STATISTICS

Closing The Tech Gap Credit Unions Holding Their Own

A

by Bruce Paul

ccording to the most recent Banking Benchmarks, the perceived technology gap is closing between big banks, community banks and credit unions. Over 3.3 million ratings were collected from credit union members and bank customers across New England. When consumers were asked to rank banks they have not used, they were only slightly more likely to assume that the larger banks have better technology than smaller banks and credit unions.

DOES BIGGER EQUAL BETTER IN TECHNOLOGY?

This gap has been narrowing over the past five to six years as more and more consumers tell us that they assume all institutions have basically the same level of online and mobile services. In fact, when we analyzed the latest Banking Benchmarks results for each individual town across Massachusetts, Connecticut, Rhode Island and New Hampshire, we found that in over 80% of the towns, there was at least one credit union or community bank ranked in the top three in technology by potential consumers. When consumers and businesses are asked to rate their own credit union, it is a different story. As you can see from the regional rankings listed here, credit unions are rated as high BRUCE PAUL or higher than the largest banks over 55% of the time. It also shows that some institutions are inconsistent in different areas of their footprint. Some credit unions are rated highly by members in one area but lower by members in other areas. This is usually due to inconsistent training (see case study on page 6 for two examples). This serves to remind all credit unions that while big banks might have an advantage in spending and image, credit unions can certainly hold their own.

DO BETTER TECHNOLOGY AND TOOLS REALLY HELP RETAIN MEMBERS?

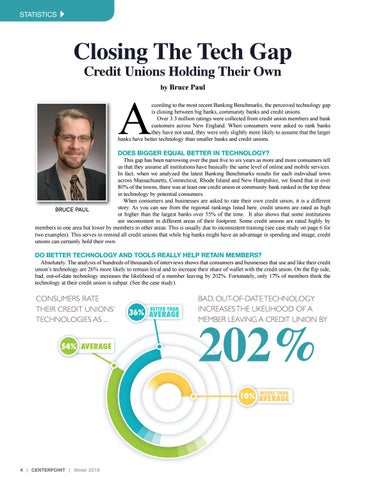

Absolutely. The analysis of hundreds of thousands of interviews shows that consumers and businesses that use and like their credit union’s technology are 26% more likely to remain loyal and to increase their share of wallet with the credit union. On the flip side, bad, out-of-date technology increases the likelihood of a member leaving by 202%. Fortunately, only 17% of members think the technology at their credit union is subpar. (See the case study).

CONSUMERS RATE THEIR CREDIT UNIONS’ TECHNOLOGIES AS ... 54% AVERAGE

BETTER THAN

36% AVERAGE

BAD, OUT-OF-DATE TECHNOLOGY INCREASES THE LIKELIHOOD OF A MEMBER LEAVING A CREDIT UNION BY

202% WORSE THAN

10% AVERAGE

4 | CENTERPOINT | Winter 2018