10 minute read

How to earn money from forex trading in Pakistan

from Exness

by Exness Blog

Understanding Forex Trading

What is Forex Trading?

Forex trading, or foreign exchange trading, is the act of buying and selling currencies on the global financial market. The Forex market is one of the largest and most liquid financial markets, allowing participants to trade currencies from around the world. In Forex trading, currencies are traded in pairs, such as USD/PKR, where the value of one currency is measured against the other. Traders attempt to profit by predicting changes in these exchange rates, buying a currency when its value is low and selling it when its value rises.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Forex trading operates 24 hours a day, divided into major trading sessions across financial centers like New York, London, Tokyo, and Sydney. This accessibility makes Forex trading convenient for traders worldwide, including in Pakistan.

Key Terminology in Forex

To be successful in Forex trading, it’s important to understand key terms commonly used in the market:

Currency Pair: The two currencies involved in a Forex transaction (e.g., USD/PKR).

Bid and Ask Price: The bid is the price at which a trader can sell a currency pair, while the ask is the price at which they can buy it. The difference between the bid and ask price is known as the spread.

Pip: The smallest unit of price movement in a currency pair, often used to measure changes in value.

Leverage: A tool that allows traders to control larger positions with a smaller amount of capital, amplifying both gains and potential losses.

Margin: The collateral required to open a leveraged position, expressed as a percentage of the trade size.

Familiarity with these terms is essential to navigate the Forex market and make informed trading decisions.

The Forex Market Landscape in Pakistan

Overview of Forex Regulations in Pakistan

In Pakistan, Forex trading is regulated by the State Bank of Pakistan (SBP) and the Securities and Exchange Commission of Pakistan (SECP). Retail Forex trading, particularly in currency pairs involving PKR, is allowed within certain guidelines. Pakistani residents are permitted to trade Forex through SECP-regulated brokers, which ensures that the trading practices are legitimate and secure.

However, Pakistani traders interested in trading international currency pairs (like EUR/USD) should be cautious. Engaging in offshore or unregulated Forex trading could lead to legal issues, so it's essential to choose SECP-regulated brokers or authorized international brokers that comply with Pakistan's legal framework.

Popular Forex Brokers Operating in Pakistan

In Pakistan, several reputable brokers cater to Forex traders, including both local and international options. Some popular SECP-regulated brokers include OctaFX, FBS, and XM. These brokers offer robust trading platforms, competitive spreads, and customer support tailored to Pakistani traders.

It’s essential to evaluate brokers based on factors like regulation, trading fees, platform features, and customer support. Choosing a reliable broker not only protects your investments but also ensures a smoother and safer trading experience.

Setting Up for Success in Forex Trading

Choosing a Reliable Forex Broker

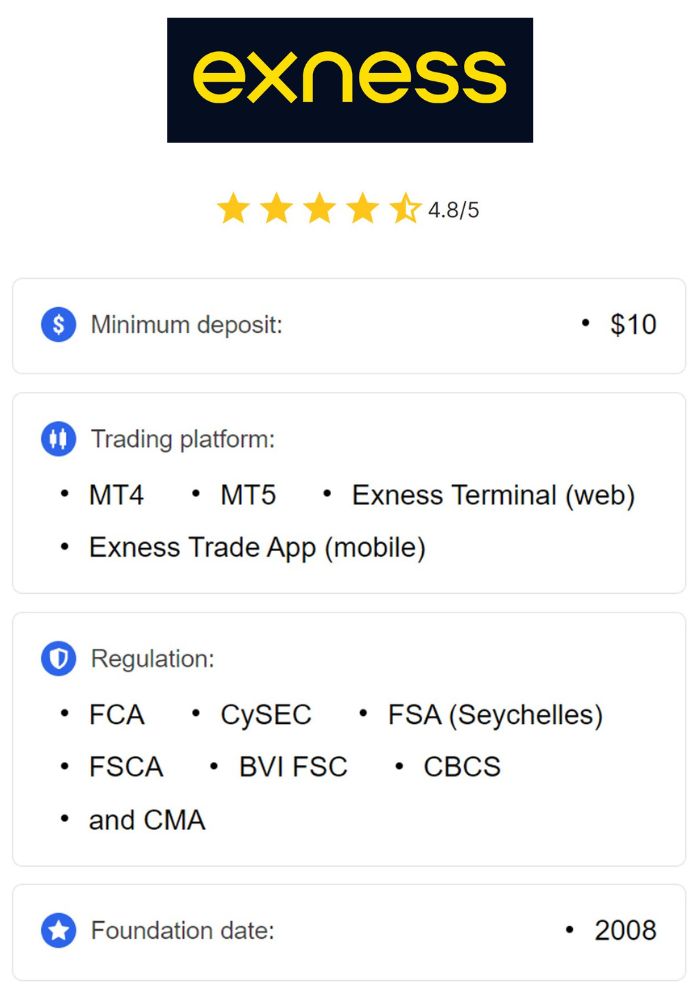

Selecting a reputable and regulated Forex broker is the first step to successful trading. A trustworthy broker offers transparent pricing, low spreads, reliable customer support, and robust security for funds. Ensure that the broker you choose is regulated by SECP or internationally recognized regulatory bodies like CySEC or FCA.

Additionally, look for a broker with advanced trading platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), as these platforms provide the tools needed for effective analysis and trading.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Creating a Demo Trading Account

Before investing real money, it’s highly recommended to practice on a demo account. Demo accounts allow you to trade with virtual money in real market conditions, helping you understand market dynamics, test strategies, and gain confidence. Most brokers provide demo accounts, which are invaluable for building a strong foundation in trading without risking your funds.

Developing a Trading Plan

A well-defined trading plan is crucial for long-term success in Forex trading. This plan should include your trading goals, preferred currency pairs, risk tolerance, and criteria for entering and exiting trades. A trading plan helps you stay disciplined, avoid emotional decisions, and increase your chances of profitability.

Consistency is key—adhering to your trading plan can help you manage risks better and make calculated moves based on strategy rather than impulse.

Fundamental Analysis in Forex Trading

Importance of Economic Indicators

Fundamental analysis involves evaluating economic data and indicators that affect a currency’s value. Key economic indicators include interest rates, inflation rates, employment data, and GDP growth. For example, if Pakistan’s interest rates rise, the PKR may strengthen as foreign investors seek higher returns, driving demand for the currency.

Keeping track of economic indicators helps traders make informed decisions by understanding the underlying factors influencing currency values. Many trading platforms and news sources provide access to economic calendars, allowing traders to plan their trades around major economic events.

Political Factors Affecting Currency Value

Political events such as elections, policy changes, and international relations can significantly impact currency values. For instance, political instability in a country may lead to a decline in its currency value as investors seek safer assets.

Monitoring political developments in major economies, especially those related to your chosen currency pairs, is crucial for assessing potential impacts on currency markets and adjusting trading strategies accordingly.

Technical Analysis for Trading Decisions

Reading Forex Charts

Technical analysis relies on analyzing historical price data to predict future price movements. Reading Forex charts involves understanding candlestick patterns, line charts, and bar charts, each offering different insights into price action. Candlestick charts, for example, reveal trends, support and resistance levels, and reversal patterns.

By studying charts and identifying patterns, traders can make informed decisions on when to enter or exit trades. Familiarity with different chart types is essential for identifying opportunities and managing risks.

Understanding Trends and Patterns

Identifying trends and chart patterns is a key part of technical analysis. Common patterns include head and shoulders, double tops and bottoms, and flags. Recognizing these patterns helps traders predict potential price movements and plan their trades accordingly.

Traders often use trend-following strategies, aiming to trade in the direction of the current trend, which can be upward (bullish), downward (bearish), or sideways (consolidation). Understanding trends and patterns can help traders align their trades with market sentiment and enhance profitability.

Risk Management Strategies

Importance of Risk Management in Forex

Risk management is crucial in Forex trading to protect your capital and avoid significant losses. Strategies like limiting your exposure to a certain percentage of your account per trade and diversifying across different assets can help manage risk effectively.

Adopting a risk management plan helps traders stay focused and reduces the likelihood of emotional decision-making, ensuring they trade within their means and preserve capital for future opportunities.

Using Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders are essential tools for managing risk in Forex trading. A stop-loss order automatically closes a trade if the price moves against you beyond a set limit, minimizing potential losses. Conversely, a take-profit order locks in profits when the price reaches a target level, allowing you to capture gains without monitoring the trade constantly.

These tools provide control over your trades and help manage both risk and reward, ensuring that you stick to your trading plan even when market volatility increases.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Developing a Winning Trading Strategy

Day Trading vs. Swing Trading

Day trading involves executing multiple trades within a single day, focusing on short-term price movements. It requires fast decision-making and continuous monitoring of the market. Swing trading, on the other hand, involves holding positions for several days or weeks, allowing traders to capitalize on medium-term trends.

Each approach has its pros and cons, so it’s essential to choose one that aligns with your goals, experience level, and availability.

Scalping Techniques

Scalping is a high-frequency trading strategy that focuses on making small profits from minor price changes, often within minutes. Scalpers make multiple trades in a short period, requiring precision and discipline. This strategy is suitable for experienced traders with quick reflexes, as it demands focus and a strong understanding of the market.

Scalping can be profitable but comes with higher risk, as frequent trades can amplify both gains and losses.

Emotional Discipline in Forex Trading

Overcoming Fear and Greed

Emotions like fear and greed can lead to impulsive decisions, often resulting in losses. For instance, fear of missing out (FOMO) may cause a trader to enter a trade prematurely, while greed may lead to holding onto a trade longer than planned. Developing emotional discipline through self-control and adhering to a trading plan helps traders make rational decisions.

Keeping a Trading Journal

Maintaining a trading journal is a valuable practice that allows traders to review their past trades, assess strategies, and learn from mistakes. Recording entry and exit points, profits, losses, and reasons for each trade provides insights that can help improve future trading decisions.

A trading journal promotes self-reflection and continuous improvement, enabling traders to refine their skills over time.

Leveraging Technology in Forex Trading

Utilizing Trading Platforms and Tools

Advanced trading platforms like MT4 and MT5 offer tools for market analysis, trade execution, and risk management. These platforms support technical indicators, customizable charts, and automated trading, making them essential for effective trading. Understanding how to use these tools enables traders to make more informed decisions.

Importance of Automation and Algorithms

Automated trading systems, such as Expert Advisors (EAs), allow traders to execute trades based on predefined criteria. Automation reduces the impact of emotions and allows for continuous trading, even when the trader is away. Automated trading strategies are especially useful for high-frequency trading and managing large portfolios.

Automation offers consistency and can help traders execute complex strategies with minimal effort, enhancing efficiency and accuracy.

Legal and Tax Implications of Forex Trading in Pakistan

Understanding Tax Obligations for Traders

In Pakistan, Forex trading income is subject to income tax. Profits from Forex trading must be declared, and traders should understand the applicable tax rates based on their income bracket. Consulting a tax professional can help traders understand their obligations and avoid potential legal issues.

Reporting Forex Income

It’s essential for traders to report their Forex income accurately in tax filings. Keeping track of profits and losses ensures compliance with tax regulations and helps traders manage their finances responsibly. Proper reporting also reduces the risk of audits or penalties.

Building a Community and Learning Resources

Joining Forex Trading Forums and Groups

Participating in Forex trading communities, such as forums and social media groups, provides opportunities to learn from other traders. Platforms like Forex Factory and TradingView allow traders to exchange ideas, discuss strategies, and stay updated on market trends.

Engaging with a community helps traders access diverse perspectives, enhancing their understanding and confidence in the market.

Recommended Books and Online Courses

Learning resources like books and online courses offer in-depth knowledge on Forex trading strategies, technical analysis, and risk management. Books like “Currency Trading for Dummies” and courses on Udemy or Coursera provide valuable insights for traders at all experience levels.

Continuous learning is essential for staying updated on strategies and market trends, allowing traders to improve their skills over time.

Conclusion

Forex trading in Pakistan offers opportunities for profit, but it requires knowledge, discipline, and a clear trading strategy. By understanding the Forex market, choosing reliable brokers, managing risk, and learning continuously, traders can improve their chances of success. Adhering to legal guidelines, using technology to enhance trades, and cultivating emotional discipline are all key to building a profitable Forex trading career in Pakistan.

Read more: