10 minute read

10 Best Forex Brokers in Zimbabwe for 2025: A Comprehensive Guide

from Exness

by Exness Blog

Forex trading has surged in popularity across Zimbabwe, driven by growing internet access, a youthful population eager to explore financial markets, and the potential for financial independence. However, navigating the forex market requires partnering with a reliable broker that offers secure platforms, competitive fees, and tailored services for Zimbabwean traders. With the Reserve Bank of Zimbabwe (RBZ) imposing strict foreign exchange regulations, selecting a broker with seamless deposit and withdrawal options, such as mobile money platforms like EcoCash or international payment methods, is critical. In this guide, we explore the 10 best forex brokers in Zimbabwe for 2025, with Exness leading the pack for its exceptional features, low fees, and accessibility. Whether you’re a novice or an experienced trader, this article will help you choose the right broker to succeed in forex trading.

Top 4 Best Forex Brokers in Zimbabwe

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ XM: Open An Account or Visit Brokers 💥

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

Why Choosing the Right Forex Broker Matters in Zimbabwe

Forex trading in Zimbabwe operates in a unique economic landscape marked by currency fluctuations and a history of hyperinflation. While the Securities and Exchange Commission of Zimbabwe (SECZ) regulates local financial activities, many international brokers accept Zimbabwean traders under global regulatory frameworks like the Financial Sector Conduct Authority (FSCA) or Cyprus Securities and Exchange Commission (CySEC). A trusted broker ensures:

· Regulatory Compliance: Protection of funds through oversight by reputable authorities.

· Low Fees and Spreads: Cost-effective trading to maximize profits.

· Accessible Platforms: User-friendly interfaces and mobile apps for seamless trading.

· Local Payment Options: Support for methods like EcoCash, bank cards, or e-wallets.

· Educational Resources: Tools and tutorials to empower beginners and advanced traders.

With these factors in mind, let’s dive into our list of the top 10 forex brokers in Zimbabwe for 2025, starting with the standout performer, Exness.

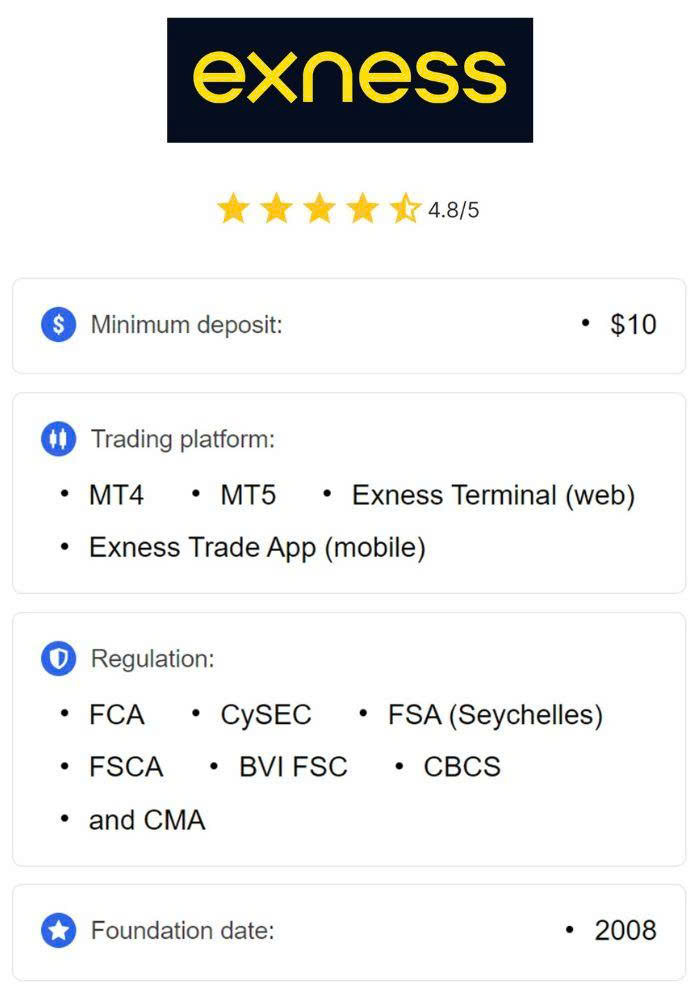

1. Exness – The Best Forex Broker for Zimbabwean Traders

Why Exness Tops the List

Exness has earned its position as the number one forex broker in Zimbabwe due to its unbeatable combination of low-cost trading, instant withdrawals, and beginner-friendly features. Founded in 2008, Exness operates under strict regulatory oversight from authorities like the FSCA (South Africa), CySEC (Cyprus), and the Financial Services Authority (FSA) in Seychelles, ensuring a secure trading environment for Zimbabweans.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Key Features:

· Low Spreads and Fees: Exness offers some of the tightest spreads in the industry, starting from 0.0 pips on Raw Spread and Zero accounts, with no deposit or withdrawal fees.

· Multiple Account Types: From the Standard Cent account (with a $1 minimum deposit) to advanced Pro and Zero accounts, Exness caters to all skill levels.

· Instant Withdrawals: Exness is renowned for its lightning-fast withdrawal process, a critical feature for Zimbabwean traders navigating currency restrictions.

· Local Payment Options: While EcoCash isn’t directly supported, Exness accepts USD via bank cards, Skrill, and Neteller, which are accessible in Zimbabwe.

· High Leverage: Offers up to 1:2000 leverage, allowing traders to maximize returns with small capital (though high leverage carries risks).

· Trading Platforms: Supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the proprietary Exness Terminal, all available on desktop, web, and mobile.

· Educational Resources: The Exness Academy provides free webinars, tutorials, and market analysis to empower beginners.

Why It’s Ideal for Zimbabwe: Exness’s transparency, with no hidden fees or manipulative practices, builds trust among local traders. Its low minimum deposit and instant withdrawals make it accessible for Zimbabweans facing economic constraints. The broker’s 24/7 multilingual customer support via live chat, email, and phone ensures traders get help anytime.

Cons:

· Limited support for local mobile money like EcoCash.

High leverage may be risky for inexperienced traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

2. AvaTrade – Best for Mobile Trading and Education

AvaTrade is a globally recognized broker known for its superior trading experience and extensive educational resources. Regulated by multiple authorities, including the FSCA and ASIC (Australia), AvaTrade is a trusted choice for Zimbabwean traders.

Key Features:

· Advanced Trading Tools: Offers technical analysis charts, economic calendars, and integration with automated trading systems like ZuluTrade and DupliTrade.

· Mobile App: The AvaTradeGO app provides a seamless trading experience with real-time notifications and portfolio management.

· Account Types: Multiple account options to suit different trading styles, from beginners to professionals.

· Educational Resources: SharpTrader Academy offers comprehensive courses for traders at all levels.

· Spreads: Competitive spreads starting from 0.9 pips on major pairs like EUR/USD.

Why It’s Ideal for Zimbabwe: AvaTrade’s mobile app and copy-trading features make it ideal for beginners and mobile-savvy traders in Zimbabwe. Its educational resources help new traders build confidence, while its regulation ensures fund security.

Cons:

· No direct EcoCash support.

· Slightly higher spreads compared to Exness.

3. XM – Best for Low Deposits and Bonuses

XM is a popular choice among Zimbabwean traders for its low minimum deposit and attractive bonuses. Regulated by CySEC, ASIC, and IFSC (Belize), XM offers a secure and accessible trading environment.

Key Features:

· Low Minimum Deposit: Start trading with as little as $5.

· Bonuses: Offers a $30 no-deposit bonus for new traders, allowing them to trade without risking personal funds.

· Trading Platforms: Supports MT4 and MT5, with robust charting tools and technical indicators.

· Spreads: Competitive spreads starting from 0.6 pips on Ultra-Low accounts.

· Education: Extensive webinars, tutorials, and market analysis for beginners.

Why It’s Ideal for Zimbabwe: XM’s low deposit requirement and no-deposit bonus make it highly accessible for Zimbabwean traders with limited capital. Its support for mobile money deposits (via third-party agents) adds convenience.

Cons:

· Bonuses come with strict terms and conditions.

· Limited local payment options.

4. FBS – Best for Beginners

FBS is renowned for its beginner-friendly features and low entry barriers. Regulated by CySEC, ASIC, and IFSC, FBS serves over 27 million clients globally, including many in Zimbabwe.

Key Features:

· Low Minimum Deposit: Accounts can be opened with just $1.

· High Leverage: Up to 1:3000 leverage, though caution is advised.

· Trading Platforms: Offers MT4, MT5, and a proprietary mobile app.

· Promotions: Regular bonuses, including welcome and referral bonuses.

· Copy Trading: Allows beginners to follow experienced traders’ strategies.

Why It’s Ideal for Zimbabwe: FBS’s low deposit and extensive educational resources make it a top choice for new traders. Its demo accounts allow risk-free practice, and promotions boost trading capital.

Cons:

· High leverage increases risk.

· Withdrawal processing can be slower than Exness.

5. IC Markets – Best for Advanced Traders

IC Markets is an Australian-based broker favored by experienced traders for its raw spreads and fast execution. Regulated by ASIC and FSA (Seychelles), it offers over 2150 trading instruments.

Key Features:

· Raw Spreads: Spreads start from 0.0 pips with a small commission.

· Trading Platforms: Supports MT4, MT5, cTrader, and TradingView.

· Fast Execution: Average execution speed of 30 milliseconds.

· Instruments: Over 61 forex pairs, plus commodities, indices, and cryptocurrencies.

· No Minimum Deposit: Flexible for traders with varying budgets.

Why It’s Ideal for Zimbabwe: IC Markets’ low-cost structure and advanced platforms suit scalpers and algorithmic traders. Its global accessibility makes it viable for Zimbabweans, though local payment options are limited.

Cons:

· Higher minimum deposit for ECN accounts ($200).

· Limited beginner-focused resources.

6. Pepperstone – Best for Scalping

Pepperstone is a trusted broker regulated by ASIC, FCA (UK), and CySEC, known for its low spreads and fast execution, making it ideal for scalpers.

Key Features:

· Low Spreads: Starting from 0.0 pips on Razor accounts.

· Trading Platforms: Supports MT4, MT5, and cTrader.

· No Minimum Deposit: Flexible for all traders.

· Funding Options: Includes PayPal, Skrill, and bank cards.

· Tools: Offers Autochartist and Capitalise.ai for automated trading.

Why It’s Ideal for Zimbabwe: Pepperstone’s competitive spreads and fast execution appeal to active traders. Its PayPal support is a plus for Zimbabweans with access to international payment methods.

Cons:

· No direct EcoCash support.

· Limited educational content for beginners.

7. FXTM (ForexTime) – Best for Local Accessibility

FXTM is a global broker regulated by CySEC, FCA, and FSC Mauritius, known for its low spreads and local deposit options for African traders.

Key Features:

· Low Minimum Deposit: Start with $10.

· Spreads: From 0.0 pips on ECN accounts.

· Trading Platforms: MT4, MT5, and proprietary platforms.

· Local Deposits: Supports African mobile money via third-party agents.

· Education: Extensive resources and copy-trading via FXTM Invest.

Why It’s Ideal for Zimbabwe: FXTM’s low deposit and local payment options make it accessible for Zimbabwean traders. Its educational tools support beginners, while ECN accounts cater to pros.

Cons:

· Withdrawal fees may apply.

· Limited ZWD support.

8. BlackBull Markets – Best for High-Frequency Trading

BlackBull Markets, based in New Zealand, is regulated by FMA and FSA (Seychelles), offering deep liquidity and fast execution for advanced traders.

Key Features:

· Spreads: From 0.0 pips on ECN accounts.

· Instruments: Over 26,000 assets, including forex, equities, and cryptocurrencies.

· Trading Platforms: MT4, MT5, and TradingView.

· No Minimum Deposit: Flexible for all budgets.

· VPS Hosting: Supports algorithmic trading.

Why It’s Ideal for Zimbabwe: BlackBull’s advanced infrastructure suits high-frequency traders, and its low deposit requirement makes it accessible. However, local payment options are limited.

Cons:

· High deposit ($2,000) for ECN Prime accounts.

· Limited beginner support.

9. Oanda – Best for Research Tools

Oanda is a US-based broker regulated by multiple authorities, including the CFTC and NFA, known for its robust research tools and transparent pricing.

Key Features:

· Spreads: Competitive, starting from 0.8 pips.

· Trading Platforms: MT4, MT5, and Oanda’s proprietary platform.

· Research Tools: Advanced charting, market analysis, and economic calendars.

· Minimum Deposit: No minimum, but $100 recommended.

· Regulation: Highly trusted with a long track record.

Why It’s Ideal for Zimbabwe: Oanda’s research tools and transparent pricing appeal to traders who value data-driven decisions. Its global accessibility suits Zimbabweans, though local payment support is limited.

Cons:

· No mobile money support.

· Fewer promotions compared to competitors.

10. Capital.com – Best for User Experience

Capital.com is a user-friendly broker regulated by FCA, CySEC, and ASIC, offering a seamless trading experience and low fees.

Key Features:

· Low Fees: Spreads from 0.6 pips with no commissions.

· Trading Platforms: Proprietary platform, MT4, and TradingView.

· Account Opening: Fast and fully online.

· Instruments: Wide range of forex pairs, CFDs, and cryptocurrencies.

· Education: Extensive resources for beginners.

Why It’s Ideal for Zimbabwe: Capital.com’s intuitive platform and low fees make it beginner-friendly, while its global regulation ensures trust. It lacks direct EcoCash support but accepts international payment methods.

Cons:

· Limited local payment options.

· No copy-trading features.

How to Choose the Right Forex Broker in Zimbabwe

Selecting the best forex broker depends on your trading goals, experience level, and budget. Here are key factors to consider:

· Regulation: Ensure the broker is regulated by reputable authorities like FSCA, CySEC, or ASIC to protect your funds.

· Fees and Spreads: Compare spreads, commissions, and withdrawal fees to minimize costs.

· Payment Methods: Look for brokers supporting accessible methods like Skrill, Neteller, or local agents for mobile money.

· Trading Platforms: Choose user-friendly platforms like MT4 or MT5 with mobile access.

· Account Types: Opt for brokers offering demo accounts and low minimum deposits for beginners.

· Customer Support: Prioritize brokers with 24/7 support via live chat, email, or phone.

· Educational Resources: Essential for beginners to learn trading strategies and market analysis.

Tips for Zimbabwean Traders:

· Start with a demo account to practice without risking real money.

· Be cautious with high leverage due to increased risk.

· Verify local payment agent reliability for deposits and withdrawals.

· Stay updated on RBZ regulations to ensure compliance.

Conclusion

Forex trading offers Zimbabweans a pathway to financial empowerment, but success hinges on choosing the right broker. Exness stands out as the best forex broker in Zimbabwe for 2025, thanks to its low spreads, instant withdrawals, and beginner-friendly features. Other brokers like AvaTrade, XM, and FBS cater to beginners with low deposits and educational resources, while IC Markets and Pepperstone appeal to advanced traders with raw spreads and fast execution. Before diving in, test brokers with demo accounts, compare fees, and ensure they align with your trading goals. With the right broker and a solid strategy, you can navigate the forex market confidently and unlock its potential.

Read more: