8 minute read

Is Forex Trading Profitable in Uganda? A Comprehensive Guide

from Exness

by Exness Blog

Forex trading has gained significant traction worldwide, and Uganda is no exception. With its growing internet penetration, youthful population, and increasing interest in financial markets, many Ugandans are asking: Is forex trading profitable in Uganda? This article dives deep into the realities of forex trading in Uganda, exploring its profitability, challenges, opportunities, and practical tips for success. Whether you're a beginner or an experienced trader, this guide will help you navigate the forex market in Uganda in 2025.

Top 4 Best Forex Brokers in Uganda

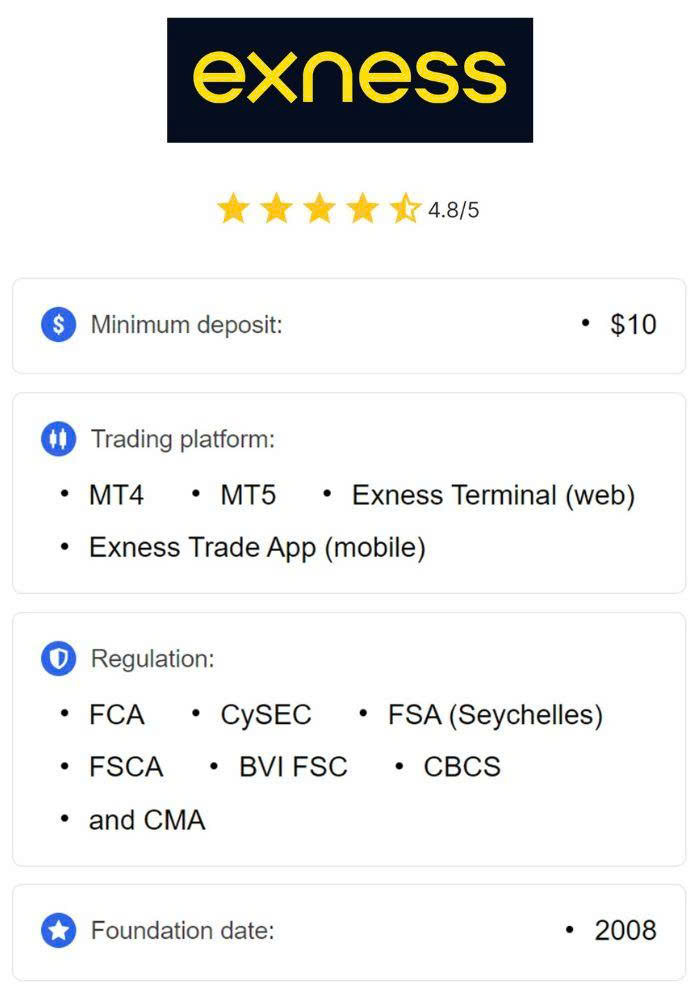

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ XM: Open An Account or Visit Brokers 💥

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

What Is Forex Trading?

Forex trading, or foreign exchange trading, involves buying and selling currencies to profit from fluctuations in their exchange rates. For example, you might buy US dollars (USD) against the Ugandan shilling (UGX) if you believe the USD will strengthen. The global forex market is the largest financial market, with a daily trading volume exceeding $7 trillion.

In Uganda, forex trading has become popular due to its accessibility. All you need is a smartphone, internet connection, and a trading account with a broker. But is it a viable way to make money in Uganda? Let’s explore.

The Potential for Profit in Forex Trading

1. High Profit Potential

Forex trading offers significant profit potential due to leverage, which allows traders to control large positions with small capital. For instance, with a 1:100 leverage, a $100 account can control $10,000 in trades. If the market moves in your favor, even small price changes can yield substantial returns.

2. 24/5 Market Access

The forex market operates 24 hours a day, five days a week, making it ideal for Ugandans with flexible schedules. Whether you're a student, employee, or entrepreneur, you can trade during your free time.

3. Low Entry Barrier

Unlike other investments like real estate, forex trading requires minimal startup capital. Many brokers offer accounts with deposits as low as $10, making it accessible to Ugandans from various economic backgrounds.

4. Growing Financial Literacy

Uganda’s young population is increasingly tech-savvy and financially curious. Online resources, webinars, and local forex communities are helping Ugandans learn trading strategies, increasing their chances of profitability.

Challenges of Forex Trading in Uganda

While forex trading holds promise, it’s not a get-rich-quick scheme. Several challenges can affect profitability, especially in Uganda.

1. High Risk

Forex trading is inherently risky due to market volatility and leverage. A single wrong move can wipe out your account. Many beginners in Uganda lose money because they lack proper risk management strategies.

2. Limited Regulation

Uganda’s forex market is not as tightly regulated as in developed countries. The Capital Markets Authority (CMA) oversees financial markets, but many Ugandans trade with offshore brokers that may not be regulated locally. This increases the risk of scams or unreliable platforms.

3. Internet and Infrastructure Issues

While internet access has improved, connectivity issues in rural areas can disrupt trading. Frequent power outages may also affect traders relying on desktop platforms.

4. Lack of Knowledge

Many Ugandans dive into forex trading without adequate education. Misinformation from unregulated "mentors" or social media influencers can lead to costly mistakes.

5. Economic Factors

Uganda’s economy is heavily influenced by external factors like commodity prices and foreign exchange rates. The Ugandan shilling’s volatility can complicate trading pairs involving UGX, making it harder to predict market movements.

Is Forex Trading Profitable in Uganda?

The profitability of forex trading in Uganda depends on several factors, including your skills, strategy, discipline, and market conditions. Here’s a balanced perspective:

· Success Stories: Some Ugandans have achieved consistent profits through forex trading. For example, local traders like Kato Paul (a pseudonymous trader featured in Ugandan forex communities) claim to earn a living by trading major currency pairs like EUR/USD. These traders emphasize discipline, continuous learning, and risk management.

· Statistics: Globally, only about 10-15% of forex traders are consistently profitable. In Uganda, this percentage may be lower due to limited education and resources. However, with the right approach, profitability is achievable.

· Realistic Expectations: Forex trading is not a guaranteed income source. Beginners may take months or years to become profitable. Losses are part of the learning process, but they can be minimized with proper strategies.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

How to Succeed in Forex Trading in Uganda

To increase your chances of profitability, follow these practical steps tailored to the Ugandan context.

1. Educate Yourself

Knowledge is your greatest asset. Invest time in learning the basics of forex trading, including:

· Technical Analysis: Study charts, indicators, and patterns to predict price movements.

· Fundamental Analysis: Understand how economic events (e.g., US Federal Reserve interest rate decisions) affect currencies.

· Risk Management: Learn to set stop-loss orders and limit your risk per trade (e.g., risk only 1-2% of your account per trade).

Free resources like YouTube, Babypips.com, and Investopedia are excellent starting points. Local forex communities in Kampala and online groups on WhatsApp or Telegram also offer valuable insights.

2. Choose a Reliable Broker

Selecting a trustworthy broker is critical. Look for brokers with:

· Regulation by reputable authorities (e.g., FCA, ASIC, or CySEC).

· Low spreads and fees.

· Support for mobile trading platforms like MetaTrader 4 or 5.

· Easy deposit and withdrawal options, preferably supporting mobile money (e.g., MTN Mobile Money or Airtel Money).

Popular brokers among Ugandans include XM, Exness, and HotForex. Always verify a broker’s legitimacy to avoid scams.

3. Start with a Demo Account

Before risking real money, practice with a demo account. Most brokers offer free demo accounts with virtual funds. This allows you to test strategies and build confidence without financial risk.

4. Develop a Trading Plan

A trading plan outlines your goals, risk tolerance, and strategy. For example:

· Goal: Earn $100/month.

· Strategy: Trade major pairs like EUR/USD using a 50-pip stop-loss.

· Risk: Risk no more than 2% of your account per trade.

Stick to your plan to avoid emotional trading, which often leads to losses.

5. Manage Your Emotions

Greed and fear are the biggest enemies of forex traders. Avoid chasing losses or overtrading after a win. Discipline and patience are key to long-term success.

6. Leverage Local Opportunities

Uganda’s growing forex community offers networking opportunities. Attend seminars in Kampala or join online forums to learn from experienced traders. Some brokers also host local events to educate traders.

Legal and Regulatory Considerations

Forex trading is legal in Uganda, but it operates in a gray area due to limited regulation. The CMA regulates financial markets, but most Ugandans trade with international brokers not licensed by the CMA. To stay safe:

· Trade with regulated brokers.

· Be cautious of "mentors" promising guaranteed profits.

· Report suspicious activities to the CMA or Uganda Police.

Taxation is another consideration. Forex profits may be subject to income tax under the Uganda Revenue Authority (URA). Consult a tax professional to ensure compliance.

Tools and Resources for Ugandan Forex Traders

To succeed, leverage these tools and resources:

· Trading Platforms: MetaTrader 4/5, cTrader.

· Economic Calendars: Websites like Forex Factory provide updates on market-moving events.

· Mobile Apps: MTN Mobile Money or Airtel Money for deposits/withdrawals.

· Communities: Join Uganda Forex Traders on Facebook or WhatsApp groups for peer support.

Common Mistakes to Avoid

· Overleveraging: High leverage can amplify losses. Use leverage cautiously.

· Lack of Strategy: Trading without a plan is like gambling.

· Ignoring Risk Management: Always use stop-loss orders.

· Falling for Scams: Avoid brokers or mentors promising unrealistic returns.

The Future of Forex Trading in Uganda

The forex trading landscape in Uganda is evolving. Here’s what to expect in 2025 and beyond:

· Increased Regulation: The CMA may introduce stricter rules to protect traders.

· Better Infrastructure: Improved internet and power supply will make trading more accessible.

· Growing Education: More Ugandans will access quality forex education, boosting profitability.

· Youth Involvement: Uganda’s youthful population will drive forex adoption, creating a vibrant trading community.

Conclusion: Is Forex Trading Worth It in Uganda?

So, is forex trading profitable in Uganda? The answer is yes, but it comes with caveats. Forex trading offers significant profit potential, but it requires education, discipline, and risk management. While challenges like limited regulation and infrastructure issues exist, they can be overcome with the right approach.

If you’re a Ugandan considering forex trading in 2025, start small, educate yourself, and practice with a demo account. Join local communities, choose a reliable broker, and develop a solid trading plan. With patience and persistence, forex trading can be a profitable venture in Uganda.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: