17 minute read

How to trade in forex market in India?

from Exness

by Exness Blog

How to trade in forex market in India? The foreign exchange market, or forex market, is a vast and complex arena where currencies are traded. For those interested in exploring this dynamic market, particularly in India, it offers numerous opportunities for profit and growth. However, navigating the forex market requires a solid understanding of its intricacies, regulations, and strategies. This guide will provide you with essential knowledge and insights to embark on your forex trading journey in India.

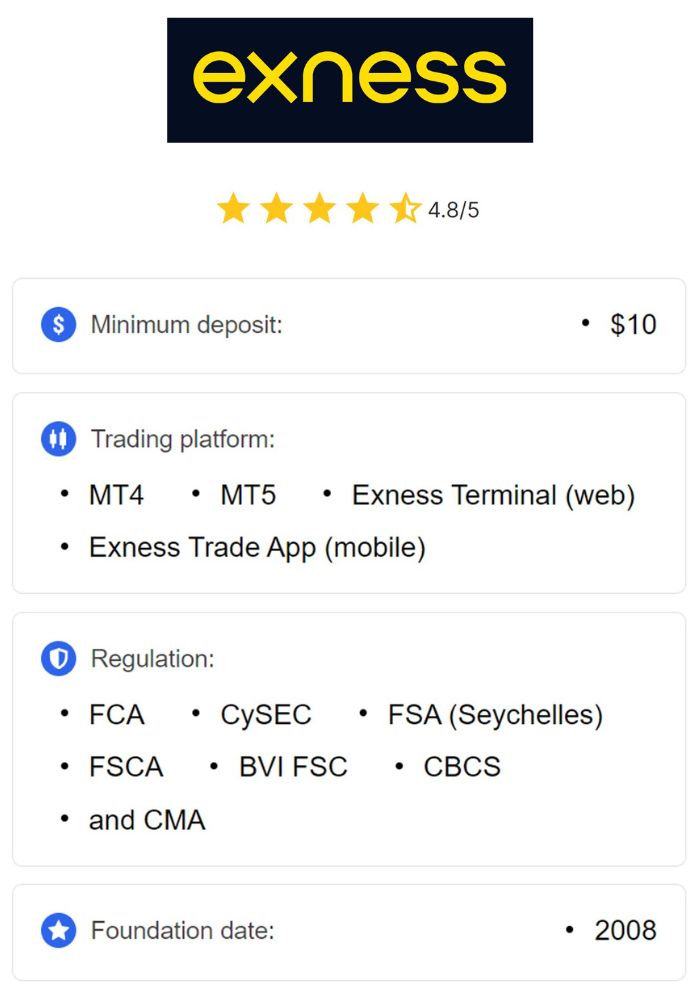

Top 4 Best Forex Brokers in India

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

Understanding Forex Trading

Forex trading is not just about exchanging currencies; it's a global phenomenon influencing economies, businesses, and individuals alike. To be successful in this market, traders must grasp its fundamental aspects.

Definition of Forex Trading

Forex trading involves the simultaneous buying of one currency while selling another. Traders speculate on the future direction of currency pairs to make profits from fluctuations in exchange rates. Essentially, when a trader buys a currency pair, they believe that the base currency will increase in value relative to the quote currency. Conversely, if they sell a currency pair, they anticipate a decrease in value.

This trading can take place 24 hours a day, five days a week, making it an accessible option for those who have varying schedules. Many factors influence currency values, including geopolitical events, economic indicators, and market sentiment. Therefore, staying informed and continuously learning is crucial for success.

Importance of the Forex Market

The significance of the forex market extends beyond individual traders. Here’s why it’s pivotal:

Facilitates International Trade: The forex market allows businesses involved in international trade to convert currencies for transactions, ensuring smooth operations worldwide.

Supports Foreign Investment: Investors seeking opportunities in foreign assets and companies heavily rely on the forex market for seamless currency conversion.

Provides Hedging Opportunities: Businesses can hedge against unfavorable currency movements, protecting their financial interests and maintaining stability.

Offers Investment Opportunities: Individual and institutional investors can earn profits through strategic currency speculation.

Creates Liquidity: With trillions of dollars traded daily, the forex market offers high liquidity, enabling traders to buy and sell currencies swiftly.

Understanding the relevance of the forex market within the global economy is essential for anyone considering trading in this space.

Regulatory Framework for Forex Trading in India

To ensure transparency, stability, and investor protection, the forex market in India is governed by various regulatory authorities.

Role of the Reserve Bank of India (RBI)

The Reserve Bank of India (RBI) plays a pivotal role in the forex market, acting as the central bank responsible for managing the Indian economy's monetary policy. Here are some key responsibilities:

Managing Exchange Rates: The RBI intervenes in the forex market to stabilize the Indian Rupee (INR) against other currencies, ensuring economic stability.

Setting Forex Policy: The central bank outlines the regulations governing forex transactions, including permissible transactions, limits, and reporting requirements.

Supervising Authorized Dealers: Forex transactions primarily occur through authorized dealers, which include banks and financial institutions licensed by the RBI.

Maintaining Foreign Exchange Reserves: The RBI manages India's foreign exchange reserves, safeguarding the economy's stability and supporting INR during economic fluctuations.

These functions of the RBI create a structured framework within which forex trading operates in India.

Guidelines from the Securities and Exchange Board of India (SEBI)

In addition to the RBI, the Securities and Exchange Board of India (SEBI) regulates the forex market concerning derivative products such as currency futures and options. SEBI's guidelines focus on:

Regulation of Forex Derivatives: SEBI oversees trading in forex derivatives, ensuring they are conducted on recognized exchanges, providing a safe environment for traders.

Protection of Investor Interests: The agency promotes fair trading practices, striving to protect individuals engaged in forex derivatives trading from fraud and malpractice.

Monitoring of Forex Brokers: SEBI diligently monitors forex brokers offering derivative products to ensure compliance with regulations, reducing the risk of fraudulent activities.

By understanding the regulatory environment, traders can navigate the market more confidently and responsibly.

Key Terminologies in Forex Trading

Navigating the forex market requires familiarity with specific terminologies. Knowing these terms enhances your ability to trade effectively.

Currency Pairs Explained

At the heart of forex trading lies the concept of currency pairs. Every trade involves two currencies. A currency pair represents how much of the quote currency is needed to purchase one unit of the base currency.

For example, in the currency pair EUR/USD, the Euro (EUR) is the base currency, while the U.S. Dollar (USD) is the quote currency. If the EUR/USD exchange rate is 1.2000, it means one Euro costs 1.20 U.S. Dollars.

Understanding currency pairs is crucial for traders, as it shapes their trading decisions and strategies.

Bid and Ask Price

Every currency pair has both a bid price and an ask price, which are vital terms for traders to comprehend:

Bid Price: This is the price at which a forex broker is willing to buy a currency from you. When selling a currency pair, you receive this price.

Ask Price: This indicates the price at which a forex broker is willing to sell a currency to you. When buying a currency pair, this is the price you pay.

Spread: The difference between the bid and ask price represents the broker's profit margin for facilitating the transaction. A narrower spread implies lower trading costs.

Grasping bid and ask prices enables traders to optimize their entry and exit points, ultimately enhancing profitability.

Pips and Lots

Furthering your understanding of forex trading necessitates familiarity with pips and lots:

Pips: Short for "percentage in point," a pip signifies the smallest unit of price change in a currency pair's exchange rate. It typically represents the last decimal place of a quoted price.

Lots: In forex, trades are measured in lots, which represent the size of a trade. A standard lot comprises 100,000 units of the base currency, while mini lots and micro lots represent smaller amounts.

Understanding the concepts of pips and lots is essential for effective trade sizing and risk management.

Choosing the Right Forex Broker

Selecting a reliable forex broker is a critical step in your trading journey. The right broker can significantly impact your trading experience and overall success.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Factors to Consider When Selecting a Broker

When choosing a forex broker, several factors should be taken into account, including:

Regulation and Licensing: Verify that the broker is regulated by a reputable authority, such as SEBI or another recognized regulator. This ensures adherence to industry standards and protects your funds.

Trading Platform: Opt for a broker with a user-friendly trading platform equipped with essential features like charting tools, technical indicators, and order execution capabilities.

Spreads and Commissions: Compare the spreads and commissions charged by different brokers. Look for competitive rates that align with your trading strategy.

Customer Support: A responsive and helpful customer support team is crucial, especially for new traders who may require assistance in navigating the platform or addressing concerns.

Educational Resources: Seek brokers that provide educational resources such as webinars, tutorials, and market analysis to enhance your trading skills and knowledge.

Taking the time to research and select a broker that meets your needs can pave the way for a more successful trading journey.

List of Popular Forex Brokers in India

While this list does not constitute an endorsement, some popular forex brokers in India include:

FXTM: Known for its diverse range of trading instruments and comprehensive educational resources.

XM: Offers competitive spreads and a user-friendly trading platform, making it suitable for both beginners and experienced traders.

IC Markets: Popular for its raw spreads and advanced trading tools, catering to serious traders.

Pepperstone: Provides access to various trading platforms and advanced order types, appealing to experienced traders.

Ensure you conduct thorough due diligence before selecting a forex broker, verifying their regulatory status and customer reviews.

Setting Up Your Trading Account

Once you've chosen a forex broker, the next step is to set up a trading account. Here’s what to expect in this process.

Types of Accounts Offered

Forex brokers offer multiple account types, each catering to different trading styles and experience levels. Common account types include:

Demo Account: A risk-free environment to practice trading using virtual funds. Ideal for beginners looking to familiarize themselves with trading platforms and strategies.

Micro Account: Suitable for novice traders with limited capital, allowing for trades with smaller lot sizes.

Standard Account: Designed for traders with moderate capital and experience, offering a balanced trading environment.

ECN/STP Account: Tailored for experienced traders seeking access to raw market pricing, offering tighter spreads and faster execution.

Understanding the available account types helps you choose the one that aligns with your trading objectives.

Required Documentation

When opening a trading account, you’ll typically need to provide specific documentation, including:

Proof of Identity: Documents like a passport or Aadhaar card to verify your identity.

Proof of Address: Utility bills or bank statements reflecting your current address.

Bank Account Details: Information regarding your bank account to facilitate fund transfers.

Providing accurate documentation ensures a smooth account setup process and complies with regulatory requirements.

Understanding Different Trading Strategies

Forex trading encompasses a wide range of strategies, each tailored to different trading styles and risk appetites. A solid understanding of these strategies is key to developing a personalized approach.

Scalping Strategy

Scalping is a high-frequency trading strategy that involves entering and exiting trades rapidly to profit from small price movements. It requires disciplined decision-making, quick execution, and continuous monitoring of price action.

Traders employing scalping techniques often utilize short-term charts, aiming for minimal losses and quick gains. While this method can yield consistent profits, it demands a high-speed internet connection and a deep understanding of market dynamics.

Day Trading vs Swing Trading

Different approaches define day trading and swing trading:

Day Trading: This strategy focuses on opening and closing trades within a single day. Day traders capitalize on short-term price fluctuations, relying heavily on technical analysis and real-time data.

Swing Trading: Unlike day trading, swing trading aims to capture price swings over several days or weeks. Swing traders analyze both technical and fundamental factors, looking for optimal entry and exit points based on market trends.

Both strategies possess unique advantages and challenges. Ultimately, the choice depends on your lifestyle, risk tolerance, and trading preferences.

Position Trading

Position trading involves holding trades for extended periods, often weeks or even months, to benefit from significant long-term trends. This strategy relies heavily on fundamental analysis, as position traders evaluate economic indicators, geopolitical events, and market sentiment.

Position trading may appeal to individuals who prefer a less active trading style, allowing them to avoid the stress associated with shorter-term trading.

Technical Analysis in Forex Trading

Technical analysis plays a vital role in forex trading, enabling traders to evaluate market trends and potential price movements.

Importance of Charts and Indicators

Charts are invaluable tools for visualizing historical price movements over time. Various chart types, such as candlestick, line, and bar charts, provide insights into market behavior and trends.

Technical indicators serve as mathematical calculations based on historical price and volume data. These indicators help traders identify trends, momentum, and potential reversal points, guiding their trading decisions.

Common Technical Indicators Used

Several technical indicators are widely employed by forex traders. Some of the most common ones include:

Moving Averages: These indicators provide insight into the average price over a specific period, helping identify trends and potential reversal points.

Relative Strength Index (RSI): This momentum oscillator measures the magnitude of recent price changes to identify overbought or oversold conditions. Traders use RSI to spot potential reversals.

Stochastic Oscillator: This indicator compares a currency pair's closing price to its price range over a given period. It helps traders assess momentum and identify potential trend shifts.

MACD (Moving Average Convergence Divergence): MACD is a trend-following momentum indicator that reveals changes in momentum and potential trend reversals, assisting traders in making informed decisions.

Mastering technical analysis equips traders with the necessary tools to navigate the forex market successfully.

Fundamental Analysis in Forex Trading

Fundamental analysis involves examining the underlying economic and political factors that influence currency values.

Economic Indicators That Affect Forex Markets

Various economic indicators impact the forex market, with traders closely monitoring these reports. Key indicators include:

Gross Domestic Product (GDP): GDP measures a country's economic performance. Strong GDP growth can lead to currency appreciation, while a decline may result in depreciation.

Inflation Rates: Inflation affects purchasing power and can influence central bank monetary policies. Rising inflation rates may prompt interest rate hikes, attracting foreign investment and strengthening the currency.

Employment Data: Employment figures, such as non-farm payrolls, provide insight into labor market health. Positive employment data signals economic strength, positively impacting the currency.

Understanding these economic indicators empowers traders to make informed decisions based on macroeconomic trends.

News Events and Their Impact on Trading

News events play a significant role in shaping market sentiment and driving currency movements. Important announcements, such as central bank meetings, geopolitical developments, and economic releases, can lead to heightened volatility.

Traders must stay informed about upcoming news events and their potential impact on the market. Employing a calendar to track crucial economic releases helps traders prepare for potential price fluctuations.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Risk Management Techniques

Successful forex trading hinges on effective risk management strategies. Protecting your capital is paramount to long-term success in the market.

Importance of Risk Management

Risk management is essential because it minimizes potential losses and safeguards your trading capital. Successful traders understand that loss is an inevitable part of trading, and having a plan in place to manage risk is vital.

Proper risk management allows traders to maintain discipline, avoid emotional decision-making, and preserve their trading accounts during adverse market conditions.

Setting Stop Loss and Take Profit Orders

Two key components of effective risk management are stop-loss and take-profit orders:

Stop-Loss Orders: A stop-loss order automatically closes your trade once the price reaches a predetermined level. By setting a stop-loss, you limit your potential losses and prevent emotional trading decisions.

Take-Profit Orders: A take-profit order enables traders to lock in profits once a trade reaches a specified price level. This ensures that you secure gains without risking a reversal in the market.

Implementing these orders is a cornerstone of sound risk management practices, promoting a disciplined approach to trading.

Learning Trading Platforms

Familiarity with trading platforms is crucial for executing trades efficiently and effectively.

Overview of Popular Trading Platforms

Many trading platforms are available to forex traders, each offering unique features and functionalities. Some popular platforms include:

MetaTrader 4 (MT4): MT4 is widely recognized for its user-friendly interface, extensive charting tools, and automated trading capabilities. It’s favored by many traders globally.

MetaTrader 5 (MT5): MT5 is an upgraded version of MT4, featuring additional analytical tools, a broader asset range, and enhanced order types.

cTrader: cTrader is known for its intuitive interface, advanced order types, and integrated social trading features, appealing to traders seeking an alternative to MT4/MT5.

Choosing a platform that aligns with your trading style and preferences enhances your trading experience.

Features to Look for in a Trading Platform

When selecting a trading platform, consider the following features:

User Interface: A straightforward and intuitive interface is crucial for efficient navigation and execution of trades.

Charting Tools: Look for platforms that offer comprehensive charting capabilities, including different chart types and technical indicators.

Execution Speed: Fast order execution is essential, particularly for day traders and scalpers who rely on quick trades to capture small price movements.

Mobile Compatibility: A mobile-friendly platform allows you to trade on-the-go, ensuring you can monitor the market and execute trades anytime, anywhere.

Assessing these features will help you find a trading platform that suits your needs and enhances your trading effectiveness.

Practicing with Demo Accounts

Utilizing a demo account is a valuable way for traders to hone their skills without risking real money.

Benefits of Using a Demo Account

Demo accounts offer several advantages:

Risk-Free Environment: You can practice trading using virtual funds, allowing you to experiment with different strategies without financial consequences.

Familiarization with the Platform: A demo account provides an opportunity to explore the trading platform's features and functionalities before transitioning to live trading.

Testing Strategies: Traders can test various strategies and assess their effectiveness in real-market conditions without the pressure of losing money.

Practicing with a demo account builds confidence and competence, setting the stage for a smoother transition to live trading.

Transitioning from Demo to Live Trading

Transitioning from a demo account to a live trading account requires careful consideration. Before making the switch, traders should:

Evaluate Performance: Assess your performance in the demo account, identifying successful strategies and areas for improvement.

Set Realistic Goals: Establish achievable goals for your live trading account based on your demo performance, focusing on risk management and consistency.

Embrace Emotions: Understand that live trading introduces emotional factors that aren’t present in demo trading. Prepare yourself mentally for the psychological aspects of trading.

A thoughtful transition ensures you’re better equipped to handle the challenges of live trading.

Keeping Emotions in Check

Emotional control is often the difference between success and failure in forex trading. Recognizing and managing emotions plays a crucial role in decision-making.

Psychological Aspects of Trading

The psychological aspects of trading can significantly influence a trader's performance. Fear and greed are two dominant emotions that traders encounter:

Fear: Fear of losing money can lead to hesitation in making trades or premature exits. It's crucial to implement risk management strategies to mitigate fear.

Greed: Greed can prompt traders to take excessive risks or hold onto winning trades for too long. Balancing ambition with discipline is essential for sustainable success.

Understanding these emotional influences allows traders to develop coping strategies, fostering a disciplined approach to trading.

Strategies for Maintaining Discipline

Maintaining discipline requires conscious effort. Here are some strategies:

Create a Trading Plan: Establish a well-defined trading plan that outlines your goals, strategies, and risk management rules. Adhering to this plan reduces impulsive decision-making.

Set Realistic Expectations: Avoid placing undue pressure on yourself for immediate profits. Focus on gradual growth and consistent performance over time.

Practice Mindfulness: Engage in mindfulness practices to cultivate awareness of your emotions and reactions. This self-awareness can enhance decision-making under pressure.

Implementing these strategies fosters a disciplined mindset, promoting long-term success in forex trading.

Taxation on Forex Earnings in India

Understanding the tax implications of forex earnings is crucial for traders operating in India.

Understanding Income Tax Implications

In India, forex trading is subject to taxation under the Income Tax Act. Profits earned from forex trading are considered income, which attracts income tax according to applicable tax slabs.

It's essential to maintain accurate records of all trading activities, including profits and losses, to ensure compliance with tax regulations. Consulting with a tax professional can provide clarity on your specific tax obligations.

Reporting Forex Income

Forex traders must report their trading income in their annual income tax return. Accurate reporting is crucial to avoid penalties and legal complications.

Additionally, engaging in forex trading may classify you as a trader under the Income Tax Act, subjecting you to different tax treatments compared to casual investors. Being aware of these distinctions is vital.

Read more: Is Exness Legal in Dubai?

Staying Updated with Market Trends

Market dynamics evolve constantly, making it imperative for traders to stay informed about trends and developments.

Resources for Market Analysis

Various resources assist traders in analyzing market trends:

Economic Calendars: Economic calendars provide information about upcoming economic releases, helping traders anticipate potential market movements.

News Outlets: Reputable financial news outlets report on significant events affecting the forex market, offering insights into market sentiment and directional bias.

Analytical Tools: Many trading platforms feature built-in analytical tools that provide real-time data and allow traders to conduct technical analysis.

Leveraging these resources ensures that traders remain well-informed and adaptable in response to market changes.

Joining Forex Trading Communities

Engaging with other traders can enhance your knowledge and provide support. Online trading communities and forums offer platforms for discussion, sharing insights, and gaining perspectives from experienced traders.

Participating in these communities fosters continuous learning, helping you refine your trading strategies and stay updated with industry trends.

Conclusion

Trading in the forex market in India presents immense opportunities for those willing to invest time in understanding the dynamics at play. From comprehending regulatory frameworks to mastering technical and fundamental analysis, every facet contributes to building a robust trading strategy.

As you embark on your journey, remember to prioritize risk management, maintain discipline, and stay updated with market trends. With commitment, education, and the right approach, you can navigate the forex market successfully and achieve your trading aspirations.

Read more: