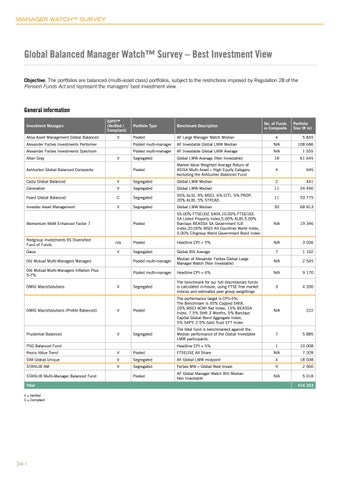

MANAGER WATCH™ SURVEY

Global Balanced Manager Watch™ Survey – Best Investment View Objective: The portfolios are balanced (multi-asset class) portfolios, subject to the restrictions imposed by Regulation 28 of the Pension Funds Act and represent the managers’ best investment view.

General information Investment Managers Absa Asset Management Global Balanced

GIPS™ (Verified / Compliant) V

Alexander Forbes Investments Performer Alexander Forbes Investments Spectrum Allan Gray

V

Ashburton Global Balanced Composite

Portfolio Size (R m)

Benchmark Description

Pooled

AF Large Manager Watch Median

Pooled multi-manager

AF Investable Global LMW Median

N/A

Pooled multi-manager

AF Investable Global LMW Average

N/A

1 555

Segregated

Global LMW Average (Non Investable)

18

61 645

Pooled

Market Value Weighted Average Return of ASISA Multi Asset – High Equity Category excluding the Ashburton Balanced Fund

4

4

5 845 108 686

645

Cadiz Global Balanced

V

Segregated

Global LMW Median

2

Coronation

V

Segregated

Global LMW Median

11

24 450

Foord Global Balanced

C

Segregated

55% ALSI, 9% MSCI, 6% CITI, 5% PROP, 20% ALBI, 5% STFCAD

11

53 775

Investec Asset Management

V

Segregated

Global LMW Median

30

68 813

Pooled

55.00% FTSE/JSE SWIX,10.00% FTSE/JSE SA Listed Property Index,5.00% ALBI,5.00% Barclays BEASSA SA Government ILB Index,20.00% MSCI All Countries World Index, 5.00% Citigroup World Government Bond Index

N/A

19 346

Pooled

Headline CPI + 5%

N/A

3 036

Segregated

Global BIV Average

7

1 102

Old Mutual Multi-Managers Managed

Pooled multi-manager

Median of Alexander Forbes Global Large Manager Watch (Non Investable)

N/A

2 545

Old Mutual Multi-Managers Inflation Plus 5-7%

Pooled multi-manager

Headline CPI + 6%

N/A

9 170

Segregated

The benchmark for our full discretionary funds is calculated in-house, using FTSE free market indices and estimated peer group weightings

3

4 330

Momentum MoM Enhanced Factor 7

Nedgroup Investments XS Diversified Fund of Funds Oasis

OMIG MacroSolutions

n/a V

V

441

OMIG MacroSolutions (Profile Balanced)

V

Pooled

The performance target is CPI+5%. The Benchmark is 45% Capped SWIX, 20% MSCI ACWI Net Index, 15% BEASSA Index, 7.5% Stefi 3 Months, 5% Barclays Capital Global Bond Aggregate Index, 5% SAPY, 2.5% Gold Trust EFT Index

Prudential Balanced

V

Segregated

The total fund is benchmarked against the Median performance of the Global Investable LMW participants.

Rezco Value Trend

V

Pooled

SIM Global Unique

V

Segregated

AF Global LMW midpoint

4

18 038

STANLIB AM

V

Segregated

Forbes MW – Global Best Invest

9

2 560

Pooled

AF Global Manager Watch BIV Median Non Investable

N/A

5 018

PSG Balanced Fund

STANLIB Multi-Manager Balanced Fund Total V = Verified C = Compliant

34

No. of Funds in Composite

Portfolio Type

N/A

222

7

5 885

Headline CPI + 5%

1

10 008

FTSE/JSE All Share

N/A

7 209

414 323