AgCountry Farm Credit Services / GROW / June 2022

Is Margin Protection Right For You? Written by: Amanda Pilgrim

Senior Insurance Specialist Even though Margin Protection has been around for a few years, you may not have heard much about it before the Fall of 2021. At that time, it started to look more appealing based on where prices were at that time, along with input costs, which caused Margin Protection to gain traction along with the Supplemental Coverage Option (SCO) and the Enhanced Coverage Option (ECO). We are going to explore what Margin Protection is, how it works, provide an example of it, and take a look at the history of prices for it. What is Margin Protection? Margin Protection is available in select counties for corn, soybeans, and wheat. Margin Protection allows you to consider certain variable costs of production in formulating the insurance guarantee. It is an area-based option that uses county-level estimates of average revenue and input costs to establish the amount of coverage and indemnity. Ultimately, it diversifies your risk management strategy with different variables than your multiperil crop insurance (MPCI) policy by insuring some risks associated with yield, crop price fluctuation, and increases in the prices of production inputs. How does Margin Protection Work? Margin Protection can be purchased by itself or with a Yield/Revenue Protection policy as long as it is written with the same approved insurance provider. Margin Protection uses a different price period than the standard MPCI policy. For a 2023 Margin Protection policy on corn, soybeans, and wheat, the Projected Price and Cost Discovery Period is August 15, 2022 to September 14, 2022. Margin Protection includes a harvest Price Option, which is the same harvest price as a Revenue Protection policy (announced in the Fall of 2023). It also uses the same Risk Management Agency

6

(RMA) Expected and Harvest Yields as SCO/ECO and area revenue protection. Prior to the sales closing deadline of September 30, RMA will release the following information for each county: • • • •

Expected county yield Projected price Expected cost Expected margin is calculated

After Harvest, RMA releases the following for each county: • • • •

Final county yield Harvest price Harvest cost Harvest margin is calculated

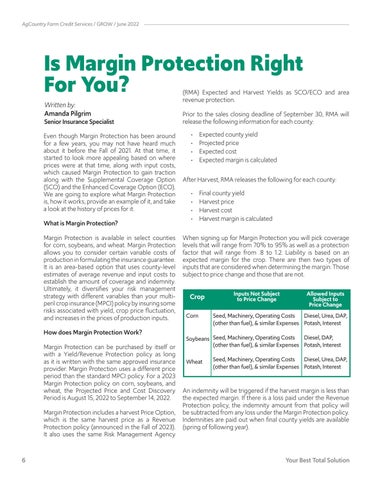

When signing up for Margin Protection you will pick coverage levels that will range from 70% to 95% as well as a protection factor that will range from .8 to 1.2. Liability is based on an expected margin for the crop. There are then two types of inputs that are considered when determining the margin: Those subject to price change and those that are not.

Crop Corn

Inputs Not Subject to Price Change

Allowed Inputs Subject to Price Change

Seed, Machinery, Operating Costs Diesel, Urea, DAP, (other than fuel), & similar Expenses Potash, Interest

Diesel, DAP, Soybeans Seed, Machinery, Operating Costs (other than fuel), & similar Expenses Potash, Interest Wheat

Seed, Machinery, Operating Costs Diesel, Urea, DAP, (other than fuel), & similar Expenses Potash, Interest

An indemnity will be triggered if the harvest margin is less than the expected margin. If there is a loss paid under the Revenue Protection policy, the indemnity amount from that policy will be subtracted from any loss under the Margin Protection policy. Indemnities are paid out when final county yields are available (spring of following year).

Your Best Total Solution