11 minute read

Is forex trading legal in Trinidad and Tobago?

from Exness

by Exness Blog

Overview of Forex Trading

Definition of Forex Trading

Forex trading, or foreign exchange trading, involves the buying and selling of currency pairs to profit from fluctuations in exchange rates. It is a decentralized global market where traders, including individuals, corporations, and financial institutions, engage in currency trading. With a daily trading volume exceeding $6 trillion, forex is the world’s largest financial market, operating 24 hours a day due to its international nature. Traders speculate on currency values, such as the USD/TTD pair, which reflects the value of the U.S. Dollar against the Trinidad and Tobago Dollar, aiming to profit from price changes over time.

Top 4 Best Forex Brokers in Trinidad and Tobago

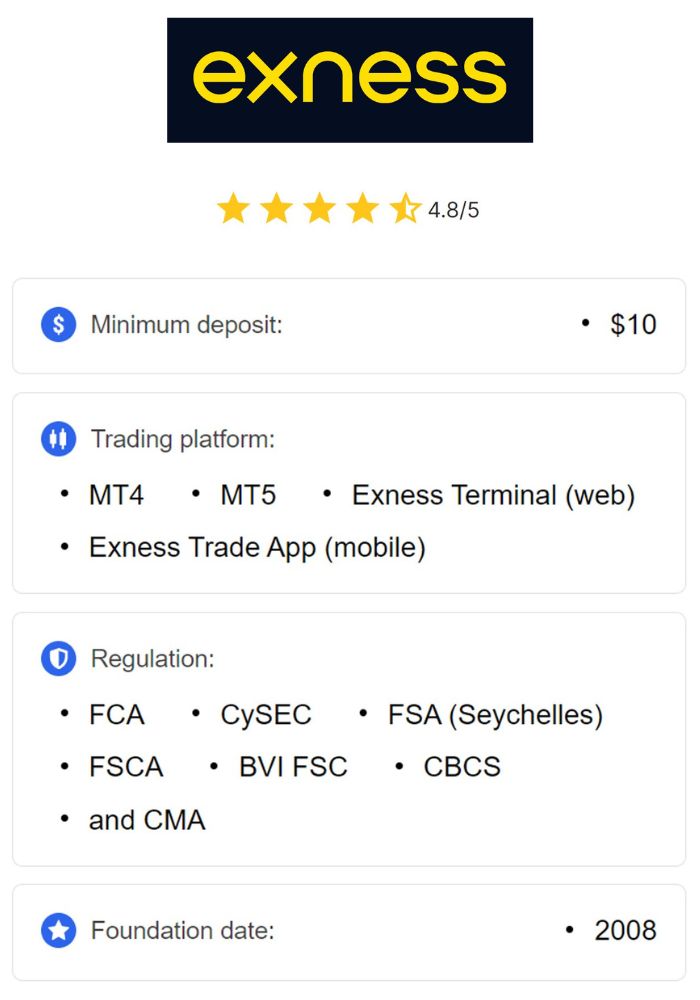

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

Importance of Forex Markets Globally

The forex market plays a crucial role in the global economy, facilitating international trade, investment, and tourism. It allows businesses to manage currency risks and enables governments to stabilize their economies through currency interventions. For individual traders, forex offers unique opportunities for profit through currency speculation, supported by high liquidity and market accessibility. Forex trading also impacts economies like Trinidad and Tobago by providing a way for locals to participate in the global financial system, thus diversifying income opportunities and attracting foreign investment.

Regulatory Environment in Trinidad and Tobago

Financial Institutions in Trinidad and Tobago

The financial landscape in Trinidad and Tobago is composed of a network of banks, credit unions, insurance companies, and investment firms, all regulated to ensure financial stability and consumer protection. Key institutions include the Central Bank of Trinidad and Tobago (CBTT) and the Trinidad and Tobago Securities and Exchange Commission (TTSEC), both of which monitor financial activities and enforce laws to ensure ethical practices. These organizations work together to create a stable and transparent financial environment, which includes overseeing forex trading to protect investors and maintain market integrity.

Role of the Central Bank of Trinidad and Tobago

The CBTT is the primary regulatory authority responsible for maintaining monetary stability, supervising financial institutions, and ensuring economic growth in Trinidad and Tobago. While the CBTT does not directly regulate retail forex trading, it sets monetary policies and guidelines that influence currency exchange. The CBTT also issues regulations for banks and financial entities that facilitate forex transactions, making sure they comply with anti-money laundering (AML) and consumer protection standards. Through its oversight, the CBTT plays a vital role in supporting a secure environment for forex trading in Trinidad and Tobago.

Existing Laws and Regulations

Forex trading in Trinidad and Tobago is legal, but it is regulated to ensure consumer protection and compliance with local laws. Regulations emphasize transparency and require that brokers comply with licensing, financial stability, and reporting standards. While retail forex trading is allowed, traders must work with brokers who adhere to CBTT and TTSEC guidelines. Laws such as the Financial Institutions Act and AML regulations ensure that currency trading activities align with the country’s economic policies and protect individuals from financial fraud.

Legality of Forex Trading

Current Legal Status of Forex Trading

Forex trading is legal in Trinidad and Tobago, but it is subject to regulations that aim to protect investors and maintain economic stability. The CBTT and TTSEC oversee financial practices and ensure that forex brokers comply with local regulations. While residents are free to trade forex, they must work with licensed brokers who operate within the country’s regulatory framework. Engaging in forex trading through unlicensed brokers can lead to financial loss and limited legal protection, making it essential for traders to understand the legal landscape.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Comparison with Other Financial Activities

Compared to other financial activities, such as stock trading and real estate investment, forex trading in Trinidad and Tobago is unique due to its high liquidity, 24-hour market accessibility, and reliance on currency pairs rather than individual assets. Forex trading is generally more volatile than stocks or bonds, attracting those who seek higher returns and are willing to manage the associated risks. However, like all financial markets, it requires compliance with local laws and regulations, which adds an extra layer of complexity compared to traditional investments.

Implications for Local Traders

For local traders in Trinidad and Tobago, understanding the legal status of forex trading is critical. While trading is permitted, working with unlicensed brokers, whether domestic or foreign, can expose traders to fraud and legal consequences. Local traders benefit from choosing regulated brokers that offer a safe trading environment, transparent fees, and compliance with Trinidad and Tobago’s legal standards. Understanding the legal implications helps traders avoid potential pitfalls and make informed decisions about their investments.

Requirements for Forex Trading

Necessary Licenses and Registrations

Forex brokers operating in Trinidad and Tobago are required to obtain licenses from the relevant regulatory bodies, such as the TTSEC. This licensing ensures brokers meet standards related to financial stability, client protection, and ethical conduct. For traders, working with licensed brokers provides added security and compliance with national regulations, offering legal recourse if issues arise. These licenses safeguard traders by ensuring brokers operate under strict regulatory oversight.

Compliance with Financial Regulations

Compliance with financial regulations is essential for both brokers and traders. Brokers must follow anti-money laundering policies, maintain transparent reporting practices, and ensure adequate fund segregation to protect client investments. Traders are also responsible for verifying the regulatory status of brokers, as engaging with unregulated brokers can lead to financial and legal risks. Adhering to these regulations supports a fair and transparent market environment, helping to build trust in forex trading within Trinidad and Tobago.

Risks Associated with Forex Trading

Market Volatility

Market volatility is a fundamental risk in forex trading, as currency values can fluctuate rapidly due to economic data releases, geopolitical events, and shifts in market sentiment. For traders in Trinidad and Tobago, this volatility presents both opportunities and risks, as sudden changes in currency pairs can lead to quick gains or significant losses. Effective risk management strategies, such as setting stop-loss orders and limiting leverage, are crucial to navigate the unpredictable nature of the forex market.

Scams and Fraudulent Schemes

The forex market’s popularity has led to a rise in scams and fraudulent schemes targeting traders in Trinidad and Tobago. Common scams include fake investment platforms, unlicensed brokers, and promises of guaranteed returns. To avoid falling victim to these schemes, traders should verify a broker’s registration with local regulatory bodies and be cautious of offers that seem too good to be true. Awareness of common scam tactics and conducting due diligence can help traders protect their funds and avoid financial loss.

Benefits of Forex Trading in Trinidad and Tobago

Economic Opportunities

Forex trading offers economic opportunities for individuals in Trinidad and Tobago by providing a flexible way to generate additional income. With the forex market’s accessibility, traders can engage in currency speculation from their own homes. This flexibility, combined with the potential for high returns, makes forex trading an attractive option for those seeking economic diversification. The growth of online platforms and educational resources has further enabled local traders to participate in the global forex market.

Diversification of Investment Portfolio

Forex trading allows Trinidad and Tobago residents to diversify their investment portfolios beyond traditional assets like stocks and bonds. By including forex in their investment strategies, traders can spread risk across different asset classes, potentially balancing out their portfolios. Forex trading can complement other investments, offering unique advantages, such as market flexibility and access to international financial instruments. Diversification through forex can provide both stability and growth potential, enhancing long-term investment strategies.

Popular Forex Brokers in Trinidad and Tobago

Criteria for Choosing a Broker

Selecting a reliable broker is essential for secure forex trading. Traders in Trinidad and Tobago should prioritize brokers with proper licenses, transparent fee structures, and positive client reviews. Other important factors include the platform’s ease of use, the availability of customer support, and the range of available trading tools. Ensuring a broker meets these criteria can enhance the trading experience, providing a secure and efficient environment for forex transactions.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Broker Regulation and Trustworthiness

Broker regulation is crucial to establishing trustworthiness in forex trading. Regulated brokers are held to high standards for transparency, security, and ethical conduct, which helps protect traders from fraud and misconduct. Traders can verify a broker’s licensing status through the TTSEC or CBTT and should avoid engaging with unlicensed brokers, which lack regulatory oversight. Working with regulated brokers offers a safer and more transparent trading environment, supporting the long-term success of forex traders.

Tax Implications for Forex Traders

Understanding Tax Obligations

Forex trading income in Trinidad and Tobago is generally subject to taxation, similar to other forms of investment income. Traders are required to report their forex earnings as part of their annual tax filings, with rates varying depending on the total income bracket. Understanding tax obligations is essential to avoid legal issues, and traders may benefit from consulting a tax professional to ensure compliance. Meeting these tax obligations supports financial transparency and aligns with national regulations.

Reporting Requirements for Income from Forex Trading

Forex traders in Trinidad and Tobago must maintain accurate records of all trades, profits, and losses for tax purposes. These records help traders calculate their taxable income and fulfill reporting requirements with the Inland Revenue Division. Brokers often provide statements and transaction summaries, simplifying the reporting process. Accurate reporting ensures compliance with tax laws and reduces the risk of audits, helping traders manage their financial responsibilities effectively.

Educational Resources for Forex Traders

Online Courses and Webinars

Various online platforms offer courses and webinars on forex trading, catering to beginners and advanced traders alike. These resources cover essential topics such as technical analysis, risk management, and trading strategies. For traders in Trinidad and Tobago, online courses provide flexible learning options, enabling them to build a foundation of forex knowledge from reputable sources. Platforms like Coursera, Udemy, and broker-specific webinars are valuable tools for those looking to deepen their understanding of forex trading.

Local Seminars and Workshops

Local seminars and workshops hosted by financial institutions or brokerages in Trinidad and Tobago offer practical, in-person learning experiences. These events often cover topics specific to the local market and allow traders to interact with professionals and other traders. Seminars and workshops provide opportunities for hands-on learning, enabling participants to ask questions and receive guidance directly. Engaging in these events can help traders develop skills and network with experienced individuals in the forex community.

Community and Support Networks

Online Forums and Discussion Groups

Online forums and discussion groups are valuable resources for forex traders in Trinidad and Tobago, providing a platform to share insights, strategies, and market news. Forums like Forex Factory and trading communities on social media allow traders to discuss forex trends and learn from each other’s experiences. These groups foster a supportive environment, helping both new and experienced traders exchange knowledge, stay informed, and enhance their trading skills.

Networking Events in Trinidad and Tobago

Networking events organized by financial institutions and local trading communities offer valuable opportunities for forex traders to connect and share insights. These events facilitate interaction with industry professionals, providing access to expert opinions and market analysis. By building connections within the local forex community, traders can gain deeper insights into market trends and develop a support network that encourages continuous learning and growth in the forex market.

Future of Forex Trading in Trinidad and Tobago

Potential Changes in Regulation

As forex trading grows in Trinidad and Tobago, future regulatory changes may introduce stricter guidelines to protect traders and enhance market stability. The CBTT and TTSEC may consider implementing additional licensing requirements, transparency obligations, or limits on leverage to reduce risk for retail traders. These changes would align Trinidad and Tobago with global regulatory standards, providing a safer and more secure environment for forex trading in the country.

Growth of Digital Currency Impact

The rise of digital currencies is expected to influence forex trading in Trinidad and Tobago by offering new avenues for currency exchange and investment. As digital assets like Bitcoin and stablecoins gain popularity, they may complement traditional forex trading, attracting more participants to the market. The CBTT’s potential exploration of digital currency regulations could shape the future of forex trading, introducing innovative ways for Trinidad and Tobago residents to participate in the evolving financial landscape.

Conclusion

Forex trading in Trinidad and Tobago is a legal and regulated activity, supported by a robust framework designed to protect traders and ensure financial stability. The CBTT and TTSEC oversee the market, encouraging compliance and preventing fraud. Traders in Trinidad and Tobago benefit from economic opportunities, portfolio diversification, and access to global markets through forex. By selecting licensed brokers, staying informed about tax obligations, and utilizing educational resources, traders can engage responsibly in forex trading. As digital advancements and regulatory developments continue, the future of forex trading in Trinidad and Tobago looks promising, offering growth and innovation for both local and international traders.

Read more: