5 minute read

Government Relations: Annual Washington Visit

A group of 27 bankers and guests made the trip to our nation’s capital September 15-17 for the ABA’s Annual Washington Visit. This year’s event started out with something different: a dinner reception at President Lincoln’s Cottage. In addition to networking and dining on the lawn with Legislative Assistants, Congressman French Hill, and Senator John Boozman, our group was able to tour the historic estate, even taking the opportunity to stand in the very room where President Lincoln drafted the Emancipation Proclamation. While a new tradition for us, events of this nature will continue during our Washington Visits. Pushing the Pendulum VP / DIRECTOR OF GOVERNMENT RELATIONS AVA FRANKS

American Bankers (AmBA) opened their doors to our group on Wednesday morning with breakfast and prep work. We discussed current bills and the approaches to get them moving, including what to say to your Congressmen when you call or write, and pointers to keep in mind when conveying your message. An important takeaway from this session is to focus on specific stories concerning the impact of federal over-regulation on customers, such as inability to receive a loan, or the amount of time it now takes a customer to receive those monies. While at AmBA, our group met with representatives from the Consumer Financial Protection Bureau (CFPB) for a briefing. It was nice to have them on our turf, if you will, and a mostly candid discussion commenced, including much about TRID and its effective date this month. CFPB verbally assured us that examiners will not examine immediately following the TRID effective date, but will instead look at a best efforts approach. Discussion advanced to small customer loans. CFPB said they need to hear from the bankers that make small loans 1 , because they want to know how big the market is for these loans. Our bankers immediately spoke up—almost simultaneously—with examples of why one would need a small loan in Arkansas: air units, car maintenance, Christmas presents, catch-up money! Our bankers deal with these issues on a daily basis, and know what matters Arkansas customers face; as one banker stated, Idealistically, CFBP’s lending works; realistically, our customers need their money now.

Next, we met with the Conference of State Bank Supervisors (CSBS) for lunch and strategizing among allies. CSBS left us with this message: Congress has a short attention span and you have to keep coming. If you do not stay in front of them, they’re going to forget us, even if it is frustrating and you feel like you’re saying the same thing over and over.

12 The Arkansas Banker | October 2015 From CSBS to a brief stop at the Federal Housing Authority (FHA), we then marched onward to the Office of the Comptroller of the Currency (OCC). Similarly to the CFPB, the OCC expressed that examiners will execute fines for those that blatantly disregard the rules, and intend to take a checks-andbalances approach with regard to fines. The chief of staff affirmed that “we aren’t expecting perfection on day one, we expect effort.” After a bit of discussion surrounding cybersecurity and its impact on our banks, we were off to the Capitol to meet with Senator Boozman for our final meeting of the day. Senator Boozman sat among us and discussed the universal impact of Federal over-regulation: if you can’t get a home loan, you aren’t buying plumbing fixtures to go in those homes. We broached S. 774, the Financial Institutions Examination Fairness and Reform Act, which, among other issues, mandates a 60-day time frame for examination reports. The Senator was interested to hear examples of turn-around periods for Federal exam Congressman French Hill speaks with ABA Chairman Robert Taylor, Parkway Bank, Rogers; and his wife, Judy, during the group’s dinner reception at President Lincoln’s Cottage.

1. The determination of what constituted a “small loan” was debated, but seemed to range below $8,000 for CFPB.

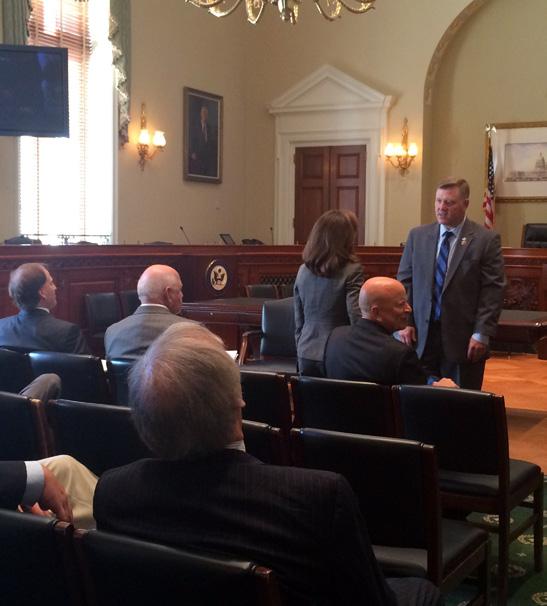

reports. Examples such as these help our Representatives with negotiations and in testimony. Thursday was spent at the U.S. Capitol. Our morning began with a breakfast meeting with Congressmen Steve Womack, French Hill, and Bruce Westerman, during which Congressman Womack explained the importance of keeping our ‘majority makers,’ or members with seniority. Congressman Hill gave some very good advice: call Congressional staffers to tell your stories and facts. The information you share with our Congressmen becomes ammunition at the negotiation table. Senator Cotton and Jonathan Hiler, Cotton’s Legislative Assistant, reiterated the need for stories. When our bankers shared customer impact accounts, they took notes. One banker recounted the story of a long-term customer who would rather borrow from the bank at a higher rate than do business with someone he did not know, yet the bank was unable to lend to that customer. The Senator promised he would help bankers get language into the bills that would offer the most relief, but stated he could not promise he would vote for that bill because he did not know what would ultimately be packed into it. The stakes are high in Washington right now. Perhaps one of the more spontaneous opportunities we had during our trip was the chance to have our last meeting in a House Committee room with Congressman Rick Crawford. The Congressman asked each banker to introduce him or herself and provide an example of needed relief, which turned into a “we didn’t cause these problems” discourse. With regard to federal relief, an Emerging Leader declared: “I’m ready for the pendulum to swing the other way.” We just have to keep pushing. These trips are always good, beneficial, and worth our bankers’ time; these trips are also vital to federal regulatory relief. Face time with your Congressman is of paramount importance because it is how we keep our message in the forefront of the (Above) Sean Williams, First National Bank of Wynne, Wynne; House Financial Services Committee Chairman Congressman Frank Hensarling (R-TX); Robert Taylor, Parkway Bank, Rogers; and Jim Taylor, First Security Bancorp, Fayetteville. (Left) Arkansas bankers had a sit-down meeting with Congressman John Boozman during the Annual Washington Visit, with conversation focusing on overregulation and its impact on bank customers.

Cathy Owen, Eagle Bank, Little Rock, introduces herself to Congressman Rick Crawford during the group’s final meeting of the trip on Thursday, September 17. Congressman Steve Womack — along with Congressmen Hill and Westerman — had a breakfast meeting with the Arkansas bankers.

fight. Share your stories, call your Congressman; we do not have much longer before the year runs out, so let’s push on. Send me examples of Federal Law impact on your customers at ava.franks@arkbankers.org!

Cary Martin of Little Rock Tours, Little Rock, AR

LENDING E MPOWERMENT - together with your bank -