7 minute read

2024 PAST CHAIRMAN’S DINNER

From Agriculture To Law To Banking

“There are several seed companies in that part of the state, and I already had an offer to go get your degree, come back and you can take over for us. That was the plan and that's exactly what happened. I came back home in 1990 and started work operating that seed company and realized very quickly I didn't want to work 16 and 18 hours a day when trucks are coming in and out,” Chambless said.

Soon after working full-time for the seed company, he took the LSAT pre-law school exam and took off to Fayetteville to get his law degree.

“I graduated from there in 1996 - which seems like a million years ago now - took the bar and passed. During that interim period when I'd taken the bar and got my score for licensure, I worked for a local attorney. Kenny Johnson gave me my first job and I began immediately in litigation. That was the path. He was a great litigator. I started trying cases with him, as I was not a transactional type lawyer. I always wanted to be in court and practice,” he said.

Chambless and his wife, Ja, located in DeWitt to practice law and raise a family.

He represented some area banks, but Farmers and Merchants Bank headquartered in Stuttgart wasn’t one of them. Still, they came calling on Chambless. Being as well-connected in southeast Arkansas as he was, the bank wanted him to be a market president and commercial lender. Chambless couldn’t see the path of exiting his law practice and going to work for the bank, so he turned them down.

Also capitalizing on his agricultural background, Chambless represented a variety of farm-related cases, including a seed company that proved to be a landmark case.

“In 2005, I tried at that time the largest seed intellectual property case in the nation in federal court. I'd also just had my first child and was living the dream. Practicing law is one thing, but when you layer in your first child, it kind of changes your perspective,” he recalled.

The new dad had been in court for more than a half-month on the trial and had not seen his newborn son during most of that time.

“When I came home from that long jury trial and had not seen my son in two-and-a-half weeks, the bank showed up at the door and they were like, ‘We want to talk to you again.’ And I'm like, ‘I'm not as hardheaded as I used to be.’ We started a conversation. I took that leap of faith and they've been better to me than I could have ever asked for my family. It also gave me structure and the ability to go home on my terms and know where I was supposed to be for my family. That's how I pivoted and came into banking,” he said.

Family First

Putting family first was the motivation that shifted Chambless’ career path into banking. He beams with pride when the conversation turns to his wife, Ja. She is the director of the Pattillo Center-School in DeWitt, now the family’s hometown.

The school was established to meet the needs of children with developmental disabilities and their families in the Arkansas County region. The center focuses on intervention and offers speech therapy, occupational therapy, and physical therapy.

“She services the entire county of Arkansas County and services about 105 children every day. Most of those families don't have the means to get them there and they certainly couldn't get them to metropolitan area like in Easter Seals here that they would love to get to. It is just not economically possible and it's her passion and her calling.”

The Pattillo Center is named after Don Pattillo's family, a previous president and CEO of Farmers and Merchants Bank. Chambless described him as “a great banker, a great mentor.” Pattillo had been in business a long time and had a similar background to Chambless having also been an attorney.

Chambless’ two sons are 19-year old Reece, a student at the University of Central

MAJORING IN AGRICULTURAL BUSINESS AND ECONOMICS, HE WORKED FOR A LOCAL FARMER THROUGH COLLEGE AND HAD INSTANT EMPLOYMENT UPON GRADUATION IN THE AGRICULTURE SECTOR.

Arkansas, and 15-year old Jackson, a 10th grader at DeWitt High School (Go Dragons!). He’s been known to coach a team or two for the boys, who have been active in baseball, basketball and golf.

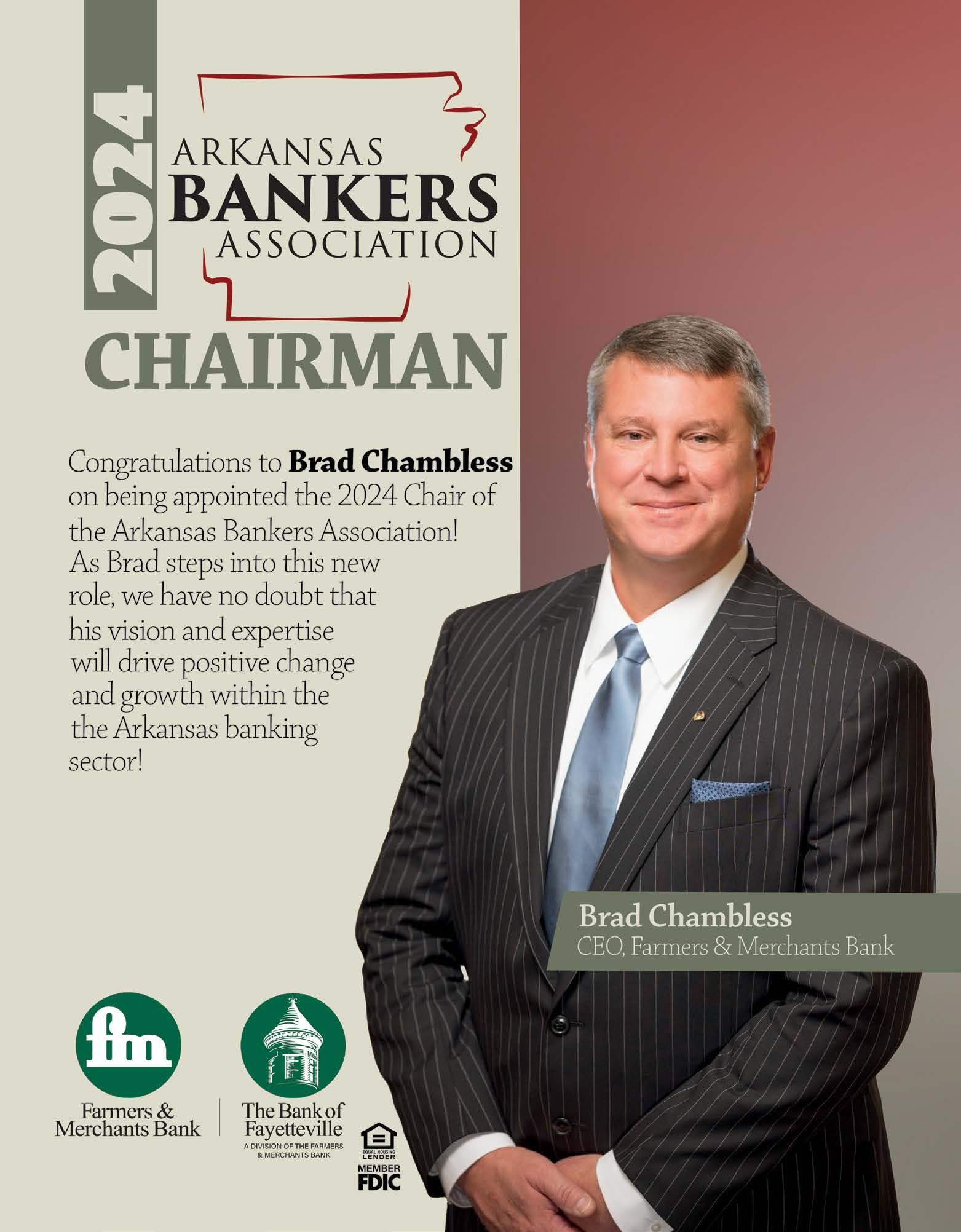

Climbing The Banking Ladder

Farmers and Merchants Bank is headquartered in Stuttgart, Arkansas and has branches in Des Arc, DeWitt, Hazen, Morrilton, and Perryville. It was founded in 1945 and has made two major acquisitions in the last decade. In 2015, Farmers and Merchants acquired The Bank of Fayetteville to broaden its footprint into bustling Northwest Arkansas. In 2019, the bank’s holding company purchased Integrity Bank of Mountain Home, which also had branches in Bentonville, Gassville, Lakeview, Pocahontas and Jonesboro. Chambless was named President and CEO in 2021.

When Chambless started his banking career, Pattillo was the president. His advice to Chambless?

“You're going to make mistakes. Just make sure they're little ones,” Chambless laughs.

Gary Hudson succeeded Pattillo, and Chambless also considers him a great mentor and role model.

“I was very fortunate beginning with Mr. Pattillo and then further with Gary Hudson. They encouraged me and asked me to engage and be a part of the legislative side of the Banker's Association,” he said, noting that his legal background positioned him to be knowledgeable and tactical on dealing with state and federal legislation and its potential impact on banking.

“I began traveling some with the state association to Washington D.C. learning the regulatory side of banking and then dealing with our delegation on an in-person basis there. That moved from one trip a year to two trips a year, and I continued to grow with the association. I was then asked to come onto the board and worked up through the leadership program,” he added.

As he has moved into the ABA Chairman's role, Chambless' experience as government relations chair for the association, which puts him square in the middle of a plethora of state and federal legal issues. At the state level, Arkansas lawmakers have pushed for protections for elder abuse and have chosen to regulate state investments regarding Environmental, Social and Governance (ESG) decisions.

“When the legislature goes into the session, which will happen in six months, we'll be super busy and start tracking all of the state bills along with everything that's federal,” he said.

THE CHAIRMAN’S BIGGEST ISSUES

Elder abuse is a major concern for Chambless. He has seen it happen to unsuspected elderly customers with his bank and he knows it’s a widespread issue. The warning signs can range from nervous customers with strangers, online scams to simply noticing checks out of sequential order.

“I deal with elder exploitation almost daily. This week alone, I've had two cases that I've had to deal with,” he said.

He sees three overarching themes in most cases where elderly customers are exploited. Older Arkansans are more trustworthy than younger generations and that can often lead to them helping someone in need without being careful. Social media and technology have developed new methods for predators to prey on the elderly. And, the COVID-19 pandemic created a new wave of scams that targeted older bank customers who were isolated and lonely.

“It's hard to believe it's possible, but it's heartbreaking,” Chambless said.

In the month of June, the Arkansas Bankers Association made a big push to its member banks to provide materials to raise awareness of elder financial exploitation.

“The other thing that I really have a passion for are veterans and service members. We are really trying to make a big push to make products available, especially in some of our more rural markets, some of the markets that I operate in. We're creating products and services just to give a reward and service for those who've already served and allow us to do what we do,” he said. “Out of utter respect, there are a lot of service members who need some help and some support, whether they're active or inactive as veterans.”

Other regulatory issues that will be on Chambless’ radar during his term as ABA Chairman include:

• Section 1071 of the Dodd-Frank Act, where small business owners will have onerous data reporting requirements put on them;

• The Corporate Transparency Act that will require business owners to submit additional data to a government type repository or database; and

• The Durbin amendment, which would reduce credit card transaction fees and shift fraud costs onto issuers and consumers.

As chairman of the Arkansas Bankers Association, Chambless expresses a lot of pride in the organization and the difference it is making for the industry and the communities they serve.

“For me, it's about small town banking, rural Arkansas. There are more banks in rural Arkansas than there are in our urban areas just because we can't afford to have banking deserts. Community banks have always carried that burden of making sure that all of our communities have consumer and business products that are fair and equitable to keep that community thriving and growing,” he said. “I think it was never more true than when the government asked us to engage in PPP, the Payroll Protection Program. The government could not have pulled that off without Arkansas banks.”

CONSUMER AND BUSINESS PRODUCTS ... TO KEEP THAT COMMUNITY THRIVING AND GROWING.”

“My goal is to always say 'thank you' to the member banks we have around the state for what they do and make sure that it's a source of pride. It should be. Every banker in Arkansas should have that pride when they wake up. A community bank is only known as a community bank by its customers, but if you do it correctly, that community should see you every day taking care of that community and all of the people that have needs in it,” Chambless said. “It's just super important that we keep our community banks very strong.”