9 minute read

What’s Up With That?

Reed Hastings founded Net ix after being charged $40 in late fees for a video rental from Blockbuster.

WHAT’S UP WITH THAT?

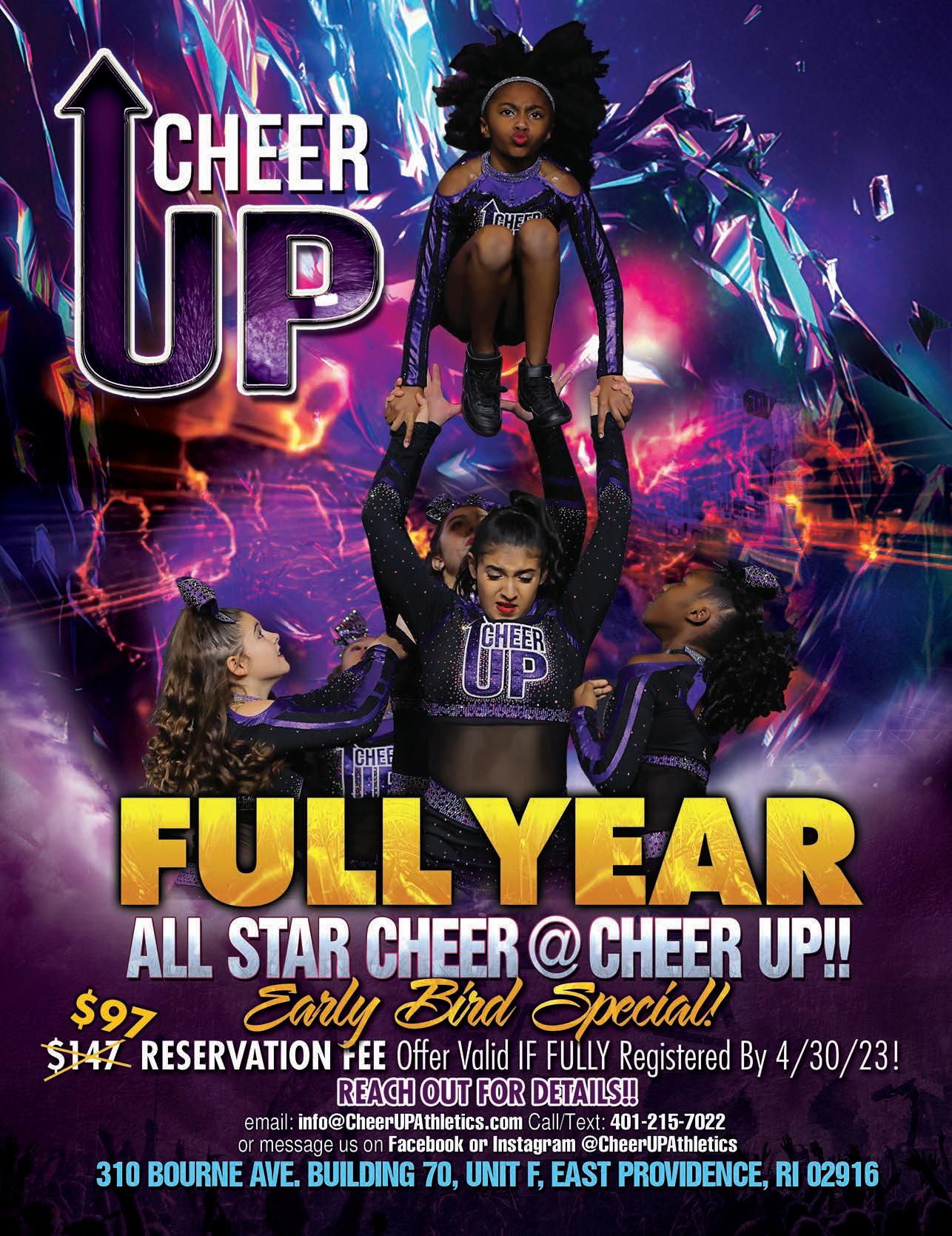

Advertisement

It’s faster to say “World Wide Web” than it is to say “WWW”.

WHAT’S UP WITH THAT?

If you have a net worth of $93,170, you’re richer than 90% of the world.

WHAT’S UP WITH THAT?

The Pope hasn’t watched television for the past 33 years.

WHAT’S UP WITH THAT?

Prince left behind a vault of unreleased music containing enough material to put out an album every year for a century.

WHAT’S UP WITH THAT?

Research has found that when we fall in love, the brain’s judgment and critical thinking areas show reduced activity, leading to idealization and overlooking a person’s aws.

WHAT’S UP WITH THAT?

Talking to yourself can help improve cognitive function, focus, and problem-solving.

WHAT’S UP WITH THAT?

Bananascontainnutrientslikepotassiumand tryptophan, which can help regulate mood and reduce stress.

WHAT’S UP WITH THAT?

Reading for 20 minutes a day exposes you to roughly 1.8 million words a year.

WHAT’S UP WITH THAT?

Drinking eight glasses of tap water daily costs about $0.33 per year, while the same amount of bottled water can cost more than $200.

WHAT’S UP WITH THAT?

Laughing All the Way to the Bank!

By Mark Berger

What began as an idea between two friends and fellow comedians has become a useful resource for people who want to raise money for various causes. Funny4Funds is a fundraising company with a comedy show kicker.

Funny4Funds was born in Rhode Island in 2014, and was co-founded by Mike Murray and Bill Simas. Over the last eight years, their proven system of laughter and fundraising has helped more than 2,800 groups and causes, raising over $8.4 million dollars. Their company goal is to surpass $10 million raised by year’s end. While each event has different fundraising goals, Simas said that the average amount raised at their events is between $5,000 and $7,000, after expenses. Their formula is unique because they are not just a mic stand and a stool. The duo wanted of and groups and Their company year’s end. at after because are wanted to serve their clients by offering not only a flat rate for their services, but also by providing so much more.

From the beginning, Funny4Funds meets with your group for what they call a “Game Plan,” where everyone huddles up and is given the formula for success. The goal for the client is to make the most fundraising dollars for their group or cause.

Funny4Funds helps take a ton of stress away and they do most of the work that slows people down. They take care of the staging, the setup, the breakdown, the lighting, the backdrop, the mic, the sound, raffles tickets, and even emcee the entire night.

“Mike and I look to make people happy,” Simas said. “We can do shows that are either clean or more adult. However, we never do anything vulgar or offensive. It’s a night out for everyone and we want people to leave smiling and saying they enjoyed themselves. They also have a Clean Comedy Division, which specializes in church groups and cleaner events. No matter what, every Funny4Funds show is an amazing date night out to support your group or cause.”

The majority of shows are booked on weekends, but they are available to host on any night. Many people believe holding a fundraiser during the weekend will bring in the most money. Simas was adamant that this is not always the case. “We held events on Mondays that have raised a lot of money,” said Simas. “There was one event that we had on a Monday night that raised $12,000. It really depends on what the show entails, the crowd, and the type of event. No matter the situation, no matter the day the event is booked, as long as people follow the Funny4Funds system, whatever the goal, it can be raised on any given night.”

Some of the events can be very emotional and can have people on stage and in the audience holding back tears at the end of the night during the “Big Check” presentation. Bill and Mike have had to hold back tears many times themselves. The revelation to both as they were building this company early on became very clear. PTE. Passion Trumps Everything! “We don’t book shows, we book moments.” Every show is a unique moment captured by all and shared within the community and beyond.

It didn’t take Funny4Funds long to expand throughout New England and up and down the East Coast. They also hold events on the same day at different venues. There are many nights that Funny4Funds in the New England area will be doing multiple shows at the same time in different locations. Check out their website, www. Funny4Funds.com, for shows near you!

The online site you see today would not be possible without their behind-the-scenes IT guru, Dave Cordeiro. Dave’s passion for Funny4Funds came from him seeing firsthand the impact this company has had on our communities. His hard work and dedication to the site has kept Funny4Funds ahead of the curve and out of the dark ages of paper tickets only.

Today, the organization continues to thrive with the addition of their new executive assistant, Bethany Linden. Simas said that she is the reason why Funny4Funds runs as smoothly as it does, with all its moving parts. Believe it or not, unlike most other companies out there, she actually answers the phone when you call! Simas praised her work and hopes they enjoy a long, healthy relationship.

Anyone who is thinking about holding a fundraiser should contact Funny4Funds. They help all types of groups from churches to schools to sports teams and corporate events. They can help with medical bills, cancer benefits, wheelchair vans, and anything you can dream up.

For more details about their services and availability, please call Bethany at 401-996-3907, or email her at beth@funny4funds.com or visit their website at www.funny4funds.com.

A new company based in Central Falls actively bridges the gap between the myths and facts regarding cannabis and ensuring people have the education to make informed choices.

Aura of Rhode Island, located at 1136 Lonsdale Avenue, offers a variety of quality products at competitive prices for both medical patients and adult recreational customers. They also offer private consultations for patients and customers that require more one-on-one time to help educate them and ensure their needs are met.

Colin Chabot, Director of Marketing, believes the best approach is educating their customers on all things pertaining to cannabis. He said, “A better informed consumer will most certainly have a better cannabis journey and that is our number one goal.”

Aura’s initial educational push has been through Instagram reels on their page @auraofri. Their short videos introduce various subjects, starting with basic knowledge and eventually refining into more complex topics. Chabot said that the reels and posts have had a positive reaction from consumers.

Human Resources Director Andrea Biszko said, “Our budtenders and staff are both extremely friendly and knowledgeable on all the products that make up our menu.” Each month, a learning video is posted on our social media platforms that explain a particular cannabis topic to help educate those who are interested.

“There is a lot of misinformation out there. As a new business, it is important for us to help inform our customers so they can have the most personalized positive cannabis experience,” she said.

Aura of Rhode Island is open to adults, 18 and over, with a medical marijuana card and ages 21 and over, for recreational customers.

The shop is open Monday through Thursday from 9:30 AM to 7:00 PM, Friday and Saturday from 9:30 AM to 8:00 PM, and Sunday from 11:00 AM to 5:00 PM. Delivery for medical patients is coming soon!

More details can be found by calling 401-335-5356, or visiting their website at www.auraofri.com.

Scan For Menu

What Will You Do with Your Tax Refund?

By: Edward Pontarelli Jr.

The average refund in 2022 (for the 2021 tax year) was $3,176 for individual income taxpayers, according to the IRS.1 If you expect to receive a refund in 2023 after filing your 2022 tax return, will you save or spend it? While you may be tempted to indulge, consider using the money to solidify your long-term financial position.

No matter your stage in life or the size of your refund, there are ways you can use it to help reach your current and future financial goals. Here are a few:

FOR PEOPLE STARTING OUT IN THEIR CAREERS:

• Add to your emergency fund.

Consider saving enough to have the equivalent of at least threeto-six months’ worth of income in an emergency fund. This could come in handy if you experience a sudden interruption to your income or a major unexpected expense.

• Pay off student loans.

If you are carrying college debt or other loans, applying your refund to the balance can help reduce the total interest you pay or eliminate the debt entirely. Once you pay off your loans, allocate the amount you spent each month on student loans to another financial goal to keep building your financial foundation.

• Invest in an IRA.

Think about starting a habit of investing your tax refund each year into an IRA, where any earnings can accumulate on a tax-deferred basis. While you are limited to contributing $6,500 annually ($7,500 for those age 50 and older), the savings can add up. For example, investing a $3,000 refund each year from age 26 to 65 earning seven percent annually would build to more than $640,000.

FOR THOSE STARTING FAMILIES:

• Save for a down payment on a home.

A tax refund can make a meaningful impact as you accumulate enough to purchase your first home. Consider saving enough to cover at least 20 percent of the home’s value. Doing so will eliminate the need for private mortgage insurance, which will cost you extra in interest payments.

• Start or add to a college fund for your children. With the cost of higher education continuing to rise, starting early and saving often can help you make funding tuition a reality. Certain options may provide tax advantages, so work with your financial and tax professionals to find the best strategy for you.

• Invest your refund.

Consider adding your refund to your portfolio, using it to accelerate progress toward your long-term goals. Your refund could be used to purchase stocks, bonds, mutual funds, or other investments that are aligned with your goals, risk tolerance and time horizon.

• Create or update your legacy plan.

Developing a will, trust, or other estate documents is important so that your wishes are clear in the event of your death. If you need to create or update legal matters, use your refund as a reason to take the next step.

FOR THOSE WHO HAVE A SOLID FINANCIAL FOUNDATION:

• Apply to home improvements

If you are planning to remodel your home, you may want to use the money to fund specific upgrades, or to keep as a contingency fund throughout the project.

• Save for starting a new business If you want to start your own business now or in retirement, the refund can provide a cash buffer to help you get started. It can either replace some of your regular income or be used to fund expenditures required to get the business up-and-running.

FOR THOSE APPROACHING RETIREMENT:

• Increase your retirement savings. As your retirement date and goals get clearer, maximizing your retirement savings should take priority. Your refund can help you make an additional investment towards your financial future. If you are 50 or older and have earned income, current tax laws allow you to invest extra dollars in your IRA and workplace retirement plan. Work with your tax professional to learn about the opportunities and limitations that apply to your situation.

• Pay down your mortgage. Consider using your refund to make an additional principal payment to your home mortgage. Erasing debt prior to retirement can minimize a major financial burden.

FOR RETIREES:

• Spend it on your retirement dream. If you plan to travel or pursue a hobby in retirement, use the refund as a trigger to make it happen. Allow yourself to spend the money without guilt – after all, you’ve earned and planned for this opportunity.

• Invest in a Roth IRA. If you have any earned income that allows you to make retirement contributions, your tax refund can likely be placed into a Roth IRA. This vehicle provides potential tax-free growth of any earnings.

• Pay health care expenses. Today’s rising health care costs are often one of the biggest expenses for retirees. Consider applying the funds to Medicare or long-term care policy premiums. If your health care expenses are manageable, save the refund to pay for future expenses.

Review your tax withholding

If you regularly receive a large tax refund, you may want to adjust the withholding on your paycheck. Decreasing your refund may increase your monthly net pay, allowing you to allocate extra income each month to your financial goals. This strategy isn’t right for everyone. Consult with your tax professional and financial advisor before making adjustments or deciding how to manage your refund.

for 20 years.

Pleasecontacthim at www.ameripriseadvisors.com/team/beacon-point-wealth-advisors or (401)824-2532, 1 Citizens Plaza Ste 610 Providence, RI 02903

Ameriprise Financial and its affiliates do not offer tax or legal advice. Consumers should consult with their tax advisor or attorney regarding their specific situation.

Investment products are not insured by the FDIC, NCUA or any federal agency, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.

A Roth IRA is tax free as long as investors leave money in the account for at least 5 years and are 59 ½ or older when they take distributions or meet another qualifying event, such as death, disability or purchase of a first home.