10 minute read

How to Open a Forex Account in South Africa

Forex trading has become increasingly popular in South Africa due to its potential for high returns and the ability to trade 24 hours a day. Whether you're a beginner looking to enter the world of forex trading or an experienced trader aiming to refine your strategy, opening a forex account in South Africa requires careful consideration and knowledge of both the local regulatory environment and the global forex market. In this guide, we will walk you through everything you need to know about opening a forex account in South Africa, from selecting a broker to navigating the trading platform and managing risks effectively.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Understanding Forex Trading

What is Forex Trading?

Forex trading refers to the buying and selling of currencies in the foreign exchange market. It is one of the largest and most liquid markets in the world, with daily transactions exceeding $6 trillion. Forex traders speculate on the movement of currency prices by trading currency pairs, such as USD/ZAR, EUR/USD, or GBP/JPY. The goal is to profit from changes in the value of one currency relative to another.

Forex trading is attractive to many due to its flexibility, the ability to trade with leverage, and the 24/5 availability of the market. However, it also comes with significant risks, including volatility and the potential for substantial losses if not managed correctly.

The Importance of the Forex Market in South Africa

South Africa has become one of the leading forex trading hubs in Africa, largely due to the country's robust financial infrastructure and access to global markets. The South African Rand (ZAR) is one of the most traded emerging market currencies, making it an attractive option for both local and international traders. Additionally, the presence of regulated brokers and a strong regulatory framework ensures a safe environment for forex traders in the country.

The Financial Sector Conduct Authority (FSCA) plays a crucial role in maintaining the integrity of the forex market in South Africa, protecting traders from fraudulent practices and ensuring compliance with financial regulations.

Choosing the Right Forex Broker

Factors to Consider When Selecting a Broker

Selecting the right forex broker is one of the most critical steps when opening a forex account. Several factors should be considered, including:

Regulation: Ensure the broker is regulated by a reputable authority, such as the FSCA in South Africa or other international regulators like CySEC, FCA, or ASIC.

Trading Conditions: Look at the broker’s spreads, commissions, and leverage offerings. Tight spreads and low commissions are beneficial, especially for high-frequency traders.

Trading Platforms: The availability of popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) is important for ease of use and access to advanced charting tools.

Customer Support: A broker with responsive customer service is essential for resolving issues quickly.

Deposit and Withdrawal Options: Consider the broker’s payment methods and whether they offer fast, fee-free transactions.

Regulated vs. Unregulated Brokers

The difference between regulated and unregulated brokers can have a significant impact on your trading experience. Regulated brokers are subject to strict financial rules and audits, ensuring that they operate transparently and protect client funds. Unregulated brokers, on the other hand, may not adhere to any financial standards, increasing the risk of fraud or unethical trading practices.

In South Africa, the FSCA regulates brokers to ensure they comply with local financial laws. Traders should avoid unregulated brokers, as they may offer higher leverage or lower spreads at the cost of increased risk, including loss of funds.

Comparison of Popular Forex Brokers in South Africa

Some of the most popular forex brokers operating in South Africa include:

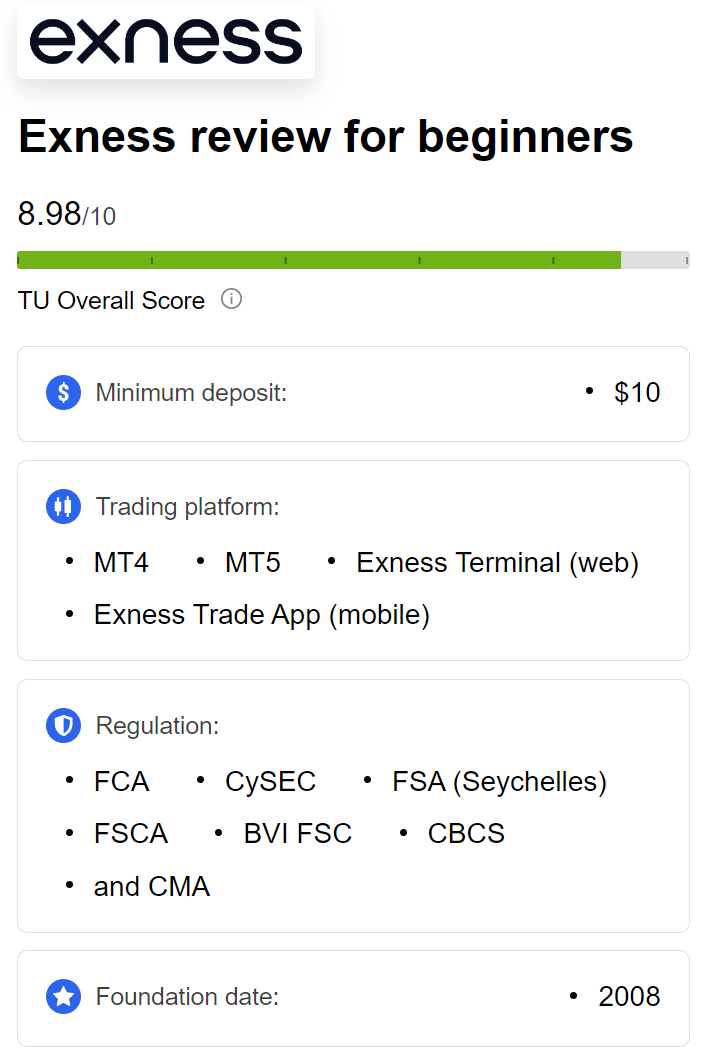

Exness: Offers competitive spreads, high leverage, and instant withdrawals, with regulation by both the FSCA and CySEC.

XM: Known for its tight spreads, fast execution speeds, and wide range of educational resources. It is regulated by multiple authorities, including the FSCA.

HotForex: A well-established broker with an FSCA license, offering low spreads and a variety of account types to suit different trading styles.

FXTM: Provides comprehensive educational materials and is regulated by the FSCA, making it a great option for beginners.

Requirements for Opening a Forex Account

Legal Age and Identification

To open a forex account in South Africa, you must be at least 18 years old. Brokers require proof of identity, typically a government-issued ID such as a passport or driver’s license. This is to comply with Know Your Customer (KYC) regulations, which help prevent fraud and ensure the safety of the financial system.

Proof of Address Documentation

In addition to proof of identity, you will also need to provide proof of address. This can be a utility bill or bank statement issued within the last three months, showing your full name and residential address. Most brokers require this document to verify that you are a legitimate resident of South Africa or another country in which they operate.

Financial Capability and Experience Level

Some brokers may ask for information about your financial capability and trading experience to assess whether forex trading is suitable for you. This information is typically collected during the account opening process through a questionnaire that asks about your income, investment experience, and risk tolerance.

Types of Forex Accounts

Standard Accounts

Standard Account is the most common type of forex account offered by brokers. It allows traders to access the full range of trading features, including competitive spreads, leverage, and access to all available trading instruments. Standard accounts are suitable for both beginners and experienced traders due to their flexibility and comprehensive features.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Mini and Micro Accounts

Mini and Micro Accounts are designed for traders who want to start trading with smaller capital. These accounts allow you to trade smaller lot sizes, reducing your overall risk. Mini Accounts typically offer lot sizes one-tenth the size of standard accounts, while Micro Accounts offer even smaller lot sizes, making them ideal for beginners or those testing new trading strategies.

Managed Accounts and Their Benefits

For traders who prefer a hands-off approach, Managed Accounts allow professional traders to manage your funds on your behalf. These accounts can be beneficial for individuals with limited time or experience, as they let experienced traders make decisions for you. However, managed accounts come with additional fees, and it is crucial to choose a reputable and transparent manager.

The Account Opening Process

Online Application vs. Offline Application

Opening a forex account in South Africa is generally done online, though some brokers may offer offline options. The online application process is straightforward and typically involves filling out a registration form on the broker’s website. The form will ask for personal details, financial information, and your preferred account type.

For an offline application, you may need to contact the broker's customer support or visit their local office (if available) to complete the necessary paperwork.

Verification Process Explained

Once you submit your application, you will need to complete the verification process. This involves uploading your identification documents (proof of ID and proof of address) to the broker’s secure platform. The broker will review your documents to verify your identity, a process that usually takes between 24 to 48 hours. Some brokers offer instant verification for certain types of accounts or payment methods.

Funding Your Account: Deposit Methods

After your account is verified, you can fund it using a variety of deposit methods. Common payment options include:

Bank transfers

Credit/debit cards

E-wallets such as Skrill or Neteller

Cryptocurrency payments (with certain brokers)

Make sure to check if your broker charges any deposit fees and what the minimum deposit requirements are. Many brokers in South Africa offer low minimum deposits, allowing beginners to start with a modest capital.

Navigating the Trading Platform

Overview of Popular Trading Platforms

Once your account is set up, you’ll need to navigate the trading platform. The most popular platforms offered by brokers in South Africa are MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are user-friendly and come equipped with advanced charting tools, technical indicators, and automated trading capabilities through Expert Advisors (EAs).

MT4 is ideal for beginners due to its simplicity and intuitive design.

MT5 offers additional features, such as more timeframes and extended asset classes, making it suitable for experienced traders.

Understanding Charting Tools and Features

Successful forex trading requires a strong understanding of charting tools and market analysis. Most platforms offer a variety of tools to help traders analyze price movements and identify trends. These tools include:

Candlestick charts

Moving averages

Bollinger Bands

Relative Strength Index (RSI)

Fibonacci retracements

Learning to use these tools effectively will enhance your trading strategy and improve your decision-making process.

Risk Management in Forex Trading

Importance of Risk Management Strategies

Risk management is crucial in forex trading, as the market’s high volatility can lead to significant losses. Effective risk management strategies include setting stop-loss orders to limit potential losses and using position sizing to ensure that no single trade can wipe out your account.

Setting Stop-Loss and Take-Profit Orders

Stop-loss orders automatically close a trade when it reaches a specified loss level, protecting you from losing more than you’re comfortable with. Similarly, take-profit orders close trades when they reach a certain profit level, locking in gains. These tools are essential for managing risk and maintaining discipline in your trading.

Tax Implications of Forex Trading in South Africa

Understanding Capital Gains Tax

In South Africa, profits from forex trading are subject to Capital Gains Tax (CGT). Any profits made from forex trading should be declared to the South African Revenue Service (SARS). Traders must keep accurate records of all their trades, including profits and losses, to ensure they are correctly reporting their income to the tax authorities.

Reporting Requirements for Forex Traders

Forex traders in South Africa must report their income from forex trading on their annual tax returns. It's advisable to consult with a tax professional to ensure compliance with local tax laws, especially if forex trading is your primary source of income.

Trading Regulations in South Africa

Role of the Financial Sector Conduct Authority (FSCA)

The FSCA is the main regulatory body overseeing forex trading in South Africa. The FSCA ensures that brokers comply with financial laws and regulations, protecting traders from fraud and malpractice. Only brokers licensed by the FSCA can legally offer trading services in the country.

Compliance and Legal Obligations for Traders

Traders must comply with local laws, including tax regulations and financial reporting requirements. It’s important to only trade with FSCA-regulated brokers to ensure that your funds are secure and that the broker operates transparently.

Educational Resources for Forex Traders

Online Courses and Webinars

Many brokers offer free educational resources to help traders improve their skills. These resources include online courses, webinars, and tutorial videos covering topics such as risk management, technical analysis, and forex trading strategies.

Books and Publications on Forex Trading

There are several well-regarded books on forex trading that can help you deepen your understanding of the market. Some popular titles include:

"Currency Trading for Dummies" by Kathleen Brooks

"Forex Trading: The Basics Explained in Simple Terms" by Jim Brown

"Trading in the Zone" by Mark Douglas

Common Mistakes to Avoid When Opening a Forex Account

Overlooking Broker Regulations

One of the biggest mistakes new traders make is choosing an unregulated broker. Always ensure that your broker is regulated by a reputable authority, such as the FSCA, to protect your funds and ensure a fair trading environment.

Ignoring Demo Accounts for Practice

Many traders skip the demo account stage and jump straight into live trading, which can lead to significant losses. It’s essential to practice your trading strategy on a demo account before risking real money. This will help you familiarize yourself with the platform and test your strategy in a risk-free environment.

Conclusion

Opening a forex account in South Africa is a straightforward process if you follow the right steps. From choosing a regulated broker and verifying your account to navigating the trading platform and managing risks, it's essential to be well-prepared before you begin trading. By understanding the regulatory environment, leveraging educational resources, and practicing good risk management, you can set yourself up for success in the dynamic world of forex trading in South Africa.

Read more: