16 minute read

How to Open a Forex Account in Kenya

from Exness

by Exness Blog

Understanding Forex Trading

What is Forex Trading?

Forex trading, also known as foreign exchange trading, involves buying and selling currencies in a global market that operates 24 hours a day. In forex trading, currencies are traded in pairs, such as EUR/USD or USD/KES. Traders aim to profit by anticipating changes in currency values, which can fluctuate due to economic factors, political events, or market sentiment. With the global daily forex trading volume surpassing $6 trillion, the forex market is the largest and most liquid financial market in the world, attracting traders from all backgrounds, including Kenya.

Top 4 Best Forex Brokers in Kenya

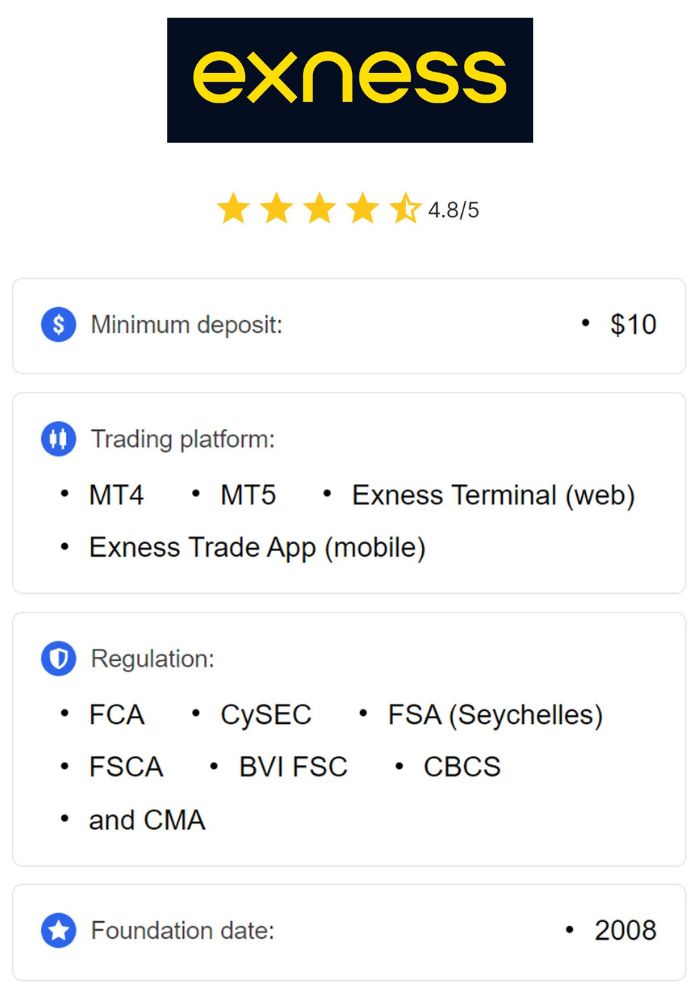

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

Importance of Forex Trading in Kenya

Forex trading has gained significant popularity in Kenya over recent years. The increasing access to online trading platforms and improved internet connectivity has made it easier for Kenyans to participate in the forex market. Forex trading offers a unique opportunity for Kenyans to diversify their income sources, invest globally, and hedge against currency risks, particularly with the fluctuations in the Kenyan Shilling. The ability to trade from anywhere with a mobile device or computer has further contributed to the growth of forex trading in the country.

The Regulatory Environment for Forex Trading in Kenya

Role of the Capital Markets Authority (CMA)

The Capital Markets Authority (CMA) in Kenya is the primary regulatory body overseeing the financial markets, including forex trading. The CMA ensures that forex brokers operating in Kenya adhere to strict regulatory standards to protect investors. It enforces regulations on capital adequacy, transparency, client fund protection, and ethical trading practices. By choosing a broker regulated by the CMA, Kenyan traders can enjoy a safer and more secure trading environment, knowing their investments are protected.

Legal Requirements for Forex Brokers

To operate legally in Kenya, forex brokers must be licensed by the CMA and meet specific regulatory requirements. These include maintaining adequate capitalization, ensuring data privacy, segregating client funds, and providing transparent pricing. Brokers are also required to disclose their fee structures and adhere to fair trading practices. For Kenyan traders, working with CMA-regulated brokers provides a layer of trust and accountability, reducing the risk of fraud and unethical trading practices.

Choosing the Right Forex Broker

Factors to Consider When Selecting a Broker

Choosing the right forex broker is essential for a successful trading experience. Here are key factors to consider:

Regulation: Ensure the broker is regulated by reputable authorities, such as the CMA, which enhances the security of your funds.

Fees and Spreads: Look for brokers with competitive spreads and low fees, as trading costs can affect profitability.

Account Types: Select a broker offering account types that suit your trading goals, whether you’re a beginner or an experienced trader.

Customer Support: Choose a broker with responsive customer support, available in local languages if possible, to assist you with issues or inquiries.

Trading Platform: A user-friendly and reliable platform is crucial for executing trades and analyzing the market.

Popular Forex Brokers in Kenya

Several CMA-regulated forex brokers operate in Kenya, making it easier for traders to find reputable options. These brokers offer various account types, trading tools, and customer support options tailored to Kenyan traders. Some well-known brokers include Eagle Global Markets, Pepperstone, and HotForex. It’s essential to research each broker’s offerings, fees, and reputation to find the best fit for your trading style and goals.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Types of Forex Accounts Available

Standard Accounts

Standard accounts are ideal for traders who have a moderate to high level of experience in the forex market and are comfortable trading with larger capital amounts. These accounts offer access to a wide range of trading features, such as competitive spreads, higher leverage, and more advanced trading tools. Standard accounts typically require a minimum deposit, which may vary depending on the broker. For Kenyan traders looking to trade larger lot sizes and take advantage of tighter spreads, a standard account provides a balanced option between features and costs.

The primary advantage of a standard account is its flexibility, allowing traders to manage risk effectively while accessing comprehensive trading features. Standard accounts often provide access to major, minor, and exotic currency pairs, giving traders a diverse selection to build their portfolio.

Mini and Micro Accounts

For beginners or traders with limited capital, mini and micro accounts offer a low-cost way to enter the forex market. Mini accounts allow trading in smaller lot sizes, typically 10,000 units, while micro accounts trade in even smaller increments, usually 1,000 units per lot. These smaller trade sizes reduce the level of risk exposure and allow traders to gain experience without committing significant amounts of capital.

Mini and micro accounts are popular among Kenyan traders who wish to practice trading strategies or gain market familiarity. With a lower financial barrier, these accounts provide an affordable entry point into forex trading, allowing traders to build confidence gradually. Brokers offering mini and micro accounts often have low minimum deposit requirements, making them accessible to almost any trader in Kenya.

Islamic Accounts

Islamic accounts are specifically designed to comply with Sharia law, which prohibits the earning or payment of interest (riba). In standard forex accounts, overnight positions incur swap or rollover fees, which are considered a form of interest. Islamic accounts, also known as swap-free accounts, eliminate these fees, making them suitable for Muslim traders who want to trade forex while adhering to their religious principles.

For Kenyan traders who observe Islamic finance rules, Islamic accounts allow participation in forex trading without compromising religious beliefs. It’s essential to check the terms, as some brokers may charge an alternative administrative fee in place of swap fees. Many international brokers offer Islamic accounts as an option for traders, providing the same trading conditions as standard accounts, minus the interest-related charges.

Document Requirements for Opening a Forex Account

Identification Documents

To open a forex account, traders need to provide valid identification documents to comply with Know Your Customer (KYC) requirements. Commonly accepted identification includes a national ID card, passport, or driver’s license. These documents help verify the trader’s identity, ensuring they meet the legal requirements for account ownership.

Most brokers require traders to upload a clear, scanned copy or a high-quality photograph of their ID. Providing accurate and up-to-date identification helps expedite the verification process, allowing traders to access their accounts quickly.

Address Verification

Along with identification, brokers require proof of address to complete the account verification process. This proof can include recent utility bills (water, electricity, or gas), bank statements, or official government-issued documents showing the trader’s residential address. The document should typically be no older than three months and should match the information provided during registration.

For Kenyan traders, using an address verification document is essential for security and compliance, ensuring that account ownership is legitimate and safeguarding against fraudulent activity. Submitting correct documents ensures a smooth verification process, allowing traders to begin trading without delays.

Financial Information

Some brokers also ask for financial information to assess the trader’s experience, income level, and financial background. While this information is often optional, brokers may use it to offer tailored trading conditions or account recommendations. Providing financial information helps brokers understand the trader’s risk tolerance and ensure they are placed in an appropriate account type based on their financial capacity and experience level.

The Account Opening Process

Online Application Steps

Opening a forex account is a straightforward process, often completed online through the broker’s website. Here’s a step-by-step guide:

Register on the Broker’s Website: Visit the broker’s official site and click on “Open Account” or “Register.”

Complete the Application Form: Fill in personal details, such as your name, email, phone number, and residential address.

Select an Account Type: Choose the account type that best fits your trading experience and financial goals, such as standard, mini, or Islamic accounts.

Set Up Login Credentials: Create a secure password and verify your email address.

By following these steps, Kenyan traders can complete the application process in minutes, with most brokers offering immediate online access to the account dashboard.

Verifying Your Identity

After submitting the application form, most brokers require traders to complete an identity verification process to ensure compliance with KYC regulations. Traders will need to upload scanned copies or photographs of their identification documents and proof of address. Verification usually takes between 24-72 hours, depending on the broker’s processing times.

Completing this step is essential for gaining full access to the trading account, including deposits, withdrawals, and live trading features. Once verified, traders receive a confirmation email or notification on their trading platform, signaling that their account is fully activated.

Initial Deposit Requirements

Each broker has specific initial deposit requirements based on the account type. For example, standard accounts may have a higher minimum deposit than mini or micro accounts. Kenyan traders should review the broker’s deposit requirements and choose an account that aligns with their available capital. Funding your account with the required initial deposit enables full trading access, allowing you to start trading forex pairs immediately.

Funding Your Forex Account

Accepted Payment Methods

Funding your forex account is simple, with brokers offering various payment options to accommodate Kenyan traders. Common payment methods include:

Bank Transfers: Many brokers support bank transfers, which allow direct funding from your bank account to your trading account.

Credit/Debit Cards: Visa and MasterCard are widely accepted and provide a quick and convenient funding option.

E-Wallets: Digital wallets such as Skrill, Neteller, and PayPal are popular among Kenyan traders due to their fast processing times.

Mobile Money: Some brokers accept local mobile money services like M-Pesa, making it easy for Kenyan traders to deposit in their local currency.

Selecting the most convenient payment method reduces transaction costs and ensures efficient account funding.

Currency Options for Deposits

Forex accounts are often held in major currencies, such as USD, EUR, or GBP. Some brokers offer Kenyan traders the option to hold accounts in KES (Kenyan Shilling), which helps avoid conversion fees. Choosing a local currency account is beneficial for Kenyan traders looking to simplify their transactions, as it eliminates additional costs related to currency conversion.

When funding in KES, confirm the broker’s currency options to make deposits and withdrawals as efficient as possible.

Understanding Leverage and Margin

What is Leverage in Forex Trading?

Leverage allows traders to control larger positions with a smaller amount of capital, increasing the potential for profit but also amplifying risk. For example, with 1:100 leverage, a trader can control $10,000 with only $100. Kenyan brokers offer various leverage options, enabling traders to choose a ratio that matches their risk tolerance and trading style.

Leverage can maximize returns in favorable market conditions, but it requires careful management, as it increases both profit and loss potential. Traders should use leverage wisely, especially when starting, to minimize risk exposure.

Risks Associated with High Leverage

While leverage can enhance profits, it also raises the risk of significant losses. High leverage means that even small market movements can impact account balances substantially. Over-leveraging is a common mistake among beginners, leading to rapid losses. Kenyan traders are encouraged to start with lower leverage ratios, gradually increasing leverage as they gain experience.

Implementing stop-loss orders and managing position sizes are effective ways to manage the risks associated with high leverage, ensuring sustainable trading practices.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Trading Platforms and Tools

Overview of Popular Trading Platforms

A trading platform is a crucial tool for executing trades, analyzing markets, and managing your account. The most widely used platforms in the forex industry are MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms offer user-friendly interfaces, advanced charting capabilities, and a variety of technical indicators that cater to both beginners and seasoned traders.

MetaTrader 4 (MT4): MT4 is ideal for forex trading, providing traders with multiple chart types, customizable layouts, and automated trading options through Expert Advisors (EAs). It’s especially popular among traders in Kenya due to its reliability and ease of use.

MetaTrader 5 (MT5): MT5 builds upon MT4 with additional features, including more chart timeframes, enhanced analytical tools, and access to more asset classes like stocks and commodities. For traders looking for a multi-asset trading experience, MT5 offers greater flexibility.

Some brokers also offer proprietary platforms tailored to their services, providing unique tools and features exclusive to their clients. Exploring these platform options enables Kenyan traders to choose a platform that aligns with their trading preferences and strategies.

Essential Tools for Successful Trading

Forex trading platforms come equipped with various tools that enhance analysis and decision-making. Essential tools include:

Technical Indicators: Indicators such as moving averages, Relative Strength Index (RSI), and MACD help traders understand price trends and market momentum. Using these indicators allows traders to make informed predictions and set strategic entry and exit points.

Economic Calendar: An economic calendar tracks global events, such as interest rate decisions and GDP releases, which can impact currency prices. For Kenyan traders, monitoring the calendar provides insight into market-moving events that may affect currency pairs like USD/KES.

Charting Tools: Advanced charting tools enable traders to visualize price movements, identify patterns, and make strategic decisions. Candlestick charts, trend lines, and Fibonacci retracements are commonly used tools for chart analysis.

Leveraging these tools helps traders execute strategies based on both technical and fundamental analysis, allowing for a comprehensive trading approach.

Developing a Trading Strategy

Fundamental Analysis

Fundamental analysis examines economic, political, and social factors that affect currency values. By analyzing data such as interest rates, inflation, and employment figures, traders can predict currency movements based on underlying economic conditions. For example, a higher interest rate may strengthen a currency, while economic instability could lead to devaluation.

Kenyan traders who use fundamental analysis often monitor international news, central bank announcements, and reports from economic organizations. This analysis provides a long-term view and is essential for making decisions on major currency pairs, such as USD, EUR, and KES.

Technical Analysis

Technical analysis involves studying past price data to forecast future price movements. Traders use charts, indicators, and patterns to identify trends and potential reversal points. Popular technical analysis tools include moving averages, Bollinger Bands, and stochastic oscillators, which provide insight into market trends and momentum.

For Kenyan traders, mastering technical analysis is beneficial for short-term trades, as it allows for precision in timing entry and exit points. Combining technical analysis with a sound trading strategy can lead to profitable trades and consistent market analysis.

Risk Management Techniques

Setting Stop-Loss Orders

A stop-loss order is an automatic tool that limits potential losses by closing a position at a predefined price level. This tool is essential in managing risk, as it prevents significant losses during unexpected market reversals. For example, if you set a stop-loss order 20 pips below your entry point, the trade will automatically close if the price drops by that amount, minimizing losses.

Kenyan traders are encouraged to incorporate stop-loss orders into every trade, especially when using leverage. This ensures that losses remain manageable and that traders protect their capital, even during volatile market periods.

Diversification Strategies

Diversification involves spreading investments across multiple currency pairs or asset classes to reduce risk exposure. By diversifying, traders avoid concentrating risk in a single trade or market segment. For example, instead of focusing solely on major pairs like USD/KES, traders might also trade EUR/USD or GBP/USD, balancing potential gains with lower risk.

Diversification is a crucial strategy for Kenyan traders looking to build a resilient portfolio. It helps mitigate losses if one currency pair underperforms, ultimately supporting consistent returns over the long term.

Common Mistakes to Avoid When Opening a Forex Account

Overlooking Broker Fees

Broker fees, such as spreads, commissions, and overnight swap charges, directly impact trading profitability. Some traders overlook these costs, only to find that fees eat into their profits over time. Kenyan traders should review the broker’s fee structure and choose brokers with transparent and competitive rates.

Choosing brokers with tight spreads and no hidden fees ensures that trading costs are manageable, ultimately leading to higher profit potential. Comparing fees across different brokers before opening an account is an essential step in the decision-making process.

Neglecting to Read the Terms and Conditions

The terms and conditions document outlines crucial information about trading rules, fees, and policies. Skipping this document can lead to misunderstandings regarding account management, fees, and other critical aspects. Kenyan traders are encouraged to read and understand these terms before opening an account to avoid potential issues.

Understanding the terms and conditions clarifies how the broker operates and what traders can expect regarding fund withdrawals, trading policies, and account handling. This clarity provides a solid foundation for building a successful trading relationship with the broker.

Educational Resources for New Traders

Online Courses and Webinars

Education is key to developing trading skills and gaining confidence in the forex market. Many brokers offer online courses and webinars for new traders, covering topics such as trading strategies, technical analysis, and risk management. Webinars, in particular, provide live, interactive sessions where traders can ask questions and learn from experienced professionals.

For Kenyan traders, online courses and webinars offer valuable insights and practical skills that can be applied in live trading scenarios. Leveraging these resources enhances traders’ understanding of the market, allowing them to make informed decisions.

Books and Guides on Forex Trading

Books and guides are valuable resources for in-depth learning and reference. Books such as "Currency Trading for Dummies" and "Market Wizards" by Jack Schwager provide foundational knowledge and expert insights into forex trading. Many brokers and financial websites also offer free guides and e-books covering essential forex topics.

Reading books and guides helps Kenyan traders develop a comprehensive understanding of the forex market, trading psychology, and advanced strategies. Building a solid knowledge base through these resources can empower traders to navigate market complexities with confidence.

Conclusion

Opening a forex account in Kenya is an accessible and rewarding process, offering traders the opportunity to participate in the global currency market. By understanding forex trading basics, selecting a reputable broker, meeting the documentation requirements, and developing a sound trading strategy, Kenyan traders can establish a successful trading journey. Proper risk management, continued education, and the use of analytical tools further contribute to building a sustainable trading experience.

Forex trading has the potential to provide financial independence and portfolio diversification, especially in a dynamic market like Kenya. However, success requires discipline, ongoing learning, and strategic planning. With the right approach and a commitment to risk management, Kenyan traders can capitalize on the opportunities presented by the forex market and work toward their financial goals.

By following these steps, traders in Kenya can make informed decisions, build profitable trading strategies, and navigate the forex market with confidence. Whether you’re a beginner exploring demo accounts or a seasoned trader, the resources, tools, and techniques outlined here can support your growth in the ever-evolving world of forex trading.

Read more:

Exness vs HFM Compared: Which is better?