CROP INSURANCE

Getting the Most Out of Every Acre

Insurance Planning For The Year Ahead Written by: Beth Erickson, VP Insurance It is never too early to think about your 2024 multiperil crop insurance (MPCI) renewal. Now is the time to reflect on how your insurance policy worked for you this year when reviewing your numbers with your AgCountry team. There are many factors to consider when determining the right insurance policy. Keep in mind the perils that hit our territory in 2023, including spring flooding, drought, hail, and wind damage. Do not forget the last peril—declining commodity prices. At your insurance renewal meeting, you will discuss various options available to you for the upcoming year. Popular coverage options are MPCI, hail, and wind. However, the options do not end there. Lesser-known policies are becoming popular. Enhanced Coverage Option (ECO) and Supplemental Coverage Option (SCO) were extremely hot topics last spring and should be explored again when determining what is best for your operation. Here are a few examples using AgCountry’s exclusive Optimum Analyzer tool to demonstrate how ECO works. The numbers used are for corn in Stevens County, Minnesota. Assume your farm has an actual production history (APH) of 200 bushels per acre, while carrying 75% MPCI coverage and ECO 95% county-based coverage this year. How does that look now? For the ECO policy, the average county yield in Stevens County this year was 193. Due to the price change alone, dropping from $5.91 down to $4.88, producers

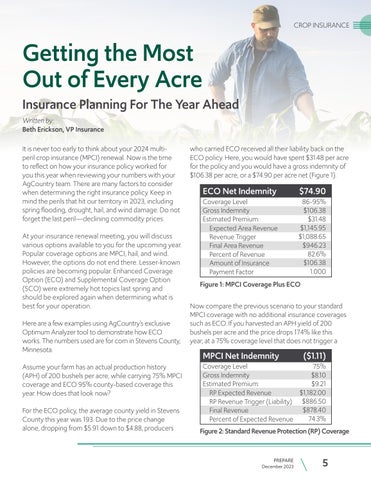

who carried ECO received all their liability back on the ECO policy. Here, you would have spent $31.48 per acre for the policy and you would have a gross indemnity of $106.38 per acre, or a $74.90 per acre net (Figure 1).

ECO Net Indemnity

Coverage Level Gross Indemnity Estimated Premium: Expected Area Revenue Revenue Trigger Final Area Revenue Percent of Revenue Amount of Insurance Payment Factor

$74.90

86-95% $106.38 $31.48 $1,145.95 $1,088.65 $946.23 82.6% $106.38 1.000

Figure 1: MPCI Coverage Plus ECO Now compare the previous scenario to your standard MPCI coverage with no additional insurance coverages such as ECO. If you harvested an APH yield of 200 bushels per acre and the price drops 17.4% like this year, at a 75% coverage level that does not trigger a

MPCI Net Indemnity

($1.11)

Coverage Level 75% Gross Indemnity $8.10 Estimated Premium: $9.21 $1,182.00 RP Expected Revenue RP Revenue Trigger (Liability) $886.50 $878.40 Final Revenue 74.3% Percent of Expected Revenue

Figure 2: Standard Revenue Protection (RP) Coverage

PREPARE

December 2023

5