13 minute read

Is Exness Regulated in UAE? Review Broker

from Exness

by Exness Blog

Introduction to Exness

Overview of the Company

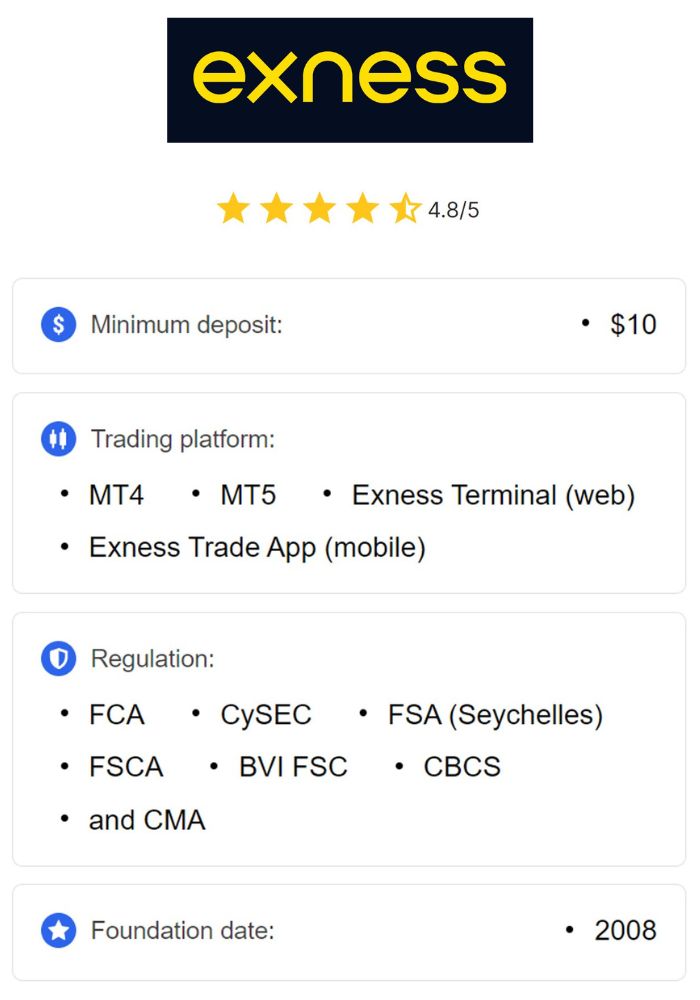

Exness is a well-established global forex and CFD broker known for its focus on transparency, client security, and competitive trading conditions. Since its founding in 2008, Exness has grown significantly, gaining recognition for offering various financial products, including currency pairs, commodities, cryptocurrencies, indices, and stocks. Exness appeals to traders at all experience levels, providing a user-friendly experience with multiple account types, low spreads, flexible leverage options, and an array of educational resources.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

With a global reach, Exness operates in over 200 countries, catering to traders across various regions. The broker is renowned for its commitment to regulatory compliance and strong customer support, which together create a reliable trading environment for clients worldwide.

History and Background

Founded in Cyprus, Exness quickly rose to prominence by focusing on transparency, security, and customer-centric service. It has expanded its operations and regulatory affiliations over the years, earning licenses from prominent regulatory authorities in Europe, Asia, and other regions. Exness’s reputation for reliability is reinforced by its adherence to international regulations and its provision of secure trading environments.

Exness's focus on compliance and innovation has contributed to its steady growth and global recognition. Today, Exness is known as a broker that upholds high standards of security, compliance, and technological innovation.

Understanding Regulation in Financial Markets

Importance of Regulation

Regulation is crucial in the financial markets as it helps ensure the safety of clients’ funds, maintain fair trading practices, and prevent fraudulent activities. A regulated broker must adhere to strict guidelines set by regulatory authorities, which include requirements for transparency, client fund segregation, and regular audits. For traders, choosing a regulated broker means having peace of mind knowing that the broker operates under the oversight of established regulatory bodies.

Regulation also fosters trust and confidence in the financial markets, protecting traders from unethical practices. By enforcing guidelines on transparency, fund security, and operational integrity, regulatory authorities ensure that brokers offer fair and secure trading environments.

Types of Regulatory Bodies

Several types of regulatory bodies operate worldwide, each overseeing financial markets within its jurisdiction. Major regulatory bodies include the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), and the Financial Sector Conduct Authority (FSCA) in South Africa. Each of these authorities enforces strict standards to ensure broker transparency, fund protection, and ethical conduct.

In the UAE, the primary regulatory authorities responsible for overseeing financial markets include the Securities and Commodities Authority (SCA) and the Dubai Financial Services Authority (DFSA), both of which play essential roles in regulating financial and investment activities within their jurisdictions.

The UAE Regulatory Landscape

Key Regulatory Authorities in the UAE

The UAE financial regulatory environment is well-structured, with key regulatory authorities ensuring the safety and security of the country’s financial markets. Two major regulators operate in the UAE:

Securities and Commodities Authority (SCA): The SCA oversees securities and commodities markets across the UAE, ensuring the integrity and stability of these markets and enforcing regulations that protect investors.

Dubai Financial Services Authority (DFSA): Operating in the Dubai International Financial Centre (DIFC), DFSA is an independent regulatory body that regulates financial services in the DIFC, including securities, asset management, and brokerage firms.

Role of the Securities and Commodities Authority (SCA)

The SCA is the primary regulatory body responsible for overseeing securities, commodities, and financial services in the UAE. It enforces strict guidelines on brokers, focusing on investor protection, transparency, and compliance with financial regulations. Forex brokers regulated by the SCA must comply with its rigorous standards, which include fund segregation, reporting transparency, and AML (anti-money laundering) protocols.

The SCA plays a critical role in maintaining the stability of financial markets in the UAE and ensuring that investors are protected from fraud and unethical practices. Brokers seeking SCA licensing must meet strict requirements, which reinforce trust in UAE’s financial system.

Role of the Dubai Financial Services Authority (DFSA)

The DFSA is the regulatory body that oversees financial services within the DIFC, a special economic zone in Dubai. The DFSA is responsible for ensuring that financial institutions in the DIFC adhere to global standards of transparency, ethics, and client protection. Forex brokers licensed by the DFSA must follow strict regulatory guidelines, which include regular audits, financial stability, and adherence to AML and KYC policies.

As an independent regulator, the DFSA promotes a safe trading environment, allowing traders to operate with confidence. By enforcing international standards, the DFSA helps maintain Dubai’s reputation as a secure and attractive financial hub for investors.

Exness and Its Regulatory Status

Current Licensing Information

As of now, Exness does not hold a direct license from the SCA or DFSA in the UAE. However, Exness operates legally in the UAE by adhering to licenses from internationally recognized regulatory authorities, such as the FCA in the UK, CySEC in Cyprus, and FSCA in South Africa. These licenses require Exness to comply with rigorous standards of client fund protection, operational transparency, and financial reporting.

Although Exness is not directly regulated by UAE authorities, its global regulatory affiliations provide UAE traders with a safe and compliant trading environment.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Compliance with UAE Regulations

Exness adheres to international regulatory standards that align with UAE’s financial regulations. By operating under FCA, CySEC, and FSCA licenses, Exness complies with fund segregation requirements, transparency in trading practices, and AML procedures. These compliance measures ensure that Exness operates legally and ethically, providing UAE traders with the same level of security as those offered by locally regulated brokers.

Comparison with Other Brokers

While some forex brokers in the UAE may hold SCA or DFSA licenses, Exness’s compliance with global regulations positions it as a competitive and reliable broker for UAE clients. Although UAE-licensed brokers have the advantage of local regulatory oversight, Exness’s commitment to international compliance standards offers similar security and protection for its clients. Exness stands out among other brokers due to its strong regulatory framework, customer-centric policies, and reputation for transparency.

Benefits of Trading with a Regulated Broker

Investor Protection

A regulated broker must comply with stringent standards to ensure client fund protection, transparency, and ethical trading practices. This means that funds are kept in segregated accounts, separate from the broker’s operational funds, reducing the risk of misuse. Additionally, regulated brokers are required to conduct regular audits, offering clients peace of mind that their funds are managed responsibly.

For UAE traders, trading with a regulated broker like Exness provides assurance that their investments are protected and that they are trading with a broker committed to following the highest standards.

Transparency and Accountability

Transparency and accountability are vital in building trust between brokers and clients. Regulated brokers must disclose their trading fees, terms, and conditions openly, ensuring clients are fully informed before making decisions. Additionally, regulatory bodies hold brokers accountable for their actions, allowing clients to seek recourse if issues arise.

Exness’s adherence to global regulations ensures that UAE traders benefit from a high level of transparency and accountability, helping them trade confidently and securely.

Risks of Trading with Non-Regulated Brokers

Potential Scams and Fraud

Trading with an unregulated broker can expose clients to potential scams and fraudulent activities, as these brokers operate without oversight or accountability. Unregulated brokers may engage in unfair practices, such as misusing client funds, manipulating prices, or imposing hidden fees. Without regulatory oversight, clients have limited options for seeking help if they encounter problems with unregulated brokers.

Legal Implications

Trading with non-regulated brokers can also have legal implications, especially if the broker does not comply with UAE’s financial regulations. In the event of a dispute, clients may find it difficult to seek legal recourse, as non-regulated brokers are not bound by regulatory requirements. Choosing a regulated broker like Exness, which follows international standards, ensures that UAE traders are protected by the law and have access to recourse if needed.

Exness's Global Regulatory Framework

Overview of Global Regulatory Bodies

Exness is regulated by several prominent regulatory authorities, including:

Financial Conduct Authority (FCA) in the UK

Cyprus Securities and Exchange Commission (CySEC)

Financial Sector Conduct Authority (FSCA) in South Africa

These regulatory bodies enforce strict guidelines on client fund segregation, transparency, and ethical trading practices, ensuring that Exness operates responsibly and provides a safe environment for traders.

Exness’s Regulatory Affiliations

Exness’s regulatory affiliations with reputable authorities reinforce its commitment to maintaining high standards of client protection, transparency, and operational integrity. Each of these regulatory bodies requires Exness to undergo regular audits, adhere to AML policies, and follow strict reporting standards. This global regulatory framework provides UAE clients with confidence that Exness operates ethically and securely, even in the absence of a local UAE license.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Client Safety Measures Implemented by Exness

Segregation of Funds

One of Exness’s primary safety measures is the segregation of client funds. This practice involves keeping traders’ funds separate from the company’s operational accounts, ensuring that clients’ money is protected from being used for Exness’s internal operations or other liabilities. By adhering to this policy, Exness complies with global regulatory standards, minimizing the risk of fund misappropriation. Segregating funds offers additional security to clients, especially during times of financial instability or if the broker faces unexpected financial challenges.

This practice is mandated by Exness’s regulatory authorities, such as the FCA, CySEC, and FSCA, and gives clients confidence that their investments are handled responsibly. By adhering to these standards, Exness maintains a secure trading environment, ensuring that client funds are readily available for withdrawals and not impacted by the company’s financial obligations.

Insurance Policies

In addition to fund segregation, Exness offers clients further protection through insurance policies mandated by its regulators. For example, in some regions, Exness participates in investor compensation schemes that provide additional protection for clients if the broker encounters financial difficulties or insolvency. These schemes offer a safety net, allowing clients to recover a portion or all of their funds if an issue arises with the broker.

Insurance policies vary by regulatory jurisdiction, but they typically cover client deposits up to a certain amount. These insurance measures reinforce Exness’s commitment to client security, adding another layer of protection for UAE-based clients who trade with Exness, even though it is not directly licensed by UAE regulators.

User Experience: Trading with Exness in the UAE

Platform Features

Exness provides traders with access to two industry-leading trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are widely recognized for their advanced charting capabilities, user-friendly interfaces, and comprehensive trading tools. MT4 and MT5 offer various features that cater to both beginner and experienced traders, including customizable indicators, algorithmic trading options, and a wide range of technical analysis tools.

MetaTrader 4 (MT4): Known for its simplicity and efficiency, MT4 is particularly popular among forex traders due to its reliable order execution, customizable interface, and support for automated trading with Expert Advisors (EAs).

MetaTrader 5 (MT5): MT5 includes all the features of MT4, along with added functionalities like more timeframes, an economic calendar, and additional order types, making it suitable for more advanced trading strategies and a broader range of asset classes.

Both platforms are available on desktop, web, and mobile devices, allowing UAE traders to monitor the markets and execute trades from anywhere. Exness also provides a WebTerminal option for those who prefer to trade directly from their browser without downloading software.

Customer Support Availability

Exness is known for its responsive and accessible customer support, available 24/7 to assist traders with any issues or inquiries. Exness offers support in multiple languages, including English and Arabic, catering to the needs of UAE-based clients. The support team can be reached via live chat, email, or phone, providing traders with multiple ways to connect and resolve their concerns quickly.

For traders in the UAE, having around-the-clock customer support is essential, especially given the dynamic nature of forex trading. Exness’s customer support team is trained to handle various queries, from account setup and verification issues to more complex trading-related questions, ensuring that traders receive timely assistance.

How to Verify the Regulation Status of a Broker

Checking Official Websites

Verifying a broker’s regulatory status is crucial to ensuring a safe trading experience. Traders can check Exness’s regulatory credentials by visiting the official websites of its licensing authorities, such as the FCA, CySEC, and FSCA. Each regulatory authority maintains an online registry of licensed brokers, which allows traders to verify Exness’s legitimacy by searching for its regulatory license number or company name.

Additionally, Exness often provides links to its regulatory licenses on its website, making it easy for traders to access official regulatory information. This transparency is a positive indicator of Exness’s commitment to compliance and provides traders with the reassurance that they are trading with a reputable broker.

Contacting Regulatory Authorities

If traders are unsure about a broker’s regulatory status, they can directly contact the regulatory authority to confirm the broker’s licensing. This step can be especially helpful if the broker claims to be regulated but does not appear in the online registry. By reaching out to the FCA, CySEC, or FSCA, traders can verify the broker’s standing and ensure that they are trading with a regulated entity.

In addition, contacting regulatory authorities allows traders to inquire about any previous complaints or issues related to the broker, providing further insight into its trustworthiness. This proactive approach is essential for traders who prioritize safety and transparency in their trading experience.

Conclusion on Exness's Regulation in UAE

Exness is a globally recognized forex broker with strong regulatory credentials, holding licenses from prominent authorities such as the FCA, CySEC, and FSCA. Although Exness is not directly regulated by UAE’s local regulatory bodies, such as the Securities and Commodities Authority (SCA) or the Dubai Financial Services Authority (DFSA), its compliance with global regulations ensures that UAE-based traders benefit from a secure and transparent trading environment.

By adhering to international standards of fund protection, transparency, and accountability, Exness provides a reliable trading experience for its clients in the UAE. The broker’s dedication to client safety is evident through its implementation of segregation of funds, insurance policies, and around-the-clock customer support.

For UAE traders considering Exness, the broker’s strong international regulatory framework offers reassurance that their funds are secure and that they are trading with a company committed to ethical practices and transparency. While Exness does not have a local UAE license, its adherence to global standards makes it a trustworthy option for traders looking to engage in forex and CFD trading.

In summary, Exness’s regulatory affiliations, client protection measures, and robust customer support establish it as a dependable choice for traders in the UAE. Traders can confidently trade on Exness, knowing that their investments are safeguarded by a broker dedicated to maintaining a secure and compliant trading environment.

Read more: