15 minute read

How to trade Gold — XAUUSD Exness

from Exness

by Exness Blog

Understanding Gold Trading Basics

What is XAUUSD?

XAUUSD is the ticker symbol for the gold to US dollar currency pair in the Forex market. It represents the price of one ounce of gold quoted in US dollars. Gold trading is a popular choice among traders due to its liquidity, volatility, and the fact that it is a tangible asset that can hedge against inflation and economic uncertainty.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

In the Forex market, XAUUSD is considered a commodity pair, as gold is traded like any other currency. Traders can speculate on the price movements of gold against the dollar, aiming to profit from fluctuations in gold prices. Understanding how XAUUSD works is crucial for anyone looking to trade gold effectively.

Why Trade Gold?

Trading gold offers numerous advantages that attract traders worldwide. Some key reasons include:

Liquidity: Gold is one of the most liquid commodities in the market, meaning that it can be bought and sold easily without causing significant price fluctuations. This liquidity is beneficial for traders as it allows for quick entry and exit from trades.

Volatility: Gold prices can be highly volatile, providing opportunities for traders to profit from price movements. This volatility can be influenced by various factors, including economic indicators, geopolitical events, and market sentiment.

Safe-Haven Asset: Gold is often viewed as a safe-haven asset during times of economic uncertainty. When markets are volatile or when there is geopolitical tension, investors flock to gold, leading to price increases. This characteristic makes gold an attractive option for risk-averse traders.

Hedging Against Inflation: Gold is historically used as a hedge against inflation. As the value of currencies decreases over time, gold tends to retain its purchasing power, making it a preferred investment during inflationary periods.

These factors make gold trading an appealing option for both novice and experienced traders looking to diversify their portfolios.

The Importance of Gold in Financial Markets

Historical Significance of Gold

Gold has been valued for centuries, serving as a form of currency and a store of wealth. Its historical significance is rooted in various cultures, where it has been used in trade, jewelry, and as a symbol of status.

Throughout history, gold has remained a constant in the financial markets, often acting as a universal medium of exchange. Its intrinsic value, rarity, and beauty contribute to its status as a valuable commodity. Even today, central banks hold significant gold reserves as part of their monetary policies, further reinforcing gold's importance in the global financial system.

Gold as a Safe-Haven Asset

Gold's reputation as a safe-haven asset is well-documented. During periods of economic downturns, financial crises, or geopolitical tensions, investors often turn to gold as a way to preserve their wealth. This behavior is driven by the perception that gold retains its value better than other assets during turbulent times.

The demand for gold tends to rise when investors are uncertain about the stability of financial markets or when there is fear of inflation. As a result, gold prices often experience upward pressure during such periods, making it a crucial asset for investors seeking stability and protection against market fluctuations.

Key Factors Influencing Gold Prices

Economic Indicators

Economic indicators play a significant role in determining gold prices. Key indicators include:

Inflation Rates: Higher inflation rates typically lead to increased demand for gold as a hedge against eroding purchasing power. When inflation rises, gold prices tend to follow suit.

Interest Rates: Central banks influence gold prices through interest rate policies. Lower interest rates reduce the opportunity cost of holding gold, leading to increased demand. Conversely, higher interest rates can lead to a decline in gold prices.

Employment Data: Strong employment figures can boost consumer confidence and economic growth, which may reduce the demand for gold as a safe haven. Conversely, weak employment data can increase gold's appeal as a safe investment.

Traders should closely monitor these economic indicators to anticipate potential price movements in the gold market.

Geopolitical Events

Geopolitical events can create uncertainty in the financial markets, impacting gold prices. Events such as wars, political instability, and diplomatic tensions can lead investors to seek refuge in gold, driving up its price.

For example, during times of conflict or unrest, gold often experiences a surge in demand as investors look to protect their assets. Traders should stay informed about global news and geopolitical developments to anticipate how these events may influence gold prices.

Central Banks and Monetary Policy

Central banks play a crucial role in the gold market through their monetary policies. Actions taken by central banks, such as adjusting interest rates or engaging in quantitative easing, can significantly impact gold prices.

When central banks increase their gold reserves or signal a shift in monetary policy, it can lead to increased demand for gold. Traders should be aware of central bank announcements and reports, as these can provide insights into potential shifts in gold prices.

Setting Up Your Trading Account with Exness

Choosing the Right Account Type

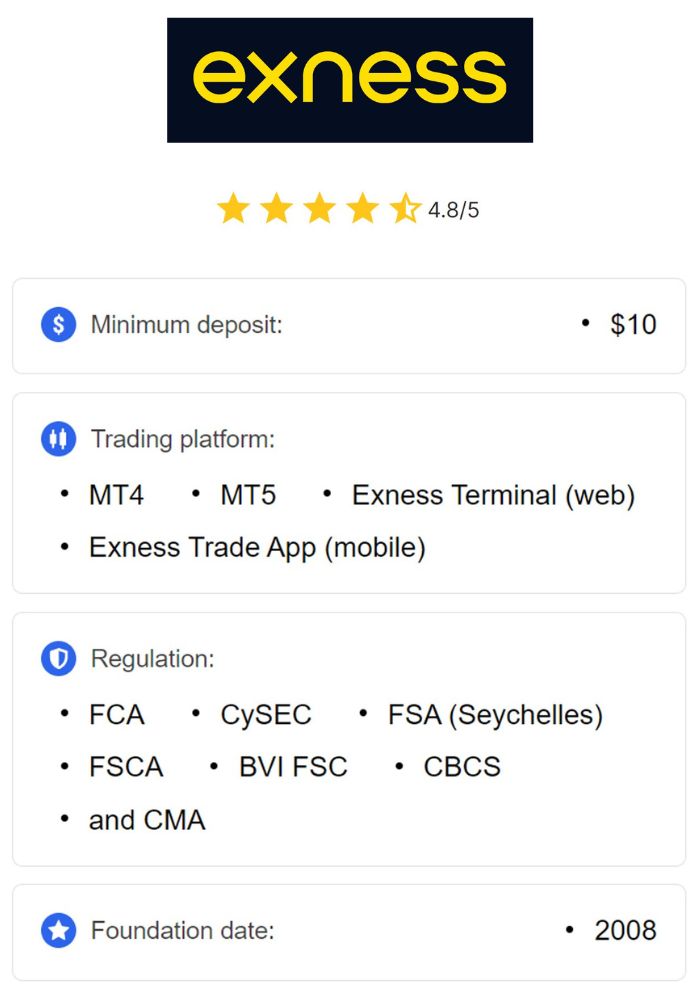

When trading gold with Exness, selecting the appropriate account type is essential. Exness offers various account options tailored to different trading styles:

Standard Account: This account type is suitable for beginners, offering competitive spreads and no commission charges. It allows traders to start with a low minimum deposit and provides access to a wide range of instruments, including XAUUSD.

Pro Account: Designed for experienced traders, the Pro account features tighter spreads and faster execution speeds. This account may involve commission fees based on trading volume, making it ideal for those who trade larger amounts.

Cent Account: This account type is specifically for new traders who want to practice with smaller amounts. It allows trading in cents rather than dollars, reducing risk while gaining valuable trading experience.

Choosing the right account type depends on your trading experience, strategy, and risk tolerance.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Necessary Documentation for Registration

To open an account with Exness, traders must provide certain documentation for verification purposes. Common requirements include:

Proof of Identity: A government-issued ID, such as a passport or national ID card, to verify your identity.

Proof of Address: A recent utility bill or bank statement that clearly shows your name and residential address.

The verification process is essential for ensuring compliance with regulatory requirements and protecting both the broker and its clients.

Funding Your Account

After successfully registering and verifying your account, the next step is to fund it. Exness offers various payment methods for deposits, including:

Bank Transfers: Traders can deposit funds using local and international bank transfers.

E-Wallets: Exness supports popular e-wallet services such as Skrill and Neteller for quick deposits.

Credit/Debit Cards: Traders can also fund their accounts using major credit and debit cards.

Cryptocurrencies: Exness offers the option to deposit funds using cryptocurrencies, catering to the growing interest in digital assets.

Each payment method may have different processing times and fees, so it’s essential to review these before making a deposit.

Tools and Platforms for Gold Trading

Overview of Exness Trading Platform

Exness provides access to multiple trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are widely recognized for their advanced trading tools and user-friendly interfaces.

MetaTrader 4 (MT4): A popular choice among Forex traders, MT4 offers a comprehensive suite of charting tools, technical indicators, and automated trading options through Expert Advisors (EAs).

MetaTrader 5 (MT5): The successor to MT4, MT5 includes additional features such as more timeframes, an integrated economic calendar, and support for trading multiple asset classes, including stocks and commodities.

Both platforms are available for desktop and mobile devices, allowing traders to manage their accounts and execute trades from anywhere.

Popular Trading Tools for Analyzing Gold

In addition to the trading platforms, Exness offers various tools to help traders analyze gold and make informed decisions:

Technical Indicators: Exness provides access to a wide range of technical indicators, including moving averages, Bollinger Bands, and MACD, to assist traders in analyzing market trends.

Charting Tools: The platform features advanced charting capabilities, allowing traders to customize their charts with different timeframes, styles, and indicators.

Economic Calendar: Traders can use the economic calendar to monitor upcoming economic events and data releases that may impact gold prices.

These tools are essential for conducting thorough analyses and developing effective trading strategies.

Technical Analysis for Gold Trading

Understanding Chart Patterns

Chart patterns play a crucial role in technical analysis for gold trading. By recognizing patterns, traders can anticipate potential price movements. Common chart patterns include:

Head and Shoulders: This reversal pattern indicates a potential trend reversal and can signal a change in market direction.

Double Tops and Bottoms: These patterns suggest potential reversal points and can help traders identify entry and exit points.

Triangles: Ascending, descending, and symmetrical triangles indicate consolidation and potential breakout points.

Understanding these chart patterns can enhance traders’ ability to make informed trading decisions.

Key Technical Indicators

Technical indicators are essential for analyzing gold prices and identifying potential trading opportunities. Key indicators to consider include:

Moving Averages: Moving averages help smooth price data to identify trends and potential support or resistance levels.

Relative Strength Index (RSI): The RSI measures the speed and change of price movements, helping traders identify overbought or oversold conditions.

MACD (Moving Average Convergence Divergence): This indicator helps identify potential trend reversals and bullish or bearish momentum.

Utilizing these indicators in conjunction with chart patterns can provide traders with a comprehensive view of market dynamics.

Using Fibonacci Retracement Levels

Fibonacci retracement levels are popular tools for identifying potential support and resistance levels in gold trading. Traders use these levels to anticipate price reversals during pullbacks in an existing trend.

To use Fibonacci retracement, traders identify a significant price movement (swing high and swing low) and apply the Fibonacci levels (23.6%, 38.2%, 50%, 61.8%, and 100%). These levels can serve as potential entry or exit points, allowing traders to manage their trades effectively.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Fundamental Analysis of Gold

Monitoring Economic Reports

Fundamental analysis involves evaluating economic reports and data to understand their impact on gold prices. Key reports to monitor include:

Non-Farm Payrolls (NFP): The NFP report provides insights into employment levels in the US economy, which can influence gold prices.

Consumer Price Index (CPI): The CPI measures inflation, and higher inflation rates can lead to increased demand for gold as a hedge.

Central Bank Statements: Statements and decisions from central banks, such as the Federal Reserve, can significantly impact market sentiment and gold prices.

By keeping an eye on these economic reports, traders can make informed decisions based on potential market movements.

Evaluating News Impact on Gold Prices

In addition to economic reports, news events can have a substantial impact on gold prices. Traders should stay informed about global news, including geopolitical tensions, natural disasters, and significant political developments.

For example, news of conflicts or instability in key regions can lead to increased demand for gold as a safe-haven asset. Traders should evaluate how news events may influence market sentiment and adjust their trading strategies accordingly.

Developing a Trading Strategy

Types of Trading Strategies for Gold

When trading gold, various strategies can be employed based on individual preferences and market conditions. Common strategies include:

Day Trading: This strategy involves executing multiple trades within a single day, capitalizing on short-term price fluctuations. Day traders often use technical analysis and chart patterns to make quick decisions.

Swing Trading: Swing traders hold positions for several days or weeks, aiming to profit from price swings. This strategy requires a thorough understanding of both technical and fundamental analysis.

Position Trading: Position traders take a long-term approach, holding positions for weeks or months based on fundamental analysis and macroeconomic trends. This strategy is suitable for those looking to ride out short-term volatility.

Risk Management Techniques

Effective risk management is crucial for successful trading, especially in a volatile market like gold. Key risk management techniques include:

Setting Stop-Loss Orders: A stop-loss order helps limit potential losses by automatically closing a position when the price reaches a specified level.

Position Sizing: Determining the appropriate position size based on your account balance and risk tolerance is essential for managing risk.

Diversification: Diversifying your portfolio by trading multiple instruments can help reduce overall risk.

Implementing these risk management techniques can help protect your trading capital and enhance long-term profitability.

Setting Entry and Exit Points

Establishing clear entry and exit points is vital for successful trading. Traders should consider technical indicators, chart patterns, and market sentiment when determining when to enter or exit a trade.

Entry Points: Identify potential entry points based on technical analysis, support and resistance levels, and market trends. Setting alerts for key price levels can help ensure timely entries.

Exit Points: Define exit points based on profit targets and stop-loss levels. Having a clear exit strategy in place can prevent emotional decision-making during trades.

By setting defined entry and exit points, traders can maintain discipline and execute their trading strategies more effectively.

Executing Trades on Exness

How to Place Orders

Placing orders on the Exness trading platform is a straightforward process. Once you have funded your account and analyzed the market, you can execute trades by following these steps:

Log in to Your Exness Account: Access the trading platform (MT4 or MT5) or the Exness trading app.

Select the XAUUSD Pair: Navigate to the market section and select the XAUUSD trading pair.

Choose the Order Type: Decide whether you want to place a market order (executed at the current price) or a pending order (executed at a specified price).

Enter Trade Parameters: Specify the trade size, stop-loss, and take-profit levels as needed.

Confirm the Order: Review the details and confirm the order to execute the trade.

Understanding Different Order Types

Exness allows traders to utilize various order types when executing trades, including:

Market Orders: These are executed immediately at the current market price. They are commonly used for quick trades based on real-time market conditions.

Pending Orders: These orders are set to execute at a specified price in the future. Common types of pending orders include limit orders (executed at a better price) and stop orders (executed once a specified price is reached).

Stop-Loss and Take-Profit Orders: These orders help manage risk by automatically closing positions when a specific loss or profit level is reached.

Understanding the different order types available on Exness can help traders execute their strategies effectively and manage their risk.

Monitoring Your Trades Effectively

Using Alerts and Notifications

Monitoring trades effectively is essential for success in trading gold. Exness provides options for setting up alerts and notifications to keep you informed about market movements and price changes.

Traders can set price alerts to receive notifications when XAUUSD reaches a specified price level, enabling timely decision-making. Utilizing alerts helps traders stay proactive and capitalize on market opportunities as they arise.

Reviewing Trade Performance

Regularly reviewing trade performance is vital for continuous improvement as a trader. Exness allows users to access their trading history, providing insights into past trades, profit/loss metrics, and overall performance.

Analyzing completed trades helps traders identify patterns, strengths, and weaknesses in their strategies. This reflection can lead to better decision-making and adjustments in trading approaches for future success.

Psychological Aspects of Trading Gold

Managing Emotions While Trading

Trading can evoke a range of emotions, including fear, greed, and anxiety. Managing these emotions is crucial for making rational decisions and avoiding impulsive trades.

Traders should establish a trading plan and stick to it, even during periods of market volatility. Practicing mindfulness and self-discipline can help traders remain calm and focused, enabling them to execute their strategies effectively.

Importance of Discipline in Trading

Discipline is a fundamental aspect of successful trading. Traders must adhere to their trading plans, manage risks appropriately, and avoid emotional decision-making.

Setting clear rules for entering and exiting trades, as well as defining risk management strategies, can help traders maintain discipline. By staying committed to their strategies and not deviating based on emotions, traders are more likely to achieve consistent results.

Common Mistakes to Avoid in Gold Trading

Over-leveraging Your Positions

One of the most common mistakes traders make is over-leveraging their positions. While leverage can amplify profits, it also increases the risk of significant losses.

Traders should use leverage judiciously and consider their risk tolerance before opening large positions. Proper position sizing and risk management techniques can help mitigate the risks associated with high leverage.

Ignoring Market Trends

Failing to recognize market trends is another mistake that can lead to poor trading decisions. Traders should conduct thorough analysis using both technical and fundamental indicators to identify prevailing trends.

By keeping a close eye on market conditions, economic indicators, and geopolitical events, traders can make informed decisions and capitalize on potential opportunities in the gold market.

Conclusion

Trading gold, particularly through the XAUUSD pair on Exness, can be a rewarding endeavor for traders looking to diversify their portfolios and take advantage of market volatility. With a solid understanding of the fundamentals, the right trading strategies, and a disciplined approach, traders can navigate the gold market effectively.

Exness provides a reliable platform with a user-friendly trading app, a variety of account types, and comprehensive educational resources. By leveraging the tools and support offered by Exness, traders can enhance their trading experience and work towards achieving their financial goals.

As with any trading activity, it is crucial to remain informed, manage risks, and continuously refine your trading strategies. With careful planning and execution, trading gold can become a valuable component of your overall investment strategy.

Read more:

How to Open a Forex Account in India