10 minute read

Forex Brokers with $1 Minimum Deposit in Nigeria for 2025

from Exness

by Exness Blog

Forex trading has surged in popularity in Nigeria, driven by increasing access to technology and a growing interest in financial markets. For many Nigerians, especially beginners, the high minimum deposit requirements of some brokers can be a significant barrier to entry. However, several reputable forex brokers offer accounts with a minimum deposit as low as $1, making trading accessible to a broader audience. This article explores the best forex brokers in Nigeria with a $1 minimum deposit, their features, benefits, and what to consider when choosing a broker. Whether you're a novice or an experienced trader, this guide will help you navigate the world of forex trading with minimal financial risk.

Top 4 Best Forex Brokers in Nigeria

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ XM: Open An Account or Visit Brokers 💥

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

Why Choose Forex Brokers with a $1 Minimum Deposit?

Forex trading involves speculating on currency price movements, which can be highly profitable but also carries significant risks. For beginners in Nigeria, starting with a low minimum deposit offers several advantages:

· Low Financial Risk: A $1 minimum deposit allows traders to test the waters without committing substantial capital, making it ideal for those new to forex trading.

· Access to Live Markets: Even with a small deposit, traders can access real-time forex markets, execute trades, and gain practical experience.

· Strategy Testing: Low-deposit accounts enable traders to experiment with strategies in live conditions without risking significant funds.

· Affordability: In Nigeria, where economic challenges may limit investment capital, a $1 deposit makes forex trading accessible to a wider audience.

However, trading with such a small amount has limitations, such as restricted lot sizes and potential profits. To maximize success, traders must combine low deposits with proper risk management and education.

Top Forex Brokers with $1 Minimum Deposit in Nigeria

Below is a detailed overview of the top forex brokers offering a $1 minimum deposit in Nigeria, based on regulation, trading conditions, and user experience. These brokers are selected for their reliability, accessibility, and suitability for Nigerian traders.

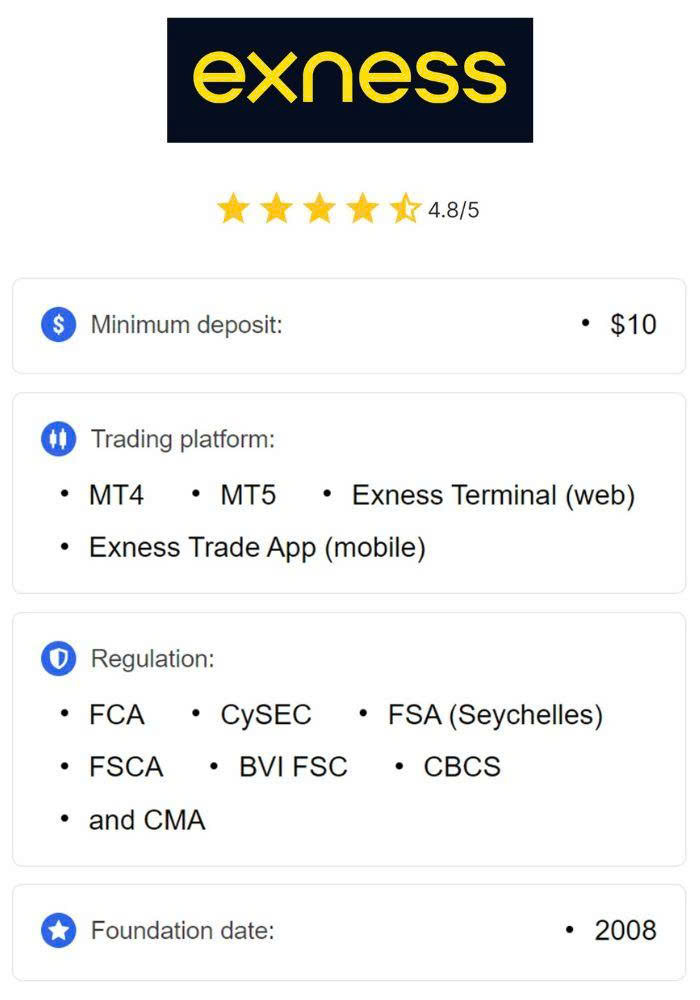

1. Exness

Overview: Founded in 2008, Exness is a globally recognized forex and CFD broker known for its low-cost trading and fast execution. It’s a popular choice in Nigeria due to its $1 minimum deposit and support for Nigerian Naira (NGN) accounts.

Key Features:

· Minimum Deposit: $1 for Micro and Standard accounts.

· Regulation: Regulated by CySEC (Cyprus), FCA (UK), FSCA (South Africa), and others, though Nigerian traders are registered under offshore regulation (Seychelles).

· Trading Platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and Exness’s proprietary web platform.

· Spreads: Start from 0.3 pips on major pairs (e.g., EUR/USD) with the Pro account.

· Leverage: Up to 1:2000, one of the highest in the industry.

· Deposit/Withdrawal Options: Supports local bank transfers, e-wallets (Neteller, Skrill), and cryptocurrencies, with no deposit or withdrawal fees.

· NGN Accounts: Allows trading in Naira, reducing currency conversion costs.

Pros:

· Fast withdrawals and local deposit options.

· Competitive spreads and high leverage.

· User-friendly platforms with trading calculators and tools.

Cons:

· Limited educational resources for beginners.

· Customer support response times can be slow (over 24 hours for email).

Opinion: Exness is an excellent choice for Nigerian traders due to its low entry barrier, NGN support, and fast execution. However, beginners should practice on a demo account to mitigate risks associated with high leverage.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

2. FBS

Overview: Established in 2009, FBS is a well-regulated broker with a strong presence in Nigeria, offering a Cent account with a $1 minimum deposit.

Key Features:

· Minimum Deposit: $1 for the Cent account.

· Regulation: Regulated by the International Financial Services Commission (IFSC) in Belize and CySEC (Cyprus).

· Trading Platforms: MT4, MT5, and FBS Trader app.

· Spreads: Start at 0.7 pips for major pairs.

· Leverage: Up to 1:1000.

· Deposit/Withdrawal Options: Local bank transfers, e-wallets, and cryptocurrencies.

· Bonuses: Offers deposit bonuses and promotions for Nigerian traders.

Pros:

· Comprehensive educational resources for beginners.

· Wide range of tradable instruments, including forex, metals, and cryptocurrencies.

· Competitive trading conditions with low fees.

Cons:

· Offshore regulation may pose risks compared to Tier-1 regulators.

· Limited customer support availability (not 24/7).

Opinion: FBS is ideal for beginners due to its low deposit requirement, educational materials, and promotional bonuses. Its Cent account is perfect for practicing with minimal risk.

3. InstaForex

Overview: InstaForex, established in 2007, is a globally recognized broker offering a Cent account with a $1 minimum deposit, popular among Nigerian traders.

Key Features:

· Minimum Deposit: $1 for Cent accounts.

· Regulation: Regulated by the British Virgin Islands Financial Services Commission (BVI FSC).

· Trading Platforms: MT4, MT5, WebTrader, and Multiterminal.

· Spreads: Start at 0.3 pips on major pairs.

· Leverage: Up to 1:1000.

· Deposit/Withdrawal Options: Supports local bank transfers, e-wallets, and cryptocurrencies.

Pros:

· Instant order execution reduces slippage.

· Diverse trading instruments, including forex, stocks, and indices.

· Educational resources and trading competitions.

Cons:

· Offshore regulation may concern some traders.

· Limited account types compared to competitors.

Opinion: InstaForex is a solid choice for traders seeking speed and variety in trading options. Its instant execution and low deposit make it suitable for beginners.

4. Octa (formerly OctaFX)

Overview: Octa is a beginner-friendly broker offering a $1 minimum deposit and swap-free accounts, making it appealing for Nigerian traders.

Key Features:

· Minimum Deposit: $1 for Micro accounts.

· Regulation: Regulated by CySEC (Cyprus) and FSCA (South Africa), with Nigerian traders under offshore MISA regulation.

· Trading Addresses: MT4, MT5, and OctaTrader platforms.

· Spreads: Start at 0.6 pips.

· Leverage: Up to 1:1000.

· Deposit/Withdrawal Options: Local bank transfers, e-wallets, and crypto.

Pros:

· Commission-free trading and zero swap fees.

· Fast deposits and withdrawals with no fees.

· Swap-free accounts for Islamic traders.

Cons:

· Limited range of CFD instruments compared to competitors.

· Offshore regulation for Nigerian traders.

Opinion: Octa combines affordability with advanced trading features, making it a great option for both new and experienced traders in Nigeria.

5. HFM (HotForex)

Overview: HFM is a well-regulated broker with a strong presence in Nigeria, offering a Cent account with no minimum deposit requirement (effectively allowing $1 deposits).

Key Features:

· Minimum Deposit: $1 for Cent accounts.

· Regulation: Regulated by FCA (UK), FSCA (South Africa), and CySEC (Cyprus).

· Trading Platforms: MT4, MT5, and HFM Platform.

· Spreads: Start at 1.2 pips on Cent accounts.

· Leverage: Up to 1:2000.

· Deposit/Withdrawal Options: Local bank transfers, e-wallets, and cryptocurrencies.

Pros:

· No minimum deposit requirement for some accounts.

· NGN-denominated accounts reduce conversion fees.

· Strong regulatory oversight.

Cons:

· Higher swap fees for overnight positions.

· Limited educational resources for beginners.

Opinion: HFM is a reliable choice for Nigerian traders, offering flexibility and strong regulation. Its Cent account is ideal for testing strategies with minimal capital.

6. Admiral Markets (Admirals)

Overview: Admirals is a globally recognized broker offering an Invest.MT5 account with a $1 minimum deposit, suitable for Nigerian traders.

Key Features:

· Minimum Deposit: $1 for Invest.MT5 accounts.

· Regulation: Regulated by FCA (UK), ASIC (Australia), and CySEC (Cyprus).

· Trading Platforms: MT4, MT5, and cTrader.

· Spreads: Start at 0.6 pips.

· Leverage: Up to 1:500.

· Deposit/Withdrawal Options: Bank transfers, e-wallets, and crypto.

Pros:

· Top-tier regulation ensures fund safety.

· Wide range of trading instruments (over 4,500 stocks and ETFs).

· Comprehensive educational resources.

Cons:

· Limited leverage compared to competitors.

· Invest.MT5 account has no leverage for forex trading.

Opinion: Admirals is a secure and versatile option for Nigerian traders, particularly those interested in diversifying beyond forex.

Key Considerations When Choosing a Forex Broker in Nigeria

When selecting a forex broker with a $1 minimum deposit, consider the following factors to ensure a safe and effective trading experience:

· Regulation and Security:

· Opt for brokers regulated by reputable authorities like FCA, CySEC, or FSCA. While some brokers operate under offshore regulation for Nigerian traders, ensure they have a strong global reputation.

· Check for negative balance protection to prevent losses exceeding your account balance.

· Trading Costs:

· Compare spreads and commissions. For example, Exness offers spreads as low as 0.3 pips, while HFM’s Cent account starts at 1.2 pips.

· Be aware of swap fees for overnight positions, especially for positional traders.

· Trading Platforms:

· Most brokers offer MT4 and MT5, which are user-friendly and feature-rich. Some, like Octa, also provide proprietary platforms like OctaTrader.

· Ensure the platform supports mobile trading for convenience.

· Deposit and Withdrawal Options:

· Look for brokers supporting local bank transfers and NGN accounts to avoid conversion fees.

· Check withdrawal processing times and fees.

· Leverage and Risk Management:

· High leverage (e.g., 1:2000 at Exness) can amplify profits but also losses. Use lower leverage (1:5 or 1:10) for safer trading.

· Practice on demo accounts to refine strategies before trading with real money.

· Customer Support:

· Choose brokers with responsive support via live chat, email, or phone. Exness, for example, has been noted for slow email response times, which may be a drawback.

· Educational Resources:

· Beginners benefit from brokers like FBS and Admirals, which offer tutorials, webinars, and market analysis.

Benefits and Risks of Trading with a $1 Deposit

Benefits:

· Low Barrier to Entry: A $1 deposit makes forex trading accessible to beginners and those with limited capital.

· Learning Opportunity: Practice real-market trading with minimal financial risk.

· Portfolio Diversification: Trade multiple assets like forex, commodities, and cryptocurrencies with small capital.

Risks:

· Limited Profit Potential: Small deposits limit trade sizes and potential returns.

· High Leverage Risks: High leverage can lead to significant losses if not managed properly.

· Market Volatility: Forex markets are highly volatile, requiring careful risk management.

To mitigate risks, traders should:

· Use stop-loss orders to limit potential losses.

· Start with a demo account to build confidence.

· Avoid over-leveraging and trade with a clear strategy.

Tips for Successful Forex Trading with a $1 Deposit

· Start with a Demo Account: Practice strategies on a demo account before risking real money. Most brokers, like HFM and FBS, offer free demo accounts with virtual funds.

· Use Cent Accounts: Cent accounts (offered by FBS, InstaForex, and HFM) allow trading in smaller lot sizes, making a $1 deposit more viable.

· Focus on Major Pairs: Trade major currency pairs like EUR/USD or GBP/USD, which typically have lower spreads and higher liquidity.

· Manage Risk: Risk no more than 1-2% of your account balance per trade to protect your capital.

· Stay Educated: Continuously learn through broker-provided resources, webinars, and market news.

· Monitor Fees: Be aware of spreads, commissions, and swap fees, as they can significantly impact small accounts.

The Future of Forex Trading in Nigeria

Nigeria’s forex trading market is growing rapidly, driven by a young, tech-savvy population and increasing internet penetration. The availability of brokers with $1 minimum deposits is making the market more inclusive, allowing more Nigerians to participate in global financial markets. However, the lack of local regulation remains a challenge, as most brokers operate under offshore jurisdictions. Traders should prioritize brokers with strong global regulation and transparent fee structures to ensure fund safety.

In 2025, we can expect continued growth in mobile trading apps and NGN-denominated accounts, further reducing barriers for Nigerian traders. Brokers like Exness and HFM, with their local deposit options and low entry points, are likely to maintain their dominance in the market.

Conclusion

Forex trading with a $1 minimum deposit in Nigeria offers an accessible entry point for beginners and budget-conscious traders. Brokers like Exness, FBS, InstaForex, Octa, HFM, and Admirals provide reliable platforms, competitive trading conditions, and low-cost entry options tailored to the Nigerian market. By prioritizing regulation, low fees, and user-friendly platforms, traders can maximize their chances of success while minimizing risks.

Before diving in, take time to research each broker’s features, test their platforms with demo accounts, and develop a disciplined trading strategy. With proper education and risk management, a $1 deposit can be the start of a rewarding forex trading journey in Nigeria.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: