11 minute read

Annual Washington Visit

Annual Washington Visit An Advocacy Success Story

by Ava F. Roberts VP / Director of Government Relations This year, the ABA headed to Washington a little later than normal; the weather was sunny and relatively cool, and our delegation seemed more responsive than usual. Maybe that was due to the timing in early October rather than mid-September; maybe that was due to actual changes in federal regulation on the horizon. About 28 bankers joined the ABA for our quick visit, which began with a cocktail hour at the Promontory Interfinancial Network in Arlington. This beautiful evening, sponsored by Federal Home Loan Bank of Dallas, was on the rooftop of Arlington Tower, which looks straight up the Potomac. Everyone enjoyed spectacular views from the Washington Monument to the Pentagon. A few Hill staffers joined our crowd as we chatted about policy, stories from back home, and appreciated invaluable networking. Wednesday morning started bright and early at the American Bankers Association; association staff took turns advising and answering questions on policy issues from Community Reinvestment Act Reform, in which we were told the Treasury plans to get report out by the year end and advised to tell lawmakers the inconsistency of how examiners apply the regulations, to speculation of CFPB Director Cordray’s tenure. Both lunch and breakfast were spent with American Bankers staffers, including a special advocacy training session. Eli Woerpel, Grassroots Manager of AmBA, walked the group through a new advocacy tool available to all members. Banks now have the ability to personalize advocacy messages to our federal delegation. From your logo, to the letter draft, your story may be personalized and shared among your bank employees. This tool is approachable, fast, and effective grassroots activity. Contact ABA’s Government Relations Division (contact information at the end of this article) to learn more. After quick lunch at AmBA, we were joined by four representatives from CFPB. As a whole, they were more congenial and interested than in the past, even asking for specific issues banks have with TILA/RESPA. The CFPB representatives seemed surprised and intrigued when asked to exempt vacant land from TRID, with the reasoning that consumers do not understand the forms the waiting periods for that type of land. Clearly, there must be a shortage of vacant land in the beltway!

The group’s Tuesday evening view of the entire National Mall. Special thanks to Federal Home Loan Bank of Dallas for sponsoring the evening and to Promontory for opening their doors to the Arkansas bankers.

Three SBA employees joined us next. They were eager to ensure everyone is aware of the request for comment period to bring up any issues SBA presents that may be problematic for bankers. Bill Holmes then brought up the matter of small business data collection to ask whether SBA will change the statutory definition of small business. These SBA representatives gave no indication there would be a change to any codes currently in place. The small business data collection issue was discussed in several of our meetings, most notably with CFBP, SBA, and the FDIC. The CFPB explained they wanted to use this information to locate ‘credit deserts,’ so they could connect banks and businesses. They also reiterated they only want a finite set of data points, which, they alluded, should not be that onerous. However, our members were quick to explain simple is best and suggested, instead, CFBP return to Congress to explain how difficult gathering this information is and how detrimental it would be to small business lending across the nation. One of the group’s afternoon meetings was with FDIC Chairman Martin Gruenberg, who opened his discussion with the statement “we have largely recovered from the crisis.” However, he pointed out that regulators are paid to

(Top) Attendees of the Annual Washington Visit were , in front, Brad Chambless, Farmers & Merchants Bank; Jim Cargill, Arvest Bank; Chip Blanchard, First State Bank; Jeff Lynch, Eagle Bank & Trust; Patty Barker, First State Bank; Michael Shelton, Generations Bank; Joe Miles, Integrity First Bank; Cathy Owen, Eagle Bank; Arkansas State Bank Department Commissioner Candace Franks; and Ava F. Roberts, Arkansas Bankers Association; in back, George Makris III, Simmons Bank; Marty Casteel, Simmons Bank; George Makris II, Simmons Bank; Steve Massanelli, Simmons Bank; Robert Fehlman, Simmons Bank; Jim Taylor, First Security Bank; Kenneth Barnard, First Service Bank; Dave Dickson, Union Bank & Trust, Bill Holmes, Arkansas Bankers Association; Barry Jackson, Arkansas Bankers Association; Patrick Burrow, Simmons Bank; Hunter Norton, First Security Bank; and Don Walker, Arvest Bank

Annual Washington Visit Attendees

Dave Dickson, ABA Chairman Union Bank & Trust Co. Cathy Owen, ABA Chairman-Elect Eagle Bank & Trust Commissioner Candace Franks Arkansas State Bank Department Patty Barker, First State Bank Kenneth Barnard, First Service Bank Chip Blanchard, First State Bank Patrick Burrow, Simmons Bank Jim Cargill, Arvest Bank Marty Casteel, Simmons Bank Brad Chmbless, Farmers & Merchants Bank Randy Dennis, DD&F Consulting Group Robert Fehlman, Simmons Bank Eric Haar, Federal Home Loan Bank of Dallas Jeff Lynch, Eagle Bank & Trust George Makris, Simmons Bank George Makris III, Simmons Bank Steve Massanelli, Simmons Bank I. Joe Miles, Integrity First Bank Hunter Norton, Emerging Leader First Security Bank Michael Shelton, Emerging Leader Generations Bank Jim Taylor, First Security Bank Don Walker, Arvest Bank Bill Holmes, Arkansas Bankers Association Barry Jackson, Arkansas Bankers Association Ava F. Roberts, Arkansas Bankers Association

H.R. 1116, the TAILOR Act The TAILOR Act, which was approved on a 39-21 vote, directs the federal regulatory agencies to tailor their rulemakings in consideration of the risk profiles and business models of institutions that are subject to such rules.

H.R. 2396, the Privacy Notification Technical Clarification Act This bipartisan bill simplifies the notice requirements for financial institutions that have not changed their privacy policies. Under the bill, which was approved on a 40-20 vote, institutions that only share information within the statutory exceptions could use a simple disclosure mechanism using the Internet.

H.R. 2706, the Financial Institution Customer Protection Act This legislation, which was approved by a 39-1 vote, prohibits the federal regulators from requesting or requiring a financial institution to terminate a banking relationship unless the regulator has a material reason. In addition, account termination requests or orders would be required to be made in writing and rely on information other than reputational risk.

H.R. 2954, the Home Mortgage Disclosure Adjustment Act H.R. 2954, which received a 36-24 vote, exempts small banks and credit unions from the new Home Mortgage Disclosure Act (HMDA) reporting requirements if they have originated 1,000 or fewer closed-end mortgages in each of the two preceding calendar years or originated 2,000 or fewer open-end lines of credit in each of the two preceding calendar years. The bill also repeals the HMDA amendments included in the Dodd-Frank Act and withdraws the CFPB’s rule to impose the new and modified HMDA data points scheduled to take effect in January 2018.

H.R. 3072, the CFPB Examination and Reporting Threshold Act This legislation raises the examination threshold for institutions subject to the supervision and reporting requirements of the Consumer Financial Protection Bureau from the current $10 billion to $50 billion. It was approved by a 39-21 vote.

H.R. 3312, the Systemic Risk Designation Improvement Act This legislation removes the arbitrary $50 billion asset threshold used to designate firms as “systemically important financial institutions” (SIFIs) and subject them to enhanced regulatory standards. Instead, the Federal Reserve would be charged with making a determination that an individual financial institution, or group of institutions, is systemically important and subject to enhanced supervision and prudential regulation. The bill was approved by a vote of 47-12.

H.R. 3971, to Amend the Truth in Lending Act and the Real Estate Settlement Procedures Act of 1974 This bipartisan legislation provides needed relief for smaller lenders with regard to escrow practices. The legislation exempts lenders with $25 billion in assets or less from escrow requirements on Higher Priced Mortgage Loans they hold in their portfolios and provides regulator relief for small services, defined as those servicing 30,000 loans or fewer, by exempting them from various servicing requirements. This bill was approved by 41-19.

see the cloud in every silver lining. He advised our members to concentrate on succession planning and attracting young people to work for banks, which is nothing new to the worries of Arkansas banks. The Chairman said a proposed rule to raise appraisal threshold is forthcoming; that members should identify parts of Arkansas with shortage of appraisals and the FDIC would issue an exemption. We thanked the Chairman for interagency cooperation and for making some regulatory reforms and headed out to the OCC. Our final regulatory of the day took place at the OCC. Several employees, including Acting Comptroller Noreika, joined us for a concise discussion of regulatory reform. We learned the Volker rule comment period resulted in 2,800 comments and were asked to send comments on their Capital Simplification Rule. Issues with CRA were shared again, with one banker explaining the discretion and the disconnect of examiners on the ground versus OCC in Washington; this banker was advised he was in violation because he had no loans in a certain region near his bank. The banker drove the examiner to that area to demonstrate the location in question was Ouachita National Forrest. OCC employees were interested and wanted follow up information regarding this event. Sharing your stories in person frequently warrants results. Wednesday culminated with the annual staff party, taking place for the second year at Sonoma Wine Bar. Hill staffers piled in, ate pigs in a blanket,

(Above) Congressmen Womack and Hill join at the podium to share political insight and their efforts on behalf of Arkansas bankers.

(Above Right) Senator Tom Cotton speaks to Arkansas bankers on the steps of the U.S. Capitol Building in Washington, D.C.

(Right) Senator Boozman explains one of the most important things bankers can do for their industry is meet face-to-face with our delegation in Washington.

and networked with bankers. Senator Boozman joined us for the second year in a row and Congressman Westerman was welcomed to our party. This event is always very popular with staffers, nearly all from each office attend, and an extremely effective way to get to know the legislation writers. Tuesday morning began at the House Visitor Center, with a breakfast with our congressional delegation. Each member was present, with some having to head

out quickly to various meetings that were called that morning. Congressman Hill discussed the breaking up of the Choice Act and how pieces of the legislation does remove small business data collection. Both Congressman Womack

and Congressman Hill discussed the proposed tax reform at great length. Bankers were reminded of how fortunate we are with our Arkansas delegation by seeing them work together and hearing of our victories as potential advancing leadership positions in the House. From the House Visitor Center, the group was led outside to meet Senator Cotton on the Capitol steps. Bankers huddled with the Senator to thank him for his work on our behalf and also to discuss important advocacy topics. The Senator assured us he understands banking issues and is working diligently to promote regulatory relief. Senator Boozman stepped out of a meeting to see us in the Senate building. The Senator congratulated us on the number of bankers present during our trip. He explained that seeing large numbers in Washington is a very effective way to promote actual regulatory relief. Since the fall Washington visit, we have had several successes in the House Financial Services Committee. Although our trips are quick and the fight for federal relief can be frustrating, we can never stop pushing. All industries advocate and most of those industries rely on the banking sector to be successful. We are blessed our delegation realizes that, but we must continue to share stories, comment on rules, and meet face-to-face with our delegation whenever possible. Special thanks to each and every banker that attended our fall Washington Visit. We depend on each other for effective advocacy efforts. Please see the sidebar on page 20 for more detailed information regarding recent successes in the House. We urge you to contact your Congressman to let them know of these successes and to reach out to your Senator to ask for more movement in the manner of financial regulatory relief. To discuss matters in this article further, contact Ava Roberts at 501-978-3606 or ava.roberts@arkbankers.org. (Above) Cathy Owen, Eagle Bank; Dave Dickson, Union Bank; and Chip Blanchard, First State Bank; listen as Karen Solomon, Deputy Chief Counsel of the OCC discusses rulemaking comment periods.

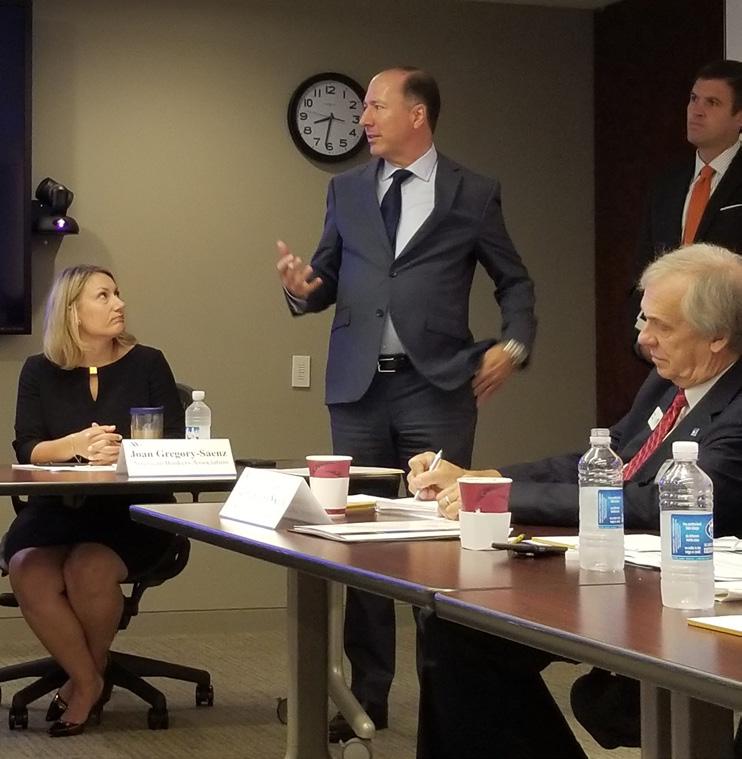

George Makris II, Simmons Bank, explains policy changes necessary to the efficiency of banks to staffers in Senator Cotton’s meeting room, the Razorback Room.

Jim Taylor, First Security Bank, discusses HVCRE with OCC Counsel, while Michael Shelton, Generations Bank, and George Makris, III, Simmons Bank, look on.