16 minute read

Exness Zero Spread Account Review

from Exness

by Exness Blog

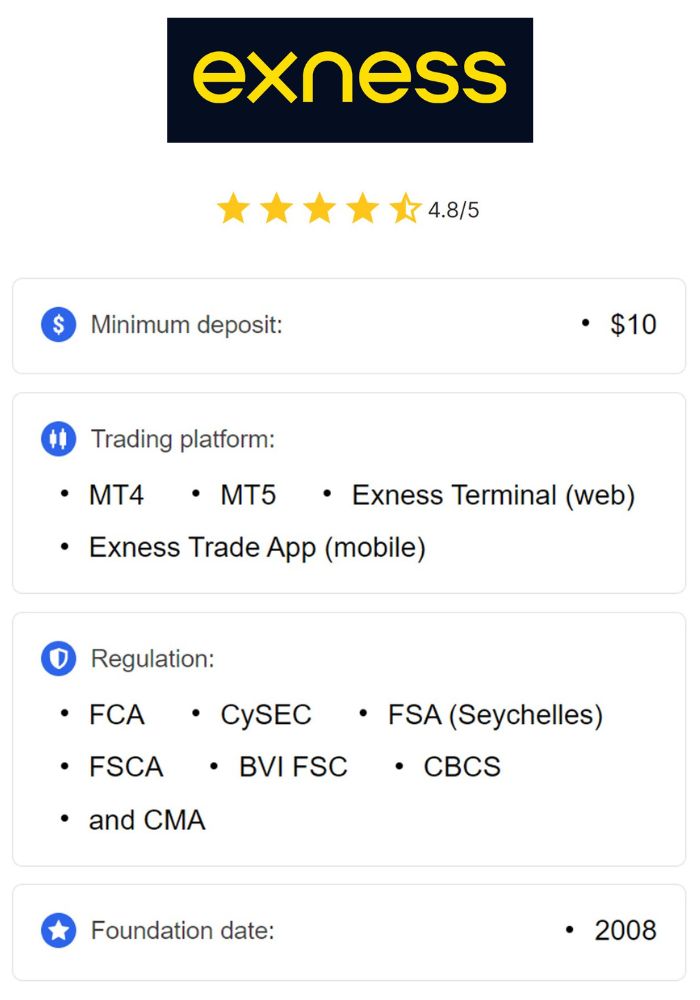

In this comprehensive Exness zero spread account review, we will delve into the features, benefits, and intricacies of one of the most popular trading accounts offered by Exness. Recognized for its trader-friendly environment and a diverse range of financial instruments, Exness has positioned itself as a leading forex broker since its establishment in 2008. This article aims to provide traders, both novices and seasoned professionals, with the essential information needed to make informed decisions about utilizing the Zero Spread account for their trading endeavors.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness

Exness is a global powerhouse in the realm of online forex and CFD trading, known for its user-centric approach and transparent practices. The firm has garnered millions of users worldwide due to its robust trading conditions, competitive fees, and cutting-edge technology. Its offerings are tailored to meet various trader needs, ensuring that every individual can find an account type suited to their trading style and objectives.

Overview of Exness as a Forex Broker

Founded in 2008, Exness has grown rapidly and now serves clients across the globe. With several licenses from reputable regulatory bodies, the broker has built a reputation for safety and reliability. Traders can access a wide array of financial instruments, including currency pairs, commodities, indices, stocks, and cryptocurrencies.

The Exness platform is known for its intuitive design, making it accessible to traders at all levels. Additionally, the broker offers multiple educational resources, ensuring that traders have the tools necessary to improve their skills and market knowledge. One of the standout features of Exness is its commitment to providing excellent customer service, which enhances the overall trading experience for its users.

Importance of Zero Spread Accounts

In the competitive world of forex trading, minimizing costs can significantly enhance profitability. Traditional accounts typically involve spreads – the difference between buying and selling prices – which can eat into a trader's profits. A Zero Spread account directly addresses this issue by eliminating the spread and replacing it with a commission structure, allowing traders to operate at more favorable conditions.

Zero Spread accounts have become increasingly popular among active traders, particularly scalpers and high-frequency traders, who benefit from reduced transaction costs. By avoiding the extra cost of the spread, these traders can capitalize on small price movements more effectively, thus improving their overall returns.

Understanding the Zero Spread Account

A Zero Spread account is designed specifically for traders who prioritize execution speed and cost efficiency. By removing the spread, Exness allows traders to enter positions at the true market price, fostering an environment where profits can be maximized.

Definition and Features of Zero Spread Accounts

As the name suggests, a Zero Spread account does not include the traditional spread typically charged by brokers on trades. Instead, Exness applies a small commission to each trade executed. This model ensures that traders know exactly what they are paying for each transaction, promoting transparency and control over trading costs.

Key features of the Exness Zero Spread account include:

No Spread: The elimination of the spread helps minimize transaction costs for traders, which is especially beneficial for those who frequently execute trades.

Commission-Based Structure: Instead of spreads, traders pay a small commission on each lot traded, which can lead to improved profit margins.

Enhanced Control: Since traders know exactly what they are paying, they can better manage their trading strategies and risk exposure.

Greater Profit Potential: The lack of spread allows traders to capture market movements more effectively, potentially translating into higher profitability.

Advantages and Disadvantages of Zero Spread Accounts

While Zero Spread accounts offer compelling advantages, it's essential to recognize their potential drawbacks as well. This balanced perspective provides traders with insights to determine whether this account type aligns with their trading goals.

Advantages:

Lower Trading Costs: For active traders and scalpers, eliminating the spread can lead to significantly reduced transaction costs, enhancing profitability.

Precise Execution: Trades are executed at the actual market price, which minimizes slippage and ensures better order fills.

Increased Profitability: Without the burden of spreads, traders can maximize their profit margins, especially when focusing on small price movements.

Transparency: Traders enjoy complete clarity regarding their transaction costs, enabling better risk management.

Disadvantages:

Commissions: Although spreads are eliminated, commissions can accumulate quickly for high-volume traders, potentially offsetting some of the savings from zero spreads.

Higher Minimum Deposit: Some brokers may require a higher initial deposit to open a Zero Spread account compared to standard accounts.

Not Suitable for All Strategies: Longer-term traders or those who prefer infrequent trading may not find the Zero Spread account optimal, especially if trading volume is low.

Key Features of Exness Zero Spread Account

The Exness Zero Spread account stands out due to its unique offerings, catering to a diverse range of trading styles and preferences. Understanding these key features can help traders make informed decisions.

Trading Instruments Available

One of the major attractions of the Exness Zero Spread account is the extensive range of tradable instruments available. Traders can access various financial markets, which broadens their options for diversifying their portfolios.

Forex Currency Pairs: The account offers trading on major, minor, and exotic currency pairs, giving traders the flexibility to exploit different market conditions.

Precious Metals: Contracts for precious metals like gold and silver are available, allowing traders to hedge against inflation or diversify their investment strategies.

Energy Commodities: Access to contracts for oil, natural gas, and other energy-related instruments enables traders to participate in volatile markets influenced by geopolitical events and economic fluctuations.

Indices and Stocks: Traders can also explore global stock indices and leading company stocks, expanding their opportunity sets beyond forex trading.

Cryptocurrencies: The inclusion of popular cryptocurrencies reflects the growing interest in digital assets, allowing traders to tap into this evolving market.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Leverage Options and Margin Requirements

Leverage plays a critical role in forex trading, as it allows traders to control larger positions with smaller margin requirements. Exness offers significant leverage for Zero Spread accounts, with maximum leverage up to 1:2000, enhancing buying power for traders.

However, it's essential to approach high leverage cautiously. While it can amplify profits, it also increases the risk of substantial losses. As such, understanding and implementing risk management strategies is necessary before leveraging trades.

Execution Speed and Order Types

Execution speed is vital, especially for traders relying on swift market movements to capitalize on trading opportunities. Exness is renowned for its rapid execution times, and the Zero Spread account benefits from this aspect significantly.

The account supports various order types, providing traders with greater control over their trades in different market conditions. Common order types available include:

Market Orders: Execute trades at the best available market price, ideal for quick entries or exits.

Limit Orders: Set specific price levels for executing trades, allowing traders to maximize profit potential or minimize losses based on their strategies.

Stop Orders: Trigger orders when the market reaches pre-set price levels, assisting in hedging strategies or managing risk.

Trailing Stop Orders: Automatically adjusts stop-loss levels based on market movements, helping traders protect profits.

Comparison with Other Account Types at Exness

Exness offers a variety of account types designed to cater to different trading styles, including Standard accounts and Pro accounts. Comparing these with the Zero Spread account can offer further insights into which option may suit traders best.

Standard Account vs. Zero Spread Account

The Standard account is often favored by beginner traders who are just starting their journey in the forex market. Here’s a comparison with the Zero Spread account:

Spreads: The Standard account has variable spreads that are typically wider compared to the Zero Spread account, which boasts fixed zero spreads.

Commissions: Standard accounts do not charge commissions per trade, whereas the Zero Spread account incorporates a commission-based model.

Suitability: The Standard account is suitable for beginners and infrequent traders, while the Zero Spread account caters to active traders and scalpers.

Minimum Deposit: Generally, the minimum deposit required to open a Standard account is lower than that of the Zero Spread account.

Pro Account vs. Zero Spread Account

The Pro account occupies a middle ground between the Standard and Zero Spread accounts, offering a blend of both structures. Here's how they compare:

Spreads: Pro accounts feature low fixed spreads, while Zero Spread accounts have no spread but charge commissions.

Commissions: Both accounts charge commissions per lot traded; however, the commission rates may vary.

Suitability: Pro accounts tend to appeal to medium-level traders employing strategies that necessitate low spreads. In contrast, the Zero Spread account is ideal for traders seeking absolute precision in execution.

Minimum Deposit: Both account types may have similar minimum deposit requirements, generally higher than Standard accounts.

Who Should Consider the Zero Spread Account?

Understanding which type of trader would benefit most from the Exness Zero Spread account can help individuals align their trading strategies with their goals.

Ideal Traders for Zero Spread Accounts

Certain types of traders are inherently more suited to the Zero Spread account due to their trading strategies and preferences. Identifying these groups can reveal the account's primary advantages.

Scalpers and High-Frequency Traders: These traders rely heavily on quick, frequent trades that capitalize on small price movements. The absence of spreads significantly lowers their transaction costs, empowering them to execute their strategies more effectively.

Active Traders: Individuals who engage in consistent trading activities and generate significant volume can take advantage of lower overall costs associated with a Zero Spread account.

Expert Traders: Seasoned traders with advanced strategies requiring high precision in execution will appreciate the transparency and control that the Zero Spread account offers.

Risk Management for Users of Zero Spread Accounts

Regardless of the chosen account type, all traders must prioritize effective risk management. This aspect becomes even more crucial for those utilizing the Zero Spread account, as the absence of spreads does not eliminate inherent trading risks.

Stop-Loss Orders: Implementing stop-loss orders can automatically close trades when the market moves against a position, safeguarding capital from excessive losses.

Position Sizing: Assessing appropriate position sizes based on trading capital and risk tolerance is essential for mitigating potential downsides.

Diversification: Spreading trades across multiple assets and markets can help reduce overall risk exposure instead of concentrating on a single instrument.

Margin Awareness: Understanding margin levels and being alert to potential margin calls can prevent unexpected liquidation of trading positions, ensuring capital longevity.

Costs and Commissions Associated with Zero Spread Accounts

Cost structures play a pivotal role in shaping trading strategies, particularly when considering the Exness Zero Spread account. Gaining insights into the various commissions and fees associated with this account can facilitate informed decision-making.

Spreads, Commissions, and Fees Explained

Understanding how Exness determines its commission structure is critical for traders considering the Zero Spread account. By providing transparency around costs, traders can tailor their strategies accordingly.

Commission Structure: The commission for the Zero Spread account is typically expressed in currency units per lot traded. For instance, if the commission rate is $3 per lot, then a trader who buys ten lots will incur a total commission of $30 on that trade.

Impact on Low-Volume Trading: For those who trade infrequently, commission charges may seem negligible; however, high-volume traders should calculate the projected commission expenses to ascertain their impact on overall profitability.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Hidden Costs and Additional Charges

In addition to the apparent commissions, traders must remain vigilant for any hidden costs that could affect their trading outcomes. These may include:

Inactivity Fees: Some brokers impose inactivity fees on accounts that remain dormant for extended periods, which can chip away at capital over time.

Withdrawal Fees: Depending on the withdrawal method selected, traders may incur additional fees for transferring funds back to their accounts.

Currency Conversion Fees: Trading in multiple currencies can lead to conversion fees, impacting profits when positions are closed.

It’s prudent for traders to read the fine print regarding fees to ensure they understand the complete cost structure associated with the Zero Spread account.

Trading Conditions on the Exness Zero Spread Account

The trading conditions offered by Exness for the Zero Spread account contribute significantly to its attractiveness among active traders. Analyzing these conditions can provide further clarity for potential users.

Minimum Deposit Requirements

Opening a Zero Spread account may require a higher minimum deposit compared to standard options. This requirement can vary depending on the broker's policies and the account type selected. However, the investment made can be worthwhile when considering the potential for reduced transaction costs and enhanced profit margins.

Withdrawal Methods and Processing Times

Efficient withdrawal processes are critical for traders who wish to access their funds promptly. Exness provides multiple withdrawal methods, including bank transfers, credit/debit cards, and eWallets, enabling users to select a preferred option based on convenience and speed.

Processing times for withdrawals can also vary significantly based on the method chosen. E-wallet transactions are typically faster, often completed within hours, while bank transfers might take longer. Ensuring an understanding of these timelines can aid traders in managing their cash flow seamlessly.

Technology and Trading Platforms Offered

With technology at the heart of modern trading, Exness excels in offering advanced platforms that cater to diverse trading preferences. The MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms are prime examples of the innovative solutions provided to traders.

MetaTrader 4 and MetaTrader 5 Capabilities

Both MT4 and MT5 are highly regarded trading platforms that offer comprehensive features, facilitating smooth trading experiences for users.

User-Friendly Interface: The platforms boast intuitive interfaces that allow traders to navigate effortlessly through charts, indicators, and order placements.

Advanced Charting Tools: Featuring advanced charting capabilities, traders can utilize multiple timeframes, technical indicators, and drawing tools to analyze market trends thoroughly.

Algorithmic Trading Support: Both MT4 and MT5 support algorithmic trading through Expert Advisors (EAs), allowing traders to automate their strategies based on predefined criteria.

Multi-Asset Trading: MT5, in particular, extends its capabilities beyond forex to include stocks and commodities, aligning with the diverse offerings of the Exness Zero Spread account.

Mobile Trading Options and User Experience

In an increasingly mobile-driven environment, Exness recognizes the importance of offering seamless mobile trading options. The availability of mobile applications for both MT4 and MT5 empowers traders to manage their accounts on the go, opening up new possibilities for executing trades and monitoring positions.

Real-Time Notifications: Mobile apps facilitate real-time notifications of market movements and trading signals, enabling traders to react promptly to changing conditions, regardless of their location.

User-Centric Design: Designed with the user experience in mind, the mobile apps mimic the desktop functionality, allowing traders to place orders, view charts, and access account information effortlessly.

Customer Support and Resources

Exceptional customer support is a hallmark of reputable brokers, and Exness strives to uphold this standard by offering a variety of services and resources to assist traders.

Availability of Customer Support Services

Traders require prompt assistance, particularly during volatile market conditions. Exness offers multiple channels for customer support, including live chat, email, and phone support.

24/5 Support: The availability of support five days a week ensures that traders can access assistance during market hours, a vital aspect when dealing with urgent issues.

Multilingual Support: Catering to its global audience, Exness provides support in multiple languages, enhancing accessibility for traders from different backgrounds.

Educational Resources and Tools for Traders

Supporting traders' growth is a core component of Exness's philosophy. The broker offers a wealth of educational resources, webinars, and analysis tools to foster continuous learning.

Webinars and Live Sessions: Traders can participate in live webinars and interactive sessions hosted by industry experts, covering topics ranging from basic trading concepts to advanced strategies.

Trading Guides and Analysis: Exness provides comprehensive trading guides, analyses, and market insights to equip traders with the knowledge needed to succeed.

User Reviews and Testimonials

User feedback plays a crucial role in assessing the effectiveness and reliability of any broker. Examining reviews and testimonials regarding the Exness Zero Spread account can shed light on the experiences of fellow traders and highlight the account's strengths and weaknesses.

Positive Experiences from Zero Spread Account Users

Numerous traders have reported positive experiences using the Exness Zero Spread account, particularly praising the following aspects:

Cost Efficiency: Many users have highlighted the significance of reduced transaction costs, emphasizing how the removal of spreads has positively impacted their profitability.

Execution Speed: Traders often commend Exness for its lightning-fast execution, noting that the ability to enter and exit positions promptly has been instrumental for their trading strategies.

Transparent Cost Structure: Users value the clarity surrounding trading costs, appreciating that they can easily calculate commissions and manage their overall expenses effectively.

Common Complaints and Areas for Improvement

Despite the numerous positive reviews, some traders have voiced concerns about particular aspects of the Exness Zero Spread account. Addressing common complaints can provide valuable insights into areas where improvements may be necessary.

Commission Rates: Certain users have expressed dissatisfaction with commission rates, especially when trading high volumes, suggesting that even minimal fees can accumulate quickly and impact overall profitability.

Customer Service Response Times: While many praise customer support, some users report delays in response times during peak trading hours, indicating a need for enhancements in support efficiency.

Regulatory Compliance and Safety Measures

When selecting a broker, regulatory compliance and safety measures play a paramount role in determining trustworthiness. Exness has established itself as a reliable broker by adhering to stringent regulations and implementing robust security protocols.

Licensing and Regulatory Bodies

Exness operates under the supervision of reputable regulatory authorities, ensuring that the firm adheres to high standards of practice. The presence of regulatory oversight enhances trader confidence and provides an added layer of protection for clients.

Regulatory Framework: Exness holds licenses from several esteemed regulatory bodies, which govern its operations and enforce compliance with local laws and trading standards.

Client Fund Protection: Funds deposited by clients are held in segregated accounts, safeguarding capital from potential misuse and ensuring that traders' funds remain secure.

Security Measures Implemented by Exness

Exness employs advanced security measures to protect clients' sensitive data and personal information from cyber threats. The broker uses encryption and two-factor authentication to fortify account security, enabling traders to conduct transactions with peace of mind.

Data Encryption: End-to-end encryption protocols are utilized to protect client data during transmission, reducing the risk of unauthorized access.

Account Verification: Exness implements rigorous verification procedures to confirm the identity of clients and mitigate the risk of fraudulent activities.

Conclusion

The Exness zero spread account review has illuminated the numerous features, advantages, and considerations associated with this account type. By eliminating the spread, Exness provides a distinctive trading environment conducive to active traders, especially scalpers and high-frequency trading enthusiasts.

While the Zero Spread account comes with its set of advantages, such as lower trading costs and precise execution, potential users should also weigh the associated commissions and ensure that their trading strategies align with the account's offerings.

For anyone looking to optimize their trading experience, the Exness Zero Spread account may represent an exceptional opportunity to capitalize on market movements without the hindrance of traditional spread costs. Ultimately, making an informed decision hinges on evaluating one's trading style, risk tolerance, and financial goals to determine whether this account type is the right fit.

Read more: