WE’RE RAISING THE BAR WITH SUPERIOR INDUSTRIAL ASSET

ADVISORY & REMARKETING SOLUTIONS

The bottom line

ALLIANCE

KEY STATISTICS

• A$75 billion of assets valued annually

• A$18 billion of assets disposed annually

• Visits to all websites: 152,000,000+

• Buyers from 150+ countries

• Equipment & Machinery Assets Sold: 600,000 in 2021

The cost-effective end-to-end asset solution that achieves the result you want, when you need it.

How

• Successful valuation and sale of assets

• The world’s largest database for buying and selling industrial equipment

• 24/7 digital marketplace

Our promise? Superior outcomes for you and your clients.

Innis

Editorial

Subscription

$49.00

Australian

ABN

Cover

MICHAEL BRERETON ARITA President, Director, William Buck

MICHAEL BRERETON ARITA President, Director, William Buck

PRESIDENT’S NOTES

It was with great delight that we saw the announcement at the end of September that the Parliamentary Joint Committee on Corporations and Financial Services was launching an inquiry into insolvency.

For the better part of five years, ARITA has been calling for a ‘root and branch’ review of our personal and corporate insolvency regimes. Earlier this year we substantially stepped up on advocacy work on this front, retaining the unquestionable expertise of the former Productivity Commissioner, Dr Warren Mundy, to advise the Board and our CEO. It was Dr Mundy who led the PC’s inquiry into Business Setup, Transfer and Closure in 2015 – being the only broad-ranging review of our regime and the roll it plays in the economy since the Harmer Inquiry of the 1980s.

The PJC’s inquiry announcement came just a few weeks after Dr Mundy and our CEO met with the PJC Chair to raise our concerns about the increasing urgency for such a review to take place as the global economy moves into more challenging times.

LAYING THE FOUNDATIONS FOR HOLISTIC REFORM

We see this inquiry – the first review of any type in three decades which was formed purely to consider the appropriateness of our current insolvency policy settings – as laying a foundation for the reform agenda. As a parliamentary inquiry, it will not redraft our legislation. Nor will it have any decision-making force. Those steps come later and, most likely, with further review from somewhere such as the Australian Law Reform Commission.

This inquiry has the ability to recommend to all sides of government that some types of reform are needed, and to give priority to that process of starting change.

Good reform shouldn’t be rushed. In our space, we’ve seen the consequence of band-aid solutions over the last couple of decades: pancaked law that is overly complex and unwieldy. So, we are deeply supportive of a process that will hopefully identify and recommend some ‘quick fixes’ while laying the foundation for holistic reform.

“ARITA will be strongly prosecuting the case for supporting the profession, and for delivering a better regime for all stakeholders.

ACCEPTING THE POLITICAL RISK

We’ve heard from many members that they are concerned that some of the terms of reference of the inquiry may see elements of it revert to the old pattern of accusation and blame of practitioners. Given the nature of the inquiry, it will naturally attract detractors. However, that’s a reality in almost every jurisdiction around the world and shouldn’t stop us from pressing for much-needed reform.

Indeed, those very reforms that we seek should help mitigate a good portion of the angst created by our current regime.

ARITA will be strongly prosecuting the case for supporting the profession, and for delivering a better regime for all stakeholders.

FINALLY, A SEASON OF GETTING TOGETHER AGAIN

ARITA recently wrapped up our conference program for the year and, as President, I was truly delighted to be able to be a part of our Small Practice and National Conferences.

The verve at both conferences was tangible and it was wonderful to be back in the room with members from across the country. Attendance at both events was surprisingly strong and we are grateful to everyone who attended for their support.

Best wishes to all for the festive season and we look forward to what 2023 brings.

Emma

Emma

Alexandra

Ali

JOEL BAROLSKY Principal, Edge International, and strategy consultant to law and accounting firms

JOEL BAROLSKY Principal, Edge International, and strategy consultant to law and accounting firms

MAKING THE RIGHT STRATEGIC CHOICES

Add value to your practice by adopting an innovative mindset to ensure you stay ahead.

One of the most important jobs you have is to develop a winning strategy for your firm. Put simply, strategy is the set of choices you make to maximise the chance of winning in the environment you compete in.

The set of strategic choices you have will usually include things like service range, market focus, people, pricing and brand.

‘Innovation’ is another essential decision domain. Doing nothing on the innovation front is a default choice because the external environment will keep changing, even if you don’t.

Dr Amantha Imber, the chief judge in AFR ’s Most Innovative Companies Awards, defines innovation as ‘change that adds value’. Using that broad definition, we note that insolvency and restructuring firms have three primary choices regarding innovation.

This article explores these three strategic choices and the options and practical issues in addressing them.

STRATEGIC CHOICE #1:

INNOVATION MINDSET AND RISK APPETITE?

Your firm’s overall innovation mindset and risk appetite is the first choice you need to make. This decision is about finding the ideal position on a continuum, with being highly innovative at one end and a laggard or late adopter at the other. The diagram below describes two intermediate points along the continuum – a Fast Follower or Sync with Majority.

In working out your ideal position, it is worth recognising the forces at play pulling you towards the two opposite ends.

Most professional services firms are naturally predisposed to a more conservative and risk-averse position. When weighing up some uncertain future innovation benefits against the immediate direct cost of time and money, and the risk to reputation and morale, the ‘Late Adopter’ position often seems the most prudent approach to take.

There are other factors that often encourage a more conservative approach:

• Firms are currently producing acceptable profits

> no obvious burning platform to provoke change.

• Many clients are not demanding significant change

> no burning platform.

• Partnership ownership structure

> no retained funds and impatient capital.

• Focus on the billable hour and utilisation

> experimentation discouraged and little time for innovation.

• No reward for intrapreneurs or risk-takers

> no one puts their hand up to lead innovation initiatives.

• Accountants are trained sceptics

> culture demands precedent/proof.

• No established innovation methodology

> good ideas go nowhere.

In contrast, the forces pulling firms in the other direction – towards the Innovator end – are growing in significance. Significant technological advances, new hybrid working arrangements, and additional cost and revenue challenges are forcing firms to question whether the past ways of working should continue into the future.

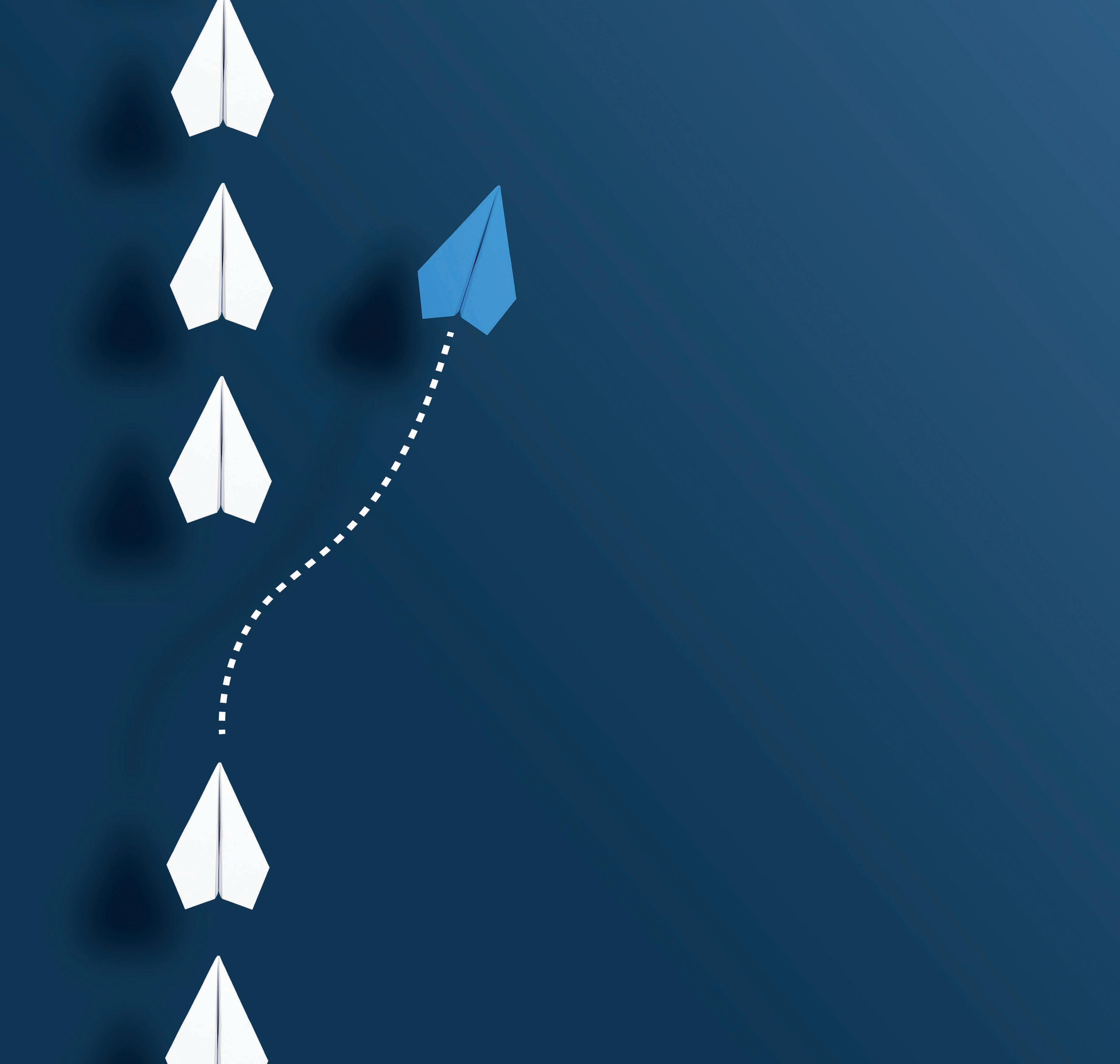

On the technology front, virtual conferencing is revolutionising creditor meetings and voting. Online portals are improving stakeholder communications. Cloud-based accounting software like MYOB and Xero are a game changer in service productivity. Machine learning algorithms to detect fraud have the potential to make workouts better, faster and cheaper.

Hybrid working means firms can fish for talent in new pools and have more flexible work schedules to accommodate staff with competing demands.

The most obvious benefit of moving towards the Innovator end is creating an advantage over direct competitors. It can also help firms access much larger mandates and compete with firms that have more staff and offices.

STRATEGIC CHOICE #2: FOCUS OF INNOVATION EFFORTS?

The second major choice refers to where you can focus your innovation efforts: external, internal or on the boundary.

When exploring external opportunities, it is worth drawing on the work of Bain & Co Partner Chris Zook, otherwise known as the father of adjacency theory. Zook states that firms usually consider adjacencies for the following reasons:

1. Provide new sources of profitable growth, especially if the core business is flat or in decline.

2. Strengthen, reinforce or defend the core business.

3. Compete in the core market in a new way or with a redefined business model.

4. Provide a hedge strategy or mitigate risk in the event of significant industry disruption.

5. Enable the firm to achieve or live its purpose more profoundly.

In his book Beyond the Core, he suggests six types of external adjacencies as illustrated in the diagram below.

“If you’re not keeping pace or changing faster than your competitive environment, you’re going backwards.

The client journey may be adjusted for different client profiles or personas, for example, first-timers or experienced purchasers.

In one professional services firm, client journey mapping found that long-standing clients were irritated by the fact the firm’s reception staff didn’t acknowledge them. In response, the firm turned an ‘ow’ into a ‘wow’ by asking reception staff to do a LinkedIn search of all office visitors at the start of the day and then to greet all visitors by name.

Zook’s research provides some useful rules of thumb regarding growing into adjacent areas. The odds of success of a move that is one step from the core business is around 35% (across all industries) and drops to less than 20% two or more steps from the core. The old adage of ‘sticking to one’s knitting’ comes to mind when considering these odds. Countering this narrative, the maxim that ‘fortune favours the brave’ is also worth considering.

The second focus area for innovation is on the boundary, that is, client experience and client interface opportunities. A growing body of research shows that a frictionless and emotionally engaging client experience is a powerful driver in fostering client loyalty and referrals.

Improvement to client experience usually starts by mapping the client journey for a typical client and then asking: (1) which steps or activities on the journey are ‘ow’ (causing pain, making life harder, causing irritation), and (2) where’s the potential for ‘wow’ (adding value, creating joy, engendering trust).

The third area of focus of innovation efforts is internal. The usual drivers here are improved efficiency and effectiveness. The Barolsky Professional Services Value Chain below can help identify specific areas worthy of innovative change.

So, for example, if ‘Service delivery – Workflow and process design’ is selected, the firm would then identify innovation opportunities by addressing three interrelated questions:

• People

What changes to ways of working, behaviours, roles and responsibilities and organisational or team structure are possible and will add value?

• Process

What changes to how tasks are performed and who performs them will add value?

• Technology

What changes to existing technology or the introduction of new automation technology can add value?

STRATEGIC CHOICE #3: ROLE AND IMPACT OF FIRM CULTURE?

The firm’s culture can be both a constraint and an enabler of innovation. If a decision is made to adopt a more innovative mindset and be less risk-averse (Transform), a shift in the firm’s culture is likely required to align with this new intent.

SEVEN AREAS THAT CAN CATALYSE CHANGE

When shifting culture it is worth reflecting on seven areas that can catalyse change, as reflected in the table below. These areas are loosely based on the McKinsey 7S framework.

IN CONCLUSION

If you’re not keeping pace or changing faster than your competitive environment, you’re going backwards.

The turbulence in insolvency and restructuring has dialled up a notch or two in recent years. Economic conditions are deteriorating for many businesses, and regulatory change never stops. Technology is making a significant impact on the way work is produced, and service is delivered. The Covid-19 pandemic has transformed the way we work and interact.

In this world, you can keep on keeping on, or you can explore with much more rigour whether you need to become more innovative. Innovation will help you start to make changes that add real value.

Area Detail Example

Systems The firm comprises numerous systems that influence and shape culture, e.g. remuneration, performance management, production, communication, etc.

Stories War stories and case studies convey compelling messages around the behaviours and attitudes that underpin the desired culture.

Style The style and role modelling of the firm’s leaders in support of the changes.

Staff The firm hires and develops people with the requisite innovation mindset.

Structure The firm is redesigning its organisational structure to provide more dedicated resources for innovation efforts. The structure could also relate to the power given to those with an innovation role.

Symbols The symbols of change ranging from tangible changes in office design to more tacit indicators of what’s more or less important.

Shared values The statement of core values used by the firm in its strategy documents, performance reviews and published materials about the firm.

A tweak to our performance management and reward system gives more weight to innovation efforts in bonus decisions.

We often tell the story about the associate who was given 4 hours a day budget relief to re-engineer the XYZ process. His efforts ultimately resulted in a 15% cost saving across the business.

Our firm’s managing partner mentions the innovation strategy in almost every meeting and presentation.

We are introducing criteria and questions in employment interviews around openness to change.

We created a new cross-disciplinary innovation committee to ensure diversity of inputs to innovation decisions and encourage broader buy-in to changes that we seek to implement.

The firm’s weekly report now includes a new section on progress and achievements of the firm’s innovation efforts.

The firm has a core value of innovation expressed as ‘Evolve Always – Curious, imaginative and tech-savvy, forever challenging the status quo’.

KAREN MATTHEWS Business Transformation Consultant

KAREN MATTHEWS Business Transformation Consultant

AUTHENTIC LEADERSHIP

What makes an authentic leader, and why is authenticity so important?

The term authentic leadership is getting a fair bit of use now, and like many other so-called ‘buzz words’, it runs the risk of being glossed over as ‘another fad’, with limited understanding from most on how to mould this very powerful concept to suit an individual leadership style, and create a stronger business culture and improved performance.

Authentic leadership is not a leadership style. It is built on character – it is who you are extended into the way you lead.

Authentic leaders have a beautiful blend of long-term vision and the here and now. They have a long-range vision, but are focused on the present, believing that conquering one-step-at-time will lead to long-term success.

GREAT CULTURES START WITH AUTHENTIC LEADERS

When you think back to the influential leaders in your life, what were the attributes they had that stand out in your memory? Were they ethical and transparent? Did you trust them? Did they have a good sense of their own skills and opportunities for improvement? If so, you are likely to have experienced authentic leadership.

Authentic leadership is more than a corporate buzzword. When an organisation has an authentic leader at the helm, employee engagement improves, job stress decreases, productivity skyrockets, work culture improves and more.

The Harvard Business Review found that 75% of employees want to experience more authenticity at work. Authentic leadership is crucial in cultivating a great culture and recruiting a diverse workforce.

AUTHENTIC LEADERS

Authentic leadership is effective leadership. With its roots in Greek philosophy, today, authentic leaders are self-aware, genuine and forthright about their humanness – the good and the bad.

If you look at some of the most well-known authentic leaders over time – Mother Teresa, Nelson Mandela, Richard Branson, Steve Jobs, to name a few – they share(d) the same qualities:

Self-awareness: Authentic leaders have a clear value system and know what they stand for. They understand and own their strengths and weaknesses and reflect on these honestly in relation to their decisions and actions. They don’t hide their mistakes and they share their learnings.

Their perspective is one of constant growth and improvement as well as a commitment to hold themselves accountable to their own values and moral compass.

Integrity and moral perspective: Strength of character is a key quality. Authentic leaders do not say things they don’t mean. They keep their word and do as they say they will do: no matter what.

Driven by ethics, an authentic leader aims to ‘do the right thing’, even when faced with situations in which doing so could negatively impact the company’s bottom line. People respect and trust them because of this quality.

Leading with vision: Authentic leaders are purpose-driven. They add value to the people they interact with and help others realise their goals. They push themselves and others to raise the bar and have the confidence to aim for excellence.

Balanced processing and good listening skills: Before making a decision, an authentic leader solicits input from the team. They genuinely want to hear opposing viewpoints and believe the best decisions come from discussion and consideration of all options. They encourage input from across the business and ensure all viewpoints are heard, tabled and considered.

Transparency: Authentic leaders do not have hidden agendas. They believe in open communication and masterfully combine their forthright communication with empathy. The balance of clarity, honesty and sensitivity creates trust and gives people confidence in their leadership.

They are open, share the wins and challenges and take the responsibility of keeping the business up to date and looking forward very seriously.

“Authentic leadership is not fluffy, it is not soft and it is not the easy way out. It is not a ‘me-too movement’, or a buzz-word, and it certainly isn’t weak.

Karen Matthews

“The great leaders are not the strongest, they are the ones who are honest about their weaknesses. The great leaders are not the smartest; they are the ones who admit how much they don’t know. The great leaders can’t do everything; they are the ones that look to others to help them. Great leaders don’t see themselves as great; they see themselves as human.Author and motivational speaker Simon Sinek

Focused on long-term results: Authentic leaders do not worry about temporary setbacks or hiccups along the way. They believe in setting a clear vision and crafting the strategic actions to get there.

They know that patience, resilience and an ability to remain open, flexible and responsive will deliver results in the long run.

Consistency: Authentic leaders aren’t fickle. They know and believe in who they are and stick to their principles. They are not swayed by superficialities, popular opinion or societal pressure. They have a strong self-image that is truly who they are, whether in the public spotlight or at home on the weekend. They are who they are.

Heart-led: Authentic leaders trust their gut. They wholeheartedly believe in their intuition and back themselves. They are not afraid to look within and encourage their teams to do the same.

Authentic leaders lead with courage and empathy first. They do not succumb to the pressure of doing what is expected, what is easier or what will deliver short-term gain; knowing that long term, heart-led leadership will deliver the vision.

Share success with their team: Authentic leaders not only build a great team, but they share success and achievements with the whole team. They celebrate the wins and acknowledge the individual efforts.

Authentic leaders know what motivates individual team members and recognise them in a way that ensures they feel valued and appreciated.

Draw on experience: Authentic leaders draw on and share lessons learnt from experience – real life stories, experiences, lessons and tips. They openly and genuinely share to inspire and to help others grow and improve.

Authentic leaders are fully invested in encouraging people to be the best they can be, and love nothing more than cheering on a team member as they achieve their goals.

BENEFITS OF AUTHENTIC LEADERSHIP

At its core, authentic leadership is a purpose and values-led approach to leadership that is centred on building the leader’s legitimacy through honest team relationships. Today, more than ever, this approach is not only crucial for overall morale, but it is also good for business.

Customers and clients have many choices when it comes to a functional product or service. The business they will ultimately chose to engage with will be the one that they connect with: the one that ‘gets them’ and that they feel is aligned to their values.

There are several good reasons to drop the facade in favour of authentic leadership:

1. Boost employee engagement

When employees are familiar with where the organisation is going and feel trusted to go beyond their comfort zone, even if it results in a mistake, they are more invested in helping the organisation achieve its goals. When people feel seen and understood they’re more likely to act and engage, whether as an employee or customer.

2. Build an inclusive culture

Studies have found that when leaders are authentic, it helps to create an inclusive, safe and aligned workplace. When leaders model comfort with values, open communication, accountability and establish rules around unacceptable behaviour, it builds a culture of alignment and trust.

When the leader encourages open dialogue, employees are free to express who they truly are and what they think. People feel that the leader genuinely cares, and their point of view is wanted, valued, will be heard and considered. From there, a powerful and truly inclusive culture is created.

“Your brand is what people say about you when you’re not in the room.

Amazon Chief Executive Jeff Bezos

3. Inspire employees to grow

An authentic leader isn’t afraid to take responsibility for their mistakes and openly encourage people to speak up, table new ideas and express opinions.

An authentic leader values diversity of opinion and perspective and is not afraid to admit that they don’t know the answer to something. As a result, employees will be inspired, motivated and believe they can achieve growth and advancement in a company when they see that even those in leadership positions aren’t perfect.

4. Drive trust

People want to do business and work with people they trust. Trust is essential for a thriving workplace culture, especially during times of change or uncertainty. When a leader demonstrates trust in their team to handle their role with care, integrity and diligence and encourages employees to be themselves while doing that, it will significantly boost productivity.

When a leader can express to the team that they recognise, value, understand and support their purpose, and encourage individuals to share their insight and opinions, it creates a sense of ‘one team in business together’ and inspires new levels of trust.

What is your brand?

5. Employees want authenticity

Millennials (in particular) have high expectations of not only the businesses they buy from, but which ones they will work for. They want to support and work for brands that are honest. A Cone Communications’ Millennial Employee Engagement study reported that 75% of millennials would take a pay cut to work for a more socially responsible company.

Authentic leadership is not a corporate buzz word and is not something that a leader can ‘fake until they make it’. Inauthentic leadership will be quickly exposed and is highly damaging to trust, confidence, respect and overall corporate culture.

6. It’s easier to be yourself

Leading as an extension of who you are makes sense and is authentic. To be able to harness your purpose and values, and extend this into the way you lead, requires a lot less effort than trying to be someone you are not, with a style that is not in keeping with who you are.

Leading from the heart and core of who you are increases the likelihood of consistency, builds trust and confidence, and will improve your ability to attract the right people into your team.

THE TRUTH

Surprisingly, there are still some who don’t believe in authentic leadership, and who are quick to dismiss it as the latest business buzz word and as emotional, soft, weak and not a fit concept for the real world of business.

Thinking about the above examples along with many others, it is fair to say authentic leadership is not fluffy, it is not soft and it is not the easy way out. It is not a ‘me-too movement’ or a buzz word, and it certainly isn’t weak.

Consider these renowned authentic leaders, their individual brands and what they stand for.

Nelson Mandela

• Represents peace, justice and wisdom.

• His integrity created a movement – a moment in history.

• When people see his image they think of human rights, strength of character and one man defying the odds.

Richard Branson

• The heart-led, back yourself, ‘screw it let’s do it’, apologise later entrepreneur.

• His infectious personality is consistently fun, adventurous and highly engaging.

• He has always been and still is a champion for innovation and disruption – a relentless supporter of entrepreneurs and those starting out.

Steve Jobs

• A meticulous, obsessive and autocratic leader.

• He stood for relentless pursuit of excellence.

• He expected a lot from himself and others and believed in the power of asking.

• He believed in breaking the rules to be different.

THE SECRET TO AUTHENTIC LEADERSHIP

Authentic leaders:

• Commit to a strong, cohesive image: What will people see/think of when they hear your name?

• Do good work: A great image will make people pay attention, but to keep them engaged and paying attention you need to do great work. You need to meet or exceed expectations and demonstrate you have the substance to back up your style.

• Are ahead of trends: No one is inspired by a leader who cannot (or refuses to) reinvent themselves. An ability to continue to evolve, grow and remain one step ahead will instil trust and confidence in the strength and longevity of your leadership.

• Are interesting and diverse: Steve Jobs wasn’t just a computer and design guru: he was a renaissance man. He studied literature and the Arts, and he brought that expertise to bear on his work at Apple.

Your personal brand needs to be cohesive, but not boring. Your interests and diversity are what make you unique, and it is that person that people will connect with.

HOW AUTHENTIC IS YOUR LEADERSHIP?

When evaluating your level of authenticity, ask yourself:

• Do you inspire new opinions, or even (constructive) disagreements? Why or why not?

• Do you ask for feedback? And from whom? Consider asking for feedback from colleagues who aren’t your direct reports. Expand your horizons to seek broader, honest opinions.

• Do you periodically self-reflect? Review and assess yourself as a leader based on your brand attributes. Ask yourself where you succeeded and where could you have acted/communicated differently. Regular reassessments can prove helpful and keep us honest.

• Do you trust your gut? Your instincts are based on your learnings. Trust them and recognise them not as a ‘spur of the moment’ decision but one based on intuition and experience.

Authentic business leaders are often known to seek constant growth through their own experiences, lead by example, recognise diversity and foster inclusion. In my experience, those who dare to be authentic have the courage to be vulnerable, embrace authenticity and build successful teams that in turn deliver strong results.

What you can do to improve the authenticity of your leadership

• Look for and take on feedback from your team, peers and other individuals.

• Reflect on your own behaviour –what do you do well and importantly, where do you need support, development or improved effort?

• Admit your mistakes.

• Apologise when necessary.

• Be aware of your own feelings and always observe them. Doing so is key to being authentic.

• Be approachable.

• Show emotion, compassion and your human side.

• Let employees know you care for them as individuals and fellow human beings.

• Do the right thing.

• Try not to micromanage your employees.

• Be genuine. Whether the message is good or bad, or whether the decision is complex, challenging or simple –be you, no matter what.

• Appreciate, value and involve your team wherever possible. The more people feel seen, heard and valued, the greater the trust, engagement and ultimately loyalty they will show.

• Acknowledge contributions, resilience and results.

DOMINIC ROLFE Business Journalist

DOMINIC ROLFE Business Journalist

LOCAL FOCUS, GLOBAL IMPACT

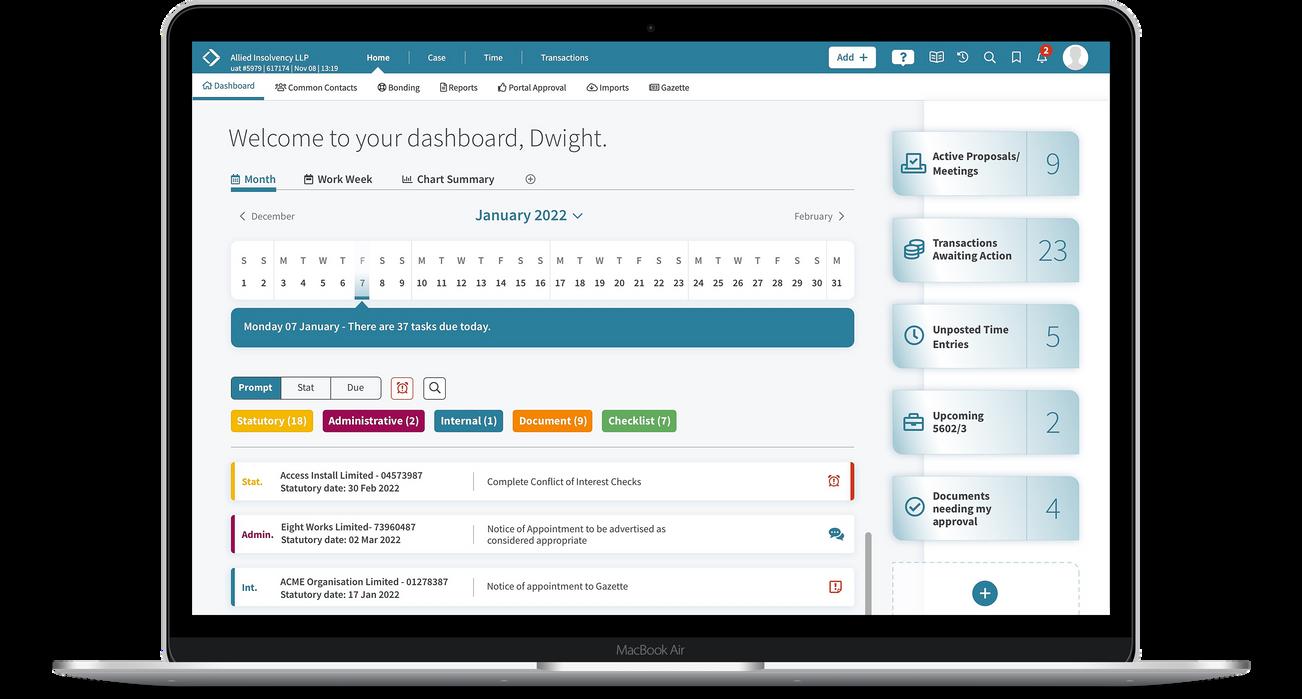

One of this country’s most accomplished insolvency professionals reflects on her career and recent receipt of an Order of Australia – recognition she says is a long overdue acknowledgement of the entire profession.

When Robyn Erskine received an email in early 2022 about being nominated for a Member of the Order of Australia (AM) award, she nearly deleted it. The Melbourne-based insolvency practitioner had no inkling that she had been nominated, so when the email from the Governor General landed in her inbox, the warning bells rang wildly.

“I never imagined the Governor General would be writing to me,” says Erskine. “My first instinct was that if I clicked on the email, all my bank accounts would be drained or frozen. It took a little while to realise it was real and for me to accept that I was actually being considered for an award within the Order of Australia.

“At that stage I really was not expecting this would go anywhere and was happy to just have been nominated,” she adds.

For someone who almost fell into her career, Erskine has been a quiet powerhouse of the insolvency and accountancy professions. She started her journey in 1978, firstly as an office assistant to insolvency specialist Neville Bird, and then later with John Brooke when he joined forces with Bird to create Brooke Bird.

Erskine says she was intrigued by the work they were doing and was drawn to the human side of insolvency, where you have the opportunity to help rebuild shattered lives.

Knowing her career path was limited without formal qualifications, Erskine returned to studying part-time while working full-time in the practice. In 1990, she juggled the final stages of her degree, starting her Professional Year with the Institute of Chartered Accountants (now known as CAANZ) and the birth of her first child.

Little did she know that things were going to get a whole lot busier with the arrival of one of the deepest recessions in Australian history.

While the significant rise in insolvency numbers and the volume of organisations needing the advice of insolvency professionals was challenging, it nevertheless provided a unique opportunity to understand the complexities of dealing with those in financial stress.

With talk of a looming worldwide recession on the back of the global COVID-19 pandemic, Erskine reflects that now is another critical moment for restructuring and insolvency professionals to be at the forefront of partnering with government, regulators and business as they work towards repairing and revitalising our economy.

In late May of this year, she received another letter from the Governor General (one that she was far less wary of), notifying her that her nomination had been successful and Erskine was to be awarded an AM in the 2022 Queen’s Birthday Honours list for her significant service to accountancy and professional associations. Her citation is particularly remarkable given it cites her extensive, concurrent volunteer commitment to three different professional associations: ARITA, CPA Australia and Australian Institute of Credit Management.

“It’s a thoroughly deserved award,” says ARITA CEO, John Winter. “In what is a tough and competitive profession, Robyn is universally respected and admired. She simply has no detractors. She is humble and generous and in a profession in which only eight percent of registered practitioners are women, Robyn has been a trailblazer, role model and inspiration for many.

“I have been CEO of ARITA for going on eight years and I can say with absolute certainty that no one in the entire restructuring, insolvency and turnaround profession comes close to Robyn in terms of commitment, engagement and contribution to ARITA or in what she does for the profession more broadly.”

The lengthy list of Erskine’s work with ARITA, CPA Australia, CAANZ, the International Federation of Accountants (IFAC) and the Australian Institute of Credit Management (AICM) unspools like a Christmas grocery receipt.

Erskine was the first woman to join ARITA’s Board in 2005 and was the first female President of ARITA in 2011 (serving her full two-year allowable term). She is serving or has served as a member or chair of no less than 14 committees across those organisations. She is also ARITA’s current representative on the INSOL International Board of Directors.

On top of her ARITA presidency and committee work, Erskine received the 2015 ARITA President’s Award for outstanding service to the profession, and was made a Life Member of ARITA in 2017 in recognition of her extraordinary contribution; making her the first and only female Life Member of ARITA. At the time, she was just the 16th person to be given this title.

Erskine believes that all this extra work has been part of a lifelong curiosity. “What has stood me in good stead is

“It’s not about one person, it’s about many people embracing opportunity and bringing about change.

that, while serving the profession and immersing myself in those opportunities, I have learned an awful lot.”

As a small practice professional, committees and roundtables have been invaluable sources of continued education.

“I remember some years ago the then principal at my son’s school spoke about the transition from primary to secondary school. He likened the students to goldfish in a

“We need to deal with the overly complex arrangements that come from having two pieces of legislation.

What’s remarkable is that Erskine has taken on all her extra roles while remaining in small practice: she has never worked in a large professional firm and her current firm, Brooke Bird, has a staff of 10.

While practitioners in large firms are able to draw on the broad support of their extensive organisational resources, Erskine sees considerable benefits from working in a smaller, more nimble operation.

“I’ve certainly had my opportunities to go to larger practices,” she explains. “At its most fundamental, the people I’ve worked with in small practice over the years have been wonderful.

bowl, and said that the goldfish will only grow as big as the bowl allows. You have to immerse yourself in the bigger pond to be challenged and continue to grow,” Erskine says.

“That approach resonated with me, and by immersing myself in the wider world, I have expanded my network and my knowledge with different thoughts, approaches and experiences,” she says.

“My work on the various committees and roundtables has been responsible for creating incredible relationships that have helped shape the future of the profession: not just the insolvency profession but the wider accounting profession.”

Erskine adds that she isn’t just aiming to solve issues of the day. She’s invested in growing and pushing the profession to improve both its technical expertise as well as its foundational principles and composition.

As one of the just 59 female registered liquidators in Australia out of pool of 644, and one of only 24 female registered trustees out of 209 – proportions that are defiantly hard to shift – Erskine’s work on the ARITA Balance Committee is crucial.

“Our members deal with all parts of the community,” she says. “We need to ensure that our professional base is reflective of the Australian community because if we don’t understand all the different human aspects of our work, we’re less able to achieve an optimal outcome.

“Our work on the committee has also identified that organisations that embrace diversity and inclusion are more successful than those who don’t. Helping members embrace this mindset is an important piece of work currently being undertaken by ARITA.

“We’re already seeing increasing numbers of women entering the wider legal and accounting profession, however, we need that to translate into the insolvency and turnaround sector. It’s one of the areas that I’m keenly aware of and want to see change in,” she says.

“They have ranged from those who gave me the opportunity at the outset and believed that I had the ability to do the role – for which I am eternally thankful – to the current team at Brooke Bird who are all exceptional people and part of a team where we support and value each other’s success.”

Small practice is where her heart is, and Erskine says it has given her the opportunity to grow into the person she is today. At a more structural level, when Erskine became partner 30 years ago, she says her colleagues at Brooke Bird were incredibly supportive and progressive: something that certainly wasn’t a given for insolvency practices in the ’80s and ’90s.

She worked hard, but the firm gave her the flexibility to pursue a career while remaining an integral part of her family with her husband and two sons.

“Family was and still is incredibly important to me, not least because it makes me the whole person I need to be so I’m good at being a wife, a mother, a friend … and an insolvency practitioner.”

Her involvement in professional groups beyond the usual four walls of her relatively small workplace has become especially important in a post-COVID era of remote and hybrid work.

“People need to be aware that it’s really easy to put yourself in a little box where you agree wholeheartedly with yourself all the time,” says Erskine.

“One of the trade-offs of working more independently is that at times there is a lack of collaboration and opportunities to challenge yourself. Insolvency and turnaround professionals, just like professionals in any sector, need to be mindful of that.”

A GLOBAL OUTLOOK

In June 2021, Erskine was appointed as ARITA’s representative on the board of INSOL International, the global federation of national associations of turnaround and insolvency specialists. (INSOL is currently headed by another former ARITA President, Scott Atkins.)

INSOL isn’t Erskine’s first international posting. From 2015 to 2020 she was a member of the International Federation of Accountants (IFAC) Small Medium Practices Advisory Group, where she was the deputy chair and also the chair of the Ethics Taskforce.

“While my expertise in the Australian insolvency and turnaround scene is obviously important, I think my international experience with IFAC has been incredibly helpful during my time on the board of INSOL,” says Erskine.

“When you’re dealing with an international board, you’re dealing with different jurisdictions, different cultures, different regulatory systems and policies. All that impacts on how the board goes about its business.

“I also think that my long-standing experience of working in a small practice environment allows me to bring that lens to the work INSOL does.”

Being able to take a step back from the local insolvency milieu has given Erskine a crucial view of worldwide issues, both present and emerging.

“INSOL looks at the international impacts and needs of the wider insolvency and turnaround profession,” says Erskine. “But some of our most important work is in

identifying and analysing global trends. Each economy is a subset of the global economy and what you see looming at a global level allows you to plan for the consequences at a domestic level. If we can spot the tsunami, it’s an opportunity to plan so you don’t get totally wiped out.”

One of the biggest takeaways for Erskine’s involvement on international boards is the unique way that Australians approach problem solving. So just what is it that Erskine thinks makes Australians different to practitioners from other countries?

“I think Australians are really good at identifying issues and getting to the point very quickly. I don’t have the answer as to why that is but it’s certainly a strength I’ve observed in Australians in the international scene and it’s one of the reasons I think Australians on the world stage are often very successful.”

Erskine does offer a word of caution, however. “While we’re good at speaking plainly and directly, some people consider that approach to be overly blunt. We have to be really mindful of that because in different cultures this can be seen as quite offensive.”

“I don’t think there is enough appreciation or kudos for the work we do.

SIMPLIFYING THE PROCESS

There has been no review of the Australian insolvency and bankruptcy laws for more than 35 years. In March, a panel of experts convened by the former Federal Government found the current regimen was “an impenetrable quagmire that is scary, complex and unknown”.

As a response, Senator Deborah O’Neill announced in late September that Federal Parliament’s Joint Committee on Corporations and Financial Services would undertake a review of these laws.

Erskine, as with most of the industry, including ARITA, is glad that there is finally movement on overhauling our insolvency laws. She is cautiously hopeful that the appetite for change will be strong enough to produce a meaningful outcome.

“If we are going to start from a blank page, and it would be lovely to think that this would happen, we need to deal with the overly complex arrangements that come from having two pieces of legislation.

“If we could create one simplified system that deals with both personal and corporate insolvency, everyone from practitioners to the average person that finds themselves in this unwieldy arrangement would benefit. I do think over the years with various amendments it has been made harder than it needs to be.”

Erskine also has issues with the amount of red tape that the industry has to deal with. Having worked on countless committees, she has heard calls from all quarters that many legislative requirements are overly burdensome, inefficient and ineffective.

“There are a lot of things we’re required to do under the legislation that don’t make a lot of sense or are not helpful,” says Erskine. “Some of our statutory reports, for example, run to many, many pages. The philosophy behind it is right, but we need to see if there’s a way to achieve the broad aim without overburdening both the practitioner and the

recipient, who often is lugged with this enormous file of information that they don’t ever read. “That’s one example, but there are a lot of others where we need to ask whether the process is the most cost-effective way of doing things and if the purpose of that regime is being met?

“A holistic approach with this is mind would relieve some of the frustrations felt by both practitioners and creditors while making the process simpler for people to understand.”

LIFTING ALL BOATS

Helping shape the profession from the inside is one thing. Now, after nearly four decades in and around the profession, Erskine is keen to see the broader community appreciate the work of insolvency and turnaround professionals. While insolvency headlines in papers and nightly news skew towards the sensational and celebrity, the work done to get businesses operating more efficiently is often overlooked.

“I don’t think there is enough appreciation or kudos for the work we do,” says Erskine.

“Dealing with people who can be antagonistic or aggressive, who want to blame someone, isn’t easy and we tend to cop their ire. But our profession is entrusted with finding solutions when others can’t, and this takes an enormous skill set. Not just a technical and financial skill set, but a knack for understanding and empathising on a very human level.”

With this in mind, Erskine is clear that she believes her AM is a fillip not just for her but for all practitioners.

“I think all of us can take pride that someone has received an Order of Australia for the work they do in the insolvency sector,” she says. “It shows that the work we do is being valued beyond our fish bowl!”

On the day of her investiture, she received confirmation of this via an unlikely source. As she stood with her family and those of the other recipients, a stranger approached her. He wasn’t an award recipient but he wanted to offer a very specific compliment.

“When he said congratulations, I thought he was just being nice because I was standing there with a medal pinned to my chest,” Erskine says. “Then he said, ‘I’m an accountant and I’m just so happy to see another accountant get one of these awards, because hardly any of us get awarded for the work we do.’

“That’s probably true to some extent, and it’s certainly true that there are even fewer insolvency practitioners recognised for their efforts.”

Through her career, Erskine’s strength of character and humility has helped move ARITA and the profession forward. She’s typically effacing even when asked about her motivation for the extra tasks she has willingly taken on.

“It’s easy when you believe in something,” she says. “And I truly believe in the work that ARITA does, the members it serves and how it does this while protecting the public interest. The team at ARITA, led by a board of dedicated experts who volunteer their time, are remarkable for the amount of heavy lifting they do in law reform and representing their members.”

At its most basic, Erskine treats people the way she wants to be treated. And she wants that sort of philosophy to be handed down the line in all her professional and personal spheres.

“It gives me a lot of satisfaction to think that I’ve helped in any small way,” she says. “And I hope that it gives people following me the strength to do the same. It’s not about one person, it’s about many people embracing opportunity and bringing about change.”

Robyn Erskine’s ARITA experience

• President, 2011–2013

• Vice-President, 2007–2011

• Director, 2005–2019

• Representative, Board of Directors, INSOL International

• Member, Balance Taskforce

• Member, Small and Medium Practices Committee

• Former Chair, Discipline Review Committee

• Former Member, Professional Conduct Committee

• Former Member, ATO Liaison Committee

• Former Member, Nominations Committee

• Former Committee Member, Victorian/Tasmanian Division (20 years)

• Life Member, 2017

• Member, since 1992

Erskine is grateful to all the people who have brought about change in her professional life, from the men who “propped open the door so I could slip into the profession –because there were no females to do that back then,” to the men and women who are helping take the profession into the future with intelligence, warmth and commitment.

She says that in 10 years’ time, she’ll “be a feather duster” but is confident that the profession is in good hands. In the interim, she will continue serving the profession as best she can.

“All the work I’ve done has never been a chore because I believe in what we’ve been trying to achieve collectively. I know that I was the one to get the award this year but I honestly think that every ARITA member deserves an Order of Australia. I can’t wait to see many more from our profession recognised for all the incredible work we do.”

JANYNE MOORE Director, In The Media PR

JANYNE MOORE Director, In The Media PR

MANAGING THE MESSAGE: HOW TO MAKE THE MEDIA WORK FOR YOU

ORYANA ANGEL Director, In The Media PR

ORYANA ANGEL Director, In The Media PR

Media coverage is an effective way to promote your insolvency practice and even position yourself as an industry expert.

Experienced former journalists

Janyne Moore and Oryana Angel from In The Media PR (inthemediapr.com.au) gave us an insight into how the media works at the ARITA 2022 Small Practice Conference. The highly rated session provided some useful observations and tips for insolvency practitioners to consider when dealing with the media, and in this article we consider some of their key takeaways.

Q: TELL US ABOUT THE AGENCY AND WHAT YOU DO FOR YOUR CLIENTS.

Oryana Angel (OA): We realised that a lot of small business owners are really busy. They don’t have time to actively learn how to deal with the media, and how to find their stories and pitch their stories while also running their business.

So we started our agency to consult to businesses and help them tell their stories, and guide them on the things that media outlets would be interested in.

Janyne Moore (JM): We hear so many different stories from businesses working in insolvency that should be in the media, and that practitioners should be talking about as the experts.

Q: WHAT ARE SOME OF THE REASONS WHY AN INSOLVENCY PRACTITIONER WOULD WANT TO BE IN THE MEDIA?

JM: The big thing about the media is the audience reach. If you look at the Australian Financial Review, for example, it has 3.5 million daily readers in print and online. That’s a big audience that you’re reaching straight away with just one story featured there.

We know for a fact that it does have a major impact on the business for our clients who are featured in it regularly.

OA: One of our clients received a $1 million investor on the back of one story in the AFR. Another received a five-figure investment. Obviously, it’s a

“Being in the media does help to gain trust and credibility.

very business-focused audience, and they get hundreds if not thousands of hits on their website for certain stories.

JM: Consider titles like The Australian and the Daily Telegraph and the syndication of media now. If something features in the Daily Telegraph, for example, and it’s of national importance, it will be in the Courier Mail, the Adelaide Advertiser or the Northern Territory News. It will also be on news.com.au, which has an audience reach of 16.5 million.

TV news is often syndicated across the country as well. You’ve also got your other targeted outlets like Mining Monthly which you might want to focus on, depending what your target is.

Being in the media does help to gain trust and credibility. One of our clients spent six months talking to a big insurance company. He was a software developer and he could see problems with their online insurance claim process. He tried to get a conversation happening with them and they wouldn’t budge. He was a smaller operator, so they just wouldn’t give him the time of day.

He ended up being featured in a story in the AFR and he was also in the Sydney Morning Herald and The Australian. Off the back of that publicity he reached out to them again, mentioning some of the things that he’d been talking about in the media.

That gave him credibility, and they opened the door, had a conversation and then it moved on from there.

There’s also the benefits to brand awareness. Someone once said to me: ‘When you start making noise in the media, there’s an echo and it comes back.’ By engaging with the media you are putting yourself out there

and potentially opening the door to new opportunities. But if you don’t do anything, there’s going to be silence coming back.

Q: HOW CAN SEO BENEFIT A PRACTITIONER’S BUSINESS?

OA: SEO, or search engine optimisation, is all about getting your website higher up in Google search results. When someone searches for terms like ‘liquidation’ or ‘insolvency’, you want to be number one on Google. Statistically, very few people will go past the first page of a Google search. Media can really improve your SEO results. A powerful way of improving

your SEO is by getting external links out. Government websites are the holy grail with SEO links, but unfortunately they won’t link to private companies generally.

The next best thing for your SEO is getting links from a media organisation. We know news.com.au has over 16 million readers. If you can get a link from news.com.au to your website, which they do all the time, that’s huge for your business’ SEO.

It’s a really powerful tool to use the media to get those links back and boost the online profile of your business with better SEO.

•

•

• Identify, connect with and close new business opportunities

• Work for listed companies and SMEs across a diverse range of industries including energy, manufacturing, financial services, construction and retail providing advice in the areas of turnaround, restructuring and insolvency

•

•

• Payment of external training courses

• Senior level insolvency practitioner

• Registered Liquidator and or Trustee in Bankruptcy or will shortly be seeking registration

• CPA or CA qualified

• ARITA Professional Member

• A proven leader

• Tailored mentoring and training

•

• Hybrid work model

Media management feature

“You’re the experts in your field. You know what’s happening before the media does.

Q: WHAT ARE SOME KEY POINTS ON HOW TO DEAL WITH THE MEDIA?

JM: When using the media, in some instances you want to control the narrative of stories that are already in the news cycle, and in others you will want to proactively create stories that the media will be interested in.

When you are dealing with the media it’s really important to know you can take the time to think about your response. If you’ve got an appointment that is laying off workers, for example, and media get wind of it and a journalist approaches you, you’ve always got time to say, ‘Look, I’m going to come back to you. Can you just send an email with some of the questions you want to ask?’

That way you are working with them, but you are also being very strategic and saying, ‘Okay, I’m going to think about this or maybe get some outside help to figure out what the strategy is going to be.’

I find some journalists don’t understand what you do as receivers and liquidators, so you have to educate them. They work on stories of all different natures, so you can assist by just being there to give them some background on what often are complex processes in an insolvency matter.

Q: TELL US ABOUT CRISIS COMMUNICATIONS, WHEN THERE ISN’T TIME TO WORK OUT A STRATEGY.

OA: There are stories where journalists are like vultures. They

want the story and they’ll do anything to get it. Journalists often have to work really quickly. So you need to help them to understand the facts.

The key thing is, if you can have someone on board helping you, that’s really good. But if you can’t or you’re not at that point, the main thing is don’t shut up shop and hide. Try to have that conversation with the journalist.

In certain instances, and if you’re not sure of something, ask for the questions in an email and then take that time to think about a strategy for how you’re going to manage this situation. That’s the main takeaway in crisis management.

Q: HOW CAN INSOLVENCY PROFESSIONALS CONTROL THE NARRATIVE AND CREATE STORIES FOR THE MEDIA?

JM: One thing to look at is industry trends. For example, we hear a lot about businesses not being prepared for cyber attacks. Or bankruptcies: people are thinking, ‘We haven’t seen the mass closures of businesses that was expected. But is this coming? Is this something you can comment on?’ These are the kinds of stories the media will be interested in.

Media like to hear what the problem is and that it’s affecting a lot of people, and then you can position yourself as the solution. So you are explaining, as an expert, what businesses need to do.

You can do educational pieces about financial recovery. For example, what if your business is not in a good place? You can provide tips like, ‘Okay, what can you do if your business is heading towards liquidation? What are the five steps you can take as a business to try to stop that from happening?’

Think about things you’re talking about around the office. What you find interesting and are talking about amongst your colleagues is often an issue that the media will be interested in.

You are at the forefront, you’re the experts in your field. You know what’s happening before the media does, it’s actually you that can let them know.

Q: WHERE DO OPINION PIECES FIT IN TO THE MEDIA MIX?

JM: Every single insolvency practitioner could write an opinion piece this week about something that is happening in the industry. The media will welcome it because it’s good content for them.

OA: You don’t want to be selling your business in an opinion piece. If there’s a particular publication you want to be published in, just read some of the opinion pieces. Follow the format, and pick a topic and try to link it in with something that’s happening in the media.

JM: You are controlling the messaging. That’s what I love about it as well, because you are basically pitching yourself as the expert in your field. The journalists can’t change your words, so your messaging is completely controlled.

People reading it may relate to it and think, ‘I need to speak to this person, because they know what they’re talking about.’ You’re engaging with an audience on a different level.

Q: WHAT CAN PRACTITIONERS DO TO HELP THE MEDIA AND GET THE BEST RESULTS?

JM: We find it’s best to ask what the deadline for a response is upfront. They’ll be quite frank and say, ‘I need this by 3:30 or I need this by 10 o’clock.’ If you want to take the opportunity, you do need to move quickly.

Journalists are very time pressured. They’re working on so many stories and they’re working very quickly – more than ever now with the job cuts in the industry. So, just making it easy for them is the best way to get that coverage.

But then at the same time, if it’s likely to be a negative story and you don’t want the coverage, you

“By engaging with the media you are putting yourself out there and potentially opening the door to new opportunities.

can deliberately give them just a small amount of information. You can control the narrative in your messaging.

If you’ve got something and the journalists are sniffing – especially if it’s a story you know will get coverage and it is negative and something that you don’t want – by not giving them anything you are basically letting them go and run what they want.

You can just release a media statement. It only needs to be two paragraphs, two quotes. You might want to say very little, because you really want to kill the story and don’t want to add fuel to the fire. But by issuing that short statement your messaging is in there.

Depending on the situation –if you’re happy, if you want it in the media – it is sometimes best to get on the front foot and send that media statement out. At least have your statement ready if someone reaches out.

But if you are thinking the messaging actually works well for your business, you can put that out there and show that you’re being proactive and taking steps to do something positive.

Q: IS THERE SUCH A THING NOW AS TALKING OFF THE RECORD?

OA: I think there’s different levels. There’s no ‘off the record’ on camera. If the cameras are rolling, everything’s on the record. You just have to take a cautious approach.

JM: Most journalists will honour your off the record comments but it’s best to speak off the record with a journalist you already trust. You don’t need to go into specifics. Just educating them more around the process, rather than giving them the juicy details, is enough. You need to know who you can trust and just tread carefully.

Often you’ll find that once you start talking with some journalists you’ll create a really good relationship with them. And then when something happens in your industry and they know you’ve got that expertise, they’ll come to you and say, ‘Hey, have you got a comment in regards to this?’

YOUNG PROFESSIONALS AND DIVERSITY & INCLUSION

Two members of the ARITA NSW Young Professionals Committee give their perspective on the importance of diversity and inclusion for the insolvency profession.

Alister Yee and Lucinda Blue, from the NSW Young Professionals Committee, were recently co-panellists at a YP event with ARITA Board Member Kathy Sozou (Partner, McGrathNicol) and ARITA CEO John Winter.

Continuing on from the important themes discussed at that event, they offer their practical insights and experience in this Q&A that explores what diversity and inclusion means to the future leaders of the profession.

Q: HOW DID YOU GET INTO THE INSOLVENCY PROFESSION?

Alister Yee (AY): During my second year of university I made an application for work experience through the Chartered Accountants Achiever program. Through this program I was offered a placement at Star Dean-Willcocks, a mid-sized insolvency firm at the time.

I didn’t know much about insolvency back then, apart from a light brush with a corporations law subject at university. During my first week of work experience I worked on my first voluntary administration.

I enjoyed working with different stakeholders, obtaining an understanding of various companies in different industries and being a part of achieving the best possible outcome for creditors; as well as the investigations aspect of working on insolvency matters.

One word I can certainly use to describe working in insolvency is ‘interesting’, and that is the main reason why I’ve continued to work in this industry.

Lucinda Blue (LB): I finished university with a hunch that commercial disputes would be a practice area I would enjoy.

I didn’t do an insolvency law elective at university, so it was not something I had really thought about in terms of a potential practice area.

When I graduated, I took a non-rotating graduate role with an international law firm in their Restructuring and Insolvency team, which had been marketed to me as (and ended up being) a mix of general commercial disputes work, plaintiff class action work and insolvency-related disputes.

Having been exposed to a small amount of insolvency work in that group, I found it particularly challenging and interesting. I decided I wanted to focus my career in that direction, and I moved into a team more specialised in the restructuring and insolvency space. So, in short, I kind of fell into it!

Q: WHAT DOES DIVERSITY & INCLUSION (D&I) IN THE WORKPLACE MEAN TO YOU?

AY: To me, there has certainly been an increase in recent times of both awareness and implementation of diversity and inclusion practices in workplaces. My take on diversity is the mix of people, whether it be gender, cultural/ethnic background, age, race, religion, disability and sexual orientation; and inclusion is having that mix of diversity in the pursuit of common interests or goals.

I’ve also seen the link between diversity and inclusion and the success of organisations and corporations. I am aware of studies and research on, for example, the business case for diversity and the increasing likelihood of financial outperformance from having a diverse workforce.

“It’s about creating and fostering a profession or organisation that reflects the society we live in.

Diversity and inclusion feature

“Having a diverse mix of people can have a direct impact on better decision making.

But I see diversity and inclusion most importantly being about the key benefits and ethical aspects. Having a diverse mix of people can have a direct impact on better decision making from simply taking into account a variety of input from different perspectives and standpoints.

I believe it is also morally right to be inclusive and give people a sense of belonging.

I don’t see the movement of diversity and inclusion as going away any time soon. I think employees will vote with their feet by choosing workplaces that hold diversity and inclusion in high regard and move away from those that don’t.

LB: Diversity & inclusion has become a bit of a buzzword in recent times. As a result, there has never been a better time for employers and professions more broadly to be thinking about their D&I goals.

In some respects it’s easy to get caught up in the idea that D&I is all about gender, because women in the workforce gets so much airtime. Corporate Australia generally has taken big strides in the last few years with programs that seek to encourage female participation in the workforce, with increases in paid parental leave schemes, the advent of much more flexible working post-Covid and the introduction of 40/40/20 gender-based targets at senior levels.

These are all obviously great steps forward for female participation, which is incredibly important, but I think it’s important that we don’t limit our thinking. D&I has such broad application and includes things like cultural diversity, LGBTI+ inclusion, diversity in socioeconomic background, etc.

It’s about creating and fostering a profession or organisation that reflects the society we live in, so that we get the diversity of opinion, viewpoints and ideas that

don’t just reflect the ideas of one particular group of people with the same or substantially similar perspectives. This is relevant at all levels of expertise and will only work to better develop the sophistication of the profession or organisation long term.

Q: WHY IS VISIBLE DIVERSITY IMPORTANT FOR THOSE ENTERING THE PROFESSION, BOTH AT GRADUATE AND MORE SENIOR LEVELS?

AY: At a graduate level, I believe visible diversity is very important. It is quite a change to move from tertiary education into the workplace. From personal experience, when I started working in the insolvency profession it took a little bit of time to have that sense of belonging. I entered at a time where I saw insolvency to be very much a Caucasian and male-dominated industry.

This has certainly shifted, with a more diverse mix of people now working in the profession. Having said that, I believe visible diversity is important at the entry level for both the initial attraction and recruitment of talent as well as the retention of those in the preliminary years of their insolvency careers.

Visible diversity at more senior levels is also important. Again, from personal experience, around four years ago I decided to take up an opportunity with my current employer. This involved working with my present director, who is a female registered liquidator and registered trustee in bankruptcy of a similar ethnic background to me, along with a diverse team of professionals.

I am aware of a very small representative ratio of females who are both a liquidator and trustee; and that percentage is even smaller based on percentage by ethnic background. I chose this opportunity in a visibly diverse team and have certainly benefited and enjoyed working in a supportive team environment where each member’s ideas are shared and valued, while also developing my skills personally as an insolvency professional through strong mentorship.

LB: In terms of visibility at the graduate level, I think it is about shared experience and feeling a sense of collegiality and belonging within a peer group. Being the only person with a different perspective within a wider group of similarly oriented people is going to be a challenge for anyone.

A diverse cohort fosters an environment where different perspectives and ideas are more easily shared and discussed. Having a diverse graduate group also reflects down to students who are thinking about where they want to go, and whether they can see themselves as a part of a similar group. That’s a lot easier to do if there is someone with a similar perspective to yourself already there.

At the senior levels, I think it comes back to that same point: it is much easier to see yourself in a particular position, like a senior role in a professional services firm, for example, if there are people with similar backgrounds/perspectives to you already living and breathing it. It becomes a lot more realistic, instead of being an aspirational goal that could easily be put into the ’too hard’ basket.

A great example (although limited to gender diversity in this case) is in the traditionally male dominated legal profession. It is well known that there have been more female graduates from law schools than male graduates for some time. However, that has not been reflected at the senior levels.

As of October 2022, for the first time in history there is now a majority of female judges on the bench of the High Court of Australia. If that doesn’t say, ‘if I can do it so can you’, then I don’t know what does!

Q: WHAT IS YOUR PERSPECTIVE ON THE STEPS ARITA IS TAKING TO FOSTER D&I WITHIN THE PROFESSION?

AY: I believe ARITA’s efforts to foster D&I in the profession is a great start to something that is a huge commitment. Having a strategy document and forming a Balance Taskforce which sets out initiatives and outcomes is something I think will foster a diverse and inclusive profession.

More recently, our committee formed a D&I young professionals sub-committee to participate and be involved

in this overall strategy. Young professionals are the entry point, and we are the pipeline of the future leaders of the industry and will be able to bring change through both improved gender representation and addressing the ageing demographic of the profession.

While I’m aware this is only the start, I believe it would be beneficial to enhance the overall strategy by considering further objectives alongside the present focus on gender and age diversity: whether it be cultural/ethnic background, race, religion, disability or sexual orientation.

By doing this now, we will only strengthen our profession and place it in good stead for the future.

LB: The road to a fully diverse profession is a long one, and it’s not something that can be achieved in five minutes, or captured in a mission statement or action plan in a few hundred words. It takes time, energy and focus, and in setting up the Balance Taskforce ARITA is defining its focus on the issues. This is a great thing.

I think that in focusing on a steady diversification initiative, starting with gender diversity given how far behind the profession sits at the senior levels, and setting defined targets and action plans to achieve those targets, makes sense.

However, and I know ARITA is cognisant of this, I think it’s important that the profession (and the wider corporate community) ensure that there is a continued focus on D&I outside of just gender, and consider the importance of intersectionality across these dimensions, to ensure for example that programs to further gender diversity in the profession do not have the effect of benefiting only women of a particular background.

No doubt, in time steps will be taken to make further progress in areas outside of gender, because it will only benefit the whole industry.

RICHARD COWEN Principal, Cowen Schwarz Marschke Lawyers

RICHARD COWEN Principal, Cowen Schwarz Marschke Lawyers

LIMITING LIABILITY

A review of recent cases shows the power of s 447A of the Corporations Act 2001 (Cth) to limit personal liability for administrators.

Given the considerable breadth of its power, s 447A of the Corporations Act 2001 (Cth) (the Act) has been described as a “magic-wand like provision” (Re Wallace-Smith; National Express Group Australia (Bayside Trans) Pty Ltd (receivers and managers appointed) (administrators appointed) and Others (2003) 46 ACSR 674, 676, [6]). This article provides some recent examples of the court’s powers able to be exercised under this section.

The section is of considerable scope which, on application, allows the court to “… make such order as it thinks appropriate about how this Part is to operate in relation to a particular company” (s 447A(1)). The purpose of providing the court with such broad and flexible discretionary powers was to fill any gaps in the legislative scheme of Part 5.3 of the Act, where the strict application of those provisions may not achieve the objects of Part 5.3 in the unique circumstances of every administration.

Pursuant to the section, the court may alter, supplement and/or modify express statutory provisions of the Act with regard to the specific circumstances of a particular company. One such application of the section is to limit the personal liability of administrators, which otherwise arises by operation of s 443A of the Act. The following cases illustrate that application.

ELLUME LIMITED

In the decision of Ellume Limited (Park (Administrator), in the matter of Ellume Limited (Administrators Appointed) v Evangayle Pty Ltd (Trustee) [2022] FCA 1102), the court considered the question of whether the administrators of Ellume Limited were justified in entering into and performing a funding agreement (and related security arrangements), and if so, if it was appropriate to exercise its power under s 447A of the Act to modify s 443A so as to limit the administrators’ personal liability as contemplated by the funding agreement.

Background

On 31 August 2022, the company was placed into voluntary administration, although Ellume USA LLC was not in any form of external administration. The company had limited readily available funds and impending liabilities in the amount of approximately $140 million (comprising unsecured trade creditor liabilities and other convertible notes).

At the time of the administrators’ appointment, the company had not granted any general security interests over their assets, although it had granted limited security interests over a small class of specific assets.

In exercising such powers, the court will have regard to the rights of the parties affected by administration: most importantly, that of creditors. Such an order is usually sought on the application of administrators, though it can also be brought by (inter alia) a creditor, ASIC or other interested persons of the relevant company.

Critically, undertaking those steps was intended to maximise the value of the business and therefore produce the greatest possible return for creditors, potentially provide return to shareholders, and further maximise the chances of retaining employees. legal update

Ellume Limited and its wholly owned subsidiary (Ellume USA LLC, incorporated in America) carried on the business of developing, manufacturing and selling diagnostic tests for infectious diseases to retail consumers (including the general public and healthcare professionals).

The administrators of the company, together with the directors of Ellume USA LLC, sought to maintain and continue trading the business as a going concern until the company could achieve a joint sale or recapitalisation. As part of this strategy, it was sought that the administration period be extended to allow a comprehensive marketing campaign to be undertaken, the negotiation of the terms of sale or recapitalisation, and also potentially for a deed of company arrangement to be entered into to give effect to the successful bid.

s 447A Corporations Act

“The powers of the courts under the section are not unlimited, and ought to be applied by reference to previous case authority.

As the forecasted cost involved in trading the business until the end of the anticipated voluntary administration period was significantly in excess of the company’s funds, the administrators sought to obtain funding to give effect to the aforementioned strategy. Without funding, the company would be forced to cease trading almost immediately.

In these circumstances, the administrators entered into a funding agreement with a syndicate of companies for a loan in the amount of $3.5 million for the purpose of advancing the strategy. Relevantly, the funding agreement limited the administrators’ personal liability to the funders to the extent of their indemnity and lien against the assets of the company, and was subject to, and conditional upon, the administrators obtaining the necessary orders permitting the limitation of their liability.

The administrators also sought an order pursuant to s 90-15 of the Insolvency Practice Schedule (Corporations) (IPS) that they were justified in entering in, and drawing down funds, pursuant to the funding agreement.

Judgment

Upon application, the court ordered that, pursuant to s 90-15 of the IPS, the administrators were justified in doing so, and that pursuant to s 447A of the Act, the operation of s 443A was to be modified such that if the indemnity in favour of the administrators pursuant to s 443D was insufficient to meet any liability arising out of the funding agreement, the administrators would not be personally liable under s 443A.