5 minute read

Using Housing Wealth to Address Common LTC Issues

This article explains how a reverse mortgage can help your client address some common LTC issues.

By Shelley Giordano and Launi Cooper

Long-term-care insurance (LTCI) policies are often difficult to sell. Despite the introduction of hybrid products that minimize loss of premium, the industry continues to languish even in the face of the risk coming from the rising cost of long term care. And of course, if the client waits too long, he faces underwriting rejection or premiums that would unduly strain the household budget. Finally, some existing policyowners face premium cost increases that result in policy lapses — a sad affair for advisors doing all they can to help clients manage risk.

In the basket of hard-to-sell financial products, reverse mortgages fit the same profile. Home ownership in retirement is exceedingly high, estimated to be over 80%. The uptake in this population for taking advantage of the roughly $7 trillion in senior home equity is growing but is still proportionally small. Like annuities, reverse mortgages rely on mortality credit-like actuarial principles so that no borrower can ever owe more than the value of the house regardless of how long he lives or what housing values do.

This is accomplished through FHA-insurance premiums that accrue on the loan balance but provide absolute nonrecourse status to the eventual outcome of the loan.

Retirement researchers extol the value of creating secure income with annuities to cover essential needs in retirement. Likewise, experts in the field recommend managing the risk of needing expensive, or possibly ruinous, long term care. Nothing new there. What is new is the growing interest in using the housing asset to assist in managing the risk of what Wade Pfau, PhD, CFA, lists as longevity, market volatility and spending shocks.

Coordinating the use of a reverse mortgage with other resources puts a dead asset to work and potentiates their resiliency. Simply put, using a reverse mortgage, depending on the client circumstances, can increase cash flow, reduce monthly outflow, substitute for portfolio draws in down markets (Sequence of Returns Risk), and/or function as a shock absorber in retirement years for unexpected spending drain.

Choice Architecture

More specifically, would a more coordinated approach with long term care needs be effective in helping advisors manage risk for their clients in the LTC arena? Rather than a binary choice of “purchase LTCI or not,” the advisor may better serve his clients with an array of options, commonly known as “choice architecture.” The idea behind presenting choices is to provide the client with a sense of control, but with a “nudge” in the right direction. In other words, the advisor is giving the client choice, but their attention is directed toward doing something to address long term care risk, not just ignoring it.

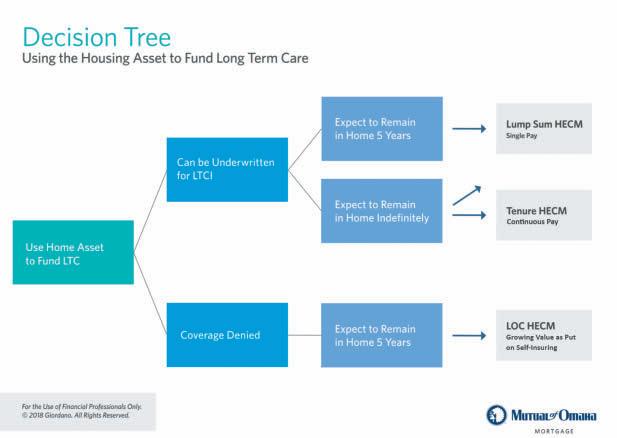

The chart below demonstrates a decision tree to assist advisors in nudging clients to a course of action that integrates a reverse mortgage with LTC planning when the client perceives the cost is prohibitive, or the client will not qualify.

Client Who Can Be Underwritten For Ltci

For the client who can be underwritten, the sting of draws on savings can be mitigated by turning to an alternate asset, the home. Because a reverse mortgage does not require mandatory monthly payments, there is less pressure on the monthly budget. This is especially important in market downturns so that the client is not spending undervalued assets. Generally, the cost of setting up a reverse mortgage would not make sense if the client plans to move within a short period of time. A minimum five-year window is suggested as a “Rule of Thumb.”

• Reverse Mortgage Lump Sum

The client may choose to buy a policy with a one-time Single Pay using reverse mortgage lump sum.

• Reverse Mortgage Tenure Payment, an “Annuity” (as long as he remains in the house)

Provides monthly cash flow for household budget to accommodate continuous pay.

CLIENT WHO CANNOT BE UNDERWRITTEN (OR WILL NOT BUY)

For the client who is denied, or refuses to consider a policy because of budget demands, reverse mortgage offers a powerful alternative that allows the client to self-insure.

• Reverse Mortgage Line of Credit

With this strategy, the client opens a reverse mortgage line of credit as early as age 62. This form of line on home equity possesses unique benefits.

1. Unlike a traditional Home Equity Line of Credit (HELOC), the lender cannot cancel, freeze or reduce the line even if the home value drops.

2. No monthly debt service is required.

3. Whatever the loan balance becomes is satisfied by the home value, whatever it may be.

4. If the line is not used, there is no loss in equity beyond the lending costs.

5. All remaining equity at loan’s end belongs to the borrower or his heirs/estate.

6. And most importantly, the line of credit compounds in borrowing power as the client ages.

The last feature is the “killer app” in reverse mortgage lending and what makes the reverse mortgage so attractive as self-insurance for LTC. Rather than earmarking savings or reducing spending to account for an eventual LTC event, the dead asset, the house, is deployed to create an ever-growing pot of cash (as long as it serves as the principal residence for at least one of the borrowers). The line of credit functions as “put” on long term needs. Unlike other insurance policies, it is not a use or lose proposition. If the line of credit is not used, it just reverts to the equity available to the homeowner or his estate.

The impact of having set up a reverse mortgage line of credit proactively is illuminated by an unsolicited email from a Mutual of Omaha Mortgage client:

“You may not remember me, but we did an HECM LOC about seven years ago. In these unprecedented times of health and financial uncertainty, my LOC (line of credit) now grown to $540,000, provides me with the comfort I might not otherwise experience.” FB, Orange County, March 2020.

Not many advisors have put their clients in a position to enjoy a half-million dollar liquid emergency fund. Clients whose advisors helped them mobilize their home equity in a growing, compounding, reverse mortgage line of credit faced the March 2020 market volatility and possible health ramifications with greater peace of mind.

Conclusion

In the financial planning community, the housing asset is rarely used to provide a long-term care solution. Advisors have tended to leave the house as a last resort, a disproved strategy that does not account for market volatility,or for future health spending shocks for the vast majority of seniors who wish to age at home. Finally, the reverse mortgage provides the means for expanding the inflow budget to purchase LTCI or prevent policy lapse without imposing a monthly debt obligation.

Disclosures

The reverse mortgage discussed in this paper is the Home Equity Conversion Mortgage (HECM) insured by FHA. One of the homeowners must be at least 62 years old. The mortgage requires that the homeowner be responsible for tax, insurance, HOA fees, and maintenance, and that the home be the principal residence.

Shelley Giordano is the Founder Academy of Home Equity in Financial Planning, University of Illinois. sgiordano@ mutuamortgage.com. Launi Cooper is with Mutual of Omaha Mortgage. lcooper@mutualmortgage.com.