10 minute read

What is the Spread of XAUUSD in Exness? A Comprehensive Guide

from Exness

by Exness Blog

Gold trading, represented by the XAUUSD pair (gold priced against the U.S. dollar), is a cornerstone of the forex and commodity markets, attracting traders worldwide due to its volatility and safe-haven status. When trading XAUUSD, one critical factor that impacts profitability is the spread—the difference between the bid and ask prices. For traders using Exness, a globally recognized forex and CFD broker, understanding the spread structure for XAUUSD is essential to trading strategies and minimizing costs. In this comprehensive guide, we’ll explore what spreads are, how Exness structures its XAUUSD spreads, how they compare to industry standards, and tips to leverage these conditions for successful trading.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Understanding Spreads in Forex and Commodity Trading

Before diving into the specifics of Exness’s XAUUSD spreads, let’s clarify what a spread is and why it matters. In forex and CFD trading, the spread is the difference between the bid price (the price at which you can sell) and the ask price (the price at which you can buy). It represents the cost of entering a trade and is typically measured in pips (a pip is the smallest price movement in a currency pair or asset). For XAUUSD, spreads are often expressed in cents per ounce or as a pip equivalent.

Spreads are a broker’s primary fee for facilitating trades. They can vary based on several factors, including:

· Market conditions: Spreads tend to widen during periods of high volatility or low liquidity, such as during major economic news releases or market openings/closings.

· Account type: Different trading accounts (e.g., Standard, Pro, Zero) offer varying spread structures.

· Broker infrastructure: Brokers with ECN-like systems often provide tighter spreads due to direct market access.

For XAUUSD, a highly liquid yet volatile pair, tight spreads are crucial for traders, especially those employing scalping or high-frequency trading strategies. Exness, known for its competitive pricing and transparency, offers some of the most attractive spread conditions for XAUUSD in the industry. Let’s explore how Exness structures its spreads for this popular trading pair.

Why Trade XAUUSD with Exness?

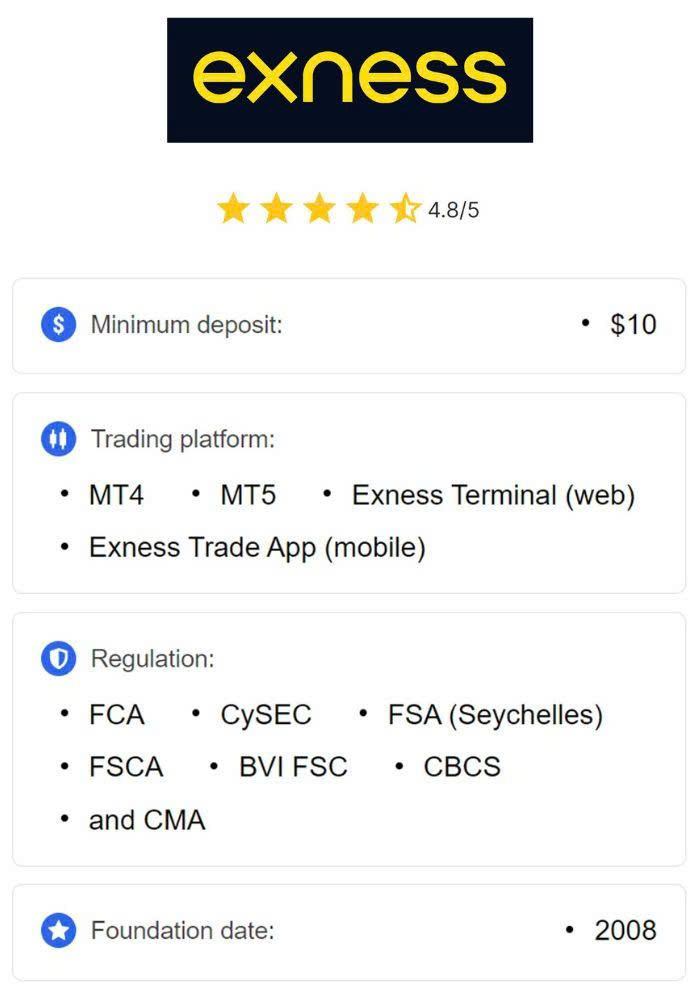

Exness, founded in 2008, has established itself as a leading broker, serving millions of traders globally. Its reputation is built on transparency, fast execution, and competitive pricing, making it a top choice for trading XAUUSD. Here are some reasons why traders choose Exness for gold trading:

· Regulation and Trust: Exness is regulated by top-tier authorities like the Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), and Financial Sector Conduct Authority (FSCA), ensuring a secure trading environment.

· Variety of Account Types: Exness offers multiple account types—Standard, Standard Cent, Pro, Zero, and Raw Spread—each tailored to different trading styles.

· High Leverage: Exness provides leverage up to 1:2000 for XAUUSD, allowing traders to amplify potential returns (though this also increases risk).

· Fast Execution: With market execution and minimal slippage, Exness is ideal for volatile assets like gold.

· Swap-Free Options: Exness offers swap-free trading for XAUUSD under specific conditions, eliminating overnight fees for eligible traders.

These features make Exness a compelling choice for XAUUSD trading, but the real differentiator lies in its spread structure. Let’s break down the spreads for XAUUSD across Exness’s account types.

Exness XAUUSD Spreads by Account Type

Exness offers variable spreads for XAUUSD, meaning they fluctuate based on market conditions, account type, and trading hours. Unlike fixed-spread brokers, Exness leverages its ECN-like infrastructure to provide dynamic pricing, which often results in tighter spreads during high liquidity periods. Below is a detailed breakdown of XAUUSD spreads across Exness’s account types, based on available data and industry insights:

1. Standard and Standard Cent Accounts

· Average Spread: 1.8–2.5 pips (18–25 cents per ounce)

· Details: These accounts are commission-free, making them ideal for beginners or casual traders. While spreads are wider than professional accounts, they remain competitive for retail trading.

· Best For: Swing traders or those holding XAUUSD positions for hours or days, where entry costs are less critical than long-term trends.

2. Pro Account

· Average Spread: 0.9–1.2 pips (9–12 cents per ounce)

· Details: The Pro account offers tighter spreads than Standard accounts, catering to experienced traders who prioritize lower costs and faster execution. It’s commission-free, balancing cost and performance.

· Best For: Day traders and those employing medium-term strategies.

3. Raw Spread Account

· Average Spread: 0.3–0.7 pips (3–7 cents per ounce)

· Details: This account charges a fixed commission per trade but offers some of the tightest spreads in the industry. The low spreads make it ideal for high-frequency trading.

· Best For: Scalpers and high-volume traders who execute multiple trades daily.

4. Zero Account

· Average Spread: 0.0 pips for 95% of the trading day

· Details: The Zero account is Exness’s flagship offering for XAUUSD, providing zero spreads during stable market conditions. Instead of spreads, traders pay a fixed commission per lot traded (typically $3.5 per lot per side). This predictable cost structure is perfect for precise cost calculations.

· Best For: High-frequency traders, scalpers, and those trading during volatile market periods.

Note: Spreads are variable and may widen during low liquidity periods (e.g., market openings, closings, or major news events). Exness provides real-time spread data on its trading platforms (MetaTrader 4, MetaTrader 5, or the Exness Trade App) for transparency.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

How Exness XAUUSD Spreads Compare to Industry Standards

Exness’s XAUUSD spreads are among the most competitive in the industry, particularly on the Zero and Raw Spread accounts. A study conducted by Exness between January and May 2024 compared its gold spreads during high-impact news events with five other leading brokers. The results showed that Exness offered the tightest and most stable spreads, even during volatile periods. For example:

· Exness Zero Account: 0.0 pips for 95% of the time, with a fixed commission.

· Industry Average: 1.5–3.0 pips for commission-free accounts and 0.5–1.0 pips for commission-based accounts.

Exness’s spreads start as low as 0.3 pips on the Raw Spread account and 0.0 pips on the Zero account, compared to competitors’ averages of 1.0–2.0 pips for similar account types. This competitive edge is particularly valuable for XAUUSD, where price swings can significantly impact profitability.

Additionally, Exness’s swap-free feature for XAUUSD (available for traders with Extended Swap-Free status or in Muslim countries) eliminates overnight financing costs, further reducing trading expenses. Traders can check their swap status in the Exness Personal Area under the Trading Conditions tab.

Factors Affecting XAUUSD Spreads on Exness

While Exness offers some of the tightest spreads, several factors can influence the spread you encounter when trading XAUUSD:

· Market Volatility: Gold prices are highly sensitive to geopolitical events, economic data (e.g., U.S. Federal Reserve announcements), and inflation trends. During such events, spreads may widen due to increased market activity.

· Trading Hours: The most liquid periods for XAUUSD trading are during the overlap of the London and New York sessions (13:00–17:00 GMT). Spreads are typically tighter during these hours but may widen during Asian sessions or low-liquidity periods.

· Account Type: As noted, professional accounts (Pro, Raw Spread, Zero) offer tighter spreads than Standard accounts but may involve commissions.

· Leverage: Exness offers high leverage (up to 1:2000) for XAUUSD, which can amplify profits but also increases risk. Margin requirements vary based on leverage, affecting trading costs indirectly.

· Liquidity: Spreads may widen during periods of low liquidity, such as market openings/closings or holidays.

Exness mitigates these factors by providing real-time spread data and tools like the Exness Trading Calculator, which helps traders estimate spread costs, margin, and pip value based on near-real-time data.

Tips for Trading XAUUSD on Exness with Optimal Spreads

To maximize profitability when trading XAUUSD on Exness, consider the following strategies:

· Choose the Right Account Type: Select an account that aligns with your trading style. For scalping or high-frequency trading, the Zero or Raw Spread accounts are ideal due to their low or zero spreads. For longer-term trades, the Standard or Pro accounts may suffice.

· Trade During High-Liquidity Hours: Focus on the London-New York session overlap (13:00–17:00 GMT) for the tightest spreads and highest liquidity. Avoid trading during low-liquidity periods to minimize costs.

· Use the Exness Trading Calculator: This tool allows you to calculate spread costs, margin, and pip value before entering a trade, helping you plan effectively.

· Monitor Economic Events: Stay informed about geopolitical events, central bank policies, and economic data releases that can impact gold prices and widen spreads. Exness provides market insights and real-time XAUUSD charts to help you analyze trends.

· Leverage Swap-Free Trading: If eligible, take advantage of Exness’s swap-free feature to eliminate overnight costs, especially for swing trading strategies.

· Practice with a Demo Account: Exness offers a risk-free demo account to test XAUUSD trading strategies and familiarize yourself with spread behavior under different market conditions.

Step-by-Step Guide to Trading XAUUSD on Exness

Ready to start trading XAUUSD with Exness? Follow these steps:

· Open an Account: Register with Exness and choose an account type (Standard, Pro, Zero, Raw Spread, or Standard Cent) based on your trading goals.

· Fund Your Account: Deposit funds using Exness’s secure payment methods. Over 98% of withdrawals are processed instantly (under 1 minute).

· Select a Trading Platform: Use MetaTrader 4 (MT4), MetaTrader 5 (MT5), or the Exness Trade App to access real-time XAUUSD prices and spreads.

· Analyze the Market: Use Exness’s XAUUSD chart, technical indicators, and market insights to identify trading opportunities.

· Execute Your Trade: Set your trade parameters (lot size, leverage, stop-loss, take-profit) and monitor spreads in real-time to optimize entry and exit points.

· Monitor and Adjust: Continuously track market conditions and adjust your strategy to account for spread fluctuations or volatility.

Risks and Considerations When Trading XAUUSD

While Exness offers competitive spreads and trading conditions, XAUUSD trading carries inherent risks:

· Market Volatility: Gold prices can be highly volatile due to geopolitical events, economic data, or central bank policies, potentially widening spreads and impacting profitability.

· Leverage Risks: High leverage (up to 1:2000) can amplify both profits and losses. Use leverage cautiously and set appropriate risk management measures.

· Liquidity Risks: Spreads may widen during low-liquidity periods, increasing trading costs.

· No Investment Advice: Past performance does not guarantee future results, and trading involves significant risks. Always conduct thorough research and consider seeking advice from a financial advisor.

Exness mitigates some of these risks with features like Stop Out Protection, which delays or avoids stop-outs during volatile periods, and transparent pricing to ensure traders are informed of real-time costs.

Why Exness Stands Out for XAUUSD Trading

Exness’s combination of tight spreads, fast execution, and robust trading tools makes it a top choice for XAUUSD traders. The Zero account’s 0.0-pip spreads and fixed commission structure offer predictable costs, while the Raw Spread and Pro accounts cater to high-frequency and professional traders. The broker’s transparency, regulatory compliance, and swap-free options further enhance its appeal.

Compared to industry standards, Exness’s XAUUSD spreads are among the lowest, particularly during high-liquidity periods. The ability to trade on MT4, MT5, or the Exness Trade App, combined with tools like the Trading Calculator and real-time charts, empowers traders to make informed decisions. Whether you’re a beginner or an experienced trader, Exness provides the flexibility and cost-efficiency needed to succeed in gold trading.

Conclusion

Trading XAUUSD on Exness offers traders a competitive edge, thanks to its tight and stable spreads, fast execution, and variety of account types. With spreads starting as low as 0.0 pips on the Zero account and 0.3 pips on the Raw Spread account, Exness stands out as a cost-effective platform for gold trading. By choosing the right account type, trading during high-liquidity hours, and leveraging Exness’s tools, traders can optimize their strategies and maximize profitability.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: