15 minute read

Is Exness legal in UAE? Review Broker

from Exness

by Exness Blog

Is Exness legal in UAE? Review Broker. The legality and regulatory status of forex brokers are paramount concerns for traders, especially those operating in regions like the United Arab Emirates (UAE). In this article, we will delve into the various facets of Exness as a broker to determine its legality within the UAE and explore the implications of trading with this platform.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness

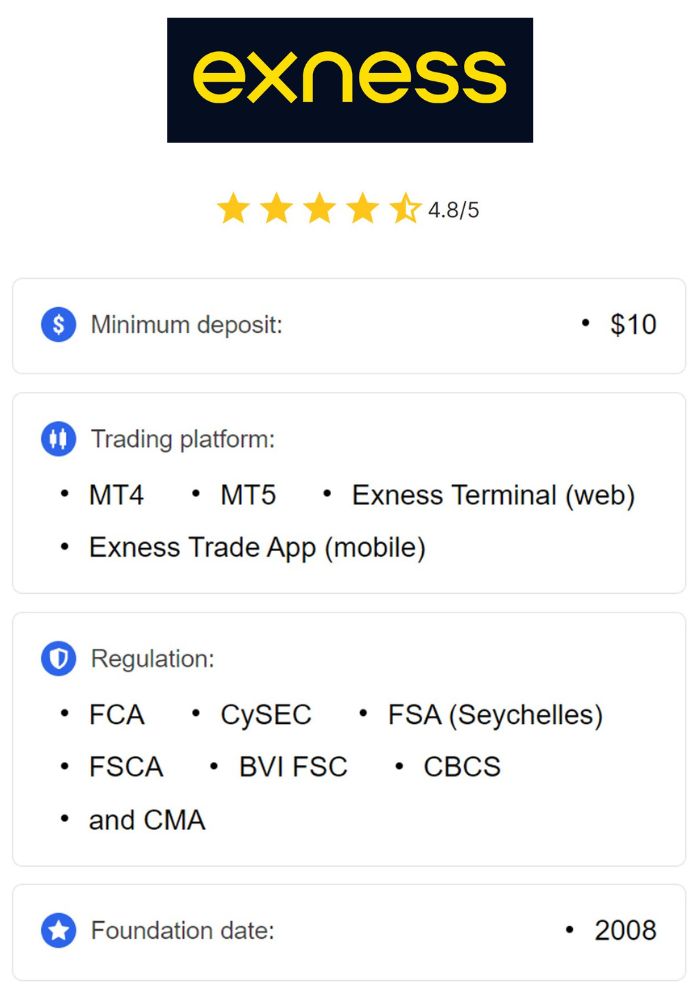

Understanding Exness as a broker involves exploring its core characteristics, history, and development. Established in 2008, Exness has positioned itself as a prominent player in the world of online trading, catering to a diverse range of traders across the globe.

Overview of Exness as a Broker

Exness is a globally recognized online brokerage firm that provides access to a vast array of financial instruments. These include Forex, commodities, indices, and cryptocurrencies. Over the years, it has garnered considerable popularity among traders due to its competitive trading conditions, advanced trading platforms, and an array of account options tailored to meet varying trader needs.

What sets Exness apart in a crowded market is its commitment to providing a user-friendly and accessible trading environment, suitable for both novice and experienced traders. The broker's dedication to customer satisfaction is reflected in its extensive offerings and functionalities, making it a viable option for many looking to engage in the forex market.

Brief History and Development

Since its inception in 2008, Exness has steadily grown into a formidable contender in the Forex market. Founded by a group of finance professionals, the company set out with a mission to make trading accessible and straightforward for everyone. Its rapid growth can be attributed to continuous technological innovation and a strategic focus on client satisfaction.

From humble beginnings, Exness quickly expanded its reach to numerous countries and regions. This growth was facilitated by embracing the latest technologies and trends in online trading. The company’s success has allowed it to adapt to changing market dynamics while remaining committed to transparency and ethical trading practices. Through its consistent evolution, Exness has effectively established a strong reputation in the global trading community.

Regulatory Framework for Forex Trading in UAE

A critical aspect of assessing whether Exness is legal in UAE is understanding the regulatory framework governing forex trading in the region. The UAE has made significant strides in ensuring a robust regulatory environment, which aims to protect investors and ensure market integrity.

Overview of Financial Regulations in UAE

The financial regulatory landscape in the UAE is primarily guided by the Central Bank of the UAE, along with other authorities such as the Dubai Financial Services Authority (DFSA) and the Securities and Commodities Authority (SCA). The UAE government has prioritized the establishment of a transparent and secure economic environment, which has led to the implementation of stringent regulations governing financial activities, including forex trading.

These regulations play a crucial role in protecting investors from potential fraud and ensuring ethical conduct among brokers. By adhering to these guidelines, brokers operating in the UAE can instill confidence in their clients and contribute to the overall stability of the financial market.

Role of the Dubai Financial Services Authority (DFSA)

The DFSA is essential in overseeing and regulating the financial services industry within the Dubai International Financial Centre (DIFC). As an independent regulatory body, the DFSA adheres to international best practices and standards, ensuring that financial entities maintain high levels of operational integrity.

The DFSA's jurisdiction extends to various financial activities, including forex trading and brokerage services. Brokers wishing to operate within the DIFC must obtain DFSA licensing, which entails meeting rigorous compliance requirements. This includes maintaining adequate capital reserves, implementing effective risk management strategies, and adhering to ethical standards.

For traders in the UAE, the presence of a regulator like the DFSA offers a sense of security, knowing that their chosen broker is subject to oversight aimed at protecting investor interests.

Importance of Regulation for Traders

Regulation plays a fundamental role in safeguarding traders and ensuring fair practices within the forex market. Choosing to trade with regulated brokers provides a level of assurance that the broker follows industry's best practices and complies with local laws.

Traders can benefit from these regulatory structures as they enforce strict compliance measures that protect client funds. These measures typically include maintaining segregated client accounts, which ensures that client funds are kept separate from the broker’s operational funds. Additionally, regulated brokers are often required to uphold strict reporting standards, enhancing transparency and trustworthiness.

In summary, regulation is vital for establishing a safe trading environment, allowing traders to focus on their strategies rather than worrying about potential risks associated with unregulated brokers.

Is Exness Regulated in UAE?

Understanding the regulatory status of Exness within the UAE is integral to determining its legality. While the regulatory landscape is robust, it is essential to analyze Exness's licensing information and compare it with other available brokerages.

Licensing Information of Exness

Currently, Exness does not hold a license from the Dubai Financial Services Authority (DFSA) or any other regulatory body within the UAE. Consequently, Exness’s operations within the UAE do not fall under the regulatory purview of the DFSA or local authorities. This lack of regulatory licensing raises concerns regarding the safety of funds for traders operating in the UAE.

While Exness is regulated by several reputable authorities in different jurisdictions, the absence of local regulation may deter some traders who prioritize working with licensed brokers that adhere to UAE-specific regulations.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Comparison with Other Brokers Operating in UAE

In contrast to Exness, several other brokerage firms operating in the UAE have obtained licenses from the DFSA or other local regulatory bodies. These firms are subject to stringent oversight and compliance requirements, which enhance the level of protection for their clients.

Traders considering forex options in the UAE may opt for DFSA-regulated brokers to ensure maximum protection and peace of mind. Engaging with regulated brokers mitigates risks associated with unlicensed operations, offering recourse options should issues arise. Therefore, evaluating the regulatory status of brokers is a wise practice for any trader navigating the market.

Advantages of Trading with Exness

Despite the regulatory challenges, Exness presents several advantages that attract many traders to its platform. Understanding these benefits can help traders evaluate whether Exness aligns with their trading goals.

Competitive Trading Conditions

One of the primary advantages of trading with Exness is its highly competitive trading conditions. Exness consistently offers tight spreads, particularly on major currency pairs. Low spreads allow traders to maximize their trading opportunities and reduce their overall trading costs.

Moreover, Exness provides variable spreads, which fluctuate based on market volatility. This feature caters to traders who prefer a more dynamic trading environment, enabling them to capitalize on potential price movements without incurring excessive costs.

The ability to leverage favorable trading conditions significantly enhances profit potential, making Exness a compelling choice for traders looking to optimize their trading experience.

Variety of Trading Instruments

Another notable advantage of Exness is the sheer breadth of trading instruments it offers. With access to a remarkably diverse range of assets, traders can choose from an extensive selection of Forex currency pairs, commodities like gold and oil, indices such as the FTSE 100 and S&P 500, and popular cryptocurrencies like Bitcoin and Ethereum.

This versatility allows traders to diversify their portfolios and explore various trading strategies. Having multiple instruments at one's disposal empowers traders to take advantage of market opportunities across different asset classes, increasing the likelihood of achieving desired outcomes.

User-Friendly Trading Platforms

Exness also excels in providing user-friendly trading platforms, making it suitable for both novice and experienced traders. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are the primary platforms offered by Exness, both of which are widely recognized in the trading community for their robust features and intuitive interfaces.

These platforms provide comprehensive charting capabilities, technical indicators, and expert advisors, allowing traders to develop and refine their trading strategies. Furthermore, Exness offers a dedicated mobile trading app for both iOS and Android devices, enabling traders to manage their accounts and execute trades on the go.

By providing accessible and functional platforms, Exness empowers traders to stay engaged with the markets and make informed decisions regardless of their location.

Disadvantages of Trading with Exness

While Exness boasts several advantages, it is equally important for traders to be aware of potential drawbacks when selecting this broker. Understanding these disadvantages can help traders make informed choices that align with their preferences and objectives.

Limitations on Customer Support

Although Exness offers various customer support options, some users have reported limitations concerning availability and responsiveness. This can become particularly pronounced during peak trading hours or when addressing complex inquiries.

Traders rely heavily on timely and efficient support to resolve issues that may arise during trading. Hence, it is advisable for potential Exness clients to weigh the specific support channels available alongside their individual trading needs before committing to the platform.

Withdrawal Processing Times

Withdrawal processing times can also pose a challenge for some Exness users. While the broker generally provides a variety of withdrawal methods, reports indicate that some traders have experienced longer-than-expected processing times for their withdrawal requests.

For traders who require fast access to their funds, understanding the potential delays involved in the withdrawal process is crucial. Any unforeseen interruptions in accessing funds could impact trading strategies and overall financial planning. Therefore, it's essential to evaluate these factors diligently.

Potential Risks Involved

As with all forex trading, inherent risks accompany trading with Exness or any other online broker. Leverage, while a double-edged sword that amplifies profits, can also magnify potential losses.

Market fluctuations, unpredictable economic events, and geopolitical tensions can significantly impact trading outcomes. It is essential for traders to fully comprehend these risks and develop a comprehensive risk management strategy before engaging in trading activities with Exness or any broker.

Exness Account Types Available

Exness recognizes the diverse needs of traders and offers several account types designed to cater to different profiles and experience levels. Understanding these account offerings can help traders identify which is best suited for their trading goals.

Standard Accounts

The standard accounts available through Exness are designed to cater to traders embarking on their forex journey. These accounts typically offer competitive trading conditions characterized by tight spreads and fast execution speeds.

Standard accounts are ideal for novice traders seeking an affordable entry point into the forex market. Additionally, they provide the essential tools needed to build confidence and develop trading skills, making it easier for beginners to navigate the complexities of online trading.

Professional Accounts

For experienced traders managing larger trading volumes, Exness offers professional accounts that provide enhanced control over their trading experience. These accounts often grant access to advanced tools and features, such as specialized analytics and personalized account management.

Professional accounts reflect the sophistication and higher expectations of seasoned traders. They enable users to implement more intricate trading strategies and gain access to broader market insights, facilitating informed decision-making.

Islamic Accounts

Exness is cognizant of the needs of Islamic traders and offers Sharia-compliant or Islamic accounts. These accounts eliminate the accrual of interest (riba) on trading positions, ensuring that traders adhere to Islamic principles while participating in the forex market.

By accommodating Islamic traders, Exness demonstrates its commitment to inclusivity and respect for diverse beliefs. This approach enables traders to engage in financial activities aligned with their faith without compromising their trading aspirations.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Trading Platforms Offered by Exness

Exness offers a selection of trading platforms, with MetaTrader 4 (MT4) and MetaTrader 5 (MT5) being the cornerstones of its offering. Understanding the capabilities of these platforms is crucial for traders looking to maximize their trading experience.

MetaTrader 4 and MetaTrader 5 Overview

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are two of the most widely utilized trading platforms globally, thanks to their robust features and user-friendly interfaces. Both platforms provide advanced charting capabilities, technical indicators, and automated trading functionalities, empowering traders to develop and refine their strategies.

MT4 is renowned for its simplicity and effectiveness, catering primarily to forex traders. On the other hand, MT5 expands upon MT4's foundation by introducing additional features and functionalities, making it suitable for various asset classes, including stocks and commodities.

The versatility of both platforms contributes significantly to the overall trading experience. Traders can customize their trading environment, harnessing the power of advanced analytical tools to enhance their decision-making processes.

Exness Mobile Trading App Features

Exness goes a step further by providing a dedicated mobile trading app compatible with both iOS and Android devices. This mobile app replicates many of the desktop platform functionalities, allowing traders to access their accounts and execute trades on the go.

With features such as real-time charting, order placement, and account management, the Exness mobile app enables traders to remain connected to the markets regardless of their location. This flexibility allows traders to monitor market conditions, manage their positions, and seize trading opportunities promptly, highlighting Exness’s commitment to enhancing the user experience.

Deposit and Withdrawal Options

When considering a broker, deposit and withdrawal options are critical aspects that traders must evaluate. Exness provides a wide range of payment methods to accommodate diverse trader demographics.

Accepted Payment Methods

Exness supports various deposit and withdrawal methods, allowing traders to choose the options that suit them best. Commonly accepted payment methods include bank transfers, credit/debit cards, e-wallets like Skrill and Neteller, and several other payment processors.

This variety in payment methods facilitates seamless transactions for traders and ensures that individuals can engage with the platform using their preferred payment solutions. However, it is essential for traders to note that the availability of specific payment methods can vary depending on their geographic location.

Fees Associated with Deposits and Withdrawals

One of the attractive features of Exness is that it generally does not charge fees for deposits or withdrawals. This can be a significant benefit for traders looking to minimize transaction costs. However, traders should be aware that third-party payment processors may impose fees for certain transactions.

It's advisable for traders to review the specifics of their chosen payment method and understand any associated charges before initiating a deposit or withdrawal. Transparency regarding potential fees can help traders manage their costs effectively.

Customer Support at Exness

Effective customer support is pivotal to a positive trading experience, and Exness strives to provide a range of support options to assist its users.

Availability and Responsiveness

Exness offers multiple customer support channels, including live chat, email, and phone support. However, the availability and responsiveness of the support team can vary based on the selected communication channel and time of day.

Timely assistance can significantly impact a trader's experience, particularly during critical trading moments. Therefore, traders need to assess the responsiveness of Exness’s support teams before relying on them for urgent matters.

Support Channels Offered

To ensure global accessibility, Exness provides support in multiple languages. The primary support channels include live chat, which offers immediate assistance, email for detailed inquiries, and phone support for specific situations.

Accessing customer support through the Exness website or within the trading platforms themselves adds layers of convenience for traders. Providing multilingual support illustrates Exness's commitment to catering to a diverse global clientele.

User Experience and Feedback

Understanding user experiences and feedback is integral to evaluating Exness as a trading option. Insights from fellow traders can provide valuable perspectives that go beyond basic facts.

Trader Reviews and Testimonials

Online trader communities and review platforms often offer rich insights regarding users' experiences with Exness. Many traders praise the broker for its competitive trading conditions, user-friendly platforms, and variety of instruments available for trading.

Positive testimonials often highlight the ease of use and reliability of the Exness trading platforms. However, as with any service, there are mixed reviews, and not all feedback is universally positive.

Common Complaints and Concerns

Despite the accolades, some common complaints from users include limitations in customer support availability and longer-than-expected withdrawal processing times. Addressing these concerns is essential for Exness to bolster its user experience and maintain a positive reputation.

Acknowledging and responding to feedback is vital for continual improvement. Traders may feel more confident in choosing Exness if the broker actively addresses these concerns and takes steps to enhance its services.

Security Measures Implemented by Exness

The safety of trader funds is a paramount concern for anyone engaging in online trading. Exness recognizes the importance of implementing robust security measures to protect its clients.

Data Protection Policies

Exness employs advanced data protection policies designed to safeguard user information and financial transactions. Utilizing encryption technology and secure servers, the broker works diligently to prevent unauthorized access to sensitive data.

Maintaining robust cybersecurity measures fosters trust between the broker and its traders. A secured environment enables traders to conduct their activities with confidence, knowing that their data is protected from potential threats.

Funds Segregation Practices

A cornerstone of financial safety lies in funds segregation practices. Exness adheres to stringent guidelines that mandate the segregation of client funds from the company's operational funds. This practice ensures that client funds are protected even in the event of financial difficulties faced by the broker.

By prioritizing fund segregation, Exness reinforces its commitment to protecting clients' assets, offering an additional layer of security for traders engaging with its platform.

Conclusion

In conclusion, deciding whether Exness is legal in the UAE requires careful consideration of various factors, including regulatory status, available trading features, and user experiences. While Exness has garnered a loyal following for its competitive trading conditions, diverse instruments, and user-friendly platforms, it currently lacks local regulatory licensing in the UAE.

Potential traders should weigh the pros and cons of engaging with Exness against the backdrop of personal preferences and risk tolerance. As the forex market continues to evolve, conducting thorough research and keeping abreast of developments will empower traders to make well-informed decisions aligned with their trading ambitions.

Read more: