AND EVS? MTD asked manufacturers to describe opportunities the growth of plug-in hybrid vehicles and pure electric vehicles (EVs) will create for shops. Are these opportunities months or years away?

Bosch: Lack of technology standardization among OEs, safety-related issues in servicing these high voltage systems, and limitations to accessing the battery pack within the vehicle all are barriers to independent aftermarket shops servicing pure electric or plug-in hybrid vehicles. In near future, these systems will mostly be serviced by authorized dealerships, which have been required by OEMs to have specialized insulated tools and hybrid/EV training to service the vehicles.

Clore: This opportunity exists now, but is small. We expect it grow significantly over the next 10 years. We would suspect that time frame for it to reach critical mass for aftermarket shops is still years away.

EnerSys: These vehicles will require a much higher degree of system knowledge and diagnostic equipment to service. There will be a high price for this equipment and the training of the service technician.

Interstate: Current EV and hybrid vehicle platforms frequently contain a 12V lead acid battery for back-up power support. Future platforms are trending toward a 48V system to accommodate the growing electrification demands in this EV/hybrid segment, which will create some unique safety and repair challenges for a shop. But for the foreseeable future it’s going to be standard lead acid, AGM-type technology in the marketplace, and that’s what we’re addressing with the Pulse.

Midtronics: Hybrid vehicles have been on the road for nearly 20 years and are coming into aftermarket shops for similar reasons as traditional gasoline-powered internal-combustion engine vehicles — oil changes, tires, wipers, and 12-volt lead acid battery service, etc.

The number of plug-in hybrids and pure electric vehicles on U.S. roads today represents only a tiny share of the total vehicles in operation.

However, the rate of customer adoption, as well as the number of different vehicles being designed and manufactured by the OEMs, is increasing. According to a recent IHS Markit forecast, more than 350,000 new EVs will be sold in the U.S. in 2020, which would still give EVs just a 2% share of the total U.S. fleet. By 2025, however, that figure is expected to reach more than 1.1 million vehicles sold for a 7% share.

This trend and transition to plug-in hybrids and full EVs represents a huge opportunity for the aftermarket, though it’s still probably years away. In the near term, most of these vehicles will still be serviced in dealership shops due to warranty considerations and technology level. But as these vehicles come off warranty, customers are going to look to the aftermarket as an option for faster, more economical service.

Shops that learn about the service requirements of these vehicles and acquire the necessary equipment to support them now will be ahead of the game when they start rolling into their bays.

Tires and the future of hybrids

By Joy Kopcha

BIGGER LOW ROLLING RESISTANCE TIRES ARE ON THE WAY

he company that brought hybrid ve

Thicles to the masses doesn’t see them as a fringe component of its business. They’re not limited to the hippies or the hipsters. They’re the future.

Toyota Motor Corp. created the world’s first mass-produced gas/electric hybrid vehicle. The Prius was introduced in late 1997 in Japan, released worldwide in 2000, and the 2001 Prius made its debut in the U.S. market in August 2000.

In 2011 Toyota Motor Sales USA sold its one millionth Prius, and by the middle of 2012 had sold another half million. And the company has extended and improved its hybrid technology to other sedans and SUVs, most recently including the world’s best-selling car, the Corolla. The Lexus line has six hybrid options of its own.

Mike Donick is the vehicle dynamics senior manager for Toyota Motor North America Inc. He says the proliferation of hybrid technology will continue throughout Toyota’s vehicle lineup. “We’re planning to grow that exponentially as we move forward. We think hybrid or electrification is growing dramatically,” says Donick. “Right now about 9% of our products are hybrid, and we expect to grow that to 15% by 2020. The target is by 2030 it will be 50% globally.”

Here’s one more goal for one of the world’s largest automakers: to have an electrified option in every Toyota and Lexus model by 2025.

“We have more development projects for North America than we’ve ever had before, so it’s a busy time, but it’s an exciting time.”

PUSHING THE ENVELOPE FOR PERFORMANCE With such an emphasis on alternative fuel vehicles for the future, Modern Tire Dealer turned to Toyota to talk about what this means for the development of original equipment tires, and ultimately, the replacement tire market.

Donick leads a team of 10 engineers that focuses on ride handling vehicle performance, including all of the tire development for Toyota in North America. Most of them work from the 12,000-acre Toyota Arizona Proving Grounds.

At any given time two of those engineers are working on tire development — so he estimates tires account for 20% of their work. And a growing amount of that tire work involves fuel efficient products. Donick says Toyota is choosing fuel efficient, low rolling resistant tires for its conventional vehicles, as well as its hybrids.

The company’s tire research is broken down into two categories — tire development for new vehicle projects, and overall improvements that result in better tires. The OE work typically stretches over a couple of years with constant back-and-forth between Toyota and its tire manufacturing partners, including Michelin North America Inc. and Goodyear Tire & Rubber Co. One tire maker creating an OE fitment on a Camry “has probably tried on the order of 40 different designs to come up with the best tire design for that specific application, and that’s just from one supplier.”

Donick says, “We develop tires that are specifically matched to that vehicle; they are purpose built for our performance. We go through many iterations so that the characteristics of that tire are perfectly matched to the characteristics of the vehicle for the best ride comfort, handling, steering feel, fuel economy and rolling resistance, and braking performance.”

And while Toyota conducts tire research alongside its OE tire makers, it also works on its own. Creating better tires for the future requires a focus on the best balance of targets so the company can accurately predict performance. Donick says that necessitates a focus on three things: the tire’s construction and shape, its compounds, and the tread pattern.

With a base of repeated tests and predictable performance, the company can make educated adjustments. For instance, if it adjusts the angle of a tire belt slightly, “we know what kind of performance change we’re going to see in the vehicle.” From there, the goal is to push the envelope while “always trying to see how we can get a bigger envelope and have both better softness and better ride comfort. We’re trying to optimize the tire in both areas.”

SERVING THE CONSUMER With its ongoing push into the hybrid market, it’s logical to expect Toyota to remain dedicated to the development of better green tires. But are fuel efficiency and low rolling resistance the first priority at the outset of a new hybrid project?

“At a higher level I’d say customer satisfaction is priority one, and low rolling resistance is a big piece of it,” Donick says. “The way we set our targets and then develop the tires to meet those targets is we start at the customer level. We want the customer to have a certain level of ride comfort, fuel economy, handling performance, snow, wet performance, etc. Then we look at the vehicle and tire as a system, and we try to figure out how we can optimize the system to try to get the best overall performance for the customer.”

One of the trade-offs of a low rolling

resistance tire is ride comfort, but Donick says Toyota expects its hybrid vehicles to perform for customers just as its non-hybrids do. That means a hybrid vehicle’s suspension system has to be tweaked and developed in a way to compensate for the loss of ride comfort. Once that’s complete, the auto maker will set specifications for the tire based on the vehicle’s fuel economy. There are other targets for stopping distance, handling, ride comfort and snow.

Another important priority for hybrid vehicles is tire noise. “When the engine’s not running it’s very quiet, so there’s a little additional emphasis on low road noise for hybrid tires.”

Consumer expectations, and requests, drive the complicated process of setting performance targets, and Donick says it involves four paths of information.

When updating a vehicle model, the

PHOTO COURTESY OF TOYOTA

“Tires are the most important single component for vehicle dynamic performance,” says Toyota’s Mike Donick. He’s spent 14 years working on vehicle dynamics for the automaker.

first goal is to address any customer dissatisfaction from the previous models. That might come from customer complaints at dealerships, or from warranty problems that were reported. The second step is to look at customer satisfaction rankings, such as those reported by J.D. Power and Associates and media outlets like Consumer Reports. Toyota also conducts interviews with customers, and talks to its dealer staff about what they’re hearing from vehicle owners. The final piece is competitive benchmarking. Toyota wants to be competitive or the best in its segment.

“Trying to take what the customer wants and converting that into our performance targets is a big part of our job, and a pretty

The rise of hybrids

complex part of the job, but it’s a very important one.”

The first alternative fuel and hybrid electric vehicles (AFV and HEV) models were introduced in 1991; the market leader Toyota entered the fray at the end of 1997 and the company brought the 2001 Prius to the U.S. in August 2000.

Two decades later, for model year 2018, 31 manufacturers and brands offered 203 different models, according to the U.S. Department of Energy’s Alternative Fuels Data Center. In the last 28 years, the “Big 3” auto manufacturers have introduced almost two-thirds of the alternative fuel vehicles to the marketplace.

By 2025, 18% of light vehicles produced will be a hybrid of alternative energy, according to a Specialty Equipment Market Association Future Trends report. Toyota’s Mike Donick says the automaker expects 15% of its products to be hybrid vehicles by 2020. By 2030, the goal is to make hybrids account for half of Toyota’s global vehicle production. — Joy Kopcha

BIGGER GREEN TIRES ARE COMING One thing that’s set the expansion of hybrid vehicles apart from the rest of the tire industry has been tire sizing.

While the tire industry has focused on larger sized tires— 17-inch and 18-tires have become the leaders — vehicles on hybrid vehicles remain smaller. (The top passenger tire size, 225/65R17, entered the U.S. Tire Manufacturers Association’s top 10 list of most popular sizes in 2014, and ascended to the top of the list three years later.) The Toyota Prius offers an option with a 17-inch tire, P215/45R17, but since 2010 it’s been fitted with P195/65R15 tires. The 2020 Corolla hybrid will debut with the same size.

But it might not always be that way.

“I think with low rolling resistance tires, as we move forward you’ll see them penetrate the entire size market, maybe with the exception of very large section widths. We still don’t have very much in the plans for your 285 and 295 and up because that large width by nature isn’t so efficient for rolling resistance. But in diameter size, I’m confident within four years you’ll have 22s that are low rolling resistant.”

Donick says he thinks the expansion will be led by the auto makers since “we’re developing larger vehicles that are also hybrid. They need to maintain a balance of good styling, performance, wheel diameter, as well as good fuel economy performance.”

Leipold Tire Keeping it simple LEIPOLD TIRE FOCUSES ON TIRES, CHASSIS SERVICE AND BRAKE WORK

By Shana O’Malley-Smith

ennis Leipold has emphasized

Dsimplicity since he started Leipold Tire Co. Inc. in 1975. “All throughout the years I’ve used the KISS philosophy, which stands for Keep It Simple, Stupid, and it’s proven well for me!” he says.

While many big box stores, car dealerships and national chains are offering bumper-tobumper service, Leipold prefers to specialize in tire, chassis and brake work.

By keeping his focus on tires, Leipold, who runs two store locations in Northeast

Ohio, says he can dedicate the very best products and services to his customers.

“We do the right things right,” he says.

FOUR DECADES OF TIRES Leipold got his start in the tire business while in high school working for a local tire shop during summer breaks. After graduation he enrolled at the University of Akron but dropped out to go back into the tire industry.

“I started off in engineering, and I became aware that it wasn’t for me so I took a general selection of business courses,” he explains. “During… my third year, I dropped out midterm and it was early enough to get my money back. I had to be signed out by every professor, and two of those guys told me what a big mistake I was making and what a failure I was going to be.”

Leipold says that was motivation for him to start his own business. He chose tires because that what he knew the most about, and he had heard it was a strong industry.

“Back when I was really starting out I remember someone telling me it was a recession- proof business,” he says. “People always have to have tires, and it’s proven to be that way.

“Sometimes recessions are our best years because people aren’t replacing their cars. Going back to 1975 and going through many economic ups and downs, it has proven to be pretty much recession-proof. The only limit is yourself. I’ve seen a lot of places go out of business, and it wasn’t because of the market. It was because of bad management.”

Leipold started his business in May 1975 and was joined by his brother, Ken, later that summer. The pair rented an old two-bay Texaco gas station in Stow, a suburb of Akron.

“Business was very slow, but back then everything was very inexpensive,” he said. “My overhead was $75 a day and that covered everything.”

As business picked up, Leipold purchased a semi-trailer and parked it next to the building to use as a warehouse. He purchased a second location in neighboring Cuyahoga Falls in 1983, and in 1986 he moved his Stow store from the Texaco station to the location where it sits today.

“In ‘87 and ‘88 we grew and expanded both buildings. I was adding warehouse space and service space and gradually increased the staff from just my brother in 1975 to currently 26 people.”

WORKING WITH WHAT YOU’VE GOT Today, both store locations sit on suburban

street corners with heavy traffic volume. Both locations are also noticeably small.

“The Stow store is around 3,500 square feet and the Cuyahoga Falls store is 5,500 square feet,” he says. “Each store has 10 seats in the waiting room, and the waiting rooms are about 400 square feet. There’s not a square inch of open space.”

Leipold says he kept the stores small on purpose, focusing on efficiency and keeping fixed costs down. He played with the idea of doing an expansion in the past, but ultimately decided to rework the space instead to save money.

“Around 2000 I had the plans drawn to double the size of the Cuyahoga Falls store for more service bays and more warehouse, and at the last minute I pulled the plug on the deal and I looked at ways to increase efficiency. We reduced our inventory and moved in three additional tire changing machines and one more balancing machine, and it kept our utilities and insurance and all of our fixed costs down.”

He took the savings from not doing the expansion and invested it into his employees.

“Instead of putting money into buildings, we put money into our employees through bonuses,” he says. “They work hard and they earn it.”

Although the shops are small, they turn out quality work in similar volumes as their larger competitors. The Cuyahoga Falls store operates with five bays while the Stow location has six.

“We have a new car scheduled every hour for the auto services,” he says. “We do five to six cars an hour on the tire side, that’s sales and tire repairs.”

They take both walk-in customers as well as appointments. “Our appointment schedule is generally full, but we have it built in a way so we can fit in the walk-in service for most of the year,” he explains. “November and December we have appointments scheduled as well as some walk-ins and we have a heavy amount of drop-off because of the weather.”

While the winter months are a busy time of year for tires, Leipold says not that many customers are buying snow tires like they used to.

“Back in the ‘80s I did a huge volume of snow tires because a lot rear-wheel drive

While the winter months are a busy time of year for tires, Leipold says not that many customers are buying snow tires like they used to.

cars existed, but I haven’t stocked snow tires in about five years,” he explains. “We’ve got so many distributors that we can have them here the same day if I order them by 11 a.m. We let them carry the inventory and we take it when we need it. Most of our customers want all-weathers.”

KEEPING UP WITH DEMAND Another aspect of business that has changed dramatically for Leipold over the years is the way he buys tires from distributors.

“I used to buy directly from the rubber companies in trailer loads, and I’d order one to two trailer loads a month and mix it up,” he says. “However now, there are so many regional distributors that we have probably six

Preventing NVH problems before they happen

Attention to detail is especially important when customers come in for noise, vibration and harshness (NVH) issues. They can be a tricky problem for tire pros since several factors can cause NVH.

At Leipold Tire Co., a two store operation based in Cuyahoga Falls, Ohio, Vice President Andy Leipold says taking time to listen to the customer’s complaint is the essential first step to identifying the problem.

“They might say, ‘It really shakes when I’m getting on the highway’ or ‘I hate these tires because they’re so noisy’ or ‘Every time I hit a bump I feel like my car is falling apart.’ Those are the three main complaints and from there we’ll have to look and narrow down all of the causes.”

The root cause of NVH tends to be the lack of regular tire maintenance, says Leipold. One way Leipold Tire is able to help customers avoid NVH issues is through its regular tire maintenance program.

“Anytime you purchase tires from us, rotation and balancing are included in the life of the tire. Obviously were moving around the tires to even out the wear as far as mileage goes, but we’re also watching for uneven wear, so if somewhere along the line it does knock the alignment out, if you come in every 5,000 miles, we can catch it in time and get the alignment set before (NVH) becomes a problem.”

to eight short truck deliveries from regional distributors daily to restock and to bring in special orders for non-stock items.”

With the rapid increase SKUs, he says it doesn’t make sense for him to keep a large warehouse of inventory on site nowadays.

“The last 10 years the size and speed ratings and profiles have gone ballistic. A trailer load would last 10-25 days. Now I have to have two-a-day deliveries from distributors because to try and have on hand what could come in the door, I would need a 90,000-square-foot warehouse to cover every potential call.”

He says about 80% of his business is stock tires and 20% is customers’ special orders. When it comes to tire brands, Leipold Tire works with all of the major brands — BFGoodrich, Continental and Michelin to name a few — but feature Cooper and Mastercraft tires.

“We are really dedicated in our relationship with Cooper Tire and Mastercraft Tire,” he says. “They’re the bulk of our market because the distributors have a fair share of all of the other brands. So when a customer comes in, a lot of them will make the decision based on our recommendation. However, we listen to customers and we’ll get any brand they want.”

One thing he won’t do is let customers buy tires from the Internet and bring them in for installation.

“If you want to buy them there, figure it out yourself,” he says. “We’re not going to build those companies. They’re successful, but they can be successful without me. That’s just another market change.”

Between Internet sales and more neighboring competition than ever, Leipold says it’s important to stay relevant in customers’ minds.

“The number of independent dealers has declined dramatically in the Akron area. They’ve been replaced by national and regional chains, and car dealerships have taken their stab at it. We’ve seen a lot of change in the competition, and it forces us to be continually on our toes to maintain our market share.”

MAINTAINING MARKET SHARE Leipold credits his quality work, attention to detail and top-notch customer service

Vice President Andy Leipold helps unload a truck full of tires at the Cuyahoga Falls, Ohio, location. Rather than manage a large tire inventory, Leipold Tire relies on six to eight short truck deliveries a day from regional distributors.

for his longevity in business.

Leipold caters to the customers who are looking for quality rather than those who are looking for a cheap deal.

“We’ll be competitive, but we won’t be the lowest price in town,” he says. “We differentiate ourselves with our service, and we provide a different level of service than our competition. The majority of customers appreciate that.

Many of Leipold Tire’s technicians have been with Leipold for decades.

In the tire department, Leipold admits that help is a little harder to come by, but he’s recently found a great group of workers.

“My tire department has gradually grown,” he says. “Finding employees has been a challenge. I currently employee five documented immigrants from Myanmar who were granted asylum. These guys are the best new hires. I’ve had them with me for four or five years.”

Leipold keeps turnover low by paying his employees good wages and maintaining a family-style relationship.

“We’re not getting these guys cheap. We pay well above the market for the field for all of our employees,” he says. “We treat them like family because they are.”

THE FUTURE OF LEIPOLD TIRE CO. Leipold officially retired in 2016, but you can still see him in the stores most days. His brother retired in 2014, but his two sons, Andy and Ben, are vice presidents. His grandson, Landon, also helps manage the business full-time.

Leipold spends the winter months in Florida, but comes back to Ohio when the weather breaks and works as a mentor to his family and employees.

Leipold says he enjoys being around the employees and the customers but his life motto is “You either live to work or work to live.” He says he never dreamt of owning dozens of stores and wholeheartedly believes in a work-life balance.

“I’m a faith-based business,” he says. “I’m not going to run a banner over my store, but I live and operate with a biblical life view. It plays into every decision and every relationship. The way we treat people, the way we treat employees.

“These things are really the driver. My best advice is the U-Haul doesn’t follow the hearse.”

Shana O’Malley Smith is a freelance writer living in northeast Ohio. She specializes in the automotive aftermarket.

Continental dealers and their guests enjoyed water sports aboard a cruise ship as part of their reward for participating in the Continental Gold associate dealer program. Trips can be one of the many rewards offered for associate dealer group participation.

You are not alone

TIRE MANUFACTURERS’ ASSOCIATE DEALER PROGRAMS OFFER BENEFITS AND REWARDS

ou are not in this alone. Tire manufacturers back your

Ybusiness in the form of associate dealer groups, which offer you payouts for purchases, discounts, training, opportunities to participate in annual trips and much more.

We asked manufacturers to update their program information and tell us what’s new for 2019.

See April’s article on independent tire dealer program groups and the tools and services they offer for more ways to increase profitability.

Program name: Growing Together Associate Dealer Program

Offered by: Balkrishna Industries Ltd. (BKT)

Website: www.bkt-tires.com/en

Who’s eligible to participate? Agricultural tire dealers who purchase a minimum of 100 BKT units from their chosen distributor each year.

What are the top benefits for participants? Quarterly payouts, the direct relationships and support offered, and benefits such as promotional giveaways, truck wraps, Monster Jam events, etc. Number of participants: Just over 400 and growing each month.

What’s new in the program for 2019? In July of 2018, BKT made a number of changes to the program by adding new products, creating tiered payouts, and changing the structure of the program to promote growth. In 2019, we will continue to listen to our dealers’ needs and make the necessary changes for the program to continue its success.

Program name: Bridgestone Affiliated Retailer Nationwide Network

Offered by: Bridgestone Americas Inc.

Website: www.affiliatedretailer.net

The details: There are more than 50 membership benefits including advertising and promotion support, volume discounts, preferred auto parts pricing from nationally recognized suppliers, a national lubricants program, training, online sales capabilities, social media, a credit card program and a nationwide tire protection plan.

Who’s eligible to participate? U.S.- and Canada-based dealers with a positive image who are able to carry a minimum amount of inventory based on a good, better, best merchandising plan.

What are the top benefits for participants? Access to world-class brands including Bridgestone and Firestone passenger and light truck tires. Financial support for purchase and sell-out of Bridgestone, Firestone and Fuzion brand tires. Deeply discounted pricing on related services and merchandise. Award-winning training and education programs that include online, experiential and in-person sessions on what dealers need to know to be successful.

Number of participants: More than 2,850.

What’s new in the program for 2019? We have added an additional aftermarket auto parts supplier to our list of vendor/ partners available to our network members. Members will now receive competitive national account pricing and quarterly rebates on qualifying purchases from our new partners at Auto Value and Bumper to Bumper.

Program name: Continental Gold Program

Offered by: Continental Tire the Americas LLC

Website: www.ContiLink.com

The details: The goal of the Continental Gold program is to be the independent tire dealer’s number one partner and supplier. Being number one means gaining complete confidence in Continental’s product, people and program. It also means making Continental’s retail partners’ views and concerns a part of the process. The Gold Program offers dealers opportunities to grow their business with an easy-to-implement and dealer-friendly system that offers a spectrum of opportunities and a lucrative program that will maximize results.

Who’s eligible to participate? Independent retailers that are brick and mortar locations that sell to consumers and perform on-site mount and balance services.

What are the top benefits for participants? Industry-leading products that are easy to sell. A program that is easy to understand and earn rewards.

Number of participants: 2,500.

What’s new in the program for 2019? The Gold Program now features Dealer Business Suite, allowing dealers to connect and benefit from a network of preferred vendors for their business needs. Continental provides Gold dealers a way to gain access to our global network of suppliers and bring savings to their bottom line.

Program name: Cooper Medallion and Mastercraft Century

Offered by: Cooper Tire & Rubber Co.

The details: Cooper has two programs, Medallion (for Cooperbrand tires) and Century (for Mastercraft-brand tires.) Cooper provides marketing insights and assistance, product education, and other tools and techniques to help dealers build their business.

Who’s eligible to participate? These programs are for local, independent tire retailers. Entry into this program can begin with purchase quantities as low as 240 to 300 tires per year. Five levels of membership exist based on yearly purchase quantity. Cooper Medallion is available to dealers in the U.S. and Canada, and Mastercraft Century in the U.S. only.

What are the top benefits for participants? Members of Cooper’s Medallion program earn rewards for tire purchases and receive bonus payouts offered through strong additional promotions launched throughout the year. Cooper Medallion members may participate in annual consumer promotions. They receive members-only perks such as exclusive access to marketing insights and collateral, product education, and sales training through eCooper University. Members joining the Cooper Medallion and Mastercraft Century programs are eligible to receive a new member bonus enrollment award. The program’s highest performers have access to exclusive benefits, including an opportunity to participate in annual trips.

Program name: Fanatic Offered by: Falken Tire Corp. Website: www.fanaticdealer.com

Who’s eligible to participate? Independent tire retailers with a physical storefront and the ability to service customers on site.

What are the top benefits for participants? Cash rewards including quarterly promotions, location awareness through our easy-to-use dealer locator on the falkentire.com website, and showroom/exterior enhancements including an extensive line of POS materials.

Program: Goodyear Tire & Service Network

Offered by: Goodyear Tire & Rubber Co.

The details: The Goodyear Tire & Service Network was established in 2009 and offers tire retailers a total business solution for consumer tires and automotive service. There is also a similar program for Goodyear commercial dealers.

Who’s eligible to participate? Direct and G3X customers can work with their local Goodyear account manager to be nominated for the Tire & Service Network program. Contact goodyeardealerprograms@goodyear.com for more information.

What are the top benefits for participants? Nationwide warranties, national account support, training, and vendor parts and equipment purchase programs. The comprehensive marketing program includes point-of-sale materials, advertising support, the Goodyear credit card, national rebates, websites and other digital assets.

Number of participants: More than 2,500 members in North America.

Program name: Hercules Power Program

Offered by: Hercules Tire & Rubber Co./American Tire Distributors Inc. (ATD)

Website: www.herculestire.com

Who’s eligible to participate? Only independent tire retailers.

What are the top benefits for participants? Each Hercules retailer is offered limited geographic “protection,” which enables the Hercules retailer a higher profit potential at the point of sale. Hercules branded passenger and light truck products come complete with an exclusive enhanced protection policy including mileage expectation, no-charge replacement on road-hazards and workmanship and materials, plus our 45-day “trust our ride” test drive. It’s a combination of dealer support peace of mind for the dealer and consumer alike. Hercules retailers are eligible to capitalize on quarterly volume bonuses, retail rewards and an annual incentive trip.

Program: Hankook One

Offered by: Hankook Tire America Corp.

Website: www.hankookone.com

The details: Hankook One dealers are grouped into one of four volume categories and earn cash rewards in the top each of the four categories. A minimum of 320 annually is required to perform on the program with each per quarter dealer earns cash for every tire sold based on their annual tracking. At the highest level, Diamond, dealers who purchase at least 1,800 Hankook brand tires annually earn $8 per tire. In addition, dealers who sell one of the premium lines of passenger and light truck Hankook brand tires earn an additional $4 premium per tire.

Who is eligible to participate? Dealers not currently participating with one of the following can participate on the One Program: car dealers, direct Hankook customers (distributors, wholesalers or retailers), or government/fleet accounts.

What are the top benefits for participants?

1. Cash rewards based on volume and premium line tire sales. 2. Accrual of program points to purchase Hankook marketing materials, merchandise and travel for dealers who are tracking to Platinum (1,200 units) or Diamond (1,600 units or more) level annually (minimum of 300 units per quarter). 3. Participation in national consumer promotions/seasonal specials.

Number of participants: 4,100

What’s new in the program for 2019? Changes include no opening order required to apply to be a One dealer (in 2018, we required a 24 unit opening order), and changes in our minimum level requirements. Premium line changes – Hankook Optimo H727 has been removed, Hankook Dynapro AT2 (RF11) and Dynapro MT2 (RT05) were added to the premium lineup; Laufenn is now available on the One program as a volume enhancer and receives $1 per tire (volume bonus is only paid on Hankook-branded products).

Program name: Kenda Traction

Offered by: Kenda USA

Website: www.kendatraction.com

The details: It is offered in conjunction with authorized Kenda distributors, dealers earn up to $2 per tire between the Kenda Traction Black Card and co-op funds. Dealers earn rewards with purchases of at least 125 tires each quarter. The program is tiered, so more tire purchases qualify for higher payouts. Purchases of 125–249 tires each quarter qualify for tier 1, purchases of 250–399 tires qualify for tier 2, and 400 tires or more qualify for tier 3. Kenda works with its distributors to offer reasonable trade area management to enhance the retailer’s value with the Kenda brand.

Who’s eligible to participate? Independent dealers buying from authorized Kenda distributors. Email kendatraction@kendausa. com to confirm qualification.

What are the top three benefits for participants? The ability to earn money back via the Kenda Traction Black Card. Co-op rewards to use on future purchases and Kenda Store Access for shopping online with dozens of products. Plus, full access to a marketing portal for branding tools — product images, logos, digital advertising and catalogs, and inclusion in the dealer locator on www.kendatire.com

Number of participants: About 1,000 dealers.

Program name: Premium Fuel

Offered by: Kumho Tire USA Inc.

Website: www.Kumhoportal.com

Who’s eligible to participate? Retail stores with physical locations that do not have more than 10% in automobile and wholesale sales.

What are the top benefits for participants? The Premium Fuel program provides dealers with POP/POS items, quarterly bonuses, annual volume bonuses and travel bonuses for their hard work.

Program name: Alliance

Offered by: Michelin North America Inc.

The details: The Alliance program is intended to offer Michelin, BFGoodrich and Uniroyal shoppers an excellent retail experience at dealerships who demonstrate professionalism, product knowledge, convenience, integrity and excellent services. It addresses the needs of specific customer types, volume levels customized to meet dealers’ actual business requirements, providing each level of retailer a profit margin sufficient to succeed and grow in a competitive environment. To support its network that recommends the company’s tires, Michelin pursues quality service, analytic tools to meet varying market conditions, a variety of delivery options, and incentives and consumer promotions.

Who’s eligible to participate? For independent retailers, Michelin requires a minimum of 60% retail business, and, depending on the program type, a purchase minimum of 250 Michelin, BFGoodrich and Uniroyal tires combined (for indirect customers) or 5,000 Michelin Americas Small Tires (MAST) units for direct service. The dealer must also provide a welcoming environment for shoppers, competent salespeople who are willing to pursue various training courses and, the capability to provide expert tire and wheel service for today’s complex vehicles.

What are the top benefits for participants? MAST brands, Michelin, BFGoodrich and Uniroyal, are recognizable brands with reputations for performance and quality that command excellent or best-in-class brand equity for consumers. The loyalty of OE tire owners provides willing buyers for Michelin tires. A well-trained, energetic and technically adept sales force willing to share information, assist in market and business analysis with support for dealer merchandising efforts; lucrative incentive programs and funding for customer advertising and promotion efforts.

Number of participants: Approximately 7,000 independent dealer outlets. The company has 300 Alliance distributor warehouses throughout the U.S.

What’s new in the program for 2019? Michelin has expanded the indirect program to 14 different levels that make the program more aligned with dealer goals.

Program name: Mickey Thompson Marketing Alliance (MTMA)

Offered by: Mickey Thompson Tires & Wheels

Website: www.mtmaprogramsignup.com

Who is eligible to participate? Any brick and mortar retailer.

What are the top benefits for participants? Direct access to the manufacturer exclusive Power promotions for higher earnings and preferred status on our website to drive more business.

Number of participants: 350 unique members with 447 locations across the U.S. and Canada.

What’s new in the program for 2019? New buy-in level of 32 units to join. Online sign-up at www.mtmaprogramsignup.com, online portal at www.mtmaprogram.com.

Program name: Next Level

Offered by: Nexen Tire America Inc.

Website: www.nexentirenextlevel.com

The details: The program rewards our valued dealers for their loyalty to our brand and to provide them opportunities for future growth and profitability. Next Level offers generous cash back rewards paid out quarterly on most Nexen patterns, as well as a lucrative volume bonus structure.

Who’s eligible to participate? Approved tire retailers who purchase Nexen tires through an authorized Next Level distributor.

What are the top benefits for participants? Fast payouts, straightforward bonuses, and top-tier support.

Number of participants: 4,000 enrolled dealers.

What’s new in the program for 2019? A new website — www. nexentirenextlevel.com. We have updated the site to be more userfriendly for both our Next Level dealers and our authorized Next

Level distributors (with more to come). The new site will make our Next Level dealers more profitable by understanding their Nexen product mix and how to maximize their sell-out based on our data.