SM Venture Farther. Travel Smarter. ®

The Travel Insurance Playbook SM roamright.com/partners 1 (866) 891-6614 Internationally-Awarded Service For You & Your Clients. Partner With Us Learn More 4

Information provided solely for general and informational purposes and should not be construed or deemed to be legal or regulatory advice to be acted upon as such.

Insurance coverages under travel insurance policies branded either as RoamRight ® or co-brand as Arch RoamRightSM are underwritten by Arch Insurance Company, NAIC #11150, under policy series LTP 2013 and amendments thereto.

Materials in this publication may not be reproduced in any form without written permission. All sources for data presentation in this document can be found in the Endnotes section on the inside back cover of this publication. Photo credits include imagery located on Shutterstock.com or Adobe.stock.com/

The term, ‘Partner’ or ‘partner’, used herein has no legal meaning whatsoever.

Copyright © 2024 Arch Insurance Company. All rights reserved. 24-03-TRV07 Your Travel Insurance Specialist. 02 04 18 36 50 56 Statistics Interviews Partner with Us About Arch Executive Summary Endnotes Table of Contents Download PDF

Executive Summary 02

Linda Fallon

Executive Vice President

Outlook for Travel in 2024

The travel industry is undergoing a dynamic transformation, influenced by evolving consumer preferences, technological advancements, and global economic factors. As we look toward the future, it is essential to analyze the trends and forecasts that will shape the travel landscape.

Within the Travel Insurance Playbook, you will discover travel trends and insights gleaned from Arch RoamRight customers alongside real-world strategies shared by some of our travel partners.

Our recent travel survey offers thoughts on what today’s travelers are looking for in terms of experiences, destinations, preferred travel companions, and more. Activities like hiking, luxury dining and sightseeing were rated high on the list of priorities for upcoming 2024 trips. Local culture and attractions also topped the list. In 2024, travelers are likely to exhibit distinct preferences, with a greater focus on health and safety, flexibility, and unique experiences.

There’s an increasing trend towards remote, less crowded destinations, and personalized travel itineraries. The demand for travel insurance products that offer adaptable coverage options is expected to grow, reflecting the need for security in uncertain times.

The outlook for travel in 2024 is optimistic, marked by a blend of post COVID recovery, innovation, and changing consumer behaviors. While challenges persist, the sector’s resilience and adaptability are key drivers in its growth trajectory. As a leading provider of travel insurance solutions, our role in supporting and enhancing this growth through our products and services is more crucial than ever.

Thank you for selecting Arch RoamRight for your and your clients’ travel protection needs. We value your partnership and your trust and look forward to growing together in support of your insured travelers everywhere.

03 A

Word From

Statistics04 1

of polled participants will take at least 1 trip per year.

99.8% 90% 82%

48.9% with

of polled travelers will be traveling internationally in 2024. of travelers surveyed stated that global events may influence travel decisions in 2024. taking 3-4 trips per year.

Importance when booking trip.

70.1% 57.2% 21.4%

100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Safety Very Impor tant Cost Distance to Destination Somewhat Impor tant Not a Factor

Europe Cruises...

Topped the List

Of most favored vacation destinations by international travelers.

Top European countries are:

Italy France England

Other destinations ranking high on the list are:

Mexico Africa Caribbean

Remain a fan favorite among travelers in 2023 and are expected to continue on that course in 2024.

06 | The Travel Insurance Playbook

06 | The Travel Insurance Playbook

activities in which travelers expect to partake in while on a trip. 01 02 03 04 05 Hiking Shopping Luxury Dining Sightseeing, Museums Theater, Shows

08

Top Five

96% & 86% 19% 65% 35% of travelers plan activities prior to their trip. of polled participants consider walking distance to dining and entertainment when booking trips. of travelers use a travel advisor while planning a trip. of travelers never use a travel advisor. of that 65% only use a travel advisor for international trips.

10 Travel Insurance Insight

44% & 51% of travelers purchase travel insurance for every trip. of travelers purchase travel insurance for international trips only.

The graph highlights some of the greatest concerns that travelers face when planning a trip.

11 0% A Medical Emergency Trip Cancellation Flight Delay/Cancellations Lost Luggage Miss Cruise Departure Personal Safety Other 20% 40% 60% 80% 100% 80.6% 57.6% 46.6% 34.4% 24.7% 22.7% 3%

Average Trip Profile

$3,086

Average Cost of Insured Trip: ⭜ Up 21% over 2023

Average Age of Traveler:

48Years Old

Average Length of Trip:

7Days

Down from 50 in 2023 ⭝ Down from 9 in 2023

12 | The Travel Insurance Playbook

⭝

2

GetaTravelInsuranceQuote. Learn More

Average Timeline from Trip Deposit to Date of Purchase to Trip Departure Date:

Trip Deposit Date to Date of Purchase:

11Days

⭝ Down from 2023

Purchase Date to Trip Departure Date:

273 Days

⭜ Up significantly from 2023

Top International Destinations for trips planned for 2024:

Italy

Mexico

Bahamas

Caribbean

France

United Kingdom

Dominican Republic

Portugal

Ireland

15

16 | The Travel Insurance Playbook 01 02 03 04 05 Trip Cancellation Trip Interruption Trip Delay Emergency Medical Evacuation/ Repatriation Top Five Used benefits for our travelers are: 16 | The Travel Insurance Playbook 3

About Claims

Four Step

Claim

Process

Reviewing a claim takes time and involves several steps.

When a traveler submits their claim form whether through online, fax, email or mail, our team will begin reviewing the information and create a claim within our system.

A claim administrator will review the claim to ensure all required documentation is with the file before sending to the examiner. The claim administrator also serves as the main point of contact for the claimant.

Once it is determined that all needed documentation is accompanying the claim, the claim is given to the claims examiner for full review.

Intake Administration Examination Decision

After the examiner makes a decision, the claim is closed and the claimant is informed of the outcome. Electronic or check payment options are based on the claimants preferred choice.

17

17

18

20 24 28 32

Jennifer Barnard from Endless Routes Travel

Nikki Hendrix from Favorite Grampy Travels

Laura Heidt from Brownell

Julie Fagley from Vacation Daze

Endless Routes Travel

Offers Bespoke Experiences that are Deeply Personal.

20 Learn More

Jennifer Barnard

Owner of Endless Routes Travel

What

inspired you to join the

travel industry?

After a significant health scare—a cancer diagnosis—I decided to pivot my life’s direction to a pursuit I was truly passionate about: travel. I felt that life was simply too short not to follow my heart. I left my previous career in financial consulting to venture into the world of travel planning.

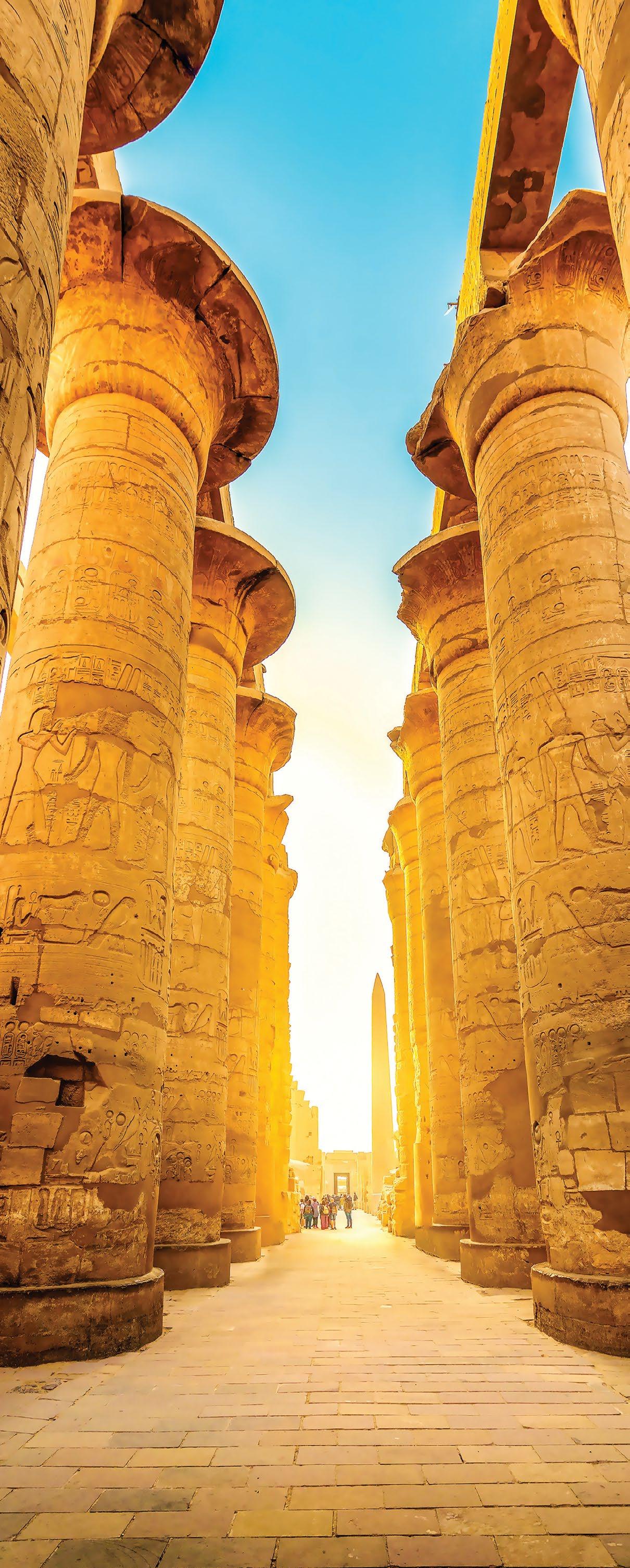

I have loved Europe since exploring the continent as a young adult. This personal affinity and existing knowledge gave me my niche in offering customized European travel experiences and river cruises. This was in 2018 and marked the birth of Endless Routes Travel—for which I am the founder and sole agent, to maintain the agency’s bespoke and highly personalized service.

What type of clients do you support?

Adventurers seeking off-the-beaten-path escapades, luxury travelers yearning for a grand European retreat, and everyone in between. A significant portion of my clientele are seasoned travelers who

value experiential journeys more than just sightseeing. But I also cater to first-time European travelers; helping them to meticulously plan every detail of their trip, by guiding them to navigate through the overwhelming options and cultural nuances that the continent offers.

What is your discovery process?

I start with an online form, as this allows me to gather initial information about the client’s ideal travel dates, budget and the number of travelers. This form is followed by a conversation and allows me to efficiently gather the basic details while providing space for a meaningful discussion about my clients’ unique travel priorities and preferences.

How do you leverage marketing to promote travel?

I find that the most effective way to promote travel is by sharing my personal experiences. For instance, when I return from a destination, I love sharing my stories, photos and insights with my email list. This offers a first-hand understanding of different travel

21

styles and diverse locales, all while inspiring my clients to think about their next adventure.

Social media platforms like Instagram and Facebook also allow me to visually showcase destinations and the unique experiences they offer both on my personal and business pages. I find that this form of storytelling resonates well with audiences, inspiring them to explore the beauty and diversity the world has to offer.

A significant portion of Endless Routes Travel’s growth has been through word-of-mouth referrals. When clients have a wonderful travel experience, they naturally share it with their friends, family and social networks. This organic form of marketing has allowed me to extend my reach to potential customers who already have a positive impression of Endless Routes Travel based on their trusted relationships.

How do you help travelers understand the value of travel insurance?

1. Share Real-Life Examples

Show them the full protection travel insurance provides by sharing examples of unforeseen situations that led to cancellations or medical emergencies and how travel insurance came to the rescue—whether these are my own personal experiences or those of previous clients.

2. Highlighting Family Benefits

When helping families plan their trips, emphasize that the recommended policy includes coverage for kids (under 18) with each insured traveling adult, depending on the plan purchased (when applicable), making it a cost-effective choice.

22 | The Travel Insurance Playbook

3. Explain Staggered Payment Options

To ease the immediate financial outlay, suggest travelers only pay the deposit initially. This flexible approach allows clients to commit to the protection travel insurance offers without having to pay the entire amount upfront.

4. Give a Personal Endorsement

I firmly believe in the protection that travel insurance offers. I personally invest in the very policy that I recommend to most of my clients. I don’t travel without it and neither does my family. This personal practice not only reinforces the confidence I have in the product, but also resonates with clients; they know I am suggesting something that I use and trust.

What is the most common travel insurance question you receive?

“What does it actually cover?” Many clients perceive travel insurance to only protect against trip cancellation… and they have no intentions of canceling. While that is one crucial component, it’s far from the whole picture. It’s important to make sure travelers understand the wide range of coverages travel insurance provides including medical emergencies and evacuations, travel delays, baggage loss and sometimes even specific events like natural disasters.

What is the top reason your clients purchase travel insurance?

The peace of mind it provides. We live in an unpredictable world and, no matter how meticulously planned, travel is not immune to unforeseen incidents. Specifically, medical emergencies while abroad are a considerable concern for many travelers. The fact that travel insurance provides coverage for unexpected medical emergencies gives travelers reassurance and

I firmly believe in the protection that travel insurance offers. “ “

allows them to focus on enjoying their trip rather than worrying about potential financial risks.

While more than 97% of my clients opt for travel insurance, for the few who choose to decline I do require them to sign a waiver. 1) To ensure they fully understand the potential risks involved with traveling uninsured and have made an informed decision to decline the recommended protection and 2) to protect my agency from potential legal liabilities.

What travel trends have you been seeing for 2024?

I’ve seen a significant rise in travel for events such as Taylor Swift’s concerts and the upcoming Summer Olympics, with fans traveling across the globe to attend these live experiences. I’ve also seen more families planning ‘bucket list’ trips in honor of milestones like graduations and anniversaries or just spending quality time with aging parents.

On the luxury travel front, many affluent travelers are looking for longer vacations or to take several trips per year. The biggest trend I anticipate will continue this year is “experiential travel”; travelers who seek unique and personalized experiences that can’t be replicated or found online. This concept goes beyond visiting an unseen place; travelers now desire something distinctly tailor-made to their interests and expectations. They want a chance to form one-of-akind memories.

23

Favorite Grampy Travels Helps

Families Build Memories.

24 Learn More

Nikki Hendrix

CEO of Favorite Grampy Travels

What was the inspiration behind Favorite Grampy Travels?

Favorite Grampy is my father. After I married and started having kiddos, Favorite Grampy began blogging. He shared his adventures with the grandkids: playing in the backyard, staying up late watching old movies, roasting s’mores around the firepit, and having chocolate cake for breakfast. Everything was always about making memories with your loved ones.

Favorite Grampy had such a large local following that in 2019, we spun off the Favorite Grampy brand and opened Favorite Grampy Travels, focusing on helping busy families make precious vacation memories together. Favorite Grampy Travels is an award winning, family owned, boutique travel agency with home offices in Leesburg, Virginia and Orlando, Florida. In 2023 we launched our luxury division and now have specialists for destinations spanning the globe. Our 45 Concierge Travel Advisors are industry leaders, offering our clients personalized service as they curate memorable adventures.

What made you decide to join the travel industry?

Even when we didn’t have much growing up, making memories together was always a priority in my family. Whether it was a picnic in the park, a weekend at the beach, a vacation to Walt Disney World, or an epic tour of France, I will always cherish the countless memories we made and continue to make.

At Favorite Grampy Travels, we have the privilege of helping thousands of families take a break from the crazy go-go-go lifestyle and reconnect with each other. We get to wake up every day and make dreams come true for a living.

To what do you owe your success?

I owe my success to my amazing village. We are not meant to do it alone. My advice is to surround yourself with people that push you to do and be better. From the real-life Favorite Grampy who taught me about business, my friends and neighbors who supported us every step of the way, my husband who lifts me up when I am down, our team of incredible travel

25

advisors who have become like family, industry partners like NEST, ASTA and ALLIES. And of course, I would not be here without God giving me health, strength and guidance.

What changes have you experienced during your career in the travel industry?

I have been in the travel industry officially since 2015—but it has been anything but a smooth journey. We launched our travel agency in 2019 and started pouring our heart and soul into it. Then in 2020, the pandemic hit and we had to undo everything we had created. After that, it was a waiting game until the world opened up again and we could rebuild.

Post pandemic, the travel industry looks much different. Prices are higher, inventory is lower, and guests are expecting more unique experiences. Most travel advisors are learning the value of their time and expertise, building up the courage to charge clients a professional fee for what they are worth. As of 2022, we encourage and support all of our Concierge Travel Advisors to charge a professional fee. They are worth it!

How are you embracing technology in the travel planning process?

Beyond the standard customer relationship management and itinerary builder tools, agencies have so much at their fingertips to save time and increase quality. Most recently, we have integrated AI into our workflow to help us with emails, blog articles, social media and website content. By leveraging technology, we are able to provide a higher level of service in a shorter time frame.

What advice do you give to travelers, especially when navigating risks?

First, we try to guide them to choose a time to travel when potential weather threats are minimal to the area in which they are headed. Second, we always offer

With travel insurance, you don’t know when you will need it until it is too late. “ “

26 | The Travel Insurance Playbook

travel insurance to our clients no matter how small the vacation package. With travel insurance, you don’t know when you will need it until it is too late. We also like to offer at least two policies so our travelers can compare and decide which fits their needs best.

Do you have tips on how to increase travel insurance sales?

Always assume the sale. Include travel insurance in your initial quotes. Do not treat it as optional or the client will as well. If you quote separately, include RoamRight’s direct link to your client’s quote so they can review multiple policies and purchase on their own if they decide to.

At Favorite Grampy Travels, we have concierge-only clients who hire us to service vacations they booked on their own but have become overwhelmed with. If your agency does as well, be sure to offer travel insurance to these clients too.

What is the most important reason your clients purchase travel insurance?

Peace of mind. Our clients want to be able to enjoy their vacation without having to worry that an international medical emergency could destroy them financially or that a travel delay will prevent them from experiencing their trip of a lifetime.

Do you require your clients to sign a waiver if they decline travel insurance?

Yes, all of our Concierge Travel Advisors have clients sign a waiver if they decline travel insurance. We actually include it on the payment authorization form.

What emerging trends do you expect for 2024?

Cruising continues to remain popular. The buzz around the shiny new ships with all the latest fun, activities and technologies has ignited a huge demand to be on the sea. We have also seen a growth in ultra luxury river cruising, as travelers see the appeal in sampling multiple European destinations along their way.

On land, Portugal is a hot destination. Cities, castles, culture, canals and coastlines, Portugal has so much to offer.

Can you tell us about a time travel insurance saved the day?

One of our clients was booked on a popular adults-only cruise line. Due to a storm, the ship could not dock at the return port at the conclusion of the cruise. The client was out at sea for an additional day, thus missing her flight home. Thankfully, the travel insurance she purchased came through and covered her new flights as well as her transfers to the airport.

27

Laura Heidt of Brownell Travel on

Laura Heidt of Brownell Travel on

Protecting Travelers Against the Unexpected.

28 Learn More

Laura Heidt

Insurance Desk Manager at Brownell Travel

What is your main responsibility as the Insurance Desk Manager at Brownell?

As the sole licensed travel insurance advisor at Brownell, I provide quotes to our more than 100 travel advisors. I also regularly share information and risk management strategies with our advisors to help their clients prepare for the unexpected. At every opportunity, I try to instill the importance of offering travel insurance with each trip and keeping meticulous records of whether their client has approved or declined travel insurance—we call this a “CYA.”

How does the insurance desk support the travel advisor?

My main responsibility is to offer quotes and provide our advisors with the best practices in offering travel insurance. Some advisors prefer I speak with their clients personally to help them understand the ins and outs of travel insurance, along with their rate quote—so in some instances, I’m working directly with our clients.

The travel insurance discussion is a key element of the “discover more” aspect of the Brownell way; travel insurance should be brought up in the first stage of discussions and remain a part of the dialogue. This way, we help clients understand the full breadth of what travel insurance covers and its true value. By helping clients protect themselves in a world of unknowns, we are able to strengthen relationships, build trust and fulfill our role as trusted advisors.

What

inspired you to get into the travel industry?

I was trained in the hospitality segment of travel, and I had the opportunity to live in many special destinations, including Hawaii, Colorado, Arizona, Florida and Georgia—just to name a few. This exposure gifted me with a love for travel and an affinity for providing our clients with top-notch products and customer services.

29

To what do you owe your success?

I love people. I love that I get to talk to people, share information and help make people happy every day. I have always made it a point to be available to customers when they have questions or are looking for advice and to provide them with accurate, tailored information every time.

Insurance may not be the most “fun” topic, but I do my best to make it light and approach the subject with stories. Stories can bring anything to life and have helped me illustrate the real-world impacts of travel insurance to countless travelers and advisors alike.

How do you address safety concerns with your clients?

Safety considerations, especially those that are location-based, are critical to ensuring our clients enjoy their trips to the fullest. We always address this at the outset and emphasize that we offer travel insurance for the unforeseen before departure and the perils that could occur while traveling.

Now more than ever, having the ability to offer policies that provide security while on a trip is critical. This is an offering that is not provided through any credit card or rewards program, and we do our best to try to point this out to the traveler.

How do you expect travel in 2024 will differ from 2023?

The desire to travel is very strong. More and more we are seeing travelers book earlier to lock in the destination and accommodations they most desire. The cost of traveling is similarly only increasing—we are seeing a 15-20% increase in the cost of trips in 2024.

We are also seeing travelers become even more adventuresome. Individuals are traveling farther, for longer periods of time, and are exploring areas that aren’t your “typical” vacation destinations. People want to see more of the world, and this is being reflected through their travel itineraries.

We are also seeing more and more of the younger generation purchasing insurance. This was not as common in previous years. Younger travelers are recognizing the value that travel insurance can offer and are prioritizing the peace of mind it provides.

What’s your best advice for people

who are making plans now for their 2024 trips?

Book early. You cannot wait until the last minute to book your trip. It takes time to properly plan and finalize the details of your trip, and as the seconds tick by, the most desirable accommodations and destinations are being gobbled up by other excited travelers. Your time away is your most treasured resource and we want to ensure that you get to spend it exactly as you imagined—but that requires ample time to craft that dream itinerary.

How important is travel insurance to your business?

Brownell believes travel insurance is just as important as designing and meticulously planning a trip. Travel insurance provides peace of mind for both the traveler and the advisor. Whether travel delays, baggage loss, medical emergencies, or other unexpected issues, guiding clients to see the value, reassurance and protection that travel insurance provides is paramount. For conversations with our advisors, I like to place the emphasis on risk management—we are putting protection in place so that if anything on a trip goes wrong, we’ve minimized the impact.

30 | The Travel Insurance Playbook

Can you tell us about a time when

travel insurance saved the day?

When the severe earthquake struck Morocco in 2023, we had several travelers in the country and several others just days away from leaving for Marrakesh. For those who had travel insurance, their pre-trip cancellations were covered, and we were also able to assist those present when the earthquake occurred with trip interruption to get them home quickly and safely. They were thrilled to have help with the cost of coming home unexpectedly.

In this instance, if a traveler was injured or hospitalized while on their trip, their travel insurance policy provided them with medical coverage to assist them with the cost of services. This was particularly important as domestic health insurance does not generally cover international medical incidents.

Travel insurance provides peace of mind for both the traveler and the advisor. “ “

Vacation Daze

Creates Magical Memories that Last a Lifetime.

32 Learn More

Julie Fagley

Owner of Vacation Daze, LLC

How did you get started in the travel industry?

When my children were born, I wanted to stay home with them. So I started looking for a way to pivot my career to a role that would allow me to work from home, before that was as common as it is in 2024. I knew Disney Destinations very well and saw an ad seeking passionate Disney fans for at-home sales. I started working with that agency in 2005 and the rest is history; I fell in love with the travel industry!

My love for people and my passion for travel, coupled with the flexibility for me to be home with my children, fueled my passion for a career in travel. I worked in the travel industry for a few different agencies until 2014, when I finally opened an agency of my own, Vacation Daze! Vacation Daze specializes in Disney Destinations, all-inclusive resorts, cruises and travel to Europe. We have grown considerably over the past decade, and now have 23 agents working across the US.

What advice would you give someone just entering the industry?

Be available and don’t ever give up! It takes time to learn the ropes and even longer to grow your client base. The key I have found is to be consistent in giving good customer service. If you care about your clients, you’ll build strong relationships. And those relationships will not just mean that those clients keep coming back, but they will also refer their friends and family to you as well!

What are the ideal characteristics of a travel advisor for Vacation Daze?

Our team has experience planning vacations all around the world. We look for individuals who are dedicated, attentive to details, good communicators, and have a desire to help people through any situation they encounter while traveling.

Vacation Daze is an Authorized Disney Vacation Planner, a distinction we don’t take lightly, so knowledge of Disney products and a love for both Disney and travel are “musts” for any prospective new team members!

33

How important is travel insurance to your business?

Extremely! Travel insurance is vital to any trip, especially if you are traveling out of the country. I always explain to each of my clients that insurance is not just for trip cancellation. It’s equally important for trip interruption; in the event of lost baggage, illness, injury or even sometimes natural disasters. Nowadays the cost of a single flight alone is extremely expensive. Once you start adding to price of a hotel stay, food, activities, you name it, the ultimate price tag of a vacation is significant to many families. Then you throw in a situation like a medical evacuation, and those costs can be astronomical. So the ability to have a tool that will have your back, and your wallet, should anything go wrong or keep you from enjoying your vacation to the fullest, that peace of mind is a game changer.

How

do you incorporate travel insurance into the travel

planning process?

I always bring the topic of travel insurance into broader discussions. For example, I provide an insurance quote with the quote for the destination. That way my clients understand the full cost picture when deciding exactly where they want to go. Throughout discussions, I continue to stress the importance of purchasing insurance within 21 days of deposit.

This all seems to work because at least 90% of my clients purchase travel insurance. For those that choose not to for whatever reason, I do require them to sign a waiver just to make sure that they fully understand their decision. The waiver also helps to protect my agency in the event something goes wrong on their trip.

When did travel insurance come through for one of your clients?

A few years ago, I helped a couple arrange a trip to Jamaica for their Anniversary. One afternoon, a few days into their trip, the couple was playing pool volleyball. The man hopped out of the pool to retrieve the ball and slipped and broke his spine. It was a horrible accident. He was immediately rushed to the hospital, but eventually needed to be medically evacuated and brought back to the US for emergency surgery. Because he had insurance, their policy was able to cover the cost of the medical evacuation, as well as the cost of the interruption to their trip, including their hotel, any pre-paid activities, and their return flights. We were so incredibly thankful they had insurance!

What major change in the travel industry you have experienced post-COVID?

There has been a major surge in travel. Everywhere, more and more people want to get out and see more of the world. Travelers are getting more adventurous in their trips, and wanting to try new resorts, destinations, and activities—and they are taking more frequent trips as well! Post-COVID people have a passion and a hunger for travel like I’ve never seen before.

I’ve also seen more multi-generational travel. More and more families are wanting to spend quality time making memories together. This means that they are looking to plan trips that cater to everyone from aging grandparents to toddlers. As a result, we’re seeing more people recognize the value of travel advisors because we know the ins and outs of planning a trip for the entire family. And we are more than happy to help take the stress out of their vacation planning, so they can focus on what really matters: creating memories that last a lifetime.

34 | The Travel Insurance Playbook

What are the emerging travel trends in 2024?

The number one travel trend we are seeing this year is a boom in interest for cruises. Regardless of the destination, travelers are really liking the convenience that comes with cruises. On a cruise, travelers are able to visit multiple destinations without the tedious planning that would be needed for a self-directed trip with multiple stops. Cruises also cater to these multi-generational travelers through their ability to offer customizable activity options for more adventurous teens, kid-friendly choices, and more laid-back selections for those who prefer to lounge. I expect cruises will only continue to grow in popularity.

“ “

Travel insurance is vital to any trip, especially if you are traveling out of the country.

36 with us. Internationally-Awarded Service For You & Your Clients. 4 Learn More

38 40 42 44 46 What We Offer A Brief Overview of Our Plans. Arch Advantages Plan Comparison & Partner Portal Case Study Epic Bike Crash in Rural Peru A Behind the Scenes Look... at Arch RoamRight’s Client Services & Claims Teams About Arch RoamRight How Does Your Travel Insurance Provider Compare? roamright.com/partners 1 (866) 891-6614

AboutArch RoamRight

How Does your Travel Insurance Provider Compare?

As an award-winning travel insurance provider 4, Arch RoamRight knows how important it is to put the traveler first, especially during stressful situations. Can you say the same about your travel insurance provider?

As travel has returned, and people are traveling again, we stand behind our service to you and your clients.

The Arch Experience is aimed at providing one-of-a-kind customer experiences, delivering a cultural journey of behaviors and actions that sets us apart from our competitors. Remaining passionate about the voice of the customer, we work diligently to maintain our high service levels, boasting a low call abandonment rate, short wait times, timely email responses, along with an efficient and prompt claims settlement process.

Dedicated Business Development and Account Manager

Award-winning claims administration and customer service 4

Competitive Commissions

Commission Protection available

Market driven plan pricing

Easy to understand products and services

Superior technology solutions

38 | The Travel Insurance Playbook

the Arch RoamRight (www.RoamRight.com) brand, Arch Insurance Company provides travel insurance to help protect U.S. residents traveling around the world. Arch RoamRight travel insurance plans are offered for leisure, business, student and group travelers taking both domestic and international trips. From trip cancellation to travel medical insurance plans and an award-winning partner website, Arch RoamRight is an industry leader in innovation and technological solutions. *Upon receipt of complete proof of loss

Under

Travel advisors who partner with Arch RoamRight can have: Low call abandonment Short wait times Timely email responses Efficient and prompt claims settlement* Interested in hearing more? Contact us to learn how Arch RoamRight can elevate your travel insurance program. partner@roamright.com | 1-866-891-6614

I know that I have an amazing team at Arch to help me with whatever I need and whenever I need it. Emails are always promptly answered and always explained in a way that is helpful to me and my clients. Arch really makes me look like a rockstar. So happy I found them.

Nicole Gerber, Smartflyer

What We Offer

Brief Overview of Our Plans.

PRO TRAVEL INSURANCE PLAN

The Pro Plan provides basic travel protection at an affordable price.

For adventure travelers, the Pro Plan also has Sports and Hazardous Sports available as an upgrade, providing coverage options for pre-paid tickets, rentals and activities such as bungee jumping, skydiving, and more.

PRO PLUS TRAVEL INSURANCE PLAN

This plan provides for primary medical coverage when traveling, as well as coverage for cancel for work reasons if purchased within 21 days of making your initial trip deposit.

Pro Plus is a family friendly plan that offers coverage for one child (under 18) with each insured traveling adult at no additional charge. Need more coverage? The Pro Plus plan also offers optional upgrades for rental car coverage, baggage, and adventure sport and activities.

40 | The Travel Insurance Playbook

ON TRIP PLUS

TRAVEL INSURANCE PLAN

The On Trip Plus Plan is a great option for last-minute travel that only needs post-departure coverage.

This plan also includes security, political and natural disaster assistance and provides for medical evacuation to the hospital of your choice, subject to the policy provisions.

CANCELFLEX

TRAVEL INSURANCE PLAN

The Cancel Flex plan provides some cancellation coverage when client’s need to cancel outside of the covered reasons in the policy

ANNUAL MULTI-TRIP

TRAVEL INSURANCE PLAN

Great for frequent travelers, our Multi-Trip plan provides travel protection coverage for multiple trips throughout the year, up to the stated trip cost limit selected. This plan takes all of the great features from our Trip Cancellation coverage and extend it into a convenient annual travel protection plan. Not available to NY or OR residents. Ask us about plans for travel advisors.

41 Learn More

42

Arch Advantages

Plan Comparison & Partner Portal

Arch RoamRight plans offer many features that may not always be available in competing plans.

• An exclusion waiver for pre-existing medical conditions if purchased within a time sensitive period.

• Political or security evacuation benefit included if purchased within a time sensitive period.

• Every account has 2 direct contacts for best customer service.

• Cancellation for normal pregnancy and being present for the birth of a family member’s child (as long as either occurs after effective date of the policy).

• Cancellation for adjustment in school year calendar due to unforeseen reasons (option available for Pro Plus and CancelFlex only) if purchased within a time sensitive period.

• Coverage for physical quarantine for medical reasons, or denied boarding due to medical screening.

• A 14-day free look period from date of purchase.

As a Arch RoamRight Partner you will have access to the Partner Portal.

43

powerful tool to consolidate all your Travel Insurance tasks. Advisor dashboard Quotes

emails Two ways to enroll large groups View/add claim documents Orders Send confirmation details Policies Training videos Policy modifications Reporting Live chat Brainstorm program Subject to terms, conditions, exclusions and limitations of the purchased policy.

A

Reminder

Case Study

Epic Bike Crash in Rural Peru

An unfortunate crash during a trip of a lifetime abruptly cut the enjoyment short.

Arch RoamRight short term care, stabilization and evacuation to the appropriate facilities.

How It Happened

The insured – a female in her fifties – was biking in a remote part of Peru. A wrong turn in rough terrain resulted in significant injuries, including several broken ribs and a collapsed lung. As if the injuries were not enough, the local healthcare facilities were not equipped to handle such a severe case and a potentially long term recovery.

The Outcome

The insured’s condition was deemed a covered injury requiring evacuation to a regional hospital with better treatment capabilities. Once stabilized and deemed fit for travel, the insured was transferred to her home hospital in the United States via air ambulance. The total cost of the claim, including local stabilization, regional treatment and required transport via air ambulance exceeded $100,000.

A bike injury resulted in a hospitalization and evacuation.

Arch RoamRight designated assistance services provider was there for the traveler every step of the way, and helped her return home safely.

Cost of travel insurance policy: Amount covered by travel insurance:

$ 495 $111,950

Case studies are provided solely for illustrative purposes and may be based on actual cases, composites of actual cases or hypothetical claim scenarios.

44 | The Travel Insurance Playbook

At A Glance

More Case Studies Here

A Behind the Scenes Look…

at Arch RoamRight’s Client Services & Claims Teams

What is the best part about working for Arch RoamRight?

We are constantly improving. We are always looking for new ways, or new solutions, that deliver enhanced products and services. This spans from digging deep into each investigation to find the best possible outcome for an insured’s claim, to collaborating across our teams to service our customers in the most efficient and responsive manner possible.

We strive for care, connection and cooperation in everything that we do, and hope we are able to offer travelers a silver lining on what might otherwise be a cloudy day.

As Client Services Advisors, tell us about what you do?

We aim to provide quality, dependable and friendly service in every interaction with our customers. We strive to be positive stewards of the Arch brand, and recognize we carry the responsibility of making sure customers have a good experience.

What you may not realize is that our role extends far beyond the typical issues management you may think of as customer service. We are licensed insurance agents and are very familiar with the

policy coverages. Day-to-day we speak directly with customers to help them understand the differences between our various policy options, we share quotes, answer coverage questions and provide support on their purchase by guiding the customer towards the policy that best fits their unique needs. Additionally, we walk our callers through what they can expect throughout the claims process, provide claim status updates and manage claimant expectations.

Travel advisors often refer their customers to us because we know the ins and outs of the policies and can give the traveler a fast and accurate answer to their questions about what may or may not be covered in any specific situation.

As Claims Administrators, where do you come in?

Our role is to gather and organize all appropriate documentation for the Claims Examiner. This requires us to be familiar with documentation required in support of a claim and accurately instruct claimants on what is needed for each claim instance. Once information is gathered, we then prepare the file and share it with the Claims Examiner for review. If any additional information or documentation is needed during the claim review process, we then liaise with the claimant to source those additional materials.

46 | The Travel Insurance Playbook

What is your main responsibility as Claims Examiners?

As the final assessment for a claim, our main role is to compare the policy purchased with the claim presented. We review each claim based on the facts and circumstances efficiently and accurately in order to determine whether it is payable under the policy purchased. A key element to this entire process is fostering open communication between us and our claimants—and in collaboration with our Client Services Advisors and Claims Administrators—so that we can provide accurate outcomes and great customer service along the way.

What tips do you have for travel advisors when their client has filed a claim?

1. Encourage customers to be informed. Remind them to review their policy, ask their insurer any questions prior to their trip and bring a copy of their policy with them on their travels. This way should an issue occur causing them to cancel, or one while they are traveling, they will have a good sense of whether or not it may be covered, as well as any additional resources they may then have at their disposal.

2. Don’t over promise. Don’t promise that travel insurance covers everything. It doesn’t and will depend on the facts and circumstances. Each circumstance is unique to the traveler and each claim has many factors that could impact coverage— even from one instance to another.

3. Advise them to timely file their claim. Include any and all information that may be relevant to their claim. Documentation is key and more information is always better. Reviewing the claim instructions on our website will help them know immediately what documentation is required and can help us process their claim more quickly. Once a claim is filed,

support can be reached by phone or via our claims department, and a claimant can easily check the status of replace claim through our site.

4. Assume good intentions. The claims team is not intending to make the claims process arduous or difficult. We only ask for the documentation that is required for the Claims Examiner to make a proper evaluation. At the end of the day, we really are working on the side of the claimant to facilitate the claim process for is payable claim.

What was your most memorable experience with a travel advisor?

There are so many, it is hard to choose. But here are a few of our favorites:

1. We once worked with an advisor who was helping an elderly couple with a claim. The advisor was extremely helpful and accommodating to both the couple and us at Arch. She really did everything in her power to make sure they were completely taken care of.

2. In another instance, we got memorable feedback from a customer that they very much enjoyed working with Arch because they appreciated the responsiveness of the team and the seamless claim process.

3. We received a call from a travel agent who had a client on vacation, who ended up getting in an accident and needing hospitalization. The travel agent was not sure how the policy they purchased could assist the traveler during this time. We explained the benefits offered under the policy and got the travel agent in contact with the emergency assistance provider to

establish a case for the client and coordinated payment to the hospital and with other related expenses.

4. Another memorable experience was a bonding moment where we found common ground with a travel advisor in our shared commitment to serving customers and providing them with the best experience. It reminded us both that we are a team pursuing the same goal.

5. We also received a heartfelt thanks from a travel advisor for communicating with them on a daily basis to resolve a problem with the documentation that needed to be provided.

What is the most popular question you get from travelers or travel advisors?

1. What exactly do our polices cover for trip cancellations? Travelers want to confirm that the policy they are purchasing will provide coverage for certain cancellation circumstances.

2. Will customers have all the benefits included in their policy? This often includes a discussion about specific customer concerns, mostly medical in nature.

3. Why do I need to provide certain documentation? Or why do I need to provide different documentation? Often this is because we require proof of purchase receipts directly from their source, rather than a third-party.

This is why we’re always here to support and answer any questions as they surface. Travelers should always reach out to us if they ever have any questions; we’re here for travelers and their advisors.

48 | The Travel Insurance Playbook

RoamRight Team Members Who Contributed to This Piece:

Anne Willenburg, Claims Administrator

Betsy Judge, Claims Administrator

Charla Davis, Senior Client Services Advisor

Daniel Buchanan, Senior Claims Examiner

Ellen Kane, Senior Claims Examiner

Hooi Chi, Claims Team Lead

Karla Garcia, Client Services Team Lead

Kathleen Boly, Senior Claims Examiner

Kimberly Russell, Claims Administrator

Leanna Gardner, Senior Claims Examiner

Marce Lawrence, Manager, Client Services

Maxwell Stutesman, Claims Examiner

Megan Calder, Senior Client Services Advisor, Client Services

Nichole Niewiadomski, Senior Claims Examiner

Niko Karlo Catubay, Claims Analyst

Sarah Moore, Claims Examiner

Sue Lochner, Senior Claims Examiner

Arch Capital Group Ltd.

Arch Capital Group Ltd. (Arch Capital or ACGL), a Bermuda-based, global insurer that writes insurance, reinsurance and mortgage insurance on a worldwide basis with a focus on specialty lines.

Arch Insurance Group

Arch Insurance North America is a part of Arch Capital Group Ltd., and includes Arch’s insurance operations in the United States and Canada. Arch Insurance is a marketleading insurer, providing a wide range of property, casualty and specialty insurance options for corporations, professional firms

and financial institutions across the U.S. Business in the U.S. is written by Arch Insurance Company, Arch Specialty Insurance Company, Arch Excess & Surplus Insurance Company and Arch Indemnity Insurance Company. Business in Canada is written by Arch Insurance Canada Ltd.

More products offered through Arch Insurance Group:

• Accident Insurance

• Alternative Markets

• Builders’ Risk

• E&S Casualty

• Construction

• Lender Products

• Disability

About 50 Arch

• Excess Worker’s Compensation

• National Accounts Casualty

• Healthcare Programs

• Professional Liability

• Contract Binding Operations

• Executive Assurance

• Defense Base Act Design & Environmental

50 | The Travel Insurance Playbook

Arch RoamRight

Arch RoamRight is a co-branding of both Arch ® and RoamRight ® marks used by Arch Insurance Company to reflect its travel insurance, including RoamRight ® policies that help individuals and groups traveling around the world. Arch RoamRight is a business unit within Arch Accident and Health and offers travel insurance plans for leisure, business, student and group travelers taking both domestic and international trips. From trip cancellation to travel medical insurance plans and an award-winning mobile app and website, Arch RoamRight is an industry leader in innovation and technological solutions.

Pursuing Better Together®

Pursuing Better Together ® encapsulates how we do business at Arch Insurance. It is an approach that is based on collaboration, responsiveness and a genuine commitment to continually raising the bar.

It is our promise to our brokers, colleagues and other partners to listen, share insights and work together to deliver informed solutions. We want to build a trusting and respectful relationship that allows us to understand our audience’s goals so we can explore the possibilities together.

Pursuing Better Together ® is a customer-focused mindset. It is a continual drive, working together with our partners, to pursue better ways of doing things and more effective solutions to respond to the needs of our customers.

52 | The Travel Insurance Playbook

Learn More

Leadership Team

Linda Fallon

Executive Vice President of Accident & Health

Linda Fallon has more than 30 years’ experience in the assistance and travel insurance industry, and has been at Arch Insurance since 2011.Thanks to her years of experience and dedication to the travel insurance industry, Fallon was elected president of the United States Travel Insurance Association, the premier trade association for the travel insurance industry, in 2018. In 2019, she was selected to the Insurance Business Magazine’s Hot 100 list, being identified as someone who has helped shape the insurance industry.

Senior Vice President Operations/COO

Senior Vice President Underwriting/CUO

Senior Vice President Operations/COO

Senior Vice President Underwriting/CUO

54 | The Travel Insurance Playbook

Brice King

Jeff Davidson

Dan Povondra

Vice President Business Development

Vice President Business Development

Vice President Operations Vice President Business Development

Vice President Marketing/CMO

55

Greg Johnson

Darnelle Phillips

Cory Sobczyk

Tim Dodge

Dana Silverman

Client

AVP,

Services

Endnotes

56

01 02 03 04

Arch RoamRight data on pages 3-9 is based on RoamRight® Travel Survey Summary data polled in 2024. 8,832 Arch RoamRight direct purchasers polled on 33 questions relating to travel, trends, & demographics. Participant purchased between 1.1.22 - 1.5.24.

Arch RoamRight data is based on RoamRight® policies data from 2024.

Arch Roamright data is based on RoamRight® claims data from 2022-2023.

Based on awards granted to Arch RoamRight® in the year 2022-2023.

Including but not limited to: 2022 Stevie Award for Customer Service Department of the Year, 2023 Stevie Award for Customer Service Manager of the Year, 2022 Business Intelligence Group Excellence in Customer Service, 2023 Travel Weekly Magellan Award for Overall Travel Insurance.

roamright.com • 866.891.6614 Learn More

Laura Heidt of Brownell Travel on

Laura Heidt of Brownell Travel on

Senior Vice President Operations/COO

Senior Vice President Underwriting/CUO

Senior Vice President Operations/COO

Senior Vice President Underwriting/CUO