11 minute read

Is forex trading legal in UAE, Dubai? A Comprehensive Guide

from Exness

by Exness Blog

Understanding Forex Trading

Definition of Forex Trading

Forex trading, or foreign exchange trading, is the global market for exchanging national currencies against one another. This decentralized financial market operates 24 hours a day, allowing investors to buy and sell currency pairs like USD/AED (U.S. Dollar vs. Emirati Dirham) based on global exchange rates. Forex is the largest financial market in the world, attracting participants from individual retail traders to large financial institutions due to its liquidity and accessibility.

Top 4 Best Forex Brokers in UAE, Dubai

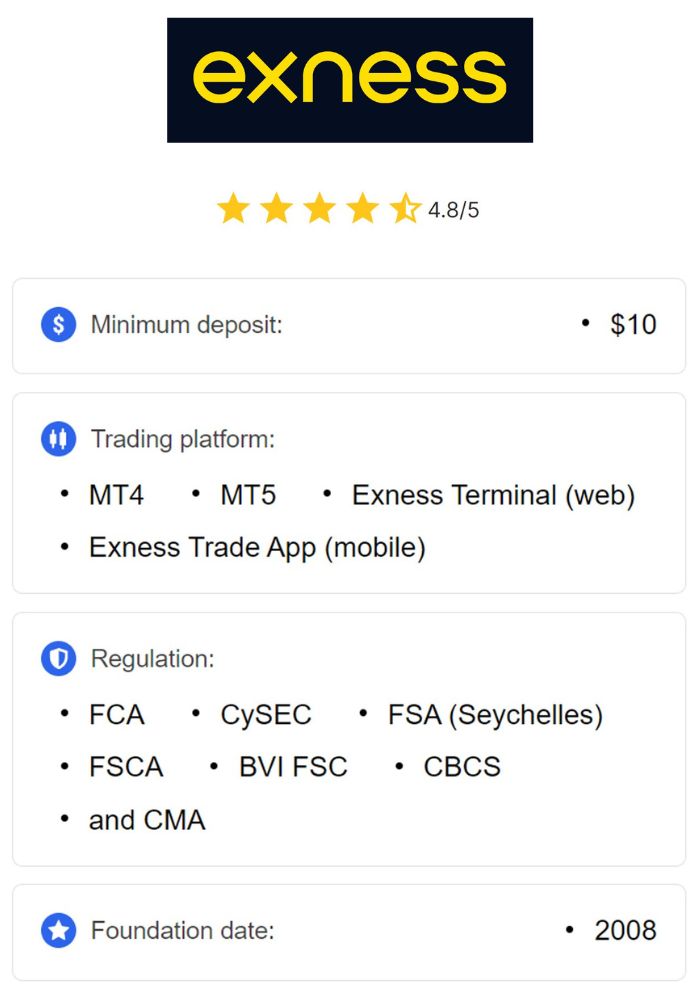

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

How Forex Trading Works

Forex trading is conducted in pairs, with one currency bought while another is simultaneously sold. Traders aim to profit by predicting the direction of currency values and using strategies that involve leverage and margin. Leverage allows traders to control larger positions with a smaller capital investment, amplifying potential gains and losses. Traders can engage in forex through various strategies, including day trading, swing trading, and scalping, depending on their risk tolerance and market analysis.

Key Terms in Forex Trading

Key terms in forex trading include "spread," which is the difference between the bid and ask price; "pips," representing the smallest price movement in currency pairs; "leverage," enabling traders to control more money than they invest; and "margin," the amount a trader must deposit to open a leveraged position. Other common terms include "stop-loss," an automatic trade closure feature, and "swap," or overnight fees, which can be waived in Sharia-compliant accounts. These terms are fundamental for understanding how forex trading operates, particularly in the UAE’s regulatory context.

Regulatory Framework for Forex Trading in UAE

Overview of Financial Regulations in UAE

The UAE has a well-developed regulatory framework for financial markets, overseen by several key institutions. The Central Bank of the UAE (CBUAE), the Emirates Securities and Commodities Authority (ESCA), and the Dubai Financial Services Authority (DFSA) play important roles in supervising financial activities. Regulations ensure transparency, protect investors, and create a stable trading environment. The DFSA, for instance, specifically oversees the Dubai International Financial Centre (DIFC), a free zone that allows forex brokers to operate within strict regulatory standards.

Role of the Central Bank of the UAE

The Central Bank of the UAE (CBUAE) is the primary regulator of monetary policy and currency-related activities in the UAE. Although it does not directly oversee forex trading, it plays a crucial role in currency stabilization and policy setting, indirectly impacting forex markets. The CBUAE ensures that financial institutions operating in the UAE are compliant with regulations, reducing the risk of money laundering and other illicit activities. The central bank also works closely with international bodies to align UAE financial policies with global standards.

Importance of Licensing in Forex Trading

Licensing is mandatory for forex brokers operating in the UAE. Regulated brokers must comply with specific standards regarding transparency, financial reporting, and client fund protection. Licensed brokers operating from the UAE are authorized by entities like the DFSA, CBUAE, or ESCA, ensuring that they operate within legal boundaries and maintain high standards. This regulation protects traders from fraudulent brokers, making it essential for traders to verify a broker’s license status before trading.

Legal Status of Forex Trading in Dubai

Acceptance of Forex Trading by the Government

Forex trading is legal in Dubai and the broader UAE, provided it is conducted through licensed and regulated brokers. The UAE government has embraced forex trading as a legitimate financial activity, supported by a robust regulatory framework that enforces ethical practices and investor protections. This legal acceptance is in line with the UAE's aim to establish itself as a global financial hub, especially through free zones like the DIFC that offer secure environments for forex trading.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Comparison with Other Financial Markets

Compared to other financial markets, the forex market in Dubai is distinct due to its adherence to both international standards and Sharia principles. While the UAE's approach is similar to regulatory frameworks in the US and Europe, it also incorporates Islamic finance principles, such as swap-free trading accounts, making it appealing to Muslim traders. The forex market is also distinct from the stock market in that it operates 24/7, providing more trading flexibility. Dubai’s unique regulatory structure, along with tax benefits, makes it a competitive environment for forex trading.

Legal Implications for Traders

Traders in Dubai must comply with UAE regulations, which require the use of licensed brokers and adherence to anti-money laundering (AML) policies. Engaging with unlicensed brokers or participating in unauthorized forex schemes can result in fines and legal consequences. To avoid issues, traders are advised to verify the legitimacy of brokers through regulatory authorities like the DFSA and ensure that their trading activities remain within the UAE’s legal framework.

Forex Brokers and Their Regulation

Types of Forex Brokers Available in Dubai

In Dubai, traders have access to a variety of broker types, including market makers, ECN (Electronic Communication Network) brokers, and STP (Straight Through Processing) brokers. Market makers create their own prices, while ECN and STP brokers provide direct market access without intermediaries. Each type of broker has specific advantages and limitations, and traders should choose based on their trading style and regulatory compliance. Licensed brokers in Dubai adhere to strict standards, ensuring fair practices regardless of the broker type.

Requirements for Forex Brokers Operating in UAE

Forex brokers in the UAE must meet stringent requirements to obtain a license from authorities like the DFSA or ESCA. These requirements include sufficient capital reserves, transparent reporting practices, and adherence to both UAE regulations and, in some cases, Sharia principles. Brokers must also provide segregated accounts to protect client funds and conduct regular audits. Compliance with these requirements ensures that brokers maintain financial integrity and protect traders from undue risk.

How to Choose a Regulated Forex Broker

Choosing a regulated forex broker in Dubai is essential for secure trading. Traders should check the broker’s license with authorities like the DFSA, CBUAE, or ESCA, and consider factors like fee transparency, fund segregation, and customer support. Reputable brokers provide Sharia-compliant options and risk management tools, enabling traders to participate in forex safely. By selecting a licensed broker, traders reduce the risks of fraud and non-compliance with UAE regulations.

Taxation on Forex Trading in UAE

Overview of Tax Policies in UAE

The UAE has favorable tax policies, with no personal income tax or capital gains tax, making it an attractive location for investors, including forex traders. This tax-free environment allows traders to retain their full earnings, increasing the appeal of forex trading in the UAE. Although corporate tax laws are being introduced, individual traders remain largely unaffected, maintaining Dubai’s appeal as a global financial hub.

Tax Obligations for Forex Traders

Forex traders in the UAE currently have no personal tax obligations on trading profits, given the country’s lack of income tax. However, businesses involved in forex trading may be subject to corporate tax laws depending on their structure and activities. Although individual traders are not taxed, it is advisable to keep clear records of trades and consult financial advisors to stay updated on any future regulatory changes.

Benefits of Forex Trading Under UAE Tax Laws

The UAE’s tax-free environment provides several benefits for forex traders, including the ability to reinvest profits without deductions. For expatriates and high-net-worth individuals, this lack of taxation on personal income enhances Dubai’s reputation as a premier destination for forex trading. The tax-free structure also facilitates wealth accumulation, making Dubai a preferred location for traders looking to maximize their returns.

Risks Associated with Forex Trading

Market Volatility and Its Impact

Forex trading is inherently volatile, with currency prices influenced by economic data, political events, and market sentiment. This volatility creates opportunities for profit but also increases the risk of loss. Traders in Dubai need to use risk management strategies, like stop-loss orders and diversified portfolios, to mitigate these risks. Understanding global economic trends and staying updated on UAE economic policies can help traders make more informed decisions.

Scams and Fraudulent Practices

The popularity of forex trading has led to a rise in scams targeting unsuspecting traders, including those in Dubai. Fraudulent schemes may involve unlicensed brokers, high-leverage promises, or guaranteed returns, often resulting in financial losses. To avoid scams, Dubai traders should verify the broker’s license with the DFSA, avoid unsolicited offers, and use trusted financial institutions. Being cautious of red flags can help traders protect themselves from potential fraud.

Risk Management Strategies for Traders

Effective risk management is essential in forex trading, especially in a volatile market like forex. Strategies include setting stop-loss limits, using appropriate leverage, and avoiding overexposure to a single currency pair. In Dubai, licensed brokers offer risk management tools, allowing traders to limit potential losses and manage their portfolios more safely. Developing a disciplined approach to trading and adhering to risk management principles can significantly improve long-term success.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Popularity of Forex Trading in UAE

Growth of Online Trading Platforms

The growth of online trading platforms has made forex more accessible in Dubai and the UAE. The availability of mobile and web-based platforms has attracted a diverse range of traders, from beginners to experienced investors. Online platforms provide easy access to global markets, real-time data, and a variety of trading tools, fostering a growing community of forex traders in the region.

Demographics of Forex Traders in Dubai

Forex trading attracts a varied demographic in Dubai, from young professionals seeking additional income to experienced investors looking to diversify their portfolios. The tax-free environment and advanced financial infrastructure make it appealing for both expatriates and locals. Younger generations, in particular, are drawn to the flexibility and potential profits offered by forex trading, contributing to its rising popularity across diverse age groups and professional backgrounds.

Cultural Attitudes Towards Trading

In Dubai, attitudes towards trading are generally positive, with investment culture strongly encouraged by the government. However, cultural considerations and adherence to Islamic finance principles shape how forex trading is conducted. Sharia-compliant options, such as swap-free accounts, reflect Dubai’s commitment to accommodating Muslim traders. The balance between modern financial opportunities and traditional values makes forex trading a respected, yet carefully regulated, activity in Dubai.

Educational Resources for Forex Traders

Training Programs and Workshops

Dubai offers various training programs and workshops to support aspiring forex traders. Licensed brokers and financial institutions frequently host events that cover basic to advanced trading techniques, risk management, and regulatory compliance. These in-person workshops offer practical knowledge, helping traders build confidence and skills in a guided environment.

Online Courses and E-books

Online courses and e-books are popular among traders in Dubai, providing flexible and accessible learning options. Many reputable brokers offer free or paid courses that cover topics like technical analysis, market psychology, and trading strategies. E-books, such as Forex for Beginners and Currency Trading for Dummies, provide foundational knowledge that is essential for new traders, helping them develop a disciplined approach to forex trading.

Importance of Continuous Learning

Forex markets are constantly evolving, making continuous learning crucial for traders in Dubai. Staying updated on global economic trends, regulatory changes, and emerging trading strategies enhances a trader’s ability to adapt. In Dubai, many traders invest in advanced courses, market analysis subscriptions, and mentorship programs, recognizing that ongoing education is key to long-term success in the dynamic forex market.

Future of Forex Trading in UAE

Predictions for Market Trends

As forex trading continues to grow, trends in the UAE are expected to align with technological advancements, including artificial intelligence and blockchain integration. These innovations could enhance trading accuracy, transparency, and security, making the market more attractive to new participants. Increased awareness and regulatory advancements may further drive the adoption of forex trading in Dubai.

Potential Changes in Regulation

The UAE may implement more stringent regulations to protect traders as forex trading expands. Future regulations could include enhanced licensing standards, greater transparency requirements, or more Sharia-compliant options. These potential changes would aim to reinforce Dubai’s position as a secure and attractive hub for global forex trading.

The Role of Technology in Forex Trading

Technology plays a transformative role in forex trading, offering tools that improve trading speed, accuracy, and security. In Dubai, AI-powered analytics, algorithmic trading, and blockchain solutions are expected to become more prominent, enhancing the forex trading landscape. As technology advances, Dubai is well-positioned to leverage these innovations, potentially becoming a leader in tech-driven financial trading.

Conclusion

Forex trading is legally recognized in Dubai and the UAE, provided traders work with licensed brokers and comply with local regulations. With no personal income tax, a strong regulatory framework, and a thriving financial market, Dubai offers a conducive environment for forex trading. However, traders must stay informed about legal requirements, choose reputable brokers, and apply effective risk management strategies. As the market evolves with technological advancements and potential regulatory changes, Dubai is likely to remain a prominent destination for forex trading, attracting both local and international investors.

Read more: