14 minute read

Byproduct-based fishmeals: Adding to the future of fishmeal production

Brett D. Glencross, Enrico Bachis, IFFO, The Marine Ingredients Organisation

Changing the face of the marine ingredients industry

There was once a time when nearly all the world’s fishmeal and fish oil supplies were obtained from forage fisheries, those that have a very limited direct food market and are using high-abundance low-trophic level fish with annual recruitment cycles. Still to this day, some of these fisheries, like the Peruvian anchoveta and the North Atlantic capelin fisheries, are among the largest single-species fisheries on earth. Despite the introduction of strict fishery quotas and third-party certification systems to substantiate sustainability credentials of these fisheries, it is widely recognized that we are generally at the limits of the global supply of forage fish.

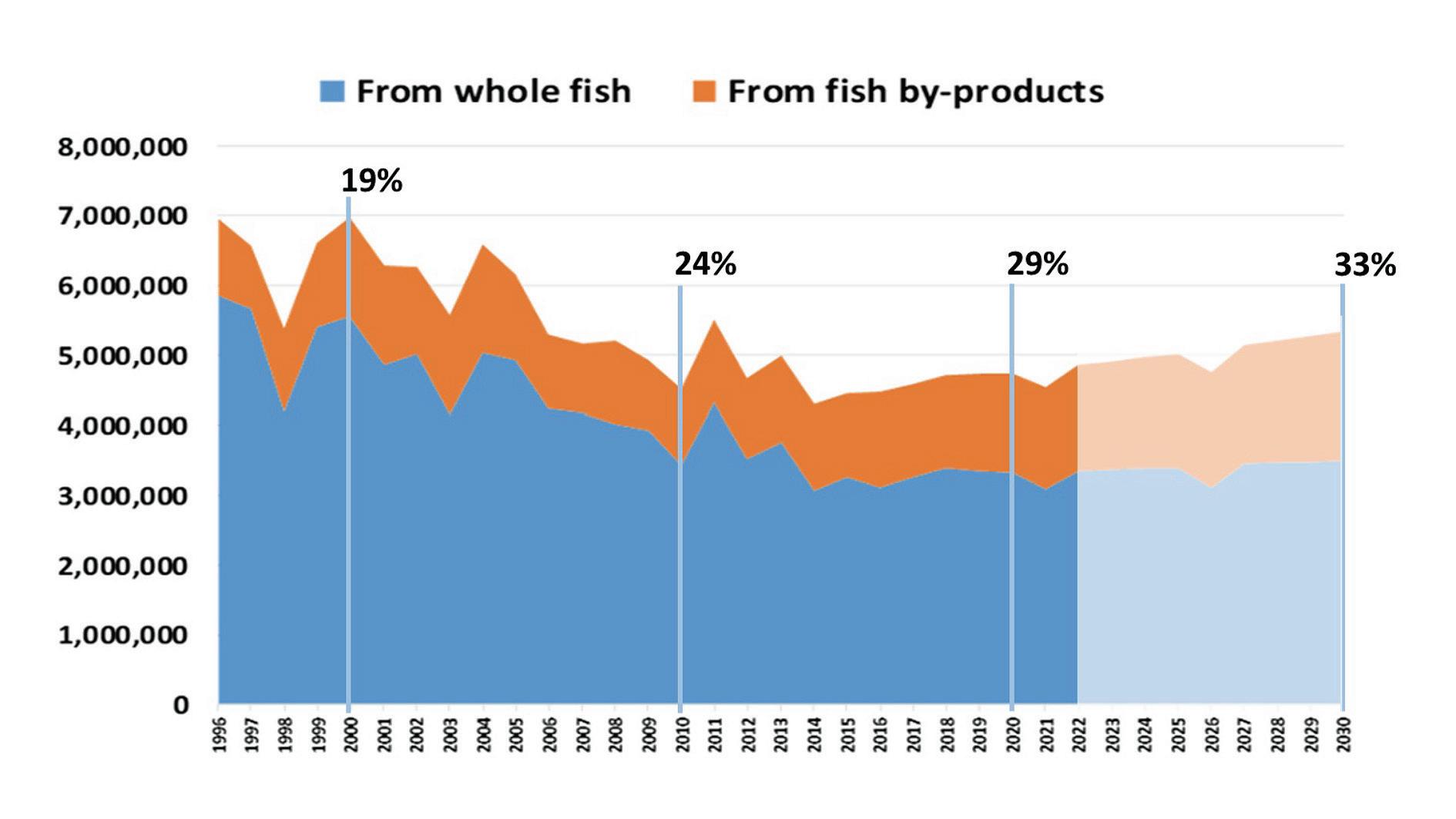

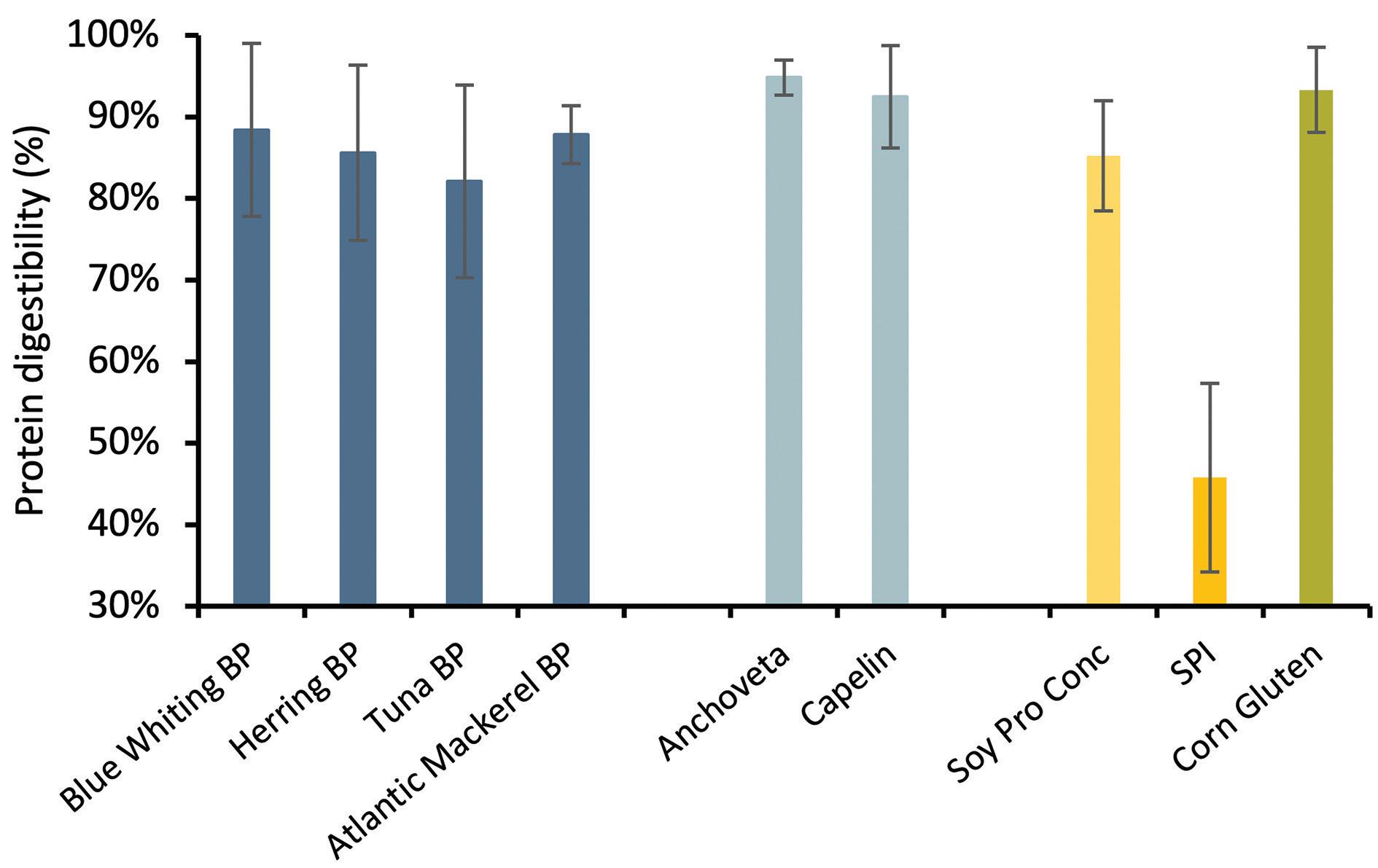

With a finite supply of forage fish, there has been an increasing focus on the use of byproducts to provide the raw material biomass for fishmeal and fish oil production. Arguably, today this represents one of the best bio-circularity stories around in terms of capturing the full value of animal production/ capture in our food chain. Increasingly, contributing to the story in providing additional biomass input are the byproducts from the aquaculture industry itself. Over the past twenty years, the volume of byproduct fishmeals has grown from 1.2 million tons (about 19% of total fishmeal production) to the present day where it now represents more than 1.4 million tons (about 29% of total fishmeal production) (Fig. 1). In 2020 it is estimated that 29% of all fishmeals and 48% of all fish oils are from byproducts (Fig. 2). Combined, that means almost one-third of all fishmeal and fish oil are now being sourced from byproducts in 2020.

Figure 1. Global fishmeal production by raw material input origin 1996 – 2030 estimates.

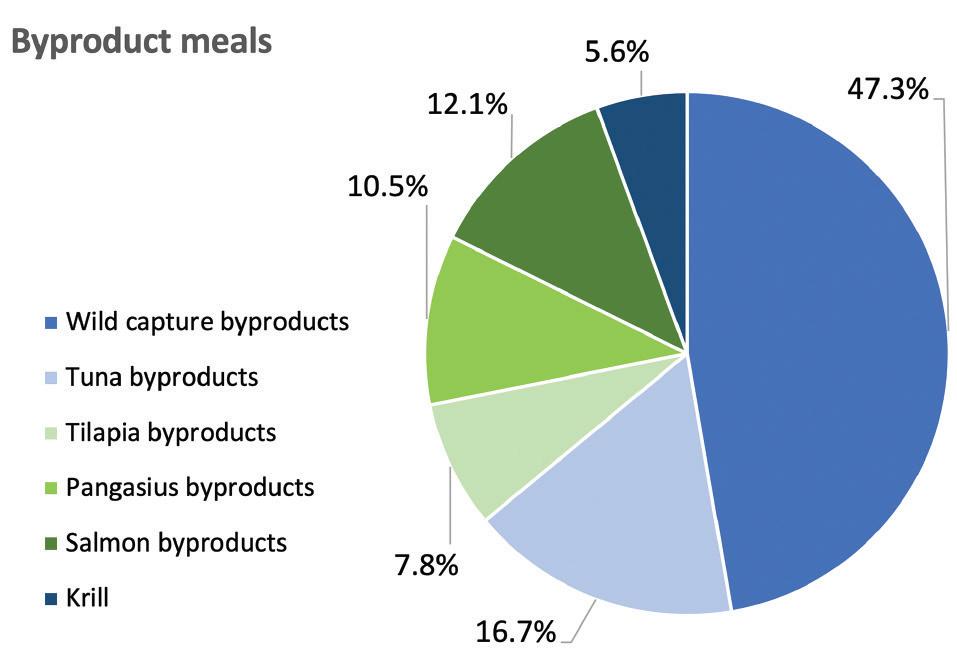

Figure 2. Global fishmeal and fish oil production by raw material input origin 2020 estimates.

Figure 3. Production of global byproduct meals by category in 2020.

Figure 4. Production of global byproduct oils by category in 2020.

Gaining momentum as aquaculture grows

Of the global production of fishmeals and oils from byproducts, there is a bit of a dichotomy. More than 69% of byproduct fishmeal production comes from wild-fishery byproducts and only just over 30% from aquaculture byproducts (Fig. 3). For fish oil, the opposite is the case, with almost 60% of fish oil byproduct production coming from aquaculture and just over 40% from wild-fishery byproducts (Fig. 4).

It is estimated that globally there is an additional 11.7 million tons of byproduct produced in processing plants that are currently not collected for the production of fishmeal and fish oil. At a typical processing yield of 4:1, this would realize another 3 million tons of fishmeal and fish oil from existing resources. While the majority of byproduct fishmeals still come from biomass obtained from wild-fisheries sourcing fish for direct human consumption (DHC), the supply of biomass from aquaculture is rapidly catching up. Presently three major aquaculture sectors contribute most of the aquaculture byproduct fishmeal, though undoubtedly there are more that we are yet to account for (Fig. 3). Salmon aquaculture byproducts are the largest contributor, followed by pangasius byproducts and then tilapia. Notably, we have not included byproducts from shrimp aquaculture in these estimates, although we know a substantial volume of this product exists. Among fish oils, the main aquaculture contributors are both salmon and pangasius aquaculture sectors, with both contributing about 45% of the byproduct oil from

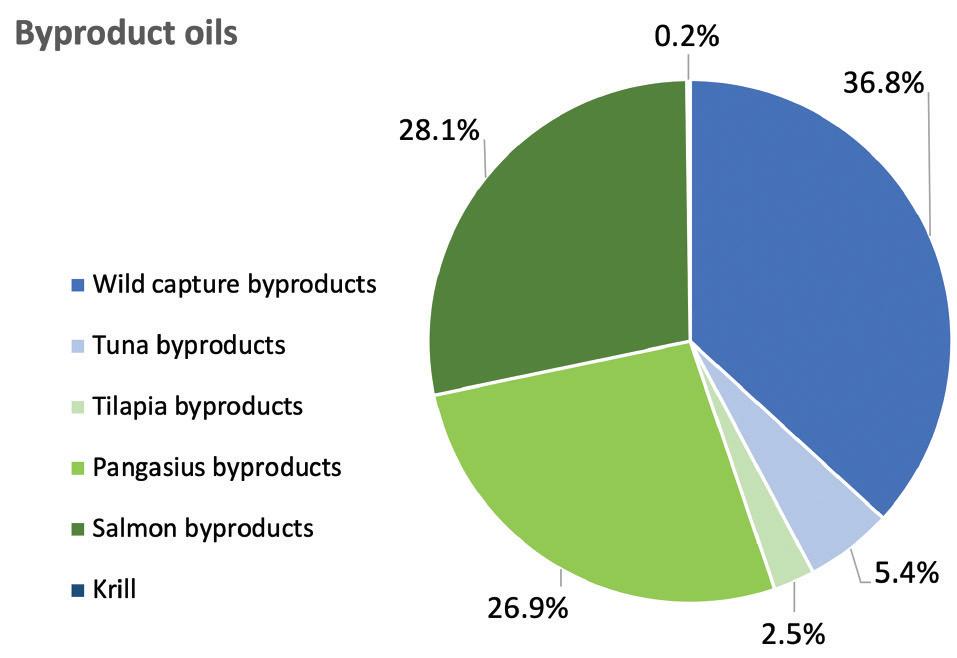

Figure 5. In vivo (Atlantic salmon) protein digestibility of a selection of byproduct fishmeals, two whole fish fishmeals and several plant protein ingredients. Data IFFO (2021). Notable is the consistency in digestibility values of both the byproduct and forage-fishery fishmeals.

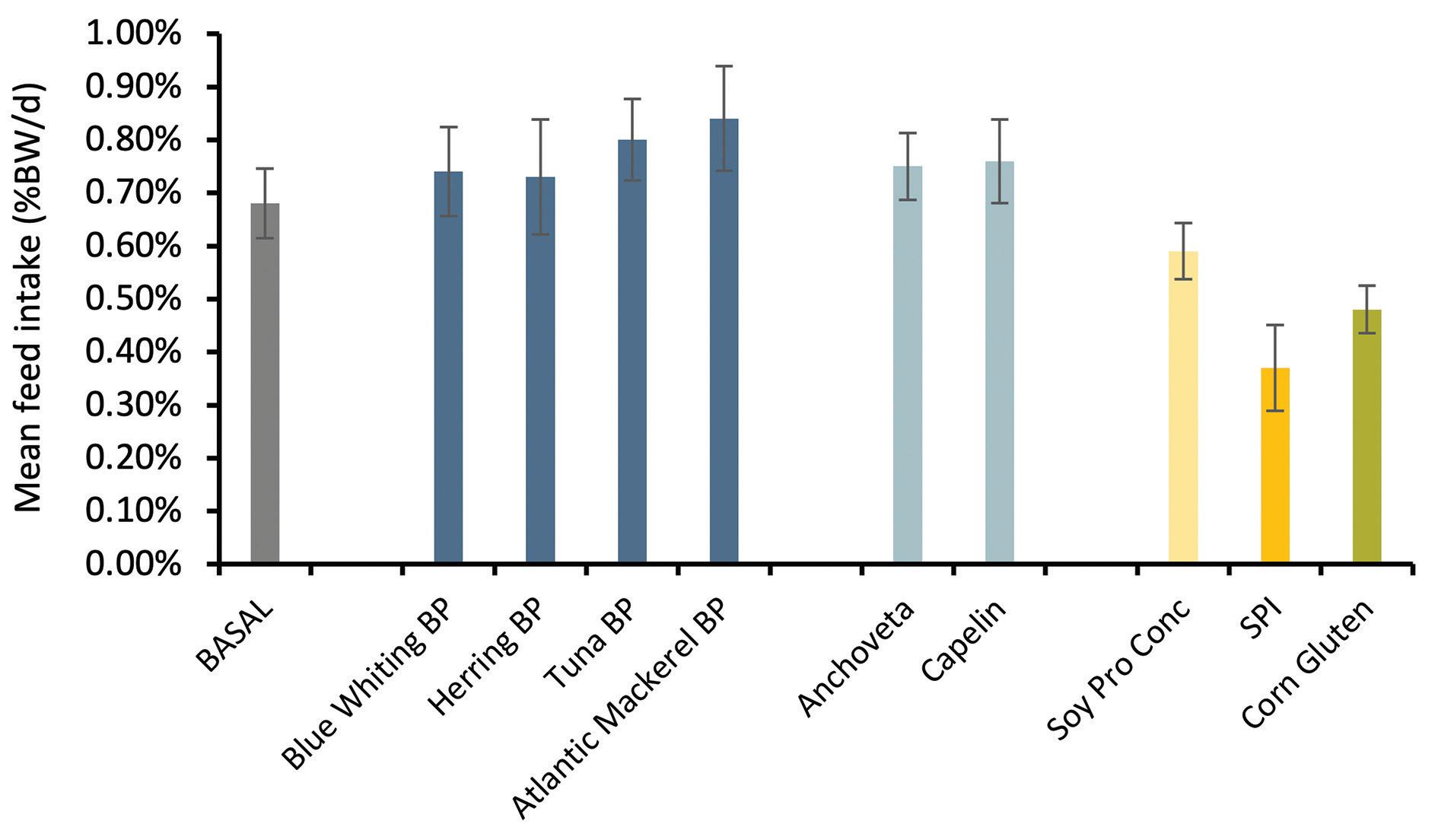

Figure 6. Mean feed intake by Atlantic salmon of a standard commercial reference diet formulation (BASAL) and diets where 30% of the diet has been made of the test ingredient. Included as test ingredients are a selection of byproduct fishmeals, two whole fish fishmeals and several plant protein ingredients. Data IFFO (2021). Notable is that all fishmeals result in a numerical improvement in feed intake, while each of the plant ingredients has the opposite effect.

aquaculture (Fig. 4).

Not so variable and still high-quality

One of the criticisms that byproduct fishmeals and fish oils attract is that they are seen as second-rate compared to other resources. While this may have been the case in the past, recent evidence does not support this with a growing volume of work showing they can be produced to high-quality specifications. Much of this comes from adopting modern processing technologies using low-temperature drying and maintenance of coldchain management systems for the raw material, to ensure biogenic amine production is kept down prior to processing. Recent work undertaken by IFFO comparing the quality of various byproduct fishmeals against several other fishmeal and grain product

Table 1. Example of the composition (g/kg as is) of different byproduct fishmeals compared to whole fish fishmeals and common plant protein ingredients.

Name Moisture Protein Lipid Ash Energy ARG CYS HIS ILE LEU LYS MET PHE THR VAL

Blue Whiting BP 77 675 107 159 20.1 46 11 14 30 54 57 22 28 29 36

Herring BP 100 660 137 163 20.9 42 6 10 26 44 47 21 24 26 32

Tuna BP 79 559 116 224 17.7 37 14 17 26 43 41 16 25 22 34

Atlantic Mackerel BP 80 672 115 133 20.4 40 4 15 27 51 52 21 27 29 32

Anchoveta

Capelin 82 670 109 139 20.1 39 9 25 30 50 53 20 27 25 37

70 667 157 116 21.9 41 8 14 27 54 53 22 27 30 36

Soy Pro Conc (SPC) 53 588 11 65 19.2 39 2 10 20 44 35 9 29 23 22 Soy Pro Isolate (SPI) 41 843 16 44 21.5 61 5 20 31 66 53 13 44 32 33 Corn Gluten 102 557 97 13 20.9 19 4 5 26 100 11 13 36 19 29

ingredients showed that both their digestibility and palatability criteria can be equally as good as that of those other resources (Fig. 5, 6).

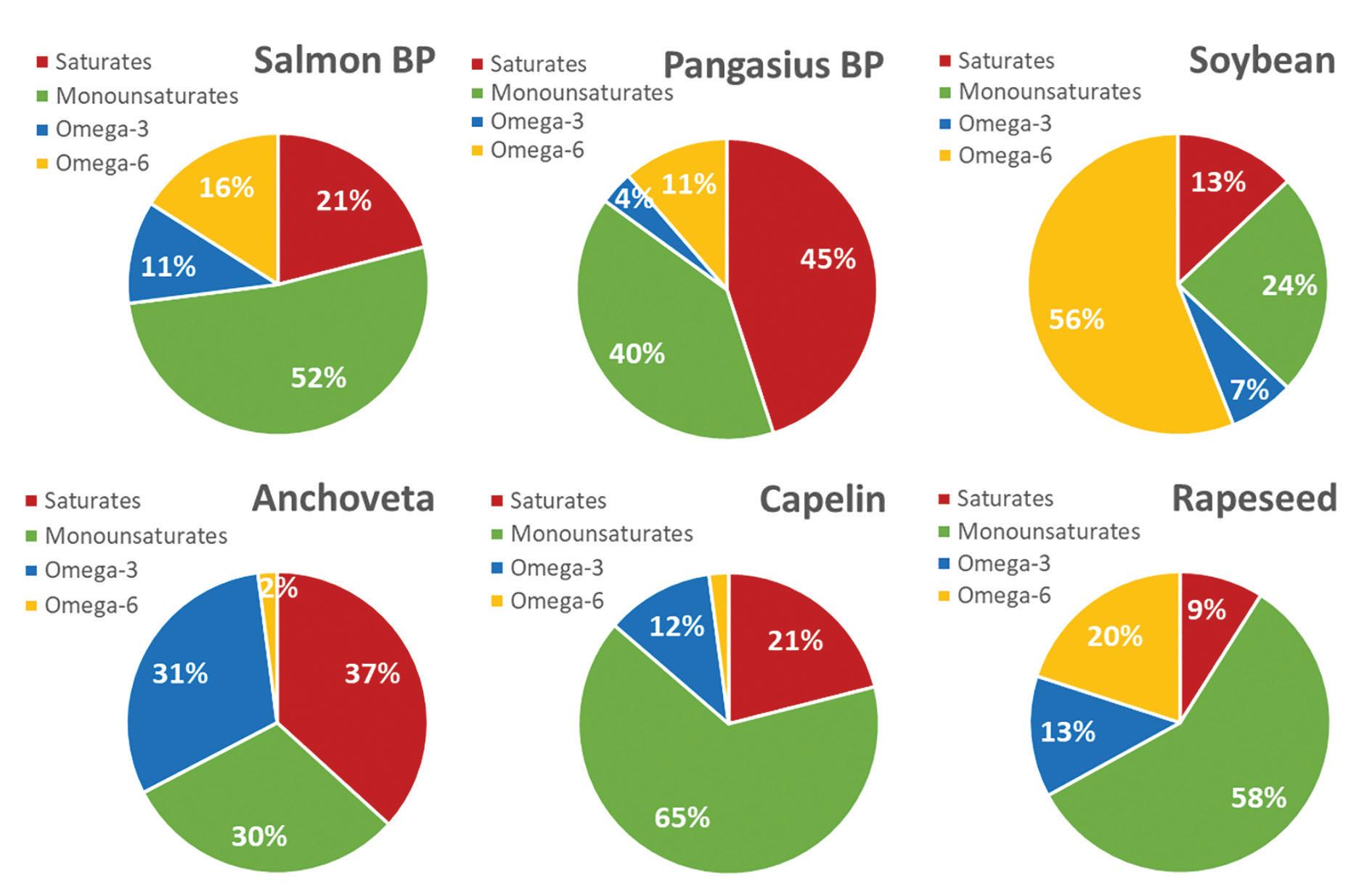

Analysis of the composition of these resources does often show that they are lower in protein (Table 1) and omega-3 (Fig. 7) than their wild-fish counterparts but given that the “best” parts of the fish have already gone for DHC, then this is perhaps not surprising. Irrespective, there are still resources with characteristics equal to that of many whole-fish fishmeals and fish oils and in most cases, they are still superior to that provided by plant protein and oil ingredients.

The future for byproducts

Looking to the future, we see positive signs. There is improving management of global fisheries throughout the world. Cuts to total allowable catches (TACs) in the early 2000’s are now reaping benefits in terms of stabilizing fishery biomasses in many of the large forage fisheries around the world. Combined with

Figure 7. Fatty acid profiles of various oils, including salmon and pangasius byproduct, whole fish oils from anchoveta and capelin and rapeseed and soybean vegetable oils.

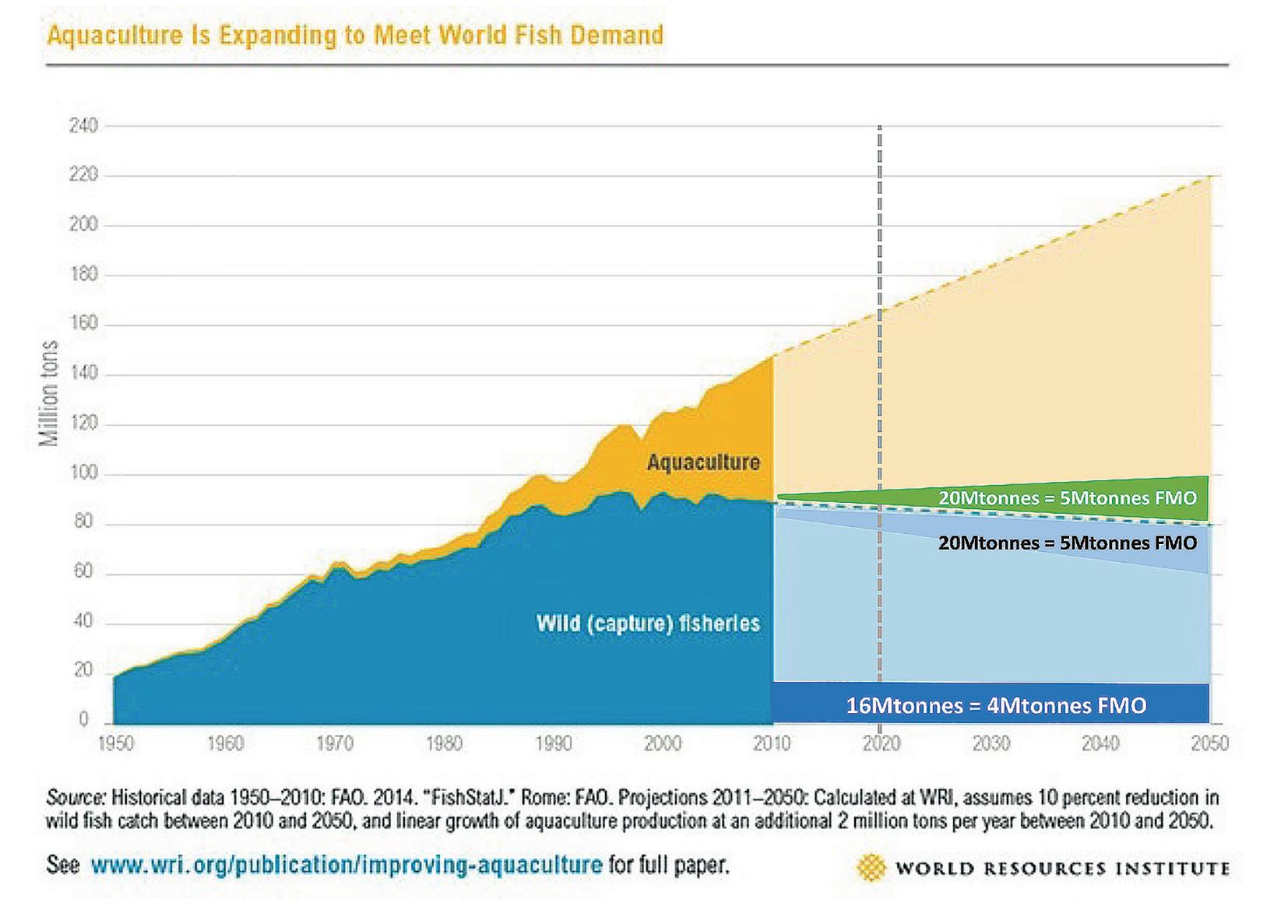

Figure 8. Projections of future fishery and aquaculture production yields with byproduct biomass potentials overlaid (dark blue = forage fishery, light-blue = byproduct from fishery, green = byproduct from aquaculture). Analysis suggest that global fishmeal and oil production could more than double over the next thirty years on the back of improved fishery byproduct management and continuing aquaculture growth.

the increased use of third-party sustainability certification systems, like MarinTrust and MSC, market forces are being used to drive responsible resource use across the sector. However, despite these positive signs, it is unlikely that we will see total forage fishery catch exceed much more than 16 million tons a year into the future. This means that fishmeal and fish oil yields from that resource are constrained to about 4 million tons a year (assuming a meal yield of 22% and oil yield of 3%).

These same improvements are extending beyond the forage fisheries into other large DHC fisheries. This of course also means that with improvements in fishery sustainability for DHC we are also improving our biomass base for the production of byproduct fishmeals and oils. Based on FAO estimates for fishery yields in 2050 of 80 million tons, we suggest that of the 64 million tons that is predicted to be caught for DHC, that we should be able to repurpose up to 33% of that biomass as byproducts (20 million tons) producing another 5 million tons of fishmeal and oil. We are presently processing almost 5 million tons of biomass (~1.25 million tons of fishmeal and oil), yet there are still many more processors around the world where we could repurpose more of this valuable resource.

Aquaculture is another dimension to add to this story. Over the past twenty years, we have seen unprecedented growth in this food production sector and predictions are for this to continue. Based on FAO estimates for aquaculture production in 2050, we could see production reach 140 million tons (Fig. 8). Even if we take a conservative view of only being able to repurpose up to 15% of that biomass as byproducts (~20 million tons) by 2050, then that would contribute another 5 million tons of fishmeal and oil. Presently in 2020 we already repurpose more than 3 million tons of aquaculture byproducts and there is still much more that could be done to improve the supply and use of these products. But one thing is for certain, so long as we keep fishing and growing fish in aquaculture for human food, then we will always have fishmeal and fish oil available as strategic feed resources.

More information: Brett D. Glencross

Technical Director IFFO, The Marine Ingredients Organisation E: bglencross@iffo.com

Fishmeal outlook

Steve Dahlblom

Steve Dahlblom is the global marine director for Scoular which handles more than 200,000 MT of various types and qualities of fishmeal. The company recently released a new brand, Encompass, for its global fishmeal products and services and is opening fishmeal facilities in Myanmar and Warrenton, USA, in the coming year. E: sdahlblom@scoular.com.

Importance of fishmeal in aquafeeds

Fishmeal is an important ingredient in aquafeeds for many reasons. It is nutrient-rich and provides a highly digestible source of amino acids and important omega3 fatty acids, in addition to acting as a strong attractant in feed. As ingredient innovation across the globe rapidly continues, fishmeal remains one of the most nutritionally balanced ingredients for aquafeed, piglet and pet diets.

In aquaculture diets, fishmeal inclusion ranges from 0% to 80% depending on the marine species and where it is being raised. U.S. catfish diets use little to no fishmeal, while eel feed in Asia requires high inclusion levels. A typical salmon diet uses 10% to 15% inclusion, while shrimp and seabass are 15% to 30%.

All feed diets must contain protein, and the protein’s nutritional value sets one ingredient apart from another. To promote growth, essential amino acids must be supplied in the feed. Plant-based concentrates and meals may measure up in protein content but cannot compete with fishmeal's robust source of essential amino acids such as lysine, methionine and cystine. Fishmeal substitutes like vegetable concentrates and proteins also contain less-digestible nitrogen, which leads to excess ammonia in the feces that can negatively affect water quality in shrimp ponds, tilapia ponds, trout streams and Recirculating Aquaculture Systems (RAS).

The fatty acid profile is another reason why fishmeal is a beneficial ingredient. The majority of fish oil is extracted when the raw material is processed into fishmeal, leaving between 6% to 10% fat by weight in the meal. This percentage provides valuable polyunsaturated fatty acids, specifically the essential omega-3’s (EPA and DHA). Most oils of vegetable origin contain high concentrations of Omega-6 fatty acids but lack the Omega-3 fatty acids.

Feed producers face a difficult decision when trying to reduce fishmeal inclusion in the diet. While fishmeal can be a relatively expensive ingredient, producers are challenged to reduce inclusion rates any further without the quality of the feed deteriorating.

Main challenges of fishmeal production

Fishmeal and fish oil production share many challenges with traditional agriculture, such as seasonality and inclement weather. However,

fishmeal and fish oil production are more complex. Even with the best acoustic equipment and perfect weather, finding and catching the targeted species is never guaranteed.

One of the fishmeal industry’s most pressing considerations is how to best manage fisheries sustainably to ensure the longevity and long-term success of the biomass. The industry, in partnership with third parties, works hard to responsibly manage fisheries around the world, including measuring and monitoring biomasses, spawning, juveniles, setting quotas (i.e. catching limits) and enforcing fishing bans. While 51% of the global fishmeal market is certified sustainable through third-party certifications under the Marin Trust and MSC standards, it is not always economical or feasible for many small-scale producers in lower volume producing countries to get these certifications. Many these producers are acting as good stewards while following similar benchmarks of the third party certifications. It is important to understand their fishing operations and support them for doing the right thing and not ignore the source completely.

Another challenge is catching and properly handling the fish both at sea and on land to maximize its nutritional value and quality. Fishing operations must keep the catch as fresh as possible until processing. If nets or vessels are too full, fish can be damaged and cause enzymes to break down amino acids, lowering protein levels, quality and value. Processing temperatures also directly impact product quality and value. For example, fish must be processed using a low temperature and without direct flame to achieve the highest level of digestibility.

Factors such as weather, food source, location of the fish, size and fat of the fish, and volume of the catchable supply all impact fishmeal and oil quality. From day to day and season to season, fishmeal is hard to predict, making delivery of consistent supply and quantity challenging. Inevitably, feed millers want and depend on consistent product quality, performance and availability.

Over the past year, the world container market has turned supply management on its head. Longer lead times have created a greater need for reserve stocks on hand for buyers. The current freight environment appears it will be long-lasting and underestimating the risk associated with that would be a mistake. Working with high-integrity trade partners who stand by their contracts matters more than ever in a high-volatility freight environment.

Supply chain management, along with seasonality, weather issues, sustainability, inconsistency and quality, are among the challenges Scoular continues to navigate in our decades-old fishmeal business, now branded as Encompass. Our large multi-national team and strategically located fishmeal facilities in Myanmar, Mexico, Indonesia and across the United States, along with fish oil tanks in Dutch Harbor, Alaska, help suppliers and customers efficiently manage their evercomplicated pipelines.

Future perspectives

Demand for all proteins is growing rapidly due to increasing global populations with higher disposable incomes, and we must find creative ways to feed 10 billion people by 2050. To help meet higher demand, aquaculture is the fastestgrowing sector in agriculture. Fishmeal production, which is critical for the aquaculture industry, remains fairly flat year-over-year, and the demand is outpacing the supply. Ocean-caught fishmeal has decreased and increases from fishmeal made from trimmings and offals from the filet and human consumption processing does not meet the increased demand.

Therefore, sustainability is crucial to the fishmeal industry’s future. As previously stated, 51% of the fishmeal produced globally is certified for sustainability, of which approximately 30% is produced from trimmings up-cycled into sustainable fishmeal. Sustainable ingredients along with sustainable aquaculture practices will become necessary, and companies without a strong sustainability strategy will struggle to exist. At Scoular, for example, fishmeal is a key ingredient in our portfolio, and in 2020, we launched a sustainability strategy with marine sourcing as a key component. Additionally, we believe a formula for success is to partner with suppliers and customers who share the same vision and values. This drives success for each party as well as for the overall industry.

In closing, many challenges and disruptions exist in the fishmeal business, and there will always be market volatility. However, one constant will be that fishmeal is a highly valuable ingredient in global feed rations.